Global Cloud Adoption in Banking Market Size, Trends & Analysis - Forecasts to 2029 By End User (Retail Banks, Commercial Banks, Investment Banks, Credit Unions, and Regulatory Bodies), By Type (Cloud Identity and Access Management Software, Cloud Email Security Software, Cloud Intrusion Detection and Prevention System, Cloud Encryption Software, and Cloud Network Security Software), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

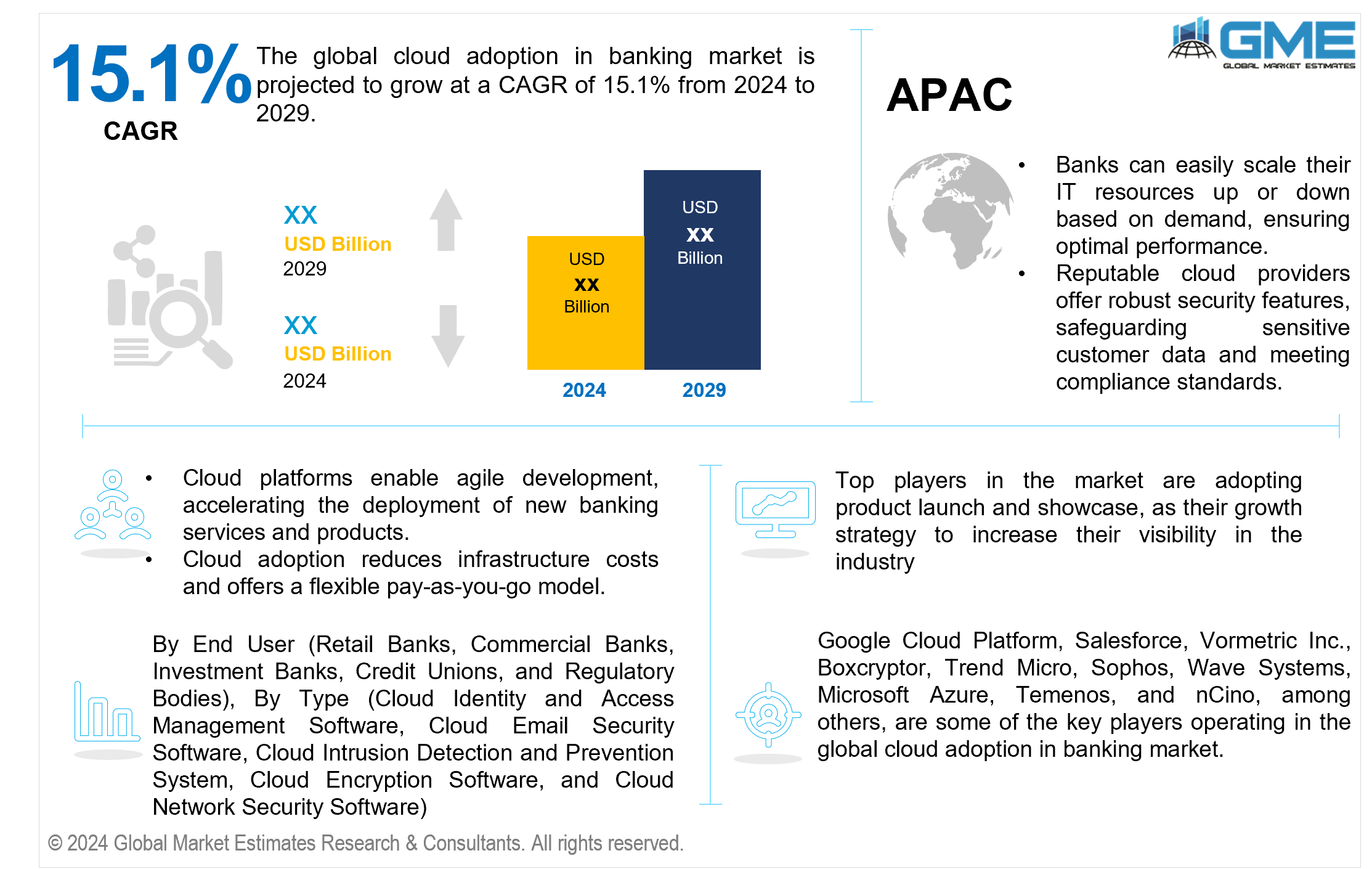

The global cloud adoption in banking market is projected to grow at a CAGR of 15.1% from 2024 to 2029.

Banks are rapidly integrating cloud technologies as an essential component of their digital transformation strategies. This strategic shift provides operational flexibility, promotes innovation, and improves client experiences. The deployment of cloud technology allows banks to quickly respond to changing business requirements, maintaining overall operational efficiency. This integration is a major driver for institutions looking to undergo thorough digital transformations, increasing their competitiveness and delivering higher customer satisfaction levels.

Banks benefit from collaborating with top cloud service providers like Microsoft Azure, Amazon Web Services (AWS), and Google Cloud Platform. This partnership provides access to innovative technologies and dependable infrastructure, empowering banks to enhance their digital capabilities, improve operational efficiency, and stay competitive in the rapidly evolving financial landscape.

Sectors like banking, insurance, and financial services, with frequent data transfers across cloud platforms, heighten the risks of data breach. While security breaches are rare, the finance industry faces potential threats such as unauthorized downloads and malware. This has led to the emergence of specialized cloud security tools, reflecting industry concerns that could impede the broader adoption of cloud technologies in the financial sector. According to the 2023 IBM Cost of a Data Breach Report, the worldwide average expense of a data breach in 2023 amounted to USD 4.45 million, marking a 15% increase from the figures recorded in 2020.

The cloud identity and access management (IAM) software segment is expected to hold the largest share of the market. The segment's growth is attributed to its critical role in improving security and regulatory compliance. IAM systems enable centralized control over user access, authentication, and authorization, critical for protecting sensitive financial data. As banks prioritize strong security measures, the broad deployment of IAM software is projected to add to its market dominance, providing secure and compliant cloud operations.

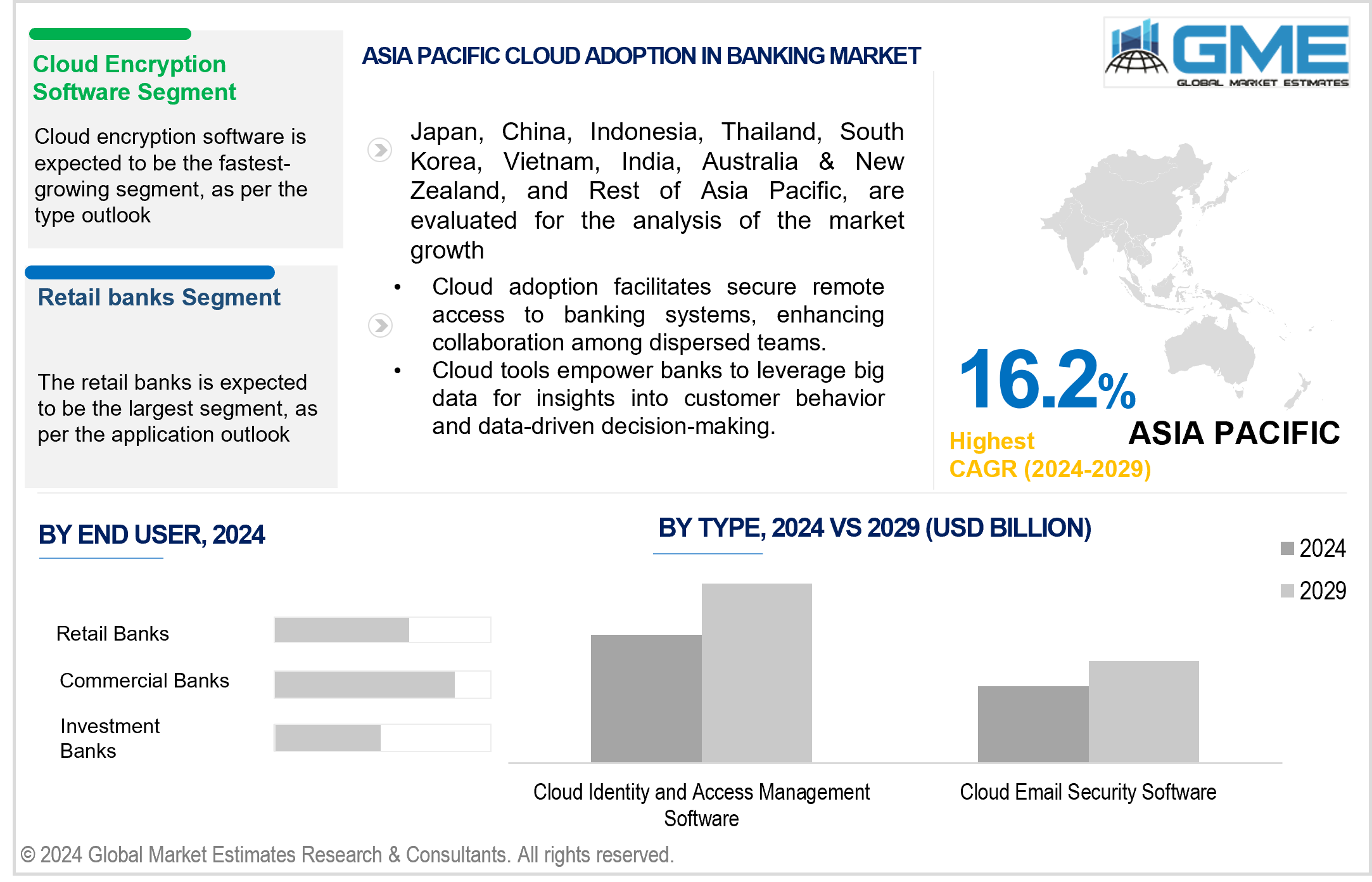

The cloud encryption software segment is expected to be the fastest-growing segment in the market from 2024-2029. The growth is attributed to the heightened emphasis on data security. As banks migrate sensitive information to the cloud, the demand for robust encryption solutions rises, ensuring the confidentiality and integrity of data. Furthermore, increasing innovation and investment in encryption software by the major players also contribute to the segment's growth. For instance, in June 2023, Amazon launched a new encryption option for Amazon Simple Storage Service (S3) called "Amazon S3 dual-layer server-side encryption with keys stored in AWS Key Management Service (DSSE-KMS)." This innovation introduced a dual-layer encryption approach, applying two layers of encryption to objects uploaded to an S3 bucket. DSSE-KMS is designed to comply with National Security Agency CNSSP 15 for FIPS and Data-at-Rest Capability Package (DAR CP) Version 5.0 guidance for two layers of CNSA encryption.

The investment banks segment is anticipated to be the fastest-growing segment in the market from 2024-2029. The growth of the segment is due to investment banks' dynamic and data-intensive environment that necessitates cutting-edge technology solutions for real-time analytics, risk management, and compliance. Many market players are collaborating with investment banks, which is further anticipated to contribute to the segment growth. For instance, in February 2024, HSBC and Google Cloud formed a ground-breaking partnership to enhance climate mitigation and resilience efforts. The collaboration involves HSBC providing financing and support to companies participating in the Google Cloud Ready–Sustainability (GCR-Sustainability) program.

The retail banks segment is expected to hold the largest share of the market. The segment’s expected dominance is due to the sector's shift towards digital transformation and customer-centric solutions. Cloud technology enables retail banks to improve their agility, scalability, and client experience. As retail banks promote innovation and seek cost-effective data management solutions, cloud services adoption is critical.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include the increasing adoption of advanced networks such as big data analytics, artificial intelligence, augmented reality, virtual reality, machine learning, and advanced network technologies (4G, 5G, LTE) by the banking sector in the region. Furthermore, large market players such as Oracle, Microsoft, IBM, and Amazon are also contributing to the expected dominance of the region in the cloud adoption in banking market.

Asia Pacific is predicted to witness rapid growth during the forecast period. The regional market growth is attributed to the increase in digital transformation projects across banking and financial services. With a developing economy and rising technical awareness, Asia Pacific financial institutions are adopting cloud technologies to improve agility, scalability, and customer service. Furthermore, the growing trend of mobile banking contributes to the increasing cloud usage in the Asia Pacific.

Google Cloud Platform, Salesforce, Vormetric Inc., Boxcryptor, Trend Micro, Sophos, Wave Systems, Microsoft Azure, Temenos, and nCino, among others, are some of the key players operating in the global cloud adoption in banking market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2023, Cloud banking firm nCino expanded its 12-year partnership with Salesforce, aiming to deepen its integration with Salesforce's platform tools. The extended partnership focuses on enhancing customer experiences in areas such as onboarding, loan origination, deposit account opening, and portfolio management for financial institutions.

In January 2023, HDFC Bank, India's largest private sector bank, entered into a partnership with Microsoft as a part of its digital transformation initiative. The partnership aims to enhance the bank's application portfolio, modernize its data landscape, and secure its enterprise using Microsoft Cloud. HDFC Bank will utilize Microsoft Azure to consolidate and modernize its enterprise data landscape, leveraging a Federated Data Lake to enhance information management capabilities.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL CLOUD ADOPTION IN BANKING MARKET, BY TYPE

4.1 Introduction

4.2 Cloud Adoption in Banking Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Cloud Identity and Access Management Software

4.4.1 Cloud Identity and Access Management Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Cloud Email Security Software

4.5.1 Cloud Email Security Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Cloud Intrusion Detection and Prevention System

4.6.1 Cloud Intrusion Detection and Prevention System Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Cloud Encryption Software

4.7.1 Cloud Encryption Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Cloud Network Security Software

4.8.1 Cloud Network Security Software Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL CLOUD ADOPTION IN BANKING MARKET, BY END USER

5.1 Introduction

5.2 Cloud Adoption in Banking Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Retail Banks

5.4.1 Retail Banks Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Commercial Banks

5.5.1 Commercial Banks Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Investment Banks

5.6.1 Investment Banks Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Credit Unions

5.7.1 Credit Unions Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Regulatory Bodies

5.8.1 Regulatory Bodies Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL CLOUD ADOPTION IN BANKING MARKET, BY REGION

6.1 Introduction

6.2 North America Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By End User

6.2.3.2 Canada Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By End User

6.2.3.3 Mexico Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By End User

6.3 Europe Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By End User

6.3.3.2 U.K. Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By End User

6.3.3.3 France Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By End User

6.3.3.4 Italy Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By End User

6.3.3.5 Spain Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By End User

6.3.3.6 Netherlands Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By End User

6.4 Asia Pacific Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By End User

6.4.3.2 Japan Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By End User

6.4.3.3 India Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By End User

6.4.3.4 South Korea Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By End User

6.4.3.5 Singapore Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By End User

6.4.3.6 Malaysia Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By End User

6.4.3.7 Thailand Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By End User

6.4.3.8 Indonesia Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By End User

6.4.3.9 Vietnam Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By End User

6.4.3.10 Taiwan Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By End User

6.5 Middle East and Africa Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By End User

6.5.3.3 Israel Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By End User

6.5.3.4 South Africa Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By End User

6.6 Central and South America Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By End User

6.6.3.2 Argentina Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By End User

6.6.3.3 Chile Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Cloud Adoption in Banking Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Google Cloud Platform

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Salesforce

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Vormetric Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Boxcryptor

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 nCino

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 TREND MICRO

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Sophos

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Wave Systems

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Microsoft Azure

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Temenos

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

2 Cloud Identity and Access Management Software Market, By Region, 2021-2029 (USD Mllion)

3 Cloud Email Security Software Market, By Region, 2021-2029 (USD Mllion)

4 Cloud Encryption Software Market, By Region, 2021-2029 (USD Mllion)

5 Cloud Network Security Software Market, By Region, 2021-2029 (USD Mllion)

6 Cloud Intrusion Detection and Prevention System Market, By Region, 2021-2029 (USD Mllion)

7 Global Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

8 Retail Banks Market, By Region, 2021-2029 (USD Mllion)

9 Commercial Banks Market, By Region, 2021-2029 (USD Mllion)

10 Investment Banks Market, By Region, 2021-2029 (USD Mllion)

11 Credit Unions Market, By Region, 2021-2029 (USD Mllion)

12 Regulatory Bodies Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

15 North America Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

16 North America Cloud Adoption in Banking Market, By COUNTRY, 2021-2029 (USD Mllion)

17 U.S. Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

18 U.S. Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

19 Canada Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

20 Canada Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

21 Mexico Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

22 Mexico Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

23 Europe Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

24 Europe Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

25 Europe Cloud Adoption in Banking Market, By Country, 2021-2029 (USD Mllion)

26 Germany Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

27 Germany Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

28 U.K. Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

29 U.K. Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

30 France Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

31 France Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

32 Italy Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

33 Italy Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

34 Spain Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

35 Spain Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

36 Netherlands Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

37 Netherlands Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

38 Rest Of Europe Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

39 Rest Of Europe Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

40 Asia Pacific Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

41 Asia Pacific Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

42 Asia Pacific Cloud Adoption in Banking Market, By Country, 2021-2029 (USD Mllion)

43 China Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

44 China Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

45 Japan Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

46 Japan Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

47 India Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

48 India Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

49 South Korea Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

50 South Korea Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

51 Singapore Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

52 Singapore Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

53 Thailand Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

54 Thailand Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

55 Malaysia Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

56 Malaysia Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

57 Indonesia Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

58 Indonesia Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

59 Vietnam Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

60 Vietnam Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

61 Taiwan Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

62 Taiwan Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

63 Rest of APAC Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

64 Rest of APAC Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

65 Middle East and Africa Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

66 Middle East and Africa Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

67 Middle East and Africa Cloud Adoption in Banking Market, By Country, 2021-2029 (USD Mllion)

68 Saudi Arabia Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

69 Saudi Arabia Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

70 UAE Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

71 UAE Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

72 Israel Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

73 Israel Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

74 South Africa Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

75 South Africa Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

77 Rest Of Middle East and Africa Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

78 Central and South America Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

79 Central and South America Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

80 Central and South America Cloud Adoption in Banking Market, By Country, 2021-2029 (USD Mllion)

81 Brazil Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

82 Brazil Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

83 Chile Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

84 Chile Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

85 Argentina Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

86 Argentina Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

87 Rest Of Central and South America Cloud Adoption in Banking Market, By Type, 2021-2029 (USD Mllion)

88 Rest Of Central and South America Cloud Adoption in Banking Market, By End User, 2021-2029 (USD Mllion)

89 Google Cloud Platform: Products & Services Offering

90 Salesforce: Products & Services Offering

91 Vormetric Inc.: Products & Services Offering

92 Boxcryptor: Products & Services Offering

93 NCino: Products & Services Offering

94 TREND MICRO: Products & Services Offering

95 Sophos : Products & Services Offering

96 Wave Systems: Products & Services Offering

97 Microsoft Azure, Inc: Products & Services Offering

98 Temenos: Products & Services Offering

99 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Cloud Adoption in Banking Market Overview

2 Global Cloud Adoption in Banking Market Value From 2021-2029 (USD Mllion)

3 Global Cloud Adoption in Banking Market Share, By Type (2023)

4 Global Cloud Adoption in Banking Market Share, By End User (2023)

5 Global Cloud Adoption in Banking Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Cloud Adoption in Banking Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Cloud Adoption in Banking Market

10 Impact Of Challenges On The Global Cloud Adoption in Banking Market

11 Porter’s Five Forces Analysis

12 Global Cloud Adoption in Banking Market: By Type Scope Key Takeaways

13 Global Cloud Adoption in Banking Market, By Type Segment: Revenue Growth Analysis

14 Cloud Identity and Access Management Software Market, By Region, 2021-2029 (USD Mllion)

15 Cloud Email Security Software Market, By Region, 2021-2029 (USD Mllion)

16 Cloud Encryption SoftwareMarket, By Region, 2021-2029 (USD Mllion)

17 Cloud Network Security Software Market, By Region, 2021-2029 (USD Mllion)

18 Cloud Intrusion Detection and Prevention System Market, By Region, 2021-2029 (USD Mllion)

19 Global Cloud Adoption in Banking Market: By End User Scope Key Takeaways

20 Global Cloud Adoption in Banking Market, By End User Segment: Revenue Growth Analysis

21 Retail Banks Market, By Region, 2021-2029 (USD Mllion)

22 Commercial Banks Market, By Region, 2021-2029 (USD Mllion)

23 Investment Banks Market, By Region, 2021-2029 (USD Mllion)

24 Credit Unions Market, By Region, 2021-2029 (USD Mllion)

25 Regulatory Bodies Market, By Region, 2021-2029 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Cloud Adoption in Banking Market: Regional Analysis

28 North America Cloud Adoption in Banking Market Overview

29 North America Cloud Adoption in Banking Market, By Type

30 North America Cloud Adoption in Banking Market, By End User

31 North America Cloud Adoption in Banking Market, By Country

32 U.S. Cloud Adoption in Banking Market, By Type

33 U.S. Cloud Adoption in Banking Market, By End User

34 Canada Cloud Adoption in Banking Market, By Type

35 Canada Cloud Adoption in Banking Market, By End User

36 Mexico Cloud Adoption in Banking Market, By Type

37 Mexico Cloud Adoption in Banking Market, By End User

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Google Cloud Platform: Company Snapshot

41 Google Cloud Platform: SWOT Analysis

42 Google Cloud Platform: Geographic Presence

43 Salesforce: Company Snapshot

44 Salesforce: SWOT Analysis

45 Salesforce: Geographic Presence

46 Vormetric Inc.: Company Snapshot

47 Vormetric Inc.: SWOT Analysis

48 Vormetric Inc.: Geographic Presence

49 Boxcryptor: Company Snapshot

50 Boxcryptor: Swot Analysis

51 Boxcryptor: Geographic Presence

52 nCino: Company Snapshot

53 nCino: SWOT Analysis

54 nCino: Geographic Presence

55 Trend Micro: Company Snapshot

56 Trend Micro: SWOT Analysis

57 Trend Micro: Geographic Presence

58 Sophos : Company Snapshot

59 Sophos : SWOT Analysis

60 Sophos : Geographic Presence

61 Wave Systems: Company Snapshot

62 Wave Systems: SWOT Analysis

63 Wave Systems: Geographic Presence

64 Microsoft Azure, Inc.: Company Snapshot

65 Microsoft Azure, Inc.: SWOT Analysis

66 Microsoft Azure, Inc.: Geographic Presence

67 Temenos: Company Snapshot

68 Temenos: SWOT Analysis

69 Temenos: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Cloud Adoption in Banking Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cloud Adoption in Banking Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS