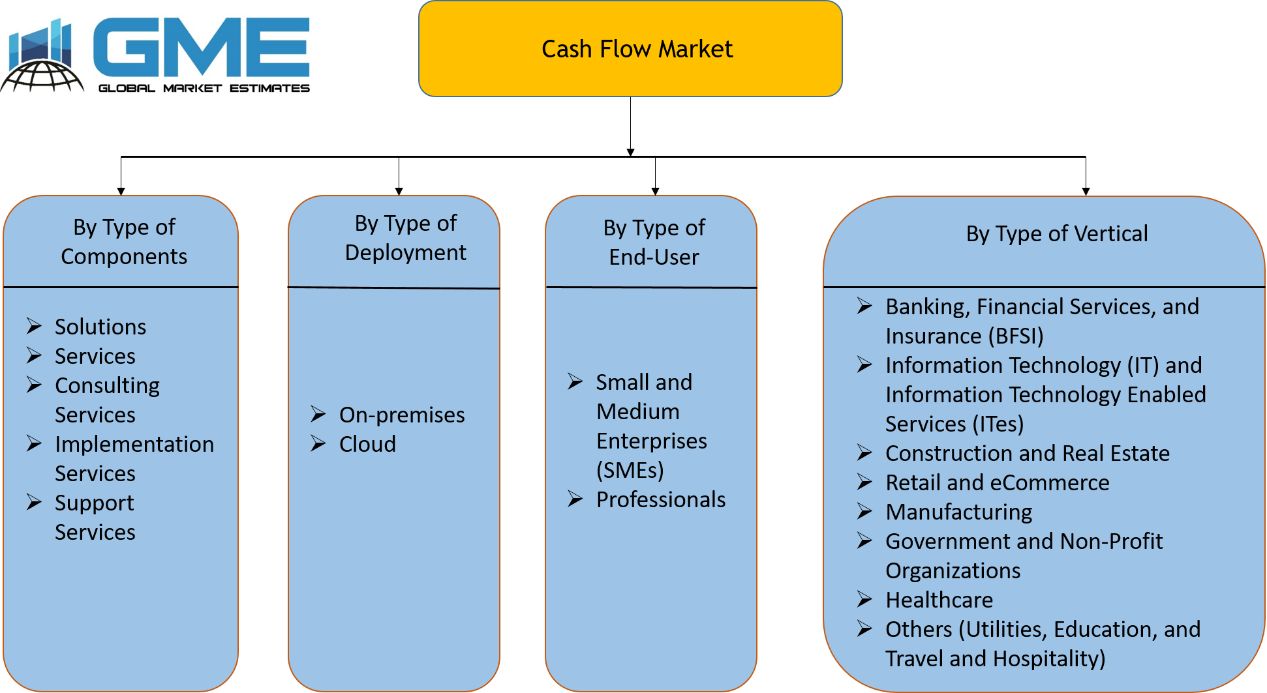

Cash Flow Market Size, Trends & Analysis with COVID-19 Impact - Forecasts to 2026 By Type of Components (Solutions, Services, Consulting Services, Implementation Services, and Support Services) By Type of Deployment (On-Premises and Cloud), By Type of End-User (Small & Medium Enterprises [SMEs] and Professionals), By Type of Vertical (Banking, Financial Services, & Insurance [BFSI], Information Technology [IT] & Information Technology Enabled Services [ITes], Construction & Real Estate, Retail & eCommerce, Manufacturing, Government & Non-Profit Organizations, Healthcare, and Others [Utilities, Education, and Travel and Hospitality]), By Type of Region (NA [North America], Europe, APAC [Asia Pacific], MEA [the Middle East & Africa], and CSA [Central & South America]), End-User Landscape, Vendor Landscape, Company Market Share Analysis & Competitor Analysis

Cash Flow Market Insights

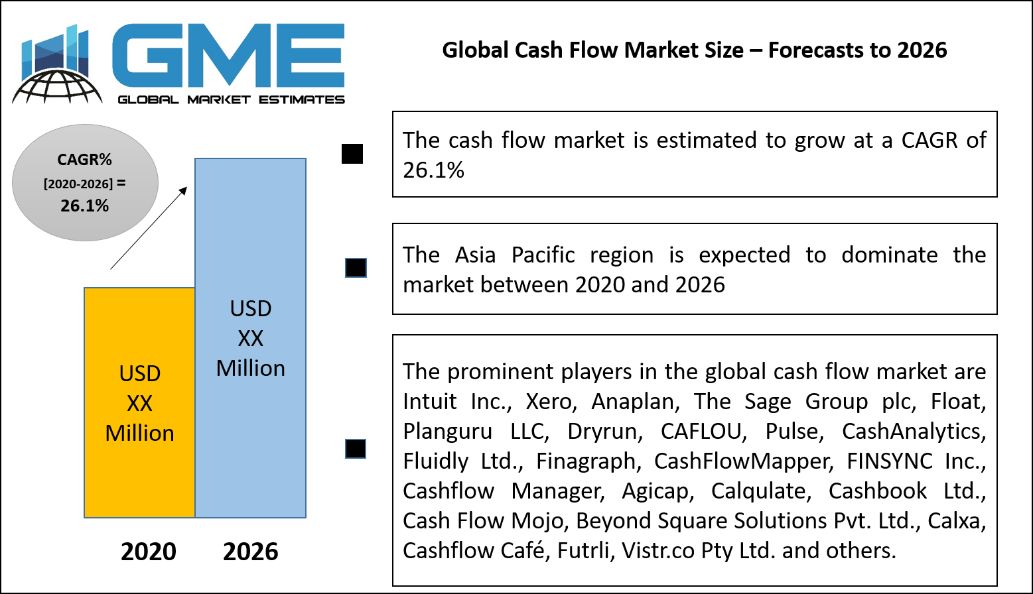

The cash flow market is grasped to analyze the prevailing augmentation of CAGR 26.1% during the forecast period (2020-2026). Cash flow can be defined as the physical and pragmatic movement of funds. In conventional understanding, cash flow is a payment from one principal bank account to another bank account. COVID-19 has impacted all domains due to the global lockdown, yet few segments flourished in the market such as healthcare, retail & e-commerce that is directly proportional to the practice of virtual payments, looking at the safety regulations concerning the prevailing situation. The factors affecting the market are an increase in digitization, the increase in industrialization, easy accessibility of the internet, centralized cash management systems (CMS) in BFSI, synthesis of high-level technologies such as AI, ML, and liquidity management.

Cash Flow Market: By Type of Components

The various components of the cash flow market are services, consulting, support &, implementation services, and solutions, where the services segment is determined to beget the fastest growth in the forecast period. Liquidity management, cash flow prediction, efficient business operations management, and insistence for fund transfer process automation are the propellors of the market.

Cash Flow Market: By Type of Deployment

Cloud and on-premises are types of deployment. The segment to see a prominent elevation would be cloud technology. Easy monitoring & management, lower cost of operation, reliable data security & storage, increase in cyber threats, the evolution of advanced technologies in the field are the motorists of the global market.

Cash Flow Market: By Type of End-User

The market classification for end-users can be noticed as small & medium enterprises (SMEs) and large enterprises. SMEs are prophesied to possess the highest share in CAGR due to the customs that are accelerating the market such as speedy industrialization, adoption of CMS, and the rise of virtual payments in retail & e-commerce.

Cash Flow Market: By Type of Verticals

Based on verticals, healthcare, information technology (IT) & information technology-enabled services (ITes), government & non-profit organizations, construction & real estate, retail & e-commerce, banking, financial services, and insurance manufacturing, and others (utilities, education, and travel and hospitality) are the categories of the market. BFSI is anticipated to grow tremendously with the aid of attributes such as dependency on cash management systems, lower manpower requirement, efficient and constant fund transfer solutions, favoring strategies & promotions by the government bodies concerning COVD-19 safety measures.

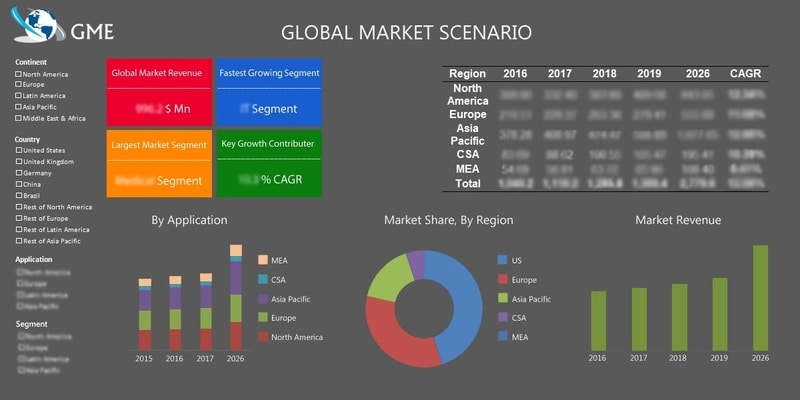

Cash Flow Market: By Region

NA (North America), APAC (Asia-Pacific), Europe, MEA (the Middle East & Africa), and CSA (Central & South America) are the zones based on the regional division. APAC is considered to cycle the market to a significant inclination due to the rowers such as an increase in industrialization, demand for swift cash flow management, arise of small-scale businesses & economy serving the growth of the market.

Cash Flow Market Share and Competitor Analysis

The prominent players in the global cash flow market are Intuit Inc., Xero, Anaplan, The Sage Group plc, Float, Planguru LLC, Dryrun, CAFLOU, Pulse, CashAnalytics, Fluidly Ltd., Finagraph, CashFlowMapper, FINSYNC Inc., Cashflow Manager, Agicap, Calqulate, Cashbook Ltd., Cash Flow Mojo, Beyond Square Solutions Pvt. Ltd., Calxa, Cashflow Café, Futrli, Vistr.co Pty Ltd. and others.

Please note: This is not an exhaustive list of companies profiled in the report.

In Nov 2019, The Sage Group plc announced a partnership with Standard Chartered PLC to empower SMEs by granting authorization to adequate tools, sufficient knowledge, and appropriate funding.

In Nov 2019, in the UK market, The Sage Group plc launched SAAS, a cloud-based accounting product. This offers a complete sequence of accounting and economic management solutions and endorsed the expansion of the market in the UK.

Check the Press Release on Cash Flow Market Report

We value your investment and offer free customization with every report to fulfil your exact research needs.

The Cash Flow Market has been studied from the year 2017 till 2026. However, the CAGR provided in the report is from the year 2018 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply side analysis for the Cash Flow Market

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the companies and customer analytics.

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS