Global Contrast Enhanced Ultrasound Market Size, Trends & Analysis - Forecasts to 2028 By Product Type (Equipment and Contrast Agent), By Type (Non-targeted and Targeted), By End-use (Hospitals, Clinics, and Ambulatory Diagnostic Centers), By Region (North America, Asia Pacific, Central & South America, Europe, the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

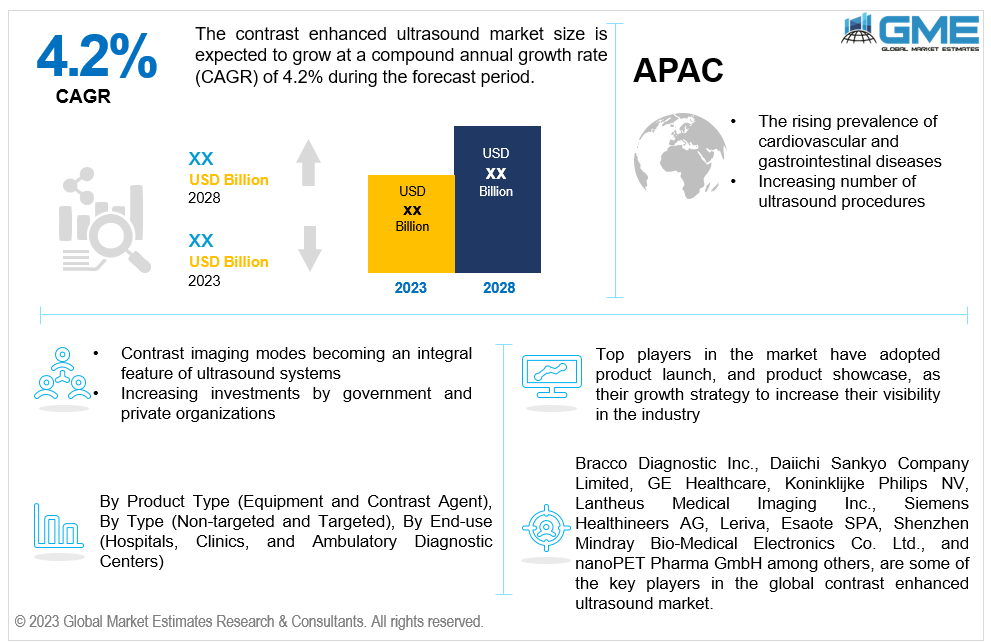

The global contrast enhanced ultrasound market is projected to grow at a CAGR of 4.2% from 2023 to 2028.

Contrast-enhanced ultrasound (CEUS) is a medical imaging technique that involves the use of ultrasound imaging in combination with the administration of contrast agents to improve the visualization and assessment of blood flow and tissue perfusion in various organs and tissues of the body. CEUS uses a radiation-free, patient-friendly technique. Contrary to imaging techniques like computed tomography (CT) or X-rays, which use ionizing radiation to produce pictures, CEUS uses ultrasonic waves to produce images without subjecting the patient to radiation. Specialized contrast agents are delivered into the bloodstream during CEUS. These contrast agents typically consist of gas-filled microbubbles or a gas core stabilized by a shell. These microbubbles cause significant echoes in reaction to the ultrasound waves as they go through the blood arteries, amplifying the signal and enabling real-time blood flow monitoring.

The assessment of liver lesions, the characterization of renal masses, the measurement of vascularity in solid tumors, the identification of vascular anomalies, and the assessment of perfusion in various organs, such as the heart and gastrointestinal tract, are common applications of contrast-enhanced ultrasound.

The major factors driving the market are the rising prevalence of cardiovascular and gastrointestinal diseases, increasing ultrasound procedural volume, and contrast imaging modes becoming an integral feature of ultrasound systems. Moreover, increasing investments by government and private organizations, the development of economic contrast agents, and technical advancements are expected to increase demand for contrast enhanced ultrasound.

Furthermore, due to better healthcare infrastructure and more access to medical services, the need for medical imaging is expanding in emerging nations. CEUS is gaining popularity in these areas due to its comparatively cheaper cost when compared to other imaging modalities like MRI or CT, presenting growth opportunities. However, the high cost associated with the devices and procedures and the shortage of helium is expected to hamper the growth of the market.

Because more patients are being referred for CEUS treatments, regular monitoring of Left Ventricular Volume (LV) and Ejection Fraction (LVEF) is essential in establishing the time and kind of medication provided to a patient with cardiovascular disorders (CVDs). Due to patients' poor endocardial boundary delineation, LV and LVEF values are frequently underestimated despite the development of improved ultrasound imaging methods like harmonic imaging.

Globally, CVDs are the main cause of mortality, according to the WHO. Around 17.9 million people worldwide perish away from CVDs each year. An increased prevalence of behavioral risk factors, such as using cigarettes or alcohol, not exercising, and eating poorly, is contributing to an increase in the incidence of CVD each year. As a result, the market is expected to grow due to the rising need for sensitive and reliable diagnostic instruments in the quantitative measurement of ventricular capacity in cardiac patients.

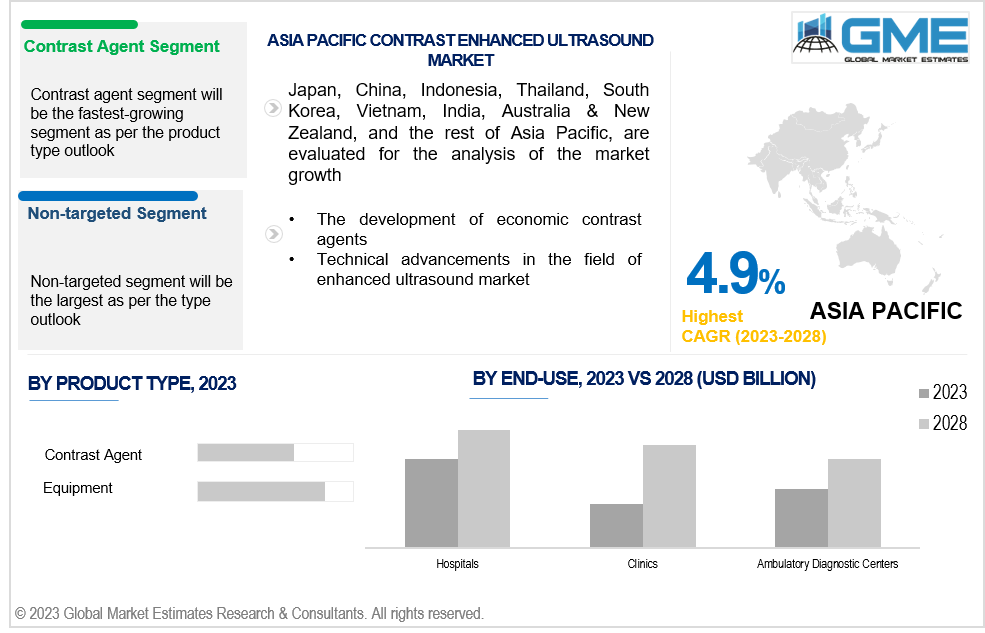

The contrast agent segment is expected to be the fastest-growing segment in the market from 2023-2028. The capacity to characterize lesions is improved by CEUS with contrast agents. It aids in determining the difference between solid and cystic lesions, locating regions of tumors with enhanced vascularity, and assessing the pattern and strength of blood flow inside the lesion. This knowledge facilitates the differentiation of benign from malignant lesions and aids in therapy preparation.

The equipment segment holds the largest share of the market. The expansion of the CEUS market has been fuelled by the introduction of improved ultrasound machines with transducer technology and nonlinear imaging methods. To promote product usability and enhance the diagnostic experience, ultrasound scanner manufacturers are increasingly inclined to offer full solutions for ultrasound imaging in a single system.

The targeted segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Vascular disruption treatments, which attempt to specifically interrupt blood flow to tumors or aberrant tissues, can be guided by and evaluated using CEUS. Clinicians may accurately target and track the effects of therapies like anti-angiogenic drugs or vascular disruptive agents by visualizing the vascular network and measuring blood flow using contrast agents. CEUS can measure therapy effectiveness, gauge the extent of vascular disturbance, and direct further treatments.

The non-targeted segment holds the largest share of the market. Every ultrasonic contrast agent that has been authorized is of the non-targeted variety. They are widely used to increase diagnostic sensitivity, measure the volume and blood flow of interest, and differentiate between malignant and benign liver tumors. Non-targeted contrast agents have the largest market share since they make up the bulk of commercially available products. They are widely used to assess the vascularity of a target lesion and measure organ perfusion. Abuse of alcohol is one of the primary causes of liver cirrhosis. As the global demographics of alcohol consumption change, it is expected that the need for ultrasonography contrast imaging services would rise.

The ambulatory diagnostic centers segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Diagnostic imaging services are becoming more and more necessary as a result of variables including a growing elderly population, an increase in the prevalence of chronic diseases, and advancements in imaging technology. With their specialized imaging emphasis, ambulatory diagnostic centers can meet this growing need by providing a variety of imaging modalities, including CEUS.

The hospitals segment holds the largest share of the market. The surge in emergency visits for conditions such as stomach pain, abdominal/thoracic traumas, and cardiac problems has led to an increase in the demand for CEUS in hospitals. The hospital segment's greatest revenue share has been attributed to the presence of a sizable patient pool and an established base of cutting-edge ultrasound technology.

The North American segment is expected to be the largest segment in the market. The region's market is expected to rise as a result of factors including the rising frequency of chronic illnesses and complicated comorbidities as well as rising private and public spending.

Asia Pacific is predicted to have rapid growth during the forecast period. The reason for this is an increase in healthcare expenditures, especially in countries like China and India. Additionally, the population's sensitivity to price in emerging countries, along with the absence of well-organized payment regulations, is anticipated to increase demand for procedures that are economical, such as contrast-enhanced ultrasound imaging. It is also projected that a rising number of government measures to enhance the region's healthcare infrastructure would accelerate market expansion.

The Europe market too is expected to have significant growth during the forecast period. Chronic disorders including cancer, liver disease, and cardiovascular disease are quite prevalent in Europe. These illnesses need the use of CEUS for diagnosis and treatment, which has boosted the demand for CEUS imaging services.

Bracco Diagnostic Inc., Daiichi Sankyo Company Limited, GE Healthcare, Koninklijke Philips NV, Lantheus Medical Imaging Inc., Siemens Healthineers AG, Leriva, Esaote SPA, Shenzhen Mindray Bio-Medical Electronics Co. Ltd., and nanoPET Pharma GmbH among others, are some of the key players in the global contrast enhanced ultrasound market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3 GLOBAL CONTRAST ENHANCED ULTRASOUND MARKET OUTLOOK

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL CONTRAST ENHANCED ULTRASOUND MARKET, BY PRODUCT TYPE

4.2 Contrast Enhanced Ultrasound Market: Product Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Equipment Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Contrast Agent Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL CONTRAST ENHANCED ULTRASOUND MARKET, BY TYPE

5.2 Contrast Enhanced Ultrasound Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Non-targeted Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Targeted Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL CONTRAST ENHANCED ULTRASOUND MARKET, BY END-USE

6.2 Contrast Enhanced Ultrasound Market: End-use Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Clinics Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Ambulatory Diagnostic Centers

6.6.1 Ambulatory Diagnostic Centers Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL CONTRAST ENHANCED ULTRASOUND MARKET, BY REGION

7.2.4.1 U.S. Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2 Canada Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3 Mexico Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.3 Europe Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1 Germany Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2 U.K. Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3 France Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4 Italy Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5 Spain Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4 Asia Pacific Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1 China Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2 Japan Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3 India Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6 Malaysia Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7 Thailand Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9 Vietnam Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10 Taiwan Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2 U.A.E. Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3 Israel Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1 Brazil Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3 Chile Contrast Enhanced Ultrasound Market Estimates and Forecast, 2020-2028 (USD Million)

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Daiichi Sankyo Company Limited

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Lantheus Medical Imaging Inc.

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6.1 Business Description & Financial Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Shenzhen Mindray Bio-Medical Electronics Co. Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11.1 Business Description & Financial Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various Type of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Mllion)

2 Equipment Market, By Region, 2020-2028 (USD Mllion)

3 Contrast Agent Market, By Region, 2020-2028 (USD Mllion)

4 Global Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Mllion)

5 Non-targeted Market, By Region, 2020-2028 (USD Mllion)

6 Targeted Market, By Region, 2020-2028 (USD Mllion)

7 Global Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Mllion)

8 Hospitals Market, By Region, 2020-2028 (USD Mllion)

9 Clinics Market, By Region, 2020-2028 (USD Mllion)

10 Ambulatory Diagnostic Centers Market, By Region, 2020-2028 (USD Mllion)

11 Regional Analysis, 2020-2028 (USD Mllion)

12 North America Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

13 North America Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

14 North America Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

15 North America Contrast Enhanced Ultrasound Market, By Country, 2020-2028 (USD Million)

16 U.S Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

17 U.S Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

18 U.S Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

19 Canada Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

20 Canada Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

21 Canada Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

22 Mexico Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

23 Mexico Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

24 Mexico Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

25 Europe Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

26 Europe Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

27 Europe Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

28 Germany Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

29 Germany Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

30 Germany Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

31 UK Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

32 UK Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

33 UK Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

34 France Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

35 France Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

36 France Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

37 Italy Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

38 Italy Contrast Enhanced Ultrasound Market, By T Type Type, 2020-2028 (USD Million)

39 Italy Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

40 Spain Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

41 Spain Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

42 Spain Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

43 Rest Of Europe Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

44 Rest Of Europe Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

45 Rest of Europe Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

46 Asia Pacific Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

47 Asia Pacific Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

48 Asia Pacific Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

49 Asia Pacific Contrast Enhanced Ultrasound Market, By Country, 2020-2028 (USD Million)

50 China Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

51 China Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

52 China Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

53 India Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

54 India Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

55 India Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

56 Japan Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

57 Japan Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

58 Japan Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

59 South Korea Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

60 South Korea Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

61 South Korea Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

62 Middle East & Africa Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

63 Middle East & Africa Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

64 Middle East & Africa Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

65 Middle East & Africa Contrast Enhanced Ultrasound Market, By Country, 2020-2028 (USD Million)

66 Saudi Arabia Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

67 Saudi Arabia Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

68 Saudi Arabia Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

69 UAE Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

70 UAE Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

71 UAE Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

72 Central & South America Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

73 Central & South America Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

74 Central & South America Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

75 Central & South America Contrast Enhanced Ultrasound Market, By Country, 2020-2028 (USD Million)

76 Brazil Contrast Enhanced Ultrasound Market, By Product Type, 2020-2028 (USD Million)

77 Brazil Contrast Enhanced Ultrasound Market, By Type, 2020-2028 (USD Million)

78 Brazil Contrast Enhanced Ultrasound Market, By End-use, 2020-2028 (USD Million)

79 Bracco Diagnostic Inc.: Products & Services Offering

80 Daiichi Sankyo Company Limited: Products & Services Offering

81 GE Healthcare: Products & Services Offering

82 Koninklijke Philips NV: Products & Services Offering

83 Lantheus Medical Imaging Inc.: Products & Services Offering

84 SIEMENS HEALTHINEERS AG: Products & Services Offering

85 Leriva : Products & Services Offering

86 Esaote SPA: Products & Services Offering

87 Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Inc: Products & Services Offering

88 NanoPET Pharma GmbH: Products & Services Offering

89 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Contrast Enhanced Ultrasound Market Overview

2 Global Contrast Enhanced Ultrasound Market Value From 2020-2028 (USD Mllion)

3 Global Contrast Enhanced Ultrasound Market Share, By Product Type (2022)

4 Global Contrast Enhanced Ultrasound Market Share, By Type (2022)

5 Global Contrast Enhanced Ultrasound Market Share, By End-use (2022)

6 Global Contrast Enhanced Ultrasound Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Contrast Enhanced Ultrasound Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Contrast Enhanced Ultrasound Market

11 Impact Of Challenges On The Global Contrast Enhanced Ultrasound Market

12 Porter’s Five Forces Analysis

13 Global Contrast Enhanced Ultrasound Market: By Product Type Scope Key Takeaways

14 Global Contrast Enhanced Ultrasound Market, By Product Type Segment: Revenue Growth Analysis

15 Equipment Market, By Region, 2020-2028 (USD Mllion)

16 Contrast Agent Market, By Region, 2020-2028 (USD Mllion)

17 Global Contrast Enhanced Ultrasound Market: By Type Scope Key Takeaways

18 Global Contrast Enhanced Ultrasound Market, By Type Segment: Revenue Growth Analysis

19 Non-targeted Market, By Region, 2020-2028 (USD Mllion)

20 Targeted Market, By Region, 2020-2028 (USD Mllion)

21 Global Contrast Enhanced Ultrasound Market: By End-use Scope Key Takeaways

22 Global Contrast Enhanced Ultrasound Market, By End-use Segment: Revenue Growth Analysis

23 Hospitals Market, By Region, 2020-2028 (USD Mllion)

24 Clinics Market, By Region, 2020-2028 (USD Mllion)

25 Ambulatory Diagnostic Centers Market, By Region, 2020-2028 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global Contrast Enhanced Ultrasound Market: Regional Analysis

28 North America Contrast Enhanced Ultrasound Market Overview

29 North America Contrast Enhanced Ultrasound Market, By Product Type

30 North America Contrast Enhanced Ultrasound Market, By Type

31 North America Contrast Enhanced Ultrasound Market, By End-use

32 North America Contrast Enhanced Ultrasound Market, By Country

33 U.S. Contrast Enhanced Ultrasound Market, By Product Type

34 U.S. Contrast Enhanced Ultrasound Market, By Type

35 U.S. Contrast Enhanced Ultrasound Market, By End-use

36 Canada Contrast Enhanced Ultrasound Market, By Product Type

37 Canada Contrast Enhanced Ultrasound Market, By Type

38 Canada Contrast Enhanced Ultrasound Market, By End-use

39 Mexico Contrast Enhanced Ultrasound Market, By Product Type

40 Mexico Contrast Enhanced Ultrasound Market, By Type

41 Mexico Contrast Enhanced Ultrasound Market, By End-use

42 Four Quadrant Positioning Matrix

43 Company Market Share Analysis

44 Bracco Diagnostic Inc.: Company Snapshot

45 Bracco Diagnostic Inc.: SWOT Analysis

46 Bracco Diagnostic Inc.: Geographic Presence

47 Daiichi Sankyo Company Limited: Company Snapshot

48 Daiichi Sankyo Company Limited: SWOT Analysis

49 Daiichi Sankyo Company Limited: Geographic Presence

50 GE Healthcare: Company Snapshot

51 GE Healthcare: SWOT Analysis

52 GE Healthcare: Geographic Presence

53 Koninklijke Philips NV: Company Snapshot

54 Koninklijke Philips NV: Swot Analysis

55 Koninklijke Philips NV: Geographic Presence

56 Lantheus Medical Imaging Inc.: Company Snapshot

57 Lantheus Medical Imaging Inc.: SWOT Analysis

58 Lantheus Medical Imaging Inc.: Geographic Presence

59 SIEMENS HEALTHINEERS AG: Company Snapshot

60 SIEMENS HEALTHINEERS AG: SWOT Analysis

61 SIEMENS HEALTHINEERS AG: Geographic Presence

62 Leriva : Company Snapshot

63 Leriva : SWOT Analysis

64 Leriva : Geographic Presence

65 Esaote SPA: Company Snapshot

66 Esaote SPA: SWOT Analysis

67 Esaote SPA: Geographic Presence

68 Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Inc.: Company Snapshot

69 Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Inc.: SWOT Analysis

70 Shenzhen Mindray Bio-Medical Electronics Co. Ltd., Inc.: Geographic Presence

71 NanoPET Pharma GmbH: Company Snapshot

72 NanoPET Pharma GmbH: SWOT Analysis

73 NanoPET Pharma GmbH: Geographic Presence

74 Other Companies: Company Snapshot

75 Other Companies: SWOT Analysis

76 Other Companies: Geographic Presence

The Global Contrast Enhanced Ultrasound Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Contrast Enhanced Ultrasound Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS