Global Coal Gasification Market Size, Trends & Analysis - Forecasts to 2026 By Process Type (Moving Bed, Fluidized Bed, Entrained Bed, Molten Bed), By Application (Fuel Gas, Feedstock, Power Generation, Fertilizer, Chemical Production); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis.

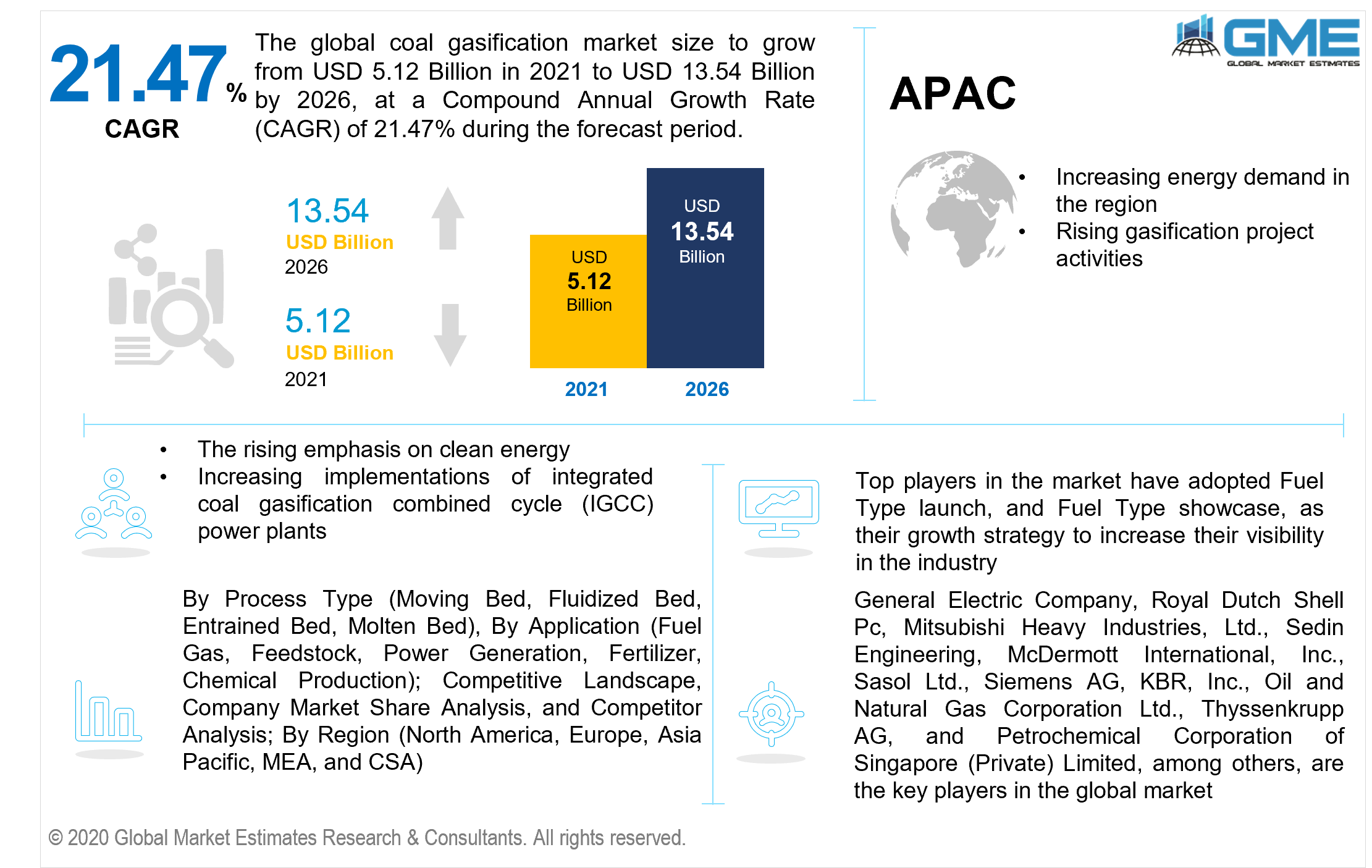

The global coal gasification market is estimated to be valued at USD 5.12 billion in 2021 and is projected to reach USD 13.54 billion by 2026 at a CAGR of 21.47%. The growing utilization of synthetic natural gas has boosted the demand for this gasification in fuel gas production. The global trend of integrated coal gasification combined cycle (IGCC) power plants has expanded the prospects for this gasification process in power production. The monetary advantages of this gasification are a pivotal aspect propelling the development of the global market. Gasification maximizes the energy potential of the raw material whilst also lowering dumping expenses and ecological implications. Furthermore, underground coal gasification (UCG) can be utilized to transform coal into valuable gases without the need for mining. Thus, boosting the overall market development.

Additionally, UCG excludes numerous operations correlated with underground coal mining, such as coal cleaning, coal warehousing, and waste management, such as ash collection and processing. As a result, UCG is a cost-effective and environment-friendly method of lowering the operating expenses involved with the usage of coal. This will help to increase the prominence of this gasification in both developed and emerging markets. Some of the significant considerations that are prone to incentivize the advancement of the global market are the need for less capital and the relatively low expense of plant deployment.

The expanding demand for hygienic and reliable energy production innovation in numerous industrial sectors and household implementations is presumed to drive market development. Certain energy production innovations entail energy waste during the combustion procedure. Conversely, gasification is a more efficient method of energy production that maximizes energy utilization. The resulting gas in the methodology is recognized as syngas or producer gas, and it has a relatively high calorific value than fossil fuels. This gas contains more energy than the straightforward combustion of fossil fuels, which is another crucial catalyst of the market's expansion.

One other pertinent driver that outperforms conventional combustion innovation is the use of biodegradable substances as raw materials for production. The methodology is prevalently utilized in industrial sectors to generate electricity. In addition, the improved deployment of electric motor structures by end-user sectors has enhanced energy requirements in the manufacturing industry. The rising global demand for energy is presumed to boost the expansion of the global market.

The rising emphasis on clean energy, on the other hand, has resulted in a considerable increment in demand for sustainable energy gas sources. Furthermore, the high demand for oil in the petrochemicals industry is foreseen to stymie the advancement of the overall market. Besides this, rising power production from biofuels is expected to stymie global market development over the forecast period.

The expansion of the global economy has resulted in a substantial boost in energy consumption. The prevalence of digitally integrated devices, digitalization along with all nations, and modernization of transportation and the heating industry are among the variables driving up energy requirements. The rise in the metropolitan populace's discretionary income has resulted in an increment in demand for energy service provision. In addition, the improved implementation of electric motor frameworks by end-user sectors has intensified energy requirements in the industrial sector. The increasing requirement for energy around the world is presumed to have a constructive influence on the global market's advancement.

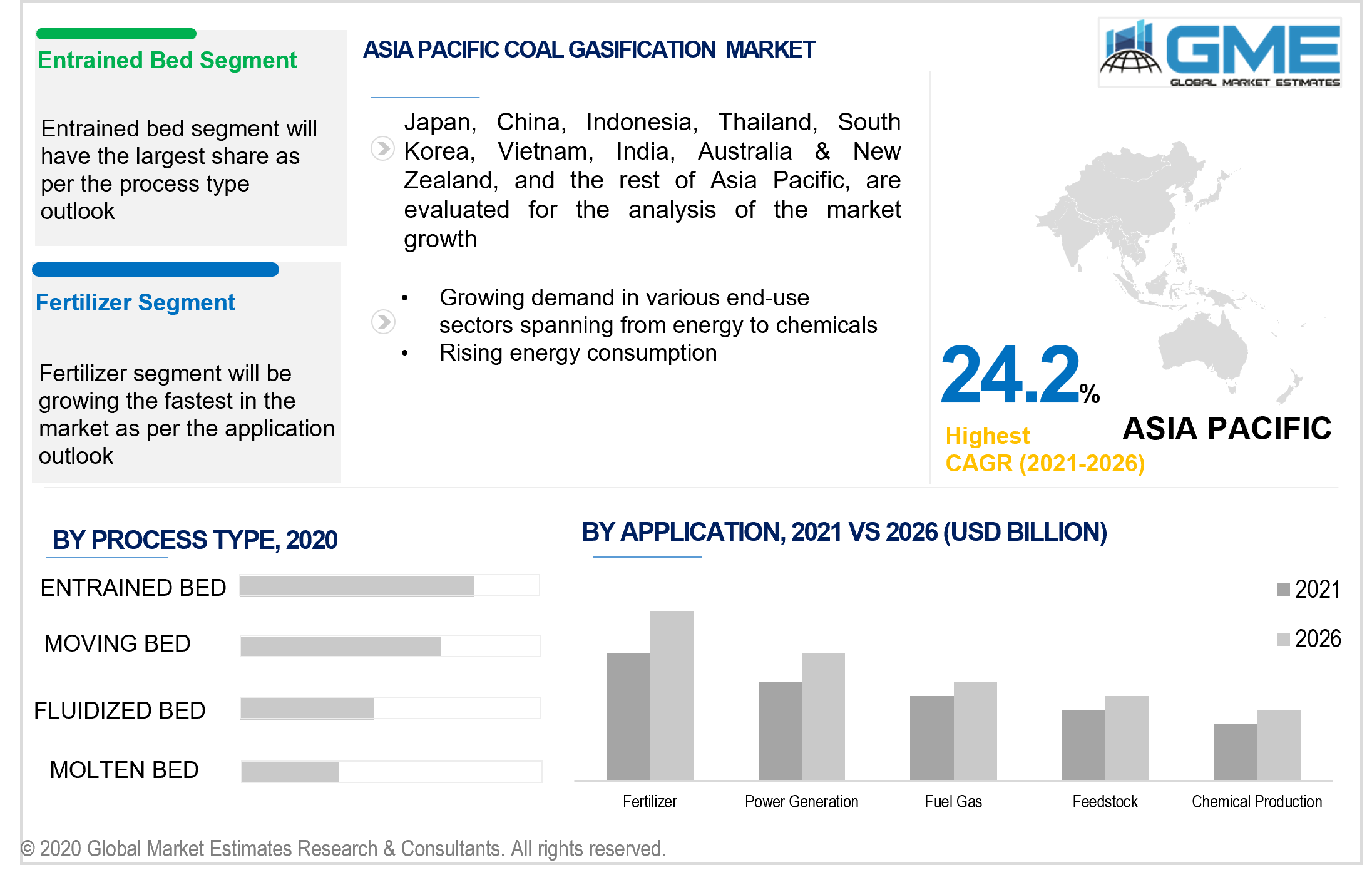

Depending on the process type, the market is categorized as moving bed, fluidized bed, entrained bed, and molten bed. The entrained bed segment is foreseen to hold the largest market share. The benefits of this procedure, including its versatility with any coal raw material and ability to produce clean, tar-free syngas, have enhanced its demand in the global market.

During the forecast period, the moving bed segment is also expected to contribute a significant market share. This procedure has a reasonable prerequisite for steam and oxidizing agent and offers energy and load versatility, that also improves the requirement for this procedure on a massive level.

Depending on the application, the market is categorized as fuel gas, feedstock, power generation, fertilizer, and chemical production. During the forecast period, the fertilizer segment is expected to have the largest market share. The manufacturing of ammonia through this gasification process has enhanced the demand for nitrogen-rich fertilizers. Furthermore, the coal-gasification-based fertilizer plant utilizes coal-produced gas, reducing reliance on urea and gas imported products.

Power generation is another industry that is expected to grow rapidly. The global trend toward integrated coal gasification combined cycle (IGCC) power stations has expanded the possibilities for such gasification in energy production. Because of the enhanced use of synthesized energy resources, the clamor for this gasification technology in fuel gas manufacturing has been boosted.

North America is expected to account for a significant portion of the global market and to dominate in the coming years. A substantial involvement from the United States is likely to supplement advancement in this region during the forecast period. Furthermore, undiscovered markets in this area are expected to provide remunerative opportunities for key market players. Furthermore, North America is foreseen to grow rapidly in the coming years as a result of rapid advancement in a multitude of sectors.

Owing to the sizable proportion of gasification activities in the syngas and chemical industry in China, Japan, and India, the market in the Asia-Pacific area is presumed to proffer remunerative potential. Due to the remarkable proliferation of end-use sectors spanning from energy to chemicals, Asia Pacific is presumed to be the strongest market over the forecast period. Notably, China, India, and Australia are major markets for these gasification project activities.

China is the world's largest customer and manufacturer of coal-based energy. It devours nearly half of total coal manufacturing to meet its energy needs. Since 1991, China has implemented 17 UCC trials to assess the economic efficacy of underground coal gasification (UCG). Thus, the APAC area is the world's largest coal manufacturer, and rising energy consumption has aided the area's coal production. According to the World Energy Council, Asia Pacific holds approximately 37% of the total recoverable coal. Thus, these aforementioned factors will positively impact the market growth in this region.

General Electric Company, Royal Dutch Shell Plc, Mitsubishi Heavy Industries, Ltd., Sedin Engineering, McDermott International, Inc., Sasol Ltd., Siemens AG, KBR, Inc., Oil and Natural Gas Corporation Ltd., Thyssenkrupp AG, and Petrochemical Corporation of Singapore (Private) Limited, among others, are the key players in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Coal Gasification Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Process Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Coal Gasification Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Demand for Efficient and Clean Energy Generation Technologies from Various End Users

3.3.1.2 Rising Government Support

3.3.2 Industry Challenges

3.3.2.1 Strong Demand for Oil from The Petrochemicals Sector

3.4 Prospective Growth Scenario

3.4.1 Process Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Coal Gasification Market, By Process Type

4.1 Process Type Outlook

4.2 Moving Bed

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Fluidized Bed

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Entrained Bed

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

4.5 Molten Bed

4.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Global Coal Gasification Market, By Application

5.1 Application Outlook

5.2 Fuel Gas

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Feedstock

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Power Generation

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Fertilizer

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

5.6 Chemical Production

5.6.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Global Coal Gasification Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Process Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Application, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Process Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Application, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Process Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Application, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Application, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Process Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Application, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Process Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Application, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Process Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 General Electric Company

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Royal Dutch Shell Pc

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Mitsubishi Heavy Industries, Ltd.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Sedin Engineering

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 McDermott International, Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Sasol Ltd.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Siemens AG

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 KBR, Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Oil and Natural Gas Corporation Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Thyssenkrupp AG

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Petrochemical Corporation of Singapore (Private) Limited

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Other Companies

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

The Global Coal Gasification Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Coal Gasification Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS