Global Coagulation Analyzer Market Size, Trends & Analysis - Forecasts to 2026 By Product (Analyzers [Clinical Laboratory Analyzers, Point of Care Analyzers] and Consumables [Reagents, Stains]), By Technology (Mechanical, Electrochemical, Optical, and Others), By Test (Prothrombin Time Testing (PT), D-Dimer Testing, Fibrinogen, Activated Clotting Time Testing (ACT), Activated Partial Thromboplastin Time Testing (APTT), Platelet Function Tests, Anti-Factor XA Tests, Heparin & Protamine Dose-Response Tests For Act, and Others), By End-User (Hospital, Diagnostic Centres, Clinical Laboratories, and Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

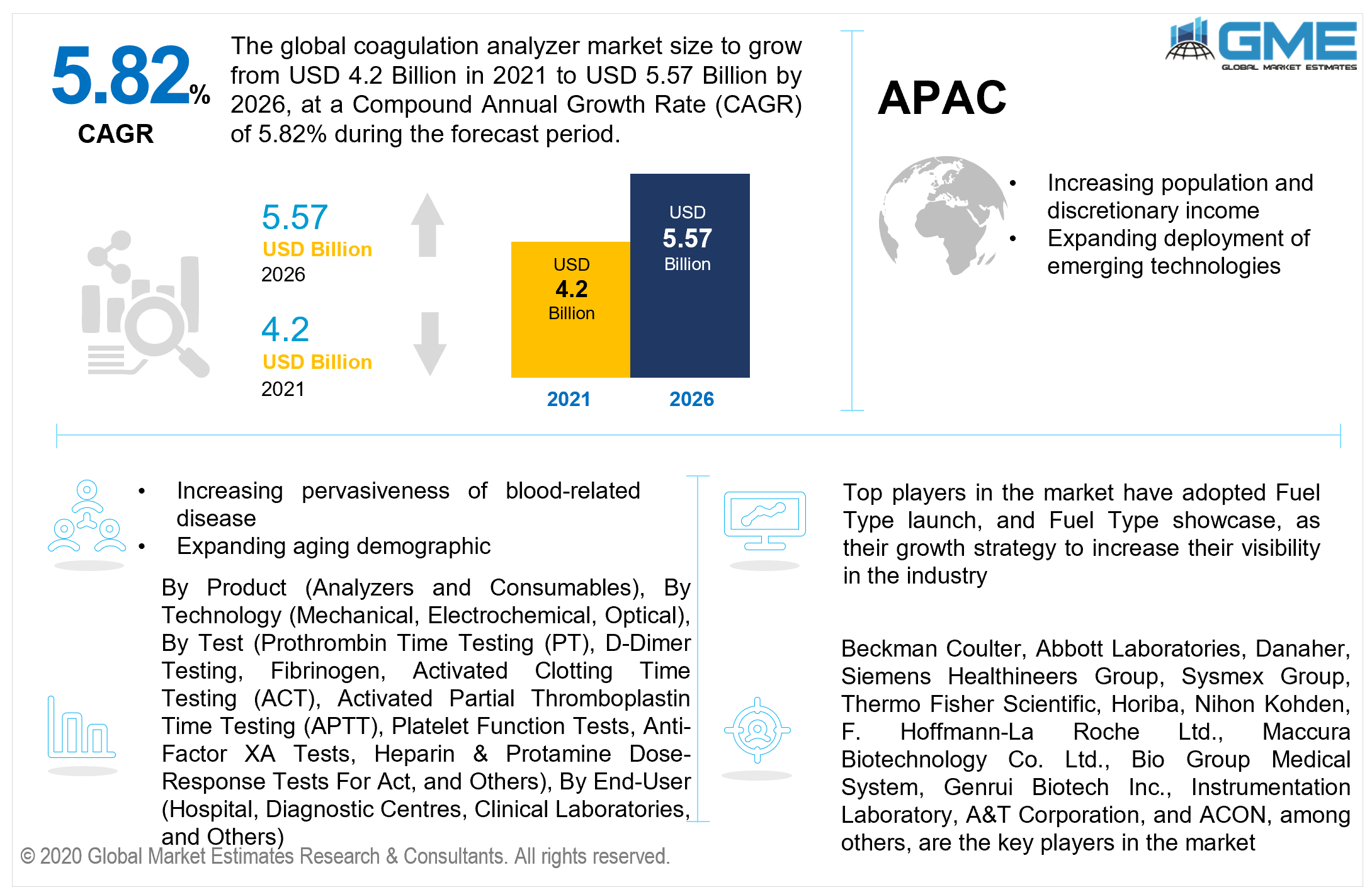

The global coagulation analyzer market is estimated to be valued at USD 4.2 billion in 2021 and is projected to reach USD 5.57 billion by 2026 at a CAGR of 5.82%. The expanding demographic base afflicted by lifestyle-related disease and chronic blood ailments is presumed to drive up the coagulation analyzers market growth. Moreover, elevating consciousness concerning these conditions is foreseen to strengthen diagnostic rates and disease prevention management, resulting in a significant spike in diagnostics volume. Additionally, according to WHO reports, the incidence of hemophilia is yet another aspect supporting the growth of the market and culminating in a growing foundation of medical device setup and enlargement of medical facilities. This aids in boosting the overall coagulation analyzers market size.

The global market is being influenced by an increment in the elderly demographic, a boost in the pervasiveness of chronic diseases such as blood-related disorders and CVDs, the improvement of point-of-care (POC) coagulation diagnostics, and an upsurge in laboratory digitalization. The slightly elevated pricing of completely automated analyzers, conversely, and the sluggish incorporation of sophisticated hemostasis methodologies in emerging and underdeveloped nations, are limiting market advancement.

Introduction of novel analyzers by key market players which are small and easy to incorporate have clamored for such analyzers to be extensively deployed in numerous medical facilities. Moreover, the growing consciousness of the health care system in many parts of the world is driving up demand for such analyzers. Skyrocketing improvements and optimization in testing facilities are also propelling the overall market.

Several nations have increased their investment funds in the healthcare sector. The subsequent uptick in the multitude of innovative health care facilities, treatment centers, laboratory facilities, and academic institutions has resulted in a considerable increment in the demand for this kind of analyzer. The rising number of heart attacks and blood disorders is also driving up demand for these analyzers. The ease of usage and performance characteristics of these analyzers made it possible for patients to use them at home to evaluate their coagulation condition. These aforementioned factors are presumed to boost growth in the global market.

Emerging economies are experiencing a paradigm transition and are investing massive volumes of government financial resources to acquire and configure such medical equipment in public healthcare institutions. Over the forecast period, the developing economies of the Middle East and Asia Pacific region are presumed to observe an increase in the senile demographic base, a rise in the preponderance of chronic diseases, and a massive expansion in foreign investments.

Rapid technological breakthroughs and the emergence of unique analyzer tests have resulted in an improvement in the performance and effectiveness of hemostasis labs. Some advanced sophisticated coagulators have high throughput, versatility, and dependability. Furthermore, the proliferation of cardiovascular disease and autoimmune diseases has increased significantly, necessitating the development of optimized analyzers around the world. Aside from that, globally, the growing proportion of hospitals, diagnostic centers, and research centers is constructively influencing the coagulation analyzers market worth.

Depending on the product, the market is categorized as analyzers and consumables. Analyzers are further classified as clinical laboratory analyzers and point of care analyzers. While consumables are further classified as reagents and stains. Analyzers are foreseen to hold a dominant share of the total revenue over the forecast period. The development of medical care facilities, soaring health care expenditure, and mounting occurrences of lifestyle-related conditions including overweight diabetes, and cardiovascular diseases are expected to drive this substantial expansion. The accentuation on offering quality and prompt patient care is assumed to drive the advancement of the diagnostic market, resulting in an increase in trends for such analyzers.

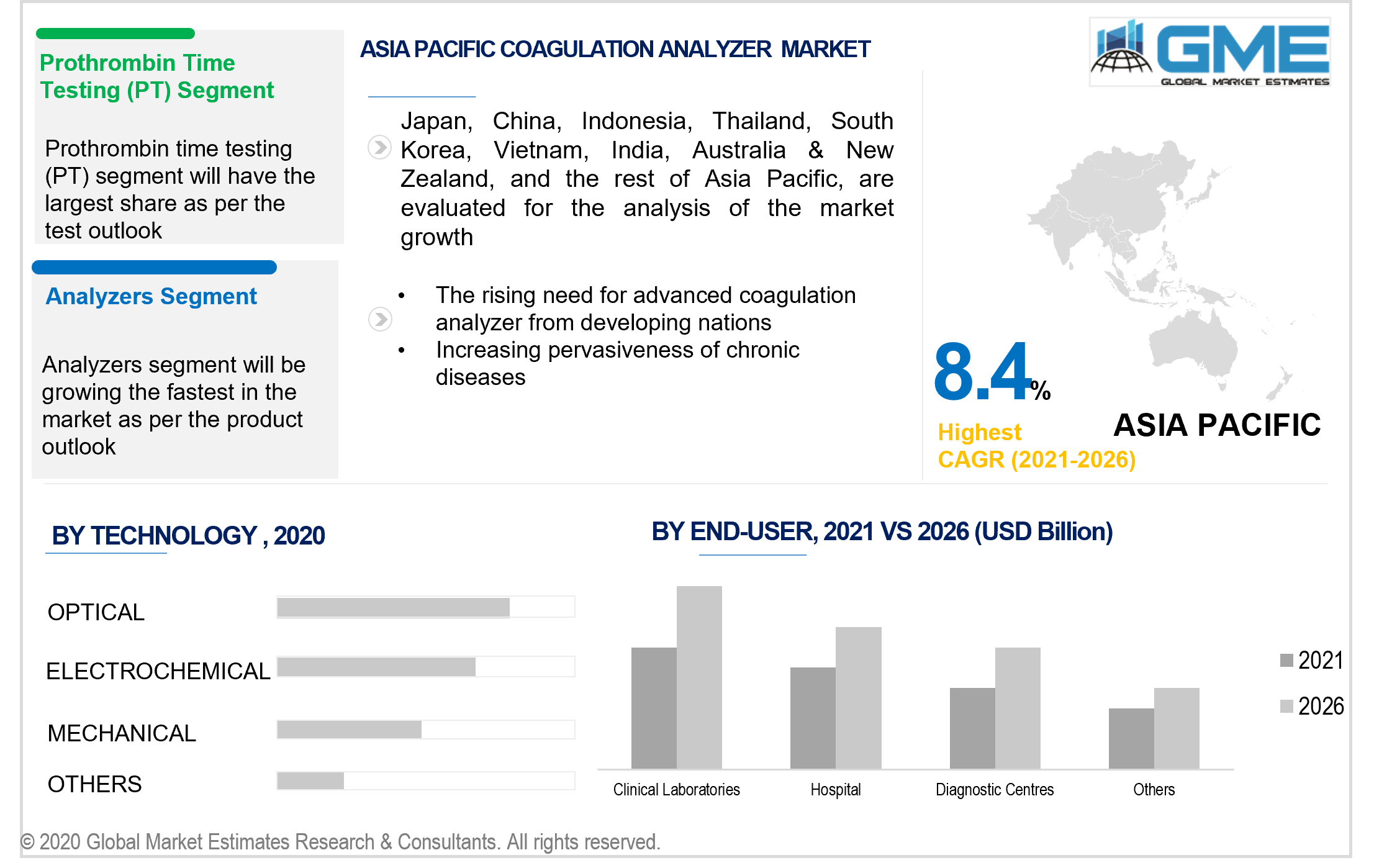

Depending on the technology, the market is categorized as mechanical, electrochemical, optical, and others. Optical technology is expected to acquire the most market share over the forecast period. This expansion is presumed to be owed to the increasing conjunction of immunological, chromogenic, and photo-optical techniques, which has contributed to the advancement of exceptional productivity, multifunctional optical clotting analyzers.

Depending on the test, the market is categorized as Prothrombin Time Testing (PT), D-Dimer Testing, Fibrinogen, Activated Clotting Time Testing (ACT), Activated Partial Thromboplastin Time Testing (APTT), Platelet Function Tests, Anti-Factor XA Tests, Heparin & Protamine Dose-Response Tests for Act, others. The prothrombin time testing segment held the largest share of the market. The dominance of this market segment is primarily credited to the widespread use of prothrombin time tests in determining the time it requires for blood clotting. It is used to screen for autoimmune diseases and to track medications utilized to avoid blood clots promptly.

Depending on the end-user, the market is categorized as hospitals, diagnostic centers, clinical laboratories, and others. Clinical laboratories are expected to hold the largest share of the market. This is due to the rising amount of coagulation testing conducted at such establishments. The rising pervasiveness of blood disorders, as well as the advancement of automated coagulation frameworks with accelerated turnaround periods, smaller size, and broadened functionality, are propelling this market segment forward.

Geographically, the North American region is presumed to dominate the global market throughout the forecast period. Significant considerations propelling the North American market include an uptick in lifestyle diseases including overweight, diabetes, heart disease, and the burgeoning recurrence of autoimmune diseases.

The dominance in this area is due to aspects such as burgeoning senile demographics, blood-related ailments, the soaring occurrence of CVDs, as well as the increased provision of sophisticated analyzers in health care facilities. The rising demand for diagnostic test analyzers and point-of-care testing analyzers to improve patients' standard of living is propelling the market forward.

During the forecast period, the European region is foreseen to be the second-largest market globally. This is attributable to the increasing aging demographic, Y-O-Y growth in the prevalence rates of chronic blood diseases, immobile lifestyle choices, and soaring blood pertinent abnormalities.

Over the forecast period, Asia-Pacific is expected to be the fastest-growing region. The spike in the deployment of APTT testing methods for identifying coagulation inhibitors, as well as the increasing capital expenditure by key players in developing sophisticated analyzers, are driving advancement in this region.

Recently, the number of instances of hypertension, heart disease, and blood pressure complications has increased significantly, which is one of the vital aspects driving market development in the APAC region. Because of the expanding deployment of emerging technologies and the emphasis of healthcare providers on entering developing markets, the Asia-Pacific region is presumed to experience accelerated advancement in the future.

Beckman Coulter, Abbott Laboratories, Danaher, Siemens Healthineers Group, Sysmex Group, Thermo Fisher Scientific, Horiba, Nihon Kohden, F. Hoffmann-La Roche Ltd., Maccura Biotechnology Co. Ltd., Bio Group Medical System, Genrui Biotech Inc., Instrumentation Laboratory, A&T Corporation, and ACON, among others, are the key market players.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2020, Sysmex launched the next-generation fully automated blood coagulation analyzers CN-6000 and CN-3000 in EMEA. Sysmex has acted to their customers' needs for rapid diagnoses and treatment selection with the introduction of the new CN-Series instruments.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Coagulation Analyzer Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Test Overview

2.1.4 Technology Overview

2.1.5 End-User Overview

2.1.6 Regional Overview

Chapter 3 Global Coagulation Analyzer Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing Technological Breakthroughs and The Emergence of Unique Analyzer Tests

3.3.1.2 Growing Pervasiveness of Chronic Diseases

3.3.2 Industry Challenges

3.3.2.1 High Costs of Completely Automated Analyzers

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Test Growth Scenario

3.4.3 Technology Growth Scenario

3.4.4 End-User Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Coagulation Analyzer Market, By Product

4.1 Product Outlook

4.2 Analyzers

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.2.2 Market Size, By Clinical Laboratory Analyzers, 2019-2026 (USD Million)

4.2.3 Market Size, By Point of Care Analyzers, 2019-2026 (USD Million)

4.3 Consumables

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.3.2 Market Size, By Reagents, 2019-2026 (USD Million)

4.3.3 Market Size, By Stains, 2019-2026 (USD Million)

Chapter 5 Global Coagulation Analyzer Market, By Test

5.1 Test Outlook

5.2 Prothrombin Time Testing (PT)

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 D-Dimer Testing, Fibrinogen

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Activated Clotting Time Testing (ACT)

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Activated Partial Thromboplastin Time Testing (APTT)

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Platelet Function Tests, Anti-Factor XA Tests

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

5.7 Anti-Factor XA Tests

5.7.1 Market Size, By Region, 2019-2026 (USD Million)

5.8 Heparin & Protamine Dose-Response Tests For Act

5.8.1 Market Size, By Region, 2019-2026 (USD Million)

5.9 Others

5.9.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Coagulation Analyzer Market, By Technology

6.1 Technology Outlook

6.2 Mechanical

6.2.1 Market Size, By Region, 2019-2026 (USD Million)

6.3 Electrochemical

6.3.1 Market Size, By Region, 2019-2026 (USD Million)

6.4 Optical

6.4.1 Market Size, By Region, 2019-2026 (USD Million)

6.5 Others

6.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 7 Global Coagulation Analyzer Market, By End-User

7.1 End-User Outlook

7.2 Hospital

7.2.1 Market Size, By Region, 2019-2026 (USD Million)

7.3 Diagnostic Centres

7.3.1 Market Size, By Region, 2019-2026 (USD Million)

7.4 Clinical Laboratories

7.4.1 Market Size, By Region, 2019-2026 (USD Million)

7.5 Others

7.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 8 Global Coagulation Analyzer Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country, 2019-2026 (USD Million)

8.2.2 Market Size, By Product, 2019-2026 (USD Million)

8.2.3 Market Size, By Test, 2019-2026 (USD Million)

8.2.4 Market Size, By Technology, 2019-2026 (USD Million)

8.2.5 Market Size, By End-User, 2019-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.6.2 Market Size, By Test, 2019-2026 (USD Million)

8.2.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.2.7.2 Market Size, By Test, 2019-2026 (USD Million)

8.2.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.2.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country, 2019-2026 (USD Million)

8.3.2 Market Size, By Product, 2019-2026 (USD Million)

8.3.3 Market Size, By Test, 2019-2026 (USD Million)

8.3.4 Market Size, By Technology, 2019-2026 (USD Million)

8.3.5 Market Size, By End-User, 2019-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.6.2 Market Size, By Test, 2019-2026 (USD Million)

8.3.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.7.2 Market Size, By Test, 2019-2026 (USD Million)

8.3.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.8.2 Market Size, By Test, 2019-2026 (USD Million)

8.3.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.9.2 Market Size, By Test, 2019-2026 (USD Million)

8.3.9.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.9.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.10.2 Market Size, By Test, 2019-2026 (USD Million)

8.3.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Product, 2019-2026 (USD Million)

8.3.11.2 Market Size, By Test, 2019-2026 (USD Million)

8.3.11.3 Market Size, By Technology, 2019-2026 (USD Million)

8.3.11.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country, 2019-2026 (USD Million)

8.4.2 Market Size, By Product, 2019-2026 (USD Million)

8.4.3 Market Size, By Test, 2019-2026 (USD Million)

8.4.4 Market Size, By Technology, 2019-2026 (USD Million)

8.4.5 Market Size, By End-User, 2019-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.6.2 Market Size, By Test, 2019-2026 (USD Million)

8.4.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.7.2 Market Size, By Test, 2019-2026 (USD Million)

8.4.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.8.2 Market Size, By Test, 2019-2026 (USD Million)

8.4.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.9.2 Market size, By Test, 2019-2026 (USD Million)

8.4.9.3 Market size, By Technology, 2019-2026 (USD Million)

8.4.9.4 Market size, By End-User, 2019-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Product, 2019-2026 (USD Million)

8.4.10.2 Market Size, By Test, 2019-2026 (USD Million)

8.4.10.3 Market Size, By Technology, 2019-2026 (USD Million)

8.4.10.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country, 2019-2026 (USD Million)

8.5.2 Market Size, By Product, 2019-2026 (USD Million)

8.5.3 Market Size, By Test, 2019-2026 (USD Million)

8.5.4 Market Size, By Technology, 2019-2026 (USD Million)

8.5.5 Market Size, By End-User, 2019-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.6.2 Market Size, By Test, 2019-2026 (USD Million)

8.5.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.7.2 Market Size, By Test, 2019-2026 (USD Million)

8.5.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.5.8.2 Market Size, By Test, 2019-2026 (USD Million)

8.5.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.5.8.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country, 2019-2026 (USD Million)

8.6.2 Market Size, By Product, 2019-2026 (USD Million)

8.6.3 Market Size, By Test, 2019-2026 (USD Million)

8.6.4 Market Size, By Technology, 2019-2026 (USD Million)

8.6.5 Market Size, By End-User, 2019-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.6.2 Market Size, By Test, 2019-2026 (USD Million)

8.6.6.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.6.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.7.2 Market Size, By Test, 2019-2026 (USD Million)

8.6.7.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.7.4 Market Size, By End-User, 2019-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Product, 2019-2026 (USD Million)

8.6.8.2 Market Size, By Test, 2019-2026 (USD Million)

8.6.8.3 Market Size, By Technology, 2019-2026 (USD Million)

8.6.8.4 Market Size, By End-User, 2019-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Beckman Coulter

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Abbott Laboratories

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Danaher

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Siemens Healthineers Group

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Sysmex Group

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Thermo Fisher Scientific

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Horiba

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Nihon Kohden

7.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 F. Hoffmann-La Roche Ltd.

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Maccura Biotechnology Co. Ltd.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Bio Group Medical System

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Genrui Biotech Inc.

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 Instrumentation Laboratory

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 ACON

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 A&T Corporation

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

9.17 Other Companies

9.17.1 Company Overview

9.17.2 Financial Analysis

9.17.3 Strategic Positioning

9.17.4 Info Graphic Analysis

The Global Coagulation Analyzer Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Coagulation Analyzer Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS