Global Drug Discovery Outsourcing Market Size, Trends & Analysis - Forecasts to 2028 By Workflow (Target Identification & Screening, Target Validation & Functional Informatics, Lead Identification & Candidate Optimization, Preclinical Development, and Other Associated Workflow), By Therapeutic Area (Oncology, Infectious Disease, Respiratory Disease, Cardiovascular, Gastrointestinal, and Others), By Drug Type (Small Molecules and Large Molecules (Biopharmaceuticals)), By Service Type (Chemistry Services and Biology Services), By End User (Pharmaceutical & Biotechnology Companies, Academic Institutes, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

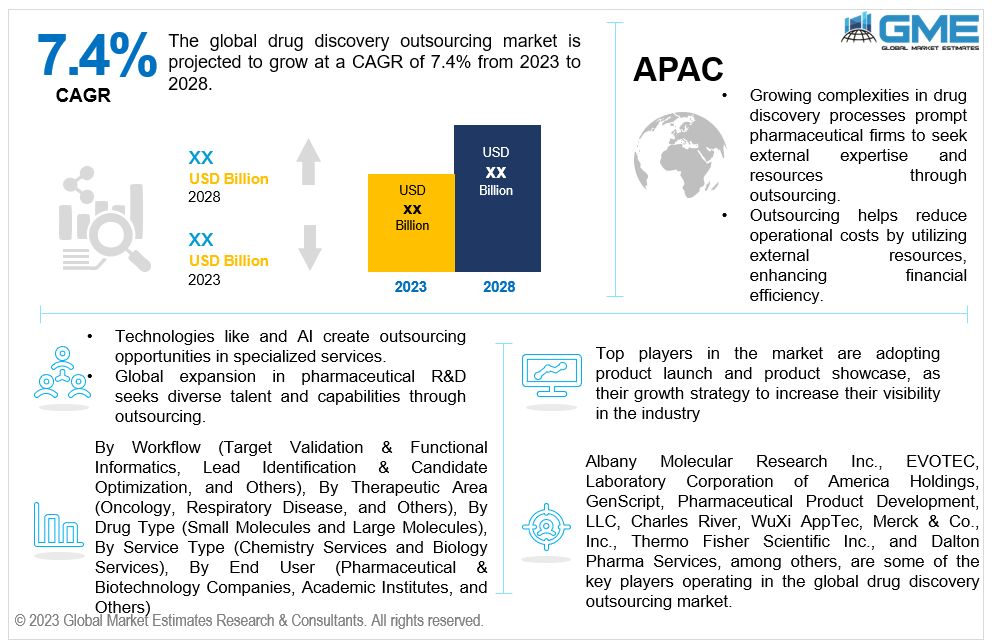

The global drug discovery outsourcing market is projected to grow at a CAGR of 7.4% from 2023 to 2028.

Pharmaceutical companies leverage outsourcing to concentrate on their primary strengths, like drug design and marketing, as outsourcing helps them to delegate non-core functions to specialized service providers. The growing complexity of drug discovery processes, including advancements in genomics and proteomics, has led pharmaceutical companies to seek technical expertise and resources through outsourcing. The increasing incidence of chronic diseases globally drives the demand for new and innovative drugs, encouraging pharmaceutical companies to explore outsourcing options to meet this demand.

Outsourcing allows companies to reduce operational costs by leveraging external expertise, infrastructure, and resources, leading to more efficient use of financial resources. Pharmaceutical and biotechnology firms must choose outsourcing for research activities to mitigate the costs associated with development.

Numerous academic and private contract research organizations (CROs) collaborate strategically with pharmaceutical companies to facilitate drug development. For example, in April 2021, Charles River Laboratories International, Inc., and Valence Discovery entered into a partnership. This partnership aims to offer clients access to Valence's artificial intelligence platform, specializing in molecular property prediction and generative chemistry. The objective is to expedite preclinical drug discovery initiatives by integrating advanced technologies and expertise.

Outsourcing involves sharing sensitive information with external partners raising concerns about data security and confidentiality. This increases the risk of keeping information safe and private. To handle this, companies need solid contracts and high-tech security measures to protect their valuable data.

The lead identification & candidate optimization segment is expected to hold the largest share of the market during the forecast period. The iterative phase of lead identification, called hit-to-lead, has considerable importance in the early stages of drug discovery, showcasing historically enhanced efficiencies and economies of scale for drug developers. Additionally, integrating advanced in silico designs to improve the lead identification process, like computer-aided drug discovery (CADD) and structure-based drug designs, is expected to boost segment growth. The rising demand for proficient resources with expertise in computer software, analytical chemistry, and metabolism further contributes to the expansion of this segment.

Oncology is anticipated to be the fastest-growing segment in the market from 2023-2028. The substantial demand for drugs to treat cancer is driving the growth of the drug discovery outsourcing market. The increasing incidence of various cancer types in the population has spurred investments in drug discovery efforts focused on cancer treatment. As per the International Agency for Research on Cancer, there were roughly 19.3 million new cases of cancer and approximately 10 million deaths attributed to cancer in 2020. New cancer cases are anticipated to increase by 47% from 2020 to 2040 globally. Consequently, an estimated 28.4 million new cancer cases are expected to be reported globally by 2040.

Respiratory segment is expected to hold the largest share of the market. The increasing investments directed towards the research and development of drugs capable of treating respiratory diseases, driven by escalating pollution levels and the growing prevalence of respiratory disorders worldwide, are anticipated to propel the market growth. According to the World Health Organization, chronic obstructive pulmonary disease (COPD) stood as the third leading cause of global mortality, claiming 3.23 million lives in 2019. Nearly 90% of COPD-related deaths among individuals are under 70 years of age and are concentrated in low- and middle-income countries (LMIC).

The biology segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This is attributed to the increasing need for skilled professionals to conduct drug discovery services in compliance with regulatory standards. Additionally, the substantial presence of biology drug discovery service providers, including prominent names like Eurofins, Aurigene Pharmaceutical Services Ltd., and Syngene International Limited, plays a pivotal role in fostering the expansion of this segment.

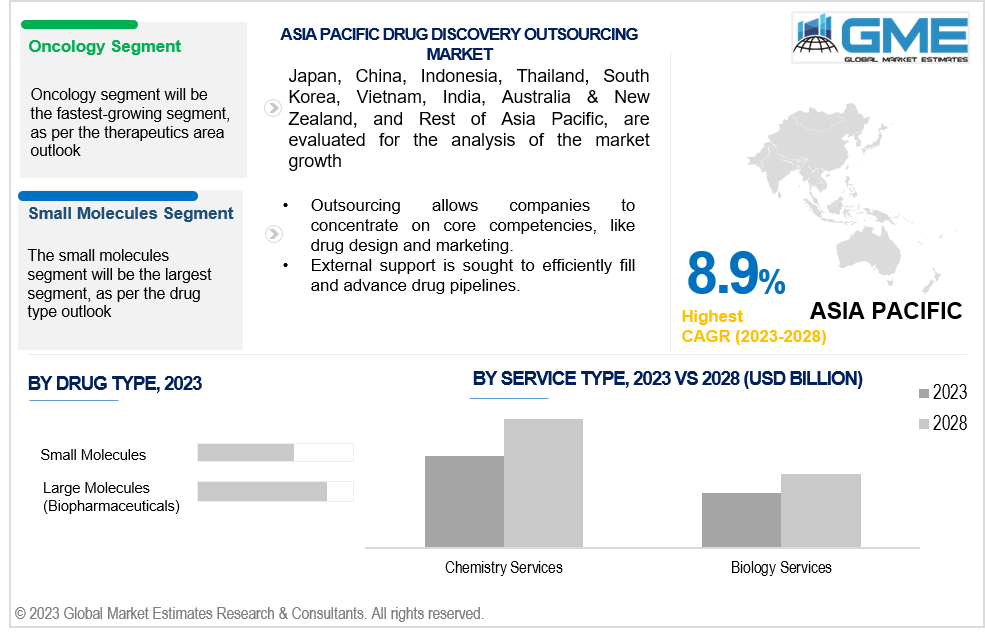

The chemistry segment is expected to hold the largest share of the market. The growth is attributed to the surge in drug discovery service providers that deliver high-quality drug chemical synthesis services, amplifying the need for outsourcing chemistry services, especially among smaller and mid-sized pharmaceutical companies that may lack in-house capabilities for drug discovery research.

The large molecules (biopharmaceuticals) segment is anticipated to be the fastest-growing segment in the market from 2023-2028 due to increasing demand for biologic drugs worldwide due to recent advancements in life-saving drugs within the biopharmaceutical sector. Moreover, the growing awareness about the effectiveness of biologics in treating diseases such as cancer, diabetes, and cardiovascular diseases is expected to drive the segment growth.

The small molecules segment holds the largest share of the market. Small molecules are crucial in advancing innovative treatments globally, contributing to the development of half of specialty medicines. This importance is evident in recent FDA approval trends, where, in 2019, 79% of the 48 newly approved drugs were small molecules. Small molecules remain pivotal in innovating treatments across key therapeutic areas, including oncology, cardiovascular, autoimmune, and respiratory diseases.

The pharmaceutical & biotechnology companies segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This is attributed to the increasing pace of therapeutic pipelines. Global pharmaceutical research and development (R&D) activities have recently demonstrated significant progress. As indicated by the Pharma R&D Annual Review for 2022, the number of drugs in research and development rose from 18,582 in 2020 to 20,109 in 2021. The expanding R&D pipeline is anticipated to impact the market positively. Moreover, the global burden of chronic and infectious diseases is steadily rising, leading to an increased interest among pharmaceutical and biopharmaceutical companies in developing novel drugs.

The academic institutes segment is anticipated to hold the largest share of the market. The growth is attributed to the rising access to academic institutions and shared resources. Many pharmaceutical companies engage with academic institutions for innovative insights and specialized knowledge. This segment's dominance reflects the strategic partnerships between academia and industry, fostering a synergy that accelerates drug discovery and development processes.

North America is expected to be the largest region in the market, owing to the increasing contract manufacturing organizations and presence of major pharmaceutical industry players. Additionally, the rising demand for novel drugs in response to the increasing prevalence of chronic diseases is expected to fuel the regional market growth.

Asia Pacific is predicted to witness rapid growth during the forecast period. The increasing elderly population and the higher incidence of various diseases are driving demand for new drugs in the region. By 2050 around 80% of the global geriatric population is estimated to reside in low and middle-income countries, according to the United Nations.

Albany Molecular Research Inc., EVOTEC, Laboratory Corporation of America Holdings, GenScript, Pharmaceutical Product Development, LLC, Charles River, WuXi AppTec, Merck & Co., Inc., Thermo Fisher Scientific Inc., and Dalton Pharma Services, among others, are some of the key players operating in the global drug discovery outsourcing market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2023, IKtos, a novel drug discovery firm employing artificial intelligence (AI) in its research, successfully concluded a financing round securing USD 16.36 million (euro15.5 million). This funding will enable the company to enhance its SaaS software capabilities and advance its AI functionalities.

AstraZeneca and Accent Therapeutics entered into a collaboration in June 2020 to jointly develop and commercialize therapeutics designed to target RNA-modifying proteins for the treatment of cancer.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL DRUG DISCOVERY OUTSOURCING MARKET, BY WORKFLOW

4.2 Drug Discovery Outsourcing Market: Workflow Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Target Identification & Screening

4.4.1 Target Identification & Screening Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Target Validation & Functional Informatics

4.6 Lead Identification & Candidate Optimization

4.7.1 Preclinical Development Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Other Associated Workflow Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL DRUG DISCOVERY OUTSOURCING MARKET, BY THERAPEUTICS AREA

5.2 Drug Discovery Outsourcing Market: Therapeutics Area Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Oncology Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Infectious Disease Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Respiratory Disease Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Cardiovascular Market Estimates and Forecast, 2020-2028 (USD Million)

5.8.1 Gastrointestinal Market Estimates and Forecast, 2020-2028 (USD Million)

5.9.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL DRUG DISCOVERY OUTSOURCING MARKET, BY DRUG TYPE

6.2 Drug Discovery Outsourcing Market: Drug Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Small Molecules Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Large Molecules (Biopharmaceuticals)

6.5.1 Large Molecules (Biopharmaceuticals) Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL DRUG DISCOVERY OUTSOURCING MARKET, BY SERVICE TYPE

7.2 Drug Discovery Outsourcing Market: Service Type Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 Chemistry Services Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 Biology Services Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL DRUG DISCOVERY OUTSOURCING MARKET, BY END USER

8.2 Drug Discovery Outsourcing Market: End User Scope Key Takeaways

8.3 Revenue Growth Analysis, 2022 & 2028

8.4 Pharmaceutical & Biotechnology Companies

8.5.1 Academic Institutes Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

9 GLOBAL DRUG DISCOVERY OUTSOURCING MARKET, BY REGION

9.2 North America Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.2.6.1 U.S. Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.2.6.1.2 By Therapeutics Area

9.2.6.2 Canada Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.2.6.2.2 By Therapeutics Area

9.2.6.3 Mexico Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.2.6.3.2 By Therapeutics Area

9.3 Europe Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.3.6.1 Germany Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.3.6.1.2 By Therapeutics Area

9.3.6.2 U.K. Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.3.6.2.2 By Therapeutics Area

9.3.6.3 France Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.3.6.3.2 By Therapeutics Area

9.3.6.4 Italy Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.3.6.4.2 By Therapeutics Area

9.3.6.5 Spain Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.3.6.5.2 By Therapeutics Area

9.3.6.6.2 By Therapeutics Area

9.3.6.7.2 By Therapeutics Area

9.4 Asia Pacific Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.1 China Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.1.2 By Therapeutics Area

9.4.6.2 Japan Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.2.2 By Therapeutics Area

9.4.6.3 India Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.3.2 By Therapeutics Area

9.4.6.4.2 By Therapeutics Area

9.4.6.5 Singapore Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.5.2 By Therapeutics Area

9.4.6.6 Malaysia Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.6.2 By Therapeutics Area

9.4.6.7 Thailand Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.7.2 By Therapeutics Area

9.4.6.8 Indonesia Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.8.2 By Therapeutics Area

9.4.6.9 Vietnam Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.9.2 By Therapeutics Area

9.4.6.10 Taiwan Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.4.6.10.2 By Therapeutics Area

9.4.6.11.2 By Therapeutics Area

9.5.6.1.2 By Therapeutics Area

9.5.6.2 U.A.E. Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.5.6.2.2 By Therapeutics Area

9.5.6.3 Israel Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.5.4.3.2 By Therapeutics Area

9.5.6.4.2 By Therapeutics Area

9.5.6.5.2 By Therapeutics Area

9.6.6.1 Brazil Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.6.6.1.2 By Therapeutics Area

9.6.6.2 Argentina Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.6.6.2.2 By Therapeutics Area

9.6.6.3 Chile Drug Discovery Outsourcing Market Estimates and Forecast, 2020-2028 (USD Million)

9.6.6.3.2 By Therapeutics Area

9.6.6.4.2 By Therapeutics Area

10.1 Company Market Share Analysis

10.2 Four Quadrant Positioning Matrix

10.4.1 Albany Molecular Research Inc.

10.4.1.1 Business Description & Financial Analysis

10.4.1.3 Poducts & Services Offered

10.4.1.4 Strategic Alliances between Business Partners

10.4.2 Thermo Fisher Scientific Inc.

10.4.2.1 Business Description & Financial Analysis

10.4.2.3 Poducts & Services Offered

10.4.2.4 Strategic Alliances between Business Partners

10.4.3 Laboratory Corporation of America Holdings

10.4.3.1 Business Description & Financial Analysis

10.4.3.3 Poducts & Services Offered

10.4.3.4 Strategic Alliances between Business Partners

10.4.4.1 Business Description & Financial Analysis

10.4.4.3 Poducts & Services Offered

10.4.4.4 Strategic Alliances between Business Partners

10.4.5 Pharmaceutical Product Development, LLC

10.4.5.1 Business Description & Financial Analysis

10.4.5.3 Poducts & Services Offered

10.4.5.4 Strategic Alliances between Business Partners

10.4.6.1 Business Description & Financial Analysis

10.4.6.3 Poducts & Services Offered

10.4.6.4 Strategic Alliances between Business Partners

10.4.7.1 Business Description & Financial Analysis

10.4.7.3 Poducts & Services Offered

10.4.7.4 Strategic Alliances between Business Partners

10.4.8.1 Business Description & Financial Analysis

10.4.8.3 Poducts & Services Offered

10.4.8.4 Strategic Alliances between Business Partners

10.4.9.1 Business Description & Financial Analysis

10.4.9.3 Poducts & Services Offered

10.4.9.4 Strategic Alliances between Business Partners

10.4.10 Dalton Pharma Services

10.4.10.1 Business Description & Financial Analysis

10.4.10.3 Poducts & Services Offered

10.4.10.4 Strategic Alliances between Business Partners

10.4.11.1 Business Description & Financial Analysis

10.4.11.3 Poducts & Services Offered

10.4.11.4 Strategic Alliances between Business Partners

11.1.2 Market Scope & SegInstrumentstation

11.2 Information ProcureInstrumentst

11.2.1.2 GMEs Internal Data Repository

11.2.1.3 Secondary Resources & Third Party Perspectives

11.2.1.4 Company Information Sources

11.2.2.1 Various Types of Respondents for Primary Interviews

11.2.2.2 Number of Interviews Conducted throughout the Research Process

11.2.2.4 Discussion Guide for Primary Participants

11.2.3.1 Expert Panels Across 30+ Industry

11.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

11.3.1.1 Macro-Economic Indicators Considered

11.3.1.2 Micro-Economic Indicators Considered

11.3.2.1 Company Share Analysis Approach

11.3.2.2 Estimation of Potential End User Sales

11.4.2 Time Series, Cross Sectional & Panel Data Analysis

11.5.1 Inhouse AI Based Real Time Analytics Tool

11.5.2 Output From Desk & Primary Research

11.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Mllion)

2 Target Identification & Screening Market, By Region, 2020-2028 (USD Mllion)

3 Target Validation & Functional InformaticsMarket, By Region, 2020-2028 (USD Mllion)

4 Lead Identification & Candidate Optimization Market, By Region, 2020-2028 (USD Mllion)

5 Preclinical DevelopmentMarket, By Region, 2020-2028 (USD Mllion)

6 Other Associated Workflow Market, By Region, 2020-2028 (USD Mllion)

7 Global Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Mllion)

8 Oncology Market, By Region, 2020-2028 (USD Mllion)

9 Infectious Disease Market, By Region, 2020-2028 (USD Mllion)

10 Respiratory Disease Market, By Region, 2020-2028 (USD Mllion)

11 Cardiovascular Market, By Region, 2020-2028 (USD Mllion)

12 Gastrointestinal Market, By Region, 2020-2028 (USD Mllion)

13 Others Market, By Region, 2020-2028 (USD Mllion)

14 Global Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Mllion)

15 Small Molecules Market, By Region, 2020-2028 (USD Mllion)

16 Large Molecules (Biopharmaceuticals) Market, By Region, 2020-2028 (USD Mllion)

17 Global Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Mllion)

18 Chemistry Services Market, By Region, 2020-2028 (USD Mllion)

19 Biology Services Market, By Region, 2020-2028 (USD Mllion)

20 Global Drug Discovery Outsourcing Market, By End User, 2020-2028 (USD Mllion)

21 Pharmaceutical & Biotechnology Companies Market, By Region, 2020-2028 (USD Mllion)

22 Academic Institutes Market, By Region, 2020-2028 (USD Mllion)

23 Others Market, By Region, 2020-2028 (USD Mllion)

24 Regional Analysis, 2020-2028 (USD Mllion)

25 North America Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

26 North America Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

27 North America Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

28 North America Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

29 North America Drug Discovery Outsourcing Market, By Country, 2020-2028 (USD Million)

30 North America Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

31 U.S Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

32 U.S Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

33 U.S Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

34 U.S Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

35 U.S America Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

36 Canada Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

37 Canada Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

38 Canada Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

39 CANADA Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

40 CANADA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

41 Mexico Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

42 Mexico Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

43 Mexico Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

44 mexico Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

45 MEXICO Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

46 Europe Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

47 Europe Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

48 Europe Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

49 europe Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

50 EUROPE Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

51 Germany Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

52 Germany Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

53 Germany Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

54 germany Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

55 GERMANY Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

56 U.K Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

57 U.K Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

58 U.K Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

59 U.k Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

60 U.K Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

61 France Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

62 France Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

63 France Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

64 france Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

65 FRANCE Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

66 Italy Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

67 Italy Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

68 Italy Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

69 italy Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

70 ITALY Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

71 Spain Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

72 Spain Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

73 Spain Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

74 spain Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

75 SPAIN Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

76 Rest Of Europe Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

77 Rest Of Europe Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

78 Rest of Europe Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

79 REST OF EUROPE Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

80 REST OF EUROPE Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

81 Asia Pacific Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

82 Asia Pacific Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

83 Asia Pacific Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

84 asia Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

85 Asia Pacific Drug Discovery Outsourcing Market, By Country, 2020-2028 (USD Million)

86 ASIA PACIFIC Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

87 China Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

88 China Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

89 China Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

90 china Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

91 CHINA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

92 India Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

93 India Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

94 India Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

95 india Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

96 INDIA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

97 Japan Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

98 Japan Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

99 Japan Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

100 japan Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

101 JAPAN Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

102 South Korea Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

103 South Korea Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

104 South Korea Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

105 south korea Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

106 SOUTH KOREA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

107 Middle East and Africa Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

108 Middle East and Africa Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

109 Middle East and Africa Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

110 MIDDLE EAST and AFRICA Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

111 Middle East and Africa Drug Discovery Outsourcing Market, By Country, 2020-2028 (USD Million)

112 MIDDLE EAST and AFRICA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

113 Saudi Arabia Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

114 Saudi Arabia Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

115 Saudi Arabia Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

116 saudi arabia Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

117 SAUDI ARABIA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

118 UAE Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

119 UAE Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

120 UAE Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

121 uae Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

122 UAE Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

123 Central and South America Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

124 Central and South America Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

125 Central and South America Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

126 CENTRAL and SOUTH AMERICA Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

127 Central and South America Drug Discovery Outsourcing Market, By Country, 2020-2028 (USD Million)

128 CENTRAL and SOUTH AMERICA Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

129 Brazil Drug Discovery Outsourcing Market, By Workflow, 2020-2028 (USD Million)

130 Brazil Drug Discovery Outsourcing Market, By Therapeutics Area, 2020-2028 (USD Million)

131 Brazil Drug Discovery Outsourcing Market, By Drug Type, 2020-2028 (USD Million)

132 brazil Drug Discovery Outsourcing Market, By Service Type, 2020-2028 (USD Million)

133 BRAZIL Drug Discovery Outsourcing Market, By END USER, 2020-2028 (USD Million)

134 Albany Molecular Research Inc.: PRODUCTS & SERVICES OFFERING

135 Thermo Fisher Scientific Inc.: PRODUCTS & SERVICES OFFERING

136 Laboratory Corporation of America Holdings: PRODUCTS & SERVICES OFFERING

137 GenScript: PRODUCTS & SERVICES OFFERING

138 Pharmaceutical Product Development, LLC: PRODUCTS & SERVICES OFFERING

139 EVOTEC: PRODUCTS & SERVICES OFFERING

140 Charles River : PRODUCTS & SERVICES OFFERING

141 WuXi AppTec: PRODUCTS & SERVICES OFFERING

142 Merck & Co., Inc., Inc: PRODUCTS & SERVICES OFFERING

143 Dalton Pharma Services: PRODUCTS & SERVICES OFFERING

144 Other Companies: PRODUCTS & SERVICES OFFERING

LIST OF FIGURES

1 Global Drug Discovery Outsourcing Market Overview

2 Global Drug Discovery Outsourcing Market Value From 2020-2028 (USD Mllion)

3 Global Drug Discovery Outsourcing Market Share, By Workflow (2022)

4 Global Drug Discovery Outsourcing Market Share, By Therapeutics Area (2022)

5 Global Drug Discovery Outsourcing Market Share, By Drug Type (2022)

6 Global Drug Discovery Outsourcing Market Share, By Service Type (2022)

7 Global Drug Discovery Outsourcing Market Share, By End User (2022)

8 Global Drug Discovery Outsourcing Market, By Region (Asia Pacific Market)

9 Technological Trends In Global Drug Discovery Outsourcing Market

10 Four Quadrant Competitor Positioning Matrix

11 Impact Of Macro & Micro Indicators On The Market

12 Impact Of Key Drivers On The Global Drug Discovery Outsourcing Market

13 Impact Of Challenges On The Global Drug Discovery Outsourcing Market

14 Porter’s Five Forces Analysis

15 Global Drug Discovery Outsourcing Market: By Workflow Scope Key Takeaways

16 Global Drug Discovery Outsourcing Market, By Workflow Segment: Revenue Growth Analysis

17 Target Identification & Screening Market, By Region, 2020-2028 (USD Mllion)

18 Target Validation & Functional InformaticsMarket, By Region, 2020-2028 (USD Mllion)

19 Lead Identification & Candidate Optimization Market, By Region, 2020-2028 (USD Mllion)

20 Preclinical Development Market, By Region, 2020-2028 (USD Mllion)

21 Other Associated Workflow Market, By Region, 2020-2028 (USD Mllion)

22 Global Drug Discovery Outsourcing Market: By Therapeutics Area Scope Key Takeaways

23 Global Drug Discovery Outsourcing Market, By Therapeutics Area Segment: Revenue Growth Analysis

24 Oncology Market, By Region, 2020-2028 (USD Mllion)

25 Infectious Disease Market, By Region, 2020-2028 (USD Mllion)

26 Respiratory Disease Market, By Region, 2020-2028 (USD Mllion)

27 Cardiovascular Market, By Region, 2020-2028 (USD Mllion)

28 Gastrointestinal Market, By Region, 2020-2028 (USD Mllion)

29 Others Market, By Region, 2020-2028 (USD Mllion)

30 Global Drug Discovery Outsourcing Market: By Drug Type Scope Key Takeaways

31 Global Drug Discovery Outsourcing Market, By Drug Type Segment: Revenue Growth Analysis

32 Small Molecules Market, By Region, 2020-2028 (USD Mllion)

33 Large Molecules (Biopharmaceuticals) Market, By Region, 2020-2028 (USD Mllion)

34 Global Drug Discovery Outsourcing Market: By Service Type Scope Key Takeaways

35 Global Drug Discovery Outsourcing Market, By Service Type Segment: Revenue Growth Analysis

36 Chemistry Services Market, By Region, 2020-2028 (USD Mllion)

37 Biology Services Market, By Region, 2020-2028 (USD Mllion)

38 Global Drug Discovery Outsourcing Market: By End User Scope Key Takeaways

39 Global Drug Discovery Outsourcing Market, By End User Segment: Revenue Growth Analysis

40 Pharmaceutical & Biotechnology Companies Market, By Region, 2020-2028 (USD Mllion)

41 Academic Institutes Market, By Region, 2020-2028 (USD Mllion)

42 Others Market, By Region, 2020-2028 (USD Mllion)

43 Regional Segment: Revenue Growth Analysis

44 Global Drug Discovery Outsourcing Market: Regional Analysis

45 North America Drug Discovery Outsourcing Market Overview

46 North America Drug Discovery Outsourcing Market, By Workflow

47 North America Drug Discovery Outsourcing Market, By Therapeutics Area

48 North America Drug Discovery Outsourcing Market, By Drug Type

49 North America Drug Discovery Outsourcing Market, By Service Type

50 North America Drug Discovery Outsourcing Market, By End User

51 North America Drug Discovery Outsourcing Market, By Country

52 U.S. Drug Discovery Outsourcing Market, By Workflow

53 U.S. Drug Discovery Outsourcing Market, By Therapeutics Area

54 U.S. Drug Discovery Outsourcing Market, By Drug Type

55 U.S. Drug Discovery Outsourcing Market, By Service Type

56 U.S. Drug Discovery Outsourcing Market, By End User

57 Canada Drug Discovery Outsourcing Market, By Workflow

58 Canada Drug Discovery Outsourcing Market, By Therapeutics Area

59 Canada Drug Discovery Outsourcing Market, By Drug Type

60 Canada Drug Discovery Outsourcing Market, By Service Type

61 Canada Drug Discovery Outsourcing Market, By End User

62 Mexico Drug Discovery Outsourcing Market, By Workflow

63 Mexico Drug Discovery Outsourcing Market, By Therapeutics Area

64 Mexico Drug Discovery Outsourcing Market, By Drug Type

65 Mexico Drug Discovery Outsourcing Market, By Service Type

66 Mexico Drug Discovery Outsourcing Market, By End User

67 Four Quadrant Positioning Matrix

68 Company Market Share Analysis

69 Albany Molecular Research Inc.: Company Snapshot

70 Albany Molecular Research Inc.: SWOT Analysis

71 Albany Molecular Research Inc.: Geographic Presence

72 Thermo Fisher Scientific Inc.: Company Snapshot

73 Thermo Fisher Scientific Inc.: SWOT Analysis

74 Thermo Fisher Scientific Inc.: Geographic Presence

75 Laboratory Corporation of America Holdings: Company Snapshot

76 Laboratory Corporation of America Holdings: SWOT Analysis

77 Laboratory Corporation of America Holdings: Geographic Presence

78 GenScript: Company Snapshot

79 GenScript: Swot Analysis

80 GenScript: Geographic Presence

81 Pharmaceutical Product Development, LLC: Company Snapshot

82 Pharmaceutical Product Development, LLC: SWOT Analysis

83 Pharmaceutical Product Development, LLC: Geographic Presence

84 EVOTEC: Company Snapshot

85 EVOTEC: SWOT Analysis

86 EVOTEC: Geographic Presence

87 Charles River : Company Snapshot

88 Charles River : SWOT Analysis

89 Charles River : Geographic Presence

90 WuXi AppTec: Company Snapshot

91 WuXi AppTec: SWOT Analysis

92 WuXi AppTec: Geographic Presence

93 Merck & Co., Inc., Inc.: Company Snapshot

94 Merck & Co., Inc., Inc.: SWOT Analysis

95 Merck & Co., Inc., Inc.: Geographic Presence

96 Dalton Pharma Services: Company Snapshot

97 Dalton Pharma Services: SWOT Analysis

98 Dalton Pharma Services: Geographic Presence

99 Other Companies: Company Snapshot

100 Other Companies: SWOT Analysis

101 Other Companies: Geographic Presence

The Global Drug Discovery Outsourcing Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Drug Discovery Outsourcing Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS