Global Comprehensive Metabolic Panel Testing Market Size, Trends, and Analysis - Forecasts To 2026 By Disease (Kidney Disease, Liver Disease, Diabetes, Others), By End-Use (Laboratories, PoC), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa); End-User Landscape, Company Market Share Analysis & Competitor Analysis

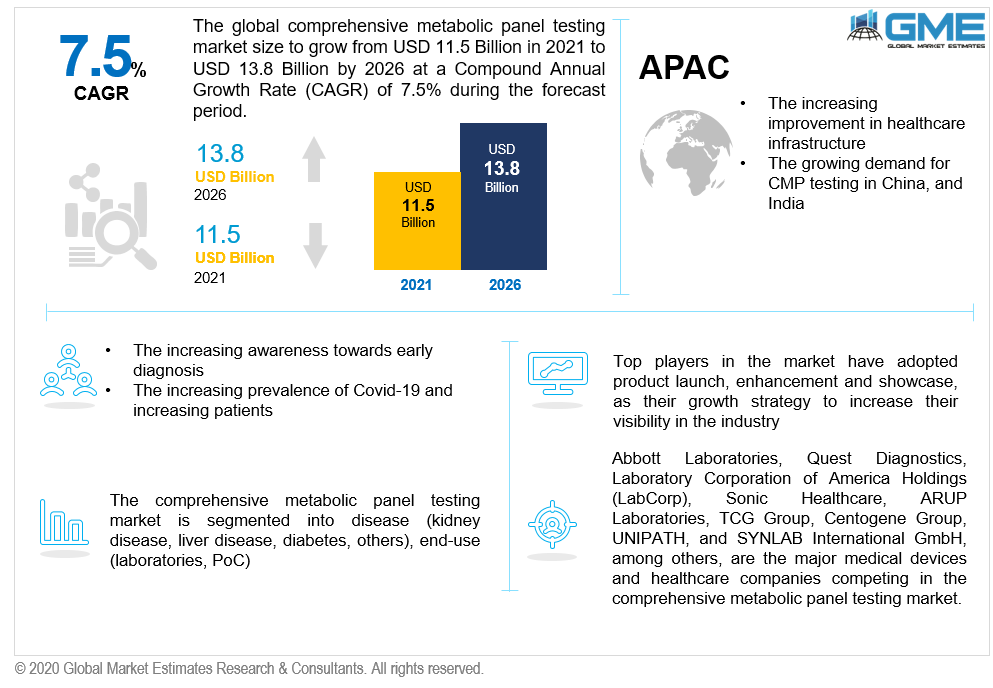

The global comprehensive metabolic panel testing market will grow from USD 11.5 billion in 2021, to USD 13.8 billion in 2026 with a CAGR value of 7.5%. Increasing prevalence of cardiovascular diseases and diabetes, the emergence of automated systems in laboratories, efficient and rapid results, development of data management solutions and introduction of innovative solutions for enhancing efficiency and minimizing errors are expected to increase demand for the comprehensive metabolic panel testing market.

Factors like the rising prevalence of chronic diseases, increasing prevalence of Covid 19 and increasing patient admission to hospitals and clinics, technological advancements, increasing disposable income, growing geriatric population, increasing adoption of electronic technology and IoT in healthcare devices are supporting the growth of this market. Moreover, new product developments, stringent government rules, and regulations, improved quality of care, emphasis on early diagnosis and treatment, availability of a diversity of applications, increasing healthcare awareness are some of the other driving factors in the market.

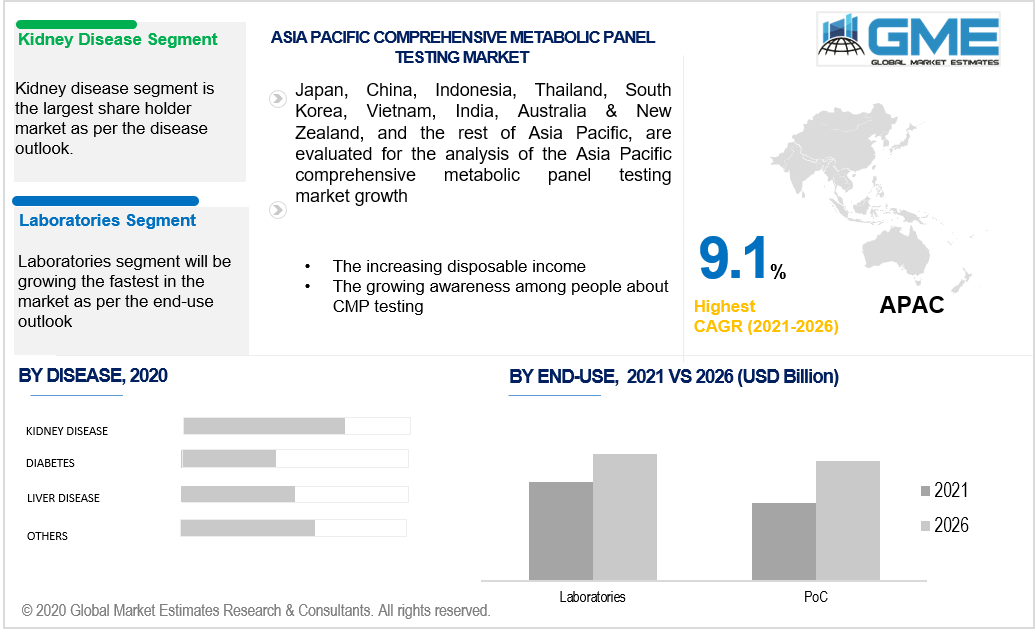

According to the type of disease segment, the market is segmented into kidney disease, liver disease, and diabetes, among others. The kidney disease is the largest shareholder during the forecast period. This is due to the characteristics like availability of effective treatment, high disease prevalence, better diagnosis, painless, low priced, maximum utilization of analyses, accessibility of multiple kidney diseases diagnostic tests, faster response time.

Other factors supporting the segment growth are higher preference of healthcare providers, patients preference for non-invasive techniques, the growing need for the early detection of kidney disorders, availability of computational support, and availability of a diversity of applications. However, the diabetes segment will grow the fastest in the market due to the increasing prevalence of diabetes, reduced costs, and high prevalence of lifestyle-associated diseases, higher scalability, integration, higher accuracy, cost-effectiveness, changing lifestyle habits, and availability of advanced technologies.

According to the end-use analysis, the two segments are laboratories and PoC. In 2020, laboratories were analyzed to be the largest shareholder in terms of revenue growth in the market This is attributed to the increasing number of people suffering from chronic diseases, higher reliability, increased patient satisfaction, easy availability, improved quality of care, and increasing number of patients.

However, the PoC segment will be growing the fastest in the market due to factors such as shorter procedure time, convenience, reduced number of clinic visits, enhanced patient’s comfort, and safety, and reduced medical error.

Lesser intake of drugs, faster response time, improved management and monitoring, availability of more advanced procedures, growing need for convenience among consumers, low-price and finer quality care are some of the other factors supporting the growth of the market.

As per the geographical analysis, the market of comprehensive metabolic panel testing can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South & America.

The market for North America will be dominant mainly due to the presence of a large number of key market players and industries, increasing number of research and development activities, increasing investments, quick adoption of latest technologies and devices, presence of adequate reimbursement policies, improvements in healthcare infrastructure, strong commercial performances of CMP diagnostics. Other factors helping to propel the growth of the market are favorable government initiatives, the high burden of disease, advancement in technology, rising consumer awareness, presence of skilled professionals, and increasing number of skilled professionals.

However, the Asia Pacific region will grow the fastest due to the rising geriatric population, increasing healthcare management, large patient population, increasing growth opportunities, rising prevalence of chronic diseases, and advancement in technology.

Abbott, Quest Diagnostics, Laboratory Corporation of America Holdings (LabCorp), Sonic Healthcare, UNIPATH, and SYNLAB International GmbH, among others, are the major medical devices and healthcare companies competing in the comprehensive metabolic panel testing market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Comprehensive Metabolic Panel Testing Industry Overview, 2020-2026

2.1.1 Disease Overview

2.1.2 End-Use Overview

Chapter 3 Global Comprehensive Metabolic Panel Testing Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The increasing prevalence of cardiovascular diseases and diabetes

3.3.1.2 The emergence of automated systems in laboratories

3.3.2 Industry Challenges

3.3.2.1 The possibility of false results

3.4 Prospective Growth Scenario

3.4.1 Disease Growth Scenario

3.4.2 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Comprehensive Metabolic Panel Testing Market, By Disease

4.1 Disease Outlook

4.2 Kidney Disease

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Liver Disease

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Diabetes

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Comprehensive Metabolic Panel Testing Market, By End-Use

5.1 End-Use Outlook

5.2 Laboratories

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 PoC

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Comprehensive Metabolic Panel Testing Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Disease, 2020-2026 (USD Million)

6.2.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Disease, 2020-2026 (USD Million)

6.2.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Disease, 2020-2026 (USD Million)

6.2.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Disease, 2020-2026 (USD Million)

6.3.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Disease, 2020-2026 (USD Million)

6.3.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Disease, 2020-2026 (USD Million)

6.3.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Disease, 2020-2026 (USD Million)

6.3.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Disease, 2020-2026 (USD Million)

6.3.7.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Disease, 2020-2026 (USD Million)

6.3.8.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Disease, 2020-2026 (USD Million)

6.3.9.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Disease, 2020-2026 (USD Million)

6.4.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Disease, 2020-2026 (USD Million)

6.4.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Disease, 2020-2026 (USD Million)

6.4.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Disease, 2020-2026 (USD Million)

6.4.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Disease, 2020-2026 (USD Million)

6.4.7.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Disease, 2020-2026 (USD Million)

6.4.8.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Disease, 2020-2026 (USD Million)

6.5.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Disease, 2020-2026 (USD Million)

6.5.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Disease, 2020-2026 (USD Million)

6.5.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Disease, 2020-2026 (USD Million)

6.5.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Disease, 2020-2026 (USD Million)

6.6.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Disease, 2020-2026 (USD Million)

6.6.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Disease, 2020-2026 (USD Million)

6.6.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Disease, 2020-2026 (USD Million)

6.6.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Abbott Laboratories

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 InfoGraphic Analysis

7.3 Quest Diagnostics

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 InfoGraphic Analysis

7.4 Laboratory Corporation of America Holdings

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 InfoGraphic Analysis

7.5 Sonic Healthcare

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 InfoGraphic Analysis

7.6 UNIPATH

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 InfoGraphic Analysis

7.7 SYNLAB International GmbH

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 InfoGraphic Analysis

7.8 ARUP Laboratories

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 InfoGraphic Analysis

7.9 CENTOGENE AG

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 InfoGraphic Analysis

7.10 TCG Corp

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 InfoGraphic Analysis

7.11 Scion Lab Services, LLC

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 InfoGraphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 InfoGraphic Analysis

The Global Comprehensive Metabolic Panel Testing Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Comprehensive Metabolic Panel Testing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS