Global Electric Roadster Market Size, Trends & Analysis - Forecasts to 2028 By Vehicle Type (Cars, Bicycle, Tricycle, and Others) and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

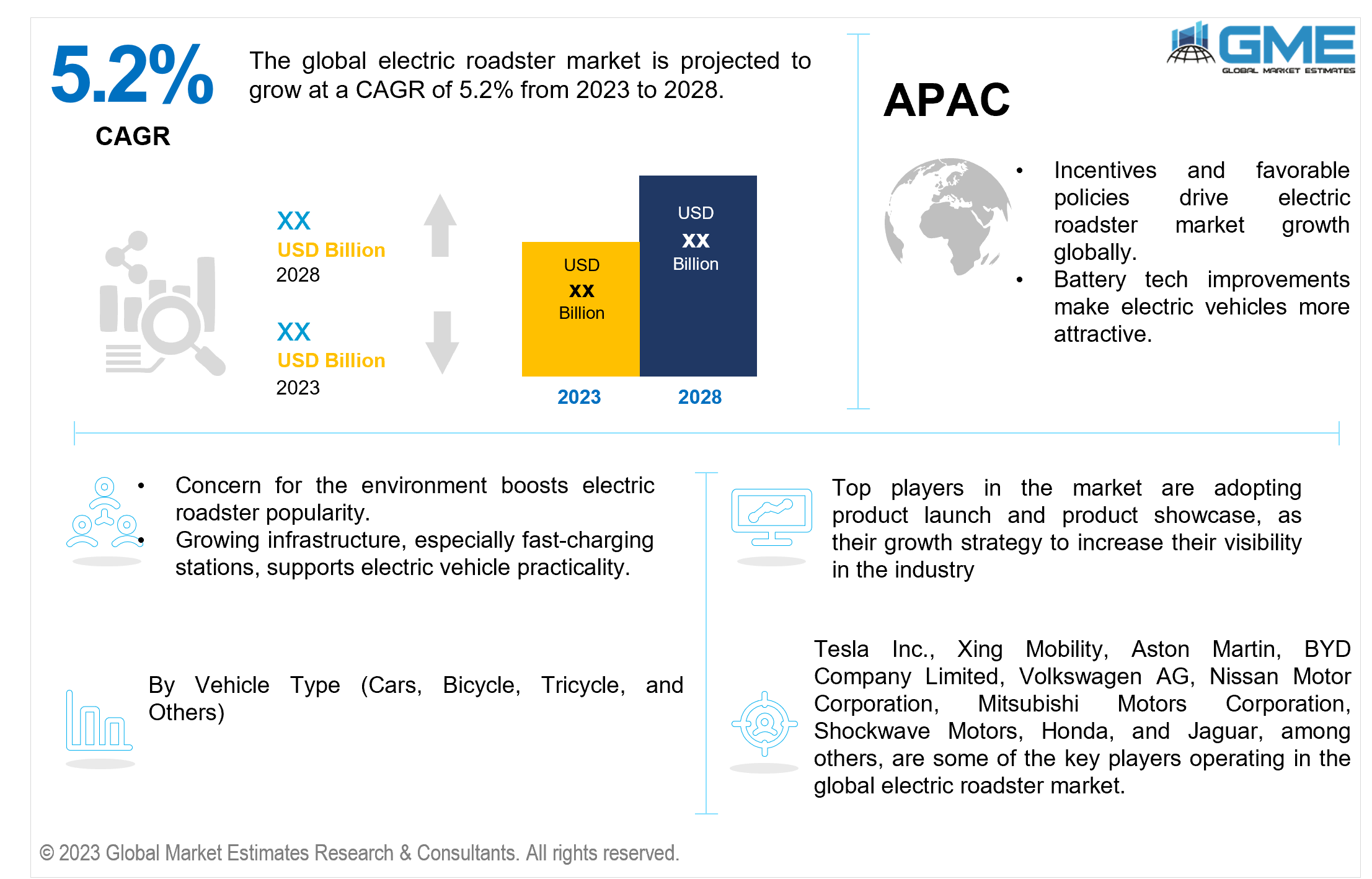

The global electric roadster market is projected to grow at a CAGR of 5.2% from 2023 to 2028.

The increasing awareness regarding environmental issues, specifically air pollution and climate change, is prompting consumers to explore cleaner and more sustainable modes of transportation. Electric roadsters are frequently designed to cater to the luxury and high-performance segments of the market. As consumers increasingly prioritize sustainable choices without sacrificing performance and style, the popularity of electric roadsters has surged. Governments across the globe have introduced incentives and regulations to encourage the uptake of electric vehicles (EVs), encompassing measures such as tax credits, subsidies, and regulations incentivizing automakers to manufacture vehicles with greater environmental friendliness.

Advancements in battery technology, such as increased energy density, more extended range, and faster charging capabilities, have played a crucial role in making electric roadsters more attractive to consumers. The progress in these technologies contributes to the improved overall performance and attractiveness of electric vehicles. With increased charging stations, consumers are likely to gain greater assurance in the feasibility of using electric vehicles for extended journeys.

Electric roadsters often exhibit high-performance capabilities, with instant torque and smooth acceleration. The integration of cutting-edge technology and innovation in design and features contributes to the appeal of electric roadsters among consumers seeking a thrilling driving experience. Established automotive manufacturers and new entrants are investing heavily in the development of electric roadsters. The presence of reputable brands in this market, coupled with healthy competition, positively impacts consumer perception and choice.

The expansion of electric vehicles, including electric roadsters, is closely tied to establishing a robust and reliable charging infrastructure. Insufficient charging stations, especially in certain regions, can be a significant obstacle. Consumers may hesitate to adopt electric roadsters if they perceive a lack of convenient and accessible charging points for long-distance travel.

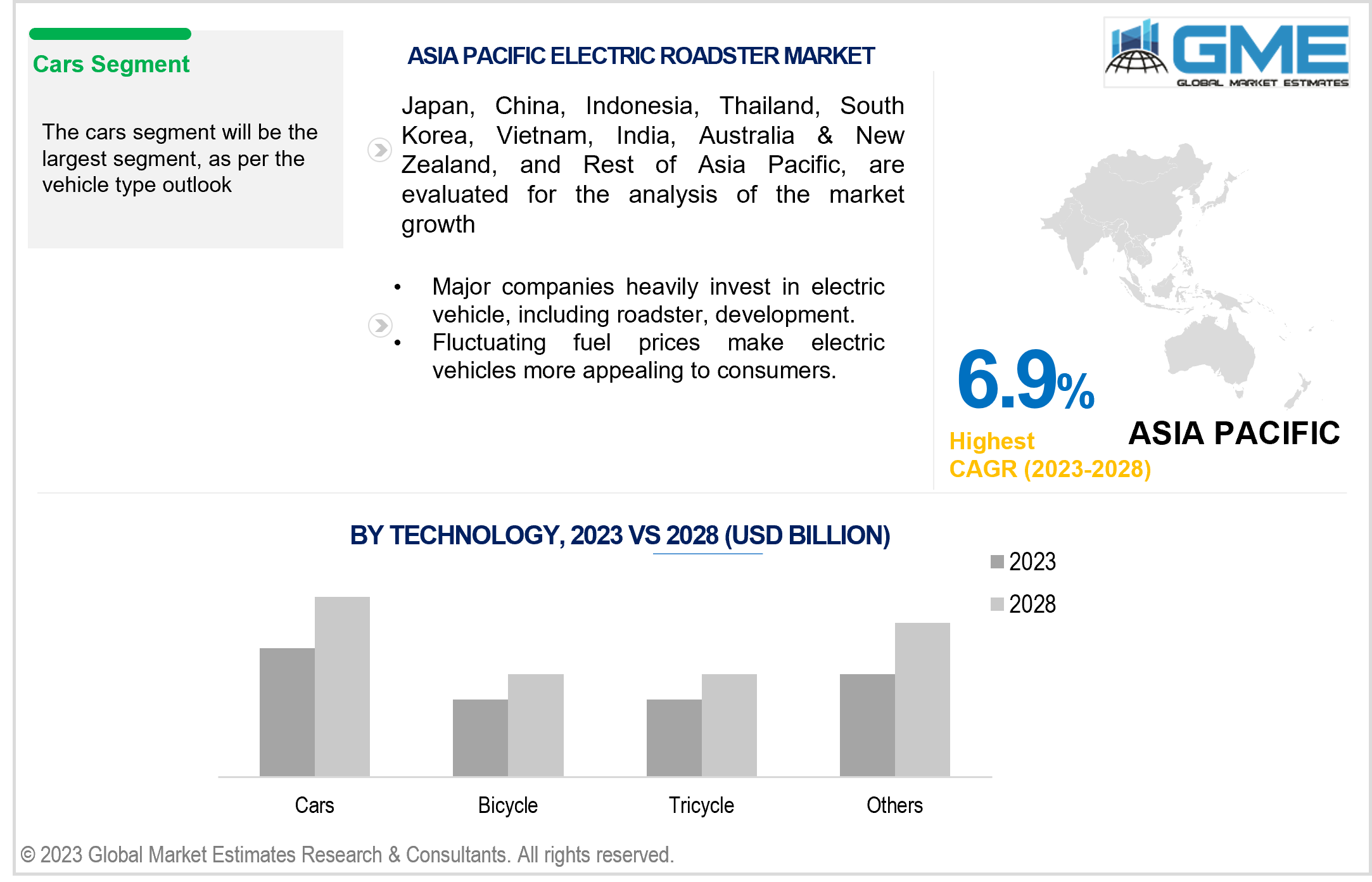

The cars segment is expected to hold the largest share of the market over the forecast period. The growth is attributed to the rising launches of sleek design and high-performance electric roadsters aligning with consumer preferences for luxury and performance. For instance, in August 2023, MG Motors launched the two-seater electric roadster Cyberster. The Cyberster aims to serve as a "brand builder" rather than a mass-market vehicle, contributing to MG's identity and success in the EV transition. Battery advancements contribute to increased range and acceleration, making electric roadsters appealing to car enthusiasts. Furthermore, as governments worldwide incentivize electric vehicle adoption and infrastructure development, the cars segment, which provides a balance of sustainability and driving experience, is expected to secure the largest market share during the forecast period.

The bicycle segment is expected to be the fastest-growing segment in the market from 2023-2028. This anticipated surge is attributed to an increasing focus on sustainable and eco-friendly urban mobility solutions. Additionally, governments promoting sustainable transportation and the integration of electric roadster bicycles into smart city initiatives contribute to the segment's accelerated growth. In August 2023, Ola Electric announced its plan to introduce electric bikes by the end of 2024, unveiling prototypes for four distinct variations – cruiser, adventurer, roadster, and 'Diamondhead'. The diverse range of electric bikes reflects Ola Electric's commitment to catering to various consumer preferences and needs. This strategic move aligns with the company's broader vision to expand its electric vehicle offerings and contribute to sustainable mobility solutions.

North America is expected to be the largest region in the market over the forecast period. The primary reasons boosting the market growth in this region include the well-developed automotive infrastructure and supportive government policies, which contribute to its dominance. Additionally, a culture of innovation and high consumer spending boost North America's market growth. With these factors and a thriving business environment, North America is positioned to be the largest market in the foreseeable future. For instance, in the U.S., programs like the Clean Vehicle Rebate Project offer cashback, such as USD 2,000 for battery electric vehicles and USD 1,000 for plug-in hybrids.

Asia Pacific is predicted to witness rapid growth during the forecast period. Increasing environmental awareness, government initiatives promoting electric vehicles, a growing affluent population, and expanding charging infrastructure all contribute to the demand surge. Furthermore, the region's thriving automotive industry, technological advancements, and a shift towards sustainable transportation solutions all contribute to the market's growth.

Tesla Inc., Xing Mobility, Aston Martin, BYD Company Limited, Volkswagen AG, Nissan Motor Corporation, Mitsubishi Motors Corporation, Shockwave Motors, Honda, and Jaguar, among others, are some of the key players operating in the global electric roadster market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2022, Jaguar introduced its third all-electric virtual gaming sports car, the Jaguar Vision Gran Turismo Roadster, to coincide with the launch of Gran Turismo 7.

In February 2023, Nissan introduced its Max-Out electric roadster concept, turning the virtual design into a physical reality. The Max-Out roadster concept was initially introduced as a wild and cool virtual concept. The real version closely mirrors the virtual design, featuring retrofuturistic illuminated grid patterns and a wedge-shaped body.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ELECTRIC ROADSTER MARKET, BY VEHICLE TYPE

4.1 Introduction

4.2 Electric Roadster Market: Vehicle Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Cars

4.4.1 Cars Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Bicycle

4.5.1 Bicycle Market Estimates and Forecast, 2020-2028 (USD Million)

4.6 Tricycle

4.6.1 Tricycle Market Estimates and Forecast, 2020-2028 (USD Million)

4.7 Others

4.7.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL ELECTRIC ROADSTER MARKET, BY REGION

5.1 Introduction

5.2 North America Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.2.1 By Vehicle Type

5.2.2 By Country

5.2.3.1 U.S. Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.2.3.1.1 By Vehicle Type

5.2.3.2 Canada Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.2.3.2.1 By Vehicle Type

5.2.3.3 Mexico Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.2.3.3.1 By Vehicle Type

5.3 Europe Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.1 By Vehicle Type

5.3.2 By Country

5.3.3.1 Germany Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.1.1 By Vehicle Type

5.3.3.2 U.K. Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.2.1 By Vehicle Type

5.3.3.3 France Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.3.1 By Vehicle Type

5.3.3.4 Italy Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.4.1 By Vehicle Type

5.3.3.5 Spain Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.5.1 By Vehicle Type

5.3.3.6 Netherlands Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.6.1 By Vehicle Type

5.3.3.7 Rest of Europe Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.3.3.5.1 By Vehicle Type

5.4 Asia Pacific Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.1 By Vehicle Type

5.4.3 By Country

5.4.3.1 China Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.1.1 By Vehicle Type

5.4.3.2 Japan Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.2.1 By Vehicle Type

5.4.3.3 India Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.3.1 By Vehicle Type

5.4.3.4 South Korea Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.4.1 By Vehicle Type

5.4.3.5 Singapore Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.5.1 By Vehicle Type

5.4.3.6 Malaysia Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.6.1 By Vehicle Type

5.4.3.7 Thailand Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.5.1 By Vehicle Type

5.4.3.8 Indonesia Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.7.1 By Vehicle Type

5.4.3.9 Vietnam Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.8.1 By Vehicle Type

5.4.3.10 Taiwan Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.10.1 By Vehicle Type

5.4.3.11 Rest of Asia Pacific Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.4.3.11.1 By Vehicle Type

5.5 Middle East and Africa Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 By Vehicle Type

5.5.2 By Type

5.5.3 By Country

5.5.3.1 Saudi Arabia Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.1.1 By Vehicle Type

5.5.3.2 U.A.E. Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.2.1 By Vehicle Type

5.5.3.3 Israel Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.3.1 By Vehicle Type

5.5.3.4 South Africa Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.4.1 By Vehicle Type

5.5.3.5 Rest of Middle East and Africa Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.5.1 By Vehicle Type

5.5 Central and South America Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 By Vehicle Type

5.5.3 By Country

5.5.3.1 Brazil Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.1.1 By Vehicle Type

5.5.3.2 Argentina Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.2.1 By Vehicle Type

5.5.3.3 Chile Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.3.1 By Vehicle Type

5.5.3.4 Rest of Central and South America Electric Roadster Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.3.4.1 By Vehicle Type

6 COMPETITIVE LANDCAPE

6.1 Company Market Share Analysis

6.2 Four Quadrant Positioning Matrix

6.2.1 Market Leaders

6.2.2 Market Visionaries

6.2.3 Market Challengers

6.2.4 Niche Market Players

6.3 Vendor Landscape

6.3.1 North America

6.3.2 Europe

6.3.3 Asia Pacific

6.3.4 Rest of the World

6.4 Company Profiles

6.4.1 Tesla Inc.

6.4.1.1 Business Description & Financial Analysis

6.4.1.2 SWOT Analysis

6.4.1.3 Products & Services Offered

6.4.1.4 Strategic Alliances between Business Partners

6.4.2 Xing Mobility

6.4.2.1 Business Description & Financial Analysis

6.4.2.2 SWOT Analysis

6.4.2.3 Products & Services Offered

6.4.2.4 Strategic Alliances between Business Partners

6.4.3 Aston Martin

6.4.3.1 Business Description & Financial Analysis

6.4.3.2 SWOT Analysis

6.4.3.3 Products & Services Offered

6.4.3.4 Strategic Alliances between Business Partners

6.4.4 BYD Company Limiteds

6.4.4.1 Business Description & Financial Analysis

6.4.4.2 SWOT Analysis

6.4.4.3 Products & Services Offered

6.4.4.4 Strategic Alliances between Business Partners

6.4.5 Nissan Motor Corporation

6.4.5.1 Business Description & Financial Analysis

6.4.5.2 SWOT Analysis

6.4.5.3 Products & Services Offered

6.4.5.4 Strategic Alliances between Business Partners

6.4.6 Mitsubishi Motors Corporation

6.4.6.1 Business Description & Financial Analysis

6.4.6.2 SWOT Analysis

6.4.6.3 Products & Services Offered

6.4.6.4 Strategic Alliances between Business Partners

6.4.7 Shockwave Motors

6.4.7.1 Business Description & Financial Analysis

6.4.7.2 SWOT Analysis

6.4.7.3 Products & Services Offered

6.4.7.4 Strategic Alliances between Business Partners

6.4.8 Volkswagen AG

6.4.8.1 Business Description & Financial Analysis

6.4.8.2 SWOT Analysis

6.4.8.3 Products & Services Offered

6.4.8.4 Strategic Alliances between Business Partners

6.4.9 Honda

6.4.9.1 Business Description & Financial Analysis

6.4.9.2 SWOT Analysis

6.4.9.3 Products & Services Offered

6.4.9.4 Strategic Alliances between Business Partners

6.4.10 Jaguar

6.4.10.1 Business Description & Financial Analysis

6.4.10.2 SWOT Analysis

6.4.10.3 Products & Services Offered

6.4.10.4 Strategic Alliances between Business Partners

6.4.11 Other Companies

6.4.11.1 Business Description & Financial Analysis

6.4.11.2 SWOT Analysis

6.4.11.3 Products & Services Offered

6.4.11.4 Strategic Alliances between Business Partners

7 RESEARCH METHODOLOGY

7.1 Market Introduction

7.1.1 Market Definition

7.1.2 Market Scope & Segmentation

7.2 Information Procurement

7.2.1 Secondary Research

7.2.1.1 Purchased Databases

7.2.1.2 GMEs Internal Data Repository

7.2.1.3 Secondary Resources & Third Party Perspectives

7.2.1.4 Company Information Sources

7.2.2 Primary Research

7.2.2.1 Various Types of Respondents for Primary Interviews

7.2.2.2 Number of Interviews Conducted throughout the Research Process

7.2.2.3 Primary Stakeholders

7.2.2.4 Discussion Guide for Primary Participants

7.2.3 Expert Panels

7.2.3.1 Expert Panels Across 30+ Industry

7.2.4 Paid Local Experts

7.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

7.3 Market Estimation

7.3.1 Top-Down Approach

7.3.1.1 Macro-Economic Indicators Considered

7.3.1.2 Micro-Economic Indicators Considered

7.3.2 Bottom Up Approach

7.3.2.1 Company Share Analysis Approach

7.3.2.2 Estimation of Potential Product Sales

7.4 Data Triangulation

7.4.1 Data Collection

7.4.2 Time Series, Cross Sectional & Panel Data Analysis

7.4.3 Cluster Analysis

7.5 Analysis and Output

7.5.1 Inhouse AI Based Real Time Analytics Tool

7.5.2 Output From Desk & Primary Research

7.6 Research Assumptions & Limitations

7.6.1 Research Assumptions

7.6.2 Research Limitations

LIST OF TABLES

1 Global Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

2 Cars Market, By Region, 2020-2028 (USD Mllion)

3 Bicycle Market, By Region, 2020-2028 (USD Mllion)

4 Tricycle Market, By Region, 2020-2028 (USD Mllion)

5 Others Market, By Region, 2020-2028 (USD Mllion)

6 Regional Analysis, 2020-2028 (USD Mllion)

7 North America Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

8 North America Electric Roadster Market, By country, 2020-2028 (USD Mllion)

9 U.S. Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

10 Canada Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

11 Mexico Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

12 Europe Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

13 Europe Electric Roadster Market, By country, 2020-2028 (USD Mllion)

14 Germany Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

15 U.K. Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

16 France Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

17 Italy Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

18 Spain Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

19 Netherlands Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

20 Rest Of Europe Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

21 Asia Pacific Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

22 Asia Pacific Electric Roadster Market, By country, 2020-2028 (USD Mllion)

23 China Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

24 Japan Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

25 India Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

26 South Korea Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

27 Singapore Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

28 Thailand Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

29 Malaysia Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

30 Indonesia Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

31 Vietnam Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

32 Taiwan Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

33 Rest of APAC Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

34 Middle East and Africa Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

35 Middle East and Africa Electric Roadster Market, By country, 2020-2028 (USD Mllion)

36 Saudi Arabia Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

37 UAE Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

38 Israel Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

39 South Africa Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

40 Rest Of Middle East and Africa Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

41 Central and South America Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

42 Central and South America Electric Roadster Market, By country, 2020-2028 (USD Mllion)

43 Brazil Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

44 Chile Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

45 Argentina Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

46 Rest Of Central and South America Electric Roadster Market, By Vehicle Type, 2020-2028 (USD Mllion)

47 Tesla Inc.: Products & Services Offering

48 Xing Mobility: Products & Services Offering

49 Aston Martin: Products & Services Offering

50 BYD Company Limiteds: Products & Services Offering

51 NISSAN MOTOR CORPORATION: Products & Services Offering

52 MITSUBISHI MOTORS CORPORATION: Products & Services Offering

53 SHOCKWAVE MOTORS : Products & Services Offering

54 Volkswagen AG: Products & Services Offering

55 Honda, Inc: Products & Services Offering

56 Stryker Corp : Products & Services Offering

57 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Electric Roadster Market Overview

2 Global Electric Roadster Market Value From 2020-2028 (USD Mllion)

3 Global Electric Roadster Market Share, By Vehicle Type (2022)

4 Global Electric Roadster Market Share, By Type (2022)

5 Global Electric Roadster Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Electric Roadster Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Electric Roadster Market

10 Impact Of Challenges On The Global Electric Roadster Market

11 Porter’s Five Forces Analysis

12 Global Electric Roadster Market: By Vehicle Type Scope Key Takeaways

13 Global Electric Roadster Market, By Vehicle Type Segment: Revenue Growth Analysis

14 Cars Market, By Region, 2020-2028 (USD Mllion)

15 BicycleMarket, By Region, 2020-2028 (USD Mllion)

16 Tricycle Market, By Region, 2020-2028 (USD Mllion)

17 Others Market, By Region, 2020-2028 (USD Mllion)

18 Regional Segment: Revenue Growth Analysis

19 Global Electric Roadster Market: Regional Analysis

20 North America Electric Roadster Market Overview

21 North America Electric Roadster Market, By Vehicle Type

22 North America Electric Roadster Market, By Country

23 U.S. Electric Roadster Market, By Vehicle Type

24 Canada Electric Roadster Market, By Vehicle Type

25 Mexico Electric Roadster Market, By Vehicle Type

26 Four Quadrant Positioning Matrix

27 Company Market Share Analysis

28 Tesla Inc.: Company Snapshot

29 Tesla Inc.: SWOT Analysis

30 Tesla Inc.: Geographic Presence

31 Xing Mobility: Company Snapshot

32 Xing Mobility: SWOT Analysis

33 Xing Mobility: Geographic Presence

34 Aston Martin: Company Snapshot

35 Aston Martin: SWOT Analysis

36 Aston Martin: Geographic Presence

37 BYD Company Limiteds: Company Snapshot

38 BYD Company Limiteds: Swot Analysis

39 BYD Company Limiteds: Geographic Presence

40 Nissan Motor Corporation: Company Snapshot

41 Nissan Motor Corporation: SWOT Analysis

42 Nissan Motor Corporation: Geographic Presence

43 Mitsubishi Motors Corporation: Company Snapshot

44 Mitsubishi Motors Corporation: SWOT Analysis

45 Mitsubishi Motors Corporation: Geographic Presence

46 Shockwave Motors : Company Snapshot

47 Shockwave Motors : SWOT Analysis

48 Shockwave Motors : Geographic Presence

49 Volkswagen AG: Company Snapshot

50 Volkswagen AG: SWOT Analysis

51 Volkswagen AG: Geographic Presence

52 Honda, Inc.: Company Snapshot

53 Honda, Inc.: SWOT Analysis

54 Honda, Inc.: Geographic Presence

55 Stryker Corp: Company Snapshot

56 Stryker Corp: SWOT Analysis

57 Stryker Corp: Geographic Presence

58 Other Companies: Company Snapshot

59 Other Companies: SWOT Analysis

60 Other Companies: Geographic Presence

The Global Electric Roadster Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electric Roadster Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS