Global Defibrillator Market Size, Trends & Analysis - Forecasts to 2026 By Product (Implantable Cardioverter Defibrillator [Subcutaneous Implantable Cardioverter-Defibrillator (S-ICD), Transvenous Implantable Cardioverter-Defibrillator (T-ISD)], External Defibrillator [Manual ED, Automated ED, Wearable Cardioverter Defibrillators]), By End-Use (Hospital, Pre-Hospital, Public Access Market, Alternate Care Market, Home Healthcare), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

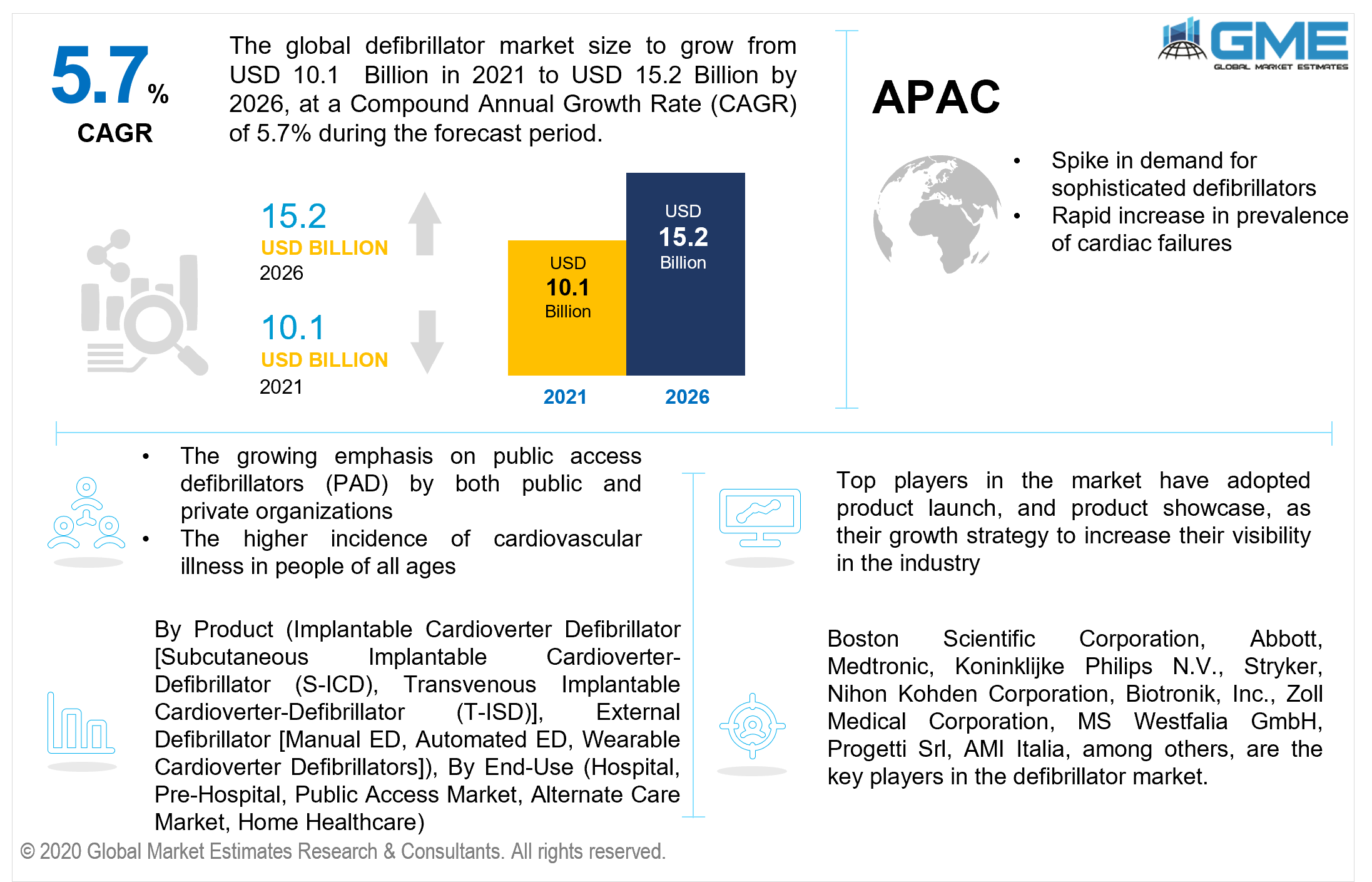

The global defibrillator market is projected to grow from USD 10.1 billion in 2021 to USD 15.2 billion by 2026 at a CAGR value of 5.7% between 2021 to 2026.

Growing awareness of the need for emergency medical devices in public spaces, the growing number of people who are trained to handle defibrillators, and the growing incidences of sudden heart arrhythmia are the major drivers of the market.

Defibrillation is a process that involves administering electrocution to the heart, which depolarizes the cardiac muscles and recovers the heart's standard electric impulse. The market has risen as both individuals and organizations place a greater commitment to public access defibrillators (PAD). Additionally, improved defibrillator devices, a rapidly rising senior population with an increased risk of specific illnesses, and a larger prevalence of cardiovascular disease in people of all ages are all driving market growth.

The primary growth factors for this market include increased adoption of integrated technology, high frequency of cardiac illnesses, heightened recognition of the need for excellent cardiac health, and legislative reforms.

According to the World Health Organization, cardiovascular illnesses were the top cause of mortality in 2017, contributing to around 17.9 million deaths worldwide. As a result, market growth is likely to be fuelled by a rise in the prevalence of cardiovascular disorders.

A growing focus on open access defibrillators by public and private organizations and major market players, as well as an increase in the number of education and induction programs around the world, are a few more reasons driving the expansion of this sector. Furthermore, encouraging next-generation external defibrillator technology to support patients suffering from chronic heart conditions and at-risk patients from heart attacks in secluded areas is expected to drive the market.

Identifying and resolving problems associated with wearable defibrillator devices by the FDA, and concentrating on providing quick emergency care to people suffering sudden cardiac arrest (SCA) is expected to generate lucrative opportunities. SCA is the most common cause of death in the world, and it is a life-threatening disorder. It can be successfully treated by intervening early in the disease and using defibrillation at the appropriate moment.

Due to the deferral of cardiovascular treatments classified as elective surgery, the market for defibrillators saw negative growth during the outbreak. Medical companies are predicted to focus on investing in the development of quick defibrillation devices for home healthcare purposes following the pandemic. In the future years, the market for Automated External Defibrillators (AEDs) is also predicted to expand.

Yearly, around 300,000 out-of-hospital cardiac arrests occur in the United States. Over the projection period, favorable government policies in developed nations may assist expand the access and availability of defibrillators, boosting the market growth. Product malfunctions and refunds, rising competitive pressures on companies, and inadequate knowledge of sudden cardiac arrest (SCA) are all limiting this market's growth.

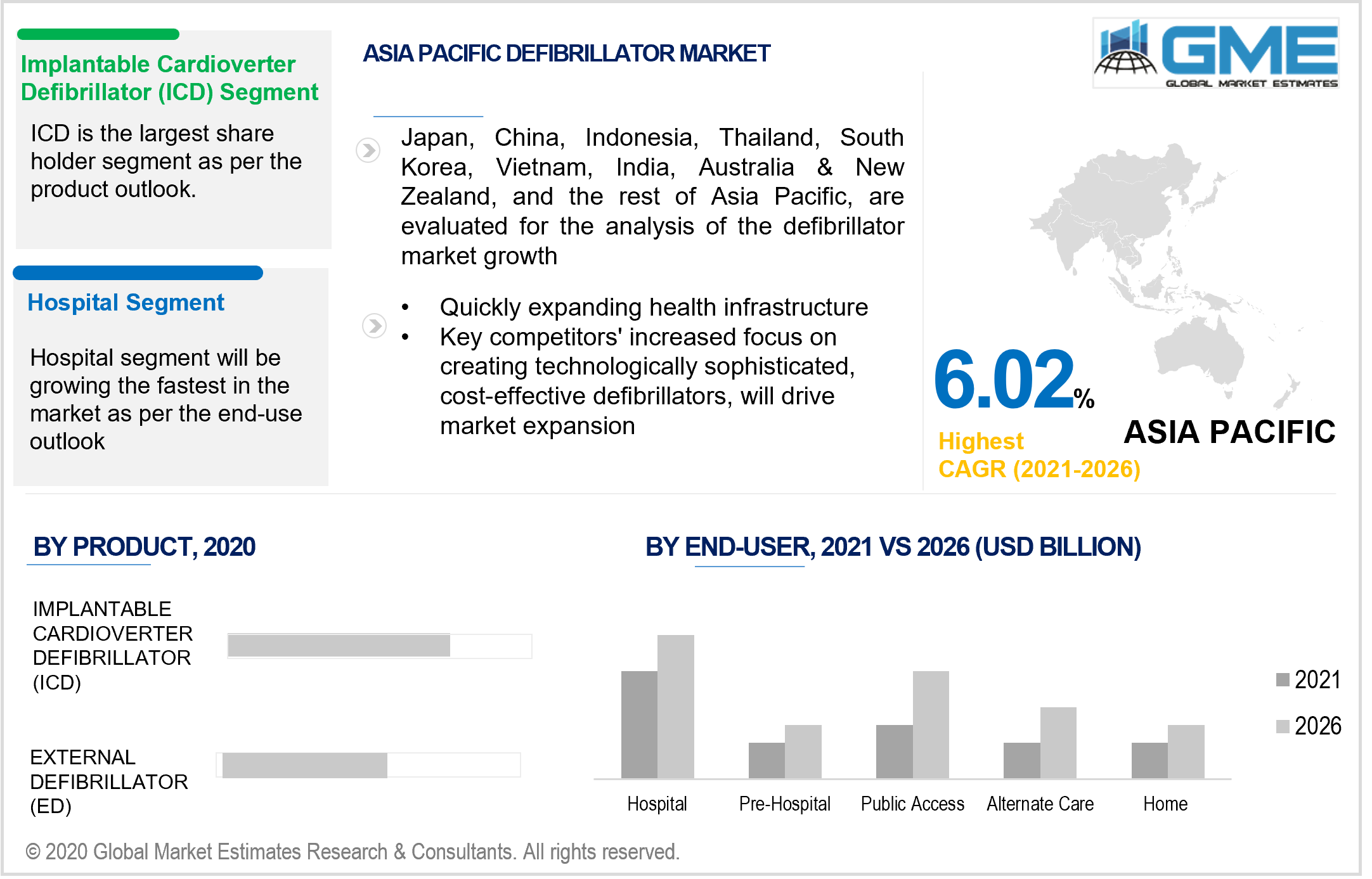

Based on the product, the market is segmented into implantable cardioverter-defibrillator (ICD) which is further segmented into subcutaneous implantable cardioverter-defibrillator (S-ICD), and transvenous implantable cardioverter-defibrillator (T-ISD) and external defibrillator which is further divided into manual ED, automated ED, and wearable cardioverter-defibrillators.

The implantable cardioverter-defibrillator (ICD) segment is expected to have the largest share in the market during the forecast period. The increased demand for ICDs for patients with nonischemic cardiomyopathy has improved the prognosis and reduced mortality risk, which is projected to provide possibilities for ICD manufacturers, supporting market expansion. An implanted cardioverter defibrillator is a wireless device that is affixed to the heart (ICD). It is used continually to discover and help control potentially dangerous electrical irregularities in the heart.

Due to technological innovations, increased R&D, and perks that come with these ICDs, transvenous and subcutaneous ICDs are predicted to grow at the largest rate over the forecast period. The European Cardiovascular Report revealed in 2019 that an implantable cardioverter-defibrillator (ICD) is effective for the avoidance of sudden cardiac death (SCD) and cardiac immediate problem.

Based on end-use, the market is divided into hospital, pre-hospital, public access market, alternate care market, home healthcare. The hospital segment is anticipated to have the largest share in the market during the forecast period. This is because hospitals are the first treatment option for any condition, especially cardiac arrests. As per the Centers for Disease and Prevention (CDC), around 655,000 Adults are likely to die from heart disease each year.

During the forecast period, the public access market segment is also estimated to grow rapidly as a result of the increased use of defibrillators in a public area. As per the Institute Of health, about 18,000 individuals in the United States suffer a defibrillation cardiac arrest with bystanders in public or out of hospitals. It is also estimated that spectators save 1,700 lives each year by utilizing an automated external defibrillator instead of seeking emergency medical help.

Based on region, the market has been broken into North America, Europe, Central, and South America, the Middle East and Africa, and Asia Pacific regions. The North American region is expected to have a lion’s share in the market during the forecast period. This is attributable to a variety of variables, including an increase in the number of diseases. Cardiovascular illnesses are the leading cause of death in the United States, accounting for almost 836,546 deaths (roughly 1 out of every 4 deaths). Over the forecast period, the rising frequency of cardiovascular illnesses in the region is expected to fuel market growth.

Europe is predicted to be the second-largest market for defibrillators, due to the increased prevalence of chronic illnesses and the availability of a massive target population base.

The Asia Pacific region is also expected to become the dominant region during the forecast period. The expansion is aided by rising demand for sophisticated defibrillators and a slew of healthcare changes. Additionally, the increasing prevalence of cardiac failures, as well as quickly expanding health infrastructure and key competitors' increased focus on creating technologically sophisticated, cost-effective defibrillators, which will drive market expansion throughout the forecast period.

Boston Scientific Corporation, Abbott, Medtronic, Koninklijke Philips N.V., Stryker, Nihon Kohden Corporation, Biotronik, Inc., Zoll Medical Corporation, MS Westfalia GmbH, Progetti Srl, AMI Italia, among others, are the key players in the defibrillator market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Defibrillator Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 End-Use Overview

2.1.4 Regional Overview

Chapter 3 Defibrillator Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increased adoption of integrated technology, and high frequency of cardiac illnesses

3.3.2 Industry Challenges

3.3.2.1 Rising competitive pressures on companies, and an inadequate knowledge of sudden cardiac arrest (SCA)

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 End-Use Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Defibrillator Market, By Product

4.1 Product Outlook

4.2 Implantable Cardioverter Defibrillator

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 External Defibrillator

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Defibrillator Market, By End-Use

5.1 End-Use Outlook

5.2 Hospital

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Pre-Hospital

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Public Access Market

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Alternate Care Market

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Home Healthcare

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Defibrillator Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Product, 2020-2026 (USD Million)

6.2.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.2.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.2.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Product, 2020-2026 (USD Million)

6.3.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.7.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.8.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Product, 2020-2026 (USD Million)

6.3.9.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Product, 2020-2026 (USD Million)

6.4.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.7.2 Market size, By End-Use, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Product, 2020-2026 (USD Million)

6.4.8.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Product, 2020-2026 (USD Million)

6.5.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.5.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.5.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.5.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Product, 2020-2026 (USD Million)

6.6.3 Market Size, By End-Use, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Product, 2020-2026 (USD Million)

6.6.4.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Product, 2020-2026 (USD Million)

6.6.5.2 Market Size, By End-Use, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Product, 2020-2026 (USD Million)

6.6.6.2 Market Size, By End-Use, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Boston Scientific Corporation

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Abbott

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Koninklijke Philips N.V

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Stryker, Nihon Kohden Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Biotronik, Inc

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Zoll Medical Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 MS Westfalia GmbH

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Progetti Srl

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Defibrillator Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Defibrillator Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS