Global Dry Docking Services Market Size, Trends & Analysis - Forecasts to 2027 By Type (Coating, Repairs and Maintenance, Cleaning, and Others), By End-user Industry (Container Ships, Bulk Carriers, Tanker Ships, Passenger Ships, Naval Ships), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

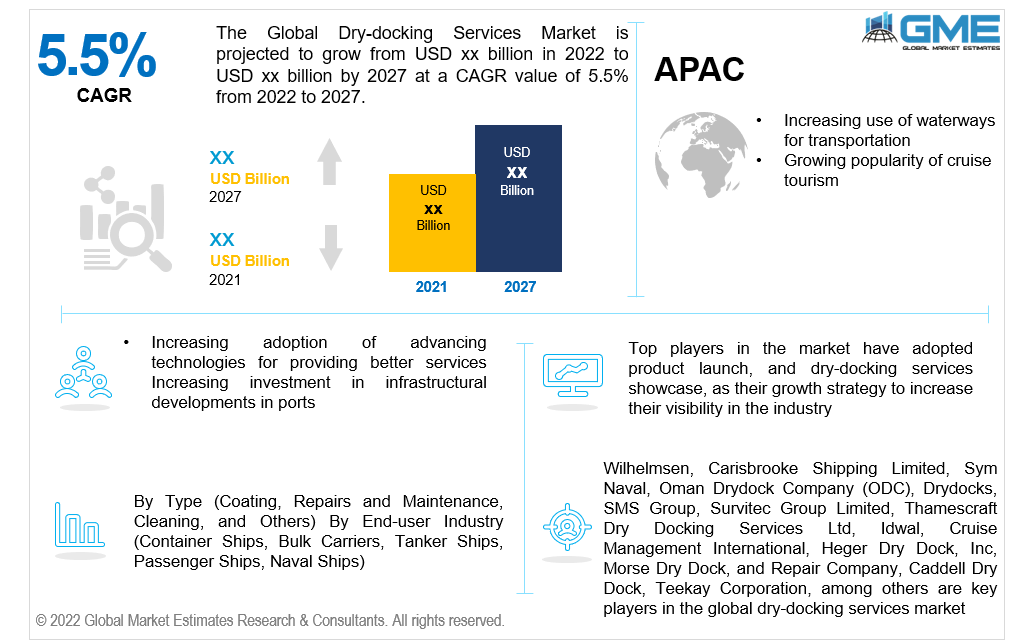

The Global Dry-Docking Services Market is projected to grow at a CAGR value of 5.5% from 2022 to 2027.

Drydocking is a ship maintenance process that has been used for decades. It is the process of building, repairing, and maintaining ships in a location known as the 'lock” and a dry dock's primary function is to expose undersea components for inspection, repair, and maintenance.

Major driving factors influencing the market growth during the forecast period, are the increasing use of waterways for transportation, the growing popularity of cruise tourism, and growing preference for ships such as container ships, bulk carriers, tanker ships, passenger ships, and naval ships on the sea.

The expansion of the dry-docking services market is driven by increasing investment in infrastructural developments in ports, expanding employment opportunities in dry dock services, and rising global sea trade among countries. Additionally, rapidly rising investment in advanced technologies and innovation for providing better services, increasing the adoption of automation for repair services, and burgeoning emphasis on improving naval capabilities by global economies are also propelling market expansion during the forecast period.

Favorable government initiatives and expenditure to uplift marine services, increase in the usage of cargo ships, coupled with increasing research and development for technological breakthroughs and innovation-led manufacturers to develop updated dry-docking services are driving the market growth.

In addition, rigorous sea provisions and laws governing ships to obtain periodic accreditations, as well as substantial collaborative partnerships and alliances among various stakeholder groups to endorse the naval forces' and navy ship development programs, are assisting businesses in gaining a sturdy and leading stance in the coming years.

One of the primary factors positively driving the market growth is increasing digitization across industrial verticals. Aside from safeguarding the boat's hull and drives, effective dry-docking makes it much easier to board, fuel, and maintain the watercraft. A dry-docked yacht also eliminates the need for lines and bumpers, as well as scrapes and bruises from banging around with a tied-off wet slip mooring.

The COVID-19 pandemic has had a detrimental influence on the global dry-docking services business, as this has harmed the ability of producers and suppliers to market their products. The outbreak also had an impact on marine trade, as limitations caused shipping services to be halted, leading to vessels not being utilized nor managed.

Nonetheless, the whole dock scaffolding building and disassembly, column and pontoon repair, operational mechanisms needing costly maintenance, and niches must always be carved into sidewalls to ensure clearance are all significant issues hindering market expansion.

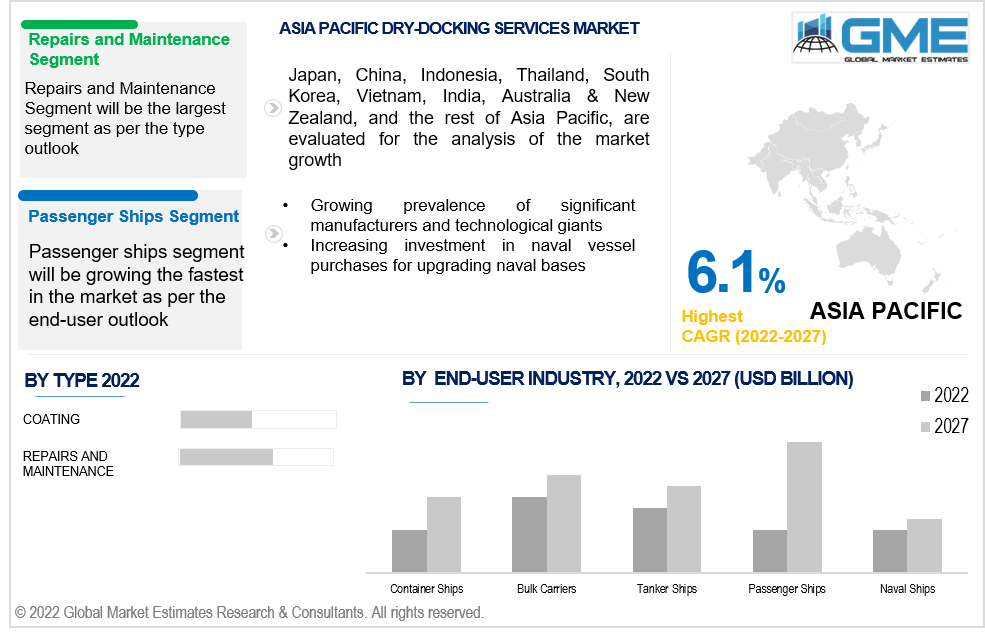

The dry-docking services market is segmented as coating, repairs and maintenance, cleaning, and others based on the type. The repairs and maintenance segment is expected to grow the fastest in the dry-docking services market from 2022 to 2027.

The market is segmented into container ships, bulk carriers, tanker ships, passenger ships, and naval ships, based on the end-user industry. The passenger ships segment is expected to grow the fastest in the dry-docking services market from 2022 to 2027. The rise of the tourist and hospitality business, as well as the growing popularity of traveling by ship as a result of the improving economy and increased disposable income, are significant drivers driving the segment's growth.

As per the geographical analysis, the global dry docking services market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will dominate the global share in the global dry-docking services market from 2022 to 2027. The increasing purchase of passenger and naval ships for tourism and defense purposes, increasing emphasis on improving naval capabilities, investment in dry docking services, and stringent regulations for ship quality are some of the factors propelling market growth in this region.

Moreover, the Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific) region is expected to be the fastest-growing segment in the global dry-docking services market during the forecast period between 2022 and 2027. The increasing use of waterways for transportation, the growing popularity of cruise tourism, growing prevalence of significant manufacturers and technological giants coupled with increasing investment in naval vessel purchases for upgrading naval bases are some factors likely to propel market expansion in the region.

Wilhelmsen, Carisbrooke Shipping Limited, Sym Naval, Oman Drydock Company (ODC), Drydocks, SMS Group, Survitec Group Limited, Thamescraft Dry Docking Services Ltd, Idwal, Cruise Management International, Heger Dry Dock, Inc, Morse Dry Dock, and Repair Company, Caddell Dry Dock, Teekay Corporation, among others are key players in the global dry-docking services market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Dry-Docking Services Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 End-user Industry Overview

2.1.4 Regional Overview

Chapter 3 Dry-Docking Services Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing use of waterways for transportation

3.3.2 Industry Challenges

3.3.2.1 Service of a ship is time consuming

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 End-user Industry Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 Dry-Docking Services Market, By Type

4.1 Type Outlook

4.2 Coating

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Repairs and Maintenance

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Cleaning

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

4.5 Others

4.5.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 Dry-Docking Services Market, By End-user Industry

5.1 End-user Industry Outlook

5.2 Container Ships

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Bulk Carriers

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Tanker Ships

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

5.5 Passenger Ships

5.5.1 Market Size, By Region, 2022-2027 (USD Billion)

5.6 Naval Ships

5.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 Dry-Docking Services Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2022-2027 (USD Billion)

6.2.2 Market Size, By Type, 2022-2027 (USD Billion)

6.2.3 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.2.4.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.2.5.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2022-2027 (USD Billion)

6.3.2 Market Size, By Type, 2022-2027 (USD Billion)

6.3.3 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.4.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.5.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.6.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.7.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.8.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2022-2027 (USD Billion)

6.3.9.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2022-2027 (USD Billion)

6.4.2 Market Size, By Type, 2022-2027 (USD Billion)

6.4.3 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.4.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.5.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.6.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.7.2 Market size, By End-user Industry, 2022-2027 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2022-2027 (USD Billion)

6.4.8.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2022-2027 (USD Billion)

6.5.2 Market Size, By Type, 2022-2027 (USD Billion)

6.5.3 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.5.4.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.5.5.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.5.6.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2022-2027 (USD Billion)

6.6.2 Market Size, By Type, 2022-2027 (USD Billion)

6.6.3 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2022-2027 (USD Billion)

6.6.4.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2022-2027 (USD Billion)

6.6.5.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2022-2027 (USD Billion)

6.6.6.2 Market Size, By End-user Industry, 2022-2027 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2022

7.2 Wilhelmsen

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Carisbrooke Shipping Limited

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Sym Naval

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 Oman Drydock Company (ODC)

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Drydocks

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 SMS Group

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Survitec Group Limited

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 Thamescraft Dry Docking Services Ltd

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Dry Docking Services Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Dry Docking Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS