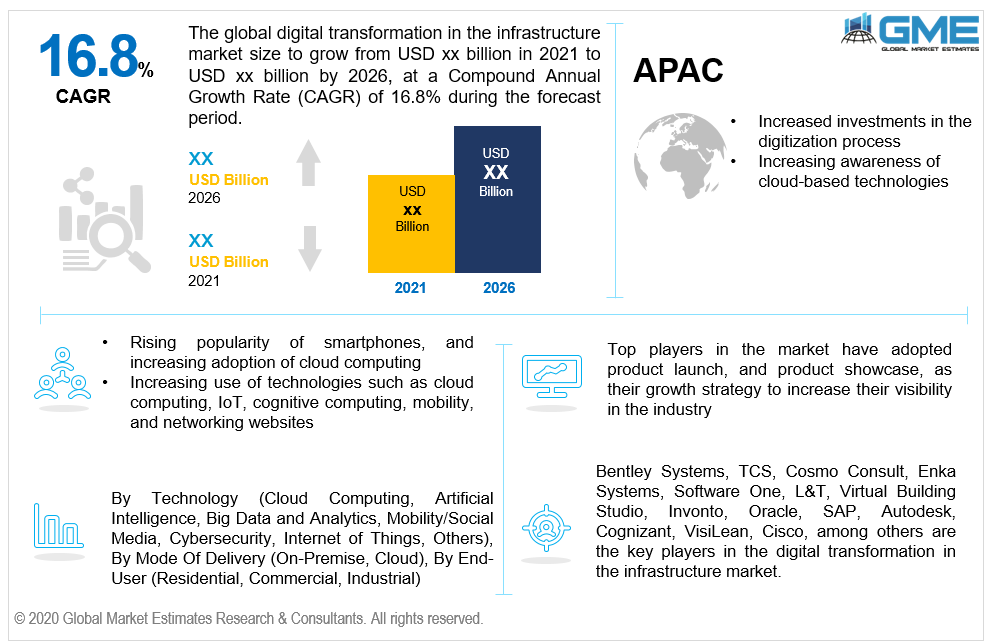

Global Digital Transformation in Infrastructure Market Size, Trends & Analysis - Forecasts to 2026 By Technology (Cloud Computing, Artificial Intelligence, Big Data and Analytics, Mobility/Social Media, Cybersecurity, Internet of Things, Others), By Mode of Delivery (On-Premise, Cloud), By End-User (Residential, Commercial, Industrial), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global digital transformation in the infrastructure market is projected to grow at a CAGR value of around 16.8% during the forecast period [2021 to 2026].

In order to strengthen IT infrastructure, many manufacturers and industrialists are adopting digital transformation approach. Digital transformation serves as the foundation for an organization's entire information technology system.

To gain a competitive edge, digital technology has transformed the classic firm paradigm into a modern one, with real-time responsiveness from big data analysis to manufacture new goods and services, improve on existing, and establish whole new business opportunities.

Increasing use of technologies such as cloud computing, IoT, cognitive computing, mobility, and networking websites has resulted in innovation and creativity, which is propelling the market to grow. Moreover, the rising penetration of smartphones in developing regions, as well as the wide adoption of cloud computing for offering greater processing power at cheaper prices, are some of the major growth drivers for the market. The capacity of digital transformation to assist organizations in building a closer connection with their customers and accelerate their revenue is the most crucial driver supporting the growth of the market.

Recent research by SAP found that 92% of CEOs use mature digital transformation techniques and strategies for improving customer experience. 70% of the managers also stated that adopting digital transformation into their process has resulted in significant enhancement of customer engagement and involvement.

Popularization of 4G and 5G networks, as well as pervasive adoption of cloud computing, infrastructure-as-a-service (IaaS), and software-as-a-service (SaaS), are also fueling the need for digital transformation in infrastructure, as implementing such conversion is bound to deliver multiple, far-reaching advantages to organizations. From assisting in the reduction of operating costs, streamlining operations, and uplifting employees to accomplish more productive capacity, better reach their target customers, and strike a closer rapport with the clients, digitalization is something that will impart a significant competitive advantage to an organization.

The demand for digital transformation in the infrastructure market has been popularized during the pandemic as amid crises, many players and companies heavily depended on cloud and internet technology. With social distancing in existence, enterprises in all industries started operating remotely, and consumers became completely reliant on internet services for both important and non-critical needs.

The security and privacy of critical company information are major concerns when implementing digital enablement technology. Furthermore, digital transformation necessitates substantial structural and process changes. Traditional incumbents, on the other hand, have a strong organizational culture and may experience opposition to implementing new workflows. Several cultural variables can impede a digital venture, ranging from long-term employees to office culture.

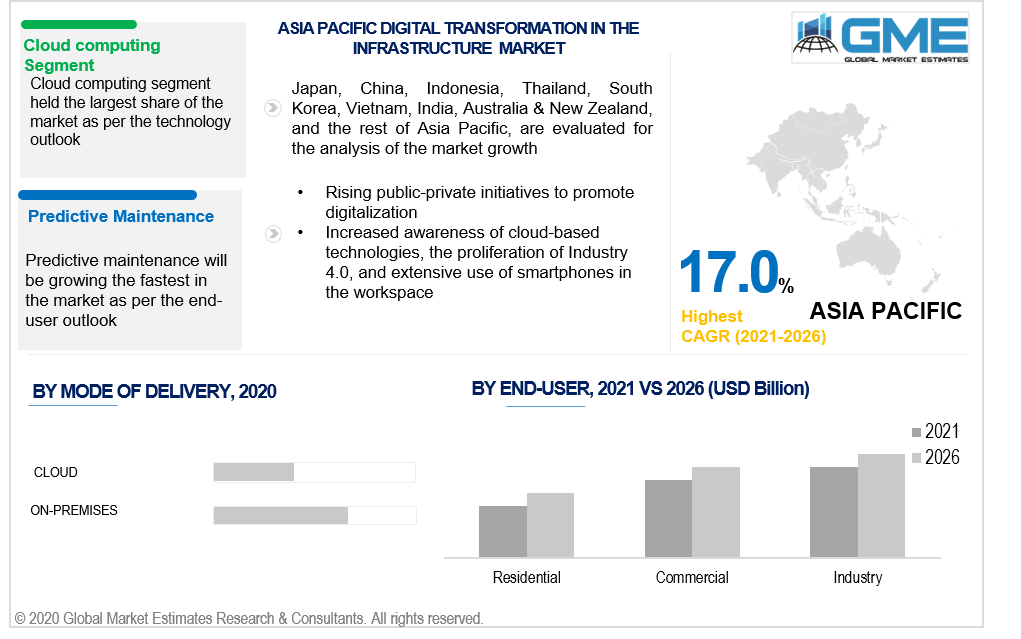

Based on technology, the market is segmented into cloud computing, artificial intelligence, big data & analytics, mobility/social media, cybersecurity, the internet of things, and others. The cloud computing segment is expected to have a lion’s share during the forecast period. This is mainly because cloud apps encourage cooperation by allowing group of people to swiftly and easily share information on the cloud system, while also lowering enterprises' hardware and software maintenance expenses.

Furthermore, cloud computing provides customers with Application Programming Interfaces (APIs) to access cloud services and charges them only on the basis of consumption.

During the forecast period of 2021 to 2026, bid data & analytics segment is analyzed to be growing the fastest in the market. This is mainly because of the advantages such as elevated, high-velocity, and higher data assets that necessitate novel processing methods to enable improved decision making, insight finding, and operational efficiencies.

Based on the mode of delivery, the market is segmented into cloud and on-premises. The cloud segment is expected to have the lion’s share in the market during the forecast period. This is so because the cloud-based deployment of digital transformation solutions allows users to access solutions from their computers or mobile devices efficiently. This type has several advantages, such as ease of deployment, minimal deployment costs, and easy upgradeability and accessibility. As a result, cloud digital transformation solutions are increasingly being adopted by small businesses and individual users.

Based on end-user, the market is segmented into residential, commercial, and industrial. The use of digital transformation for industrial purposes is on the rise and hence this segment is expected to grow rapidly during the forecast period. The use of digital transformation technologies have accelerated the process of manufacturing, handling, storing, and transporting products and goods. By creating additional jobs, digitalization assists businesses in achieving growth and scalability.

Based on application, the market is segmented into safety management, remote operations, predictive maintenance, fleet management, and others. The application of digital transformation in infrastructure for predictive maintenance is expected to have the largest share in the market during the forecast period. The adoption of maintenance 4.0 principles, or the digital transformation of predictive maintenance, relies on condition-based surveillance systems but leverages a far broader range of linked and networked sensors and devices as part of the Industrial Internet of Things. This sends a far larger collection of data points into new aggregation and analytics technologies, significantly enhancing the power and potential of predictive maintenance. Furthermore, advancements in machine learning and artificial intelligence play a role in predictive maintenance solutions.

As per the geographical analysis, the digital transformation in the infrastructure market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market from 2021 to 2026.

Rising public & private investments in the digitization process across potential economies, and increasing awareness regarding advanced IoT technologies are supporting the growth of the market. North America is a very accessible market for digital transformation. The unavoidable demand for organizations to digitize their traditional business activities, as well as the fast usage of mobile devices, IoT technologies, and cloud technology, has resulted in greater adoption of digital transformation solutions in this region.

The Asia Pacific area is predicted to be the fastest-growing region during the forecast period. This growth can be attributable to rising demand for digital transformation, increasing awareness of cloud-based technologies, the proliferation of Industry 4.0, and extensive use of smartphones in the workspace.

Bentley Systems, TCS, Cosmo Consult, Enka Systems, Software One, L&T, Virtual Building Studio, Invonto, Oracle, SAP, Autodesk, Cognizant, VisiLean, Cisco, among others are the key players in the digital transformation in the infrastructure market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Digital Transformation in Infrastructure Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Technology Overview

2.1.3 Mode of Delivery Overview

2.1.4 End-User Overview

2.1.5 Application Overview

2.1.6 Regional Overview

Chapter 3 Digital Transformation in Infrastructure Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing need to implement Industry 4.0 technology

3.3.2 Industry Challenges

3.3.2.1 Lack of expertise required to enable the digital transformation

3.4 Prospective Growth Scenario

3.4.1 Technology Growth Scenario

3.4.2 End-User Growth Scenario

3.4.3 Mode of Delivery Growth Scenario

3.4.4 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Digital Transformation in Infrastructure Market, By Technology

4.1 Technology Outlook

4.2 Cloud Computing

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Artificial Intelligence

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Big Data and Analytics

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Mobility/social media

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Cybersecurity

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

4.7 Internet of Things

4.7.1 Market Size, By Region, 2020-2026 (USD Billion)

4.8 Others

4.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Digital Transformation in Infrastructure Market, By Mode of Delivery

5.1 Mode of Delivery Outlook

5.2 Cloud

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 On-Premises

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Digital Transformation in Infrastructure Market, By End-User

6.1 Residential

6.1.1 Market Size, By Region, 2020-2026 (USD Billion)

6.2 Commercial

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Industrial

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Digital Transformation in Infrastructure Market, By Application

7.1 Safety Management

7.1.1 Market Size, By Region, 2020-2026 (USD Billion)

7.2 Remote Operations

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Predictive Maintenance

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

7.4 Fleet Management

7.4.1 Market Size, By Region, 2020-2026 (USD Billion)

7.5 Others

7.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Digital Transformation in Infrastructure Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.2.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.5 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.4.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.2.4.3 Market Size, By End-User, 2020-2026 (USD Billion)

Market Size, By Application, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.5 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.5 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.5 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.3 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.4 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.5 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Mode of Delivery, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By End-User, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Application, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Bentley Systems

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 TCS

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Cosmo Consult

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Enka Systems

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Software One

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 L&T

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Virtual Building Studio

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Invonto

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Oracle

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 SAP

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

9.12 Autodesk

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info Graphic Analysis

9.13 Cognizant

9.13.1 Company Overview

9.13.2 Financial Analysis

9.13.3 Strategic Positioning

9.13.4 Info Graphic Analysis

9.14 VisiLean

9.14.1 Company Overview

9.14.2 Financial Analysis

9.14.3 Strategic Positioning

9.14.4 Info Graphic Analysis

9.15 Cisco

9.15.1 Company Overview

9.15.2 Financial Analysis

9.15.3 Strategic Positioning

9.15.4 Info Graphic Analysis

9.16 Accenture

9.16.1 Company Overview

9.16.2 Financial Analysis

9.16.3 Strategic Positioning

9.16.4 Info Graphic Analysis

9.17 AG Technologies

9.17.1 Company Overview

9.17.2 Financial Analysis

9.17.3 Strategic Positioning

9.17.4 Info Graphic Analysis

9.18 ADOBE SYSTEMS

9.18.1 Company Overview

9.18.2 Financial Analysis

9.18.3 Strategic Positioning

9.18.4 Info Graphic Analysis

9.19 Autodesk Inc.

9.19.1 Company Overview

9.19.2 Financial Analysis

9.19.3 Strategic Positioning

9.19.4 Info Graphic Analysis

9.20 DELL EMC

9.20.1 Company Overview

9.20.2 Financial Analysis

9.20.3 Strategic Positioning

9.20.4 Info Graphic Analysis

9.21 IBM

9.21.1 Company Overview

9.21.2 Financial Analysis

9.21.3 Strategic Positioning

9.21.4 Info Graphic Analysis

9.22 GOOGLE

9.22.1 Company Overview

9.22.2 Financial Analysis

9.22.3 Strategic Positioning

9.22.4 Info Graphic Analysis

9.23 MARLABS

9.23.1 Company Overview

9.23.2 Financial Analysis

9.23.3 Strategic Positioning

9.23.4 Info Graphic Analysis

9.24 EQUINIX

9.24.1 Company Overview

9.24.2 Financial Analysis

9.24.3 Strategic Positioning

9.24.4 Info Graphic Analysis

9.25 Other Companies

9.25.1 Company Overview

9.25.2 Financial Analysis

9.25.3 Strategic Positioning

9.25.4 Info Graphic Analysis

The Global Digital Transformation in Infrastructure Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Digital Transformation in Infrastructure Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS