Global Engineered Wood Flooring Market Size, Trends & Analysis - Forecasts to 2026 By Type (I-Beams, Laminated Veneer Lumber (LVL), Plywood, Glulam (Glued Laminated Timber), Cross Laminated Timber (CLT), Oriented Strand Boards (OSB)), By End-User (Residential, Commercial & Industrial), By Offering (Packaging [Food, Cosmetic, Gift, Heavy Duty Goods, Transport], Display [Pop Display, Custom Printing]), By Region (North America, Asia Pacific, Europe, Latin America, Middle East & Africa); End-User Landscape, Company Market Share Analysis, and Competitor Analysis

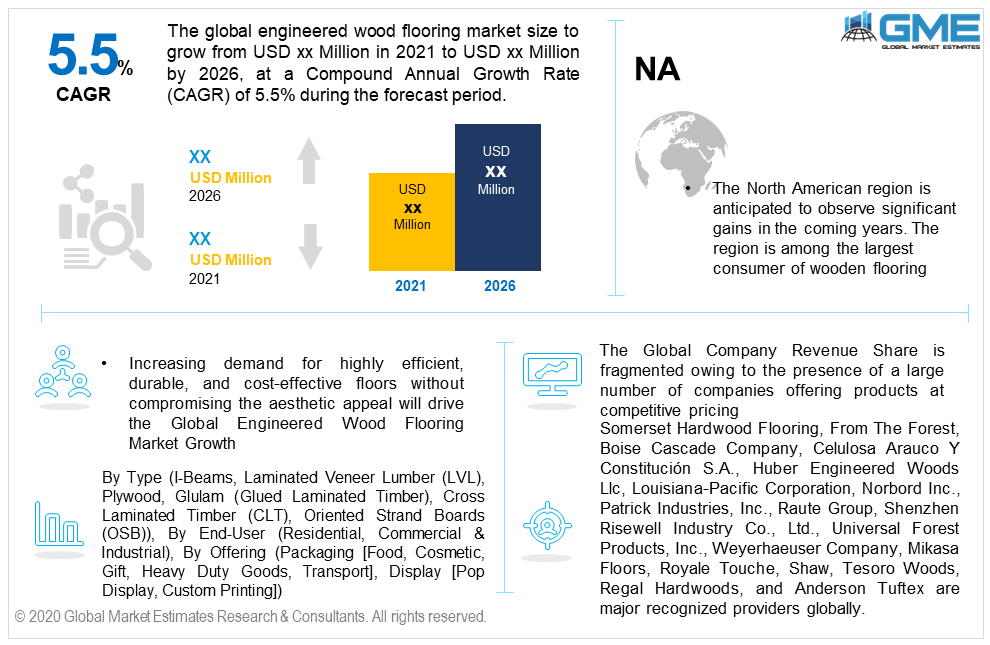

Increasing demand for highly efficient, durable, and cost-effective floors without compromising the aesthetic appeal will drive the Global Engineered Wood Flooring Market Growth. These products are a superior alternative to traditional floor types in terms of appearance, performance, and maintenance. Another major advantage offered by these materials is their resistance to compact and contract as they age. This feature makes them an optimum solution for kitchen and bathroom applications.

The Global Engineered Wood Flooring Market will observe around 5.5% CAGR from 2021 to 2026, with the Asia Pacific dominating the regional revenue share in 2019. The industry faced a sudden setback during the first phase of the Covid-19 pandemic which leads to unnecessary losses and resource wastage. However, the industry is picking its normal growth rate and is projected to attain above-average gains in the coming years.

The type segment is divided into I-Beams, Laminated Veneer Lumber (LVL), Plywood, Glulam (Glued Laminated Timber), Cross-laminated timber (CLT), and Oriented Strand Boards (OSB) among others. The Cross-laminated timber (CLT) and Glulam (Glued Laminated Timber) are projected to dominate the type segment. High performance, long-term life span, and attractive appearance are the key attributing factors to drive demand in these segments.

The Oriented Strand Boards (OSB) is predicted to witness significant gains during the forecast period. Sturdiness, lesser resource utilization, and cost efficiency will promote growth in this segment.

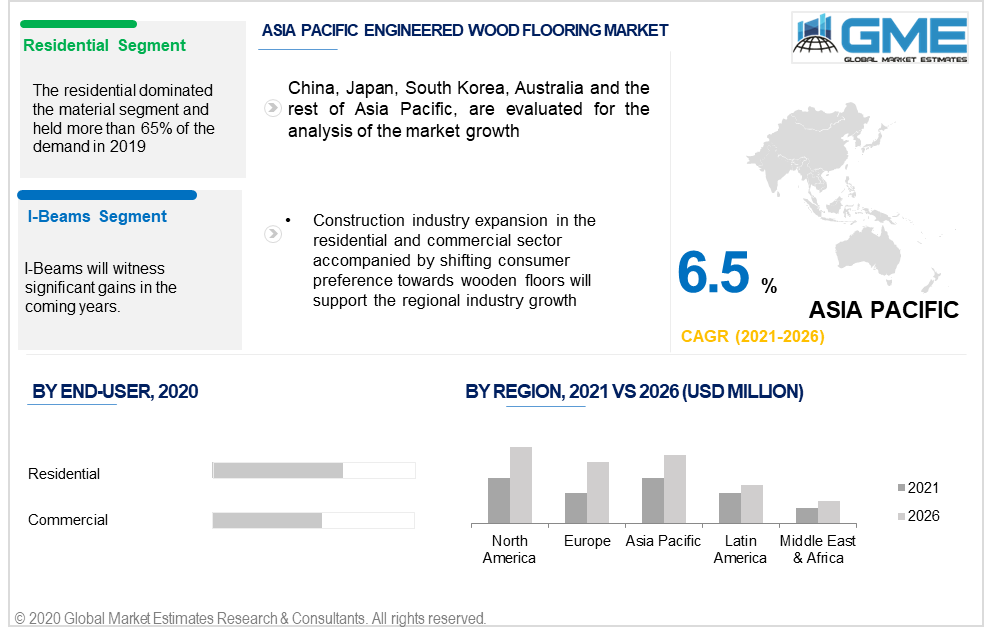

Residential and Commercial are the two classified categories in the end-user segment. The residential sector dominated the end-user segment and accounted for more than 65% of demand in 2019. Increasing the concept of individual family housing accompanied by increasing preference for wooden floors due to its high aesthetic appeal will promote consumption. Other factors such as durability, sustainability, and physical appearance make the material highly lucrative in nature. Refurbishment in the residential sector also plays a critical role in industry growth. Increased consumer affordability and interest to renovate the house will result in more product demand.

The commercial sector will witness notable gains during the forecast period. Rapid industrialization and renovation activities will promote industry growth. High aesthetic appeal, lesser maintenance cost, and material robustness will result in high penetration in commercial building applications.

The Asia Pacific dominated the overall regional demand and accounted for more than 38% of the revenue share in 2019. The region is intended to hold its dominance during the forecast period. Construction industry expansion in the residential and commercial sector accompanied by shifting consumer preference towards wooden floors will support the regional industry growth.

APAC is among the most lucrative market in terms of construction development and activities due to the presence of a large population. Increasing consumer affordability to invest in housing construction and maintenance is likely to result in high penetration.

The North American region is anticipated to observe significant gains in the coming years. The region is among the largest consumer of wooden flooring. Regional adoption is largely attributed to the increasing refurbishment activities in the residential and commercial building sector. Energy efficiency, superior quality, and minimal wastage are the prime reasons to drive demand for these sustainable flooring materials.

The European construction industry faced sluggish growth in recent years, especially during the covid-19 pandemic. However, the industry is expected to attain its normal growth pace during the forecast period. The region is highly influenced by the adoption of sustainable construction activities. Thus, a significant adoption rate is expected in the coming years.

Somerset Hardwood Flooring, From The Forest, Boise Cascade Company, Celulosa Arauco Y Constitución S.A., Huber Engineered Woods Llc, Louisiana-Pacific Corporation, Norbord Inc., Patrick Industries, Inc., Raute Group, Shenzhen Risewell Industry Co., Ltd., Universal Forest Products, Inc., Weyerhaeuser Company, Mikasa Floors, Royale Touche, Harris Wood Floors, Bruce, Mohawk, Johnson Hardwood, Kährs, LM Flooring, Mullican, Pergo, Shaw, Lauzon, Tesoro Woods, Regal Hardwoods, Hallmark Floors, and Anderson Tuftex are major recognized providers globally.

Please note: This is not an exhaustive list of companies profiled in the report.

The Global Company Revenue Share is fragmented in nature owing to the presence of a large number of companies offering products at competitive pricing. Brand recognition and creating a brand image to engage long-term repetitive customers are the prime strategies observed in the industry. Product positioning as a luxury or premium category is also seen to target high-budget commercial building customers. Product advancement in terms of design, color, finish, and appearance is adopted by manufacturers to attain a point of differentiation in the industry.

Chapter 1 Methodology

1.1 Market scope & definitions

1.2 Estimates & forecast calculation

1.3 Historical data overview and validation

1.4 Data sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Engineered Wood Flooring industry overview, 2019-2026

2.1.1 Industry overview

2.1.2 Type overview

2.1.3 End-User overview

2.1.4 Regional overview

Chapter 3 Engineered Wood Flooring Market Trends

3.1 Market segmentation

3.2 Industry background, 2019-2026

3.3 Market key trends

3.3.1 Positive trends

3.3.2 Industry challenges

3.4 Prospective growth scenario

3.4.1 Product growth scenario

3.5 Industry influence over product growth

3.6 Porter’s analysis

3.7 PESTEL analysis

3.8 Value chain & supply chain analysis

3.9 Regulatory framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology overview

3.11 Market share analysis, 2020

3.11.1 Company positioning overview, 2020

Chapter 4 Engineered Wood Flooring Market, By Type

4.1 Type Outlook

4.2 I-Beams

4.2.1 Market size, by region, 2019-2026 (USD Million)

4.3 Laminated Veneer Lumber (LVL)

4.3.1 Market size, by region, 2019-2026 (USD Million)

4.4 Plywood

4.4.1 Market size, by region, 2019-2026 (USD Million)

4.5 Glulam (Glued Laminated Timber)

4.5.1 Market size, by region, 2019-2026 (USD Million)

4.6 Cross laminated timber (CLT)

4.6.1 Market size, by region, 2019-2026 (USD Million)

4.7 Oriented Strand Boards (OSB)

4.7.1 Market size, by region, 2019-2026 (USD Million)

4.8 Others

4.8.1 Market size, by region, 2019-2026 (USD Million)

Chapter 5 Engineered Wood Flooring Market, By End-User

5.1 End-User Outlook

5.2 Residential

5.2.1 Market size, by region, 2019-2026 (USD Million)

5.3 Commercial & Industrial

5.3.1 Market size, by region, 2019-2026 (USD Million)

Chapter 6 Engineered Wood Flooring Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market size, by country 2019-2026 (USD Million)

6.2.2 Market size, by type, 2019-2026 (USD Million)

6.2.3 Market size, by end-user, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market size, by type, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market size, by type, 2019-2026 (USD Million)

6.2.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market size, by country 2019-2026 (USD Million)

6.3.2 Market size, by type, 2019-2026 (USD Million)

6.3.3 Market size, by end-user, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market size, by type, 2019-2026 (USD Million)

6.2.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market size, by type, 2019-2026 (USD Million)

6.3.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market size, by type, 2019-2026 (USD Million)

6.3.6.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market size, by type, 2019-2026 (USD Million)

6.3.7.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market size, by type, 2019-2026 (USD Million)

6.3.8.2 Market size, by end-user, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market size, by type, 2019-2026 (USD Million)

6.3.9.2 Market size, by end-user, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market size, by country 2019-2026 (USD Million)

6.4.2 Market size, by type, 2019-2026 (USD Million)

6.4.3 Market size, by end-user, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market size, by type, 2019-2026 (USD Million)

6.4.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.5 Japan

6.4.5.1 Market size, by type, 2019-2026 (USD Million)

6.4.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.6 Australia

6.4.6.1 Market size, by type, 2019-2026 (USD Million)

6.4.6.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.7 India

6.4.7.1 Market size, by type, 2019-2026 (USD Million)

6.4.7.2 Market size, by end-user, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market size, by type, 2019-2026 (USD Million)

6.4.8.2 Market size, by end-user, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market size, by country 2019-2026 (USD Million)

6.5.2 Market size, by type, 2019-2026 (USD Million)

6.5.3 Market size, by end-user, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market size, by type, 2019-2026 (USD Million)

6.5.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market size, by type, 2019-2026 (USD Million)

6.5.5.2 Market size, by end-user, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market size, by country 2019-2026 (USD Million)

6.6.2 Market size, by type, 2019-2026 (USD Million)

6.6.3 Market size, by end-user, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market size, by type, 2019-2026 (USD Million)

6.6.4.2 Market size, by end-user, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market size, by type, 2019-2026 (USD Million)

6.6.5.2 Market size, by end-user, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive analysis, 2020

7.2 Somerset Hardwood Flooring

7.2.1 Company overview

7.2.2 Financial analysis

7.2.3 Strategic positioning

7.2.4 Info graphic analysis

7.3 From The Forest

7.3.1 Company overview

7.3.2 Financial analysis

7.3.3 Strategic positioning

7.3.4 Info graphic analysis

7.4 Boise Cascade Company

7.4.1 Company overview

7.4.2 Financial analysis

7.4.3 Strategic positioning

7.4.4 Info graphic analysis

7.5 Celulosa Arauco Y Constitución S.A.

7.5.1 Company overview

7.5.2 Financial analysis

7.5.3 Strategic positioning

7.5.4 Info graphic analysis

7.6 Huber Engineered Woods Llc

7.6.1 Company overview

7.6.2 Financial analysis

7.6.3 Strategic positioning

7.6.4 Info graphic analysis

7.7 Louisiana-Pacific Corporation

7.7.1 Company overview

7.7.2 Financial analysis

7.7.3 Strategic positioning

7.7.4 Info graphic analysis

7.8 Norbord Inc.

7.8.1 Company overview

7.8.2 Financial analysis

7.8.3 Strategic positioning

7.8.4 Info graphic analysis

7.9 Patrick Industries, Inc.

7.9.1 Company overview

7.9.2 Financial analysis

7.9.3 Strategic positioning

7.9.4 Info graphic analysis

7.10 Raute Group

7.10.1 Company overview

7.10.2 Financial analysis

7.10.3 Strategic positioning

7.10.4 Info graphic analysis

7.11 Shenzhen Risewell Industry Co., Ltd.

7.11.1 Company overview

7.11.2 Financial analysis

7.11.3 Strategic positioning

7.11.4 Info graphic analysis

7.12 Universal Forest Products, Inc.

7.12.1 Company overview

7.12.2 Financial analysis

7.12.3 Strategic positioning

7.12.4 Info graphic analysis

7.13 Weyerhaeuser Company

7.13.1 Company overview

7.13.2 Financial analysis

7.13.3 Strategic positioning

7.13.4 Info graphic analysis

7.14 Mikasa Floors

7.14.1 Company overview

7.14.2 Financial analysis

7.14.3 Strategic positioning

7.14.4 Info graphic analysis

7.15 Royale Touche

7.15.1 Company overview

7.15.2 Financial analysis

7.15.3 Strategic positioning

7.15.4 Info graphic analysis

7.16 Harris Wood Floors

7.16.1 Company overview

7.16.2 Financial analysis

7.16.3 Strategic positioning

7.16.4 Info graphic analysis

7.17 Bruce

7.17.1 Company overview

7.17.2 Financial analysis

7.17.3 Strategic positioning

7.17.4 Info graphic analysis

7.18 Mohawk

7.18.1 Company overview

7.18.2 Financial analysis

7.18.3 Strategic positioning

7.18.4 Info graphic analysis

7.19 Johnson Hardwood

7.19.1 Company overview

7.19.2 Financial analysis

7.19.3 Strategic positioning

7.19.4 Info graphic analysis

7.20 Kährs

7.20.1 Company overview

7.20.2 Financial analysis

7.20.3 Strategic positioning

7.20.4 Info graphic analysis

7.21 Lm Flooring

7.21.1 Company overview

7.21.2 Financial analysis

7.21.3 Strategic positioning

7.21.4 Info graphic analysis

7.22 Mullican

7.22.1 Company overview

7.22.2 Financial analysis

7.22.3 Strategic positioning

7.22.4 Info graphic analysis

7.23 Pergo

7.23.1 Company overview

7.23.2 Financial analysis

7.23.3 Strategic positioning

7.23.4 Info graphic analysis

7.24 Shaw

7.24.1 Company overview

7.24.2 Financial analysis

7.24.3 Strategic positioning

7.24.4 Info graphic analysis

7.25 Lauzon

7.25.1 Company overview

7.25.2 Financial analysis

7.25.3 Strategic positioning

7.25.4 Info graphic analysis

7.26 Tesoro Woods

7.26.1 Company overview

7.26.2 Financial analysis

7.26.3 Strategic positioning

7.26.4 Info graphic analysis

7.27 Regal Hardwoods

7.27.1 Company overview

7.27.2 Financial analysis

7.27.3 Strategic positioning

7.27.4 Info graphic analysis

7.28 Hallmark Floors

7.28.1 Company overview

7.28.2 Financial analysis

7.28.3 Strategic positioning

7.28.4 Info graphic analysis

7.29 Anderson Tuftex

7.29.1 Company overview

7.29.2 Financial analysis

7.29.3 Strategic positioning

7.29.4 Info graphic analysis

The Global Engineered Wood Flooring Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Engineered Wood Flooring Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS