Global Energy Management Systems Market Size, Trends & Analysis - Forecasts to 2028 By System Type (Industrial Energy Management Systems (IEMS), Building Energy Management Systems (BEMS), and Home Energy Management Systems (HEMS)), By Component (Hardware, Software, and Services), By Deployment (On-premises and Cloud), By Vertical (Residential, Energy & Power, Telecom & IT, Manufacturing, Retail, Healthcare, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

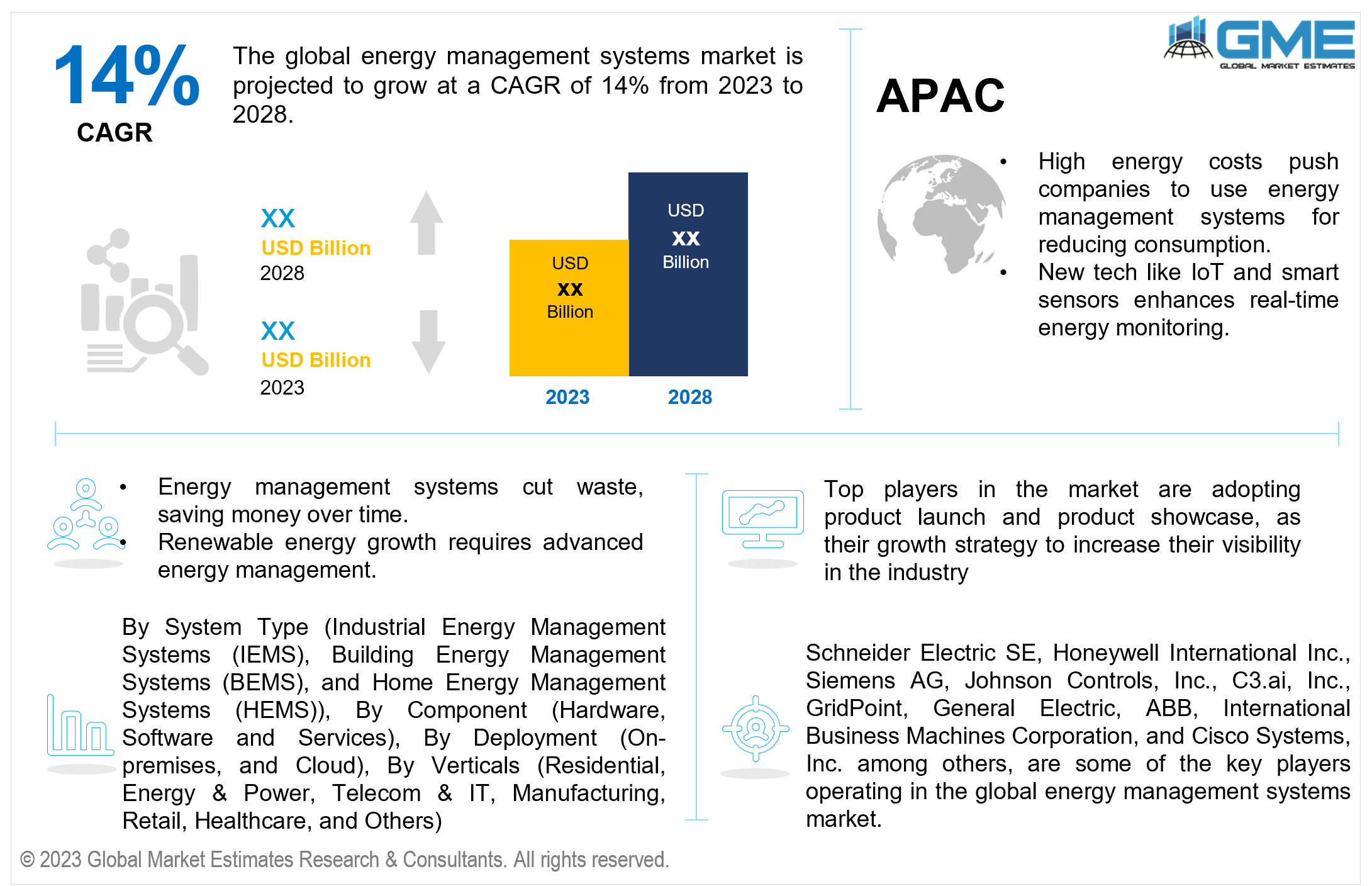

The global energy management systems market is projected to grow at a CAGR of 14% from 2023 to 2028.

Growing awareness about environmental problems and the importance of cutting down on carbon emissions has increased the use of energy-saving methods, making the energy management systems market grow. In February 2020, the World Resources Institute stated that the biggest reason for greenhouse gas emissions caused by humans was by using energy. With this ongoing pattern, companies look for solutions based on the Internet of Things (IoT) to use energy more efficiently and manage energy flows.

The global transition to renewable energy sources, such as solar and wind power, requires advanced energy management to integrate and manage fluctuating energy supply. Increasing energy expenses have led organizations to seek ways to manage and reduce energy consumption, driving the demand for energy management systems. It facilitates effective energy utilization, resulting in cost savings through the reduction of electricity wastage and enhancement of operational efficiency. It also provides real-time insights into energy usage, helping organizations make informed decisions for immediate adjustments.

Manufacturing industries increasingly focus on sustainable practices to improve their environmental footprint and reputation, leading to the increasing adoption of energy-efficient technologies. The companies like Siemens AG and Johnsons Controls, Inc. have invested to improve energy management services and to reduce the global carbon footprint.

Implementing an energy management system can involve significant upfront costs, including the purchase of hardware, software licenses, and installation expenses. For smaller businesses or organizations with limited budgets, these costs could be a restrictive factor toward sustainability, hindering the market growth.

The industrial energy management system segment is expected to hold the largest share of the market over the forecast period. According to World Green Building Council, "Bringing Embodied Carbon Upfront," buildings contribute 40% and 39% to the world's total energy usage and carbon emissions. With a rapidly growing population, urban expansion, and globalization, the building sector faces the challenge of developing comprehensive and efficient energy management systems as part of its infrastructure development. For instance, according to the World Bank (April 2023) currently, more than half of the global population resides in urban regions. By the year 2045, the world's urban population is projected to grow by 1.5 times, reaching a total of 6 billion people. Thus, smart buildings embrace IoT and digital solutions to use real-time data for efficient and sustainable management.

Home energy management system segment is expected to be the fastest-growing segment in the market from 2023-2028. The adoption of technologies such as intelligent electrical panels and energy usage tracking software is anticipated to rise for domestic energy management. According to Environmental Impact Assessment annual energy outlook 2015, energy use in homes could increase by 0.3% each year until 2040. Products like air conditioning, hot water, lighting, and appliances consume much electricity in homes, so smart gadgets like sensors and meters could become even more popular as they help manage and track energy usage. The need for home energy management systems will increase as more energy-saving gadgets become accessible. According to Statista survey conducted in Germany in 2021 with 3,000 respondents aged 18 to 64, almost three-quarters own at least one smart-home device.

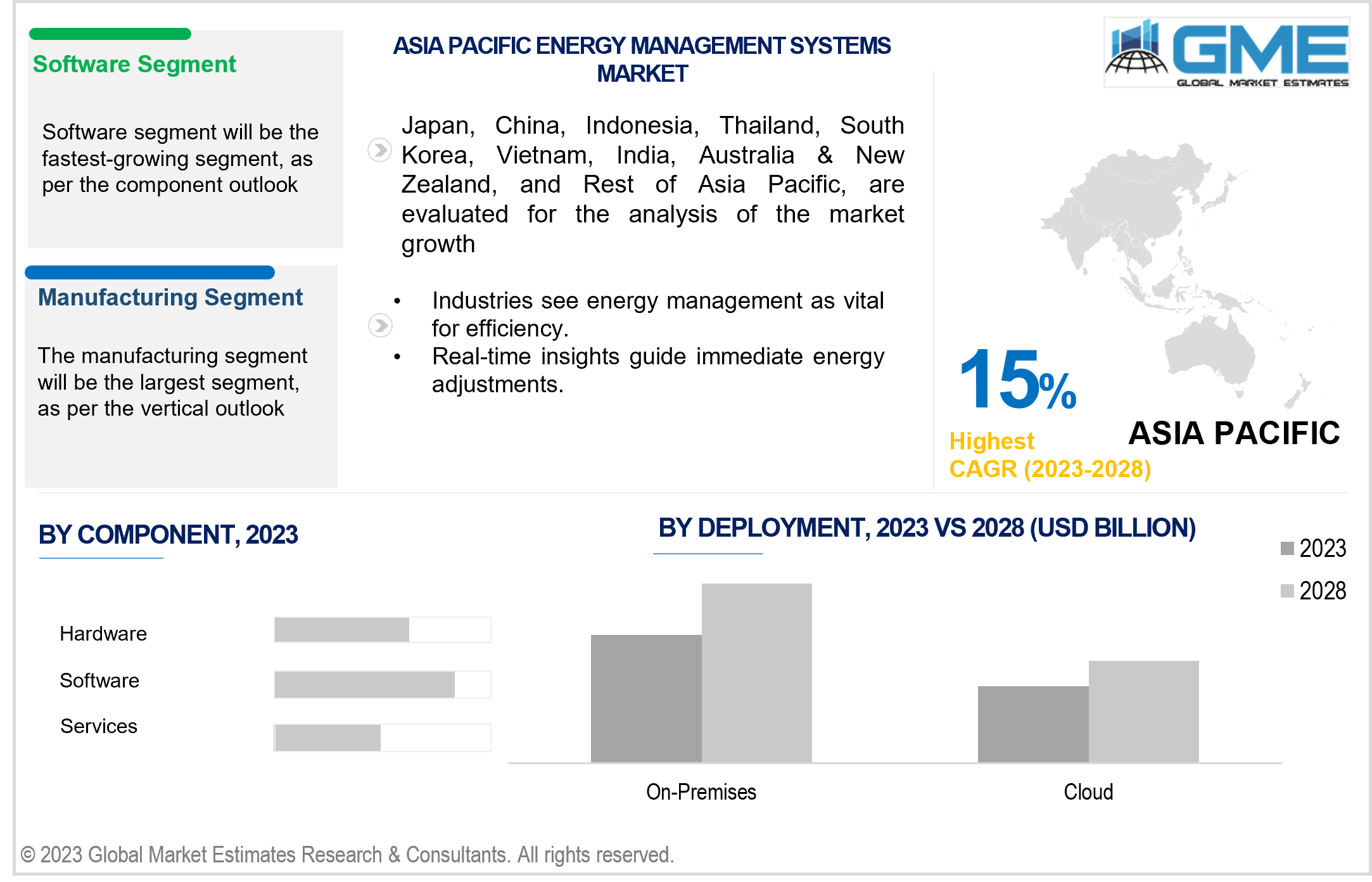

Software segment is anticipated to be the fastest-growing segment in the market from 2023-2028. The rise of advanced analytics and artificial intelligence (AI) technologies has enabled sophisticated energy data analysis, allowing for predictive and prescriptive insights that help optimize the energy consumption. Additionally, innovation of software helps to monitor energy consumption and identify opportunities for cost savings, making it an attractive option for organizations looking to reduce expenses. In April 2023, according to the Times of India, researchers at the Indian Institute of Technology (IIT) Mandi developed a new algorithm that can identify malfunctions in heating ventilation and air-conditioning (HVAC) systems in buildings without human intervention. Researchers stated that this method is budget-friendly and can assist building operators in saving time and money. It automatically identifies and resolves HVAC problems, lowers downtime, and reduces energy expenses.

Hardware segment is expected to hold the largest share of the market. Hardware systems acts as a bridge between cloud software platforms and electrical cabinets. Decline in hardware cost and new sensor technology developments are positively impacting the energy management systems market growth. For instance, Samsung’s 2021 Frame TV utilizes Infineon's BGT60LTR11AIP radar sensor to automatically transition the TV from Art Mode to Sleep Mode after a specified period of inactivity. This radar sensor detects the absence of individuals nearby and triggers the mode switch, conserving energy when the TV is not being actively viewed.

The on-premises segment is projected to hold the largest share of the market. On-premises deployment offers a higher level of control and customization, allowing organizations to customize the energy management system to their specific needs and integrate it with existing infrastructure. Furthermore, organizations with strict data security and privacy requirements may choose on-premises deployment to maintain direct control over sensitive energy usage data and ensure compliance with regulations.

Cloud segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Cloud computing enhances organizational flexibility, enabling remote data visualization, monitoring, and assessment. The increasing focus on saving energy by end users such as households and manufacturing industries, drives the adoption of cloud-based Energy Management System (EMS). For instance, in March 2021, Oracle mentioned that their cloud system helped Enloc Energy GmbH save electricity costs. Enloc Energy GmbH is a company that serves real estate and energy industries with electricity, gas, and heat and provides IT and consulting services.

The energy & power segment is expected to hold the largest share of the market. The growing requirement for monitoring energy consumption in various sectors like industries involved in power generation, oil and gas industries, as well as chemical and petrochemical complexes, has resulted in the commercialization of energy management system modules. According to World Energy Outlook 2022, electricity accounts for around 20% of the world’s total final energy consumption. However, its efficiency makes its share of energy services higher. Electricity is essential for daily life, and its consumption will increase significantly in the near future as electricity expands to new end-uses, such as heat pumps and electric vehicles (EVs).

Manufacturing segment is also expected to be one of the leading segments contributing to the market growth. Automotive industry stands out as a favourable subcategory within the energy management systems market, as electric vehicle manufacturing has gained significant importance. Traditional gasoline and diesel vehicles contribute to pollution and are substituted by fully electric vehicles, bolstering this trend. Moreover, fully electric vehicles do not cause any pollution from their exhaust and are better for the environment. For instance, in September 2021, Ford informed that they will manufacture more electric vehicles to be more sustainable. Car companies will use energy management systems to save power without making cars less comfortable or powerful.

Retail segment is anticipated to be the fastest-growing segment in the market from 2023-2028. Places such as offices, government buildings, malls, and private companies use energy management systems. These systems help control air conditioning, lighting, and heating, which consume much electricity. Moreover, these systems will gain popularity in countries like the U.S., the U.K., China, Australia, and India, as these countries are the largest energy consumers experiencing rapid urbanization and infrastructure growth.

North America is expected to be the largest region in the market. The growth is attributed to the increasing households, offices, and buildings using smart technology for energy saving and management in the region. There has been a significant increase in the demand for smart energy and investment in energy management systems. Notably, the residential, commercial, and construction sectors are expected to strongly need energy management systems based on the Internet of Things (IoT). Additionally, in 2016, North American government announced the North American Energy Management Pilot Program for preservation of natural resources, which is further expected to boost the market growth.

Asia Pacific is predicted to witness rapid growth during the forecast period. The growing residential and industrial infrastructure is fuelling demand for smart grid and smart metering systems to optimize energy utilization, and the region is witnessing increase in investments in energy management system. According to UN-Habitat, by 2050, the urban population in Asia is expected to grow by 50%. Moreover, according to a report from International Energy Agency (IEA), from 2016 to 2020, Southeast Asia spent around USD 70 billion each year on energy. Around 40% funds were invested in clean energy sources such as solar and wind power. Additionally, the rapid growth of power and energy industries is also contributing to the growth of the market.

Schneider Electric SE, Honeywell International Inc., Siemens AG, Johnson Controls, Inc., C3.ai, Inc., GridPoint, General Electric, ABB, International Business Machines Corporation, and Cisco Systems, Inc. among others, are some of the key players operating in the global energy management systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

In May 2022, Siemens announced to develop grid software aimed at improving economic viability and stability of grids. The company claims that their software can accelerate grid simulations by up to sixfold and enhance the efficiency of grid management tasks by 85%.

Moreover, in December 2021, GE Digital entered into a partnership with U.K. Power Networks for the world’s first smart substation project that focuses on enhancing the distribution network efficiency to generate renewable energy significantly throughout the United Kingdom. This partnership aims to reduce around 17.8 million tons of CO2 emissions by 2050.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL ENERGY MANAGEMENT SYSTEMS MARKET, BY VERTICAL

4.2 Energy Management Systems Market: Vertical Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Residential Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Energy & Power Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Telecom & IT Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Manufacturing Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Retail Market Estimates and Forecast, 2020-2028 (USD Million)

4.9.1 Healthcare Market Estimates and Forecast, 2020-2028 (USD Million)

4.10.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL ENERGY MANAGEMENT SYSTEMS MARKET, BY SYSTEM TYPE

5.2 Energy Management Systems Market: System Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Industrial Energy Management Systems (IEMS)

5.5 Building Energy Management Systems (BEMS)

5.6 Home Energy Management Systems (HEMS)

5.6.1 Home Energy Management Systems (HEMS) Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL ENERGY MANAGEMENT SYSTEMS MARKET, BY COMPONENT

6.2 Energy Management Systems Market: Component Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4.1 Hardware Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.1 Software Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.1 Services Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL ENERGY MANAGEMENT SYSTEMS MARKET, BY DEPLOYMENT

7.2 Energy Management Systems Market: Deployment Scope Key Takeaways

7.3 Revenue Growth Analysis, 2022 & 2028

7.4.1 On-premises Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 Cloud Market Estimates and Forecast, 2020-2028 (USD Million)

8 GLOBAL ENERGY MANAGEMENT SYSTEMS MARKET, BY REGION

8.2 North America Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.1 U.S. Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.2 Canada Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.2.5.3 Mexico Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.3 Europe Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.1 Germany Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.2 U.K. Presered Flowers Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.3 France Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.4 Italy Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.5 Spain Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.3.5.6 Netherlands Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4 Asia Pacific Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.1 China Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.2 Japan Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.3 India Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.4 South Korea Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.5 Singapore Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.6 Malaysia Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.7 Thailand Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.8 Indonesia Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.9 Vietnam Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.4.5.10 Taiwan Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.2 U.A.E. Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.5.5.3 Israel Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.1 Brazil Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.2 Argentina Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

8.6.5.3 Chile Energy Management Systems Market Estimates and Forecast, 2020-2028 (USD Million)

9.1 Company Market Share Analysis

9.2 Four Quadrant Positioning Matrix

9.4.1.1 Business Description & Financial Analysis

9.4.1.3 Products & Services Offered

9.4.1.4 Strategic Alliances between Business Partners

9.4.2 Honeywell International Inc.

9.4.2.1 Business Description & Financial Analysis

9.4.2.3 Products & Services Offered

9.4.2.4 Strategic Alliances between Business Partners

9.4.3.1 Business Description & Financial Analysis

9.4.3.3 Products & Services Offered

9.4.3.4 Strategic Alliances between Business Partners

9.4.4.1 Business Description & Financial Analysis

9.4.4.3 Products & Services Offered

9.4.4.4 Strategic Alliances between Business Partners

9.4.5.1 Business Description & Financial Analysis

9.4.5.3 Products & Services Offered

9.4.5.4 Strategic Alliances between Business Partners

9.4.6.1 Business Description & Financial Analysis

9.4.6.3 Products & Services Offered

9.4.6.4 Strategic Alliances between Business Partners

9.4.7.1 Business Description & Financial Analysis

9.4.7.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.8.1 Business Description & Financial Analysis

9.4.8.3 Products & Services Offered

9.4.8.4 Strategic Alliances between Business Partners

9.4.9 International Business Machines Corporation

9.4.9.1 Business Description & Financial Analysis

9.4.9.3 Products & Services Offered

9.4.9.4 Strategic Alliances between Business Partners

9.4.10.1 Business Description & Financial Analysis

9.4.10.3 Products & Services Offered

9.4.10.4 Strategic Alliances between Business Partners

9.4.11.1 Business Description & Financial Analysis

9.4.11.3 Products & Services Offered

9.4.11.4 Strategic Alliances between Business Partners

10.1.2 Market Scope & Segmentation

10.2.1.2 GMEs Internal Data Repository

10.2.1.3 Secondary Resources & Third Party Perspectives

10.2.1.4 Company Information Sources

10.2.2.1 Various Types of Respondents for Primary Interviews

10.2.2.2 Number of Interviews Conducted throughout the Research Process

10.2.2.4 Discussion Guide for Primary Participants

10.2.3.1 Expert Panels Across 30+ Industry

10.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

10.3.1.1 Macro-Economic Indicators Considered

10.3.1.2 Micro-Economic Indicators Considered

10.3.2.1 Company Share Analysis Approach

10.3.2.2 Estimation of Potential Product Sales

10.4.2 Time Series, Cross Sectional & Panel Data Analysis

10.5.1 Inhouse AI Based Real Time Analytics Tool

10.5.2 Output From Desk & Primary Research

10.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Energy Management Systems Market, By Vertical, 2020-2028 (USD Mllion)

2 Residential Market, By Region, 2020-2028 (USD Mllion)

3 Energy & Power Market, By Region, 2020-2028 (USD Mllion)

4 Telecom & IT Market, By Region, 2020-2028 (USD Mllion)

5 Manufacturing Market, By Region, 2020-2028 (USD Mllion)

6 Retail Market, By Region, 2020-2028 (USD Mllion)

7 Healthcare Market, By Region, 2020-2028 (USD Mllion)

8 Others Market, By Region, 2020-2028 (USD Mllion)

9 Global Energy Management Systems Market, By System Type, 2020-2028 (USD Mllion)

10 Industrial Energy Management Systems (IEMS) Market, By Region, 2020-2028 (USD Mllion)

11 Building Energy Management Systems (BEMS) Market, By Region, 2020-2028 (USD Mllion)

12 Home Energy Management Systems (HEMS) Market, By Region, 2020-2028 (USD Mllion)

13 Global Energy Management Systems Market, By Component, 2020-2028 (USD Mllion)

14 Hardware Market, By Region, 2020-2028 (USD Mllion)

15 Software Market, By Region, 2020-2028 (USD Mllion)

16 Services Market, By Region, 2020-2028 (USD Mllion)

17 Global Energy Management Systems Market, By Deployment, 2020-2028 (USD Mllion)

18 On-premises Market, By Region, 2020-2028 (USD Mllion)

19 Cloud Market, By Region, 2020-2028 (USD Mllion)

20 Regional Analysis, 2020-2028 (USD Mllion)

21 North America Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

22 North America Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

23 North America Energy Management Systems Market, By Component, 2020-2028 (USD Million)

24 North America Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

25 North America Energy Management Systems Market, By Country, 2020-2028 (USD Million)

26 U.S Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

27 U.S Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

28 U.S Energy Management Systems Market, By Component, 2020-2028 (USD Million)

29 U.S Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

30 Canada Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

31 Canada Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

32 Canada Energy Management Systems Market, By Component, 2020-2028 (USD Million)

33 CANADA Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

34 Mexico Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

35 Mexico Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

36 Mexico Energy Management Systems Market, By Component, 2020-2028 (USD Million)

37 mexico Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

38 Europe Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

39 Europe Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

40 Europe Energy Management Systems Market, By Component, 2020-2028 (USD Million)

41 europe Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

42 Germany Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

43 Germany Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

44 Germany Energy Management Systems Market, By Component, 2020-2028 (USD Million)

45 germany Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

46 UK Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

47 UK Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

48 UK Energy Management Systems Market, By Component, 2020-2028 (USD Million)

49 U.kEnergy Management Systems Market, By Deployment, 2020-2028 (USD Million)

50 France Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

51 France Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

52 France Energy Management Systems Market, By Component, 2020-2028 (USD Million)

53 france Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

54 Italy Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

55 Italy Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

56 Italy Energy Management Systems Market, By Component, 2020-2028 (USD Million)

57 italy Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

58 Spain Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

59 Spain Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

60 Spain Energy Management Systems Market, By Component, 2020-2028 (USD Million)

61 spain Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

62 Rest Of Europe Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

63 Rest Of Europe Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

64 Rest of Europe Energy Management Systems Market, By Component, 2020-2028 (USD Million)

65 REST OF EUROPE Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

66 Asia Pacific Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

67 Asia Pacific Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

68 Asia Pacific Energy Management Systems Market, By Component, 2020-2028 (USD Million)

69 asia Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

70 Asia Pacific Energy Management Systems Market, By Country, 2020-2028 (USD Million)

71 China Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

72 China Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

73 China Energy Management Systems Market, By Component, 2020-2028 (USD Million)

74 china Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

75 India Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

76 India Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

77 India Energy Management Systems Market, By Component, 2020-2028 (USD Million)

78 india Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

79 Japan Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

80 Japan Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

81 Japan Energy Management Systems Market, By Component, 2020-2028 (USD Million)

82 japan Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

83 South Korea Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

84 South Korea Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

85 South Korea Energy Management Systems Market, By Component, 2020-2028 (USD Million)

86 south korea Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

87 Middle East and Africa Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

88 Middle East and Africa Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

89 Middle East and Africa Energy Management Systems Market, By Component, 2020-2028 (USD Million)

90 MIDDLE EAST and AFRICA Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

91 Middle East and Africa Energy Management Systems Market, By Country, 2020-2028 (USD Million)

92 Saudi Arabia Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

93 Saudi Arabia Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

94 Saudi Arabia Energy Management Systems Market, By Component, 2020-2028 (USD Million)

95 saudi arabia Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

96 UAE Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

97 UAE Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

98 UAE Energy Management Systems Market, By Component, 2020-2028 (USD Million)

99 uae Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

100 Central and South America Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

101 Central and South America Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

102 Central and South America Energy Management Systems Market, By Component, 2020-2028 (USD Million)

103 CENTRAL and SOUTH AMERICA Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

104 Central and South America Energy Management Systems Market, By Country, 2020-2028 (USD Million)

105 Brazil Energy Management Systems Market, By Vertical, 2020-2028 (USD Million)

106 Brazil Energy Management Systems Market, By System Type, 2020-2028 (USD Million)

107 Brazil Energy Management Systems Market, By Component, 2020-2028 (USD Million)

108 brazil Energy Management Systems Market, By Deployment, 2020-2028 (USD Million)

109 Schneider Electric SE: Products & Services Offering

110 Honeywell International Inc.: Products & Services Offering

111 Siemens AG: Products & Services Offering

112 Johnson Controls, Inc.: Products & Services Offering

113 C3.ai, Inc.: Products & Services Offering

114 ABB: Products & Services Offering

115 GridPoint : Products & Services Offering

116 General Electric: Products & Services Offering

117 International Business Machines Corporation, Inc: Products & Services Offering

118 Cisco Systems, Inc.: Products & Services Offering

119 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Energy Management Systems Market Overview

2 Global Energy Management Systems Market Value From 2020-2028 (USD Mllion)

3 Global Energy Management Systems Market Share, By Vertical (2022)

4 Global Energy Management Systems Market Share, By System Type (2022)

5 Global Energy Management Systems Market Share, By Component (2022)

6 Global Energy Management Systems Market Share, By Deployment (2022)

7 Global Energy Management Systems Market, By Region (Asia Pacific Market)

8 Technological Trends In Global Energy Management Systems Market

9 Four Quadrant Competitor Positioning Matrix

10 Impact Of Macro & Micro Indicators On The Market

11 Impact Of Key Drivers On The Global Energy Management Systems Market

12 Impact Of Challenges On The Global Energy Management Systems Market

13 Porter’s Five Forces Analysis

14 Global Energy Management Systems Market: By Vertical Scope Key Takeaways

15 Global Energy Management Systems Market, By Vertical Segment: Revenue Growth Analysis

16 Residential Market, By Region, 2020-2028 (USD Mllion)

17 Energy & Power Market, By Region, 2020-2028 (USD Mllion)

18 Telecom & IT Market, By Region, 2020-2028 (USD Mllion)

19 Manufacturing Market, By Region, 2020-2028 (USD Mllion)

20 Retail Market, By Region, 2020-2028 (USD Mllion)

21 Healthcare Market, By Region, 2020-2028 (USD Mllion)

22 Others Market, By Region, 2020-2028 (USD Mllion)

23 Global Energy Management Systems Market: By System Type Scope Key Takeaways

24 Global Energy Management Systems Market, By System Type Segment: Revenue Growth Analysis

25 Industrial Energy Management Systems (IEMS) Market, By Region, 2020-2028 (USD Mllion)

26 Building Energy Management Systems (BEMS) Market, By Region, 2020-2028 (USD Mllion)

27 Home Energy Management Systems (HEMS) Market, By Region, 2020-2028 (USD Mllion)

28 Global Energy Management Systems Market: By Component Scope Key Takeaways

29 Global Energy Management Systems Market, By Component Segment: Revenue Growth Analysis

30 Hardware Market, By Region, 2020-2028 (USD Mllion)

31 Software Market, By Region, 2020-2028 (USD Mllion)

32 Services Market, By Region, 2020-2028 (USD Mllion)

33 Global Energy Management Systems Market: By Deployment Scope Key Takeaways

34 Global Energy Management Systems Market, By Deployment Segment: Revenue Growth Analysis

35 On-premises Market, By Region, 2020-2028 (USD Mllion)

36 Cloud Market, By Region, 2020-2028 (USD Mllion)

37 Regional Segment: Revenue Growth Analysis

38 Global Energy Management Systems Market: Regional Analysis

39 North America Energy Management Systems Market Overview

40 North America Energy Management Systems Market, By Vertical

41 North America Energy Management Systems Market, By System Type

42 North America Energy Management Systems Market, By Component

43 North America Energy Management Systems Market, By Deployment

44 North America Energy Management Systems Market, By Country

45 U.S. Energy Management Systems Market, By Vertical

46 U.S. Energy Management Systems Market, By System Type

47 U.S. Energy Management Systems Market, By Component

48 U.S. Energy Management Systems Market, By Deployment

49 Canada Energy Management Systems Market, By Vertical

50 Canada Energy Management Systems Market, By System Type

51 Canada Energy Management Systems Market, By Component

52 Canada Energy Management Systems Market, By Deployment

53 Mexico Energy Management Systems Market, By Vertical

54 Mexico Energy Management Systems Market, By System Type

55 Mexico Energy Management Systems Market, By Component

56 Mexico Energy Management Systems Market, By Deployment

57 Four Quadrant Positioning Matrix

58 Company Market Share Analysis

59 Schneider Electric SE: Company Snapshot

60 Schneider Electric SE: SWOT Analysis

61 Schneider Electric SE: Geographic Presence

62 Honeywell International Inc.: Company Snapshot

63 Honeywell International Inc.: SWOT Analysis

64 Honeywell International Inc.: Geographic Presence

65 Siemens AG: Company Snapshot

66 Siemens AG: SWOT Analysis

67 Siemens AG: Geographic Presence

68 Johnson Controls, Inc.: Company Snapshot

69 Johnson Controls, Inc.: Swot Analysis

70 Johnson Controls, Inc.: Geographic Presence

71 C3.ai, Inc.: Company Snapshot

72 C3.ai, Inc.: SWOT Analysis

73 C3.ai, Inc.: Geographic Presence

74 ABB: Company Snapshot

75 ABB: SWOT Analysis

76 ABB: Geographic Presence

77 GridPoint : Company Snapshot

78 GridPoint : SWOT Analysis

79 GridPoint : Geographic Presence

80 General Electric: Company Snapshot

81 General Electric: SWOT Analysis

82 General Electric: Geographic Presence

83 International Business Machines Corporation, Inc.: Company Snapshot

84 International Business Machines Corporation, Inc.: SWOT Analysis

85 International Business Machines Corporation, Inc.: Geographic Presence

86 Cisco Systems, Inc.: Company Snapshot

87 Cisco Systems, Inc.: SWOT Analysis

88 Cisco Systems, Inc.: Geographic Presence

89 Other Companies: Company Snapshot

90 Other Companies: SWOT Analysis

91 Other Companies: Geographic Presence

The Global Energy Management Systems Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Energy Management Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS