Global Commercial Satellite Imaging Market Size, Trends & Analysis - Forecasts to 2027 By Application (Geospatial Data Acquisition and Mapping, Natural Resource Management, Surveillance and Security, Conservation and Research, Disaster Management, Defence and Intelligence), By End-User (Government, Construction, Transportation, and Logistics, Military and Defence, Forestry and Agriculture), By Region (North America, Asia Pacific, Central, and South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

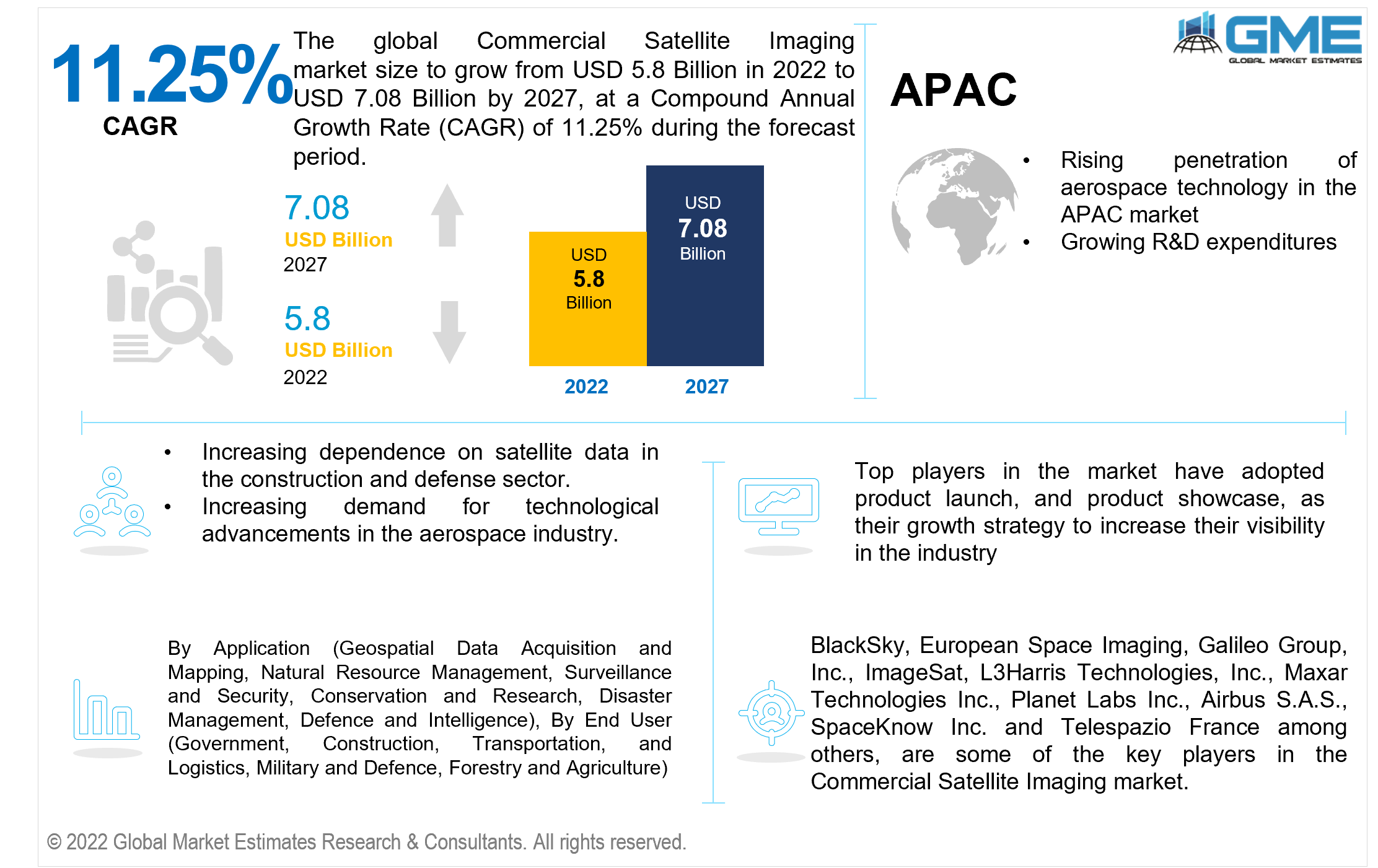

The Global Commercial Satellite Imaging Market is projected to grow from USD 5.8 Billion in 2022 to USD 7.08 Billion in 2027 at a CAGR value of 11.25% from 2022 to 2027.

Commercial satellite imaging is largely concerned with taking pictures of the world from space, commonly referred to as "earth observation," and using these pictures for different commercial reasons. Some of the most significant applications for commercial satellites are capture and mapping, disaster risk management, energy production management, urban development and planning, and surveillance systems. Due to the increased usage of satellite-based photos for environmental forecasts and quick responses to emergencies like defence and security incidents and natural disasters, the significance of these images is growing.

The development of smart cities and smart automobiles, the rise in reliance on location-based facilities, and the expansion of applications in government and defense services are all contributing to the growth of the worldwide commercial satellite imaging market.

The market is projected to increase during the forecast period as more satellite imagery is used for commercial reasons, including those related to energy, agriculture, and the military. Additionally, the market has benefited from the increased demand for high-resolution and contemporary satellite images in the areas of national development administration, national military organisations, emergency services, and environmental protection.

Globally speaking, the aircraft industry was significantly impacted by the COVID-19 epidemic. Due to supply chain disruption, the COVID-19 pandemic has delayed mission deployments and new product deliveries for the bulk of the main space technology manufacturers. The pandemic has adversely disrupted funding options for research & development activities and the implementation of technological innovations in the commercial satellite imaging industry. The commercial satellite imaging systems are expected to increase in demand in the post pandemic era as various industries begin to utilize satellite imagery for improving their services.

The conflict between Ukraine and Russia had a significant impact on the aerospace sector. The commercial satellite sector is expanding quickly, thus there is more imagery available and it can be processed more quickly than during earlier wars. Due to its value in the defence industry, commercial satellite imaging has seen a rise in demand as a result of the conflict.

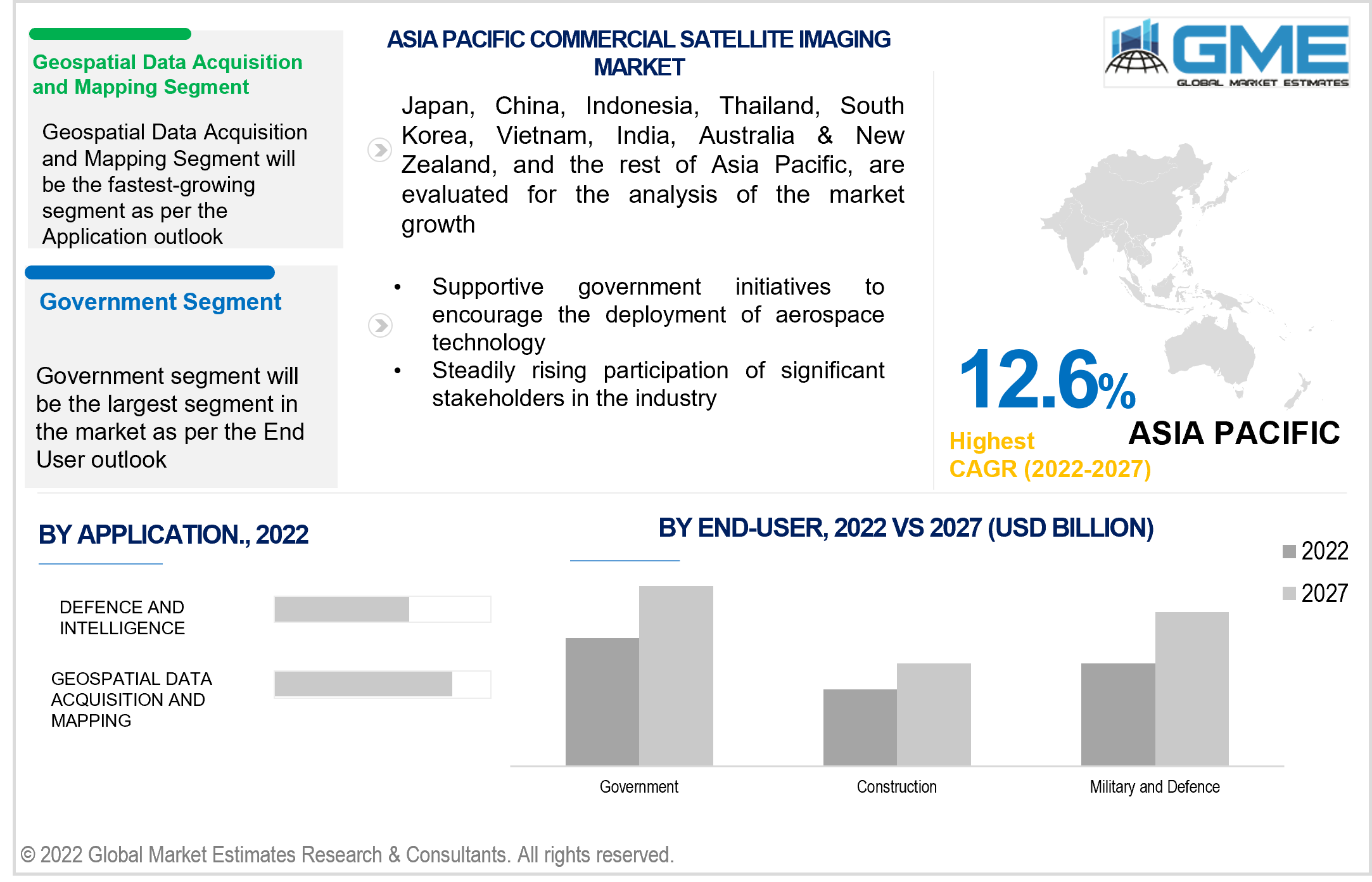

The geospatial data acquisition & mapping segment is expected to be the fastest-growing segment in the market from 2022 to 2027. This is a result of the broad variety of applications in numerous fields, including environmental condition analysis, archaeology, mining research, and map and chart creation.

Defence and intelligence segment is expected to grow at the fastest rate during the forecast period owing to the increased public-sector spending.

The government segment is expected to be the largest segment in the market from 2022 to 2027. This is a result of its use in projects including land mapping, emergency preparedness, environmental preservation, urban development, GIS updates, and public safety.

The civil engineering and archaeology segment is predicted to grow at the fastest rate during the forecast period, owing to its use in real-time monitoring of building projects and exploration and monitoring of archaeological sites using imagery provided by commercial satellites.

North America will have a dominant share in the Commercial Satellite Imaging market from 2022 to 2027 due to the region's early and widespread adoption of commercial satellite imaging across a variety of industries, the market's highest concentration of research and investment, and the presence of sophisticated infrastructure for carrying out space programmes.

APAC is expected to be the fastest-growing region during the projected period. China is expected to make the most substantial contribution to market development. The presence of developing countries such as India, China, Japan, and others has contributed to the market's growth. Furthermore, increased government involvement as a result of rising national security concerns is expected to have a positive impact on the market in the near future.

BlackSky, European Space Imaging, Galileo Group, Inc., ImageSat, L3Harris Technologies, Inc., Maxar Technologies Inc., Planet Labs Inc., Airbus S.A.S., SpaceKnow Inc. and Telespazio France among others, are some of the key players in the Commercial Satellite Imaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources: Annual Reports, Investor Presentation, Press Release, SEC Filling, Company Blogs & Website

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.6.1 Model Details

1.6.1.1 Top-Down Approach

1.6.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1. Global Market Outlook

2.2 Application Outlook

2.3 End-User Outlook

2.4 Regional Outlook

Chapter 3 Global Commercial Satellite Imaging Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Commercial Satellite Imaging Market

3.4 Metric Data on Commercial Satellite Imaging Industry

3.5 Market Driver Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Commercial Satellite Imaging Market: Application Trend Analysis

4.1 Application: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

4.2 Geospatial Data Acquisition and Mapping

4.2.1 Market Estimates & Forecast Analysis of Geospatial Data Acquisition and Mapping Segment, By Region, 2019-2027 (USD Billion)

4.3 Natural Resource Management

4.3.1 Market Estimates & Forecast Analysis of Natural Resource Management Segment, By Region, 2019-2027 (USD Billion)

4.4 Surveillance and Security

4.4.1 Market Estimates & Forecast Analysis of Surveillance and Security Segment, By Region, 2019-2027 (USD Billion)

4.5 Conservation and Research

4.5.1 Market Estimates & Forecast Analysis of Conservation and Research Segment, By Region, 2019-2027 (USD Billion)

4.6 Disaster Management

4.6.1 Market Estimates & Forecast Analysis of Disaster Management Segment, By Region, 2019-2027 (USD Billion)

4.7 Defence and Intelligence

4.7.1 Market Estimates & Forecast Analysis of Defence and Intelligence Segment, By Region, 2019-2027 (USD Billion)

Chapter 5 Commercial Satellite Imaging Market: End-User Trend Analysis

5.1 End-User: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Physicochemical Properties Testing

5.2.1 Market Estimates & Forecast Analysis of Physicochemical Properties Testing Segment, By Region, 2019-2027 (USD Billion)

5.3 Construction

5.3.1 Market Estimates & Forecast Analysis of Construction Segment, By Region, 2019-2027 (USD Billion)

5.4 Transportation and Logistics

5.4.1 Market Estimates & Forecast Analysis of Transportation and Logistics Segment, By Region, 2019-2027 (USD Billion)

5.4 Military and Defence

5.4.1 Market Estimates & Forecast Analysis of Military and Defence Segment, By Region, 2019-2027 (USD Billion)

5.4 Forestry and Agriculture

5.4.1 Market Estimates & Forecast Analysis of Forestry and Agriculture Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Commercial Satellite Imaging Market, By Region

6.1 Regional Outlook

6.2 North America

6.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.2.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.3 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.5 U.S.

6.2.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.2.6 Canada

6.2.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.2.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.7 Mexico

6.5.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3 Europe

6.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.3.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.3 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.5 Germany

6.3.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.6 UK

6.3.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.7 France

6.3.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.7.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.8 Russia

6.3.8.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.8.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.9 Italy

6.3.9.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.9.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.10 Spain

6.3.10.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.11 Rest of Europe

6.3.11.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.11.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.4.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.5 China

6.4.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.6 India

6.4.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.7 Japan

6.4.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.7.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.8 Australia

6.4.8.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.8.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.4.9 South Korea

6.4.9.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.4.9.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.3.10 Rest of Asia Pacific

6.3.10.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.3.10.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5 Central & South America

6.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.5.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.3 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.5 Brazil

6.5.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.6 Rest of Central & South America

6.5.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6 Middle East & Africa

6.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

6.6.2 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.5 Saudi Arabia

6.6.5.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.6 United Arab Emirates

6.6.6.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.6.7 South Africa

6.6.7.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.6.67.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

6.5.8 Rest of Middle East & Africa

6.5.8.1 Market Estimates & Forecast Analysis, By Application, 2019-2027 (USD Billion)

6.5.8.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

7.1 Key Global Players, Recent Developments & their Impact on the Industry

7.2 Four Quadrant Competitor Positioning Matrix

7.2.1 Key Innovators

7.2.2 Market Leaders

7.2.3 Emerging Players

7.2.4 Market Challengers

7.3 Vendor Landscape Analysis

7.4 End-User Landscape Analysis

7.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

8.1 BlackSky

8.1.1 Company Overview

8.1.2 Financial Analysis

8.1.3 Strategic Initiatives

8.1.4 Product Benchmarking

8.2 European Space Imaging

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Initiatives

8.2.4 Product Benchmarking

8.3 Galileo Group, Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Initiatives

8.3.4 Product Benchmarking

8.4 ImageSat

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Initiatives

8.4.4 Product Benchmarking

8.5 L3Harris Technologies

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Initiatives

8.5.4 Product Benchmarking

8.6 MAXAR TECHNOLOGIES INC.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.7 PLANET LABS INC.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Initiatives

8.6.4 Product Benchmarking

8.8 Airbus S.A.S.

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Initiatives

8.7.4 Product Benchmarking

8.9 SpaceKnow Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Initiatives

8.8.4 Product Benchmarking

8.10 Telespazio France

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Initiatives

8.10.4 Product Benchmarking

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Initiatives

8.11.4 Product Benchmarking

List of Tables

1 Technological Advancements In Commercial Satellite Imaging Market

2 Global Commercial Satellite Imaging Market: Key Market Drivers

3 Global Commercial Satellite Imaging Market: Key Market Challenges

4 Global Commercial Satellite Imaging Market: Key Market Opportunities

5 Global Commercial Satellite Imaging Market: Key Market Restraints

6 Global Commercial Satellite Imaging Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

8 Geospatial Data Acquisition and Mapping: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

9 Natural Resource Management: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

10 Surveillance and Security: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

11 Conservation and Research: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

12 Disaster Management: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

13 Defence and Intelligence: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

14 Global Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

15 Government: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

16 Construction: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

17 Transportation and Logistics: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

18 Military and Defence: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

19 Forestry and Agriculture: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

20 Regional Analysis: Global Commercial Satellite Imaging Market, By Region, 2019-2027 (USD Billion)

21 North America: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

22 North America: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

23 North America: Commercial Satellite Imaging Market, By Country, 2019-2027 (USD Billion)

24 U.S: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

25 U.S: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

26 Canada: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

27 Canada: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

28 Mexico: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

29 Mexico: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

30 Europe: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

31 Europe: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

32 Europe: Commercial Satellite Imaging Market, By Country, 2019-2027 (USD Billion)

33 Germany: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

34 Germany: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

35 UK: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

36 UK: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

37 France: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

38 France: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

39 Italy: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

40 Italy: Commercial Satellite Imaging Market, By End-User Ype, 2019-2027 (USD Billion)

41 Spain: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

42 Spain: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

43 Rest Of Europe: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

44 Rest Of Europe: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

45 Asia Pacific: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

46 Asia Pacific: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

47 Asia Pacific: Commercial Satellite Imaging Market, By Country, 2019-2027 (USD Billion)

48 China: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

49 China: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

50 India: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

51 India: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

52 Japan: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

53 Japan: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

54 South Korea: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

55 South Korea: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

56 Middle East & Africa: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

57 Middle East & Africa: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

58 Middle East & Africa: Commercial Satellite Imaging Market, By Country, 2019-2027 (USD Billion)

59 Saudi Arabia: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

60 Saudi Arabia: Commercial Satellite Imaging Market, By Platform, 2019-2027 (USD Billion)

61 UAE: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

62 UAE: Commercial Satellite Imaging Market, By Platform, 2019-2027 (USD Billion)

63 Central & South America: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

64 Central & South America: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

65 Central & South America: Commercial Satellite Imaging Market, By Country, 2019-2027 (USD Billion)

66 Brazil: Commercial Satellite Imaging Market, By Application, 2019-2027 (USD Billion)

67 Brazil: Commercial Satellite Imaging Market, By End-User, 2019-2027 (USD Billion)

68 BlackSky: Products Offered

69 European Space Imaging: Products Offered

70 Galileo Group, Inc. ImageSat: Products Offered

71 ImageSat: Products Offered

72 L3Harris Technologies: Products Offered

73 MAXAR TECHNOLOGIES INC.: Products Offered

74 PLANET LABS INC.: Products Offered

75 Airbus S.A.S. Products Offered

76 SpaceKnow Inc.: Products Offered

77 Telespazio France: Products Offered

78 Q Laboratories: Products Offered

79 Other Companies: Products Offered

List of Figures

1. Global Commercial Satellite Imaging Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Commercial Satellite Imaging Market: Penetration & Growth Prospect Mapping

7. Global Commercial Satellite Imaging Market: Value Chain Analysis

8. Global Commercial Satellite Imaging Market Drivers

9. Global Commercial Satellite Imaging Market Restraints

10. Global Commercial Satellite Imaging Market Opportunities

11. Global Commercial Satellite Imaging Market Challenges

12. Key Commercial Satellite Imaging Market Manufacturer Analysis

13. Global Commercial Satellite Imaging Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. BlackSky: Company Snapshot

16. BlackSky: Swot Analysis

17. European Space Imaging: Company Snapshot

18. European Space Imaging: Swot Analysis

19. Galileo Group, Inc. ImageSat: Company Snapshot

20. Galileo Group, Inc. ImageSat: Swot Analysis

21. ImageSat: Company Snapshot

22. ImageSat: Swot Analysis

23. MAXAR TECHNOLOGIES INC.: Company Snapshot

24. MAXAR TECHNOLOGIES INC.: Swot Analysis

25. L3Harris Technologies: Company Snapshot

26. L3Harris Technologies: Swot Analysis

27. PLANET LABS INC.: Company Snapshot

28. PLANET LABS INC.: Swot Analysis

29. Airbus S.A.S. Company Snapshot

30. Airbus S.A.S. Swot Analysis

31. SpaceKnow Inc.: Company Snapshot

32. SpaceKnow Inc.: Swot Analysis

33. Telespazio France: Company Snapshot

34. Telespazio France: Swot Analysis

35. Other Companies: Company Snapshot

36. Other Companies: Swot Analysis

The Global Commercial Satellite Imaging Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Commercial Satellite Imaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS