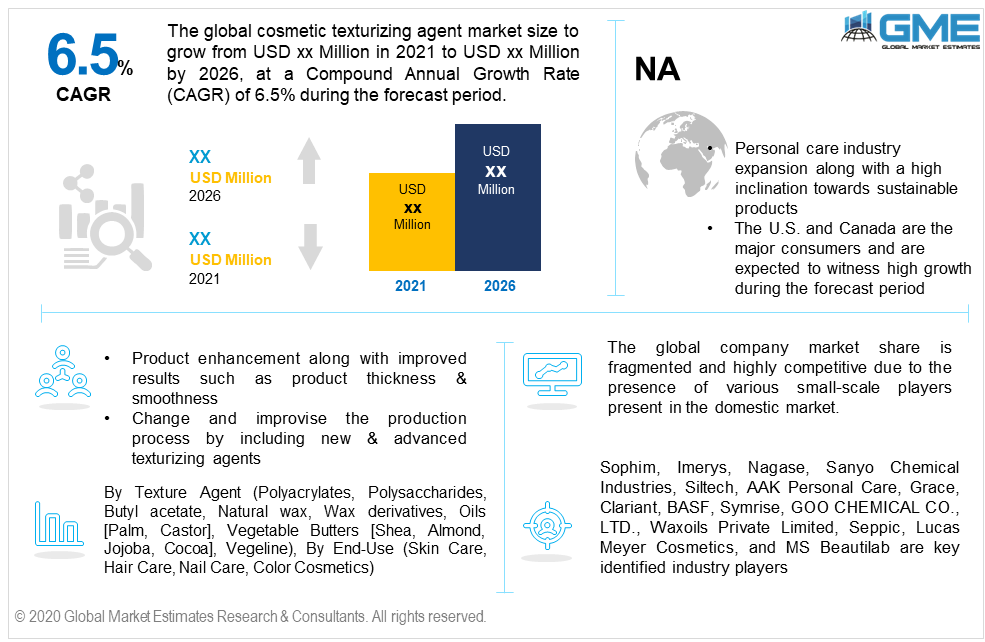

Global Cosmetic Texturizing Agent Market Size, Trends & Analysis - Forecasts to 2026 By Texture Agent (Polyacrylates, Polysaccharides, Butyl acetate, Natural wax, Wax derivatives, Oils [Palm, Castor], Vegetable Butters [Shea, Almond, Jojoba, Cocoa], Vegeline), By End-Use (Skin Care, Hair Care, Nail Care, Color Cosmetics), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

Product enhancement along with improved results such as product thickness & smoothness are the key factors to invest in diversified cosmetic texturizing agents. The global personal care ingredient spending was around USD 10 Billion in 2019 and is expected to exceed USD 15 Billion by 2026. Increasing consumer spending along with inclination towards beauty products are the prime reasons to induce demand.

The Global Cosmetic Texturizing Agent Market will observe over 6.5% CAGR up to 2026, with Asia Pacific being the major revenue contributor in 2019. New product development with more advanced and sustainable raw materials are the major trends witnessed in the industry. Also, inclination towards clean labeling and natural material-based products are projected to influence demand for natural elements such as oils, natural wax, and vegetable butter.

The chief objective of the beauty products manufacturers is to change and improvise their production process by including new & advanced raw materials. This group of natural and synthetic ingredients helps the producers in making reliable products for the long term.

Fashion and entertainment industry expansion along with the requirement to meet the quality beauty products will proliferate the industry growth in the coming years. As of now, various beauty products producers are already replacing their conventional materials with natural ones. The global market is moderately competitive owing to the availability of various materials. The materials are not exclusive and widely available, but the usage pattern can be different by using the ingredients differently for various products due to their high efficiency and availability.

The texture agent segment is categorized into natural and synthetic elements. The synthetic elements include polyacrylates, polysaccharides, butyl acetate, and other wax derivatives. These are chemical-based materials help in enhancing the consistency of the products. The natural materials include natural wax, palm oil, castor oil, shea butter, almond, jojoba, and cocoa.

The other potential element is added in the industry is the vegeline which holds a promising future for numerous beauty products. Palm oil and castor oil are the majorly consumed natural oil in the making of beauty products. Wide availability and favorable results are the major reasons to witness high demand for these materials. In the case of natural butter, the shea and jojoba are the prime sourced butter for beauty products.

Skin care, nail care, hair care, and color cosmetics are the major end-users in the industry. Skin care is the prime end-user of these materials owing to their high production rate to meet the continuously increasing demand. Improving product performance by providing them the optimum thickness, consistency, and uniformity are the key reasons to induce high adoption of these materials in skincare products. Major products under skincare include but are not limited to face creams, lotions, sunscreen, and cleansers.

The hair care segment is likely to witness high gains during the forecast period. Increasing consumer preference towards hair care products owing to the increasing challenges related to early gray, hair fall, and thinness. The other lucrative segment is the color cosmetics which is highly impacted by the increasing demand for lipsticks and lip balms that are more smooth and long-lasting. The segment will foresee over 5.5% CAGR up to 2026.

The Asia Pacific led the global regional revenue and consumption of these materials. The region held responsible for more than 35% of the total revenue share in 2019. The presence of large-scale manufacturing facilities along with high spending on personal care and beauty products are the prime reasons to support growth in this region. China, India, South Korea, and Japan are the key contributing countries due to their high involvement and influence towards beauty care products.

The North American market will observe significant gains of around 5% in the coming years. Personal care industry expansion along with a high inclination towards sustainable products will result in high product penetration in the region. The U.S. and Canada are the major consumers and are expected to witness high growth in the coming years.

The European region is highly inclined towards the adoption of natural substitute materials which will result in high penetration of natural oils and waxes in the region. Government intervention to support green-labeled products along with increased consumer consciousness towards organic and natural products will induce the regional demand for natural cosmetic texturizing agents.

Sophim, Imerys, Nagase, Sanyo Chemical Industries, Siltech, AAK Personal Care, Grace, Clariant, BASF, Symrise, GOO CHEMICAL CO., LTD., Waxoils Private Limited, Seppic, Lucas Meyer Cosmetics, and MS Beautilab are key identified industry players.

Please note: This is not an exhaustive list of companies profiled in the report.

The global company market share is fragmented and highly competitive due to the presence of various small-scale players present in the domestic market. Material development related to product performance, texture, and sustainability are the prime concerns of the producers. Long-term agreements across the value chain to attain maximum profitability are the key strategies witnessed in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cosmetic Texturizing Agent industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Texture agent overview

2.1.3 End-use overview

2.1.4 Regional overview

Chapter 3 Cosmetic Texturizing Agent Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Cosmetic Texturizing Agent Market, By Texture Agent

4.1 Texture Agent Outlook

4.2 Polyacrylates

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Polysaccharides

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Butyl acetate

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Natural wax

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Wax derivatives

4.6.1 Market size, by region, 2019-2026 (USD Million)

4.7 Oils

4.7.1 Market size, by region, 2019-2026 (USD Million)

4.7.2 Palm

4.7.2.1 Market size, by region, 2019-2026 (USD Million)

4.7.3 Castor

4.7.3.1 Market size, by region, 2019-2026 (USD Million)

4.7.4 Others

4.7.4.1 Market size, by region, 2019-2026 (USD Million)

4.8 Vegetable butters

4.8.1 Market size, by region, 2019-2026 (USD Million)

4.8.2 Shea

4.8.2.1 Market size, by region, 2019-2026 (USD Million)

4.8.3 Almond

4.8.3.1 Market size, by region, 2019-2026 (USD Million)

4.8.4 Jojoba

4.8.4.1 Market size, by region, 2019-2026 (USD Million)

4.8.5 Cocoa

4.8.5.1 Market size, by region, 2019-2026 (USD Million)

4.8.6 Others

4.8.6.1 Market size, by region, 2019-2026 (USD Million)

4.9 Vegeline

4.9.1 Market size, by region, 2019-2026 (USD Million)

4.10 Others

4.10.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Cosmetic Texturizing Agent Market, By End-Use

5.1 End-Use Outlook

5.2 Skin care

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Hair care

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Nail care

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Color cosmetics

5.5.1 Market size, by region, 2019-2026 (USD Million)

5.6 Others

5.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Cosmetic Texturizing Agent Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by texture agent, 2019-2026 (USD Million)

6.2.3 Market size, by end-use, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by texture agent, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by texture agent, 2019-2026 (USD Million)

6.2.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by texture agent, 2019-2026 (USD Million)

6.3.3 Market size, by end-use, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by texture agent, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by texture agent, 2019-2026 (USD Million)

6.3.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by texture agent, 2019-2026 (USD Million)

6.3.6.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by texture agent, 2019-2026 (USD Million)

6.3.7.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by texture agent, 2019-2026 (USD Million)

6.3.8.2 Market size, by end-use, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by texture agent, 2019-2026 (USD Million)

6.3.9.2 Market size, by end-use, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by texture agent, 2019-2026 (USD Million)

6.4.3 Market size, by end-use, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by texture agent, 2019-2026 (USD Million)

6.4.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by texture agent, 2019-2026 (USD Million)

6.4.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by texture agent, 2019-2026 (USD Million)

6.4.6.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.7 Singapore

6.4.7.1 Market size, by texture agent, 2019-2026 (USD Million)

6.4.7.2 Market size, by end-use, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by texture agent, 2019-2026 (USD Million)

6.4.8.2 Market size, by end-use, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by texture agent, 2019-2026 (USD Million)

6.5.3 Market size, by end-use, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by texture agent, 2019-2026 (USD Million)

6.5.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by texture agent, 2019-2026 (USD Million)

6.5.5.2 Market size, by end-use, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by texture agent, 2019-2026 (USD Million)

6.6.3 Market size, by end-use, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by texture agent, 2019-2026 (USD Million)

6.6.4.2 Market size, by end-use, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by texture agent, 2019-2026 (USD Million)

6.6.5.2 Market size, by end-use, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 Sophim

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 Imerys

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Nagase

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Sanyo Chemical Industries

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Siltech

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 AAK Personal Care

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Grace

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Clariant

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 BASF

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Symrise

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 GOO CHEMICAL CO., LTD

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Waxoils Private Limited

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Seppic

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Lucas Meyer Cosmetics

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 MS Beautilab

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

The Global Cosmetic Texturizing Agent Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cosmetic Texturizing Agent Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS