Global Digital Evidence Management Market Size, Trends & Analysis - Forecasts to 2029 By Component (Hardware, Software, and Services), By End User (Law Enforcement Agencies and Criminal Justice Agencies), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

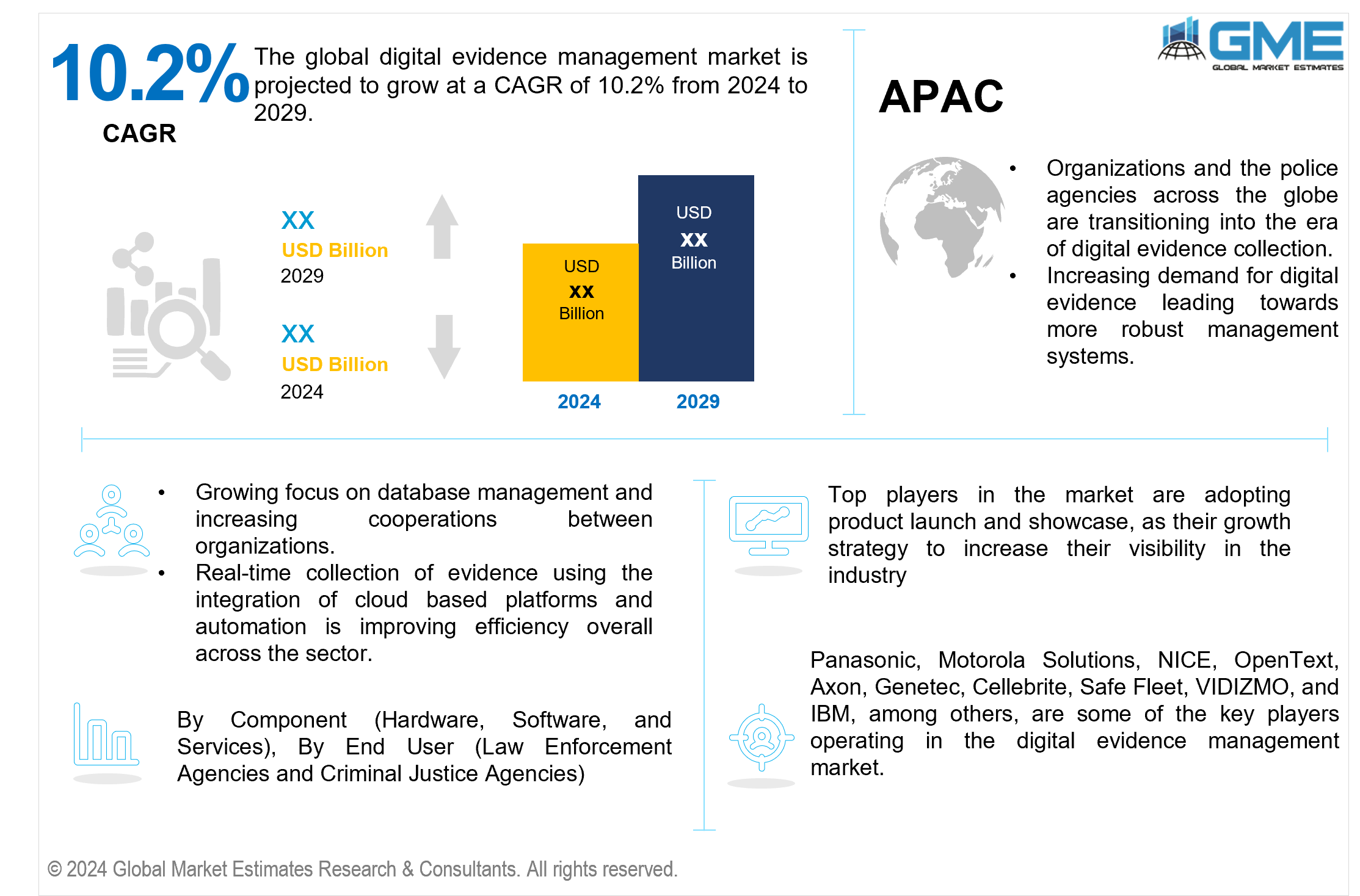

The global digital evidence management market is projected to grow at a CAGR of 10.2% from 2024 to 2029.

As intelligence agencies progressively utilize digital services, they need effective storage solutions to cater to the demand. Traditional storage methods are being replaced by digital evidence management systems (DEMS), which cannot successfully handle modern digital data's increasing amount, complexity, and security needs. With the proliferation of digital devices and widespread internet adoption across devices such as smartphones, laptops, computer systems, and data transmitted via text messages, email, photos, and social media, the digital footprint has grown, necessitating robust management solutions.

Latest and technically advanced software are revolutionizing the digital evidence management market by offering efficiency in collection, storage, analysis, and presentation of digital evidence. These software are currently being adopted in the legal justice system of most of the developed nations such as North America and Europe. These systems automate the process of documentation and reduces the risk of tampering with critical evidence, which will ensure transparency. Rigorous evidence handling procedures are followed to safeguard the integrity of physical and electronic evidence from the crime scene to the courtroom.

The market is expanding significantly as a result of new technologies that are modernizing several industries, including cybersecurity, law enforcement, and the judicial system. Examples of these technologies include artificial intelligence and cloud-based evidence management systems. By automating data analysis, spotting patterns, and enhancing the precision and effectiveness of evidence processing, artificial intelligence can speed up growth. Additionally, cloud-based evidence management systems offer scalable, safe, and easily accessible storage options. This makes it easier to collaborate and share data across many devices and places, something that traditional systems may find labour-intensive and time-consuming. Implementing digital evidence management best practices ensures that electronic evidence remains valid, secure, and admissible throughout the investigation and judicial processes. However, the increase in the need for management systems has also led to the rise of digital threats. Cyberattacks are a by-product of such market growth, which can lead to significant data breaches that can have a negative impact on privacy. This can be managed by implementing a comprehensive cybersecurity strategy.

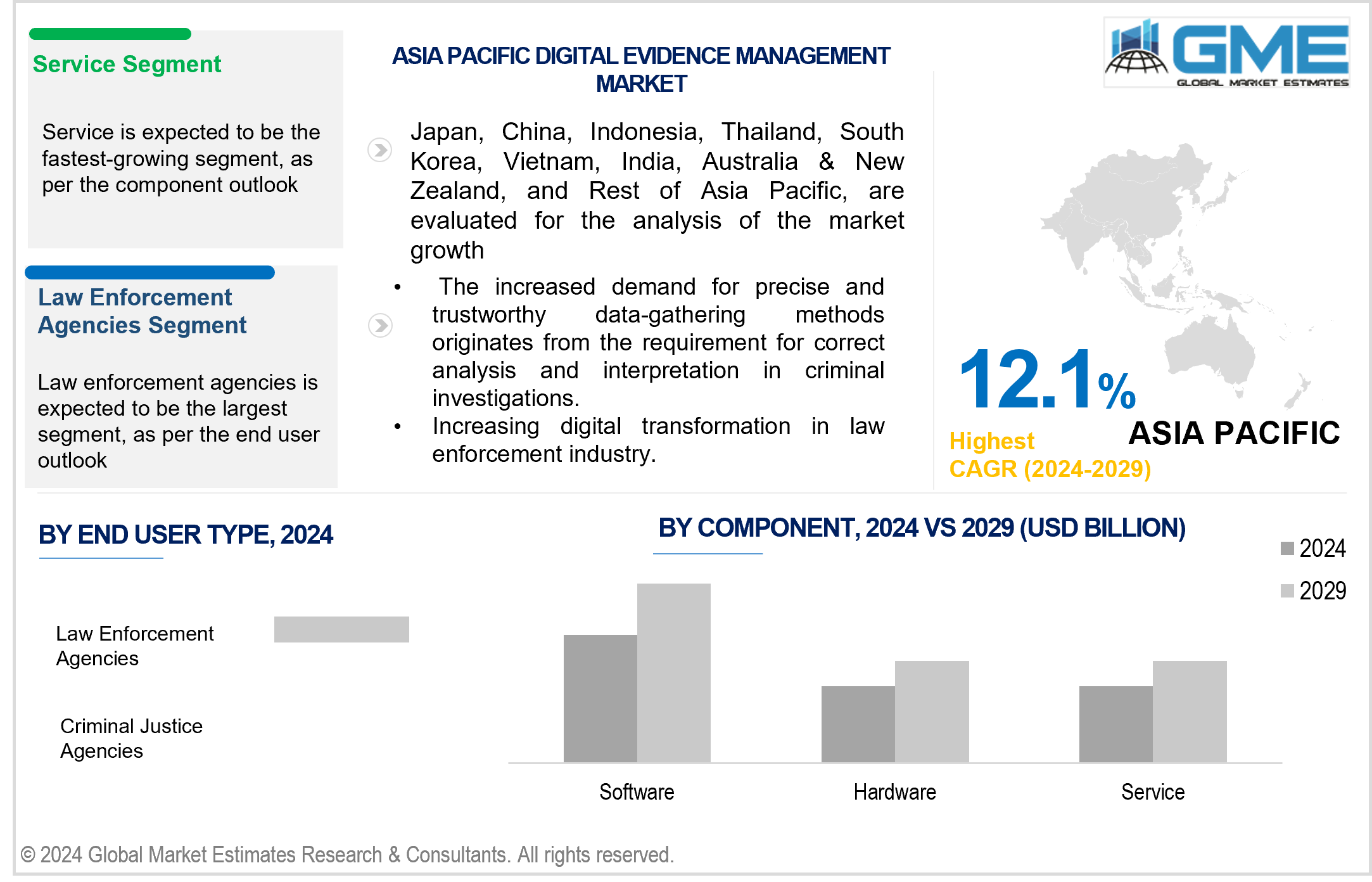

The service segment is expected to witness fastest growth in the market. As intelligence agencies implement increasingly advanced digital evidence preservation technologies, they will require continual technical assistance, system integration, and customization to fit their specific operational requirements.

The software segment is expected to hold the largest market share over the forecast period. Its primary responsibility is to enable the systems essential operations. Electronic evidence management is one such system used for evidence collection tools, forensic analysis capabilities, safe storage options, and advanced data analytics. They are also responsible for ensuring the accuracy of the data collected.

The law enforcement agencies category is expected to hold the greatest share of the market during the forecast period. These agencies deal with a large volume of digital evidence, such as cybercrimes, which are becoming increasingly common. DEM systems such as digital forensic lab equipment assist agencies in maintaining integrity by using a chain of custody management system that adheres to legal criteria for evidence authentication methods, which is admissible, and improves coordination among investigators and prosecutors. They also help to ensure prompt and thorough investigations by utilizing new technology, such as forensic data analysis tools and evidence tracking systems, thereby boosting the accuracy and efficiency of law enforcement operations.

The criminal justice agencies segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Legal experts have long been unsatisfied by the lengthy process of collecting, organizing, reviewing, and distributing evidence. A legal evidence management system provides a single platform for storing, organizing, and managing various sorts of digital evidence. In addition, an evidence integrity verification apparatus has powerful search and retrieval capabilities, allowing users to quickly locate and obtain specific pieces of evidence using keyword searches or filters. This not only improves the general efficiency of investigations and legal proceedings but also assures that no critical material is ignored or lost.

North America is predicted to be the world's largest market. The growing adoption of advanced digital management systems is the primary driver of market growth. In North American investigative agencies, crime scene investigation tools are widely used to analyze various crime scenes. North America is a leader in the early adoption of many new technologies, as the law enforcement agencies are funded by the government which is ready to make huge investments in developing digital forensic solutions. Having robust legislation and legal frameworks in jurisdictions such as the United States and Canada that need collaboration across several agencies at simultaneously necessitates the transition to a digital evidence management system.

Asia Pacific is predicted to witness rapid growth during the forecast period. As per Statista, the adoption of digital technology has led to increased cyberattacks and cybercrimes across the region. The government and various other organizations are shifting their technology to digital portals. This will eventually lead to further increases in countering such threats across the digital domain. The governments in the Asia Pacific region understand the need for cybercrime investigation tools that can help law enforcement technology understand police evidence management software in this digital space.

Panasonic, Motorola Solutions, NICE, OpenText, Axon, Genetec, Cellebrite, Safe Fleet, VIDIZMO, and IBM, among others, are some of the key players operating in the global digital evidence management market.

Please note: This is not an exhaustive list of companies profiled in the report.

On April 24, 2023, IBM introduced its new security suite designed to unify and accelerate the security analyst experience across the entire incident lifecycle. This initiative will help speed up digital evidence collection and further analyze threat detection analysis.

On March 8, 2023, Axon Technology in collaboration with Scotland Police announced the First-Of-Its-Kind National Digital Evidence Sharing System. Scotland's historic commitment to establish a national system for digital evidence is a huge step forward in digital transformation for public safety. This ground-breaking step will streamline digital evidence collection, storage, and analysis across the country, increasing law enforcement efficiency and effectiveness.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL DIGITAL EVIDENCE MANAGEMENT MARKET, BY COMPONENT

4.1 Introduction

4.2 Digital Evidence Management Market: Component Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Hardware

4.4.1 Hardware Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Software

4.5.1 SoftwareMarket Estimates and Forecast, 2021-2029 (USD Million)

4.6 Services

4.6.1 Services Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL DIGITAL EVIDENCE MANAGEMENT MARKET, BY END USER

5.1 Introduction

5.2 Digital Evidence Management Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Law Enforcement Agencies

5.4.1 Law Enforcement Agencies Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Criminal Justice Agencies

5.5.1 Criminal Justice Agencies Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL DIGITAL EVIDENCE MANAGEMENT MARKET, BY REGION

6.1 Introduction

6.2 North America Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Component

6.2.2 By End User

6.2.3 By Country

6.2.3.1 U.S. Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Component

6.2.3.1.2 By End User

6.2.3.2 Canada Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Component

6.2.3.2.2 By End User

6.2.3.3 Mexico Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Component

6.2.3.3.2 By End User

6.3 Europe Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Component

6.3.2 By End User

6.3.3 By Country

6.3.3.1 Germany Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Component

6.3.3.1.2 By End User

6.3.3.2 U.K. Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Component

6.3.3.2.2 By End User

6.3.3.3 France Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Component

6.3.3.3.2 By End User

6.3.3.4 Italy Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Component

6.3.3.4.2 By End User

6.3.3.5 Spain Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Component

6.3.3.5.2 By End User

6.3.3.6 Netherlands Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Component

6.3.3.6.2 By End User

6.3.3.7 Rest of Europe Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Component

6.3.3.6.2 By End User

6.4 Asia Pacific Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Component

6.4.2 By End User

6.4.3 By Country

6.4.3.1 China Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Component

6.4.3.1.2 By End User

6.4.3.2 Japan Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Component

6.4.3.2.2 By End User

6.4.3.3 India Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Component

6.4.3.3.2 By End User

6.4.3.4 South Korea Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Component

6.4.3.4.2 By End User

6.4.3.5 Singapore Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Component

6.4.3.5.2 By End User

6.4.3.6 Malaysia Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Component

6.4.3.6.2 By End User

6.4.3.7 Thailand Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Component

6.4.3.6.2 By End User

6.4.3.8 Indonesia Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Component

6.4.3.7.2 By End User

6.4.3.9 Vietnam Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Component

6.4.3.8.2 By End User

6.4.3.10 Taiwan Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Component

6.4.3.10.2 By End User

6.4.3.11 Rest of Asia Pacific Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Component

6.4.3.11.2 By End User

6.5 Middle East and Africa Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Component

6.5.2 By End User

6.5.3 By Country

6.5.3.1 Saudi Arabia Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Component

6.5.3.1.2 By End User

6.5.3.2 U.A.E. Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Component

6.5.3.2.2 By End User

6.5.3.3 Israel Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Component

6.5.3.3.2 By End User

6.5.3.4 South Africa Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Component

6.5.3.4.2 By End User

6.5.3.5 Rest of Middle East and Africa Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Component

6.5.3.5.2 By End User

6.6 Central and South America Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Component

6.6.2 By End User

6.6.3 By Country

6.6.3.1 Brazil Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Component

6.6.3.1.2 By End User

6.6.3.2 Argentina Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Component

6.6.3.2.2 By End User

6.6.3.3 Chile Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Component

6.6.3.3.2 By End User

6.6.3.3 Rest of Central and South America Digital Evidence Management Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Component

6.6.3.3.2 By End User

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Panasonic

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Motorola Solutions

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 NICE

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 OpenText

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Axon

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 GENETEC

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Cellebrite

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Safe Fleet

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 VIDIZMO

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 IBM

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

2 Hardware Market, By Region, 2021-2029 (USD Mllion)

3 Software Market, By Region, 2021-2029 (USD Mllion)

4 Services Market, By Region, 2021-2029 (USD Mllion)

5 Global Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

6 Law Enforcement Agencies Market, By Region, 2021-2029 (USD Mllion)

7 Criminal Justice Agencies Market, By Region, 2021-2029 (USD Mllion)

8 Regional Analysis, 2021-2029 (USD Mllion)

9 North America Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

10 North America Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

11 North America Digital Evidence Management Market, By COUNTRY, 2021-2029 (USD Mllion)

12 U.S. Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

13 U.S. Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

14 Canada Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

15 Canada Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

16 Mexico Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

17 Mexico Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

18 Europe Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

19 Europe Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

20 Europe Digital Evidence Management Market, By Country, 2021-2029 (USD Mllion)

21 Germany Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

22 Germany Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

23 U.K. Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

24 U.K. Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

25 France Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

26 France Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

27 Italy Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

28 Italy Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

29 Spain Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

30 Spain Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

31 Netherlands Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

32 Netherlands Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

33 Rest Of Europe Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

34 Rest Of Europe Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

35 Asia Pacific Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

36 Asia Pacific Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

37 Asia Pacific Digital Evidence Management Market, By Country, 2021-2029 (USD Mllion)

38 China Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

39 China Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

40 Japan Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

41 Japan Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

42 India Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

43 India Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

44 South Korea Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

45 South Korea Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

46 Singapore Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

47 Singapore Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

48 Thailand Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

49 Thailand Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

50 Malaysia Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

51 Malaysia Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

52 Indonesia Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

53 Indonesia Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

54 Vietnam Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

55 Vietnam Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

56 Taiwan Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

57 Taiwan Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

58 Rest of APAC Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

59 Rest of APAC Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

60 Middle East and Africa Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

61 Middle East and Africa Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

62 Middle East and Africa Digital Evidence Management Market, By Country, 2021-2029 (USD Mllion)

63 Saudi Arabia Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

64 Saudi Arabia Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

65 UAE Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

66 UAE Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

67 Israel Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

68 Israel Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

69 South Africa Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

70 South Africa Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

71 Rest Of Middle East and Africa Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

72 Rest Of Middle East and Africa Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

73 Central and South America Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

74 Central and South America Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

75 Central and South America Digital Evidence Management Market, By Country, 2021-2029 (USD Mllion)

76 Brazil Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

77 Brazil Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

78 Chile Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

79 Chile Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

80 Argentina Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

81 Argentina Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

82 Rest Of Central and South America Digital Evidence Management Market, By Component, 2021-2029 (USD Mllion)

83 Rest Of Central and South America Digital Evidence Management Market, By End User, 2021-2029 (USD Mllion)

84 Panasonic : Products & Services Offering

85 Motorola Solutions : Products & Services Offering

86 NICE : Products & Services Offering

87 OpenText : Products & Services Offering

88 Axon : Products & Services Offering

89 GENETEC : Products & Services Offering

90 Cellebrite : Products & Services Offering

91 Safe Fleet : Products & Services Offering

92 VIDIZMO , Inc: Products & Services Offering

93 IBM : Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Digital Evidence Management Market Overview

2 Global Digital Evidence Management Market Value From 2021-2029 (USD Mllion)

3 Global Digital Evidence Management Market Share, By Component (2023)

4 Global Digital Evidence Management Market Share, By End User (2023)

5 Global Digital Evidence Management Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Digital Evidence Management Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Digital Evidence Management Market

10 Impact Of Challenges On The Global Digital Evidence Management Market

11 Porter’s Five Forces Analysis

12 Global Digital Evidence Management Market: By Component Scope Key Takeaways

13 Global Digital Evidence Management Market, By Component Segment: Revenue Growth Analysis

14 Hardware Market, By Region, 2021-2029 (USD Mllion)

15 Software Market, By Region, 2021-2029 (USD Mllion)

16 Services Market, By Region, 2021-2029 (USD Mllion)

17 Global Digital Evidence Management Market: By End User Scope Key Takeaways

18 Global Digital Evidence Management Market, By End User Segment: Revenue Growth Analysis

19 Law Enforcement Agencies Market, By Region, 2021-2029 (USD Mllion)

20 Criminal Justice Agencies Market, By Region, 2021-2029 (USD Mllion)

21 Investment Firms Market, By Region, 2021-2029 (USD Mllion)

22 Stock Exchanges Market, By Region, 2021-2029 (USD Mllion)

23 Financial Regulatory Bodies Market, By Region, 2021-2029 (USD Mllion)

24 Regional Segment: Revenue Growth Analysis

25 Global Digital Evidence Management Market: Regional Analysis

26 North America Digital Evidence Management Market Overview

27 North America Digital Evidence Management Market, By Component

28 North America Digital Evidence Management Market, By End User

29 North America Digital Evidence Management Market, By Country

30 U.S. Digital Evidence Management Market, By Component

31 U.S. Digital Evidence Management Market, By End User

32 Canada Digital Evidence Management Market, By Component

33 Canada Digital Evidence Management Market, By End User

34 Mexico Digital Evidence Management Market, By Component

35 Mexico Digital Evidence Management Market, By End User

36 Four Quadrant Positioning Matrix

37 Company Market Share Analysis

38 Panasonic : Company Snapshot

39 Panasonic : SWOT Analysis

40 Panasonic : Geographic Presence

41 Motorola Solutions : Company Snapshot

42 Motorola Solutions : SWOT Analysis

43 Motorola Solutions : Geographic Presence

44 NICE : Company Snapshot

45 NICE : SWOT Analysis

46 NICE : Geographic Presence

47 OpenText : Company Snapshot

48 OpenText : Swot Analysis

49 OpenText : Geographic Presence

50 Axon : Company Snapshot

51 Axon : SWOT Analysis

52 Axon : Geographic Presence

53 GENETEC : Company Snapshot

54 GENETEC : SWOT Analysis

55 GENETEC : Geographic Presence

56 Cellebrite : Company Snapshot

57 Cellebrite : SWOT Analysis

58 Cellebrite : Geographic Presence

59 Safe Fleet : Company Snapshot

60 Safe Fleet : SWOT Analysis

61 Safe Fleet : Geographic Presence

62 VIDIZMO , Inc.: Company Snapshot

63 VIDIZMO , Inc.: SWOT Analysis

64 VIDIZMO , Inc.: Geographic Presence

65 IBM : Company Snapshot

66 IBM : SWOT Analysis

67 IBM : Geographic Presence

68 Other Companies: Company Snapshot

69 Other Companies: SWOT Analysis

70 Other Companies: Geographic Presence

The Global Digital Evidence Management Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Evidence Management Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS