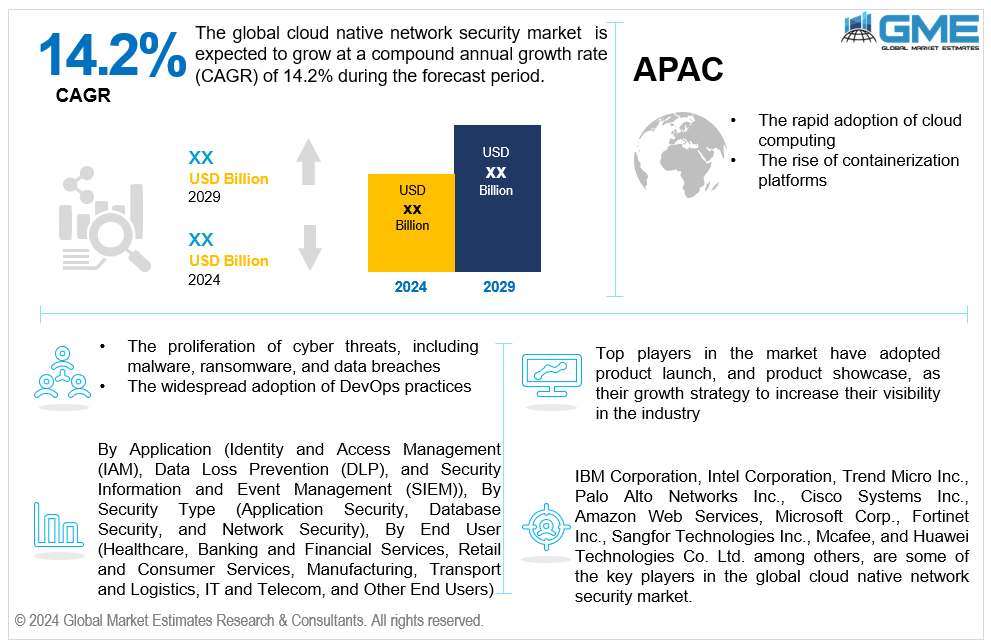

Global Cloud Native Network Security Market Size, Trends & Analysis - Forecasts to 2029 By Application (Identity and Access Management (IAM), Data Loss Prevention (DLP), and Security Information and Event Management (SIEM)), By Security Type (Application Security, Database Security, and Network Security), By End User (Healthcare, Banking and Financial Services, Retail and Consumer Services, Manufacturing, Transport and Logistics, IT and Telecom, and Other End Users), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global cloud native network security market is estimated to exhibit a CAGR of 14.2% from 2024 to 2029.

The primary factors propelling the market growth are the rapid adoption of cloud computing and the rise of containerization platforms. The growing dependence of enterprises on cloud services and infrastructure increases their attack surface due to cloud computing. This change creates a need for cloud-native security solutions since it calls for strong security measures to safeguard data, apps, and networks in the cloud. Moreover, cloud environments are inherently dynamic and ephemeral, with resources being provisioned, scaled, and deprovisioned on demand. Cloud-native security solutions are specially designed to offer protection, visibility, and control in dynamic cloud environments. For instance, according to the Eurostat, in 2020, the average cloud adoption rate in the EU was 36%.

The increasing proliferation of cyber threats, including malware, ransomware, and data breaches, along with the widespread adoption of DevOps practices, are expected to support the market growth. In order to bypass conventional security measures and take advantage of weaknesses in cloud systems, cybercriminals are constantly refining and advancing their attack methodologies. In particular, ransomware and malware attacks have grown increasingly complex, with attackers employing cutting-edge strategies like fileless attacks, encryption evasion, and polymorphic malware. Cloud-native security solutions use machine learning algorithms, behavioral analytics, and advanced threat detection to identify and neutralize these evolving risks. Additionally, cloud-native network security systems provide features like data encryption, access controls, and data loss prevention (DLP) to assist enterprises in reducing the risk of data breaches and safeguarding sensitive data stored in the cloud. For instance, according to AAG IT Services, in the first half of 2022, there were about 236.1 million ransomware attacks occurred globally.

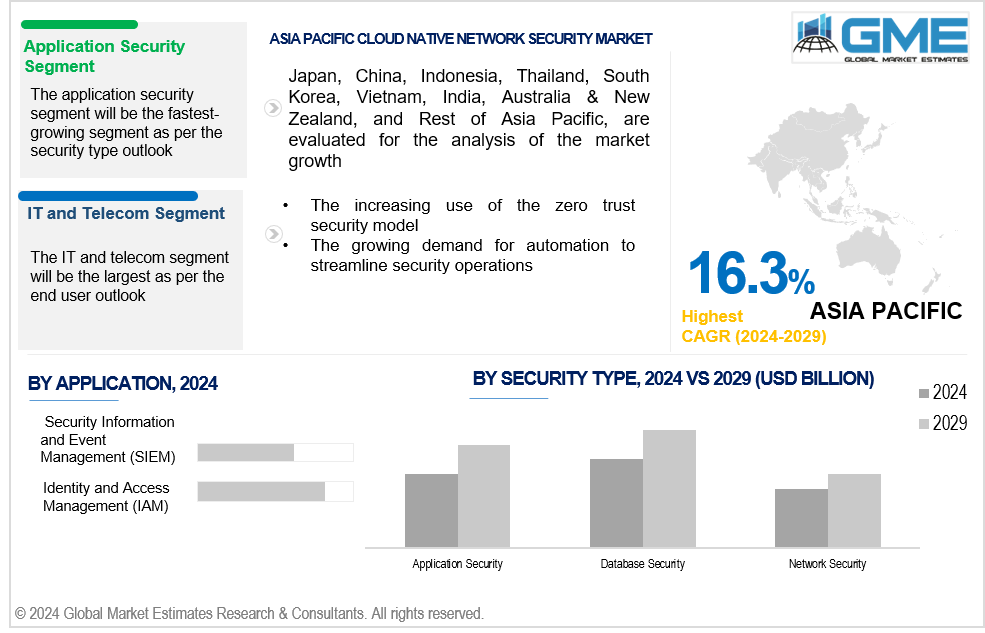

The increasing use of the zero-trust security model and the growing demand for automation to streamline security operations propel market growth. Cloud infrastructures are highly complex and dynamic, with dispersed infrastructure, a wide range of applications, and quick configuration changes. Manually managing security across various environments is complicated and resource-intensive. Automation technologies, including robotic process automation (RPA), machine learning (ML), and artificial intelligence (AI), are used by cloud-native network security systems to automate security operations and expedite duties like threat detection, incident response, and policy enforcement.

Cloud-native network security providers have the opportunity to develop specific security solutions for serverless architectures due to the growing popularity of serverless computing, often referred to as Function as a Service (FaaS). Additionally, by integrating artificial intelligence (AI) and machine learning (ML) technologies, cloud-native network security companies can enhance their capabilities for threat identification, anomaly detection, and predictive analytics.

However, limited awareness and understanding of cloud-native security solutions and integration complexities with existing security infrastructure hinder market growth.

The identity and access management (IAM) segment is expected to hold the largest share of the market over the forecast period. Since IAM solutions manage user identities, access rights, and authentication methods across cloud environments, they are essential to cloud-native network security. IAM solutions assist companies in enforcing least privilege access controls, securely authenticating individuals, and preventing illegal access to private information and resources. Additionally, IAM solutions include native IAM features for managing identities and access restrictions and are strongly linked with major cloud platforms like AWS, Azure, and Google Cloud.

The security information and event management (SIEM) segment is expected to be the fastest-growing segment in the market from 2024-2029. Cloud-native SIEM systems offer centralized logging, monitoring, and analysis of security events across cloud environments and are specifically developed to handle visibility, control, and compliance challenges. These solutions enable companies to see cloud-native workloads, apps, and infrastructure by providing native connectors with cloud platforms and services.

The database security segment is expected to hold the largest share of the market over the forecast period. Databases hold some of an organization's most sensitive and significant data, including financial records, customer information, intellectual property, and data essential to company operations. Protecting this data is necessary for enterprises to uphold trust, adhere to legal requirements, and prevent financial and reputational harm.

The application security segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Cloud-native applications are becoming increasingly prevalent, which makes them appealing targets for attackers. Threat actors constantly change the strategies and tools they use to take advantage of loopholes in cloud-native systems. In order to protect the security and integrity of their cloud-native deployments, companies can identify and eliminate threats to their applications using application security solutions.

The IT and telecom segment is expected to hold the largest share of the market over the forecast period. IT and telecom companies operate in an environment where network security is paramount. These companies manage extensive networks that process private information and communications for both internal and external users. Guaranteeing these networks' security and integrity is crucial for maintaining assurance and adhering to legal requirements.

The banking and financial services segment is anticipated to be the fastest-growing segment in the market from 2024-2029. Financial institutions are adopting cloud-native solutions more frequently to update their IT infrastructure, increase agility, and improve client experiences. Robust cloud-native network security solutions are essential to safeguard sensitive financial data and transactions as banks move their core banking apps and services to the cloud.

North America is expected to be the largest region in the global market. The regional market growth is attributed to the significant investments made by governments and companies in cutting-edge network security solutions to safeguard sensitive information, digital assets, and vital infrastructure against cyberattacks. For instance, the United States released new spending bills in June 2022 for the fiscal year 2023, which included a USD 15.6 billion budget for cybersecurity.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Cloud usage has rapidly expanded across various industries in Asia Pacific, including manufacturing, retail, healthcare, finance, and government. As more organizations embrace cloud computing to modernize their IT infrastructure and drive innovation, robust network security solutions tailored to cloud-native environments become essential. For instance, according to Canalys, in the third quarter of 2021, China spent USD 9.2 billion domestically on cloud services, an increase of 18% from 2020.

IBM Corporation, Intel Corporation, Trend Micro Inc., Palo Alto Networks Inc., Cisco Systems Inc., Amazon Web Services, Microsoft Corp., Fortinet Inc., Sangfor Technologies Inc., Mcafee, and Huawei Technologies Co. Ltd. among others, are some of the key players operating in the global cloud native network security market.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2020, Fortinet Secure SD-WAN, a new security solution for multi-cloud computing, was introduced by Fortinet Inc. This solution enables organizations and users to connect securely with cloud solutions and apps, enhancing the company's current Secure SD-WAN Cloud On-Ramp capabilities.

In July 2021, Microsoft Corporation acquired CloudKnox Security. This acquisition allows Microsoft to provide unified privileged access and cloud entitlement management.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL CLOUD NATIVE NETWORK SECURITY MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 End User Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL CLOUD NATIVE NETWORK SECURITY MARKET, BY APPLICATION

4.1 Introduction

4.2 Cloud Native Network Security Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Identity and Access Management (IAM)

4.4.1 Identity and Access Management (IAM) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Data Loss Prevention (DLP)

4.5.1 Data Loss Prevention (DLP) Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Security Information and Event Management (SIEM)

4.6.1 Security Information and Event Management (SIEM) Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL CLOUD NATIVE NETWORK SECURITY MARKET, BY SECURITY TYPE

5.1 Introduction

5.2 Cloud Native Network Security Market: Security Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Application Security

5.4.1 Application Security Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Database Security

5.5.1 Database Security Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Network Security

5.6.1 Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL CLOUD NATIVE NETWORK SECURITY MARKET, BY END USER

6.1 Introduction

6.2 Cloud Native Network Security Market: End User Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Healthcare

6.4.1 Healthcare Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Banking and Financial Services

6.5.1 Banking and Financial Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Retail and Consumer Services

6.6.1 Retail and Consumer Services Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Manufacturing

6.7.1 Manufacturing Market Estimates and Forecast, 2021-2029 (USD Million)

6.8 IT and Telecom

6.8.1 IT and Telecom Market Estimates and Forecast, 2021-2029 (USD Million)

6.9 Other End Users

6.9.1 Other End Users Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL CLOUD NATIVE NETWORK SECURITY MARKET, BY REGION

7.1 Introduction

7.2 North America Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Application

7.2.2 By Security Type

7.2.3 By End User

7.2.4 By Country

7.2.4.1 U.S. Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Application

7.2.4.1.2 By Security Type

7.2.4.1.3 By End User

7.2.4.2 Canada Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Application

7.2.4.2.2 By Security Type

7.2.4.2.3 By End User

7.2.4.3 Mexico Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Application

7.2.4.3.2 By Security Type

7.2.4.3.3 By End User

7.3 Europe Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Application

7.3.2 By Security Type

7.3.3 By End User

7.3.4 By Country

7.3.4.1 Germany Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Application

7.3.4.1.2 By Security Type

7.3.4.1.3 By End User

7.3.4.2 U.K. Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Application

7.3.4.2.2 By Security Type

7.3.4.2.3 By End User

7.3.4.3 France Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Application

7.3.4.3.2 By Security Type

7.3.4.3.3 By End User

7.3.4.4 Italy Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Application

7.3.4.4.2 By Security Type

7.2.4.4.3 By End User

7.3.4.5 Spain Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Application

7.3.4.5.2 By Security Type

7.2.4.5.3 By End User

7.3.4.6 Netherlands Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Application

7.3.4.6.2 By Security Type

7.2.4.6.3 By End User

7.3.4.7 Rest of Europe Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Application

7.3.4.7.2 By Security Type

7.2.4.7.3 By End User

7.4 Asia Pacific Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Application

7.4.2 By Security Type

7.4.3 By End User

7.4.4 By Country

7.4.4.1 China Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Application

7.4.4.1.2 By Security Type

7.4.4.1.3 By End User

7.4.4.2 Japan Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Application

7.4.4.2.2 By Security Type

7.4.4.2.3 By End User

7.4.4.3 India Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Application

7.4.4.3.2 By Security Type

7.4.4.3.3 By End User

7.4.4.4 South Korea Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Application

7.4.4.4.2 By Security Type

7.4.4.4.3 By End User

7.4.4.5 Singapore Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Application

7.4.4.5.2 By Security Type

7.4.4.5.3 By End User

7.4.4.6 Malaysia Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Application

7.4.4.6.2 By Security Type

7.4.4.6.3 By End User

7.4.4.7 Thailand Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Application

7.4.4.7.2 By Security Type

7.4.4.7.3 By End User

7.4.4.8 Indonesia Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Application

7.4.4.8.2 By Security Type

7.4.4.8.3 By End User

7.4.4.9 Vietnam Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Application

7.4.4.9.2 By Security Type

7.4.4.9.3 By End User

7.4.4.10 Taiwan Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Application

7.4.4.10.2 By Security Type

7.4.4.10.3 By End User

7.4.4.11 Rest of Asia Pacific Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Application

7.4.4.11.2 By Security Type

7.4.4.11.3 By End User

7.5 Middle East and Africa Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Application

7.5.2 By Security Type

7.5.3 By End User

7.5.4 By Country

7.5.4.1 Saudi Arabia Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Application

7.5.4.1.2 By Security Type

7.5.4.1.3 By End User

7.5.4.2 U.A.E. Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Application

7.5.4.2.2 By Security Type

7.5.4.2.3 By End User

7.5.4.3 Israel Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Application

7.5.4.3.2 By Security Type

7.5.4.3.3 By End User

7.5.4.4 South Africa Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Application

7.5.4.4.2 By Security Type

7.5.4.4.3 By End User

7.5.4.5 Rest of Middle East and Africa Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Application

7.5.4.5.2 By Security Type

7.5.4.5.2 By End User

7.6 Central and South America Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Application

7.6.2 By Security Type

7.6.3 By End User

7.6.4 By Country

7.6.4.1 Brazil Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Application

7.6.4.1.2 By Security Type

7.6.4.1.3 By End User

7.6.4.2 Argentina Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Application

7.6.4.2.2 By Security Type

7.6.4.2.3 By End User

7.6.4.3 Chile Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Application

7.6.4.3.2 By Security Type

7.6.4.3.3 By End User

7.6.4.4 Rest of Central and South America Cloud Native Network Security Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Application

7.6.4.4.2 By Security Type

7.6.4.4.3 By End User

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 IBM Corporation

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Intel Corporation

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Trend Micro Inc.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Palo Alto Networks Inc.

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Cisco Systems Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 AMAZON WEB SERVICES

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Microsoft Corp.

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Fortinet Inc.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Sangfor Technologies Inc.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Mcafee

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Application Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Cloud Native Network Security Market, By Application, 2021-2029 (USD Mllion)

2 Identity and Access Management (IAM) Market, By Region, 2021-2029 (USD Mllion)

3 Data Loss Prevention (DLP) Market, By Region, 2021-2029 (USD Mllion)

4 Security Information and Event Management (SIEM) Market, By Region, 2021-2029 (USD Mllion)

5 Global Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Mllion)

6 Application Security Market, By Region, 2021-2029 (USD Mllion)

7 Database Security Market, By Region, 2021-2029 (USD Mllion)

8 Network Security Market, By Region, 2021-2029 (USD Mllion)

9 Global Cloud Native Network Security Market, By End User, 2021-2029 (USD Mllion)

10 Healthcare Market, By Region, 2021-2029 (USD Mllion)

11 Banking and Financial Services Market, By Region, 2021-2029 (USD Mllion)

12 Retail and Consumer Services Market, By Region, 2021-2029 (USD Mllion)

13 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

14 IT and Telecom Market, By Region, 2021-2029 (USD Mllion)

15 Other End Users Market, By Region, 2021-2029 (USD Mllion)

16 Regional Analysis, 2021-2029 (USD Mllion)

17 North America Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

18 North America Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

19 North America Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

20 North America Cloud Native Network Security Market, By Country, 2021-2029 (USD Million)

21 U.S Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

22 U.S Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

23 U.S Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

24 Canada Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

25 Canada Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

26 Canada Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

27 Mexico Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

28 Mexico Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

29 Mexico Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

30 Europe Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

31 Europe Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

32 Europe Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

33 Europe Cloud Native Network Security Market, By Country 2021-2029 (USD Million)

34 Germany Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

35 Germany Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

36 Germany Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

37 U.K Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

38 U.K Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

39 U.K Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

40 France Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

41 France Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

42 France Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

43 Italy Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

44 Italy Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

45 Italy Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

46 Spain Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

47 Spain Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

48 Spain Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

49 Netherlands Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

50 Netherlands Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

51 Netherlands Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

52 Rest Of Europe Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

53 Rest Of Europe Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

54 Rest of Europe Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

55 Asia Pacific Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

56 Asia Pacific Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

57 Asia Pacific Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

58 Asia Pacific Cloud Native Network Security Market, By Country, 2021-2029 (USD Million)

59 China Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

60 China Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

61 China Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

62 India Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

63 India Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

64 India Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

65 Japan Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

66 Japan Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

67 Japan Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

68 South Korea Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

69 South Korea Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

70 South Korea Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

71 Malaysia Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

72 Malaysia Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

73 Malaysia Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

74 Thailand Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

75 Thailand Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

76 Thailand Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

77 Indonesia Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

78 Indonesia Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

79 Indonesia Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

80 Vietnam Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

81 Vietnam Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

82 Vietnam Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

83 Taiwan Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

84 Taiwan Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

85 Taiwan Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

86 Rest of Asia Pacific Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

87 Rest of Asia Pacific Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

88 Rest of Asia Pacific Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

89 Middle East and Africa Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

90 Middle East and Africa Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

91 Middle East and Africa Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

92 Middle East and Africa Cloud Native Network Security Market, By Country, 2021-2029 (USD Million)

93 Saudi Arabia Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

94 Saudi Arabia Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

95 Saudi Arabia Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

96 UAE Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

97 UAE Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

98 UAE Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

99 Israel Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

100 Israel Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

101 Israel Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

102 South Africa Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

103 South Africa Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

104 South Africa Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

107 Rest of Middle East and Africa Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

108 Central and South America Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

109 Central and South America Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

110 Central and South America Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

111 Central and South America Cloud Native Network Security Market, By Country, 2021-2029 (USD Million)

112 Brazil Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

113 Brazil Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

114 Brazil Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

115 Argentina Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

116 Argentina Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

117 Argentina Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

118 Chile Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

119 Chile Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

120 Chile Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

121 Rest of Central and South America Cloud Native Network Security Market, By Application, 2021-2029 (USD Million)

122 Rest of Central and South America Cloud Native Network Security Market, By Security Type, 2021-2029 (USD Million)

123 Rest of Central and South America Cloud Native Network Security Market, By End User, 2021-2029 (USD Million)

124 IBM Corporation: Products & Services Offering

125 Intel Corporation: Products & Services Offering

126 Trend Micro Inc.: Products & Services Offering

127 Palo Alto Networks Inc.: Products & Services Offering

128 Cisco Systems Inc.: Products & Services Offering

129 AMAZON WEB SERVICES: Products & Services Offering

130 Microsoft Corp. : Products & Services Offering

131 Fortinet Inc.: Products & Services Offering

132 Sangfor Technologies Inc., Inc: Products & Services Offering

133 Mcafee: Products & Services Offering

134 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Cloud Native Network Security Market Overview

2 Global Cloud Native Network Security Market Value From 2021-2029 (USD Mllion)

3 Global Cloud Native Network Security Market Share, By Application (2023)

4 Global Cloud Native Network Security Market Share, By Security Type (2023)

5 Global Cloud Native Network Security Market Share, By End User (2023)

6 Global Cloud Native Network Security Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Cloud Native Network Security Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Cloud Native Network Security Market

11 Impact Of Challenges On The Global Cloud Native Network Security Market

12 Porter’s Five Forces Analysis

13 Global Cloud Native Network Security Market: By Application Scope Key Takeaways

14 Global Cloud Native Network Security Market, By Application Segment: Revenue Growth Analysis

15 Identity and Access Management (IAM) Market, By Region, 2021-2029 (USD Mllion)

16 Data Loss Prevention (DLP) Market, By Region, 2021-2029 (USD Mllion)

17 Security Information and Event Management (SIEM) Market, By Region, 2021-2029 (USD Mllion)

18 Global Cloud Native Network Security Market: By Security Type Scope Key Takeaways

19 Global Cloud Native Network Security Market, By Security Type Segment: Revenue Growth Analysis

20 Application Security Market, By Region, 2021-2029 (USD Mllion)

21 Database Security Market, By Region, 2021-2029 (USD Mllion)

22 Network Security Market, By Region, 2021-2029 (USD Mllion)

23 Global Cloud Native Network Security Market: By End User Scope Key Takeaways

24 Global Cloud Native Network Security Market, By End User Segment: Revenue Growth Analysis

25 Healthcare Market, By Region, 2021-2029 (USD Mllion)

26 Banking and Financial Services Market, By Region, 2021-2029 (USD Mllion)

27 Retail and Consumer Services Market, By Region, 2021-2029 (USD Mllion)

28 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

29 IT and Telecom Market, By Region, 2021-2029 (USD Mllion)

30 Other End Users Market, By Region, 2021-2029 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global Cloud Native Network Security Market: Regional Analysis

33 North America Cloud Native Network Security Market Overview

34 North America Cloud Native Network Security Market, By Application

35 North America Cloud Native Network Security Market, By Security Type

36 North America Cloud Native Network Security Market, By End User

37 North America Cloud Native Network Security Market, By Country

38 U.S. Cloud Native Network Security Market, By Application

39 U.S. Cloud Native Network Security Market, By Security Type

40 U.S. Cloud Native Network Security Market, By End User

41 Canada Cloud Native Network Security Market, By Application

42 Canada Cloud Native Network Security Market, By Security Type

43 Canada Cloud Native Network Security Market, By End User

44 Mexico Cloud Native Network Security Market, By Application

45 Mexico Cloud Native Network Security Market, By Security Type

46 Mexico Cloud Native Network Security Market, By End User

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 IBM Corporation: Company Snapshot

50 IBM Corporation: SWOT Analysis

51 IBM Corporation: Geographic Presence

52 Intel Corporation: Company Snapshot

53 Intel Corporation: SWOT Analysis

54 Intel Corporation: Geographic Presence

55 Trend Micro Inc.: Company Snapshot

56 Trend Micro Inc.: SWOT Analysis

57 Trend Micro Inc.: Geographic Presence

58 Palo Alto Networks Inc.: Company Snapshot

59 Palo Alto Networks Inc.: Swot Analysis

60 Palo Alto Networks Inc.: Geographic Presence

61 Cisco Systems Inc.: Company Snapshot

62 Cisco Systems Inc.: SWOT Analysis

63 Cisco Systems Inc.: Geographic Presence

64 AMAZON WEB SERVICES: Company Snapshot

65 AMAZON WEB SERVICES: SWOT Analysis

66 AMAZON WEB SERVICES: Geographic Presence

67 Microsoft Corp. : Company Snapshot

68 Microsoft Corp. : SWOT Analysis

69 Microsoft Corp. : Geographic Presence

70 Fortinet Inc.: Company Snapshot

71 Fortinet Inc.: SWOT Analysis

72 Fortinet Inc.: Geographic Presence

73 Sangfor Technologies Inc., Inc.: Company Snapshot

74 Sangfor Technologies Inc., Inc.: SWOT Analysis

75 Sangfor Technologies Inc., Inc.: Geographic Presence

76 Mcafee: Company Snapshot

77 Mcafee: SWOT Analysis

78 Mcafee: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global Cloud Native Network Security Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cloud Native Network Security Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS