Global DNA Polymerase Market Size, Trends & Analysis - Forecasts to 2028 By Type (TAQ Polymerase, PFU Polymerase, Proprietary Enzyme Blends, and Others), By End Use Industry (Pharmaceutical and Biotechnology Companies, Academic and Research Institutes, Hospitals & Diagnostic Centers, and Others), By Application (Polymerase Chain Reaction, DNA Sequencing, DNA Cloning, and Others), and By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

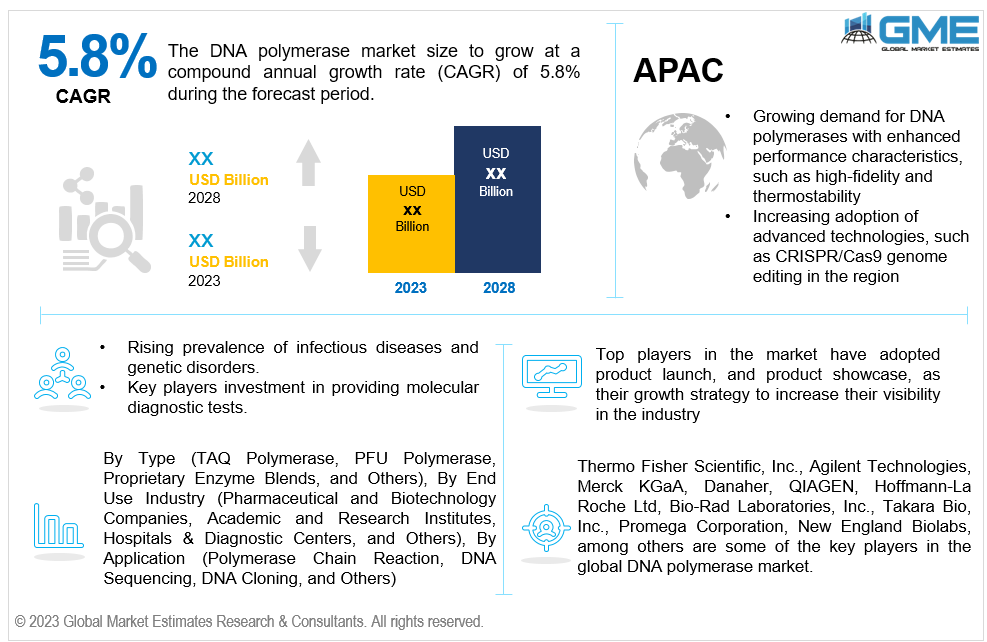

The Global DNA Polymerase Market is projected to grow at a CAGR of 5.8% from 2023 to 2028.

DNA polymerase is an enzyme found in living cells that synthesizes complementary DNA strands according to the template DNA. Numerous enzymes have been found in various organisms, and they are frequently used for in vitro DNA manipulation. When the genome is replicated and repaired, these enzymes are essential for preserving its integrity.

There have been a number of recent developments in the field of DNA polymerase, which is continually changing. One of the most significant is CRISPR-Cas9, a gene-editing technology that relies on DNA polymerases to modify specific DNA sequences. Next-Generation Sequencing (NGS) is another technology that uses DNA polymerases to amplify and sequence large amounts of DNA rapidly and cost-effectively. High-fidelity DNA polymerases have also been developed with a lower error rate and the ability to generate longer reads, improving the accuracy of DNA amplification and sequencing. Isothermal amplification is another recent development that uses DNA polymerases to amplify DNA at a constant temperature, making it simpler and faster, hence these advances are enhancing the future market scope of DNA polymerase market.

DNA polymerases are crucial enzymes used in Polymerase Chain Reaction (PCR), a laboratory technique that amplifies specific segments of DNA for various laboratory and clinical diagnostic applications. PCR amplification offers a number of medical applications, including testing for specific alleles in prospective parents, screening for genetic carriers, directly diagnosing disorders, and detecting mutations in developing embryos, according to a piece updated by NCBI in May 2022.

Moreover, the growing investment in research and development activities by pharmaceutical and biotechnology companies is expected to increase the demand for DNA polymerases in drug discovery and development. The increasing focus on synthetic biology and genome editing is also expected to drive the demand for novel DNA polymerases with unique properties. The expanding applications of DNA polymerases in various industries and the growing demand for personalized medicine and advanced diagnostics are expected to create significant opportunities for market players in the coming years.

Furthermore, the rising prevalence of infectious diseases globally is expected to enhance the growth of the DNA polymerase market segment. According to UNAIDS data from 2022, 1.5 million persons contracted HIV for the first time in 2021, and an estimated 38.4 million people globally were HIV-positive. The increasing frequency of infectious diseases is anticipated to fuel the growth of the DNA polymerase market because PCR is essential for diagnosing infectious diseases like HIV.

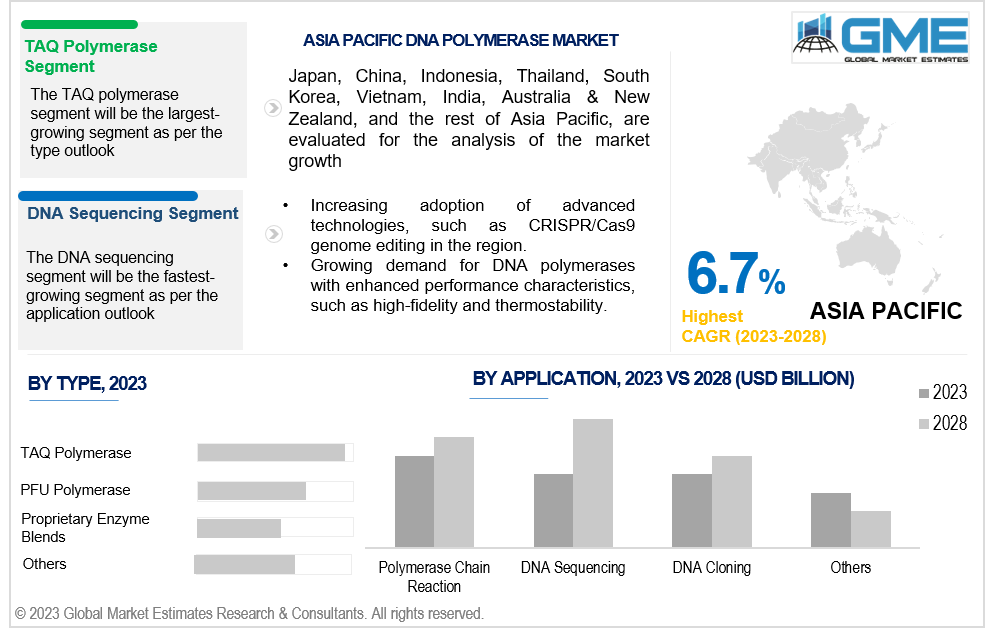

The TAQ polymerase segment is anticipated to be the largest-growing segment in the market from 2023-2028. TAQ Polymerase is widely used in research applications due to its robustness and high fidelity. It is used in applications such as gene expression analysis, genotyping, sequencing, and cloning. As research activities continue to grow globally, the demand for TAQ Polymerase is expected to increase. Several manufacturers have launched new TAQ Polymerase products with enhanced features and performance, such as higher fidelity and sensitivity, to cater to the increasing demand in the market. For instance, in 2020, New England Biolabs launched a new TAQ DNA Polymerase product, Q5 Hot Start High-Fidelity DNA Polymerase, which provides higher fidelity and lower error rates than the traditional TAQ Polymerase, hence, enhancing the segment expansion. Additionally, over the course of the forecast period, strategic initiatives taken by key market participants are anticipated to accelerate market growth. For instance, Ampliqon A/S debuted their AQ97 High Fidelity DNA Polymerase in June 2021. Such product launches have a favourable impact on market expansion in the forecast years.

The hospitals & diagnostic centers segment is anticipated to be the largest & fastest-growing segment in the market from 2023-2028. The increasing demand for molecular diagnostic tests, such as PCR and DNA sequencing, has led to a rise in the use of DNA polymerases in hospitals and diagnostic centers. For instance, in August 2021, QIAGEN launched the QIAcuity One-Step RT-PCR Kit for COVID-19 diagnostic testing. This kit uses a DNA polymerase to detect SARS-CoV-2 viral RNA in patient samples, making it an essential tool for COVID-19 diagnosis in hospitals and diagnostic centers. The prevalence of genetic disorders is increasing globally, leading to a rise in the demand for genetic testing and diagnosis. DNA polymerase enzymes are widely used in genetic testing, making hospitals and diagnostic centers a key market for DNA polymerases.

Academic and research institutes segment is anticipated to be the fastest-growing segment from 2023-2028. This is owing to the development of new diagnostic tests, therapies, and research tools that rely on DNA polymerase enzymes. The increasing demand for education and training in molecular biology and genetics, collaborations and partnerships, and government funding are all contributing to the growth of academic and research institutes in the DNA polymerase market.

The polymerase chain reaction segment is anticipated to be the largest-growing segment in the market from 2023-2028. The DNA polymerase enzymes used in PCR are crucial for the success of the technique, and the increasing demand for PCR applications is driving the growth of the DNA polymerase market. Hence, the increasing demand for PCR applications in fields such as medical diagnostics, genetics, and forensics is driving the growth of the DNA polymerase market. The introduction of new and enhanced DNA polymerases designed for PCR applications, as well as government measures to increase PCR-based testing programmes is accelerating the segment growth. For instance, In February 2021, Qiagen launched a new DNA polymerase for PCR applications, the Q5 High-Fidelity DNA Polymerase. This polymerase is designed for high-fidelity amplification of DNA, making it ideal for PCR applications that require accurate and reliable results, hence enhancing the segment expansion.

DNA sequencing segment is anticipated to be the fastest-growing segment from 2023-2028. The use of DNA polymerases in DNA sequencing has increased in recent years due to the development of new and improved sequencing technologies, such as Next-Generation Sequencing (NGS) and Single-Molecule Real-Time (SMRT) sequencing, which have led to a significant increase in the demand for DNA polymerases. Moreover, the launch of new and improved DNA polymerases optimized for DNA sequencing applications, as well as government initiatives to sequence the genomes of large populations, are expected to drive the growth of the DNA polymerase market in the coming years. For instance, in April 2021, Thermo Fisher Scientific launched its new DNA polymerase, the Phusion Hot Start Flex DNA Polymerase, which is optimized for NGS applications. This DNA polymerase is designed to deliver high accuracy and sensitivity in NGS workflows, improving the efficiency and reliability of sequencing results. Also, in Japan, the government has initiated the Genome Japan Project, which aims to sequence the genomes of 100,000 Japanese individuals by 2023. This project is expected to drive the demand for DNA polymerases in Japan, as high-quality and efficient polymerases are essential for successful genome sequencing.

North America is expected to have the largest share in the global market. This is mainly due to the increasing demand for DNA-based technologies in various fields, including research, diagnostics, and therapeutics. The rising prevalence of infectious diseases and genetic disorders in North America has led to a greater need for accurate and sensitive diagnostic assays. DNA polymerases are used in PCR-based assays, such as qPCR and digital PCR, for the detection and quantification of specific DNA sequences that are indicative of disease or genetic mutations. The adoption of advanced technologies, such as CRISPR/Cas9 genome editing and next-generation sequencing, is increasing the demand for DNA polymerases in North America.

Asia Pacific segment is anticipated to be the fastest-growing region with CAGR of 6.7% from 2023 to 2028. This is due to the significant technological advancements in the Asia Pacific region, particularly in countries like China, Japan, and South Korea. For instance, in 2021, the government of India has launched the Genome India Project, which aims to sequence the genomes of 10 million Indians over the next five years. This project is expected to drive the demand for DNA polymerases in India, as high-quality and efficient polymerases are required for successful genome sequencing. These advancements have led to the development of new and improved DNA polymerases with enhanced performance characteristics, such as high-fidelity and thermostability, which are fuelling the demand for these enzymes in research and diagnostic applications.

Thermo Fisher Scientific, Inc., Agilent Technologies, Merck KGaA, Danaher, QIAGEN, Hoffmann-La Roche Ltd, Bio-Rad Laboratories, Inc., Takara Bio, Inc., Promega Corporation, New England Biolabs, among others, are some of the key players in the global DNA polymerase market.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics on Feed Stocks

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL DNA Polymerase MARKET, BY TYPE

4.2 DNA Polymerase Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 TAQ Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 PFU Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Proprietary Enzyme Blends Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL DNA Polymerase MARKET, BY END USE INDUSTRY

5.2 DNA Polymerase Market: End Use Industry Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Pharmaceutical and Biotechnology Companies

5.5 Academic and Research Institutes

5.5.1 Academic and Research Institutes Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Hospitals & Diagnostic Centers

5.6.1 Hospitals & Diagnostic Centers Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL DNA Polymerase MARKET, BY APPLICATION

6.2 DNA Polymerase Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Polymerase Chain Reaction Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 DNA Sequencing Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 DNA Cloning Market Estimates and Forecast, 2020-2028 (USD Million)

6.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL DNA Polymerase MARKET, BY REGION

7.2 North America DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1 U.S. DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2 Canada DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3 Mexico DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3 Europe DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1 Germany DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2 U.K. DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3 France DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4 Italy DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5 Spain DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6 Netherlands DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7 Rest of Europe DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4 Asia Pacific DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1 China DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2 Japan DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3 India DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4 South Korea DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5 Singapore DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6 Malaysia DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7 Thailand DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8 Indonesia DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9 Vietnam DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10 Taiwan DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.2 By End Use Industry

7.4.4.11 Rest of Asia Pacific DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.2 By End Use Industry

7.5 Middle East & Africa DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1 Saudi Arabia DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2 U.A.E. DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3 Israel DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4 South Africa DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.6 Central & South America DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1 Brazil DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2 Argentina DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3 Chile DNA Polymerase Market Estimates and Forecast, 2020-2028 (USD Million)

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.4.1 THERMO FISHER SCIENTIFIC, INC.

8.4.1.1 Business Description & Financial Analysis

8.4.1.3 Voltages & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2.1 Business Description & Financial Analysis

8.4.2.3 Voltages & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3.1 Business Description & Financial Analysis

8.4.3.3 Voltages & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4.1 Business Description & Financial Analysis

8.4.4.3 Voltages & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5.1 Business Description & Financial Analysis

8.4.5.3 Voltages & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6.1 Business Description & Financial Analysis

8.4.7.3 Voltages & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Bio-Rad Laboratories, Inc.

8.4.7.1 Business Description & Financial Analysis

8.4.7.3 Voltages & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8.1 Business Description & Financial Analysis

8.4.8.3 Voltages & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9.1 Business Description & Financial Analysis

8.4.9.3 Voltages & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.10.1 Business Description & Financial Analysis

8.4.10.3 Voltages & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11.1 Business Description & Financial Analysis

8.4.11.3 Voltages & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9.1.2 Market Scope & Segmentation

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2.1 Various End Use Industry of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.4 Discussion Guide for Primary Participants

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Voltage Sales

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global DNA Polymerase Market, By Type, 2020-2028 (USD Mllion)

2 TAQ Polymerase Market, By Region, 2020-2028 (USD Mllion)

3 PFU Polymerase Market, By Region, 2020-2028 (USD Mllion)

4 Proprietary Enzyme Blends Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Global DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Mllion)

7 Pharmaceutical and Biotechnology Companies Market, By Region, 2020-2028 (USD Mllion)

8 Academic and Research Institutes Market, By Region, 2020-2028 (USD Mllion)

9 Hospitals & Diagnostic Centers Market, By Region, 2020-2028 (USD Mllion)

10 Others Market, By Region, 2020-2028 (USD Mllion)

11 Global DNA Polymerase Market, By Application, 2020-2028 (USD Mllion)

12 Polymerase Chain Reaction Market, By Region, 2020-2028 (USD Mllion)

13 DNA SEQUENCING Market, By Region, 2020-2028 (USD Mllion)

14 DNA Cloning Market, By Region, 2020-2028 (USD Mllion)

15 Others Market, By Region, 2020-2028 (USD Mllion)

16 Regional Analysis, 2020-2028 (USD Mllion)

17 North America DNA Polymerase Market, By Type, 2020-2028 (USD Million)

18 North America DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

19 North America DNA Polymerase Market, By Application, 2020-2028 (USD Million)

20 North America DNA Polymerase Market, By Country, 2020-2028 (USD Million)

21 U.S DNA Polymerase Market, By Type, 2020-2028 (USD Million)

22 U.S DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

23 U.S DNA Polymerase Market, By Application, 2020-2028 (USD Million)

24 Canada DNA Polymerase Market, By Type, 2020-2028 (USD Million)

25 Canada DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

26 Canada DNA Polymerase Market, By Application, 2020-2028 (USD Million)

27 Mexico DNA Polymerase Market, By Type, 2020-2028 (USD Million)

28 Mexico DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

29 Mexico DNA Polymerase Market, By Application, 2020-2028 (USD Million)

30 Europe DNA Polymerase Market, By Type, 2020-2028 (USD Million)

31 Europe DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

32 Europe DNA Polymerase Market, By Application, 2020-2028 (USD Million)

33 Germany DNA Polymerase Market, By Type, 2020-2028 (USD Million)

34 Germany DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

35 Germany DNA Polymerase Market, By Application, 2020-2028 (USD Million)

36 UK DNA Polymerase Market, By Type, 2020-2028 (USD Million)

37 UK DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

38 UK DNA Polymerase Market, By Application, 2020-2028 (USD Million)

39 France DNA Polymerase Market, By Type, 2020-2028 (USD Million)

40 France DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

41 France DNA Polymerase Market, By Application, 2020-2028 (USD Million)

42 Italy DNA Polymerase Market, By Type, 2020-2028 (USD Million)

43 Italy DNA Polymerase Market, By T End Use Industry Type, 2020-2028 (USD Million)

44 Italy DNA Polymerase Market, By Application, 2020-2028 (USD Million)

45 Spain DNA Polymerase Market, By Type, 2020-2028 (USD Million)

46 Spain DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

47 Spain DNA Polymerase Market, By Application, 2020-2028 (USD Million)

48 Rest Of Europe DNA Polymerase Market, By Type, 2020-2028 (USD Million)

49 Rest Of Europe DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

50 Rest of Europe DNA Polymerase Market, By Application, 2020-2028 (USD Million)

51 Asia Pacific DNA Polymerase Market, By Type, 2020-2028 (USD Million)

52 Asia Pacific DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

53 Asia Pacific DNA Polymerase Market, By Application, 2020-2028 (USD Million)

54 Asia Pacific DNA Polymerase Market, By Country, 2020-2028 (USD Million)

55 China DNA Polymerase Market, By Type, 2020-2028 (USD Million)

56 China DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

57 China DNA Polymerase Market, By Application, 2020-2028 (USD Million)

58 India DNA Polymerase Market, By Type, 2020-2028 (USD Million)

59 India DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

60 India DNA Polymerase Market, By Application, 2020-2028 (USD Million)

61 Japan DNA Polymerase Market, By Type, 2020-2028 (USD Million)

62 Japan DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

63 Japan DNA Polymerase Market, By Application, 2020-2028 (USD Million)

64 South Korea DNA Polymerase Market, By Type, 2020-2028 (USD Million)

65 South Korea DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

66 South Korea DNA Polymerase Market, By Application, 2020-2028 (USD Million)

67 Middle East & Africa DNA Polymerase Market, By Type, 2020-2028 (USD Million)

68 Middle East & Africa DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

69 Middle East & Africa DNA Polymerase Market, By Application, 2020-2028 (USD Million)

70 Middle East & Africa DNA Polymerase Market, By Country, 2020-2028 (USD Million)

71 Saudi Arabia DNA Polymerase Market, By Type, 2020-2028 (USD Million)

72 Saudi Arabia DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

73 Saudi Arabia DNA Polymerase Market, By Application, 2020-2028 (USD Million)

74 UAE DNA Polymerase Market, By Type, 2020-2028 (USD Million)

75 UAE DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

76 UAE DNA Polymerase Market, By Application, 2020-2028 (USD Million)

77 Central & South America DNA Polymerase Market, By Type, 2020-2028 (USD Million)

78 Central & South America DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

79 Central & South America DNA Polymerase Market, By Application, 2020-2028 (USD Million)

80 Central & South America DNA Polymerase Market, By Country, 2020-2028 (USD Million)

81 Brazil DNA Polymerase Market, By Type, 2020-2028 (USD Million)

82 Brazil DNA Polymerase Market, By End Use Industry, 2020-2028 (USD Million)

83 Brazil DNA Polymerase Market, By Application, 2020-2028 (USD Million)

84 THERMO FISHER SCIENTIFIC, INC.: Voltages & Services Offering

85 Agilent Technologies: Voltages & Services Offering

86 Merck KGaA: Voltages & Services Offering

87 Danaher Corp.: Voltages & Services Offering

88 QIAGEN: Voltages & Services Offering

89 HOFFMANN-LA ROCHE LTD: Voltages & Services Offering

90 Bio-Rad Laboratories, Inc. : Voltages & Services Offering

91 Takara Bio, Inc.: Voltages & Services Offering

92 Promega Corporation, Inc: Voltages & Services Offering

93 New England Biolabs: Voltages & Services Offering

94 Other Companies: Voltages & Services Offering

LIST OF FIGURES

1 Global DNA Polymerase Market Overview

2 Global DNA Polymerase Market Value From 2020-2028 (USD Mllion)

3 Global DNA Polymerase Market Share, By Type (2022)

4 Global DNA Polymerase Market Share, By End Use Industry (2022)

5 Global DNA Polymerase Market Share, By Application (2022)

6 Global DNA Polymerase Market, By Region (Asia Pacific Market)

7 Technological Trends In Global DNA Polymerase Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global DNA Polymerase Market

11 Impact Of Challenges On The Global DNA Polymerase Market

12 Porter’s Five Forces Analysis

13 Global DNA Polymerase Market: By Type Scope Key Takeaways

14 Global DNA Polymerase Market, By Type Segment: Revenue Growth Analysis

15 TAQ Polymerase Market, By Region, 2020-2028 (USD Mllion)

16 PFU Polymerase Market, By Region, 2020-2028 (USD Mllion)

17 Proprietary Enzyme Blends Market, By Region, 2020-2028 (USD Mllion)

18 Others Market, By Region, 2020-2028 (USD Mllion)

19 Global DNA Polymerase Market: By End Use Industry Scope Key Takeaways

20 Global DNA Polymerase Market, By End Use Industry Segment: Revenue Growth Analysis

21 Pharmaceutical and Biotechnology Companies Market, By Region, 2020-2028 (USD Mllion)

22 Academic and Research Institutes Market, By Region, 2020-2028 (USD Mllion)

23 Hospitals & Diagnostics Centers Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Global DNA Polymerase Market: By Application Scope Key Takeaways

26 Global DNA Polymerase Market, By Application Segment: Revenue Growth Analysis

27 Polymerase Chain Reaction Market, By Region, 2020-2028 (USD Mllion)

28 DNA Sequencing Market, By Region, 2020-2028 (USD Mllion)

29 DNA Cloning Market, By Region, 2020-2028 (USD Mllion)

30 Others Market, By Region, 2020-2028 (USD Mllion)

31 Regional Segment: Revenue Growth Analysis

32 Global DNA Polymerase Market: Regional Analysis

33 North America DNA Polymerase Market Overview

34 North America DNA Polymerase Market, By Type

35 North America DNA Polymerase Market, By End Use Industry

36 North America DNA Polymerase Market, By Application

37 North America DNA Polymerase Market, By Country

38 U.S. DNA Polymerase Market, By Type

39 U.S. DNA Polymerase Market, By End Use Industry

40 U.S. DNA Polymerase Market, By Application

41 Canada DNA Polymerase Market, By Type

42 Canada DNA Polymerase Market, By End Use Industry

43 Canada DNA Polymerase Market, By Application

44 Mexico DNA Polymerase Market, By Type

45 Mexico DNA Polymerase Market, By End Use Industry

46 Mexico DNA Polymerase Market, By Application

47 Four Quadrant Positioning Matrix

48 Company Market Share Analysis

49 THERMO FISHER SCIENTIFIC, INC.: Company Snapshot

50 THERMO FISHER SCIENTIFIC, INC.: SWOT Analysis

51 THERMO FISHER SCIENTIFIC, INC.: Geographic Presence

52 Agilent Technologies: Company Snapshot

53 Agilent Technologies: SWOT Analysis

54 Agilent Technologies: Geographic Presence

55 Merck KGaA: Company Snapshot

56 Merck KGaA: SWOT Analysis

57 Merck KGaA: Geographic Presence

58 Danaher Corp.: Company Snapshot

59 Danaher Corp.: Swot Analysis

60 Danaher Corp.: Geographic Presence

61 QIAGEN: Company Snapshot

62 QIAGEN: SWOT Analysis

63 QIAGEN: Geographic Presence

64 Hoffmann-La Roche Ltd: Company Snapshot

65 Hoffmann-La Roche Ltd: SWOT Analysis

66 Hoffmann-La Roche Ltd: Geographic Presence

67 Bio-Rad Laboratories, Inc. : Company Snapshot

68 Bio-Rad Laboratories, Inc. : SWOT Analysis

69 Bio-Rad Laboratories, Inc. : Geographic Presence

70 Takara Bio, Inc.: Company Snapshot

71 Takara Bio, Inc.: SWOT Analysis

72 Takara Bio, Inc.: Geographic Presence

73 Promega Corporation, Inc.: Company Snapshot

74 Promega Corporation, Inc.: SWOT Analysis

75 Promega Corporation, Inc.: Geographic Presence

76 New England Biolabs: Company Snapshot

77 New England Biolabs: SWOT Analysis

78 New England Biolabs: Geographic Presence

79 Other Companies: Company Snapshot

80 Other Companies: SWOT Analysis

81 Other Companies: Geographic Presence

The Global DNA Polymerase Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the DNA Polymerase Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS