Global Egg Processing Equipment Market Size, Trends & Analysis - Forecasts to 2026 By Product (Frozen, Liquid, Dried), By Application (Dairy, Soups & Sauces, Baking, Confectionery, Ready to Eat (RTE)), By Region (North America, Europe, Asia Pacific, MEA, and CSA), End-User Landscape, Company Market Share Analysis, and Competitor Analysis

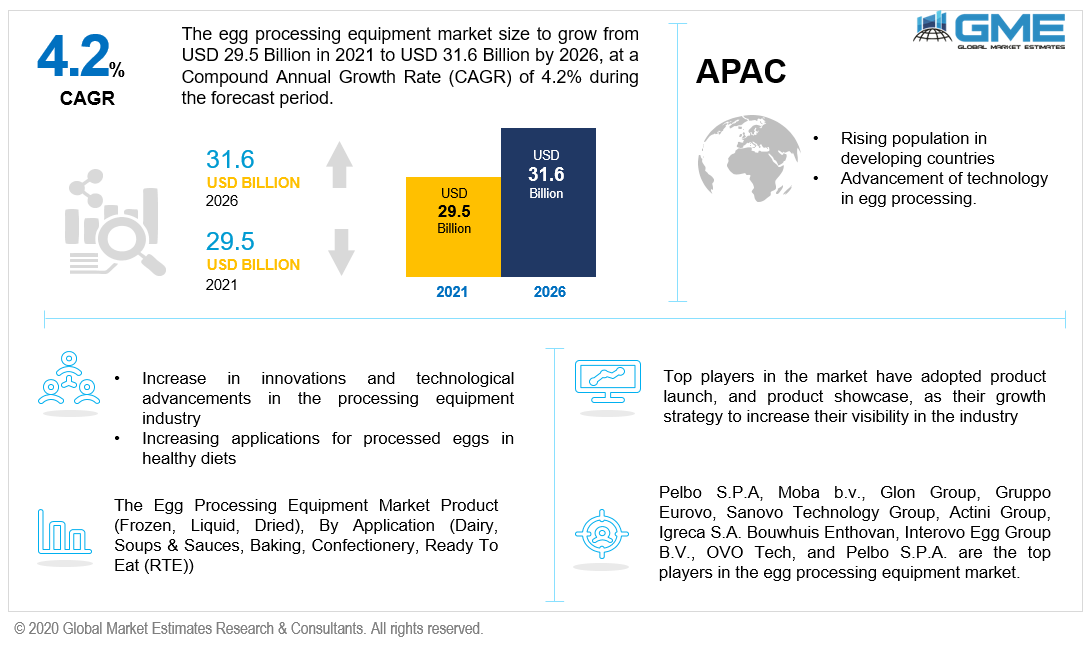

The global egg processing equipment market is projected to grow from USD 29.5 billion in 2021 to USD 31.6 billion by 2026 at a CAGR value of 4.2%. Leading drivers that are accelerating the egg processing equipment market are rising advancement in egg processing technology and increasing product launch activities by top manufacturers. The entry of new players in the market is also boosting the growth. Rising demand for egg products along with shift of consumer preference towards processed foods is helping the market gain traction.

The extraction of eggshells, filtration, mixing and blending, stabilizing, pasteurizing, cooling or drying, and packing are all stages in the processing of the eggs, and at different stages of the egg process, various types of machinery are used by manufacturers.

Egg processing machinery is a generic term for an automated assembly of machines that are used at different stages of the process. Processed eggs are commonly used in a variety of recipes, including baked goods, dairy products and dairy drinks, and confectionery. Processed eggs have better mechanical properties, such as increased freshness, longer shelf life, and ease of handling and distribution.

With the rising urban and rural population, with the changing food lifestyles there has been an increase in the demand for convenience foods, packaged and processed foods. Processed eggs minimize the need to physically break shells and separate distinct egg components, such as yolk and egg white. Furthermore, the lower risk of pollutants and germs in processed eggs is another aspect that is helping the market grow rapidly.

Egg production machinery is a catch-all word for a set of automatic machines used at various stages of the egg processing process. Baked products, cheese, and dairy foods, and confectionary are the products that use processed eggs. Processed eggs have improved mechanical properties, like freshness, lifespan, handling, and delivery convenience. The term "egg production machinery" refers to a group of automated machines that are used at different stages of the egg processing process. Processed eggs are used in baked goods, cheese, and dairy items, and confectionary, to name a few. Freshness, shelf life, handling, and shipping ease are all enhanced as eggs are processed and hence because of these advantages, the market is growing rapidly.

The most common varieties of egg products are liquid, frozen, and dry egg products, which come in whole shells, whites, yolks, and assorted blends. These egg products are commonly used as components in products such as spaghetti, noodles, salad dressings, and milk products in the food and beverage industry. Egg breakers, egg fillers, egg pasteurizers, and egg handling and storing devices are examples of egg processing machinery. The egg processing industry is expanding in tandem with consumer demand for higher quality, healthier goods. New technologies are constantly being produced in response to demand, with a strong emphasis on creativity and product quality.

The following are noteworthy developments in the egg production market: Sanovo Technology Group, a leading maker of food processing machines, launched a new pasteurizing system for the US market. This device reduces the risk of salmonella contamination of egg products. Salmonella is the most common bacteria that causes food poisoning in eggs. As a result, demand for egg processing products is growing rapidly owing to increasing number of product launch strategies. With a wide number of competitors, the business environment of the egg processing industry is very competitive.

The use of eggs in preparing various dishes like use in bakery and other items has increased, which has led to the demand for egg processing equipment. Key players focus on the introduction of specialized goods like modular assembly lines with increased production speeds and lower operating costs due to higher demand. This is considered to have a strong effect on the egg processing market development.

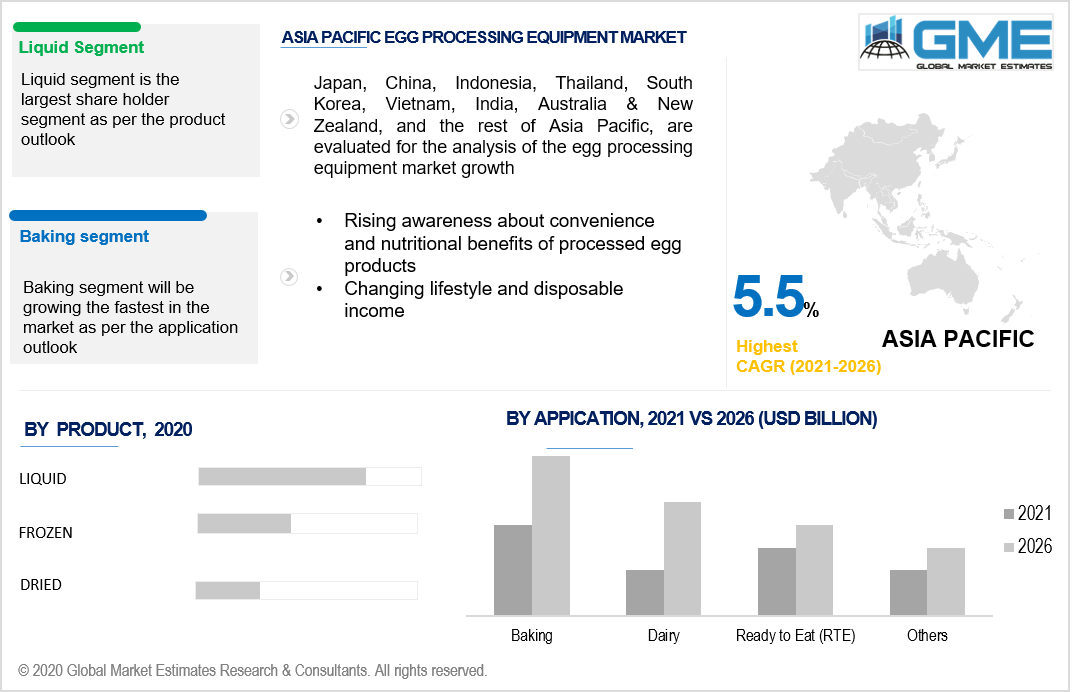

Based on the product, the egg processing equipment market can be segmented as frozen, liquid, and dried. The liquid egg segment will be holding the largest share in the market from 2021 to 2026. The most significant factor driving market growth of this segment would be the rising demand for liquid egg products in the preparation of traditional products such as baked goods and dairy products.

Based on the application, the egg processing equipment market is divided into dairy, soups & sauces, baking, confectionery, and ready to eat (RTE). The baking segment is likely to rise during the forecast period of 2021 to 2026. The use of eggs in bakery items has increased drastically in the last few years. The egg is used to make the dish soft or to bring richness to it. Most of the consumers demand cake with egg or other bakery items with egg and hence this segment will be rising the fastest during the forecast period.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central South America. Due to strict government guidelines for organic foods and processes or regulations for egg production, North America is expected to account for a large share in the global egg processing equipment market from 2021 to 2026. Besides that, increased customer perception of unhealthy and polluted eggs has contributed to the demand rise of the egg processing equipment in North America. The Asia Pacific is the fastest expanding market for egg processing and equipment, owing primarily to the growing use of eggs in processed foods and baked items.

Pelbo S.P.A, Moba b.v., Glon Group, Gruppo Eurovo, Sanovo Technology Group, Actini Group, Igreca S.A. Bouwhuis Enthovan, Interovo Egg Group B.V., and OVO Tech, among others are the top players in the egg processing equipment market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Egg Processing Equipment Market Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Product Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Global Egg Processing Equipment Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Increasing applications for processed eggs and rising demand for processed egg products

3.3.2 Industry challenges

3.3.2.1 Stringent regulatory policies in the developing regions

3.4 Prospective Growth Scenario

3.4.1 Product Overview

3.4.2 Application Overview

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Application Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Egg Processing Equipment Market, By Application

4.1 Application Outlook

4.2 Dairy

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Soups & Sauces

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Baking

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Confectionery

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Ready to Eat (RTE)

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Egg Processing Equipment Market, By Product

5.1 Product Outlook

5.2 Frozen

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Liquid

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Dried

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Global Egg Processing Equipment Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Billion)

6.2.2 Market Size, By Application, 2020-2026 (USD Billion)

6.2.3 Market Size, By Product, 2020-2026 (USD Billion)

6.2.4 U.S.

6.2.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.2.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.2.5 Canada

6.2.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.2.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Billion)

6.3.2 Market Size, By Application, 2020-2026 (USD Billion)

6.3.3 Market Size, By Product, 2020-2026 (USD Billion)

6.3.4 Germany

6.3.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.5 UK

6.3.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.6 France

6.3.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.7 Italy

6.3.7.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.7.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.8 Spain

6.3.8.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.8.2 Market Size, By Product, 2020-2026 (USD Billion)

6.3.9 Russia

6.3.9.1 Market Size, By Application, 2020-2026 (USD Billion)

6.3.9.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Billion)

6.4.2 Market Size, By Application, 2020-2026 (USD Billion)

6.4.3 Market Size, By Product, 2020-2026 (USD Billion)

6.4.4 China

6.4.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.5 India

6.4.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.6 Japan

6.4.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.4.7 Australia

6.4.7.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.7.2 Market size, By Product, 2020-2026 (USD Billion)

6.4.8 South Korea

6.4.8.1 Market Size, By Application, 2020-2026 (USD Billion)

6.4.8.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Billion)

6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

6.5.3 Market Size, By Product, 2020-2026 (USD Billion)

6.5.4 Brazil

6.5.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.5.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.5 Mexico

6.5.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.5.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.5.6 Argentina

6.5.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.5.6.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Billion)

6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

6.6.3 Market Size, By Product, 2020-2026 (USD Billion)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Application, 2020-2026 (USD Billion)

6.6.4.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.5 UAE

6.6.5.1 Market Size, By Application, 2020-2026 (USD Billion)

6.6.5.2 Market Size, By Product, 2020-2026 (USD Billion)

6.6.6 South Africa

6.6.6.1 Market Size, By Application, 2020-2026 (USD Billion)

6.6.6.2 Market Size, By Product, 2020-2026 (USD Billion)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Pelbo S.P.A

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info-Graphic Analysis

7.3 Moba b.v.

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info-Graphic Analysis

7.4 Glon Group

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info-Graphic Analysis

7.5 Gruppo Eurovo

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info-Graphic Analysis

7.6 Sanovo Technology Group

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info-Graphic Analysis

7.7 Actini Group

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info-Graphic Analysis

7.8 Igreca S.A

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info-Graphic Analysis

7.9 Bouwhuis Enthovan

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info-Graphic Analysis

7.10 Interovo Egg Group B.V.

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info-Graphic Analysis

7.11 OVO Tech

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info-Graphic Analysis

7.12 Other Companies

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info-Graphic Analysis

The Global Egg Processing Equipment Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Egg Processing Equipment Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS