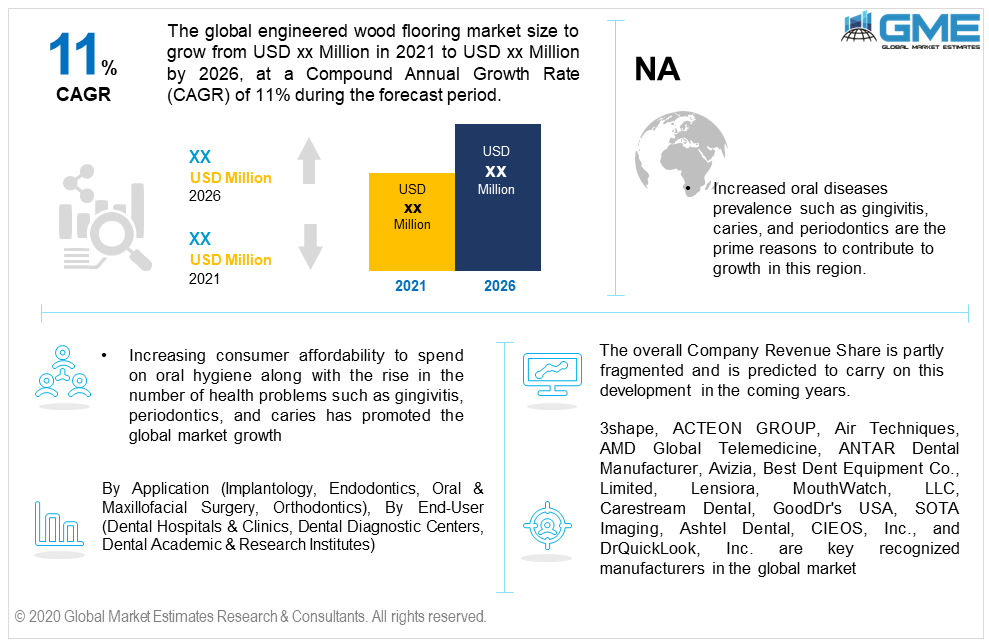

Global Digital Dental Camera Market Size, Trends & Analysis - Forecasts to 2026 By Application (Implantology, Endodontics, Oral & Maxillofacial Surgery, Orthodontics), By End-User (Dental Hospitals & Clinics, Dental Diagnostic Centers, Dental Academic & Research Institutes), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

The global digital dental camera market is likely to observe more than 11% CAGR up to 2026, with North America leading the regional penetration in 2020. Increasing consumer affordability to spend on oral hygiene along with the rise in the number of health problems such as gingivitis, periodontics, and caries has promoted the global market growth.

The traditional dentistry cameras were expensive and also difficult to operate due to their large space occupation. Therefore, the introduction of lightweight and compact alternatives took over the market in a short period. These devices are technically advanced, inexpensive, and easy to operate.

The global industry confronted unexpected setbacks which negatively impacted the industry manufacturers. Sudden lockdown and restrictions on other medical services except for covid-19 patients lead to the shutdown of other departments including dentistry. The sale was severely impacted and production went on halt. Though, the producers are now getting back to their standard business operation which brings the industry to its normal pace.

The application segment is divided into implantology, endodontics, oral & maxillofacial surgery, and orthodontics are major identified applications in the industry. The increase in number of dentistry procedures to cure different diseases and oral problems is likely to promote the use of advanced devices in the aforementioned applications.

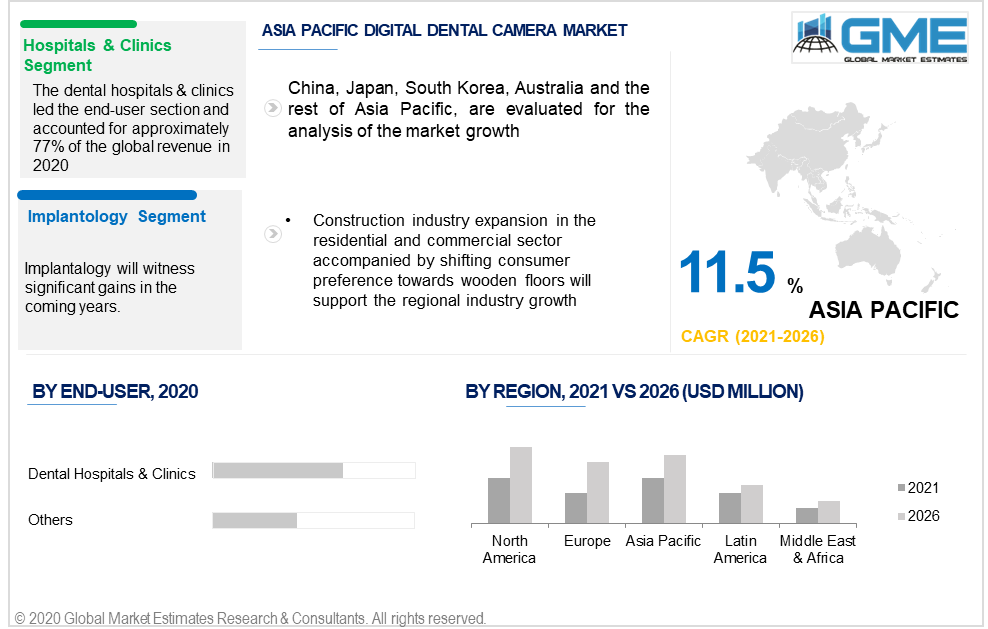

The implantology application is anticipated to witness significant growth up to 2026. Rise in number of patients opting for tooth implant due to increased affordability and availability of advanced techniques will proliferate growth in this segment.

Hospitals & Clinics, Diagnostic Centers, and Academic & Research Institutes are key end-users in the industry. The dental hospitals & clinics led the end-user section and accounted for approximately 77% of the global revenue in 2020. Heavy patient traffic in hospitals & clinics due to availability of fine services and advanced tools and devices will support the penetration in this segment. The segment will also witness fastest growth from 2021 to 2026. Availability of specialized physicians and advanced diagnostic instruments are another lucrative factors to drive demand.

The diagnostic centres will attain notable gains in the coming years. Increase in number of oral diseases due to poor oral hygiene, smoking, and drinking led to numerous tests and diagnoses to know the disease root cause. This trend will likely to support growth in this segment.

The North American region dominated the global demand and held maximum share. By the end of 2026, the region will hold more than 36% of its revenue share. Increased oral diseases prevalence such as gingivitis, caries, and periodontics are the prime reasons to contribute to the growth in this region. Also, enhancing healthcare infrastructure especially in dentistry and orthodontics has opened new avenues in the regional industry. Each year, a significant ratio of the population including geriatric, adult, and children visit dentists for regular oral check-ups and other issues. Rising consumer affordability and consciousness to maintain oral health will promote regional expansion.

In the Asia Pacific market, there is a high possibility of rapid growth and expansion during the forecast period. The region is likely to attain the fastest growth. Medical sector expansion accompanied by technology upgradation in dentistry will support regional demand. Medical tourism and oral hygiene awareness will induce market expansion in the coming years.

The European industry will witness sluggish growth in previous years, specially in the covid-19 pandemic, though, the industry will get back to its normal growth rate in the coming years. The regional market is greatly inclined by the adoption of advanced dentistry devices. Therefore, a significant CAGR rate is predictable during the forecast period.

3shape, ACTEON GROUP, Air Techniques, AMD Global Telemedicine, ANTAR Dental Manufacturer, Avizia, Best Dent Equipment Co., Limited, Lensiora, MouthWatch, LLC, Carestream Dental, GoodDr's USA, SOTA Imaging, Ashtel Dental, CIEOS, Inc., and DrQuickLook, Inc. are key recognized manufacturers in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

The overall company revenue share is partly fragmented and is predicted to carry on this development in the coming years. The presence of numerous international and domestic manufacturers in the industry made the market highly competitive. Product enhancement to upgrade the performance and operational functionalities are the prime strategies adopted by major industry players.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Dental Digital Camera industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Application overview

2.1.3 End-User overview

2.1.4 Regional overview

Chapter 3 Dental Digital Camera Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Dental Digital Camera Market, By Application

4.1 Application Outlook

4.2 Implantology

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Endodontics

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Oral & Maxillofacial Surgery

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Orthodontics

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Others

4.6.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Dental Digital Camera Market, By End-User

5.1 End-User Outlook

5.2 Dental Hospitals & Clinics

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Dental Diagnostic Centers

5.3.1 Market size, by region, 2019-2026 (USD Million)

5.4 Dental Academic & Research Institutes

5.4.1 Market size, by region, 2019-2026 (USD Million)

5.5 Others

5.5.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Dental Digital Camera Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by application, 2019-2026 (USD Million)

6.2.3 Market size, by end-user, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by application, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by application, 2019-2026 (USD Million)

6.2.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by application, 2019-2026 (USD Million)

6.3.3 Market size, by end-user, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by application, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by application, 2019-2026 (USD Million)

6.3.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by application, 2019-2026 (USD Million)

6.3.6.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by application, 2019-2026 (USD Million)

6.3.7.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by application, 2019-2026 (USD Million)

6.3.8.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by application, 2019-2026 (USD Million)

6.3.9.2 Market size, by end-user, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by application, 2019-2026 (USD Million)

6.4.3 Market size, by end-user, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by application, 2019-2026 (USD Million)

6.4.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by application, 2019-2026 (USD Million)

6.4.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by application, 2019-2026 (USD Million)

6.4.6.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.7 India

6.4.7.1 Market size, by application, 2019-2026 (USD Million)

6.4.7.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by application, 2019-2026 (USD Million)

6.4.8.2 Market size, by end-user, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by application, 2019-2026 (USD Million)

6.5.3 Market size, by end-user, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by application, 2019-2026 (USD Million)

6.5.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by application, 2019-2026 (USD Million)

6.5.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by application, 2019-2026 (USD Million)

6.6.3 Market size, by end-user, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by application, 2019-2026 (USD Million)

6.6.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by application, 2019-2026 (USD Million)

6.6.5.2 Market size, by end-user, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 3shape

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 ACTEON GROUP

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Air Techniques

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 AMD Global Telemedicine

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 ANTAR Dental Manufacturer

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Avizia

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Best Dent Equipment Co.,Limited

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Lensiora

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 MouthWatch, LLC

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Carestream Dental

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 GoodDr's USA

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 SOTA Imaging

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Ashtel Dental

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 CIEOS, Inc.

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 DrQuickLook, Inc.

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

The Global Digital Dental Camera Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Dental Camera Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS