Global Digital Transformation in Chemical Industry Market Size, Trends & Analysis - Forecasts to 2028 By Component Type (Solutions [Analytics, Cloud Computing, Mobility, Social Media, and Others] and Services [Professional Services and Implementation & Integration]), By End-use Industry (Petrochemicals, Specialty Chemicals, Agrochemicals, Pharmaceuticals, Polymers & Plastics, and Fine & Bulk Chemicals), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

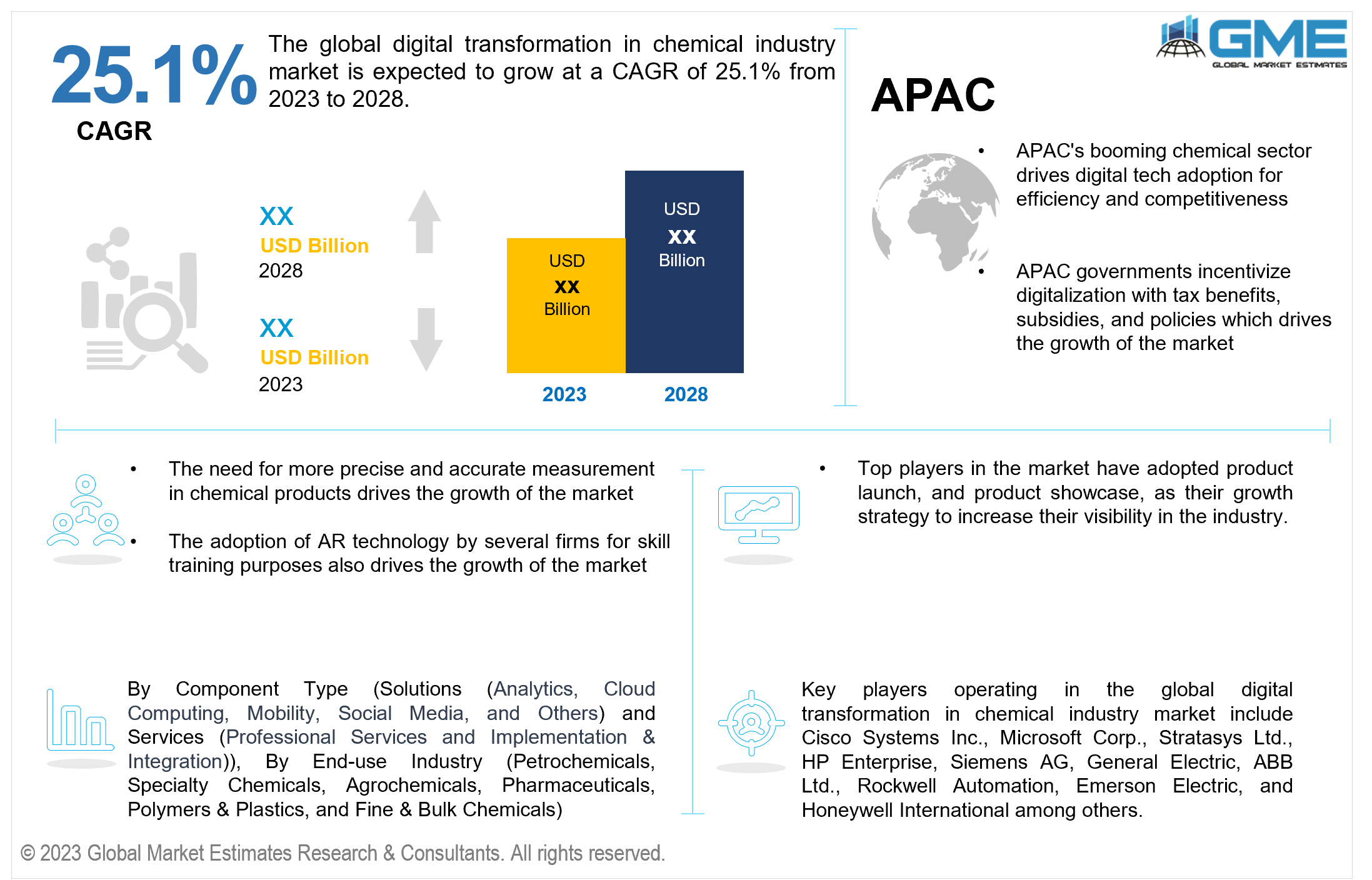

The global digital transformation in chemical industry market is expected to grow at a CAGR of 25.1% from 2023 to 2028. Digital transformation in the chemical industry refers to integrating and utilizing digital technologies, data, and analytics to enhance and optimize various aspects of the chemical manufacturing and supply chain processes. This transformation is driven by digital technologies that significantly improve the industry's efficiency, safety, sustainability, and profitability.

The global digital transformation in the chemical industry market growth is driven by several key factors. Firstly, there is an increasing need for accuracy in the chemical production. Due to the complexity of the chemical industry and rising quality standards, digital technologies such as real-time monitoring and predictive analytics are essential for ensuring precise control over production, minimizing errors, and maintaining product quality. Secondly, cost efficiency is a significant concern for chemical manufacturers. Adopting digital solutions allows for the optimization of processes, efficient resource allocation, and better inventory management, all of which contribute to significant cost savings and improved competitiveness in the market. Thirdly, the rapid technological advancements in artificial intelligence (AI) and machine learning (ML) are providing the chemical industry with powerful tools for data analysis and process optimization. Lastly, incorporating augmented reality (AR) technology for training and skill development plays a pivotal role. It helps upskill the workforce and ensures that employees are proficient in utilizing advanced digital tools and systems, ultimately leading to safer and more efficient operations.

There are also several restraints that can hinder the growth of the market. Firstly, data privacy concerns remain a pivotal issue. As chemical companies increasingly rely on digital technologies to optimize their operations, they also accumulate vast amounts of sensitive data. Maintaining the security and confidentiality of data is a significant difficulty while adhering to stringent regulations. Secondly, the high cost of technology implementation poses a significant hurdle. Adopting cutting-edge digital solutions necessitates necessary infrastructure, software, and personnel expenditures. This expenditure can be particularly disconcerting for smaller players in the industry. In navigating these restraints, businesses must strike a delicate balance between innovation and safeguarding data while also finding creative ways to manage the costs associated with digital transformation.

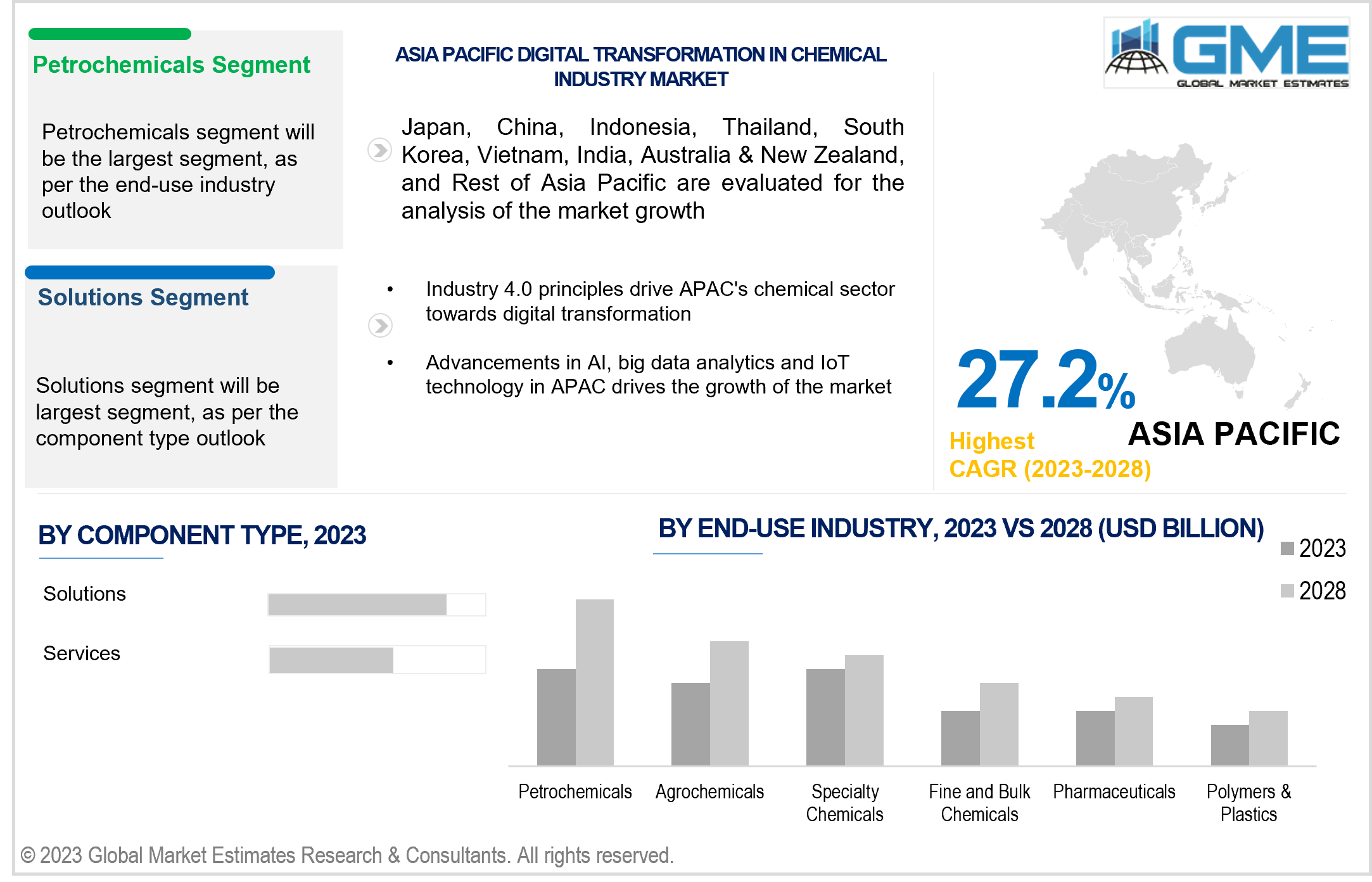

On the basis of component type, the market is segmented into solutions and services. The solutions segment is expected to dominate the market during the forecast period. The solutions segment is further divided into analytics, cloud computing, mobility, social media, and others. The analytics segment is expected to be the largest sub-segment as per the solutions outlook, whereas, the cloud computing segment is expected to be the fastest growing sub-segment. Analytic solutions dominated the solutions segment due to increasing need in data computing, analysis, and visualization.

The services segment is expected to be the fastest-growing segment in the global digital transformation in chemical industry market. Service providers offer expertise in implementing and managing digital solutions, addressing data privacy concerns, and helping companies navigate the complex digital landscape. This support is crucial in overcoming barriers to market entry, making services an integral driver for the market growth.

On the basis of end-use industry, the market is segmented into petrochemicals, specialty chemicals, agrochemicals, pharmaceuticals, polymers & plastics, and fine & bulk chemicals. The petrochemical segment is expected to dominate the market during the forecast period. This is due to its intricate and sprawling supply chain, complex manufacturing processes, and the significant potential for cost optimization and efficiency gains through digital technologies. Petrochemical companies recognize the value of data-driven insights in enhancing production, safety, and sustainability, making it a frontrunner in embracing digital transformation.

The agrochemical segment is expected to be the fastest-growing segment in the global digital transformation in chemical industry market. Digital technologies, such as data analytics and IoT sensors, empower farmers to optimize crop management, enhance yield, and minimize resource wastage. These advancements align with the industry's drive for sustainability and increased food production to meet global demands.

North America is analysed to be the region with the largest share in the global digital transformation in chemical industry market during the forecast period and the growth is attributed to various factors. Firstly, the presence of numerous top-tier technology and chemical companies in the region, fostering an environment ready for collaboration and innovation. Secondly, the region has reached a high level of technological development, providing a solid foundation for integrating digital solutions across chemical manufacturing and supply chain processes. This combination of industry expertise, technical prowess, and a conducive ecosystem has positioned North America at the forefront of digital transformation in the chemical sector, driving its leadership in this rapidly evolving market.

Asia Pacific is projected to be the fastest-growing region across the global digital transformation in chemical industry market during the forecast period, owing to the rapidly expanding technological infrastructure, facilitating the integration of digital solutions into chemical manufacturing and supply chain processes. Additionally, the region includes highly developed chemical industrial zones, notably in China and Japan, where production of most of the chemicals in the world takes place due to low labour and capital costs. This convergence of technological readiness and industrial prowess has positioned APAC at the forefront of digital transformation in the chemical sector, offering a thriving market and a source of cutting-edge digital solutions and practices.

Key players operating in the global digital transformation in chemical industry market include Cisco Systems Inc., Microsoft Corp., Stratasys Ltd., HP Enterprise, Siemens AG, General Electric, ABB Ltd., Rockwell Automation, Emerson Electric, and Honeywell International among others.

In July 2023, Reliance Industries Limited (RIL) had announced entering into an agreement to invest alongside Brookfield Infrastructure and Digital Realty in their Indian SPVs set up for developing data centers in India.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market OpportunIties: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL DIGITAL TRANSFORMATION IN CHEMICAL INDUSTRY MARKET, BY END-USE INDUSTRY

4.2 Global Digital Transformation in Chemical Industry Market: End-use Industry Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Petrochemicals Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5.1 Agrochemicals Market Estimates and Forecast, 2020-2028 (USD Billion)

4.6.1 Polymers and Plastics Market Estimates and Forecast, 2020-2028 (USD Billion)

4.7.1 Fine and Bulk Chemicals Market Estimates and Forecast, 2020-2028 (USD Billion)

4.8.1 Specialty Chemicals Market Estimates and Forecast, 2020-2028 (USD Billion)

4.9.1 Pharmaceuticals Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL DIGITAL TRANSFORMATION IN CHEMICAL INDUSTRY MARKET, BY COMPONENT TYPE

5.2 Global Digital Transformation in Chemical Industry Market: Component Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Solutions Market Estimates And Forecast, 2020-2028 (USD Billion)

5.4.1.1.1 Analytics Market Estimates and Forecast, 2020-2028 (USD Billion)

5.4.1.2.1 Cloud Computing Market Estimates and Forecast, 2020-2028 (USD Billion)

5.4.1.3.1 Mobility Market Estimates and Forecast, 2020-2028 (USD Billion)

5.4.1.4.1 Social Media Market Estimates and Forecast, 2020-2028 (USD Billion)

5.4.1.5.1 Others Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1 Services Market Estimates And Forecast, 2020-2028 (USD Billion)

5.5.1.1.1 Professional Services Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5.1.2 Implementation & Integration

5.5.1.2.1 Implementation & Integration Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL DIGITAL TRANSFORMATION IN CHEMICAL INDUSTRY MARKET, BY REGION

6.4.3.10.1 By End-use Industry

6.4.3.11.1 By End-use Industry

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

2 Petrochemicals Market, By Region, 2020-2028 (USD Billion)

3 Agrochemicals Market, By Region, 2020-2028 (USD Billion)

4 Polymers and Plastics Market, By Region, 2020-2028 (USD Billion)

5 Fine and Bulk Chemicals Market, By Region, 2020-2028 (USD Billion)

6 Specialty Chemicals Market, By Region, 2020-2028 (USD Billion)

7 Pharmaceuticals Market, By Region, 2020-2028 (USD Billion)

8 Global Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

9 Solutions Market, By Region, 2020-2028 (USD Billion)

10 Services Market, By Region, 2020-2028 (USD Billion)

11 Deploymerization Market, By Region, 2020-2028 (USD Billion)

12 Regional Analysis, 2020-2028 (USD Billion)

13 North America Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

14 North America Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

15 U.S. Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

16 U.S. Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

17 Canada Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

18 Canada Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

19 Mexico Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

20 Mexico Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

21 Europe Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

22 Europe Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

23 Germany Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

24 Germany Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

25 U.K. Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

26 U.K. Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

27 France Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

28 France Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

29 Italy Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

30 Italy Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

31 Spain Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

32 Spain Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

33 Netherlands Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

34 Netherlands Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

35 Rest Of Europe Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

36 Rest Of Europe Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

37 Asia Pacific Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

38 Asia Pacific Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

39 China Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

40 China Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

41 Japan Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

42 Japan Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

43 India Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

44 India Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

45 South Korea Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

46 South Korea Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

47 Singapore Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

48 Singapore Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

49 Thailand Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

50 Thailand Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

51 Malaysia Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

52 Malaysia Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

53 Indonesia Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

54 Indonesia Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

55 Vietnam Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

56 Vietnam Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

57 Taiwan Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

58 Taiwan Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

59 Rest of APAC Global Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

60 Rest of APAC Global Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

61 Middle East and Africa Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

62 Middle East and Africa Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

63 Saudi Arabia Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

64 Saudi Arabia Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

65 UAE Global Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

66 UAE Global Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

67 Israel Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

68 Israel Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

69 South Africa Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

70 South Africa Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

71 Rest Of Middle East and Africa Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

72 Rest Of Middle East and Africa Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

73 Central and South America Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

74 Central and South America Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

75 Brazil Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

76 Brazil Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

77 Chile Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

78 Chile Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

79 Argentina Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

80 Argentina Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

81 Rest Of Central and South America Digital Transformation in Chemical Industry Market, By End-use Industry, 2020-2028 (USD Billion)

82 Rest Of Central and South America Digital Transformation in Chemical Industry Market, By Component Type, 2020-2028 (USD Billion)

83 Cisco Systems Inc.: Products & Services Offering

84 Microsoft Corp.: Products & Services Offering

85 Stratasys Ltd.: Products & Services Offering

86 HP Enterprise: Products & Services Offering

87 Siemens AG: Products & Services Offering

88 SIEMENS AG: Products & Services Offering

89 General Electric: Products & Services Offering

90 Emerson Electric: Products & Services Offering

91 ABB Ltd.: Products & Services Offering

92 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Digital Transformation in Chemical Industry Market Overview

2 Global Digital Transformation in Chemical Industry Market Value From 2020-2028 (USD Billion)

3 Global Digital Transformation in Chemical Industry Market Share, By End-use Industry (2022)

4 Global Digital Transformation in Chemical Industry Market Share, By Component Type (2022)

5 Global Digital Transformation in Chemical Industry Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Digital Transformation in Chemical Industry Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Digital Transformation in Chemical Industry Market

10 Impact Of Challenges On The Global Digital Transformation in Chemical Industry Market

11 Porter’s Five Forces Analysis

12 Global Digital Transformation in Chemical Industry Market: By End-use Industry Scope Key Takeaways

13 Global Digital Transformation in Chemical Industry Market, By End-use Industry Segment: Revenue Growth Analysis

14 Petrochemicals Market, By Region, 2020-2028 (USD Billion)

15 Agrochemicals Market, By Region, 2020-2028 (USD Billion)

16 Polymers and Plastics Market, By Region, 2020-2028 (USD Billion)

17 Polymers and Plastics Market, By Region, 2020-2028 (USD Billion)

18 Fine and Bulk Chemicals Market, By Region, 2020-2028 (USD Billion)

19 Specialty Chemicals Market, By Region, 2020-2028 (USD Billion)

20 Pharmaceuticals Market, By Region, 2020-2028 (USD Billion)

21 Global Digital Transformation in Chemical Industry Market: By Component Type Scope Key Takeaways

22 Global Digital Transformation in Chemical Industry Market, By Component Type Segment: Revenue Growth Analysis

23 Solutions Market, By Region, 2020-2028 (USD Billion)

24 Services Market, By Region, 2020-2028 (USD Billion)

25 Deploymerization Market, By Region, 2020-2028 (USD Billion)

26 Regional Segment: Revenue Growth Analysis

27 Global Digital Transformation in Chemical Industry Market: Regional Analysis

28 North America Digital Transformation in Chemical Industry Market Overview

29 North America Digital Transformation in Chemical Industry Market, By End-use Industry

30 North America Digital Transformation in Chemical Industry Market, By Component Type

31 North America Digital Transformation in Chemical Industry Market, By Country

32 U.S. Digital Transformation in Chemical Industry Market, By End-use Industry

33 U.S. Digital Transformation in Chemical Industry Market, By Component Type

34 Canada Digital Transformation in Chemical Industry Market, By End-use Industry

35 Canada Digital Transformation in Chemical Industry Market, By Component Type

36 Mexico Digital Transformation in Chemical Industry Market, By End-use Industry

37 Mexico Digital Transformation in Chemical Industry Market, By Component Type

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Cisco Systems Inc.: Company Snapshot

41 Cisco Systems Inc.: SWOT Analysis

42 Cisco Systems Inc.: Geographic Presence

43 Microsoft Corp.: Company Snapshot

44 Microsoft Corp.: SWOT Analysis

45 Microsoft Corp.: Geographic Presence

46 Stratasys Ltd.: Company Snapshot

47 Stratasys Ltd.: SWOT Analysis

48 Stratasys Ltd.: Geographic Presence

49 HP Enterprise: Company Snapshot

50 HP Enterprise: Swot Analysis

51 HP Enterprise: Geographic Presence

52 Siemens AG: Company Snapshot

53 Siemens AG: SWOT Analysis

54 Siemens AG: Geographic Presence

55 Siemens AG: Company Snapshot

56 Siemens AG: SWOT Analysis

57 Siemens AG: Geographic Presence

58 General Electric: Company Snapshot

59 General Electric: SWOT Analysis

60 General Electric: Geographic Presence

61 Emerson Electric: Company Snapshot

62 Emerson Electric: SWOT Analysis

63 Emerson Electric: Geographic Presence

64 ABB Ltd.: Company Snapshot

65 ABB Ltd.: SWOT Analysis

66 ABB Ltd.: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global Digital Transformation in Chemical Industry Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Transformation in Chemical Industry Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS