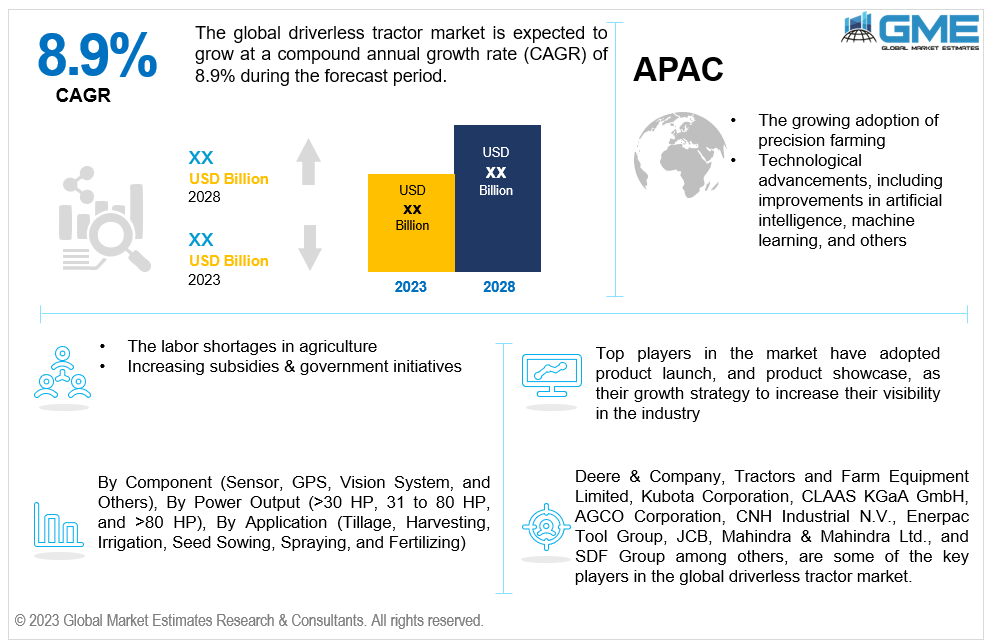

Global Driverless Tractor Market Size, Trends & Analysis - Forecasts to 2028 By Component (Sensor, GPS, Vision System, and Others), By Power Output (>30 HP, 31 to 80 HP, and >80 HP), By Application (Tillage, Harvesting, Irrigation, Seed Sowing, Spraying, and Fertilizing), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global driverless tractor market is estimated to exhibit a CAGR of 8.9% from 2023 to 2028.

The primary factors propelling the market growth are the growing adoption of precision farming and technological advancements, including improvements in artificial intelligence, machine learning, and others. Driverless tractors can traverse fields independently with the help of AI-powered navigation systems, which can detect impediments and choose the best route. This is critical for the successful implementation of autonomous farming equipment. Moreover, driverless tractors are integral to precision agriculture machinery, working in tandem with other advanced equipment. Modern agricultural practices are more efficient and effective when AI and ML technologies are seamlessly integrated into precision agriculture systems. For instance, Monarch and Einsite, an artificial intelligence start-up located in India, collaborated in 2022 to enhance the creation of edge applications and autonomous models.

The labor shortages in agriculture and increasing subsidies and government initiatives for adopting autonomous agricultural machinery are expected to support the market growth throughout the forecast period. There is an urgent need for creative solutions due to the skilled labor scarcity in agriculture. This problem is addressed by self-driving tractor technology, which reduces reliance on manual labor by automating numerous farm activities. Farm automation solutions incorporating self-driving tractor technology are increasingly viewed as a cost-effective alternative in the long term. Even though there can be high upfront costs, automation of tasks can result in considerable cost savings since it eliminates the need for physical labor. Additionally, integrating smart farming equipment featuring autonomous tractors plays a pivotal role in precision agriculture. By precisely controlling and managing farming activities, these automated technologies maximize resource utilization and reduce the challenges brought on by a labor shortage. For instance, globally, agricultural employment out of total employment decreased sharply from 29.43% in 2014 to 26.75% in 2019, according to the World Bank database.

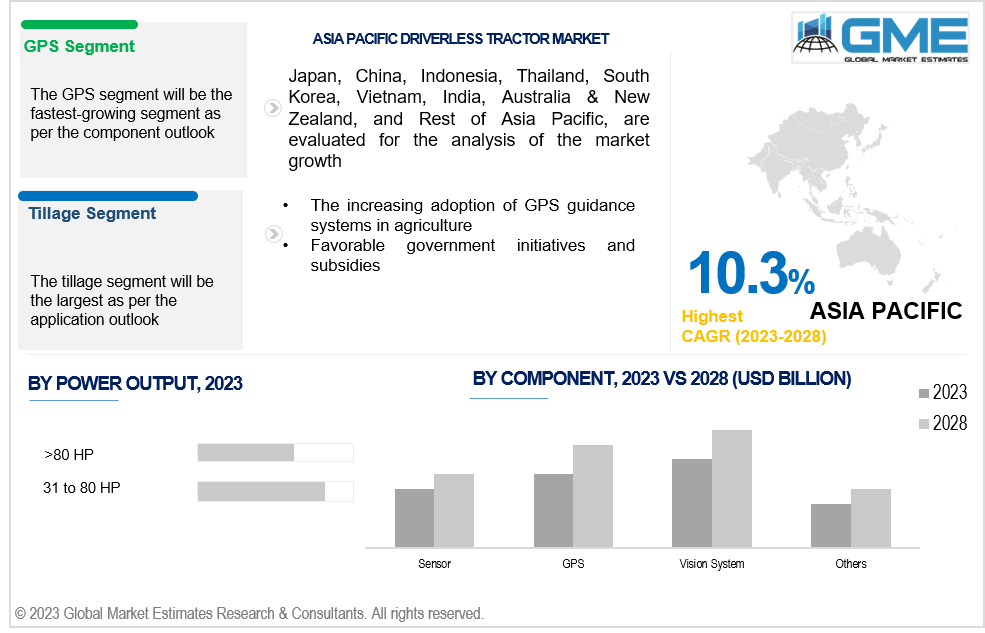

The increasing adoption of GPS guidance systems in agriculture and favorable government initiatives and subsidies propel market growth. GPS guidance systems, including driverless tractors, are integral to farm equipment automation. Tractor automation is improved by the exact positional data that GPS provides, making it possible to carry out operations like planting, plowing, and harvesting more precisely and effectively. Moreover, agriculture's optimal use of resources is aided by GPS-guided autonomous tractors. This fits with the efficiency and sustainability-focused farming technology trends. Accurate navigation ensures that resources like seeds, fertilizer, and insecticides are administered precisely by preventing overlaps and gaps in operations.

Driverless tractors, coupled with agricultural robotics innovations, offer opportunities for enhanced precision agriculture. By using cutting-edge robotic technology, agricultural processes can become more precise and productive, enhancing crop yields and resource efficiency. Moreover, the emergence of remote-controlled farming is a key opportunity within the global driverless tractor market. With autonomous tractors' remote-controlled features, farmers can oversee and manage operations from a distance, increasing flexibility and enabling last-minute modifications.

However, a lack of awareness, technology integration, and high initial investments in driverless tractors hinder market growth.

The vision system segment is expected to hold the largest share of the market. When compared to certain other sensor technologies, vision systems provide a more affordable option. Driverless tractor manufacturers find vision systems to be scalable, making them a practical choice for large-scale deployment in the agriculture sector. Moreover, due to vision systems' superior real-time data processing capabilities, driverless tractors can make judgments instantly based on visual inputs. This capacity is necessary to ensure proper task performance, avoid impediments, and adjust to changing field circumstances.

The GPS segment is expected to be the fastest-growing segment in the market from 2023-2028. GPS technology makes accurate mapping, location, and navigation in agricultural lands possible. Precision agriculture is made possible by the GPS integration in autonomous tractors, which enables farmers to apply pesticides, fertilizers, and seeds with unmatched precision.

The 31 to 80 HP segment is expected to hold the largest share of the market. Tractors in the 31 to 80 HP range are well-suited for small to medium-sized farms. Tractors that are adaptable, quick, and capable of effectively performing various duties, such as planting, plowing, and harvesting, are frequently needed on these farms. This horsepower range of driverless tractors serves a sizable segment of the world's agricultural market. Additionally, tractors with 31 to 80 HP generally offer a balance between power and affordability. Moreover, many farmers, particularly those who operate on a smaller scale, can afford these tractors. Their affordability facilitates the widespread use of autonomous tractors in this horsepower range.

The >80 HP segment is anticipated to be the fastest-growing segment in the market from 2023-2028. With their powerful performance, the >80 HP tractors can handle labor-intensive jobs, including deep tillage, extensive planting, and heavy-duty harvesting. This qualifies them for huge farms and agribusinesses that need strong and powerful machinery. Additionally, driverless tractors in the >80 HP segment can operate efficiently in large fields, contributing to increased productivity and reduced operational timelines for tasks like planting and harvesting.

The tillage segment is expected to hold the largest share of the market. Tillage is an essential agricultural practice involving soil preparation, cultivation, and seedbed creation. The automation of these tillage processes is made possible by driverless tractors, which also increase the general productivity of agricultural operations. Additionally, tillage tasks become much more precise with driverless tractors. They can employ GPS-guided devices and adhere to exact routes for accurate and reliable soil cultivation. This accuracy enhances the crop's overall performance and the seeds' positioning.

The harvesting segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Since harvesting requires much labor, adopting driverless tractors tackles the issues related to a labor shortage. Autonomous tractors' capacity to carry out harvesting duties without the need for human intervention boosts productivity and reduces the need for manual labor.

North America is expected to be the largest region in the global market. The advancement of innovative agricultural technologies, such as autonomous tractors, has been facilitated by government regulations and initiatives. These have played a crucial role in propelling market growth in North America. For instance, the U.S. Department of Agriculture's NIFA conducts sensor, GIS, and precision technology programs to raise farmer awareness.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Several Asia Pacific nations' populations have significantly shifted from rural to urban regions. Since the younger generation frequently looks for work in non-agricultural industries, this rural-to-urban movement has resulted in a labor deficiency in agriculture. A solution is provided by driverless tractors, which lessen the need for physical labor. For instance, the Indian Council of Food and Agriculture (ICFA) projects that by 2050, there will be a 25.7% decrease in the proportion of agricultural workers in India.

Deere & Company, Tractors and Farm Equipment Limited, Kubota Corporation, CLAAS KGaA GmbH, AGCO Corporation, CNH Industrial N.V., Enerpac Tool Group, JCB, Mahindra & Mahindra Ltd., and SDF Group among others, are some of the key players operating in the global driverless tractor market.

Please note: This is not an exhaustive list of companies profiled in the report.

In 2020, Kubota and U.S. chipmaker Nvidia announced a partnership to create highly advanced autonomous agricultural tractors that can achieve total autonomy.

In 2021, Deere & Co. acquired an autonomous tractor startup, Bear Flag Robotics Inc., based in California. The USD 250 million acquisition boosted agricultural autonomy and advanced Deere's long-term goal of building more intelligent machinery with cutting-edge technology to meet market demands.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL DRIVERLESS TRACTOR MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Application Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL DRIVERLESS TRACTOR MARKET, BY COMPONENT

4.1 Introduction

4.2 Driverless Tractor Market: Component Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Sensor

4.4.1 Sensor Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 GPS

4.5.1 GPS Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Vision System

4.6.1 Vision System Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL DRIVERLESS TRACTOR MARKET, BY POWER OUTPUT

5.1 Introduction

5.2 Driverless Tractor Market: Power Output Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 >30 HP

5.4.1 >30 HP Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 31 to 80 HP

5.5.1 31 to 80 HP Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 >80 HP

5.6.1 >80 HP Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL DRIVERLESS TRACTOR MARKET, BY APPLICATION

6.1 Introduction

6.2 Driverless Tractor Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Tillage

6.4.1 Tillage Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Harvesting

6.5.1 Harvesting Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Irrigation

6.6.1 Irrigation Market Estimates and Forecast, 2020-2028 (USD Million)

6.7 Seed Sowing

6.7.1 Seed Sowing Market Estimates and Forecast, 2020-2028 (USD Million)

6.8 Spraying

6.8.1 Spraying Market Estimates and Forecast, 2020-2028 (USD Million)

6.9 Fertilizing

6.9.1 Fertilizing Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL DRIVERLESS TRACTOR MARKET, BY REGION

7.1 Introduction

7.2 North America Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Component

7.2.2 By Power Output

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Component

7.2.4.1.2 By Power Output

7.2.4.1.3 By Application

7.2.4.2 Canada Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Component

7.2.4.2.2 By Power Output

7.2.4.2.3 By Application

7.2.4.3 Mexico Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Component

7.2.4.3.2 By Power Output

7.2.4.3.3 By Application

7.3 Europe Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Component

7.3.2 By Power Output

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Component

7.3.4.1.2 By Power Output

7.3.4.1.3 By Application

7.3.4.2 U.K. Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Component

7.3.4.2.2 By Power Output

7.3.4.2.3 By Application

7.3.4.3 France Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Component

7.3.4.3.2 By Power Output

7.3.4.3.3 By Application

7.3.4.4 Italy Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Component

7.3.4.4.2 By Power Output

7.2.4.4.3 By Application

7.3.4.5 Spain Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Component

7.3.4.5.2 By Power Output

7.2.4.5.3 By Application

7.3.4.6 Netherlands Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6.1 By Component

7.3.4.6.2 By Power Output

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Component

7.3.4.7.2 By Power Output

7.2.4.7.3 By Application

7.4 Asia Pacific Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Component

7.4.2 By Power Output

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Component

7.4.4.1.2 By Power Output

7.4.4.1.3 By Application

7.4.4.2 Japan Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Component

7.4.4.2.2 By Power Output

7.4.4.2.3 By Application

7.4.4.3 India Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Component

7.4.4.3.2 By Power Output

7.4.4.3.3 By Application

7.4.4.4 South Korea Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Component

7.4.4.4.2 By Power Output

7.4.4.4.3 By Application

7.4.4.5 Singapore Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Component

7.4.4.5.2 By Power Output

7.4.4.5.3 By Application

7.4.4.6 Malaysia Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6.1 By Component

7.4.4.6.2 By Power Output

7.4.4.6.3 By Application

7.4.4.7 Thailand Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Component

7.4.4.7.2 By Power Output

7.4.4.7.3 By Application

7.4.4.8 Indonesia Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Component

7.4.4.8.2 By Power Output

7.4.4.8.3 By Application

7.4.4.9 Vietnam Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Component

7.4.4.9.2 By Power Output

7.4.4.9.3 By Application

7.4.4.10 Taiwan Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Component

7.4.4.10.2 By Power Output

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Component

7.4.4.11.2 By Power Output

7.4.4.11.3 By Application

7.5 Middle East and Africa Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Component

7.5.2 By Power Output

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Component

7.5.4.1.2 By Power Output

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Component

7.5.4.2.2 By Power Output

7.5.4.2.3 By Application

7.5.4.3 Israel Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Component

7.5.4.3.2 By Power Output

7.5.4.3.3 By Application

7.5.4.4 South Africa Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Component

7.5.4.4.2 By Power Output

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Component

7.5.4.5.2 By Power Output

7.5.4.5.2 By Application

7.6 Central and South America Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.1 By Component

7.6.2 By Power Output

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1.1 By Component

7.6.4.1.2 By Power Output

7.6.4.1.3 By Application

7.6.4.2 Argentina Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2.1 By Component

7.6.4.2.2 By Power Output

7.6.4.2.3 By Application

7.6.4.3 Chile Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3.1 By Component

7.6.4.3.2 By Power Output

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Driverless Tractor Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.4.1 By Component

7.6.4.4.2 By Power Output

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Deere & Company

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Tractors and Farm Equipment Limited

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Kubota Corporation

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 CLAAS KGaA GmbH

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 AGCO Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 CNH INDUSTRIAL N.V.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Enerpac Tool Group

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 JCB

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Mahindra & Mahindra Ltd.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 SDF

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Component Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Driverless Tractor Market, By Component, 2020-2028 (USD Mllion)

2 Sensor Market, By Region, 2020-2028 (USD Mllion)

3 GPS Market, By Region, 2020-2028 (USD Mllion)

4 Vision System Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Global Driverless Tractor Market, By Power Output, 2020-2028 (USD Mllion)

7 >30 HP Market, By Region, 2020-2028 (USD Mllion)

8 31 to 80 HP Market, By Region, 2020-2028 (USD Mllion)

9 >80 HP Market, By Region, 2020-2028 (USD Mllion)

10 Global Driverless Tractor Market, By Application, 2020-2028 (USD Mllion)

11 Tillage Market, By Region, 2020-2028 (USD Mllion)

12 Harvesting Market, By Region, 2020-2028 (USD Mllion)

13 Irrigation Market, By Region, 2020-2028 (USD Mllion)

14 Seed Sowing Market, By Region, 2020-2028 (USD Mllion)

15 Spraying Market, By Region, 2020-2028 (USD Mllion)

16 Fertilizing Market, By Region, 2020-2028 (USD Mllion)

17 Regional Analysis, 2020-2028 (USD Mllion)

18 North America Driverless Tractor Market, By Component, 2020-2028 (USD Million)

19 North America Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

20 North America Driverless Tractor Market, By Application, 2020-2028 (USD Million)

21 North America Driverless Tractor Market, By Country, 2020-2028 (USD Million)

22 U.S Driverless Tractor Market, By Component, 2020-2028 (USD Million)

23 U.S Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

24 U.S Driverless Tractor Market, By Application, 2020-2028 (USD Million)

25 Canada Driverless Tractor Market, By Component, 2020-2028 (USD Million)

26 Canada Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

27 Canada Driverless Tractor Market, By Application, 2020-2028 (USD Million)

28 Mexico Driverless Tractor Market, By Component, 2020-2028 (USD Million)

29 Mexico Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

30 Mexico Driverless Tractor Market, By Application, 2020-2028 (USD Million)

31 Europe Driverless Tractor Market, By Component, 2020-2028 (USD Million)

32 Europe Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

33 Europe Driverless Tractor Market, By Application, 2020-2028 (USD Million)

34 Europe Driverless Tractor Market, By Country 2020-2028 (USD Million)

35 Germany Driverless Tractor Market, By Component, 2020-2028 (USD Million)

36 Germany Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

37 Germany Driverless Tractor Market, By Application, 2020-2028 (USD Million)

38 U.K Driverless Tractor Market, By Component, 2020-2028 (USD Million)

39 U.K Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

40 U.K Driverless Tractor Market, By Application, 2020-2028 (USD Million)

41 France Driverless Tractor Market, By Component, 2020-2028 (USD Million)

42 France Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

43 France Driverless Tractor Market, By Application, 2020-2028 (USD Million)

44 Italy Driverless Tractor Market, By Component, 2020-2028 (USD Million)

45 Italy Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

46 Italy Driverless Tractor Market, By Application, 2020-2028 (USD Million)

47 Spain Driverless Tractor Market, By Component, 2020-2028 (USD Million)

48 Spain Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

49 Spain Driverless Tractor Market, By Application, 2020-2028 (USD Million)

50 Netherlands Driverless Tractor Market, By Component, 2020-2028 (USD Million)

51 Netherlands Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

52 Netherlands Driverless Tractor Market, By Application, 2020-2028 (USD Million)

53 Rest Of Europe Driverless Tractor Market, By Component, 2020-2028 (USD Million)

54 Rest Of Europe Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

55 Rest of Europe Driverless Tractor Market, By Application, 2020-2028 (USD Million)

56 Asia Pacific Driverless Tractor Market, By Component, 2020-2028 (USD Million)

57 Asia Pacific Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

58 Asia Pacific Driverless Tractor Market, By Application, 2020-2028 (USD Million)

59 Asia Pacific Driverless Tractor Market, By Country, 2020-2028 (USD Million)

60 China Driverless Tractor Market, By Component, 2020-2028 (USD Million)

61 China Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

62 China Driverless Tractor Market, By Application, 2020-2028 (USD Million)

63 India Driverless Tractor Market, By Component, 2020-2028 (USD Million)

64 India Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

65 India Driverless Tractor Market, By Application, 2020-2028 (USD Million)

66 Japan Driverless Tractor Market, By Component, 2020-2028 (USD Million)

67 Japan Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

68 Japan Driverless Tractor Market, By Application, 2020-2028 (USD Million)

69 South Korea Driverless Tractor Market, By Component, 2020-2028 (USD Million)

70 South Korea Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

71 South Korea Driverless Tractor Market, By Application, 2020-2028 (USD Million)

72 malaysia Driverless Tractor Market, By Component, 2020-2028 (USD Million)

73 malaysia Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

74 malaysia Driverless Tractor Market, By Application, 2020-2028 (USD Million)

75 Thailand Driverless Tractor Market, By Component, 2020-2028 (USD Million)

76 Thailand Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

77 Thailand Driverless Tractor Market, By Application, 2020-2028 (USD Million)

78 Indonesia Driverless Tractor Market, By Component, 2020-2028 (USD Million)

79 Indonesia Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

80 Indonesia Driverless Tractor Market, By Application, 2020-2028 (USD Million)

81 Vietnam Driverless Tractor Market, By Component, 2020-2028 (USD Million)

82 Vietnam Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

83 Vietnam Driverless Tractor Market, By Application, 2020-2028 (USD Million)

84 Taiwan Driverless Tractor Market, By Component, 2020-2028 (USD Million)

85 Taiwan Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

86 Taiwan Driverless Tractor Market, By Application, 2020-2028 (USD Million)

87 Rest of Asia Pacific Driverless Tractor Market, By Component, 2020-2028 (USD Million)

88 Rest of Asia Pacific Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

89 Rest of Asia Pacific Driverless Tractor Market, By Application, 2020-2028 (USD Million)

90 Middle East and Africa Driverless Tractor Market, By Component, 2020-2028 (USD Million)

91 Middle East and Africa Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

92 Middle East and Africa Driverless Tractor Market, By Application, 2020-2028 (USD Million)

93 Middle East and Africa Driverless Tractor Market, By Country, 2020-2028 (USD Million)

94 Saudi Arabia Driverless Tractor Market, By Component, 2020-2028 (USD Million)

95 Saudi Arabia Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

96 Saudi Arabia Driverless Tractor Market, By Application, 2020-2028 (USD Million)

97 UAE Driverless Tractor Market, By Component, 2020-2028 (USD Million)

98 UAE Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

99 UAE Driverless Tractor Market, By Application, 2020-2028 (USD Million)

100 Israel Driverless Tractor Market, By Component, 2020-2028 (USD Million)

101 Israel Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

102 Israel Driverless Tractor Market, By Application, 2020-2028 (USD Million)

103 South Africa Driverless Tractor Market, By Component, 2020-2028 (USD Million)

104 South Africa Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

105 South Africa Driverless Tractor Market, By Application, 2020-2028 (USD Million)

106 Rest of Middle East and Africa Driverless Tractor Market, By Component, 2020-2028 (USD Million)

107 Rest of Middle East and Africa Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

108 UAE Rest of Middle East and Africa Driverless Tractor Market, By Application, 2020-2028 (USD Million)

109 Central and South America Driverless Tractor Market, By Component, 2020-2028 (USD Million)

110 Central and South America Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

111 Central and South America Driverless Tractor Market, By Application, 2020-2028 (USD Million)

112 Central and South America Driverless Tractor Market, By Country, 2020-2028 (USD Million)

113 Brazil Driverless Tractor Market, By Component, 2020-2028 (USD Million)

114 Brazil Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

115 Brazil Driverless Tractor Market, By Application, 2020-2028 (USD Million)

116 Argentina Driverless Tractor Market, By Component, 2020-2028 (USD Million)

117 Argentina Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

118 Argentina Driverless Tractor Market, By Application, 2020-2028 (USD Million)

119 Chile Driverless Tractor Market, By Component, 2020-2028 (USD Million)

120 Chile Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

121 Chile Driverless Tractor Market, By Application, 2020-2028 (USD Million)

122 Rest of Central and South America Driverless Tractor Market, By Component, 2020-2028 (USD Million)

123 Rest of Central and South America Driverless Tractor Market, By Power Output, 2020-2028 (USD Million)

124 Rest of Central and South America Driverless Tractor Market, By Application, 2020-2028 (USD Million)

125 Deere & Company: Products & Services Offering

126 Tractors and Farm Equipment Limited: Products & Services Offering

127 Kubota Corporation: Products & Services Offering

128 CLAAS KGaA GmbH: Products & Services Offering

129 AGCO Corporation: Products & Services Offering

130 CNH INDUSTRIAL N.V.: Products & Services Offering

131 Enerpac Tool Group : Products & Services Offering

132 JCB: Products & Services Offering

133 Mahindra & Mahindra Ltd., Inc: Products & Services Offering

134 SDF: Products & Services Offering

135 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Driverless Tractor Market Overview

2 Global Driverless Tractor Market Value From 2020-2028 (USD Mllion)

3 Global Driverless Tractor Market Share, By Component (2022)

4 Global Driverless Tractor Market Share, By Power Output (2022)

5 Global Driverless Tractor Market Share, By Application (2022)

6 Global Driverless Tractor Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Driverless Tractor Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Driverless Tractor Market

11 Impact Of Challenges On The Global Driverless Tractor Market

12 Porter’s Five Forces Analysis

13 Global Driverless Tractor Market: By Component Scope Key Takeaways

14 Global Driverless Tractor Market, By Component Segment: Revenue Growth Analysis

15 Sensor Market, By Region, 2020-2028 (USD Mllion)

16 GPS Market, By Region, 2020-2028 (USD Mllion)

17 Vision System Market, By Region, 2020-2028 (USD Mllion)

18 Others Market, By Region, 2020-2028 (USD Mllion)

19 Global Driverless Tractor Market: By Power Output Scope Key Takeaways

20 Global Driverless Tractor Market, By Power Output Segment: Revenue Growth Analysis

21 >30 HP Market, By Region, 2020-2028 (USD Mllion)

22 31 to 80 HP Market, By Region, 2020-2028 (USD Mllion)

23 >80 HP Market, By Region, 2020-2028 (USD Mllion)

24 Global Driverless Tractor Market: By Application Scope Key Takeaways

25 Global Driverless Tractor Market, By Application Segment: Revenue Growth Analysis

26 Tillage Market, By Region, 2020-2028 (USD Mllion)

27 Harvesting Market, By Region, 2020-2028 (USD Mllion)

28 Irrigation Market, By Region, 2020-2028 (USD Mllion)

29 Seed Sowing Market, By Region, 2020-2028 (USD Mllion)

30 Spraying Market, By Region, 2020-2028 (USD Mllion)

31 Fertilizing Market, By Region, 2020-2028 (USD Mllion)

32 Regional Segment: Revenue Growth Analysis

33 Global Driverless Tractor Market: Regional Analysis

34 North America Driverless Tractor Market Overview

35 North America Driverless Tractor Market, By Component

36 North America Driverless Tractor Market, By Power Output

37 North America Driverless Tractor Market, By Application

38 North America Driverless Tractor Market, By Country

39 U.S. Driverless Tractor Market, By Component

40 U.S. Driverless Tractor Market, By Power Output

41 U.S. Driverless Tractor Market, By Application

42 Canada Driverless Tractor Market, By Component

43 Canada Driverless Tractor Market, By Power Output

44 Canada Driverless Tractor Market, By Application

45 Mexico Driverless Tractor Market, By Component

46 Mexico Driverless Tractor Market, By Power Output

47 Mexico Driverless Tractor Market, By Application

48 Four Quadrant Positioning Matrix

49 Company Market Share Analysis

50 Deere & Company: Company Snapshot

51 Deere & Company: SWOT Analysis

52 Deere & Company: Geographic Presence

53 Tractors and Farm Equipment Limited: Company Snapshot

54 Tractors and Farm Equipment Limited: SWOT Analysis

55 Tractors and Farm Equipment Limited: Geographic Presence

56 Kubota Corporation: Company Snapshot

57 Kubota Corporation: SWOT Analysis

58 Kubota Corporation: Geographic Presence

59 CLAAS KGaA GmbH: Company Snapshot

60 CLAAS KGaA GmbH: Swot Analysis

61 CLAAS KGaA GmbH: Geographic Presence

62 AGCO Corporation: Company Snapshot

63 AGCO Corporation: SWOT Analysis

64 AGCO Corporation: Geographic Presence

65 CNH INDUSTRIAL N.V.: Company Snapshot

66 CNH INDUSTRIAL N.V.: SWOT Analysis

67 CNH INDUSTRIAL N.V.: Geographic Presence

68 Enerpac Tool Group : Company Snapshot

69 Enerpac Tool Group : SWOT Analysis

70 Enerpac Tool Group : Geographic Presence

71 JCB: Company Snapshot

72 JCB: SWOT Analysis

73 JCB: Geographic Presence

74 Mahindra & Mahindra Ltd., Inc.: Company Snapshot

75 Mahindra & Mahindra Ltd., Inc.: SWOT Analysis

76 Mahindra & Mahindra Ltd., Inc.: Geographic Presence

77 SDF: Company Snapshot

78 SDF: SWOT Analysis

79 SDF: Geographic Presence

80 Other Companies: Company Snapshot

81 Other Companies: SWOT Analysis

82 Other Companies: Geographic Presence

The Global Driverless Tractor Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Driverless Tractor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS