Global E-merchandising Market Size, Trends & Analysis - Forecasts to 2029 By Industry Vertical (Apparel & Footwear, Groceries & Food, Home & Furniture, Electronics & Jewelry, Beauty & Personal Care, and Others), By Pricing Model (Subscription and On-time License), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

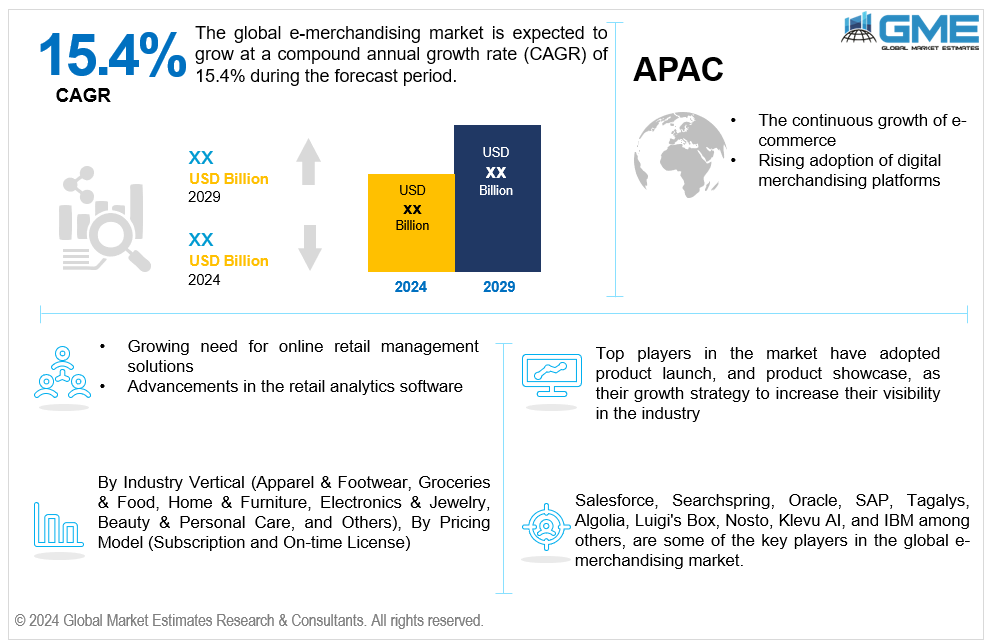

The global e-merchandising market is estimated to exhibit a CAGR of 15.4% from 2024 to 2029.

The primary factors propelling the market growth are the continuous growth of the e-commerce industry and the rising adoption of digital merchandising platforms. With more businesses establishing an online presence, there is an escalating demand for effective digital retail strategy platforms to differentiate brands in the competitive digital landscape. E-commerce optimization tools, such as retail data analytics solutions and AI-driven platforms, empower businesses to understand customer behavior, optimize product placement, and enhance user experience, thus driving sales and revenue. Additionally, e-commerce merchandising platforms provide comprehensive solutions for managing product catalogs, creating visually appealing storefronts, and implementing dynamic pricing strategies. Furthermore, digital commerce solutions integrate e-merchandising capabilities across various web, mobile, and social media channels to deliver consistent and engaging customer shopping experiences. For instance, according to Manaferra Inc. (2024), mobile shopping accounts for 63% of all e-commerce purchases worldwide.

The growing need for online retail management solutions and advancements in retail analytics software are expected to support the market growth. As the e-commerce landscape continues to evolve, businesses face increasing complexity in managing their online retail operations efficiently. Retail merchandising technology plays a crucial role in streamlining this process by enabling companies to effectively curate product assortments, optimize pricing strategies, and enhance visual merchandising tactics to attract and engage customers. Web-based retail optimization solutions, including web merchandising tools, allow businesses to adapt to changing market dynamics and consumer preferences in real-time, maximizing sales and profitability. Moreover, online inventory management systems play a pivotal role in ensuring accurate inventory tracking, replenishment, and fulfilment, ultimately improving operational efficiency and customer satisfaction.

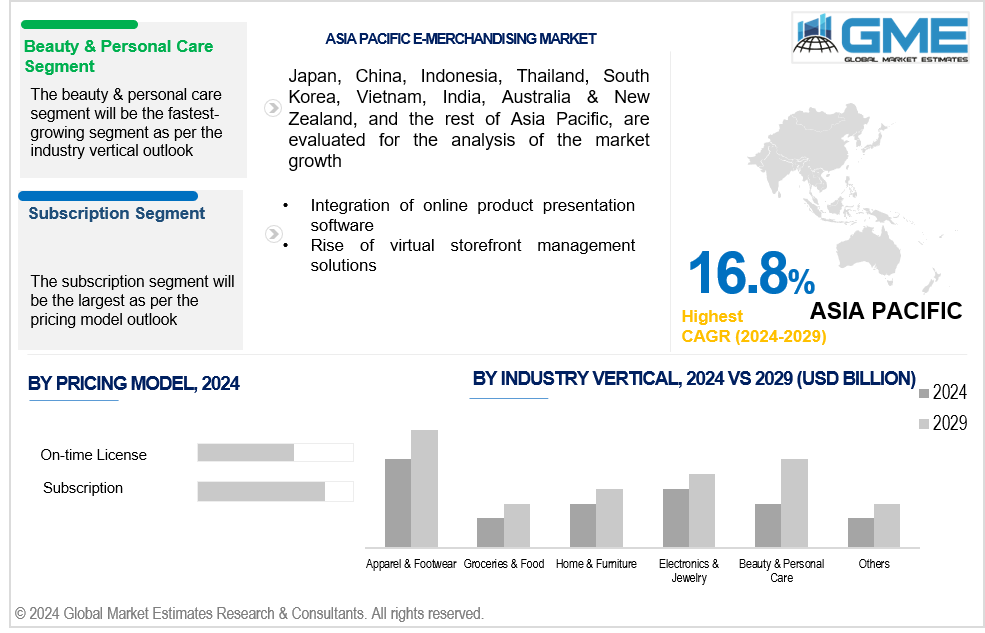

Integration of online product presentation software and the rise of virtual storefront management solutions propel market growth. Digital storefront optimization solutions empower businesses to enhance their online storefronts' visual appeal, usability, and overall performance, thereby improving customer engagement and conversion rates. Moreover, online product placement software enables businesses to strategically position products within their virtual storefronts based on popularity, seasonality, and customer preferences, maximizing visibility and sales potential. Additionally, dynamic product showcasing solutions allow businesses to create interactive and personalized shopping experiences by showcasing products dynamically based on user behavior and preference.

With the increasing integration of online and offline channels, there is a growing opportunity for e-merchandising solutions that facilitate seamless omnichannel retail experiences. By implementing e-merchandising techniques that integrate consumer experiences across many touchpoints, such as websites, mobile applications, social media, and physical stores, businesses can take advantage of this trend. Moreover, the widespread use of online retail software presents a substantial opportunity for companies to improve their e-merchandising capabilities. Numerous features are available with these software programs, including analytics, product suggestions, inventory management, and tailored marketing.

However, consumer aversion to invasive marketing strategies and concerns about data security and privacy impede market growth.

The apparel & footwear segment is expected to hold the largest share of the market over the forecast period. Apparel and footwear are among the most frequently purchased items online. Online shoppers are more at ease when purchasing apparel and footwear owing to convenient return policies, sophisticated size tools, and enhanced visualization technology. Fashion trends and seasonal changes can significantly impact apparel and footwear sales. E-commerce platforms use data analytics and merchandising techniques to take advantage of these trends to provide customers with curated collections and tailored suggestions.

The beauty & personal care segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Niche and independent companies that target specific consumer demands and preferences have become increasingly prominent in the beauty & personal care industry. By avoiding traditional retail channels, e-commerce platforms provide these companies with a platform to reach a bigger audience. The ability to find and buy specialty beauty items online plays an essential role in the e-merchandising beauty segment's rapid growth.

The subscription segment is expected to hold the largest share of the market over the forecast period. By delivering products that customers use regularly, subscription services give customers convenience and predictability. Subscribers prefer the ease of having necessities delivered to their houses regularly without placing new orders—be it food, clothing, or cosmetics, supporting the segment's growth.

The on-time license segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The on-time license model provides flexibility and scalability for companies of all sizes. Rather than committing to continuous subscription costs, clients can buy licenses for individual programs or services as needed. Companies that need e-merchandising solutions but would instead control expenditures per project or usage find this flexibility appealing.

North America is expected to be the largest region in the global market. With ongoing developments in fields like artificial intelligence, augmented reality, and data analytics, North America is a center for technological innovation, propelling market growth in the region. E-merchandising platforms use these technologies to improve user experiences, customize suggestions, and maximize marketing tactics.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The Asia Pacific region has a significant mobile-first population, with numerous consumers accessing the internet primarily through smartphones. Growing numbers of consumers are making purchases through mobile applications and websites while they are on the go, which is a significant factor contributing to the growth of the e-merchandising market in the region.

Salesforce, Searchspring, Oracle, SAP, Tagalys, Algolia, Luigi's Box, Nosto, Klevu AI, and IBM, among others, are some of the key players operating in the global e-merchandising market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2024, Dotdigital, an all-in-one platform for customer experience and analytics, and Searchspring unveiled a new integration that would improve email marketing by making product recommendations based on the recipient's brand interactions.

In January 2024, Algolia unveiled crucial new features that drive greater efficiencies by utilizing Algolia's next-generation AI-enhanced, data-driven Merchandising Studio, which propels companies into a new era of efficiency and profitability. These features eliminate the hassle of having to merchandise hundreds of category and product landing pages manually.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL E-MERCHANDISING MARKET, BY Industry Vertical

4.1 Introduction

4.2 E-merchandising Market: Industry Vertical Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Apparel & Footwear

4.4.1 Apparel & Footwear Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Groceries & Food

4.5.1 Groceries & Food Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Home & Furniture

4.6.1 Home & Furniture Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 Electronics & Jewelry

4.7.1 Electronics & Jewelry Market Estimates and Forecast, 2021-2029 (USD Million)

4.8 Beauty & Personal Care

4.8.1 Beauty & Personal Care Market Estimates and Forecast, 2021-2029 (USD Million)

4.9 Others

4.9.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL E-MERCHANDISING MARKET, BY PRICING MODEL

5.1 Introduction

5.2 E-merchandising Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Subscription

5.4.1 Subscription Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 On-time License

5.5.1 On-time License Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL E-MERCHANDISING MARKET, BY REGION

6.1 Introduction

6.2 North America E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Industry Vertical

6.2.2 By Pricing Model

6.2.3 By Country

6.2.3.1 U.S. E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Industry Vertical

6.2.3.1.2 By Pricing Model

6.2.3.2 Canada E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Industry Vertical

6.2.3.2.2 By Pricing Model

6.2.3.3 Mexico E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Industry Vertical

6.2.3.3.2 By Pricing Model

6.3 Europe E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Industry Vertical

6.3.2 By Pricing Model

6.3.3 By Country

6.3.3.1 Germany E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Industry Vertical

6.3.3.1.2 By Pricing Model

6.3.3.2 U.K. E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Industry Vertical

6.3.3.2.2 By Pricing Model

6.3.3.3 France E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Industry Vertical

6.3.3.3.2 By Pricing Model

6.3.3.4 Italy E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Industry Vertical

6.3.3.4.2 By Pricing Model

6.3.3.5 Spain E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Industry Vertical

6.3.3.5.2 By Pricing Model

6.3.3.6 Netherlands E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Industry Vertical

6.3.3.6.2 By Pricing Model

6.3.3.7 Rest of Europe E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Industry Vertical

6.3.3.6.2 By Pricing Model

6.4 Asia Pacific E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Industry Vertical

6.4.2 By Pricing Model

6.4.3 By Country

6.4.3.1 China E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Industry Vertical

6.4.3.1.2 By Pricing Model

6.4.3.2 Japan E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Industry Vertical

6.4.3.2.2 By Pricing Model

6.4.3.3 India E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Industry Vertical

6.4.3.3.2 By Pricing Model

6.4.3.4 South Korea E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Industry Vertical

6.4.3.4.2 By Pricing Model

6.4.3.5 Singapore E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Industry Vertical

6.4.3.5.2 By Pricing Model

6.4.3.6 Malaysia E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Industry Vertical

6.4.3.6.2 By Pricing Model

6.4.3.7 Thailand E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Industry Vertical

6.4.3.6.2 By Pricing Model

6.4.3.8 Indonesia E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Industry Vertical

6.4.3.7.2 By Pricing Model

6.4.3.9 Vietnam E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Industry Vertical

6.4.3.8.2 By Pricing Model

6.4.3.10 Taiwan E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Industry Vertical

6.4.3.10.2 By Pricing Model

6.4.3.11 Rest of Asia Pacific E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Industry Vertical

6.4.3.11.2 By Pricing Model

6.5 Middle East and Africa E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Industry Vertical

6.5.2 By Pricing Model

6.5.3 By Country

6.5.3.1 Saudi Arabia E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Industry Vertical

6.5.3.1.2 By Pricing Model

6.5.3.2 U.A.E. E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Industry Vertical

6.5.3.2.2 By Pricing Model

6.5.3.3 Israel E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Industry Vertical

6.5.3.3.2 By Pricing Model

6.5.3.4 South Africa E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Industry Vertical

6.5.3.4.2 By Pricing Model

6.5.3.5 Rest of Middle East and Africa E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Industry Vertical

6.5.3.5.2 By Pricing Model

6.6 Central and South America E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Industry Vertical

6.6.2 By Pricing Model

6.6.3 By Country

6.6.3.1 Brazil E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Industry Vertical

6.6.3.1.2 By Pricing Model

6.6.3.2 Argentina E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Industry Vertical

6.6.3.2.2 By Pricing Model

6.6.3.3 Chile E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Industry Vertical

6.6.3.3.2 By Pricing Model

6.6.3.3 Rest of Central and South America E-merchandising Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Industry Vertical

6.6.3.3.2 By Pricing Model

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 IBM

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Salesforce

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Searchspring

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Oracle

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 SAP

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 TAGALYS

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Algolia

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Luigi’s Box

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Nosto

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Klevu AI

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Type of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

2 Apparel & Footwear Market, By Region, 2021-2029 (USD Mllion)

3 Groceries & Food Market, By Region, 2021-2029 (USD Mllion)

4 Home & Furniture Market, By Region, 2021-2029 (USD Mllion)

5 Electronics & Jewelry Market, By Region, 2021-2029 (USD Mllion)

6 Beauty & Personal Care Market, By Region, 2021-2029 (USD Mllion)

7 Others Market, By Region, 2021-2029 (USD Mllion)

8 Global E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

9 Subscription Market, By Region, 2021-2029 (USD Mllion)

10 On-time License Market, By Region, 2021-2029 (USD Mllion)

11 Regional Analysis, 2021-2029 (USD Mllion)

12 North America E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

13 North America E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

14 North America E-merchandising Market, By COUNTRY, 2021-2029 (USD Mllion)

15 U.S. E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

16 U.S. E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

17 Canada E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

18 Canada E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

19 Mexico E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

20 Mexico E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

21 Europe E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

22 Europe E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

23 EUROPE E-merchandising Market, By COUNTRY, 2021-2029 (USD Mllion)

24 Germany E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

25 Germany E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

26 U.K. E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

27 U.K. E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

28 France E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

29 France E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

30 Italy E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

31 Italy E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

32 Spain E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

33 Spain E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

34 Netherlands E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

35 Netherlands E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

36 Rest Of Europe E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

37 Rest Of Europe E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

38 Asia Pacific E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

39 Asia Pacific E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

40 ASIA PACIFIC E-merchandising Market, By COUNTRY, 2021-2029 (USD Mllion)

41 China E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

42 China E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

43 Japan E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

44 Japan E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

45 India E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

46 India E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

47 South Korea E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

48 South Korea E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

49 Singapore E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

50 Singapore E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

51 Thailand E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

52 Thailand E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

53 Malaysia E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

54 Malaysia E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

55 Indonesia E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

56 Indonesia E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

57 Vietnam E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

58 Vietnam E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

59 Taiwan E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

60 Taiwan E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

61 Rest of APAC E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

62 Rest of APAC E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

63 Middle East and Africa E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

64 Middle East and Africa E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

65 MIDDLE EAST & ADRICA E-merchandising Market, By COUNTRY, 2021-2029 (USD Mllion)

66 Saudi Arabia E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

67 Saudi Arabia E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

68 UAE E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

69 UAE E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

70 Israel E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

71 Israel E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

72 South Africa E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

73 South Africa E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

74 Rest Of Middle East and Africa E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

75 Rest Of Middle East and Africa E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

76 Central and South America E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

77 Central and South America E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

78 CENTRAL AND SOUTH AMERICA E-merchandising Market, By COUNTRY, 2021-2029 (USD Mllion)

79 Brazil E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

80 Brazil E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

81 Chile E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

82 Chile E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

83 Argentina E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

84 Argentina E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

85 Rest Of Central and South America E-merchandising Market, By Industry Vertical, 2021-2029 (USD Mllion)

86 Rest Of Central and South America E-merchandising Market, By Pricing Model, 2021-2029 (USD Mllion)

87 IBM: Products & Services Offering

88 Salesforce: Products & Services Offering

89 Searchspring: Products & Services Offering

90 Oracle: Products & Services Offering

91 SAP: Products & Services Offering

92 TAGALYS: Products & Services Offering

93 Algolia: Products & Services Offering

94 Luigi’s Box: Products & Services Offering

95 Nosto, Inc: Products & Services Offering

96 Klevu AI: Products & Services Offering

97 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global E-merchandising Market Overview

2 Global E-merchandising Market Value From 2021-2029 (USD Mllion)

3 Global E-merchandising Market Share, By Industry Vertical (2023)

4 Global E-merchandising Market Share, By Pricing Model (2023)

5 Global E-merchandising Market, By Region (Asia Pacific Market)

6 Technological Trends In Global E-merchandising Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global E-merchandising Market

10 Impact Of Challenges On The Global E-merchandising Market

11 Porter’s Five Forces Analysis

12 Global E-merchandising Market: By Industry Vertical Scope Key Takeaways

13 Global E-merchandising Market, By Industry Vertical Segment: Revenue Growth Analysis

14 Apparel & Footwear Market, By Region, 2021-2029 (USD Mllion)

15 Groceries & Food Market, By Region, 2021-2029 (USD Mllion)

16 Home & Furniture Market, By Region, 2021-2029 (USD Mllion)

17 Electronics & Jewelry Market, By Region, 2021-2029 (USD Mllion)

18 Beauty & Personal Care Market, By Region, 2021-2029 (USD Mllion)

19 Others Market, By Region, 2021-2029 (USD Mllion)

20 Global E-merchandising Market: By Pricing Model Scope Key Takeaways

21 Global E-merchandising Market, By Pricing Model Segment: Revenue Growth Analysis

22 Subscription Market, By Region, 2021-2029 (USD Mllion)

23 On-time License Market, By Region, 2021-2029 (USD Mllion)

24 Global E-merchandising Market: Regional Analysis

25 North America E-merchandising Market Overview

26 North America E-merchandising Market, By Industry Vertical

27 North America E-merchandising Market, By Pricing Model

28 North America E-merchandising Market, By Country

29 U.S. E-merchandising Market, By Industry Vertical

30 U.S. E-merchandising Market, By Pricing Model

31 Canada E-merchandising Market, By Industry Vertical

32 Canada E-merchandising Market, By Pricing Model

33 Mexico E-merchandising Market, By Industry Vertical

34 Mexico E-merchandising Market, By Pricing Model

35 Four Quadrant Positioning Matrix

36 Company Market Share Analysis

37 IBM: Company Snapshot

38 IBM: SWOT Analysis

39 IBM: Geographic Presence

40 Salesforce: Company Snapshot

41 Salesforce: SWOT Analysis

42 Salesforce: Geographic Presence

43 Searchspring: Company Snapshot

44 Searchspring: SWOT Analysis

45 Searchspring: Geographic Presence

46 Oracle: Company Snapshot

47 Oracle: Swot Analysis

48 Oracle: Geographic Presence

49 SAP: Company Snapshot

50 SAP: SWOT Analysis

51 SAP: Geographic Presence

52 TAGALYS: Company Snapshot

53 TAGALYS: SWOT Analysis

54 TAGALYS: Geographic Presence

55 Algolia : Company Snapshot

56 Algolia : SWOT Analysis

57 Algolia : Geographic Presence

58 Luigi’s Box: Company Snapshot

59 Luigi’s Box: SWOT Analysis

60 Luigi’s Box: Geographic Presence

61 Nosto, Inc.: Company Snapshot

62 Nosto, Inc.: SWOT Analysis

63 Nosto, Inc.: Geographic Presence

64 Klevu AI: Company Snapshot

65 Klevu AI: SWOT Analysis

66 Klevu AI: Geographic Presence

67 Other Companies: Company Snapshot

68 Other Companies: SWOT Analysis

69 Other Companies: Geographic Presence

The Global E-merchandising Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the E-merchandising Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS