Global Electric Traction Motor Market Size, Trends & Analysis - Forecasts to 2029 By Type (Alternating Current and Direct Current), By Application (Railway, Electric Vehicle, Industrial Machinery, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

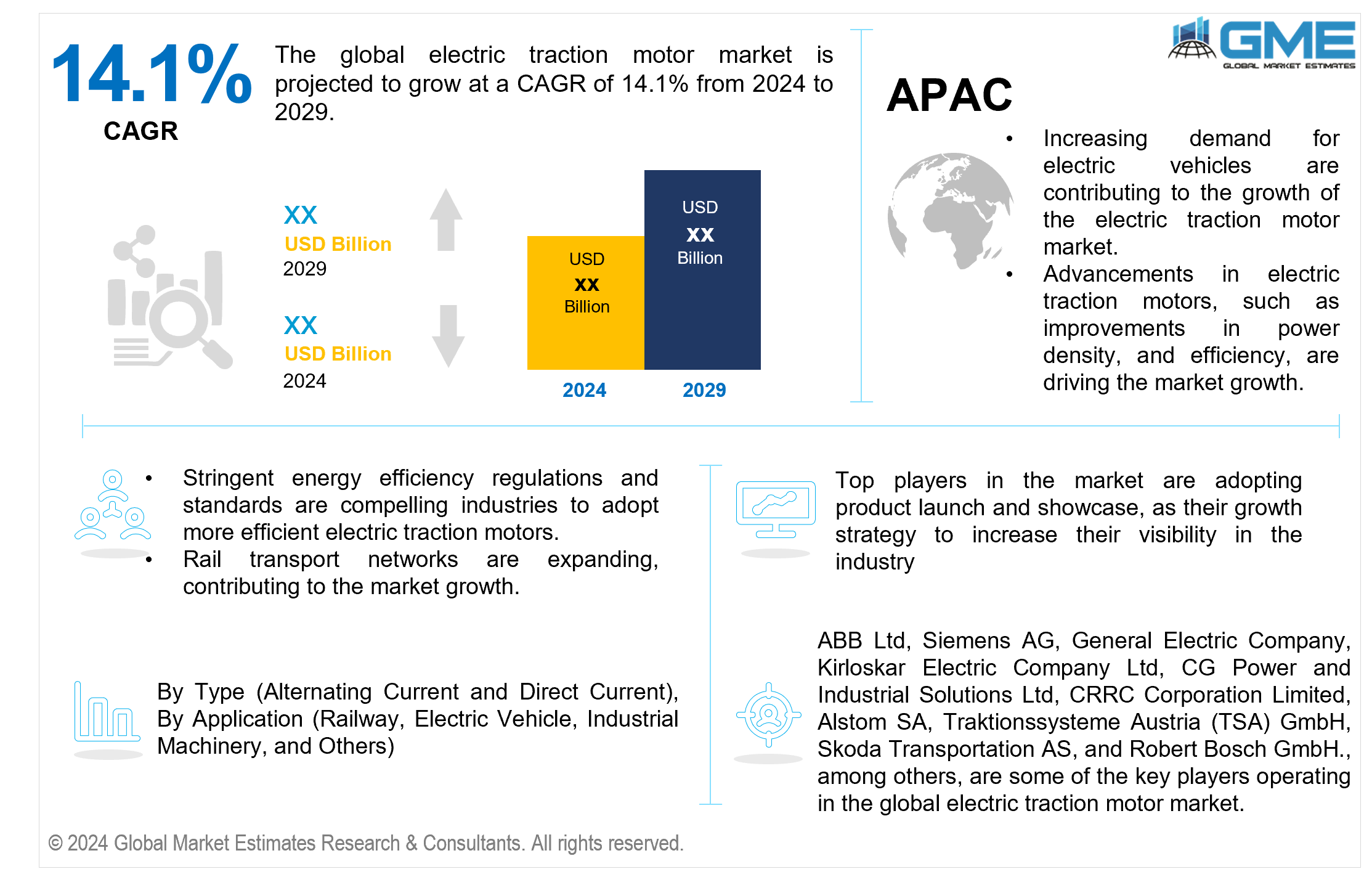

The global electric traction motor market is projected to grow at a CAGR of 14.1% from 2024 to 2029.

Electric vehicle (EV) motors, particularly those manufactured by major traction motor manufacturers, have become key components in the transition to vehicle electrification solutions. High-speed electric motors and permanent magnet motors are becoming increasingly popular due to their efficiency and performance in electric driving systems. These sophisticated motors are critical for improving the efficiency and reliability of electric vehicles, which contributes to their increased market adoption.

Another important factor is the advancement of electric traction technology, which includes brushless traction motors and hybrid electric motors. These advancements provide greater economy and performance, making them suitable for various applications, including urban electric transportation and heavy-duty traction motors used in commercial and industrial sectors. Advancements in electric locomotive motors and railway traction motors further highlight the versatility and scalability of these technologies, emphasizing their position in the continuous transformation of the transportation sector to more sustainable solutions.

Regenerative braking systems and electric motor controllers are other important factors in the growth of the electric traction motor market. Regenerative braking not only increases the energy efficiency of electric vehicle motors by capturing and recycling energy, but it also improves the vehicle's overall performance. Electric motor controllers, on the other hand, are critical in managing the power and efficiency of motors, assuring peak performance, and increasing the lifespan of vehicle drivetrain components. These technologies all contribute to the growing popularity of electric vehicle propulsion systems among consumers and manufacturers.

Additionally, thorough electric motor testing and the development of efficient electric vehicle drivetrain components are critical to maintaining high levels of performance and dependability. As the urban electric transportation sector expands, the importance of high-quality electric motors grows. This includes guaranteeing traction motor efficiency, which directly impacts the operational costs and long-term viability of electric vehicles. Together, these factors propel the growth of the global electric traction motor market, demonstrating the industry's dedication to transportation innovation and sustainability.

One of the most significant challenges is the high initial cost of electric propulsion systems and vehicle electrification options. The development and integration of modern electric vehicle (EV) motors, such as high-speed electric motors and permanent magnet motors, necessitate significant expenditure. These costs can be prohibitive for both manufacturers and users, limiting the adoption of electric vehicles despite their long-term benefits.

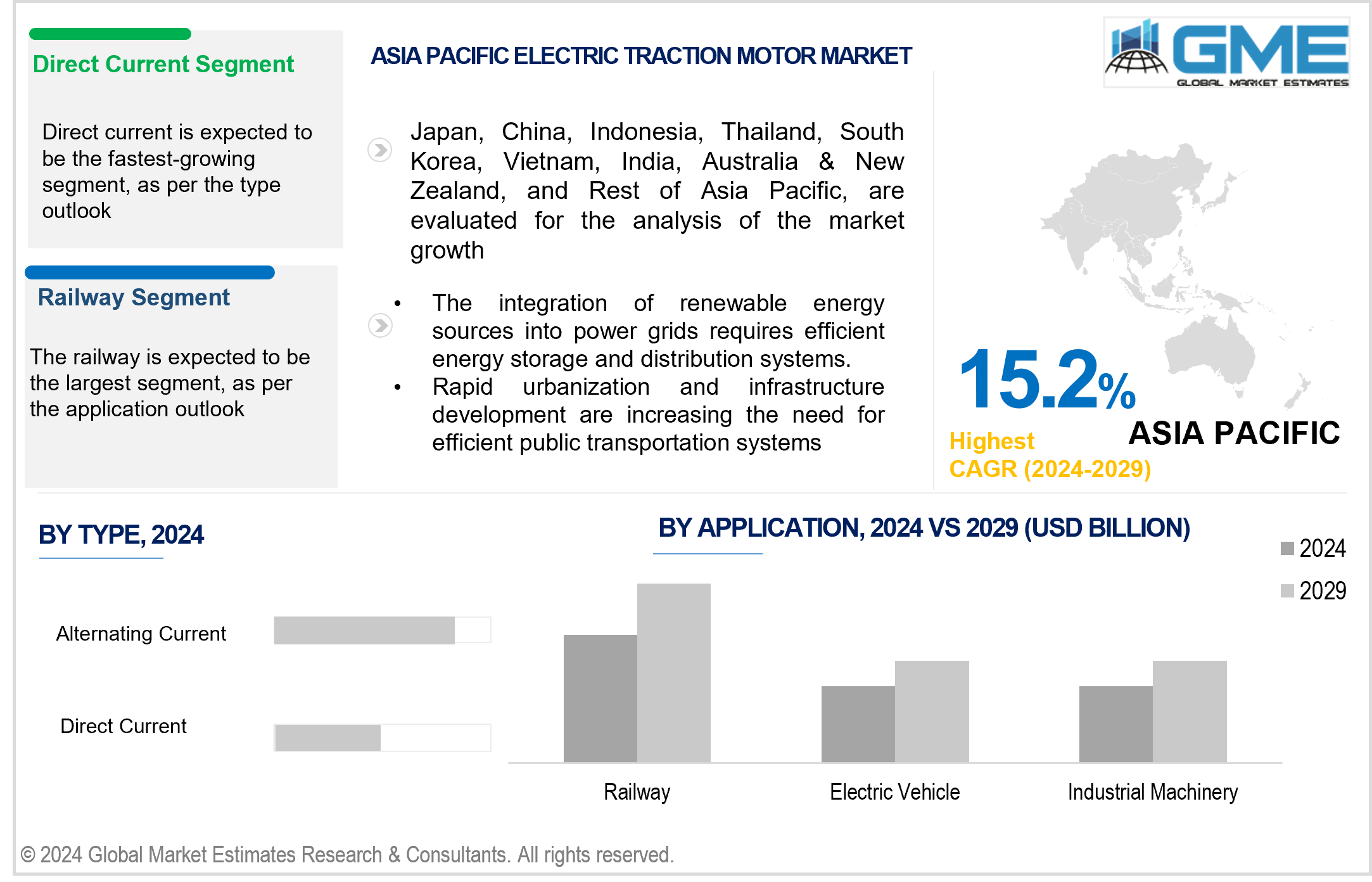

The alternating current segment is expected to hold the largest share of the market. The segment's growth is due to its high efficiency, dependability, and cost-effectiveness. AC motors, particularly induction motors, perform better in high-speed and heavy-duty applications, making them excellent for electric vehicles and industrial use. Their simpler construction and cheaper maintenance requirements than direct current (DC) motors add to their appeal, resulting in widespread application across various industries, including transportation and industry.

The direct current segment is expected to be the fastest-growing segment in the market from 2024 to 2029. DC motors, particularly brushless DC motors (BLDC), provide accurate speed control and great torque at low speeds, which is critical for electric vehicles and other industrial applications. Advances in DC motor technology are improving efficiency and performance. Furthermore, rising demand for electric vehicles and the introduction of regenerative braking systems that frequently use DC motors fuel significant growth in this segment.

The electric vehicle segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. The growth of the segment is attributed to the increasing adoption of EVs worldwide. Stringent emissions rules, rising fuel prices, and growing environmental awareness are driving the transition to electric mobility. As automakers engage substantially in EV technology and extend their electric vehicle offerings, demand for electric traction motors for passenger cars, buses, and commercial vehicles is likely to increase, driving the segment's growth.

The railway segment is expected to hold the largest share of the market over the forecast period. Electric traction motors are commonly utilized in trains and trams because they have higher efficiency, lower pollutants, and cheaper operating costs than traditional diesel engines. The widespread use of electric locomotives in urban and intercity transportation, driven by the need for environmentally friendly and energy-efficient transportation solutions, increases demand in this category. Furthermore, government initiatives and investments in railway electrification projects contribute to the market dominance.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include the well-established automotive industry, with a significant emphasis on electric vehicle development and production. Favorable government policies, such as subsidies for electric vehicle adoption and charging infrastructure expenditures, drive demand for electric traction motors. Furthermore, rising consumer environmental consciousness and rigorous emissions rules fuel the demand for electric vehicles, leading to North America's dominance in the electric traction motor industry.

Asia Pacific is predicted to witness rapid growth during the forecast period. The region's growing population, fast urbanization, and increased emphasis on sustainable transportation options fuel demand for electric automobiles and electrified public transportation networks. Additionally, supporting government regulations, electric car adoption incentives, and charging infrastructure investments all contribute to market growth. As a result, Asia Pacific has emerged as the fastest-growing market for electric traction motor manufacturers and suppliers.

ABB Ltd, Siemens AG, General Electric Company, Kirloskar Electric Company Ltd, CG Power and Industrial Solutions Ltd, CRRC Corporation Limited, Alstom SA, Traktionssysteme Austria (TSA) GmbH, Skoda Transportation AS, and Robert Bosch GmbH., among others, are some of the key players operating in the global electric traction motor market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2024, a Switzerland-based manufacturing company, ABB, secured a USD 150 million contract with Hyundai Rotem Company to supply traction packages for 65 new trains built in Queensland, Australia. This contract is a key part of the Queensland Train Manufacturing Programme (QTMP), a USD 3 billion initiative to deliver new electric multiple units (EMUs) in time for the 2032 Olympic and Paralympic Games in Brisbane.

In June 2023, CRRC, a leading Chinese state-owned railway equipment manufacturer, successfully modernized a locomotive for hydrogen traction, marking a significant milestone in sustainable rail technology. The upgraded locomotive, named Ningdong, was developed over two years at the Datun factory and features an 800-kilowatt hydrogen engine capable of running up to 190 hours.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ELECTRIC TRACTION MOTOR MARKET, BY TYPE

4.1 Introduction

4.2 Electric Traction Motor Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Alternating Current

4.4.1 Alternating Current Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Direct Current

4.5.1 Direct Current Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ELECTRIC TRACTION MOTOR MARKET, BY APPLICATION

5.1 Introduction

5.2 Electric Traction Motor Market: Application Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Railway

5.4.1 Railway Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Electric Vehicle

5.5.1 Electric VehicleMarket Estimates and Forecast, 2021-2029 (USD Million)

5.6 Industrial Machinery

5.6.1 Industrial Machinery Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL ELECTRIC TRACTION MOTOR MARKET, BY REGION

6.1 Introduction

6.2 North America Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Application

6.2.3 By Country

6.2.3.1 U.S. Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Application

6.2.3.2 Canada Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Application

6.2.3.3 Mexico Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Application

6.3 Europe Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Application

6.3.3 By Country

6.3.3.1 Germany Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Application

6.3.3.2 U.K. Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Application

6.3.3.3 France Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Application

6.3.3.4 Italy Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Application

6.3.3.5 Spain Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Application

6.3.3.6 Netherlands Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.3.3.7 Rest of Europe Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Application

6.4 Asia Pacific Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Application

6.4.3 By Country

6.4.3.1 China Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Application

6.4.3.2 Japan Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Application

6.4.3.3 India Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Application

6.4.3.4 South Korea Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Application

6.4.3.5 Singapore Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Application

6.4.3.6 Malaysia Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.7 Thailand Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Application

6.4.3.8 Indonesia Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Application

6.4.3.9 Vietnam Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Application

6.4.3.10 Taiwan Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Application

6.4.3.11 Rest of Asia Pacific Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Application

6.5 Middle East and Africa Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Application

6.5.3 By Country

6.5.3.1 Saudi Arabia Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Application

6.5.3.2 U.A.E. Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Application

6.5.3.3 Israel Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Application

6.5.3.4 South Africa Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Application

6.5.3.5 Rest of Middle East and Africa Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Application

6.6 Central and South America Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Application

6.6.3 By Country

6.6.3.1 Brazil Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Application

6.6.3.2 Argentina Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Application

6.6.3.3 Chile Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

6.6.3.3 Rest of Central and South America Electric Traction Motor Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Application

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 ABB Ltd

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Siemens AG

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 General Electric Company

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Kirloskar Electric Company Ltd

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 CG Power and Industrial Solutions Ltd

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 CRRC Corporation Limited

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 Alstom SA

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Traktionssysteme Austria (TSA) GmbH

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Skoda Transportation AS

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Robert Bosch GmbH

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

2 Alternating Current Market, By Region, 2021-2029 (USD Mllion)

3 Direct Current Market, By Region, 2021-2029 (USD Mllion)

4 Global Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

5 Railway Market, By Region, 2021-2029 (USD Mllion)

6 Electric VehicleMarket, By Region, 2021-2029 (USD Mllion)

7 Industrial Machinery Market, By Region, 2021-2029 (USD Mllion)

8 Others Market, By Region, 2021-2029 (USD Mllion)

9 Regional Analysis, 2021-2029 (USD Mllion)

10 North America Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

11 North America Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

12 North America Electric Traction Motor Market, By COUNTRY, 2021-2029 (USD Mllion)

13 U.S. Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

14 U.S. Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

15 Canada Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

16 Canada Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

17 Mexico Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

18 Mexico Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

19 Europe Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

20 Europe Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

21 Europe Electric Traction Motor Market, By Country, 2021-2029 (USD Mllion)

22 Germany Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

23 Germany Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

24 U.K. Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

25 U.K. Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

26 France Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

27 France Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

28 Italy Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

29 Italy Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

30 Spain Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

31 Spain Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

32 Netherlands Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

33 Netherlands Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

34 Rest Of Europe Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

35 Rest Of Europe Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

36 Asia Pacific Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

37 Asia Pacific Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

38 Asia Pacific Electric Traction Motor Market, By Country, 2021-2029 (USD Mllion)

39 China Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

40 China Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

41 Japan Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

42 Japan Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

43 India Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

44 India Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

45 South Korea Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

46 South Korea Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

47 Singapore Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

48 Singapore Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

49 Thailand Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

50 Thailand Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

51 Malaysia Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

52 Malaysia Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

53 Indonesia Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

54 Indonesia Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

55 Vietnam Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

56 Vietnam Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

57 Taiwan Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

58 Taiwan Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

59 Rest of APAC Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

60 Rest of APAC Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

61 Middle East and Africa Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

62 Middle East and Africa Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

63 Middle East and Africa Electric Traction Motor Market, By Country, 2021-2029 (USD Mllion)

64 Saudi Arabia Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

65 Saudi Arabia Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

66 UAE Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

67 UAE Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

68 Israel Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

69 Israel Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

70 South Africa Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

71 South Africa Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

72 Rest Of Middle East and Africa Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

73 Rest Of Middle East and Africa Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

74 Central and South America Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

75 Central and South America Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

76 Central and South America Electric Traction Motor Market, By Country, 2021-2029 (USD Mllion)

77 Brazil Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

78 Brazil Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

79 Chile Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

80 Chile Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

81 Argentina Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

82 Argentina Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

83 Rest Of Central and South America Electric Traction Motor Market, By Type, 2021-2029 (USD Mllion)

84 Rest Of Central and South America Electric Traction Motor Market, By Application, 2021-2029 (USD Mllion)

85 ABB Ltd: Products & Services Offering

86 Siemens AG: Products & Services Offering

87 General Electric Company: Products & Services Offering

88 Kirloskar Electric Company Ltd: Products & Services Offering

89 CG Power and Industrial Solutions Ltd: Products & Services Offering

90 CRRC CORPORATION LIMITED: Products & Services Offering

91 Alstom SA : Products & Services Offering

92 Traktionssysteme Austria (TSA) GmbH: Products & Services Offering

93 Skoda Transportation AS, Inc: Products & Services Offering

94 Robert Bosch GmbH: Products & Services Offering

95 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Electric Traction Motor Market Overview

2 Global Electric Traction Motor Market Value From 2021-2029 (USD Mllion)

3 Global Electric Traction Motor Market Share, By Type (2023)

4 Global Electric Traction Motor Market Share, By Application (2023)

5 Global Electric Traction Motor Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Electric Traction Motor Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Electric Traction Motor Market

10 Impact Of Challenges On The Global Electric Traction Motor Market

11 Porter’s Five Forces Analysis

12 Global Electric Traction Motor Market: By Type Scope Key Takeaways

13 Global Electric Traction Motor Market, By Type Segment: Revenue Growth Analysis

14 Alternating Current Market, By Region, 2021-2029 (USD Mllion)

15 Direct Current Market, By Region, 2021-2029 (USD Mllion)

16 Global Electric Traction Motor Market: By Application Scope Key Takeaways

17 Global Electric Traction Motor Market, By Application Segment: Revenue Growth Analysis

18 Railway Market, By Region, 2021-2029 (USD Mllion)

19 Electric Vehicle Market, By Region, 2021-2029 (USD Mllion)

20 Industrial Machinery Market, By Region, 2021-2029 (USD Mllion)

21 Others Market, By Region, 2021-2029 (USD Mllion)

22 Regional Segment: Revenue Growth Analysis

23 Global Electric Traction Motor Market: Regional Analysis

24 North America Electric Traction Motor Market Overview

25 North America Electric Traction Motor Market, By Type

26 North America Electric Traction Motor Market, By Application

27 North America Electric Traction Motor Market, By Country

28 U.S. Electric Traction Motor Market, By Type

29 U.S. Electric Traction Motor Market, By Application

30 Canada Electric Traction Motor Market, By Type

31 Canada Electric Traction Motor Market, By Application

32 Mexico Electric Traction Motor Market, By Type

33 Mexico Electric Traction Motor Market, By Application

34 Four Quadrant Positioning Matrix

35 Company Market Share Analysis

36 ABB Ltd: Company Snapshot

37 ABB Ltd: SWOT Analysis

38 ABB Ltd: Geographic Presence

39 Siemens AG: Company Snapshot

40 Siemens AG: SWOT Analysis

41 Siemens AG: Geographic Presence

42 General Electric Company: Company Snapshot

43 General Electric Company: SWOT Analysis

44 General Electric Company: Geographic Presence

45 Kirloskar Electric Company Ltd: Company Snapshot

46 Kirloskar Electric Company Ltd: Swot Analysis

47 Kirloskar Electric Company Ltd: Geographic Presence

48 CG Power and Industrial Solutions Ltd: Company Snapshot

49 CG Power and Industrial Solutions Ltd: SWOT Analysis

50 CG Power and Industrial Solutions Ltd: Geographic Presence

51 CRRC Corporation Limited: Company Snapshot

52 CRRC Corporation Limited: SWOT Analysis

53 CRRC Corporation Limited: Geographic Presence

54 Alstom SA : Company Snapshot

55 Alstom SA : SWOT Analysis

56 Alstom SA : Geographic Presence

57 Traktionssysteme Austria (TSA) GmbH: Company Snapshot

58 Traktionssysteme Austria (TSA) GmbH: SWOT Analysis

59 Traktionssysteme Austria (TSA) GmbH: Geographic Presence

60 Skoda Transportation AS, Inc.: Company Snapshot

61 Skoda Transportation AS, Inc.: SWOT Analysis

62 Skoda Transportation AS, Inc.: Geographic Presence

63 Robert Bosch GmbH: Company Snapshot

64 Robert Bosch GmbH: SWOT Analysis

65 Robert Bosch GmbH: Geographic Presence

66 Other Companies: Company Snapshot

67 Other Companies: SWOT Analysis

68 Other Companies: Geographic Presence

The Global Electric Traction Motor Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Electric Traction Motor Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS