Global Crypto Tax Software Market Size, Trends & Analysis - Forecasts to 2029 By Enterprise Size (Large Enterprises and SMEs), By Deployment Mode (Cloud-based and On-premises), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

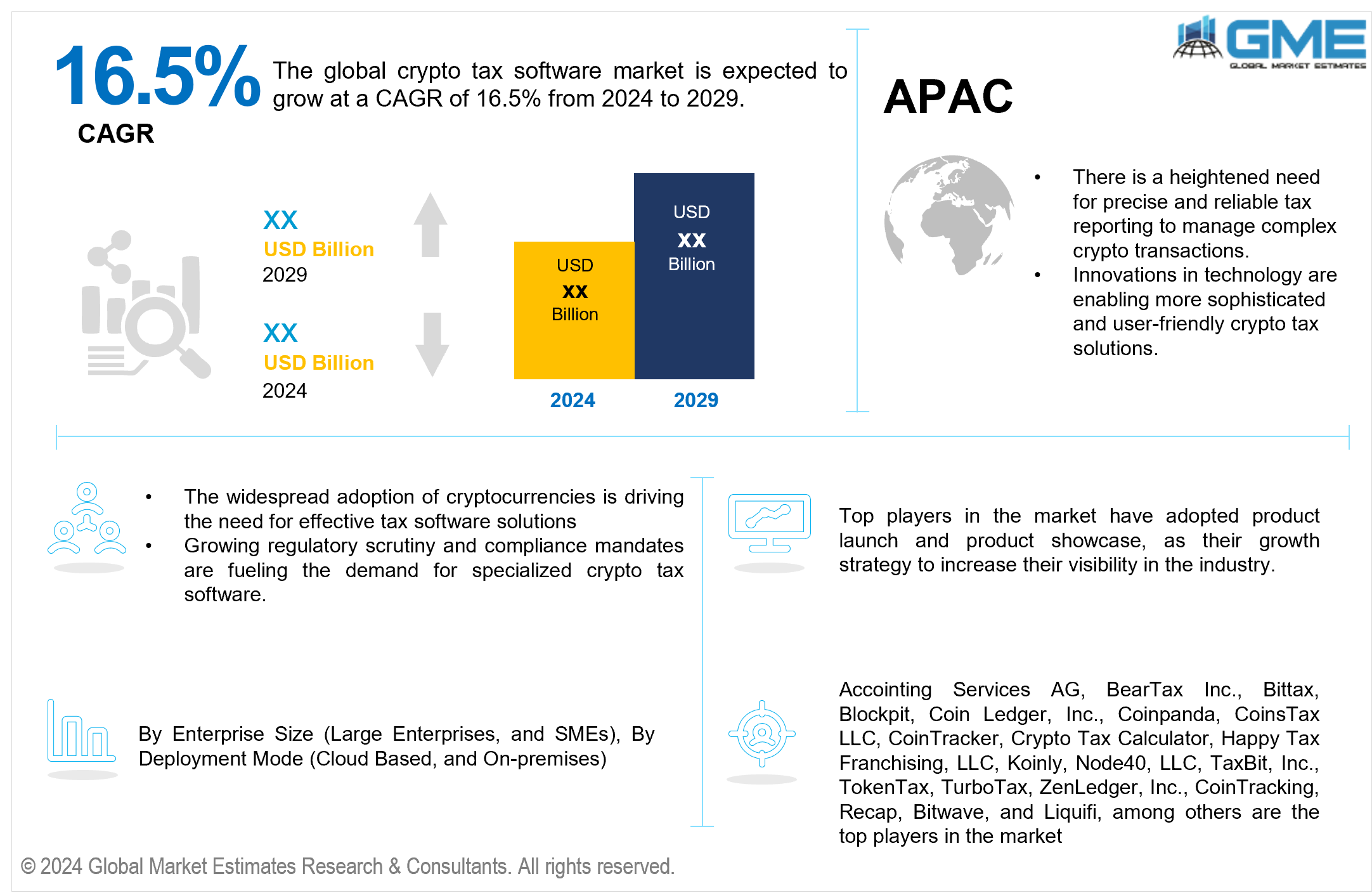

The global crypto tax software market is expected to exhibit a CAGR of 16.5% from 2024 to 2029.

The global crypto tax software market encompasses various solutions tailored to meet the growing demand for efficient cryptocurrency tax management. From automated crypto tax reporting to blockchain tax solutions, these platforms offer comprehensive features for crypto tax compliance and accurate calculation of tax liabilities. Digital asset tax software simplifies crypto tax management by providing crypto tax calculation tools for tracking crypto gains and losses, as well as managing crypto portfolios. Blockchain tax reporting ensures transparency and accountability in tax filings, while crypto accounting software streamlines the process of crypto transaction tracking and tax optimization. With the rise of decentralized finance (DeFi) and non-fungible tokens (NFTs), specialized DeFi tax software and NFT tax reporting solutions have emerged to address the unique challenges of taxing these digital assets. Bitcoin tax software and cryptocurrency capital gains software further cater to the specific needs of Bitcoin and other cryptocurrencies, offering tailored crypto tax filing solutions for digital currency investors and traders. As the crypto market continues to evolve and regulatory scrutiny increases, the demand for advanced cryptocurrency tax software is expected to grow, driving innovation and expansion in this dynamic market segment.

Cryptocurrency tax automation streamlines the process of crypto gains and losses tracking and crypto portfolio tax tracking, ensuring accurate tax reporting for digital currency transactions. Tax software for digital currencies offers comprehensive solutions for crypto tax filing, providing users with the tools needed to optimize tax liabilities. By automating crypto transaction tracking and offering tax optimization for crypto features, these platforms simplify the complexities of cryptocurrency taxation, enabling users to efficiently manage their tax obligations in the ever-evolving crypto landscape.

One of the most important market drivers is the growing adoption of cryptocurrencies globally. As more individuals and organizations engage in cryptocurrency transactions for investing, trading, and payment, the demand for reliable tax reporting solutions grows. Crypto tax software automates the time-consuming and error-prone manual record-keeping process, giving customers a simple and dependable way to track their cryptocurrency-related revenue and expenses. Furthermore, the growing regulatory landscape surrounding cryptocurrencies, with tax authorities increasingly scrutinizing crypto transactions, adds to the demand for compliant tax reporting solutions.

The market provides valuable tools for cryptocurrency users to manage their tax liabilities effectively. By automating tax reporting processes and guaranteeing regulatory compliance, these software solutions reduce the complications of bitcoin taxes. As the popularity of cryptocurrencies continues to expand and tax regulations evolve, the demand for trustworthy crypto tax software is likely to increase, driving additional innovation and expansion in this market.

Both large corporations and small and medium-sized businesses play essential roles in driving growth. Large organizations frequently have substantial cryptocurrency portfolios and complex tax requirements, necessitating robust and scalable crypto tax solutions to manage transactions and comply with regulations. As a result, major businesses account for a significant percentage of the market demand for cryptocurrency tax software. Small and medium-sized enterprises require effective tax management solutions to negotiate the intricacies of cryptocurrency taxation despite having lower crypto holdings. SMEs' increased usage of cryptocurrencies for investment and payment purposes adds to the demand for crypto tax software in this market.

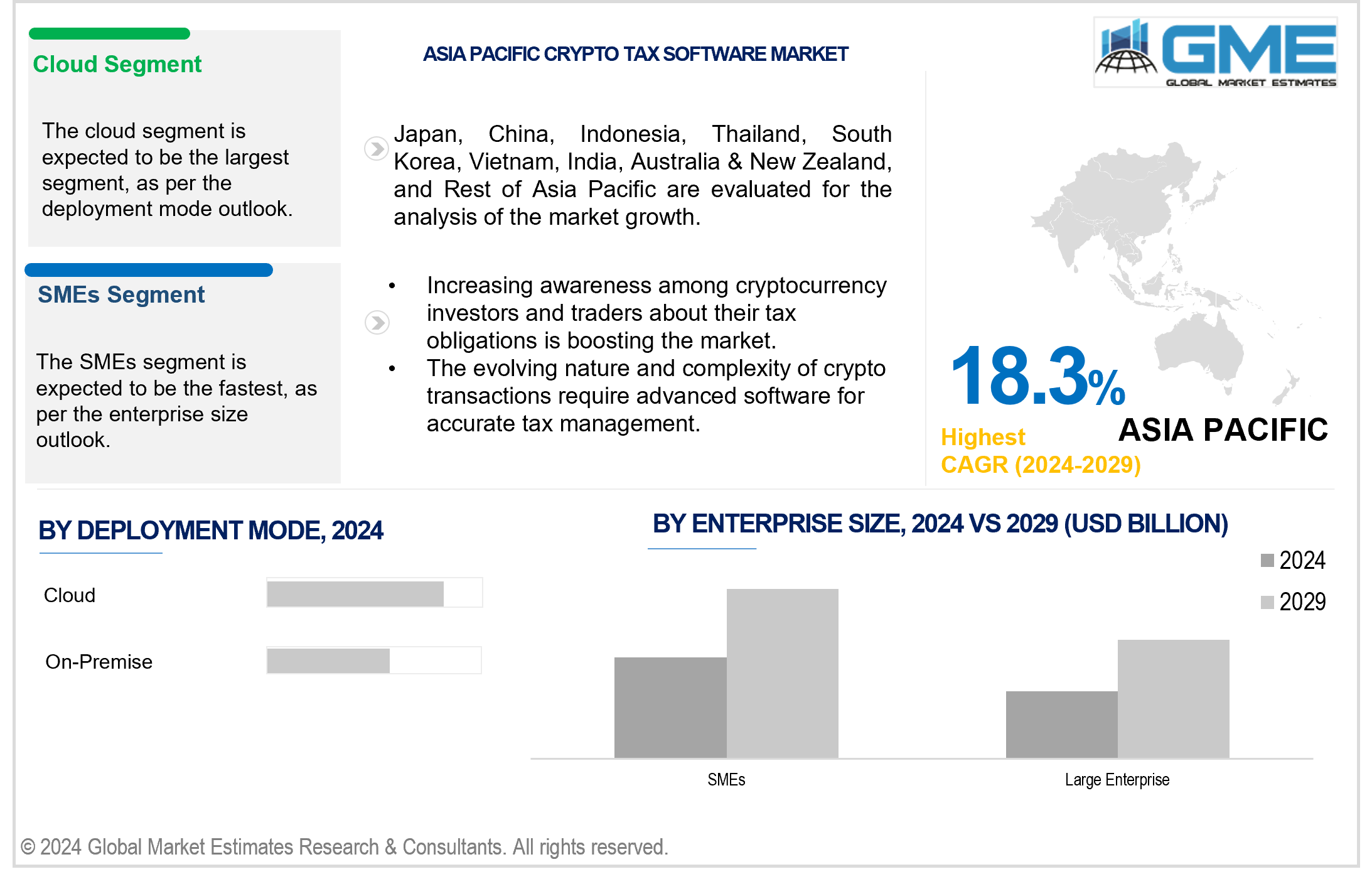

While large enterprises currently represent the largest market share due to their substantial crypto holdings and sophisticated tax needs, SMEs are the fastest-growing segment. SMEs increasingly understand the necessity of correct tax reporting and compliance in cryptocurrency. As a result, they are investing in crypto tax software to help them expedite their tax operations. Furthermore, the increasing number of SMEs entering the cryptocurrency industry, combined with legislative developments requiring tax compliance, is pushing the rapid adoption of crypto tax solutions among SMEs. As a result, while large firms continue to dominate the industry in terms of revenue share, SMEs are anticipated to enjoy significant growth, making them a crucial priority for crypto tax software suppliers in the future.

Cloud-based and on-premises deployment techniques meet the varying needs of organizations across industries. Cloud deployment provides flexibility, scalability, and accessibility, making it a popular alternative for businesses of all sizes. Large enterprises, in particular, frequently prefer cloud-based crypto tax solutions because they can manage massive amounts of data and allow real-time access to tax information from anywhere, at any time. On the other hand, SMEs benefit from the lower upfront expenses and decreased IT infrastructure requirements associated with cloud deployment, making it an appealing choice for managing their cryptocurrency tax obligations.

While cloud-based deployment presently dominates the global crypto tax software industry, on-premises implementation is the fastest-growing category. Some businesses, particularly those in highly regulated industries or with unique security and compliance needs, prefer to have complete control over their crypto tax software and data by implementing it on-premises. Furthermore, certain geographical regions may have data sovereignty requirements requiring on-premises deployment. As the demand for crypto tax software grows and businesses seek solutions adapted to their requirements, cloud-based and on-premises deployment types are projected to expand further. However, the flexibility and cost-effectiveness of cloud-based deployment, together with developments in cloud technology, are likely to maintain its dominance in the industry for the foreseeable future.

North America is analyzed to hold the largest market share in the global crypto tax software market due to the region's early adoption of cryptocurrencies, robust regulatory framework, and high concentration of cryptocurrency investors and enterprises. The existence of top crypto tax software companies and the proactive approach of regulatory agencies in addressing cryptocurrency taxation contribute to North America's dominance in the field.

However, Asia Pacific is analyzed to be the fastest-growing region in the market. With the rapid spread of cryptocurrencies and blockchain technology in nations such as China, Japan, South Korea, and Singapore, the demand for crypto tax software solutions is increasing exponentially. Furthermore, the Asia Pacific area is home to many tech-savvy individuals, SMEs, and fintech firms actively involved in the cryptocurrency industry. The lack of rigorous laws compared to North America creates a more conducive climate for research and adoption of crypto tax software solutions. As a result, the Asia Pacific region is likely to witness significant growth in the crypto tax software market in the forecast period, driven by increasing cryptocurrency usage, legislative advancements, and rising awareness of tax compliance among industry participants.

Accointing Services AG, BearTax Inc., Bittax, Blockpit, Coin Ledger, Inc., Coinpanda, CoinsTax LLC, CoinTracker, Crypto Tax Calculator, Happy Tax Franchising, LLC, Koinly, Node40, LLC, TaxBit, Inc., TokenTax, TurboTax, ZenLedger, Inc., CoinTracking, Recap, Bitwave, and Liquifi, among others are the top players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2024, MetaMask, a prominent self-custodial wallet company, officially partnered with Crypto Tax Calculator (CTC) to offer users a comprehensive tax solution for managing complex crypto activity. This strategic collaboration followed CTC's recent global tax partnership with Coinbase, strengthening its status as a leading provider of cryptocurrency tax reporting solutions.

In January 2024, CoinTracking announced that they had launched crypto tax tools and software for the UK region. CoinTracking operates in over 25 countries, including the UK, offering investors a range of services to choose from, such as premium support, account reviews, or complete UK crypto tax return assistance.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL CRYPTO TAX SOFTWARE MARKET, BY ENTERPRISE SIZE

4.1 Introduction

4.2 Crypto Tax Software Market: Enterprise Size Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Large Enterprises

4.4.1 Large Enterprises Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 SMEs

4.5.1 SMEs Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL CRYPTO TAX SOFTWARE MARKET, BY DEPLOYMENT MODE

5.1 Introduction

5.2 Crypto Tax Software Market: Deployment Mode Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Cloud-based

5.4.1 Cloud-based Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 On-premises

5.5.1 On-premises Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL CRYPTO TAX SOFTWARE MARKET, BY REGION

6.1 Introduction

6.2 North America Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Enterprise Size

6.2.2 By Deployment Mode

6.2.3 By Country

6.2.3.1 U.S. Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Enterprise Size

6.2.3.1.2 By Deployment Mode

6.2.3.2 Canada Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Enterprise Size

6.2.3.2.2 By Deployment Mode

6.2.3.3 Mexico Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Enterprise Size

6.2.3.3.2 By Deployment Mode

6.3 Europe Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Enterprise Size

6.3.2 By Deployment Mode

6.3.3 By Country

6.3.3.1 Germany Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Enterprise Size

6.3.3.1.2 By Deployment Mode

6.3.3.2 U.K. Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Enterprise Size

6.3.3.2.2 By Deployment Mode

6.3.3.3 France Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Enterprise Size

6.3.3.3.2 By Deployment Mode

6.3.3.4 Italy Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Enterprise Size

6.3.3.4.2 By Deployment Mode

6.3.3.5 Spain Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Enterprise Size

6.3.3.5.2 By Deployment Mode

6.3.3.6 Netherlands Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Enterprise Size

6.3.3.6.2 By Deployment Mode

6.3.3.7 Rest of Europe Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Enterprise Size

6.3.3.6.2 By Deployment Mode

6.4 Asia Pacific Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Enterprise Size

6.4.2 By Deployment Mode

6.4.3 By Country

6.4.3.1 China Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Enterprise Size

6.4.3.1.2 By Deployment Mode

6.4.3.2 Japan Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Enterprise Size

6.4.3.2.2 By Deployment Mode

6.4.3.3 India Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Enterprise Size

6.4.3.3.2 By Deployment Mode

6.4.3.4 South Korea Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Enterprise Size

6.4.3.4.2 By Deployment Mode

6.4.3.5 Singapore Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Enterprise Size

6.4.3.5.2 By Deployment Mode

6.4.3.6 Malaysia Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Enterprise Size

6.4.3.6.2 By Deployment Mode

6.4.3.7 Thailand Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Enterprise Size

6.4.3.6.2 By Deployment Mode

6.4.3.8 Indonesia Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Enterprise Size

6.4.3.7.2 By Deployment Mode

6.4.3.9 Vietnam Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Enterprise Size

6.4.3.8.2 By Deployment Mode

6.4.3.10 Taiwan Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Enterprise Size

6.4.3.10.2 By Deployment Mode

6.4.3.11 Rest of Asia Pacific Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Enterprise Size

6.4.3.11.2 By Deployment Mode

6.5 Middle East and Africa Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Enterprise Size

6.5.2 By Deployment Mode

6.5.3 By Country

6.5.3.1 Saudi Arabia Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Enterprise Size

6.5.3.1.2 By Deployment Mode

6.5.3.2 U.A.E. Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Enterprise Size

6.5.3.2.2 By Deployment Mode

6.5.3.3 Israel Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Enterprise Size

6.5.3.3.2 By Deployment Mode

6.5.3.4 South Africa Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Enterprise Size

6.5.3.4.2 By Deployment Mode

6.5.3.5 Rest of Middle East and Africa Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Enterprise Size

6.5.3.5.2 By Deployment Mode

6.6 Central and South America Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Enterprise Size

6.6.2 By Deployment Mode

6.6.3 By Country

6.6.3.1 Brazil Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Enterprise Size

6.6.3.1.2 By Deployment Mode

6.6.3.2 Argentina Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Enterprise Size

6.6.3.2.2 By Deployment Mode

6.6.3.3 Chile Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Enterprise Size

6.6.3.3.2 By Deployment Mode

6.6.3.3 Rest of Central and South America Crypto Tax Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Enterprise Size

6.6.3.3.2 By Deployment Mode

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Accointing Services AG

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 BearTax Inc.

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Bittax

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Blockpit

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Coin Ledger, Inc.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 Coinpanda

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 CoinsTax LLC

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 CoinTracker

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Crypto Tax Calculator

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Happy Tax Franchising, LLC

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Koinly

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

7.4.12 Node40, LLC

7.4.12.1 Business Description & Financial Analysis

7.4.12.2 SWOT Analysis

7.4.12.3 Products & Services Offered

7.4.12.4 Strategic Alliances between Business Partners

7.4.13 TaxBit, Inc.

7.4.13.1 Business Description & Financial Analysis

7.4.13.2 SWOT Analysis

7.4.13.3 Products & Services Offered

7.4.13.4 Strategic Alliances between Business Partners

7.4.14 TokenTax

7.4.14.1 Business Description & Financial Analysis

7.4.14.2 SWOT Analysis

7.4.14.3 Products & Services Offered

7.4.14.4 Strategic Alliances between Business Partners

7.4.15 TurboTax

7.4.15.1 Business Description & Financial Analysis

7.4.15.2 SWOT Analysis

7.4.15.3 Products & Services Offered

7.4.15.4 Strategic Alliances between Business Partners

7.4.16 ZenLedger, Inc.

7.4.16.1 Business Description & Financial Analysis

7.4.16.2 SWOT Analysis

7.4.16.3 Products & Services Offered

7.4.16.4 Strategic Alliances between Business Partners

7.4.17 CoinTracking

7.4.17.1 Business Description & Financial Analysis

7.4.17.2 SWOT Analysis

7.4.17.3 Products & Services Offered

7.4.17.4 Strategic Alliances between Business Partners

7.4.18 Recap

7.4.18.1 Business Description & Financial Analysis

7.4.18.2 SWOT Analysis

7.4.18.3 Products & Services Offered

7.4.18.4 Strategic Alliances between Business Partners

7.4.19 Bitwave

7.4.19.1 Business Description & Financial Analysis

7.4.19.2 SWOT Analysis

7.4.19.3 Products & Services Offered

7.4.19.4 Strategic Alliances between Business Partners

7.4.20 Liquifi

7.4.20.1 Business Description & Financial Analysis

7.4.20.2 SWOT Analysis

7.4.20.3 Products & Services Offered

7.4.20.4 Strategic Alliances between Business Partners

7.4.21 Other Companies

7.4.21.1 Business Description & Financial Analysis

7.4.21.2 SWOT Analysis

7.4.21.3 Products & Services Offered

7.4.21.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

2 Large Enterprises Market, By Region, 2021-2029 (USD Mllion)

3 SMEs Market, By Region, 2021-2029 (USD Mllion)

4 Global Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

5 Cloud-based Market, By Region, 2021-2029 (USD Mllion)

6 On-premises Market, By Region, 2021-2029 (USD Mllion)

7 Regional Analysis, 2021-2029 (USD Mllion)

8 North America Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

9 North America Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

10 North America Crypto Tax Software Market, By COUNTRY, 2021-2029 (USD Mllion)

11 U.S. Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

12 U.S. Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

13 Canada Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

14 Canada Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

15 Mexico Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

16 Mexico Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

17 Europe Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

18 Europe Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

19 Europe Crypto Tax Software Market, By Country, 2021-2029 (USD Mllion)

20 Germany Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

21 Germany Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

22 U.K. Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

23 U.K. Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

24 France Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

25 France Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

26 Italy Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

27 Italy Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

28 Spain Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

29 Spain Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

30 Netherlands Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

31 Netherlands Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

32 Rest Of Europe Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

33 Rest Of Europe Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

34 Asia Pacific Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

35 Asia Pacific Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

36 Asia Pacific Crypto Tax Software Market, By Country, 2021-2029 (USD Mllion)

37 China Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

38 China Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

39 Japan Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

40 Japan Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

41 India Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

42 India Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

43 South Korea Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

44 South Korea Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

45 Singapore Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

46 Singapore Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

47 Thailand Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

48 Thailand Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

49 Malaysia Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

50 Malaysia Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

51 Indonesia Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

52 Indonesia Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

53 Vietnam Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

54 Vietnam Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

55 Taiwan Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

56 Taiwan Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

57 Rest of APAC Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

58 Rest of APAC Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

59 Middle East and Africa Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

60 Middle East and Africa Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

61 Middle East and Africa Crypto Tax Software Market, By Country, 2021-2029 (USD Mllion)

62 Saudi Arabia Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

63 Saudi Arabia Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

64 UAE Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

65 UAE Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

66 Israel Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

67 Israel Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

68 South Africa Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

69 South Africa Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

70 Rest Of Middle East and Africa Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

71 Rest Of Middle East and Africa Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

72 Central and South America Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

73 Central and South America Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

74 Central and South America Crypto Tax Software Market, By Country, 2021-2029 (USD Mllion)

75 Brazil Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

76 Brazil Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

77 Chile Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

78 Chile Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

79 Argentina Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

80 Argentina Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

81 Rest Of Central and South America Crypto Tax Software Market, By Enterprise Size, 2021-2029 (USD Mllion)

82 Rest Of Central and South America Crypto Tax Software Market, By Deployment Mode, 2021-2029 (USD Mllion)

83 Accointing Services AG: Products & Services Offering

84 BearTax Inc.: Products & Services Offering

85 Bittax: Products & Services Offering

86 Blockpit : Products & Services Offering

87 Coin Ledger, Inc.: Products & Services Offering

88 Coinpanda: Products & Services Offering

89 CoinsTax LLC : Products & Services Offering

90 CoinTracker: Products & Services Offering

91 Crypto Tax Calculator, Inc: Products & Services Offering

92 Happy Tax Franchising, LLC: Products & Services Offering

93 Liquifi: Products & Services Offering

94 Bitwave: Products & Services Offering

95 Recap: Products & Services Offering

96 CoinTracking: Products & Services Offering

97 ZenLedger, Inc.: Products & Services Offering

98 TurboTax: Products & Services Offering

99 TokenTax: Products & Services Offering

100 TaxBit, Inc.: Products & Services Offering

101 Node40, LLC: Products & Services Offering

102 Koinly: Products & Services Offering

103 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Crypto Tax Software Market Overview

2 Global Crypto Tax Software Market Value From 2021-2029 (USD Mllion)

3 Global Crypto Tax Software Market Share, By Enterprise Size (2023)

4 Global Crypto Tax Software Market Share, By Deployment Mode (2023)

5 Global Crypto Tax Software Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Crypto Tax Software Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Crypto Tax Software Market

10 Impact Of Challenges On The Global Crypto Tax Software Market

11 Porter’s Five Forces Analysis

12 Global Crypto Tax Software Market: By Enterprise Size Scope Key Takeaways

13 Global Crypto Tax Software Market, By Enterprise Size Segment: Revenue Growth Analysis

14 Large Enterprises Market, By Region, 2021-2029 (USD Mllion)

15 SMEs Market, By Region, 2021-2029 (USD Mllion)

16 Global Crypto Tax Software Market: By Deployment Mode Scope Key Takeaways

17 Global Crypto Tax Software Market, By Deployment Mode Segment: Revenue Growth Analysis

18 Cloud-based Market, By Region, 2021-2029 (USD Mllion)

19 On-premises Market, By Region, 2021-2029 (USD Mllion)

20 Regional Segment: Revenue Growth Analysis

21 Global Crypto Tax Software Market: Regional Analysis

22 North America Crypto Tax Software Market Overview

23 North America Crypto Tax Software Market, By Enterprise Size

24 North America Crypto Tax Software Market, By Deployment Mode

25 North America Crypto Tax Software Market, By Country

26 U.S. Crypto Tax Software Market, By Enterprise Size

27 U.S. Crypto Tax Software Market, By Deployment Mode

28 Canada Crypto Tax Software Market, By Enterprise Size

29 Canada Crypto Tax Software Market, By Deployment Mode

30 Mexico Crypto Tax Software Market, By Enterprise Size

31 Mexico Crypto Tax Software Market, By Deployment Mode

32 Four Quadrant Positioning Matrix

33 Company Market Share Analysis

34 Accointing Services AG: Company Snapshot

35 Accointing Services AG: SWOT Analysis

36 Accointing Services AG: Geographic Presence

37 BearTax Inc.: Company Snapshot

38 BearTax Inc.: SWOT Analysis

39 BearTax Inc.: Geographic Presence

40 Bittax: Company Snapshot

41 Bittax: SWOT Analysis

42 Bittax: Geographic Presence

43 Blockpit : Company Snapshot

44 Blockpit : Swot Analysis

45 Blockpit : Geographic Presence

46 Coin Ledger, Inc.: Company Snapshot

47 Coin Ledger, Inc.: SWOT Analysis

48 Coin Ledger, Inc.: Geographic Presence

49 Coinpanda: Company Snapshot

50 Coinpanda: SWOT Analysis

51 Coinpanda: Geographic Presence

52 CoinsTax LLC : Company Snapshot

53 CoinsTax LLC : SWOT Analysis

54 CoinsTax LLC : Geographic Presence

55 CoinTracker: Company Snapshot

56 CoinTracker: SWOT Analysis

57 CoinTracker: Geographic Presence

58 Crypto Tax Calculator, Inc.: Company Snapshot

59 Crypto Tax Calculator, Inc.: SWOT Analysis

60 Crypto Tax Calculator, Inc.: Geographic Presence

61 Happy Tax Franchising, LLC: Company Snapshot

62 Happy Tax Franchising, LLC: SWOT Analysis

63 Happy Tax Franchising, LLC: Geographic Presence

64 Liquifi: Company Snapshot

65 Liquifi: SWOT Analysis

66 Liquifi: Geographic Presence

67 Bitwave: Company Snapshot

68 Bitwave: SWOT Analysis

69 Bitwave: Geographic Presence

70 Recap: Company Snapshot

71 Recap: SWOT Analysis

72 Recap: Geographic Presence

73 CoinTracking: Company Snapshot

74 CoinTracking: SWOT Analysis

75 CoinTracking: Geographic Presence

76 ZenLedger, Inc.: Company Snapshot

77 ZenLedger, Inc.: SWOT Analysis

78 ZenLedger, Inc.: Geographic Presence

79 TurboTax: Company Snapshot

80 TurboTax: SWOT Analysis

81 TurboTax: Geographic Presence

82 TokenTax: Company Snapshot

83 TokenTax: SWOT Analysis

84 TokenTax: Geographic Presence

85 TaxBit, Inc.: Company Snapshot

86 TaxBit, Inc.: SWOT Analysis

87 TaxBit, Inc.: Geographic Presence

88 Node40, LLC: Company Snapshot

89 Node40, LLC: SWOT Analysis

90 Node40, LLC: Geographic Presence

91 Koinly: Company Snapshot

92 Koinly: SWOT Analysis

93 Koinly: Geographic Presence

94 Other Companies: Company Snapshot

95 Other Companies: SWOT Analysis

96 Other Companies: Geographic Presence

The Global Crypto Tax Software Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Crypto Tax Software Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS