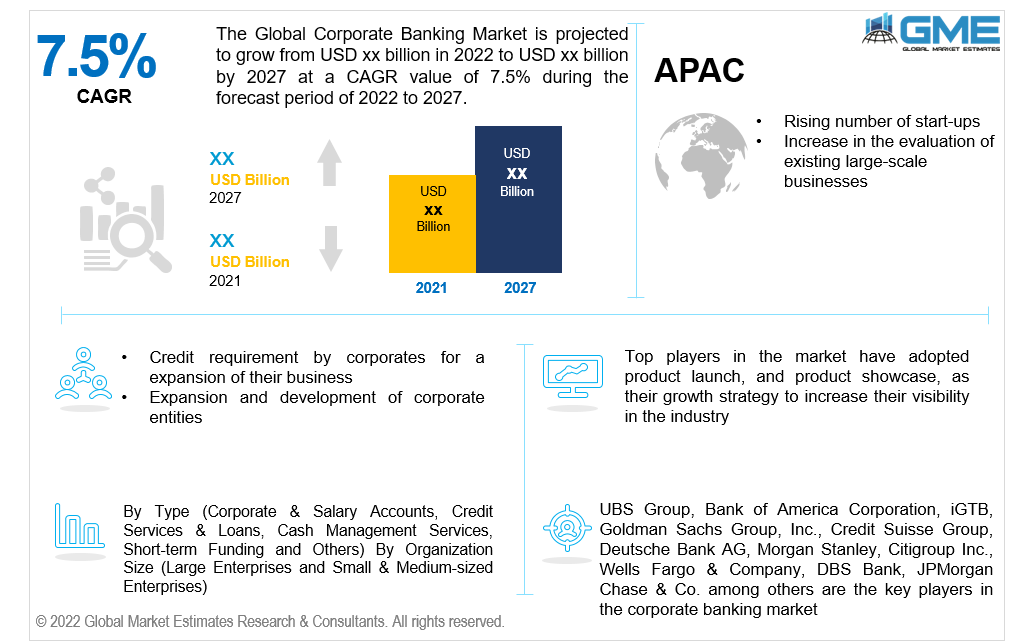

Global Corporate Banking Market Size, Trends & Analysis - Forecasts to 2027 By Type (Corporate & Salary Accounts, Credit Services & Loans, Cash Management Services, Short-term Funding, and Others) By Organization Size (Large Enterprises and Small & Medium-sized Enterprises), By Region (North America, Asia Pacific, Europe, Central & South America, Middle East & Africa), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The global corporate banking market is projected to grow at a CAGR value of 7.5% from 2022 to 2027.

Corporate banking is a specialist sector of a commercial bank that provides major corporations and small and medium-sized businesses (SMEs) with financial services such as credit risk management, wealth management, treasury services, and underwriting. The global need for corporate banking has increased dramatically in recent years, and it is expected to continue to rise as the economy and business flourish.

Payment’s solution for major enterprises is one of the fastest-growing areas, according to McKinsey's Panorama fintech database, which analyses over 1,000 financial start-ups. The recent series of mergers and acquisitions among retail banks and fintech has added to the belief that the land grab is ended. The development in corporate entities and their need to keep a bank account, considering cash with banks is regarded to be a secure alternative, are major driving factors.

The demand for corporate banking is expected to grow during the forecast period, as it offers large amounts of money at a high-interest rate than conventional loans, including its capacity to provide trade finance, supply chain services, money transfers, treasury services, and deposit services, catapulting the market forward. Furthermore, corporate banking's ability to provide financial solutions tailored to all enterprises, regardless of their size or nature, as well as a huge range of goods and technology enables seamless delivery of these services at any location and time, is propelling the market forward.

The COVID 19 outbreak caused a momentary halt in operations for several businesses, resulting in a loss of revenue. Banks, as the backbone of an economy, were not shut down, but their operations were scaled back for the time being. The COVID-19 crisis, on the other hand, has accelerated innovation and process digitization in the banking sector. Since the emergence of COVID-19, over three-quarters of banks (72%) have observed an increase in the integration of corporate banking APIs.

However, the high demand for new or recalibrated business credit restrictions put a larger strain on banks' lending businesses. Several firms and organizations, on the other hand, prefer reputable banks and financial institutions to smaller financial institutions. As a result, greater competition from large banks, FinTech disruptions that enable additional sources, and a heavily regulated environment stifled the industry growth.

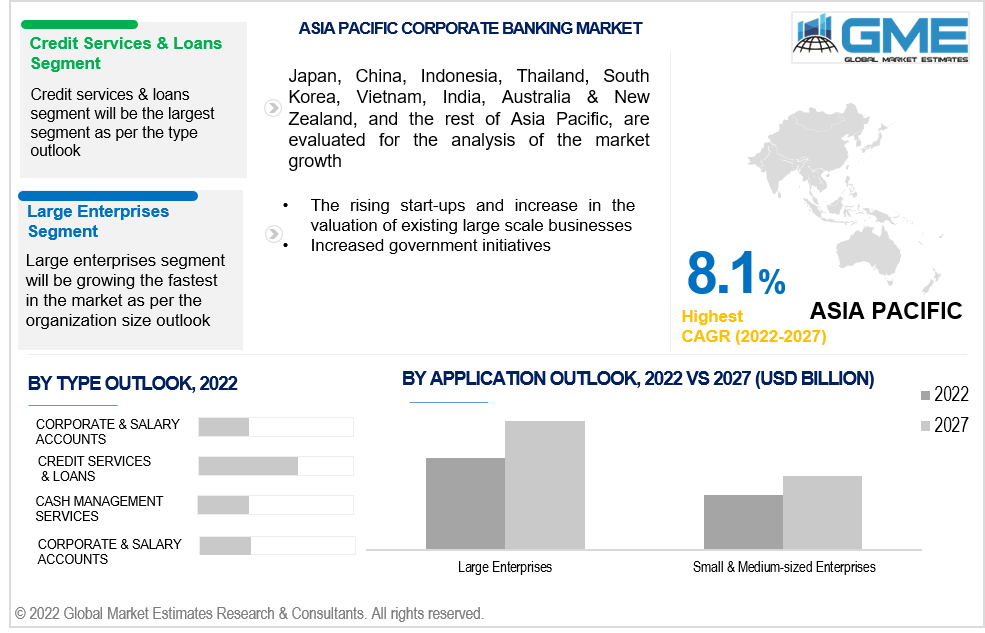

Based on the type, the market is divided into corporate & salary accounts, credit services & loans, cash management services, short-term funding, and others. The credit services & loans segment is expected to be the fastest-growing segment in the corporate banking market from 2022 to 2027.

Based on the organization size, the market is divided into large enterprises and small & medium-sized enterprises. The large enterprise segment is expected to hold a larger share as compared to other segments. Corporate banking particularly focuses on delivering loans and other financial services to multinational corporations, as they are frequently used by large companies to find solutions. Corporate banking caters to large corporations rather than small businesses or start-ups, whereas business and investment banks may be able to assist smaller businesses in growing.

As per the geographical analysis, the corporate banking market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the corporate banking market from 2022 to 2027. The dominant presence of top players in this region and the presence of well-established corporate banks headquartered, along with ongoing cyber research in the field of banking in the U.S. and Canada are driving market growth in this region.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the corporate banking market during the forecast period. Due to the rising number of start-ups and increase in the evaluation of existing large-scale businesses, increased government initiatives, and the expanding number of awareness campaigns to have a corporate account are factors driving the market growth. China and Singapore have a huge market for corporate banking services followed by India. Additionally, an increase in employment opportunities among citizens with the rise in population, as well as favorable government policies for supporting and encouraging corporate banking are propelling growth in this region.

UBS Group, Bank of America Corporation, iGTB, Goldman Sachs Group, Inc., Credit Suisse Group, Deutsche Bank AG, Morgan Stanley, Citigroup Inc., Wells Fargo & Company, DBS Bank, and JPMorgan Chase & Co. among others are the key players in the corporate banking market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Corporate Banking Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Organization Overview

2.1.4 Regional Overview

Chapter 3 Corporate Banking Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rise in business entities, and increasing adoption of internet banking

3.3.2 Industry Challenges

3.3.2.1 Impact of COVID-19

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Organization Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Organization Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2022

Chapter 4 Corporate Banking Market, By Type

4.1 Type Outlook

4.2 Corporate & Salary Accounts

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Credit Services & Loans

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Cash Management Services

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Corporate Banking Market, By Organization Size

5.1 Organization Outlook

5.2 Large Enterprises

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Small & Medium-sized Enterprises

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Corporate Banking Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Type, 2022-2027 (USD Billion)

6.2.3 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Type, 2022-2027 (USD Billion)

6.3.3 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Type, 2022-2027 (USD Billion)

6.4.3 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.7.2 Market size, By Organization Size, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Type, 2022-2027 (USD Billion)

6.5.3 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Type, 2022-2027 (USD Billion)

6.6.3 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By Organization Size, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 UBS Group

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Bank of America Corporation

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 iGTB

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Goldman Sachs Group, Inc

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Credit Suisse Group

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Deutsche Bank AG

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Morgan Stanley

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Citigroup Inc.

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Corporate Banking Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Corporate Banking Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS