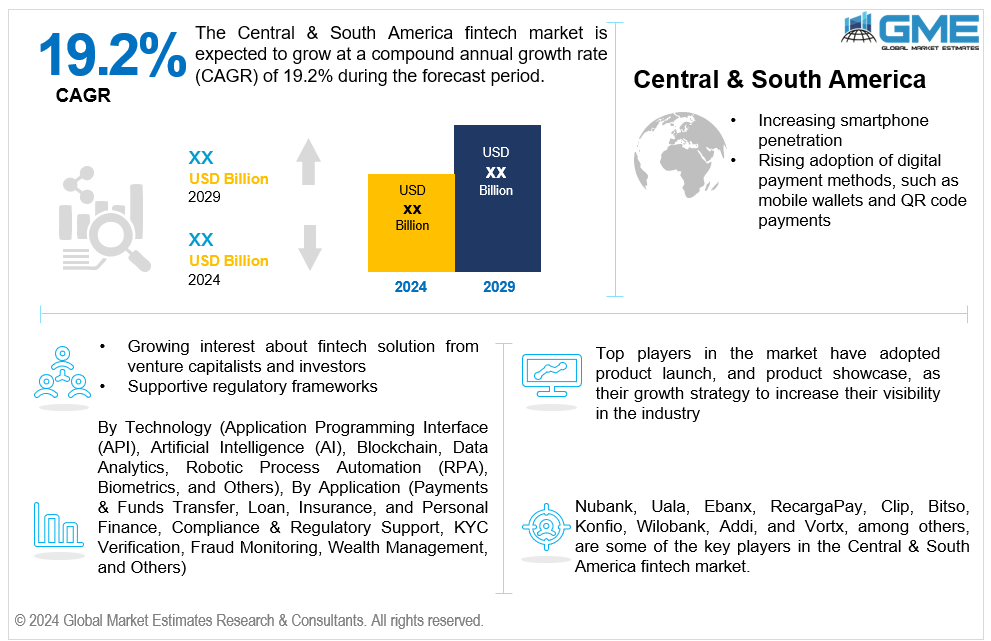

Central & South America Fintech Market Size, Trends & Analysis - Forecasts to 2029 By Technology (Application Programming Interface (API), Artificial Intelligence (AI), Blockchain, Data Analytics, Robotic Process Automation (RPA), Biometrics, and Others), By Application (Payments & Funds Transfer, Loan, Insurance, and Personal Finance, Compliance & Regulatory Support, KYC Verification, Fraud Monitoring, Wealth Management, and Others), By End-use (Bank, Financial Institutes & Insurance (BFSI), Retail and E-commerce, Healthcare, Education, Real Estate, Travel and Hospitality, Transportation and Logistics, Entertainment & Media, and Others), and By Region (Central and South America), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The Central & South America fintech market is estimated to exhibit a CAGR of 19.2% from 2024 to 2029.

The primary factors propelling the market growth are increasing smartphone penetration and rising adoption of digital payment methods, such as mobile wallets and QR code payments. With the proliferation of smartphones and greater internet access, customers increasingly rely on these easy, safe, and fast electronic payment methods. Mobile wallets and QR code payments provide an alternative to traditional banking systems, which is especially useful in regions where a large proportion of the population is unbanked or underbanked. These technologies allow users to complete transactions swiftly and effortlessly, eliminating the need for real currency or cards. Companies are increasingly using digital payment methods to streamline operations and cut expenses connected with cash handling. This spike in digital payment use promotes innovation, attracts investments, and drives overall growth in the region's fintech sector. For instance, according to ACI Worldwide (2024), in Brazil, 43% of payments are made through electronic methods.

Growing interest about fintech solution from venture capitalists and investors and supportive regulatory frameworks such as crypto-assets Law are expected to support the market growth. Venture capitalists' funding enables fintech companies to improve their technology infrastructure, increase their product offerings, and penetrate new markets aggressively. Furthermore, this financial assistance is frequently accompanied by strategic advice and networking opportunities, which help accelerate companies' growth. Investors' confidence also contributes to the validation of the fintech industry, enabling additional firms to enter the market and creating a competitive atmosphere that encourages innovation.

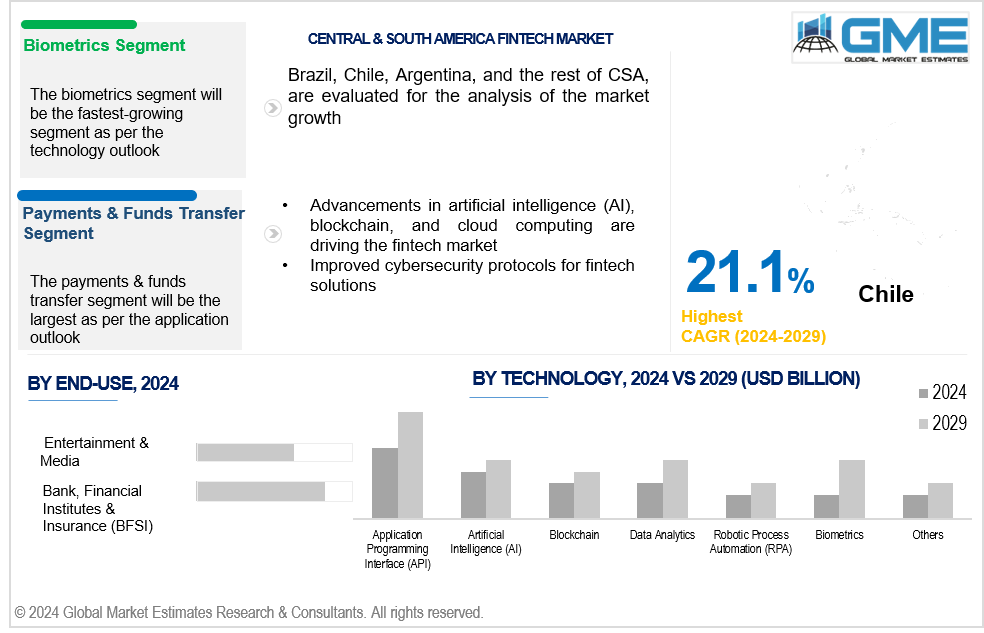

Advancements in artificial intelligence (AI), blockchain, and cloud computing and improved cybersecurity protocols propel market growth. AI is enhancing customer service by providing chatbots, individualized financial advice, fraud detection, and credit scoring algorithms. Blockchain technology is transforming the industry by providing safe, transparent, and efficient transaction mechanisms, especially appealing to sectors with high financial fraud and regulatory inefficiencies. On the other hand, cloud computing provides the scalable infrastructure that fintech companies require to function effectively, cut costs, and rapidly launch new services. These technical breakthroughs enable fintech companies to provide more trustworthy, creative, and accessible financial solutions, catering to the requirements of a varied and disadvantaged population.

Small loans and credit are in high demand, especially among small enterprises and individuals who do not have access to regular credit. Fintech platforms can employ alternative data to assess creditworthiness and issue microloans, providing market opportunities. Furthermore, Developing RegTech solutions can help financial companies comply with rules more effectively, lowering costs and boosting transparency.

However, inadequate technological infrastructure and lack of skilled workforce may impede market growth.

The application programming interface (API) segment is expected to hold the largest share of the market over the forecast period. APIs enable fintech companies to create novel products quickly. Fintech companies can develop new apps and services by utilizing existing APIs rather than developing all capabilities from scratch, lowering development costs and increasing time to market.

The biometrics segment is expected to be the fastest-growing segment in the market from 2024 to 2029. The ubiquitous use of smartphones with biometric sensors (for example, fingerprint scanners and face recognition cameras) makes integrating biometric authentication into fintech apps easier. This technological readiness supports rapid growth in the biometrics segment.

The payments & funds transfer segment is expected to hold the largest share of the market over the forecast period. A sizable proportion of the population in the region is unbanked or underbanked. Fintech payment solutions give these people access to key financial services like mobile wallets and peer-to-peer (P2P) transactions, resulting in increased financial inclusion.

The wealth management segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The usage of robo-advisers and AI-driven investment techniques enables fintech companies to provide sophisticated wealth management services for a fraction of the cost of traditional advisors. These technologies offer automated, individualized financial advice and portfolio management.

The bank, financial institutes & insurance (BFSI) segment is expected to hold the largest share of the market over the forecast period. Fintech solutions help BFSI firms to improve client experiences by providing personalized services, smooth digital interfaces, and 24/7 access to financial products. Improved customer satisfaction leads to greater retention and market share.

The entertainment & media segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Fintech allows entertainment and media organizations to explore new monetization alternatives outside of traditional advertising and subscription models. Fintech systems, for example, can enable micropayments for specific articles, videos, or music tracks, allowing content providers to generate new revenue streams.

Brazil is expected to be the largest country in the Central & South America market. Its high smartphone penetration rate makes it ideal for adopting mobile-based finance solutions. Mobile applications provide easy access to financial services, especially in distant or underdeveloped locations where traditional banking infrastructure can be limited.

Chile is anticipated to witness rapid growth during the forecast period. The Chilean government has demonstrated a strong commitment to supporting innovation and entrepreneurship, particularly in the fintech industry. Fintech companies can benefit from initiatives like Start-Up Chile, which give investment, coaching, and tools to help them grow and flourish.

Nubank, Uala, Ebanx, RecargaPay, Clip, Bitso, Konfio, Wilobank, Addi, and Vortx, among others, are some of the key players in the Central & South America fintech market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2024, Nubank, a Brazilian challenger bank, collaborated with Wise Platform, a payment infrastructure for banks and fintechs, to support the launch of its new Global Account offering and international debit card.

In December 2023, RecargaPay, a Brazilian fintech, raised USD 14.1 million from the Finance Industry Development Council (FIDC) to expand its credit vertical. Milenio Capital, a credit-focused investment manager, arranged the transaction. RecargaPay aims to use the cash to extend its lending offer.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 CENTRAL & SOUTH AMERICA FINTECH MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 CENTRAL & SOUTH AMERICA FINTECH MARKET, BY TECHNOLOGY

4.1 Introduction

4.2 Fintech Market: Technology Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Application Programming Interface (API)

4.4.1 Application Programming Interface (API) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Artificial Intelligence (AI)

4.5.1 Artificial Intelligence (AI) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Blockchain

4.6.1 Blockchain Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Data Analytics

4.7.1 Data Analytics Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Robotic Process Automation (RPA)

4.8.1 Robotic Process Automation (RPA) Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Biometrics

4.9.1 Biometrics Market Estimates and Forecast, 2021-2029 (USD Million)

4.10 Others

4.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 CENTRAL & SOUTH AMERICA FINTECH MARKET, BY APPLICATION

5.1 Introduction

5.2 Fintech Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Payments & Funds Transfer

5.4.1 Payments & Funds Transfer Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Loan, Insurance, and Personal Finance

5.5.1 Loan, Insurance, and Personal Finance Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Compliance & Regulatory Support

5.6.1 Compliance & Regulatory Support Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 KYC Verification

5.7.1 KYC Verification Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Fraud Monitoring

5.8.1 Fraud Monitoring Market Estimates and Forecast, 2021-2029 (USD Million)

5.9 Wealth Management

5.9.1 Wealth Management Market Estimates and Forecast, 2021-2029 (USD Million)

5.10 Others

5.10.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 CENTRAL & SOUTH AMERICA FINTECH MARKET, BY END-USE

6.1 Introduction

6.2 Fintech Market: End-use Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Bank, Financial Institutes & Insurance (BFSI)

6.4.1 Bank, Financial Institutes & Insurance (BFSI) Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Retail and E-commerce

6.5.1 Retail and E-commerce Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Healthcare

6.6.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Education

6.7.1 Education Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 Real Estate

6.8.1 Real Estate Market Estimates and Forecast, 2021-2029 (USD Million)

6.9 Travel and Hospitality

6.9.1 Travel and Hospitality Market Estimates and Forecast, 2021-2029 (USD Million)

6.10 Transportation and Logistics

6.10.1 Transportation and Logistics Market Estimates and Forecast, 2021-2029 (USD Million)

6.11 Entertainment & Media

6.11.1 Entertainment & Media Market Estimates and Forecast, 2021-2029 (USD Million)

6.12 Others

6.12.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 CENTRAL & SOUTH AMERICA FINTECH MARKET, BY COUNTRY

7.1 Introduction

7.2 Central & South America Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Technology

7.2.2 By Application

7.2.3 By End-use

7.2.4 By Country

7.2.4.1 Brazil Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Technology

7.2.4.1.2 By Application

7.2.4.1.3 By End-use

7.2.4.2 Argentina Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Technology

7.2.4.2.2 By Application

7.2.4.2.3 By End-use

7.2.4.3 Chile Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Technology

7.2.4.3.2 By Application

7.2.4.3.3 By End-use

7.2.4.4 Rest of Central and South America Fintech Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.4.1 By Technology

7.2.4.4.2 By Application

7.2.4.4.3 By End-use

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 Central & South America

8.4 Company Profiles

8.4.1 Nubank

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Uala

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Ebanx

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 RecargaPay

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Clip

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 BITSO

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Konfio

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Wilobank

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Addi

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Vortx

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Type Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Central & South America Fintech Market, By Technology, 2021-2029 (USD Mllion)

2 Application Programming Interface (API) Market, BY Country, 2021-2029 (USD Mllion)

3 Artificial Intelligence (AI) Market, BY Country, 2021-2029 (USD Mllion)

4 Blockchain Market, BY Country, 2021-2029 (USD Mllion)

5 Data Analytics Market, BY Country, 2021-2029 (USD Mllion)

6 Robotic Process Automation (RPA) Market, BY Country, 2021-2029 (USD Mllion)

7 Biometrics Market, BY Country, 2021-2029 (USD Mllion)

8 Others Market, BY Country, 2021-2029 (USD Mllion)

9 Central & South America Fintech Market, By Application, 2021-2029 (USD Mllion)

10 Payments & Funds Transfer Market, BY Country, 2021-2029 (USD Mllion)

11 Loan, Insurance, and Personal Finance Market, BY Country, 2021-2029 (USD Mllion)

12 Compliance & Regulatory Support Market, BY Country, 2021-2029 (USD Mllion)

13 KYC Verification Market, BY Country, 2021-2029 (USD Mllion)

14 Fraud Monitoring Market, BY Country, 2021-2029 (USD Mllion)

15 Wealth Management Market, BY Country, 2021-2029 (USD Mllion)

16 Others Market, BY Country, 2021-2029 (USD Mllion)

17 Central & South America Fintech Market, By End-use, 2021-2029 (USD Mllion)

18 Bank, Financial Institutes & Insurance (BFSI) Market, BY Country, 2021-2029 (USD Mllion)

19 Retail and E-commerce Market, BY Country, 2021-2029 (USD Mllion)

20 Healthcare Market, BY Country, 2021-2029 (USD Mllion)

21 Education Market, BY Country, 2021-2029 (USD Mllion)

22 Real Estate Market, BY Country, 2021-2029 (USD Mllion)

23 Travel and Hospitality Market, BY Country, 2021-2029 (USD Mllion)

24 Transportation and Logistics Market, BY Country, 2021-2029 (USD Mllion)

25 Entertainment & Media Market, BY Country, 2021-2029 (USD Mllion)

26 Others Market, BY Country, 2021-2029 (USD Mllion)

27 Regional Analysis, 2021-2029 (USD Mllion)

28 Central & South America Fintech Market, By Technology, 2021-2029 (USD Million)

29 Central & South America Fintech Market, By Application, 2021-2029 (USD Million)

30 Central & South America Fintech Market, By End-use, 2021-2029 (USD Million)

31 Central & South America Fintech Market, By Country, 2021-2029 (USD Million)

32 Brazil Fintech Market, By Technology, 2021-2029 (USD Million)

33 Brazil Fintech Market, By Application, 2021-2029 (USD Million)

34 Brazil Fintech Market, By End-use, 2021-2029 (USD Million)

35 Argentina Fintech Market, By Technology, 2021-2029 (USD Million)

36 Argentina Fintech Market, By Application, 2021-2029 (USD Million)

37 Argentina Fintech Market, By End-use, 2021-2029 (USD Million)

38 Chile Fintech Market, By Technology, 2021-2029 (USD Million)

39 Chile Fintech Market, By Application, 2021-2029 (USD Million)

40 Chile Fintech Market, By End-use, 2021-2029 (USD Million)

41 Rest of Central and South America Fintech Market, By Technology, 2021-2029 (USD Million)

42 Rest of Central and South America Fintech Market, By Application, 2021-2029 (USD Million)

43 Rest of Central and South America Fintech Market, By End-use, 2021-2029 (USD Million)

44 Nubank: Products & Services Offering

45 Uala: Products & Services Offering

46 Ebanx: Products & Services Offering

47 RecargaPay: Products & Services Offering

48 Clip: Products & Services Offering

49 BITSO: Products & Services Offering

50 Konfio: Products & Services Offering

51 Wilobank: Products & Services Offering

52 Addi, Inc: Products & Services Offering

53 Vortx: Products & Services Offering

54 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Central & South America Fintech Market Overview

2 Central & South America Fintech Market Value From 2021-2029 (USD Mllion)

3 Central & South America Fintech Market Share, By Technology (2023)

4 Central & South America Fintech Market Share, By Application (2023)

5 Central & South America Fintech Market Share, By End-use (2023)

6 Technological Trends In Central & South America Fintech Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Central & South America Fintech Market

10 Impact Of Challenges On The Central & South America Fintech Market

11 Porter’s Five Forces Analysis

12 Central & South America Fintech Market: By Technology Scope Key Takeaways

13 Central & South America Fintech Market, By Technology Segment: Revenue Growth Analysis

14 Application Programming Interface (API) Market, BY Country, 2021-2029 (USD Mllion)

15 Artificial Intelligence (AI) Market, BY Country, 2021-2029 (USD Mllion)

16 Blockchain Market, BY Country, 2021-2029 (USD Mllion)

17 Data Analytics Market, BY Country, 2021-2029 (USD Mllion)

18 Robotic Process Automation (RPA) Market, BY Country, 2021-2029 (USD Mllion)

19 Biometrics Market, BY Country, 2021-2029 (USD Mllion)

20 Others Market, BY Country, 2021-2029 (USD Mllion)

21 Central & South America Fintech Market: By Application Scope Key Takeaways

22 Central & South America Fintech Market, By Application Segment: Revenue Growth Analysis

23 Payments & Funds Transfer Market, BY Country, 2021-2029 (USD Mllion)

24 Loan, Insurance, and Personal Finance Market, BY Country, 2021-2029 (USD Mllion)

25 Compliance & Regulatory Support Market, BY Country, 2021-2029 (USD Mllion)

26 KYC Verification Market, BY Country, 2021-2029 (USD Mllion)

27 Fraud Monitoring Market, BY Country, 2021-2029 (USD Mllion)

28 Wealth Management Market, BY Country, 2021-2029 (USD Mllion)

29 Others Market, BY Country, 2021-2029 (USD Mllion)

30 Central & South America Fintech Market: By End-use Scope Key Takeaways

31 Central & South America Fintech Market, By End-use Segment: Revenue Growth Analysis

32 Bank, Financial Institutes & Insurance (BFSI) Market, BY Country, 2021-2029 (USD Mllion)

33 Retail and E-commerce Market, BY Country, 2021-2029 (USD Mllion)

34 Healthcare Market, BY Country, 2021-2029 (USD Mllion)

35 Education Market, BY Country, 2021-2029 (USD Mllion)

36 Real Estate Market, BY Country, 2021-2029 (USD Mllion)

37 Travel and Hospitality Market, BY Country, 2021-2029 (USD Mllion)

38 Transportation and Logistics Market, BY Country, 2021-2029 (USD Mllion)

39 Entertainment & Media Market, BY Country, 2021-2029 (USD Mllion)

40 Others Market, BY Country, 2021-2029 (USD Mllion)

41 Regional Segment: Revenue Growth Analysis

42 Central & South America Fintech Market: Regional Analysis

43 Central & South America Fintech Market Overview

44 Central & South America Fintech Market, By Technology

45 Central & South America Fintech Market, By Application

46 Central & South America Fintech Market, By End-use

47 Central & South America Fintech Market, By Country

48 Brazil Fintech Market, By Technology

49 Brazil Fintech Market, By Application

50 Brazil Fintech Market, By End-use

51 Argentina Fintech Market, By Technology

52 Argentina Fintech Market, By Application

53 Argentina Fintech Market, By End-use

54 Chile Fintech Market, By Technology

55 Chile Fintech Market, By Application

56 Chile Fintech Market, By End-use

57 Rest of Central and South America Fintech Market, By Technology

58 Rest of Central and South America Fintech Market, By Application

59 Rest of Central and South America Fintech Market, By End-use

60 Four Quadrant Positioning Matrix

61 Company Market Share Analysis

62 Nubank: Company Snapshot

63 Nubank: SWOT Analysis

64 Nubank: Geographic Presence

65 Uala: Company Snapshot

66 Uala: SWOT Analysis

67 Uala: Geographic Presence

68 Ebanx: Company Snapshot

69 Ebanx: SWOT Analysis

70 Ebanx: Geographic Presence

71 RecargaPay: Company Snapshot

72 RecargaPay: Swot Analysis

73 RecargaPay: Geographic Presence

74 Clip: Company Snapshot

75 Clip: SWOT Analysis

76 Clip: Geographic Presence

77 BITSO: Company Snapshot

78 BITSO: SWOT Analysis

79 BITSO: Geographic Presence

80 Konfio : Company Snapshot

81 Konfio : SWOT Analysis

82 Konfio : Geographic Presence

83 Wilobank: Company Snapshot

84 Wilobank: SWOT Analysis

85 Wilobank: Geographic Presence

86 Addi, Inc.: Company Snapshot

87 Addi, Inc.: SWOT Analysis

88 Addi, Inc.: Geographic Presence

89 Vortx: Company Snapshot

90 Vortx: SWOT Analysis

91 Vortx: Geographic Presence

92 Other Companies: Company Snapshot

93 Other Companies: SWOT Analysis

94 Other Companies: Geographic Presence

The Global Central & South America Fintech Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Central & South America Fintech Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS