Global Cyclopentane Market Size, Trends & Analysis - Forecasts to 2026 By Function (Blowing Agent & Refrigerant, Solvent & Reagent, Others), By Application (Residential Refrigerators, Commercial Refrigerators, Insulated Containers and Sippers, Insulating Construction Refrigerators, Electrical & Electronics, Personal Care Products, Fuel Additives, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

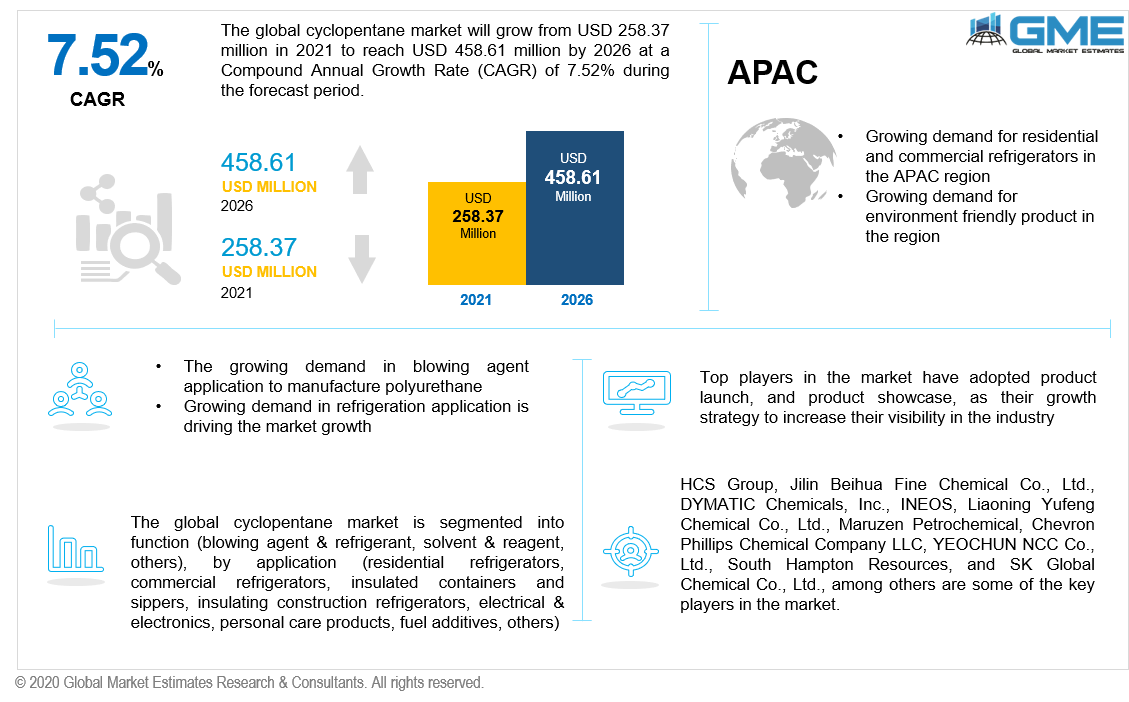

The Global Cyclopentane Market will grow from USD 258.37 million in 2021 to reach USD 378.61 million in 2026, with a CAGR of 7.52% over the forecast period.

The global market for Cyclopentane is growing rapidly owing to factors such as rising demand for Cyclopentane in commercial refrigerator segment, increasing demand for environmentally friendly electronic devices, increasing product launch activities and rising R&D initiatives in the advance material industry.

Cyclopentane is a five-carbon acyclic hydrocarbon molecule with a ring structure. It belongs to the cycloalkane’s family. Resins, synthetic rubber, and rubber adhesive are all made with Cyclopentane. Cyclopentane foam is also utilized as a blowing agent in the manufacture of polyurethane. They're also utilized as a solvent in the production of fuels. It has a colorless appearance and a smell that is comparable to that of petrol.

The growing usage of blowing agents in the automotive, appliance, and construction industries, along with increased research and development activities in the Cyclopentane market, and flourishing advanced chemical industry are some of the factors driving the growth of the Cyclopentane market.

Other major aspects driving the Cyclopentane market are the rising demand for composite materials made of fiberglass, and the rising support from government organizations in the form of research funds.

Rising plans of phasing out the usage of hydro chlorofluorocarbon is the vital factor escalating the Cyclopentane market growth. Also rising increasing performance standards and growing environmental concerns, increasing demand for cyclopentane in refrigerators, rising technological advancements in material science field, increasing financial improvement, and rising application of Cyclopentane in analytical and scientific applications segment such as manufacturing of reinforcement & composite materials of fiberglass are the some of the other major factors among others driving the cyclopentane market.

As a result of nationwide lockdowns, the outbreak of Covid-19 has disrupted worldwide supply networks and production activity of advanced chemicals. As a result, consumer electronics, such as refrigerators and stabilizers, saw a decline in demand. Similarly, falling construction activity has slowed demand for Cyclopentane. According to the comprehensive forecast trend analysis by GME, the Cyclopentane market is expected to be influenced by rising awareness of the impact of greenhouse gas emissions and a changing regulatory framework as soon as the COVID-19 restrictions are uplifted.

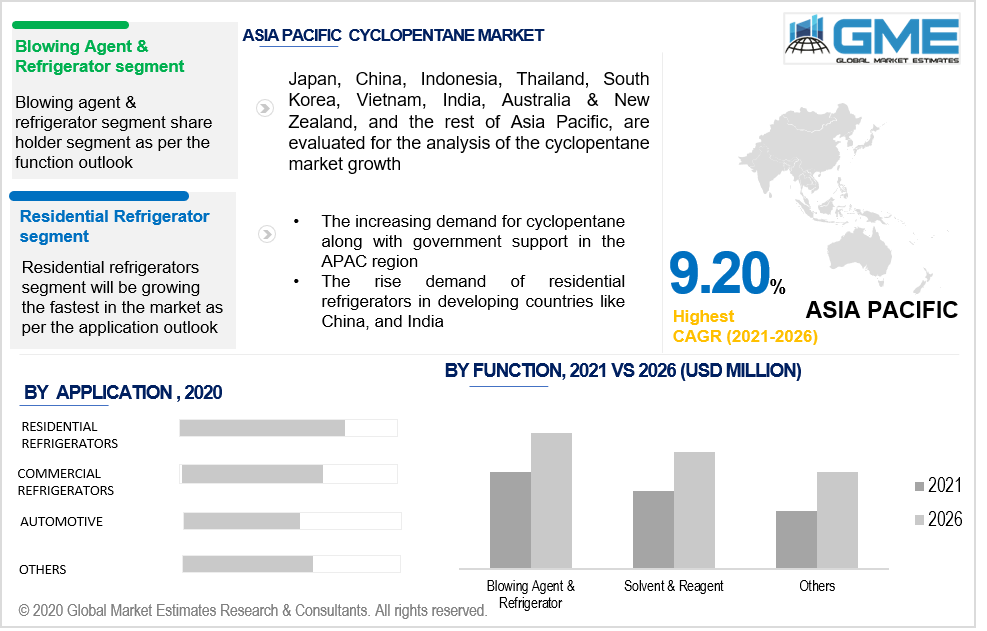

The function segment is categorized into blowing agent & refrigerant, and solvent & reagent, others. According to the Cyclopentane market report, the blowing agent & refrigerant segment is expected to hold the largest market share from 2021 to 2026. Cyclopentane is used to manufacture protective materials that are used in sippers and shielded compartments. Moreover, blowing agent Cyclopentane is commonly used for protective materials used in covered holders and sippers. During the forecast period, demand for Cyclopentane is expected to rise owing to the planned phase-out of 85 % of Cyclopentane. The use of Cyclopentane insulation of blowing agents for rigid polyurethane foam has helped the segment grow rapidly. It’s been utilized in the manufacturing of cold storage, fluorine-free refrigerators, pipeline insulation, freezers, and other fields.

Residential refrigerators, commercial refrigerators, insulated containers and sippers, insulating construction refrigerators, electrical & electronics, personal care products, fuel additives, and other applications are the major segments of the global Cyclopentane market 2020. The residential refrigerators will be the fastest-growing segment with the highest CAGR value from 2021 to 2026. The reduced usage of fluorinated blowing agents in this application due to stringent government regulations is driving demand for Cyclopentane refrigerants during the forecast period. Cyclopentane is a low-cost alternative as compared to the existing blowing agents.

As per the geographical analysis, the Cyclopentane market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

Asia Pacific region will grow with the highest CAGR rate in the market. Rising technological innovations, products approvals, and increasing demand for residential and commercial refrigerators will impact the Cyclopentane market size across the region. China and India, according to the International Monetary Fund (IMF), are two of the world's fastest-growing economies. India is likely to overtake China as the world's fastest-growing economy, boosting the global economy. China is recognized as the world's largest consumer and producer of hydrochlorofluorocarbons (HFCs), and it intends to phase them out due to environmental concerns. This will open up a lot of opportunities for non-HCFC foaming agents like Cyclopentane.

Furthermore, North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026. The largest share of the North American region is mainly due to the presence of key competitors in the US market, and the growing stringent restrictions imposed on HCFCs by government authorities along with the increasing demand for storing food at suitable temperature are some of the factors increasing the Cyclopentane market size in the US over the forecast period of 2021 to 2026.

HCS Group, Jilin Beihua Fine Chemical Co., Ltd., DYMATIC Chemicals, Inc., INEOS, Liaoning Yufeng Chemical Co., Ltd., Maruzen Petrochemical, Chevron Phillips Chemical Company LLC, YEOCHUN NCC Co., Ltd., South Hampton Resources, and SK Global Chemical Co., Ltd., among others are some of the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Cyclopentane Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.1 Function Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Cyclopentane Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing use of blowing agents in construction and automotive industries

3.3.2 Industry Challenges

3.3.2.1 Requirement of high capital investment

3.4 Prospective Growth Scenario

3.4.1 Function Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Cyclopentane Market, By Function

4.1 Function Outlook

4.2 Blowing Agent & Refrigerant

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Solvent & Reagent

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Others

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Global Cyclopentane Market, By Application

5.1 Application Outlook

5.2 Residential Refrigerators

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Commercial Refrigerators

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Insulated Containers and Sippers

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Insulating Construction Materials

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Electrical & Electronics

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

5.7 Personal Care Products

5.7.1 Market Size, By Region, 2020-2026 (USD Million)

5.8 Fuel & Fuel Additives

5.8.1 Market Size, By Region, 2020-2026 (USD Million)

5.9 Others

5.9.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Global Cyclopentane Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Function, 2020-2026 (USD Million)

6.2.3 Market Size, By Application, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Function, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Function, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Function, 2020-2026 (USD Million)

6.3.3 Market Size, By Application, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Function, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Function, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Function, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Function, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Function, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Function, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Function, 2020-2026 (USD Million)

6.4.3 Market Size, By Application, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Function, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Function, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Function, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Function, 2020-2026 (USD Million)

6.4.7.2 Market Size, By Application, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Function, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Function, 2020-2026 (USD Million)

6.5.3 Market Size, By Application, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Function, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Function, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Function, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Function, 2020-2026 (USD Million)

6.6.3 Market Size, By Application, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Function, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Function, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Function, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 HCS Group

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 Jilin Beihua Fine Chemical Co., Ltd.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 DYMATIC Chemicals, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 INEOS

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Maruzen Petrochemical

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 Chevron Phillips Chemical Company LLC

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 YEOCHUN NCC Co., Ltd.

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 South Hampton Resources

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 SK Global Chemical Co., Ltd.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 Liaoning Yufeng Chemical Co., Ltd.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Cyclopentane Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Cyclopentane Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS