Global Digital Lending Platform Market Size, Trends & Analysis - Forecasts to 2026 By Offering (Solution [Business Process Management, Lending Analytics, Loan Management, Loan Origination, Risk & Compliance Management, Others], Service [Design & Implementation, Training & Education, Risk Assessment, Consulting, Support & Maintenance]), By Deployment Mode (On-premise, Cloud), By End-User (Banks, Insurance Companies, Credit Unions, Savings & Loan Associations, Peer-to-Peer Lending, Others), By Region (By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

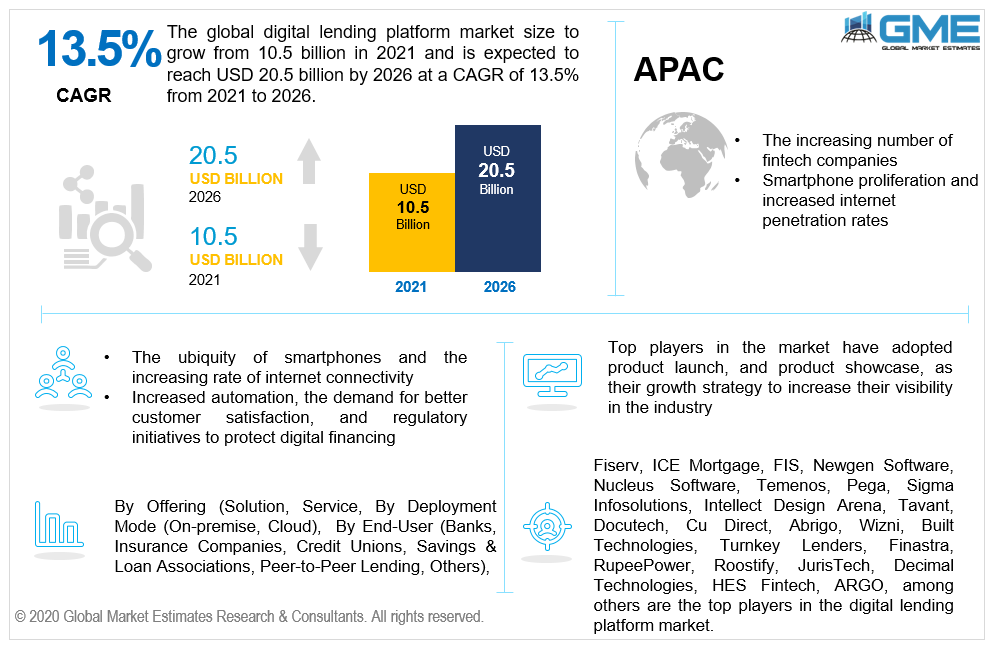

The global digital lending platform market is projected to grow from USD 10.5 billion in 2021 and is expected to reach USD 20.5 billion by 2026 at a CAGR of 13.5% from 2021 to 2026.

In recent years, digital lending has made transactions easier for both depositors and borrowers. Even during the Covid19 pandemic, when social isolation was the norm while doing business, the digital lending platform, together with other fintech breakthroughs like Unified Account Opening and Video KYC software, simplified the way for both lender and the borrower. With the help of digital lending platform, borrowers had the option to choose the loan product of their preference at their leisure, while lenders had the chance to reach out to individual borrowers and broaden their loyal customer base.

The ubiquity of smartphones and the increasing rate of internet connectivity have helped the market grow well. Furthermore, increased automation, the demand for better customer satisfaction, and regulatory initiatives to protect digital financing are fuelling market growth during the forecast period. Moreover, breakthroughs in the modern innovations, such as cryptocurrency, Artificial Intelligence (AI), machine learning, and cognitive technologies, combined with effective deployment of the modern trends to mitigate fraud, such as e-mandates, authentication systems, and e-signatures, are expected to play a pivotal role in steering market growth.

Multiple electronic borrowing platforms are focusing on integrating these advanced technologies into their systems in an attempt to optimize their services. As per Forbes, the current study shows that combining AI and big data can eliminate approximately 80% of all manual labor, 70% of data processing activities, and 64% of data collecting chores. This implies that, in addition to their benefits to corporate and marketing operations, the two notions have the potential to cause a significant impact on the workforce.

Some of the benefits of digital lending platforms include the elimination of geographical barriers and the need for physical movement, the ability for lenders to digitize the decision-making process to ease the procedure, and the replacement of human judgment with decision rules that provide uniformity to the procedure.

Digital Lending Software has irrevocably altered the lending landscape. The digital lending platform has the potential to be an end-to-end digital platform that assists banking institutions in adapting to evolving expectations of customers and enhancing customer experience. A digital lending platform provides integrated customer engagement for both depositors and investors while also guaranteeing transactional transparency and efficiency. Borrowers' growing preference for open transactions demands the use of digital lending platforms.

The digital lending sector has played a significant role in increasing global financial inclusion. It has also cut customer acquisition expenses and expanded credit access to the remaining 70% of the population. Furthermore, it has forever transformed the way lenders do business and how clients see loan procurement. Lenders can use the newest developments in digital lending technology to build a fully digital loan origination process. A great lending platform must allow for easy application submission, quick approvals owing to auto decisions, compliance lending processes, and the capacity to continuously enhance process efficiency.

The advent of the COVID-19 pandemic has benefited the digital lending platform business. In the aftermath of the epidemic, credit unions and banks are upgrading their digital banking capabilities, in particular, to better fulfill the demands of their consumers. Despite having fewer consumers in comparison, lending platforms have seen a 25% increase in user numbers. This is primarily because many enterprises require speedy loan approvals to continue operations during difficult times. People have also begun to favour contactless transactions to prevent the virus from spreading.

Nonetheless, constraints such as considerations about data protection and privacy compliance are projected to limit market expansion. Several governments throughout the world have already begun efforts to address concerns about data protection linked with digital lending platforms. For example, according to Section 69A of the Information Technology Act of 2000, India's Ministry of Electronics and Information Technology barred 27 loan lending applications in June 2021. Other constraints, such as a preference for traditional lending techniques and lower levels of digital literacy in developing nations, are projected to limit market expansion to some extent.

Based on offering, the market is segmented into solutions and services. The services segment of the digital lending market is expected to have a higher growth rate during the forecast period. Services are further segmented into design & implementation, training & education, risk assessment, consulting, support & maintenance. The consultancy segment is expected to grow at the fastest rate as they enable credit unions to create training programs tailored to their specific needs. Consulting services can also aid in the improvement of the operations of employees, clients, and technology teams. Consulting services can help operations function more quickly and efficiently.

Solutions are further divided into business process management, lending analytics, loan management, loan origination, risk & compliance management, others. Under this, the lending analytics segment is expected to grow the fastest. Lending analytics enable lenders to analyze consumer segmentation and optimize customer acquisition. It also assists lenders in lowering costs, improving performance, and increasing profitability.

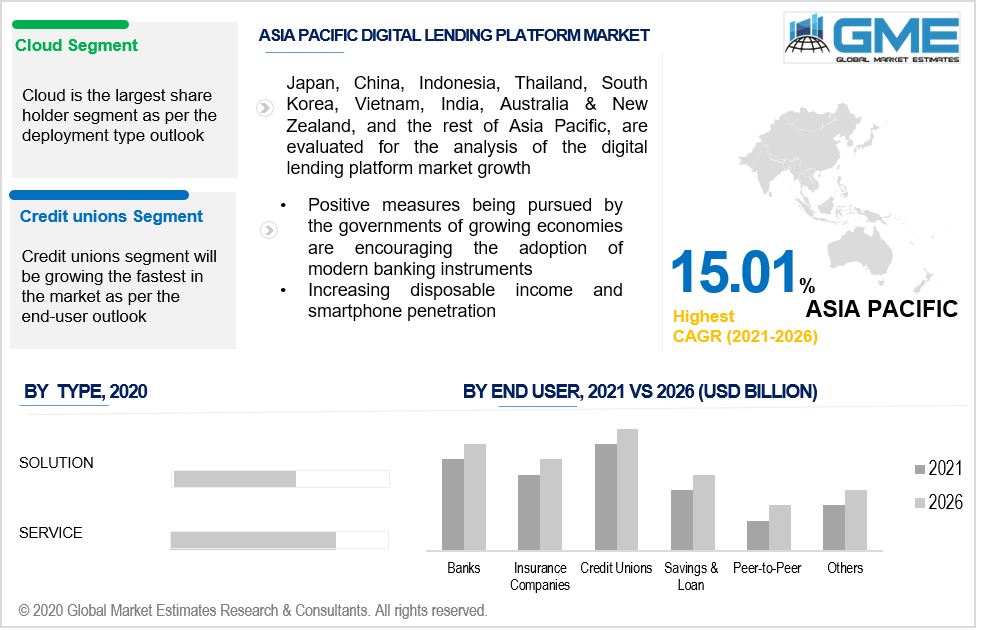

Based on deployment mode, the market is segmented into on-premise and cloud. The market for the cloud segment is predicted to have the largest share during the forecast period owing to the continued acceptance of novel methods and a growing desire for cloud-based systems, the cloud segment is gaining traction. It also contributes to meeting the increased demand in back-end operations to streamline the online payment and client onboarding procedures. The increased preference for digital channels for customer support, such as instant messaging and email, together with rising volumes of digitized documents and loan applications, are likely to boost cloud segment growth throughout the forecast period.

Based on end-user, the market is segmented into banks, insurance companies, credit unions, savings & loan associations, peer-to-peer lending, and others. Credit unions are predicted to grow the fastest during the forecast period since digital lending platforms can assist credit unions in raising client conversion rates. E-signature and cross-channel support, among other features connected with digital lending platforms, might be especially beneficial to credit unions. The e-signature capability can often help credit unions save processing time and improve customer experience.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America.

The North American region is expected to hold the lion’s share of the global revenue generated in the market. Since, the region has been an early user of cutting-edge technologies, as a result, demand for digital, end-to-end financial solutions in North America has always been high. A strong mobile workforce in the region is encouraging financial institutions to digitalize their services and improve customer experience. As a result, as part of efforts to achieve a significant competitive edge, financial institutions in NA are attempting to separate themselves from their competitors by launching unique digital solutions.

During the forecast period, the Asia Pacific region is expected to grow rapidly. The rising number of fintech companies in the region are the major drivers of the APAC market’s growth. Smartphone proliferation and increased internet penetration rates are also expected to drive regional market growth. Furthermore, positive measures being pursued by the governments of growing economies, such as China, India, and others, are encouraging the adoption of modern banking instruments, hence fueling the regional market's growth.

Fiserv, ICE Mortgage, FIS, Newgen Software, Nucleus Software, Temenos, Pega, Sigma Infosolutions, Intellect Design Arena, Tavant, Docutech, Cu Direct, Abrigo, Wizni, Built Technologies, Turnkey Lenders, Finastra, RupeePower, Roostify, JurisTech, Decimal Technologies, HES Fintech, ARGO, among others are the top players in the digital lending platform market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Digital Lending Platform Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Offering Overview

2.1.3 Deployment Mode Overview

2.1.4 End-User Overview

2.1.6 Regional Overview

Chapter 3 Digital Lending Platform Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The ubiquity of smartphones and the increasing rate of internet connectivity portend well for market expansion

3.3.2 End-User Challenges

3.3.2.1 Considerations about data protection and privacy compliance are projected to limit market expansion

3.4 Prospective Growth Scenario

3.4.1 Offering Growth Scenario

3.4.2 Deployment Mode Growth Scenario

3.4.3 End-User Growth Scenario

3.5 COVID-19 Influence over End-User Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Digital Lending Platform Market, By Offering

4.1 Offering Outlook

4.2 Solutions

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Services

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Digital Lending Platform Market, By Deployment Mode

5.1 Deployment Mode Outlook

5.2 On-premise

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Cloud

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Digital Lending Platform Market, By End-User

6.1 Banks, Insurance Companies

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Credit Unions

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Savings & Loan Associations

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Peer-to-Peer Lending

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Others

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Digital Lending Platform Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.2.3 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.6 U.S.

7.2.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.2.4.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.2.7 Canada

7.2.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.2.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.3 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.6 Germany

7.3.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.7 UK

7.3.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.8 France

7.3.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.9 Italy

7.3.9.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.10 Spain

7.3.10.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.3.11 Russia

7.3.11.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.3.11.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country 2020-2026 (USD Billion)

7.4.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.3 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.6 China

7.4.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.7 India

7.4.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.8 Japan

7.4.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.9 Australia

7.4.9.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.9.2 Market size, By Deployment Mode, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.4.10 South Korea

7.4.10.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.4.10.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.3 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.6 Brazil

7.5.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.7 Mexico

7.5.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Deployment Mode , 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.5.8 Argentina

7.5.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.3 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Offering, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Deployment Mode, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Fiserv

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.2.4 Info Graphic Analysis

8.3 ICE Mortgage Technology

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 FIS

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Newgen Software

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Nucleus Software

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Temenos

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Pega

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Sigma Infosolutions

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.10 Intellect Design Arena

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Tavant

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Docutech

8.12.1 Company Overview

8.12.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.13 Other Companies

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

The Global Digital Lending Platform Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Lending Platform Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS