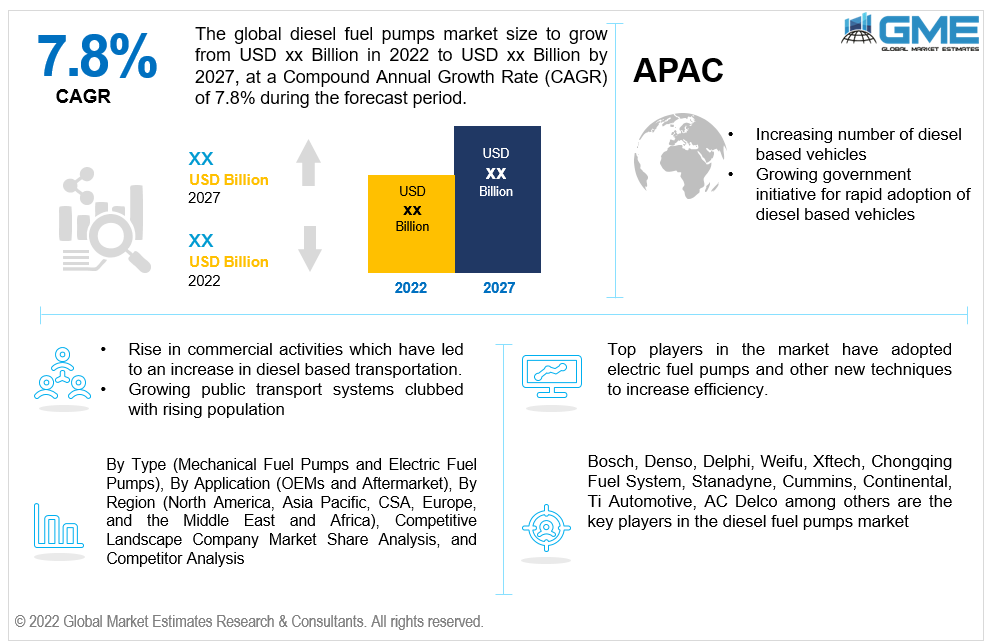

Global Diesel Fuel Pumps Market Size, Trends & Analysis - Forecasts to 2027 By Type (Mechanical Fuel Pumps and Electric Fuel Pumps), By Application (OEMs and Aftermarket), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

The global diesel fuel pumps market is projected to grow at a CAGR value of 7.8% from 2022 to 2027.

According to ACEA, 29.4% of vehicles globally are diesel powered. According to EIA (Energy Information Administration) diesel is majorly used in a number of transport systems such as freight, and luxury trucks, buses, trains, some cars as well as military engines. In 2020, the U.S transportation sector used approximately 44.61 billion gallons (around 1.06 billion barrels) of diesel.

Diesel also tends to have a reduced risk of catching fire and hence is beneficial in avoiding fires. It can be safely said that many commercial vehicles make use of diesel for their day-to-day activities. With a lot of activities needing the use of diesel, diesel fuel pumps have gained the attention of manufacturers and its usage has been increasing all over the world.

The market will be driven by increasing usage of diesel fuels in farm vehicles, public transport and military vehicles, growing demand for fuel-efficient vehicles, and stringent emission control norms by government regulations.

Commercial and industrial organizations have adopted the use of diesel as their backup source of power generation. Increase in mineral activity for commercial purposes by government has considerably increased the use of diesel. Governments have also been encouraging the setting up of fuel pumps across the country. For instance, the Indian government had allowed non-oil companies to enter the market which has increased the competitiveness of fuel pumps and has also provided the opportunity to manufactures to earn additional revenue.

Furthermore, the research and development taking place in the diesel fuel pumps sector for better efficiency is one of the prime driving factors of the market. The introduction of diesel transfer pump has helped both small scale and large sale industries to transport fuel easily while being cost-effective. The electronic diesel fuel pump is also gaining prominence for delivering fuel in a precise manner using metering.

The COVID-19 has bought along with it several restrictions to traveling which has decreased the consumption of diesel. But with the situation returning back to normal, the diesel consumption is expected to improve. With schools and offices opening up and the lockdown restrictions coming to an end, diesel using public transport is back on the road. The rising exuberance is an aftereffect of the pent-up demand of diesel. Hence, the demand of customers can act as an incentive for manufacturers to get into the production of diesel fuel pumps.

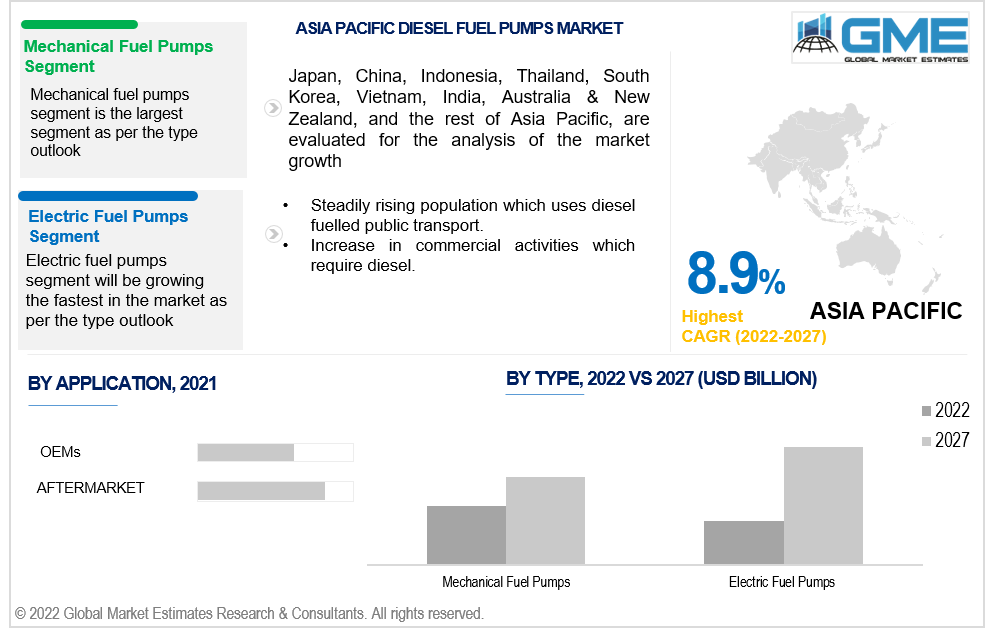

Based on the type, the diesel fuel pumps market is divided into mechanical fuel pumps and electric fuel pumps. The mechanical fuel pumps currently holds the largest share in the market but its usage is expected to decline with the rise in electric diesel fuel pumps. The electric fuel pumps segment is expected to be the fastest-growing segment in the market from 2022 to 2027.

Growing demand for diesel fuel pumps that are efficient and comparatively eco-friendly has boosted the rise of electric diesel fuel pumps across the globe. Electric fuel pumps compared to the mechanical fuel pumps offer manufacturers and customers alike the benefits of fuel efficiency, reduction in energy consumption, long- term usage features and accident and shock safe pumps. Along with this the decline of mechanical diesel fuel pumps and the growth of vehicle manufacturing has led to the advent of lighter weight and efficient electric fuel pumps.

Based on the application, the diesel fuel pumps market is divided into OEMs and aftermarket. An OEM (original equipment manufacturer) is compatible with the fuel injector in the vehicle. OEM provide quality in their services as they are directly produced by original manufacturer of the vehicle. They also tend to be more expensive due to its efficiency.

The aftermarket segment on the other hand provides more affordability but may not meet the same expectations as that of an OEM. Hence, the OEM segment is expected to grow at a faster rate than the aftermarket segment.

As per the geographical analysis, the diesel fuel pumps market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the diesel fuel pumps market from 2022 to 2027. The major factor driving the growth of the market in the North American region is due to an increase in transportation activities, presence of the highest proportion of diesel stations across the region, and rising awareness of electric vehicles. Public transport and trucks in the North American region use diesel heavily and hence the need for diesel fuel pumps have been growing rapidly. The region has consistently been a steady consumer of diesel in its many activities.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the diesel fuel pumps market during the forecast period. The reason behind this is the rising consumer preference for diesel fuel-based vehicles along with rising commercial activities which require transport vehicle. The growing population in the Asia-Pacific region, who rely on diesel fuelled public transport may also be a reason for a future rise in diesel fuel pumps in the region. Farm-activities in this region are also prevalent and as farm vehicles like tractors need diesel, diesel fuel pumps are expected to completely reach the villages too.

Bosch, Denso, Delphi, Weifu, Xftech, Chongqing Fuel System, Stanadyne, Cummins, Continental, Ti Automotive, AC Delco among others are the key players in the diesel fuel pumps market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Diesel Fuel Pumps Market Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Diesel Fuel Pumps Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increase in public transport vehicles

3.3.2 Industry Challenges

3.3.2.1 Increasing fuel prices

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2022

3.11.1 Company Positioning Overview, 2022

Chapter 4 Diesel Fuel Pumps Market, By Type

4.1 Type Outlook

4.2 Mechanical Fuel Pumps

4.2.1 Market Size, By Region, 2022-2027 (USD Million)

4.3 Electric Fuel Pumps

4.3.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 5 Diesel Fuel Pumps Market, By Application

5.1 Application Outlook

5.2 OEMs

5.2.1 Market Size, By Region, 2022-2027 (USD Million)

5.3 Aftermarket

5.3.1 Market Size, By Region, 2022-2027 (USD Million)

Chapter 6 Diesel Fuel Pumps Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Million)

6.2.2 Market Size, By Type, 2022-2027 (USD Million)

6.2.3 Market Size, By Technology, 2022-2027 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.2.4.2 Market Size, By Technology, 2022-2027 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.2.5.2 Market Size, By Technology, 2022-2027 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Million)

6.3.2 Market Size, By Type, 2022-2027 (USD Million)

6.3.3 Market Size, By Technology, 2022-2027 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.4.2 Market Size, By Technology, 2022-2027 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.5.2 Market Size, By Technology, 2022-2027 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.6.2 Market Size, By Technology, 2022-2027 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.7.2 Market Size, By Technology, 2022-2027 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.8.2 Market Size, By Technology, 2022-2027 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2022-2027 (USD Million)

6.3.9.2 Market Size, By Technology, 2022-2027 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Million)

6.4.2 Market Size, By Type, 2022-2027 (USD Million)

6.4.3 Market Size, By Technology, 2022-2027 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.4.2 Market Size, By Technology, 2022-2027 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.5.2 Market Size, By Technology, 2022-2027 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.6.2 Market Size, By Technology, 2022-2027 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.7.2 Market size, By Technology, 2022-2027 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2022-2027 (USD Million)

6.4.8.2 Market Size, By Technology, 2022-2027 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Million)

6.5.2 Market Size, By Type, 2022-2027 (USD Million)

6.5.3 Market Size, By Technology, 2022-2027 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.5.4.2 Market Size, By Technology, 2022-2027 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.5.5.2 Market Size, By Technology, 2022-2027 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.5.6.2 Market Size, By Technology, 2022-2027 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Million)

6.6.2 Market Size, By Type, 2022-2027 (USD Million)

6.6.3 Market Size, By Technology, 2022-2027 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2022-2027 (USD Million)

6.6.4.2 Market Size, By Technology, 2022-2027 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2022-2027 (USD Million)

6.6.5.2 Market Size, By Technology, 2022-2027 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2022-2027 (USD Million)

6.6.6.2 Market Size, By Technology, 2022-2027 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Bosch

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Denso

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Delphi

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Weifu

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Xftech

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Chongqing Fuel System

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Stanadyne

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Cummins

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 Ti Automotive

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 AC Delco

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Others

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

The Global Diesel Fuel Pumps Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Diesel Fuel Pumps Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS