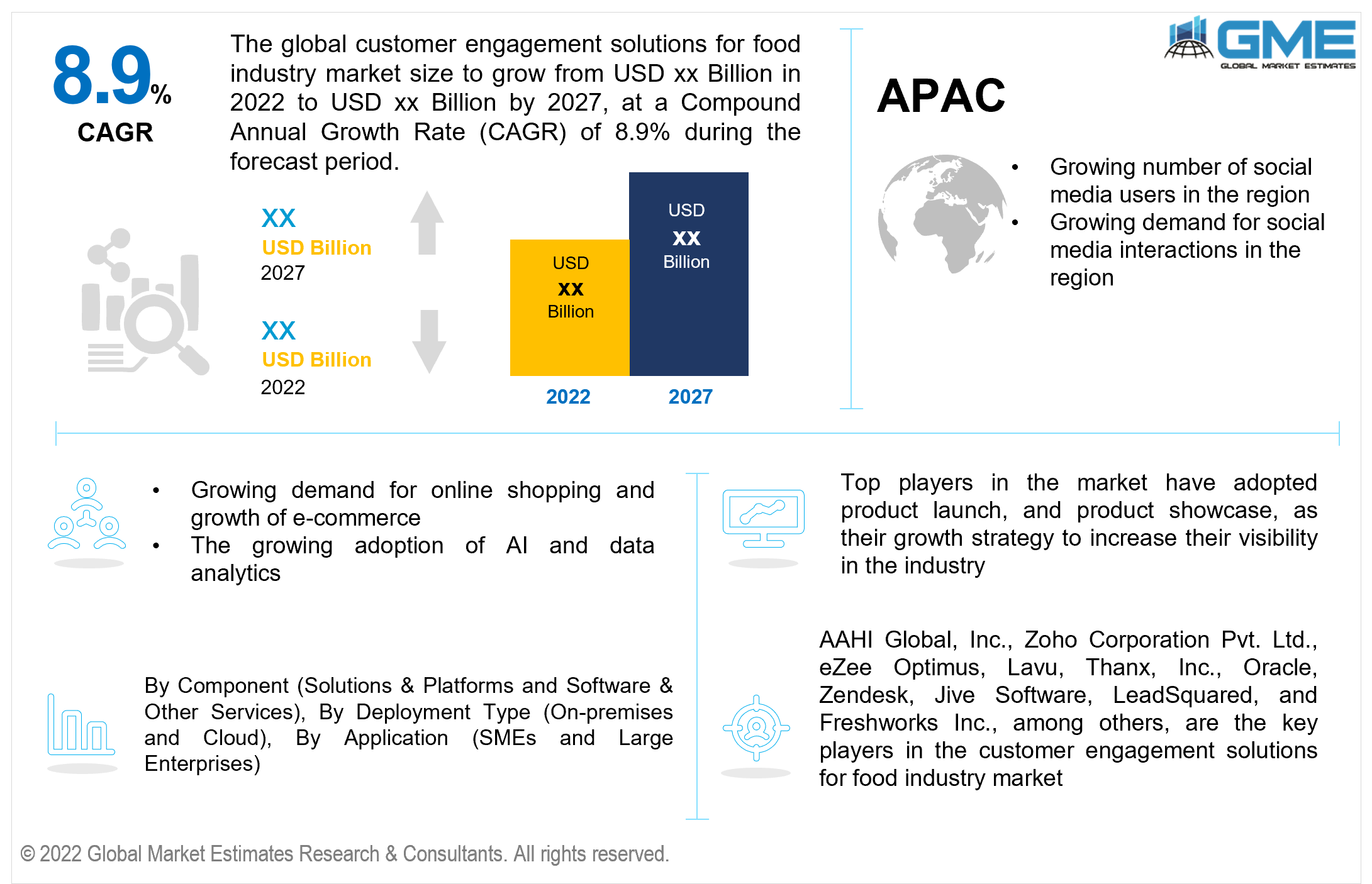

Global Customer Engagement Solutions for Food Industry Market Size, Trends & Analysis - Forecasts to 2027 By Component (Solutions & Platforms and Software & Other Services), By Deployment Type (On-premises and Cloud), By Application (SMEs and Large Enterprises), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The Global Customer Engagement Solutions for Food Industry Market is projected to grow at a CAGR value of 8.9% from 2022 to 2027.

The growing number of interactions between customers and the company through social media platforms has primarily driven the customer engagement solutions for the food industry market. The increasing need to maintain positive customer engagement and increased pressure on social media teams to maintain a positive social media image is expected to increase the demand.

The growing number of independent food bloggers, reviewers, and cooking content on social media is expected to positively influence the demand for customer engagement solutions in the food industry.

Due to the ever-increasing number of social media platforms, most businesses now have multiple accounts and use digital marketing and social media professionals to raise brand exposure. Marketing teams can use customer engagement tools to schedule content development and delivery across different channels, allowing for more interactions and better replies to customer comments and messages.

The need for diverse data analytics tools has developed from the vast amounts of data created by client interactions across multiple platforms. These analytics technologies enable businesses to optimize their interactions and content to maximize their exposure and customer engagement.

Better consumer connections through digital media have proven critical for businesses to stay relevant and deliver increased visibility and marketing potential in the current digital era. As more people resort to e-commerce and online purchasing, the requirement for a more substantial online presence is projected to fuel the market for consumer engagement solutions in the food industry.

The food industry actively uses big data to innovate and compete in the sector. The growth of the e-commerce industry has increased the availability of data surrounding consumer behaviour online. Food and beverage organizations are increasing the adoption of customer engagement solutions based on these data. Consumer purchasing habits are being analysed and studied through the use of data analytics. Businesses utilize big data technologies to increase customer interactions and create more personalized experiences.

Integrating AI and other technologies like Machine Learning (ML) and Natural Language Processing (NLP) is expected to enhance the demand for customer engagement solutions further. For example, voice-based systems and recommendation engines that deliver individualized product ideas assist consumers in finding products 24/7.

Food & beverage companies are increasingly employing AI-based solutions to improve consumer happiness resulting in better customer retention. Adopting technology to improve customer experience is a significant driver of customer engagement solutions for the food industry market.

The customer engagement solutions for food Industry market is restrained by the growing cost of social media engagement and optimization of social media analytics through AI and IoT-based solutions. Concerns regarding the collection of data and customer privacy are expected to hamper the growth of customer engagement solutions for the food industry market. The threat of cyberattacks and robust data protection laws are also likely to inhibit the development of the industry.

As a result of the COVID-19 pandemic, more people use online marketing tools. The pandemic's lockdown limitations increased digital content consumption and social media traffic, resulting in a more robust adoption of consumer engagement solutions in the food industry.

Following the pandemic, the increased demand for online shopping and the expansion of the e-commerce business is projected to boost the use of customer engagement solutions in the food industry.

The customer engagement solutions for food Industry market is driven mainly by the growing demand for ensuring positive customer engagement through social media platforms, growth of the e-commerce industry, and increased adoption of cloud-based services.

Based on the component, the customer engagement solutions for food industry market is segmented into solutions & platforms and software & other services. The software & other services segment is expected to hold the most significant piece of the market during the forecast period.

The growing demand for customer engagement monitoring software across multiple social media platforms has led to the segment holding the largest market share based on components. The segment is also expected to become the fastest-growing segment as companies are beginning to outsource customer engagement and content creation services.

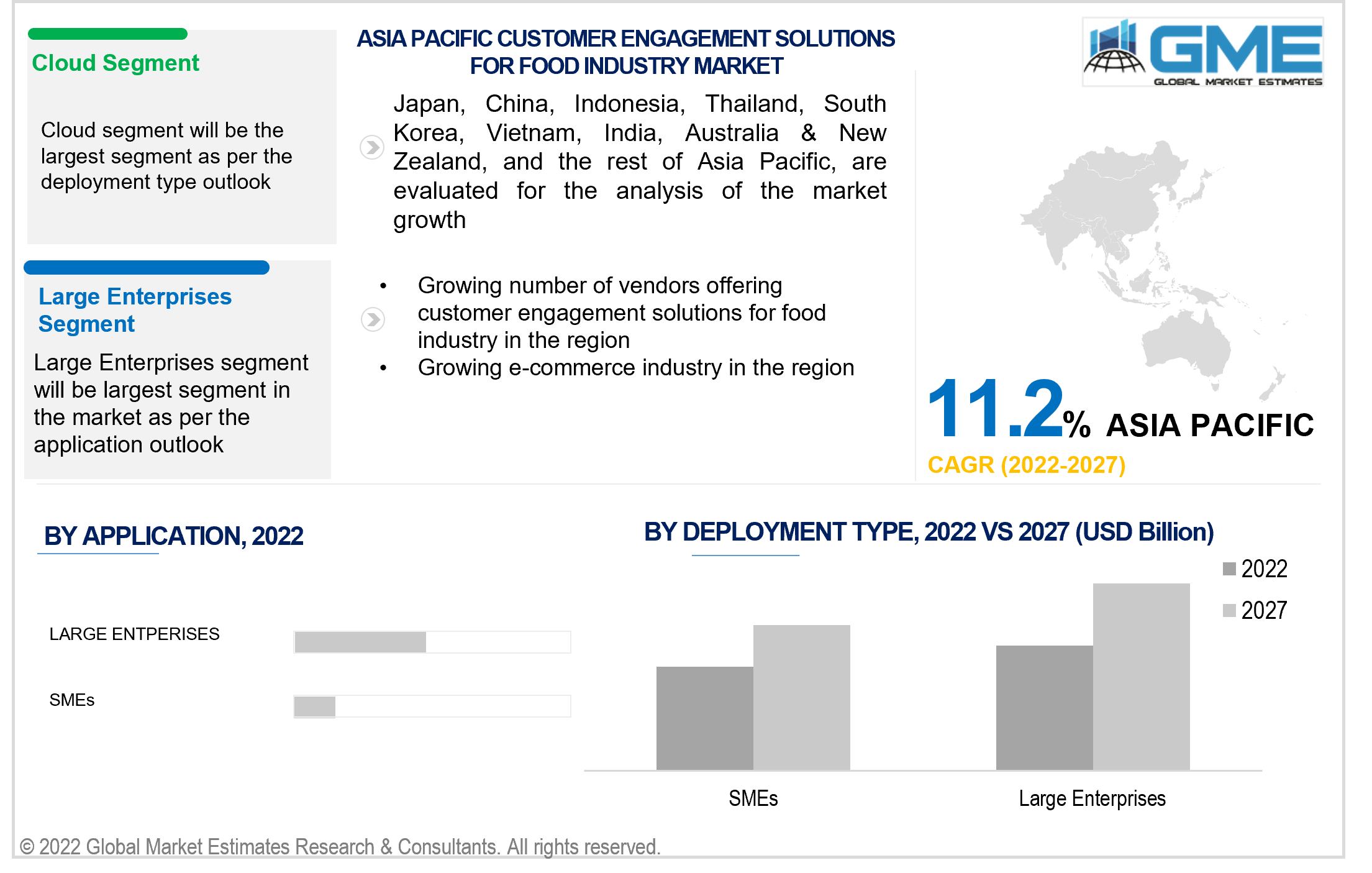

Based on the various avenues of application of customer engagement solutions for food industry, the market is segmented into small and medium enterprises and large enterprises.

The large enterprises segment held the lion's share of the market. The growing number of social media campaigns and the increasing presence of social media marketing strategies among top companies in the food industry has led to the rapid growth of the large enterprises segment.

The growing involvement of SMEs in e-commerce is expected to result in the SMEs segment becoming the fastest-growing segment in the market.

Based on the deployment type, the market is segmented into cloud and on-premises. The cloud segment held the lion's share of the market and is expected to register the fastest growth rate.

The high demand for cloud services stems from their ease of use and increasing demand for greater accessibility to services and tools. The growing trend of WFH is expected further to enhance the growth of cloud-based services and solutions.

Based on region, the market can be segmented into various regions such as North America, Europe, Central and South America, the Middle East and North Africa, and Asia Pacific regions.

The North American region is expected to be the dominant force in the market during the forecast period. The presence of significant food and beverage industry players in the region and the growing number of companies offering customer engagement solutions in the region have been the primary drivers of the North American region. The growing demand for an increase in online presence in the region due to the massive rate of digital consumption in the region has also been crucial in developing the market in the region.

The APAC region is anticipated to become the fastest-growing region.

AAHI Global, Inc., Zoho Corporation Pvt. Ltd., eZee Optimus, Lavu, Thanx, Inc., Oracle, Zendesk, Jive Software, LeadSquared, and Freshworks Inc., among others, are the key players in the customer engagement solutions for food industry market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Customer Engagement Solutions for Food Industry Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Application Overview

2.1.4 Deployment Type Overview

2.1.6 Regional Overview

Chapter 3 Customer Engagement Solutions for Food Industry Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for positive social media engagement between companies and customers

3.3.2 Industry Challenges

3.3.2.1 Data collection and privacy regulations

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Deployment Type Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Customer Engagement Solutions for Food Industry Market, By Component

4.1 Component Outlook

4.2 Solutions & Platforms

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Software & Other Services

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Customer Engagement Solutions for Food Industry Market, By Application

5.1 Application Outlook

5.2 SMEs

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Large Enterprises

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Customer Engagement Solutions for Food Industry Market, By Deployment Type

6.1 Cloud

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 On-premises

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Customer Engagement Solutions for Food Industry Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Million)

7.2.2 Market Size, By Component, 2020-2026 (USD Million)

7.2.3 Market Size, By Application, 2020-2026 (USD Million)

7.2.4 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.2.6 U.S.

7.2.6.1 Market Size, By Component, 2020-2026 (USD Million)

7.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.4.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.2.7 Canada

7.2.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.2.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.2.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Million)

7.3.2 Market Size, By Component, 2020-2026 (USD Million)

7.3.3 Market Size, By Application, 2020-2026 (USD Million)

7.3.4 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3.6 Germany

7.3.6.1 Market Size, By Component, 2020-2026 (USD Million)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.6.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3.7 UK

7.3.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3.8 France

7.3.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3.9 Italy

7.3.9.1 Market Size, By Component, 2020-2026 (USD Million)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.9.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3.10 Spain

7.3.10.1 Market Size, By Component, 2020-2026 (USD Million)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.10.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.3.11 Russia

7.3.11.1 Market Size, By Component, 2020-2026 (USD Million)

7.3.11.2 Market Size, By Application, 2020-2026 (USD Million)

7.3.11.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Million)

7.4.2 Market Size, By Component, 2020-2026 (USD Million)

7.4.3 Market Size, By Application, 2020-2026 (USD Million)

7.4.4 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.4.6 China

7.4.6.1 Market Size, By Component, 2020-2026 (USD Million)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.6.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.4.7 India

7.4.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.4.8 Japan

7.4.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.4.9 Australia

7.4.9.1 Market Size, By Component, 2020-2026 (USD Million)

7.4.9.2 Market size, By Application, 2020-2026 (USD Million)

7.4.9.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.4.10 South Korea

7.4.10.1 Market Size, By Component, 2020-2026 (USD Million)

7.4.10.2 Market Size, By Application, 2020-2026 (USD Million)

7.4.10.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Million)

7.5.2 Market Size, By Component, 2020-2026 (USD Million)

7.5.3 Market Size, By Application, 2020-2026 (USD Million)

7.5.4 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.5.6 Brazil

7.5.6.1 Market Size, By Component, 2020-2026 (USD Million)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.6.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.5.7 Mexico

7.5.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.5.8 Argentina

7.5.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.5.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Million)

7.6.2 Market Size, By Component, 2020-2026 (USD Million)

7.6.3 Market Size, By Application, 2020-2026 (USD Million)

7.6.4 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.6.6 Saudi Arabia

7.6.6.1 Market Size, By Component, 2020-2026 (USD Million)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.6.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.6.7 UAE

7.6.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

7.6.8 South Africa

7.6.7.1 Market Size, By Component, 2020-2026 (USD Million)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Million)

7.6.7.3 Market Size, By Deployment Type, 2020-2026 (USD Million)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 AAHI Global, Inc.

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Zoho Corporation Pvt. Ltd.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 eZee Optimus

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Lavu

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Thanx, Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Oracle

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Zendesk

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Jive Software

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 LeadSquared

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Other Companies

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

The Global Customer Engagement Solutions for Food Industry Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Customer Engagement Solutions for Food Industry Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS