Global Digestive Health Supplements Market Size, Trends & Analysis - Forecasts to 2026 By Product (Prebiotics, Probiotics, Food Enzymes, Fulvic Acid, Others), By Form (Capsules, Tablets, Powders, Liquids, Others), By Distribution Channel (OTC [Supermarkets/ Hypermarkets/Food Stores, Drug Stores & Pharmacies, Convenience Stores, Online Stores, Others], Prescribed), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

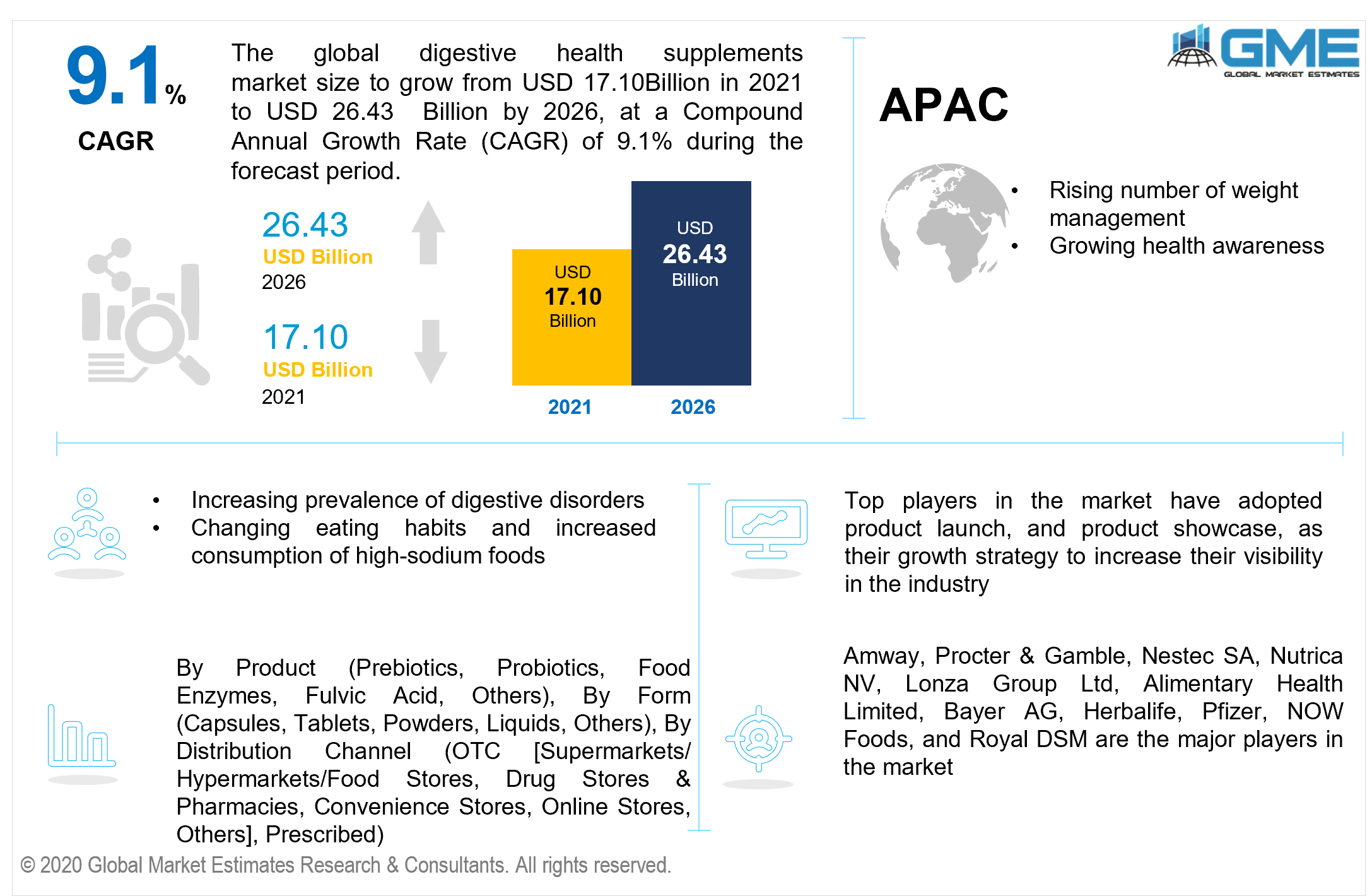

The digestive health supplements market is projected to grow from USD 17.10 billion in 2021 to USD 26.43 billion by 2026 at a CAGR value of 9.1% between 2021 to 2026. Increased digestive health concerns among consumers, unhealthy & sedentary lifestyles, rising weight loss and obesity, and malnutrition among consumers are all driving factors for digestive health supplements. All of these reasons have resulted in a greater emphasis on such supplements that strengthen the immune system and prevent sickness. The emphasis on health and better living has resulted in a flourished market for such supplements. Access to appropriate nutrition information is also expected to attract a greater number of customers.

A constructive perspective regarding medicinal nourishment as a result of the growing frequency of digestive disorders, along with an increase in the number of weight control programmes, is projected to drive development. In industrialised economies, rising health consciousness has manifested in higher per capita spending on digestive dietary supplements. The high incidence of digestive problems in various nations is expected to boost product consumption even further.

Changes in eating patterns and increasing intake of high-sodium foodstuffs, for example, are considered to correlate to the significant incidence of gastrointestinal diseases in both established and developing economies. This aspect is expected to increase the consumption of digestive health products in the near future. The rising elderly demographic, combined with increased demand for digestive nutritional supplements, is projected to fuel market expansion.

To attract a larger consumer base, companies emphasize product advancement, adding sustainability initiatives, and offering human clinical trials and assertions. The digestive nutritional supplements market now has more prospects because of advanced manufacturing technologies. Digestive supplements are utilised in a variety of foods, and the rising demand for nutritious foods will provide possibilities for the global digestive nutritional supplements market.

Such supplements aid in the improvement of digestive health by maintaining appropriate gut function. Digestive health products might be fortified foods, functional foods, or dietary supplements that are derived from natural plant, animal, or microbial sources. The products are intended to prevent problems with the gastrointestinal tract. The products are often rich in fibre to aid in optimal meal absorption in the stomach. These benefits aid in wider acceptance of the product globally.

Sedentary lifestyles and physical inactivity have resulted in an exponential increase in digestive disorders worldwide. Weight gain is one of the biggest health issues associated with a sedentary lifestyle. People nowadays are focusing on living healthy lifestyles. Apps that track diet and smart wristbands that monitor physical activity are assisting people in reaching their fitness objectives. These aspects act as a catalyst and help the overall market gain traction.

The abundance of information available on the internet also provides customers with the knowledge that may be used to make healthy decisions. As a consequence of these reasons, the dietary supplement market is witnessing enormous growth. Individuals seek strategies to battle obesity and the negative repercussions of being overweight, and as a consequence, they are always seeking for solutions to enhance their digestive health, paving the way for growth in this related sector. Regulatory organisations seek scientific evidence and demonstrated health impacts before accepting company claims, which is projected to limit market growth during the forecast period.

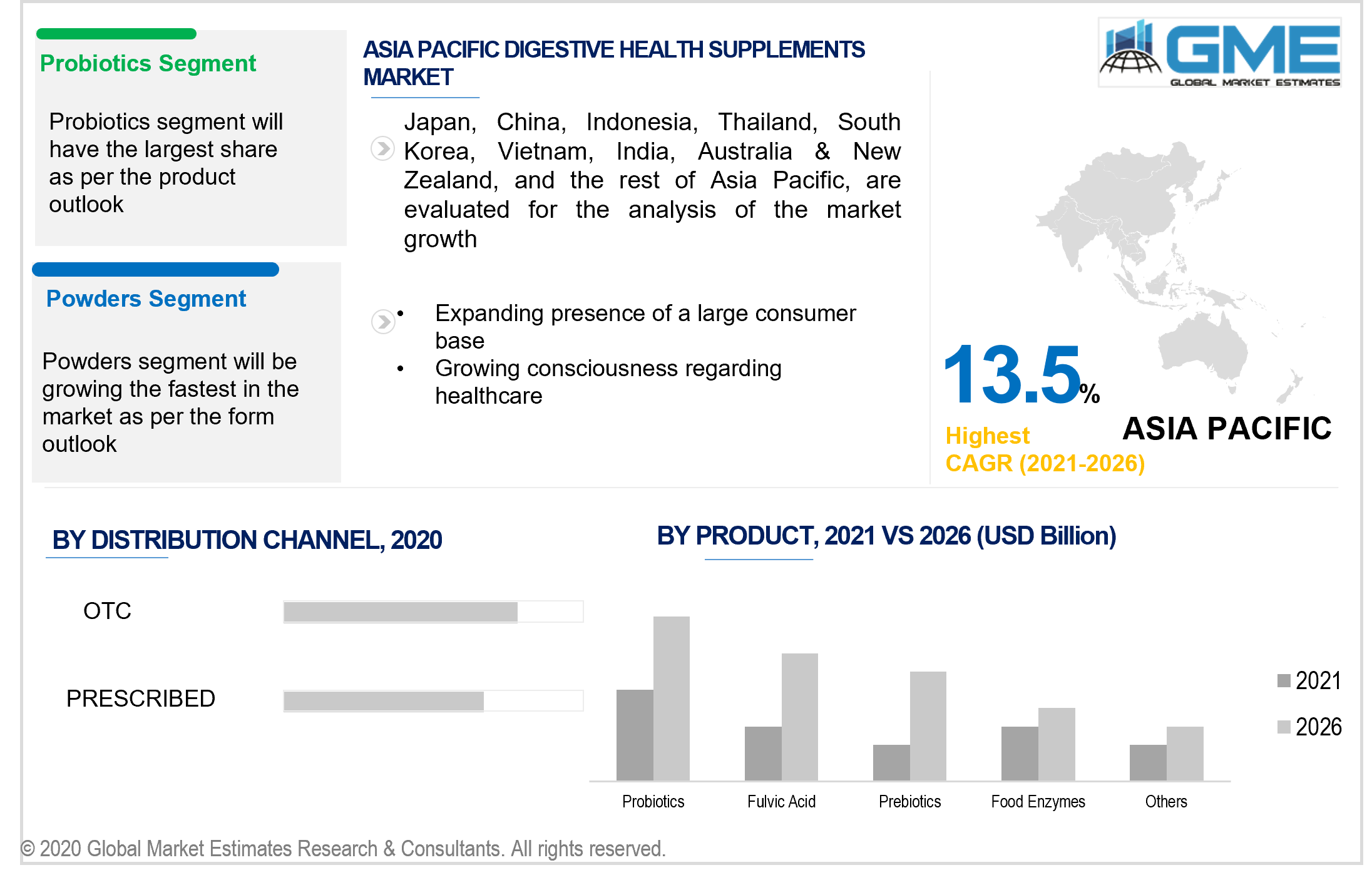

Based on the product, the market is divided into prebiotics, probiotics, food enzymes, fulvic acid, and others. Expanding consumer knowledge about gut wellbeing is presumed to drive growth in the probiotic market. The growing desire for supplements to manage healthcare expenditures is also expected to benefit market expansion. The introduction of innovative delivery modes, scientific data to back up the claims, and improved consumer awareness are likely to drive the market of probiotic supplements.

Based on the form, the market is divided into capsules, tablets, powders, liquids, and others. The growing prominence of organic components, along with increased consciousness of the negative effects of hazardous chemicals, is expected to fuel the demand for powdered supplements over tablets or capsules. As a result, producers are developing powders that can be mixed into any beverage or drink to get the advantages of the tablets. This characteristic is likely to open up new prospects for producers in the near future.

Powdered dietary supplements are more readily assimilated than tablets, enabling the body to begin experiencing the health advantages as soon as feasible. Over the forecast period, all of these elements are expected to fuel the expansion of digestive health powder supplements.

Based on the type of distribution channel, the market is divided into OTC and prescribed. Government measures to expand healthcare facilities, combined with favourable legislation, are expected to boost demand for over-the-counter digestive nutritional supplements. Market participants are working to improve the functioning of these supplements via product improvement and ingredient advancement, which is expected to drive demand during the forecast period.

During the forecast period, North America is projected to recommence to have a high demand for digestive nutritional supplements. Obesity, digestive problems, and lifestyle-related illnesses are presumed to boost demand for digestive nutritional supplements, owing to suboptimal dietary habits and a high intake of processed, high-sodium, and prepackaged meals.

High popularity for healthy ingredients, elevated youngsters involvement in workouts, wellness, and sporting events, breakthroughs in probiotic and prebiotic active ingredients, and a growing accentuation on the vocation of digestive supplements in immunity and ultimate wellbeing are all aspects that are expected to endorse market expansion in North America.

Asia Pacific region is foreseen to register the highest CAGR. As key players implement tactics including the launching of their products in underdeveloped markets in South East Asia, Asia Pacific is expected to see strong demand for digestive health products. Due to the existence of a huge customer base, China, Japan, and India are among the major regional markets for digestive health supplements in the Asia-Pacific. Skyrocketing product consumption in countries including Japan and Australia is anticipated to promote regional market advancement over the forecast period.

Amway, Procter & Gamble, Nestec SA, Nutrica NV, Lonza Group Ltd, Alimentary Health Limited, Bayer AG, Herbalife, Pfizer, NOW Foods, and Royal DSM are the major players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Digestive Health Supplements Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Form Overview

2.1.4 Distribution Channel Overview

2.1.5 Regional Overview

Chapter 3 Digestive Health Supplements Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing awareness about healthy diet & its effect on weight

3.3.1.2 Rising prevalence of digestive disorders

3.3.2 Industry Challenges

3.3.2.1 Conflicts between the industry participants and regulatory agencies

3.4 Prospective Growth Scenario

3.4.1 Product Growth Scenario

3.4.2 Form Growth Scenario

3.4.3 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Digestive Health Supplements Market, By Product

4.1 Product Outlook

4.2 Prebiotics

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3 Probiotics

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.4 Food Enzymes

4.4.1 Market Size, By Region, 2019-2026 (USD Billion)

4.5 Fulvic Acid

4.5.1 Market Size, By Region, 2019-2026 (USD Billion)

4.6 Others

4.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 5 Digestive Health Supplements Market, By Form

5.1 Form Outlook

5.2 Capsules

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 Tablets

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Liquids

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 Powders

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Others

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Digestive Health Supplements Market, By Distribution Channel

6.1 Distribution Channel Outlook

6.2 OTC

6.2.1 Market size, By Region, 2019-2026 (USD Billion)

6.3 Prescribed

6.3.1 Market size, By Region, 2019-2026 (USD Billion)

Chapter 7 Digestive Health Supplements Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Product, 2019-2026 (USD Billion)

7.2.3 Market Size, By Form, 2019-2026 (USD Billion)

7.2.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Product, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Form, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Product, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Form, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Product, 2019-2026 (USD Billion)

7.3.3 Market Size, By Form, 2019-2026 (USD Billion)

7.3.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.5 Germany

7.2.5.1 Market Size, By Product, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Form, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Product, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Form, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Product, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Form, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Product, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Form, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Product, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Form, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Product, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Form, 2019-2026 (USD Billion)

7.3.10.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2019-2026 (USD Billion)

7.4.2 Market Size, By Product, 2019-2026 (USD Billion)

7.4.3 Market Size, By Form, 2019-2026 (USD Billion)

7.4.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Product, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Form, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Product, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Form, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Product, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Form, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Product, 2019-2026 (USD Billion)

7.4.8.2 Market size, By Form, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Product, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Form, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Product, 2019-2026 (USD Billion)

7.5.3 Market Size, By Form, 2019-2026 (USD Billion)

7.5.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Product, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Form, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Product, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Form, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Product, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Form, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Billion)

7.6.2 Market Size, By Product, 2019-2026 (USD Billion)

7.6.3 Market Size, By Form, 2019-2026 (USD Billion)

7.6.4 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Product, 2019-2026 (USD Billion)

7.6.5.2 Market Size, By Form, 2019-2026 (USD Billion)

7.6.5.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Product, 2019-2026 (USD Billion)

7.6.6.2 Market Size, By Form, 2019-2026 (USD Billion)

7.6.6.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Product, 2019-2026 (USD Billion)

7.6.7.2 Market Size, By Form, 2019-2026 (USD Billion)

7.6.7.3 Market Size, By Distribution Channel, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Amway

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 Procter & Gamble

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Nestec SA

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Nutrica NV

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Lonza Group Ltd

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Alimentary Health Limited

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Bayer AG

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Herbalife

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 Pfizer

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 NOW Foods

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Royal DSM

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Other Companies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

The Global Digestive Health Supplements Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digestive Health Supplements Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS