Global Commercial Aircraft Video Surveillance Systems Market Size, Trends & Analysis - Forecasts to 2028 By System Type (Cockpit Door Surveillance System, Environmental Camera System, Cabin Surveillance System), Aircraft Type (Narrow Body, Wide Body, Regional & Business Aircraft, Freighter), Application Type (Passenger, Cargo), Region (North America, Asia Pacific, Central & South America, Europe, Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

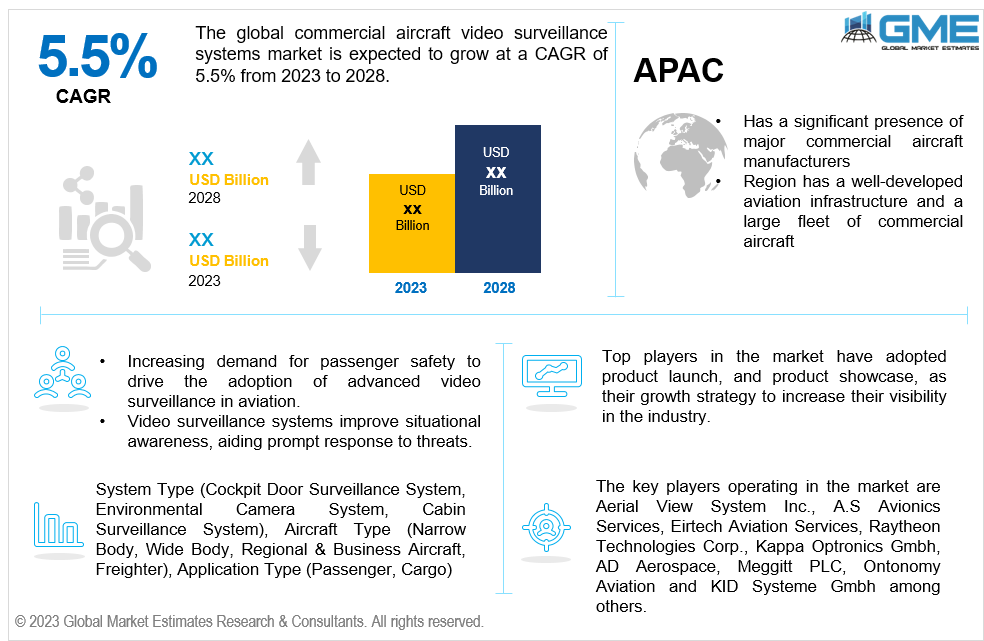

The global commercial aircraft video surveillance systems market is expected to grow at a CAGR of 5.5% from 2023 to 2028. Commercial aircraft video surveillance systems are comprehensive security and monitoring solutions installed on commercial airplanes, including cameras, recording devices, and display screens, to capture and monitor activities within the aircraft cabin, cockpit, cargo areas, and external surroundings, enhancing safety, security, and operational efficiency. These systems provide real-time video surveillance, incident recording, and analysis, enabling flight crew members and ground personnel to monitor passenger behavior, identify potential threats, and ensure compliance with safety regulations.

The aviation industry is focusing on passenger safety and security, leading to the implementation of advanced surveillance systems to monitor and deter potential threats. Enhancing situational awareness and real-time monitoring capabilities contributes to market growth. Video surveillance systems offer a comprehensive view of the aircraft cabin, enabling prompt detection and response to unusual or suspicious activities. Advancements in technology, such as high-definition cameras, facial recognition, and behaviour analysis algorithms, improve the effectiveness and efficiency of these systems. Additionally, the growing demand for operational efficiency and improved passenger experiences drives the market, with video surveillance systems aiding in passenger flow management, cabin crew training, and incident investigation, contributing to streamlined operations and customer satisfaction.

The commercial aircraft video surveillance systems market offers companies opportunities to capitalize on the growing demand for enhanced safety and security in the aviation industry. The focus on passenger safety and comprehensive security solutions presents a significant opportunity for advanced video surveillance systems. Advancements in technology offer opportunities for innovation, such as sophisticated cameras, intelligent analytics, and integrated systems. Companies can explore partnerships with technology providers to leverage cutting-edge solutions and enhance their product offerings. The trend of connectivity and data-driven solutions in aviation also opens opportunities for integrated video surveillance systems. Emerging markets and global airline fleet expansion provide opportunities for companies to tap into new customer segments and geographies, gaining a competitive edge and establishing themselves as leading providers of commercial aircraft video surveillance systems.

Based on system type, the market is segmented into cockpit door surveillance system, environmental camera system and cabin surveillance system. The cockpit door surveillance system segment is expected to hold the largest share in the commercial aircraft video surveillance systems market due to its critical role in ensuring the safety and security of the cockpit area. With increasing security concerns and regulatory requirements, airlines are investing in advanced surveillance systems to monitor and control access to the cockpit. The cockpit door surveillance system provides real-time video monitoring of the cockpit entrance, enabling flight crew members to visually verify the identity of individuals seeking access. This segment is driven by the need for enhanced security measures, prevention of unauthorized access, and compliance with aviation safety regulations. The continuous advancements in technology, such as high-resolution cameras and integrated access control systems, further contribute to the dominance of the cockpit door surveillance system segment in the market.

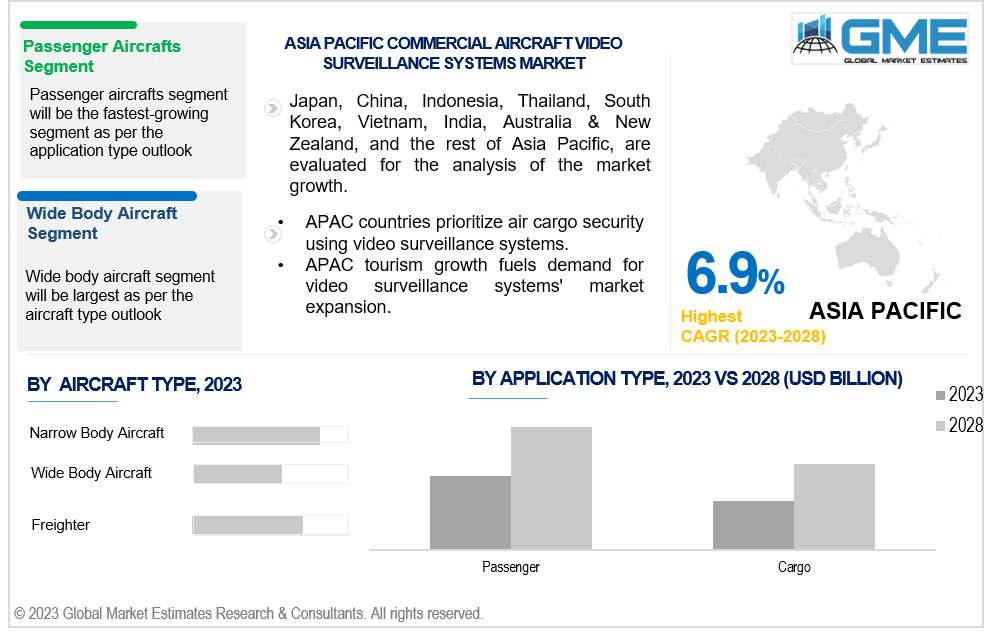

Based on aircraft type, the market is segmented narrow body, wide body, regional & business and freighter aircrafts. The wide body aircraft segment is expected to dominate the commercial aircraft video surveillance systems market due to its larger passenger capacity and longer flight durations. Wide body aircraft, commonly used for long-haul flights, require comprehensive surveillance systems to ensure the safety and security of passengers and crew members throughout the journey. These aircraft often have multiple cabin sections, larger seating areas, and more complex layouts, necessitating the installation of a robust video surveillance system. Additionally, wide body aircraft are commonly deployed by major airlines and are frequently upgraded with advanced avionics and safety features, including video surveillance systems. The growing demand for air travel, coupled with the increasing focus on passenger safety, drives the adoption of video surveillance systems in the wide body aircraft segment, making it the largest segment in the market.

Based on application type, the market is segmented into passenger and cargo aircrafts. The passenger aircraft segment is projected to hold the largest share in the commercial aircraft video surveillance systems market. This can be attributed to the high volume of passenger aircraft in operation globally and the increasing emphasis on passenger safety and security. Passenger aircraft, including narrow-body, wide-body, and regional jets, cater to a wide range of travel needs, from short-haul flights to long-haul international journeys. With a primary focus on providing a safe and comfortable flying experience, these aircraft require robust video surveillance systems to monitor critical areas such as the cabin, entrances, and exits. Implementing video surveillance systems in passenger aircraft enhances security measures, enables effective incident management, and instills confidence among passengers, thereby driving the demand for such systems in the passenger aircraft segment and making it the largest segment in the commercial aircraft video surveillance systems market.

The North American region is anticipated to hold the largest share in the global commercial aircraft video surveillance systems market during the forecast period. This can be attributed to several factors. Firstly, North America has a significant presence of major commercial aircraft manufacturers, leading to a higher adoption of advanced surveillance systems in their aircraft models. Secondly, the region has a well-developed aviation infrastructure and a large fleet of commercial aircraft, including both passenger and cargo planes. This creates a substantial demand for video surveillance systems to enhance safety and security measures. Additionally, stringent regulations and guidelines pertaining to aviation safety in North America drive the implementation of video surveillance systems in commercial aircraft. These factors collectively contribute to North America's dominance in the global commercial aircraft video surveillance systems market.

Asia Pacific is projected to be the fastest-growing segment in the global commercial aircraft video surveillance systems market. This can be attributed to several factors driving market growth in the region. Firstly, the Asia Pacific region has been witnessing a significant increase in air passenger traffic, leading to higher demand for commercial aircraft and associated surveillance systems. Secondly, rapid economic growth and infrastructure development in countries like China, India, and Southeast Asian nations have resulted in increased investments in the aviation sector. This, in turn, fuels the demand for advanced video surveillance systems to ensure safety and security in commercial aircraft operations. Additionally, favorable government initiatives and regulations promoting aviation safety and security contribute to the growing adoption of video surveillance systems in the region. These factors collectively position Asia Pacific as a promising and high-growth market for commercial aircraft video surveillance systems.

Europe, particularly Germany, is analyzed to be the largest country in the commercial aircraft video surveillance systems market. The region's stringent safety regulations and thriving aviation industry drive the growing adoption of advanced video surveillance systems. Germany, as a key player in Europe, plays a significant role in the market due to its robust manufacturing capabilities and technological expertise. The country's emphasis on aviation safety and security presents opportunities for companies to offer innovative video surveillance solutions and establish a strong foothold in the European market.

The key players operating in the market are Aerial View System Inc., A.S Avionics Services, Eirtech Aviation Services, Raytheon Technologies Corp., Kappa Optronics Gmbh, AD Aerospace, Meggitt PLC, Ontonomy Aviation and KID Systeme Gmbh among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL COMMERCIAL AIRCRAFT VIDEO SURVEILLANCE SYSTEMS MARKET, BY SYSTEM TYPE

4.2 Commercial Aircraft Video Surveillance Systems Market: System Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Cockpit Door Surveillance Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Environmental Camera Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Cabin Surveillance Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL COMMERCIAL AIRCRAFT VIDEO SURVEILLANCE SYSTEMS MARKET, BY AIRCRAFT TYPE

5.2 Commercial Aircraft Video Surveillance Systems Market: Aircraft Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Narrow Body Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1 Wide Body Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6.1 Regional & Business Market Estimates and Forecast, 2020-2028 (USD Billion)

5.7.1 Freighter Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL COMMERCIAL AIRCRAFT VIDEO SURVEILLANCE SYSTEMS MARKET, BY APPLICATION TYPE

6.2 Commercial Aircraft Video Surveillance Systems Market: Application Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Passenger Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5.1 Cargo Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL COMMERCIAL AIRCRAFT VIDEO SURVEILLANCE SYSTEMS MARKET, BY REGION

7.4.4.10.3 By Application Type

7.4.4.11.3 By Application Type

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Eirtech Aviation Services

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Raytheon Technologies Corp.

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Aircraft Type of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

2 Cockpit Door Surveillance Market, By Region, 2020-2028 (USD Billion)

3 Environmental Camera Market, By Region, 2020-2028 (USD Billion)

4 Cabin Surveillance Market, By Region, 2020-2028 (USD Billion)

5 Global Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

6 Narrow Body Market, By Region, 2020-2028 (USD Billion)

7 Wide Body Market, By Region, 2020-2028 (USD Billion)

8 Regional & Business Market, By Region, 2020-2028 (USD Billion)

9 Freighter Market, By Region, 2020-2028 (USD Billion)

10 Global Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

11 Passenger Market, By Region, 2020-2028 (USD Billion)

12 Cargo Market, By Region, 2020-2028 (USD Billion)

13 Regional Analysis, 2020-2028 (USD Billion)

14 North America Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

15 North America Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

16 North America Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

17 North America Commercial Aircraft Video Surveillance Systems Market, By Country, 2020-2028 (USD Billion)

18 U.S Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

19 U.S Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

20 U.S Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

21 Canada Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

22 Canada Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

23 Canada Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

24 Mexico Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

25 Mexico Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

26 Mexico Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

27 Europe Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

28 Europe Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

29 Europe Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

30 Germany Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

31 Germany Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

32 Germany Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

33 UK Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

34 UK Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

35 UK Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

36 France Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

37 France Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

38 France Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

39 Italy Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

40 Italy Commercial Aircraft Video Surveillance Systems Market, By T Aircraft Type Type, 2020-2028 (USD Billion)

41 Italy Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

42 Spain Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

43 Spain Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

44 Spain Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

45 Rest Of Europe Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

46 Rest Of Europe Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

47 Rest of Europe Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

48 Asia Pacific Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

49 Asia Pacific Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

50 Asia Pacific Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

51 Asia Pacific Commercial Aircraft Video Surveillance Systems Market, By Country, 2020-2028 (USD Billion)

52 China Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

53 China Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

54 China Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

55 India Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

56 India Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

57 India Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

58 Japan Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

59 Japan Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

60 Japan Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

61 South Korea Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

62 South Korea Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

63 South Korea Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

64 Middle East & Africa Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

65 Middle East & Africa Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

66 Middle East & Africa Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

67 Middle East & Africa Commercial Aircraft Video Surveillance Systems Market, By Country, 2020-2028 (USD Billion)

68 Saudi Arabia Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

69 Saudi Arabia Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

70 Saudi Arabia Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

71 UAE Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

72 UAE Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

73 UAE Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

74 Central & South America Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

75 Central & South America Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

76 Central & South America Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

77 Central & South America Commercial Aircraft Video Surveillance Systems Market, By Country, 2020-2028 (USD Billion)

78 Brazil Commercial Aircraft Video Surveillance Systems Market, By System Type, 2020-2028 (USD Billion)

79 Brazil Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type, 2020-2028 (USD Billion)

80 Brazil Commercial Aircraft Video Surveillance Systems Market, By Application Type, 2020-2028 (USD Billion)

81 Aerial View System Inc.: Products & Services Offering

82 KID Systeme Gmbh: Products & Services Offering

83 Ontonomy Aviation: Products & Services Offering

84 Meggitt PLC: Products & Services Offering

85 AD Aerospace: Products & Services Offering

86 KAPPA OPTRONICS GMBH: Products & Services Offering

87 Eirtech Aviation Services : Products & Services Offering

88 Raytheon Technologies Corp.: Products & Services Offering

89 A.S Avionics Services, Inc: Products & Services Offering

90 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Commercial Aircraft Video Surveillance Systems Market Overview

2 Global Commercial Aircraft Video Surveillance Systems Market Value From 2020-2028 (USD Billion)

3 Global Commercial Aircraft Video Surveillance Systems Market Share, By System Type (2022)

4 Global Commercial Aircraft Video Surveillance Systems Market Share, By Aircraft Type (2022)

5 Global Commercial Aircraft Video Surveillance Systems Market Share, By Application Type (2022)

6 Global Commercial Aircraft Video Surveillance Systems Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Commercial Aircraft Video Surveillance Systems Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Commercial Aircraft Video Surveillance Systems Market

11 Impact Of Challenges On The Global Commercial Aircraft Video Surveillance Systems Market

12 Porter’s Five Forces Analysis

13 Global Commercial Aircraft Video Surveillance Systems Market: By System Type Scope Key Takeaways

14 Global Commercial Aircraft Video Surveillance Systems Market, By System Type Segment: Revenue Growth Analysis

15 Cockpit Door Surveillance Market, By Region, 2020-2028 (USD Billion)

16 Environmental Camera Market, By Region, 2020-2028 (USD Billion)

17 Cabin Surveillance Market, By Region, 2020-2028 (USD Billion)

18 Global Commercial Aircraft Video Surveillance Systems Market: By Aircraft Type Scope Key Takeaways

19 Global Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type Segment: Revenue Growth Analysis

20 Narrow Body Market, By Region, 2020-2028 (USD Billion)

21 Wide Body Market, By Region, 2020-2028 (USD Billion)

22 Regional & Business Market, By Region, 2020-2028 (USD Billion)

23 Freighter Market, By Region, 2020-2028 (USD Billion)

24 Global Commercial Aircraft Video Surveillance Systems Market: By Application Type Scope Key Takeaways

25 Global Commercial Aircraft Video Surveillance Systems Market, By Application Type Segment: Revenue Growth Analysis

26 Passenger Market, By Region, 2020-2028 (USD Billion)

27 Cargo Market, By Region, 2020-2028 (USD Billion)

28 Regional Segment: Revenue Growth Analysis

29 Global Commercial Aircraft Video Surveillance Systems Market: Regional Analysis

30 North America Commercial Aircraft Video Surveillance Systems Market Overview

31 North America Commercial Aircraft Video Surveillance Systems Market, By System Type

32 North America Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type

33 North America Commercial Aircraft Video Surveillance Systems Market, By Application Type

34 North America Commercial Aircraft Video Surveillance Systems Market, By Country

35 U.S. Commercial Aircraft Video Surveillance Systems Market, By System Type

36 U.S. Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type

37 U.S. Commercial Aircraft Video Surveillance Systems Market, By Application Type

38 Canada Commercial Aircraft Video Surveillance Systems Market, By System Type

39 Canada Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type

40 Canada Commercial Aircraft Video Surveillance Systems Market, By Application Type

41 Mexico Commercial Aircraft Video Surveillance Systems Market, By System Type

42 Mexico Commercial Aircraft Video Surveillance Systems Market, By Aircraft Type

43 Mexico Commercial Aircraft Video Surveillance Systems Market, By Application Type

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 Aerial View System Inc.: Company Snapshot

47 Aerial View System Inc.: SWOT Analysis

48 Aerial View System Inc.: Geographic Presence

49 KID Systeme Gmbh: Company Snapshot

50 KID Systeme Gmbh: SWOT Analysis

51 KID Systeme Gmbh: Geographic Presence

52 Ontonomy Aviation: Company Snapshot

53 Ontonomy Aviation: SWOT Analysis

54 Ontonomy Aviation: Geographic Presence

55 Meggitt PLC: Company Snapshot

56 Meggitt PLC: Swot Analysis

57 Meggitt PLC: Geographic Presence

58 AD Aerospace: Company Snapshot

59 AD Aerospace: SWOT Analysis

60 AD Aerospace: Geographic Presence

61 Kappa Optronics Gmbh: Company Snapshot

62 Kappa Optronics Gmbh: SWOT Analysis

63 Kappa Optronics Gmbh: Geographic Presence

64 Eirtech Aviation Services : Company Snapshot

65 Eirtech Aviation Services : SWOT Analysis

66 Eirtech Aviation Services : Geographic Presence

67 Raytheon Technologies Corp.: Company Snapshot

68 Raytheon Technologies Corp.: SWOT Analysis

69 Raytheon Technologies Corp.: Geographic Presence

70 A.S Avionics Services, Inc.: Company Snapshot

71 A.S Avionics Services, Inc.: SWOT Analysis

72 A.S Avionics Services, Inc.: Geographic Presence

73 Other Companies: Company Snapshot

74 Other Companies: SWOT Analysis

75 Other Companies: Geographic Presence

The Global Commercial Aircraft Video Surveillance Systems Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Commercial Aircraft Video Surveillance Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS