Global ENT Devices Market Size, Trends & Analysis - Forecasts to 2028 By Product (Diagnostic ENT Devices, Surgical ENT Devices, Hearing Aids, Hearing Implants, and Nasal Splints), By End-use (Hospitals, Ambulatory Settings, ENT Clinics, Home-use, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

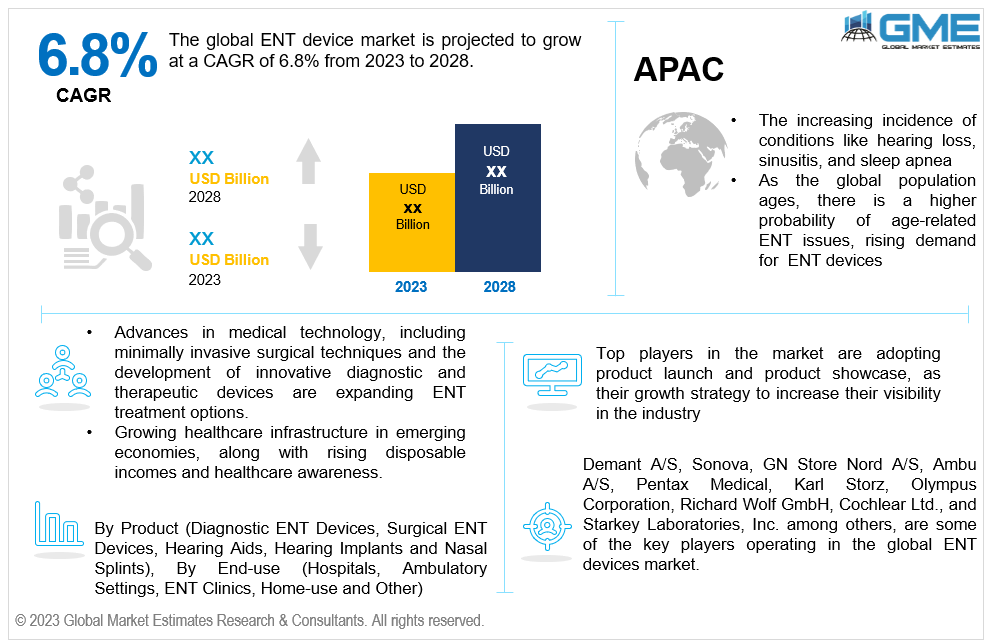

The global ENT devices market is projected to grow at a CAGR of 6.8% from 2023 to 2028.

The increasing prevalence of ENT (Ear, Nose, and Throat) disorders, increasing demand for ENT devices, and rising health awareness about these disorders are key factors propelling the growth of the market. According to the World Health Organization (WHO) (2023), by 2050 over 430 million people, accounting for over 5% of the world's population, will require rehabilitation to address their disabling hearing loss.

This hearing loss affects more than 80% of the population in low- and middle-income countries.

Furthermore, the market is experiencing growth driven by advancements in ENT device technology. Technology is evolving rapidly, leading to a wide range of innovative products designed to enhance convenience and quality of life. For instance, hearing aid manufacturers are utilizing the power of artificial intelligence (AI) to expand the capabilities of their devices. These devices incorporate integrated sensors that leverage AI technology to collect data on daily activity levels, social interactions, and attentive listening, ultimately generating a comprehensive well-being assessment.

For instance, in September 2021, Acclarent, Inc., a subsidiary company of Johnson & Johnson Medical Devices, introduced AI-powered ENT technology in the United States. This innovative software, which is part of the TruDi Navigation System, aims to streamline surgical planning and offer real-time guidance during ENT navigation procedures, particularly for endoscopic sinus surgery.

Diagnostics ENT device segment is expected to hold the largest share of the market over the forecast period. Technological advancements, product launches, and the availability of mobile apps for monitoring and diagnostics drive the segment growth. For instance, in July 2022, Zsquare, a privately held medical device company, announced that it had received the U.S. Food and Drug Administration (FDA's) 510K approval to launch its inaugural product, the Zsquare ENT-Flex Rhinolaryngoscope. This device is designed as a single-use endoscope, enhancing convenience and hygiene in medical practice.

Additionally, in 2018, the World Health Organization (WHO) developed hearWHO, a no-cost mobile application designed for individuals at risk of hearing impairment or currently exhibiting signs of hearing loss. This app enables users to assess their hearing health regularly.

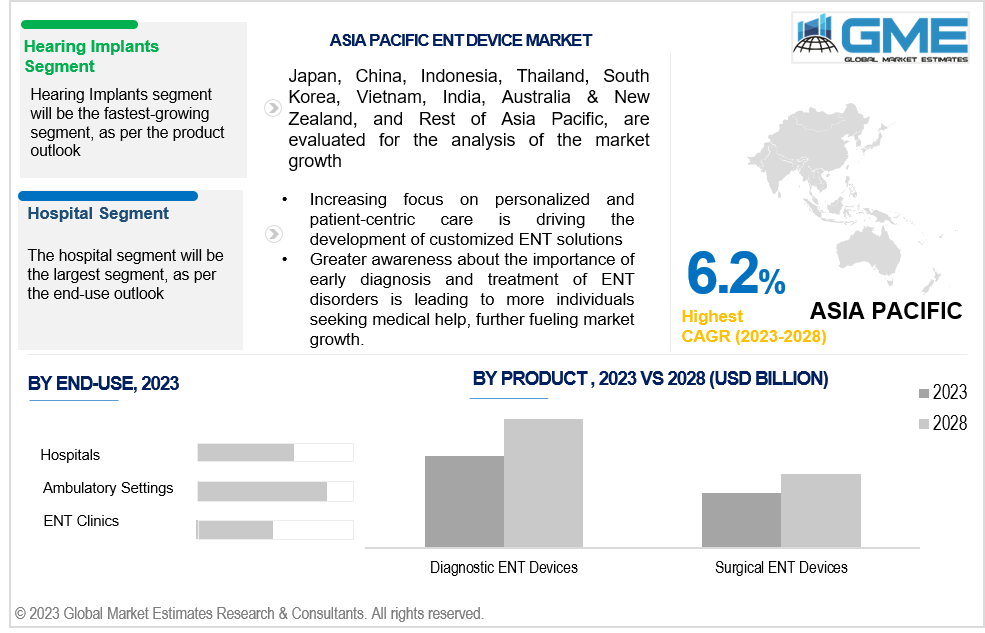

Hearing implants segment is expected to be the fastest-growing segment in the market from 2023-2028. The segment growth is attributed to the heightened awareness of cochlear implants as non-invasive options and major industry players' introduction of new products. For instance, in August 2021, Cochlear Ltd. launched the Nucleus Kanso-2 sound processor in Singapore. Designed for cochlear implants placed off the ear, it is notable for being the smallest sound processor globally. It offers direct streaming capabilities from Android and iOS devices and integrates with the Nucleus Smart App.

The ENT clinics segment is anticipated to be the fastest-growing segment in the market from 2023-2028. This growth can be attributed to advancements in clinical diagnostics. Patients can access various surgical and therapeutic options at clinics operated by skilled ENT (Ear, Nose, and Throat) physicians and choose a treatment method that suits their needs. Medical facilities such as the Mayo Clinic's Otolaryngology (ENT)/Head and Neck Surgery research teams have been leading in advancing state-of-the-art surgical techniques. These innovations encompass procedures like laryngeal transplants, transoral robotic surgery, laser microsurgery conducted through the mouth, and microvascular surgery for head and neck reconstruction.

The hospital segment is expected to hold the largest share of the market due to the introduction and accessibility of new healthcare policies and healthcare infrastructure. For instance, in 2021 the Departments of Labor, Treasury, and the Office of Personnel Management jointly released the interim final regulation titled "Requirements Related to Surprise Billing; Part I." The primary objective of these interim rules is to enforce the provisions of the No Surprises Act, which are designed to protect participants, beneficiaries, and enrolees covered by group health plans and both group and individual health insurance policies. These protective measures established by the regulation apply consistently to Americans with commercial and employer-sponsored health insurance plans, further solidifying hospitals' prominence in the ENT device market.

North America is expected to be the largest region in the market. The primary reasons boosting the market growth in this region include increasing awareness of the benefits associated with ENT devices. For instance, according to the report by the National Institute of Deafness and Other Communication Disorders in the United States (March 2021), based on common hearing tests, around one in eight Americans aged 12 and older (equivalent to 13 percent, or 30 million people) experience hearing loss in both ears. The prevalence of hearing loss among adults aged 45 to 54 is approximately 2%, but for those aged 55 to 64, the rate increases to 8.5%. Furthermore, the growing elderly population has contributed to a rise in the prevalence of conditions such as hearing loss and laryngeal cancer, along with other ENT disorders in the region.

Asia Pacific is predicted to witness rapid growth during the forecast period. This growth can be attributed to several factors including growing need of early disease detection, increased healthcare spending, and increasing investments and product launches by major regional market players. For instance, in May 2022, Olympus Corporation announced the launch of VISERA ELITE III, its latest surgical visualization platform designed to cater to the needs of healthcare professionals (HCPs) across various medical disciplines such as general surgery, urology, gynecology, ENT surgery and more. This platform is intended for use in endoscopic procedures, including minimally invasive surgeries such as Laparoscopic Colectomy and Laparoscopic Cholecystectomy.

Technological advancements such as wireless and real-time monitoring, an increase in healthcare spending, and support from regulatory authorities to offer safety and effective outcome of policies are expected to contribute to the market growth in the Asia Pacific.

Demant A/S, Sonova, GN Store Nord A/S, Ambu A/S, Pentax Medical, Karl Storz, Olympus Corporation, Richard Wolf GmbH, Cochlear Ltd., and Starkey Laboratories, Inc. among others, are some of the key players operating in the global ENT devices market.

Please note: This is not an exhaustive list of companies profiled in the report.

In February 2022, Medtronic introduced the NuVent Eustachian tube dilation balloon, offering surgeons an outpatient solution for addressing certain ear, nose, and throat conditions.

In March 2020, WS Audiology introduced WIDEX MOMENT, the first generation of hearing aids designed to provide a natural sound experience

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL ENT DEVICES MARKET, BY PRODUCT

4.2 ENT Devices Market: Application Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Diagnostic ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

4.5.1 Surgical ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

4.6.1 Hearing Aids Market Estimates and Forecast, 2020-2028 (USD Million)

4.7.1 Hearing Implants Market Estimates and Forecast, 2020-2028 (USD Million)

4.8.1 Nasal Splints Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL ENT DEVICES MARKET, BY END-USE

5.2 ENT Devices Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Hospitals Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Ambulatory Settings Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 ENT Clinics Market Estimates and Forecast, 2020-2028 (USD Million)

5.7.1 Home-use Market Estimates and Forecast, 2020-2028 (USD Million)

5.8.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL ENT DEVICES MARKET, BY REGION

6.2 North America ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.1 U.S. ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2 Canada ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3 Mexico ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1 Germany ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2 U.K. ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3 France ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4 Italy ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5 Spain ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.6 Netherlands ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.7 Rest of Europe ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4 Asia Pacific ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2 Japan ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3 India ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.4 South Korea ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.5 Singapore ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6 Malaysia ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7 Thailand ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.8 Indonesia ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.9 Vietnam ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10 Taiwan ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.11 Rest of Asia Pacific ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Middle East and Africa ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.1 Saudi Arabia ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2 U.A.E. ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3 Israel ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.4 South Africa ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.6 Central and South America ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1 Brazil ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.2 Argentina ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3 Chile ENT Devices Market Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7.1 Business Description & Financial Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8.1 Business Description & Financial Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9.1 Business Description & Financial Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 Starkey Laboratories, Inc.

7.4.10.1 Business Description & Financial Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & Segmentation

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global ENT Devices Market, By Product, 2020-2028 (USD Mllion)

2 Diagnostic ENT Devices Market, By Region, 2020-2028 (USD Mllion)

3 Surgical ENT Devices Market, By Region, 2020-2028 (USD Mllion)

4 Hearing Aids Market, By Region, 2020-2028 (USD Mllion)

5 Hearing Implants Market, By Region, 2020-2028 (USD Mllion)

6 Nasal Splints Market, By Region, 2020-2028 (USD Mllion)

7 Global ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

8 Hospitals Market, By Region, 2020-2028 (USD Mllion)

9 Ambulatory Settings Market, By Region, 2020-2028 (USD Mllion)

10 ENT Clinics Market, By Region, 2020-2028 (USD Mllion)

11 home-use Market, By Region, 2020-2028 (USD Mllion)

12 others Market, By Region, 2020-2028 (USD Mllion)

13 Regional Analysis, 2020-2028 (USD Mllion)

14 North America ENT Devices Market, By Product, 2020-2028 (USD Mllion)

15 North America ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

16 U.S. ENT Devices Market, By Product, 2020-2028 (USD Mllion)

17 U.S. ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

18 Canada ENT Devices Market, By Product, 2020-2028 (USD Mllion)

19 Canada ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

20 Mexico ENT Devices Market, By Product, 2020-2028 (USD Mllion)

21 Mexico ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

22 Europe ENT Devices Market, By Product, 2020-2028 (USD Mllion)

23 Europe ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

24 Germany ENT Devices Market, By Product, 2020-2028 (USD Mllion)

25 Germany ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

26 U.K. ENT Devices Market, By Product, 2020-2028 (USD Mllion)

27 U.K. ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

28 France ENT Devices Market, By Product, 2020-2028 (USD Mllion)

29 France ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

30 Italy ENT Devices Market, By Product, 2020-2028 (USD Mllion)

31 Italy ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

32 Spain ENT Devices Market, By Product, 2020-2028 (USD Mllion)

33 Spain ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

34 Netherlands ENT Devices Market, By Product, 2020-2028 (USD Mllion)

35 Netherlands ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

36 Rest Of Europe ENT Devices Market, By Product, 2020-2028 (USD Mllion)

37 Rest Of Europe ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

38 Asia Pacific ENT Devices Market, By Product, 2020-2028 (USD Mllion)

39 Asia Pacific ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

40 China ENT Devices Market, By Product, 2020-2028 (USD Mllion)

41 China ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

42 Japan ENT Devices Market, By Product, 2020-2028 (USD Mllion)

43 Japan ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

44 India ENT Devices Market, By Product, 2020-2028 (USD Mllion)

45 India ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

46 South Korea ENT Devices Market, By Product, 2020-2028 (USD Mllion)

47 South Korea ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

48 Singapore ENT Devices Market, By Product, 2020-2028 (USD Mllion)

49 Singapore ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

50 Thailand ENT Devices Market, By Product, 2020-2028 (USD Mllion)

51 Thailand ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

52 Malaysia ENT Devices Market, By Product, 2020-2028 (USD Mllion)

53 Malaysia ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

54 Indonesia ENT Devices Market, By Product, 2020-2028 (USD Mllion)

55 Indonesia ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

56 Vietnam ENT Devices Market, By Product, 2020-2028 (USD Mllion)

57 Vietnam ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

58 Taiwan ENT Devices Market, By Product, 2020-2028 (USD Mllion)

59 Taiwan ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

60 Rest of APAC ENT Devices Market, By Product, 2020-2028 (USD Mllion)

61 Rest of APAC ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

62 Middle East and Africa ENT Devices Market, By Product, 2020-2028 (USD Mllion)

63 Middle East and Africa ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

64 Saudi Arabia ENT Devices Market, By Product, 2020-2028 (USD Mllion)

65 Saudi Arabia ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

66 UAE ENT Devices Market, By Product, 2020-2028 (USD Mllion)

67 UAE ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

68 Israel ENT Devices Market, By Product, 2020-2028 (USD Mllion)

69 Israel ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

70 South Africa ENT Devices Market, By Product, 2020-2028 (USD Mllion)

71 South Africa ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

72 Rest Of Middle East and Africa ENT Devices Market, By Product, 2020-2028 (USD Mllion)

73 Rest Of Middle East and Africa ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

74 Central and South America ENT Devices Market, By Product, 2020-2028 (USD Mllion)

75 Central and South America ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

76 Brazil ENT Devices Market, By Product, 2020-2028 (USD Mllion)

77 Brazil ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

78 Chile ENT Devices Market, By Product, 2020-2028 (USD Mllion)

79 Chile ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

80 Argentina ENT Devices Market, By Product, 2020-2028 (USD Mllion)

81 Argentina ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

82 Rest Of Central and South America ENT Devices Market, By Product, 2020-2028 (USD Mllion)

83 Rest Of Central and South America ENT Devices Market, By End-use, 2020-2028 (USD Mllion)

84 Demant A/S: Products & Services Offering

85 Sonova: Products & Services Offering

86 GN Store Nord A/S: Products & Services Offering

87 Ambu A/S: Products & Services Offering

88 Pentax Medical: Products & Services Offering

89 KARL STORZ: Products & Services Offering

90 Olympus Corporation : Products & Services Offering

91 Richard Wolf GmbH: Products & Services Offering

92 Cochlear Ltd., Inc: Products & Services Offering

93 Starkey Laboratories, Inc.: Products & Services Offering

94 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global ENT Devices Market Overview

2 Global ENT Devices Market Value From 2020-2028 (USD Mllion)

3 Global ENT Devices Market Share, By Product (2022)

4 Global ENT Devices Market Share, By End-use (2022)

5 Global ENT Devices Market, By Region (Asia Pacific Market)

6 Technological Trends In Global ENT Devices Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global ENT Devices Market

10 Impact Of Challenges On The Global ENT Devices Market

11 Porter’s Five Forces Analysis

12 Global ENT Devices Market: By Product Scope Key Takeaways

13 Global ENT Devices Market, By Product Segment: Revenue Growth Analysis

14 Diagnostic ENT Devices Market, By Region, 2020-2028 (USD Mllion)

15 Surgical ENT Devices Market, By Region, 2020-2028 (USD Mllion)

16 Hearing Aids Market, By Region, 2020-2028 (USD Mllion)

17 Hearing Impant Market, By Region, 2020-2028 (USD Mllion)

18 Nasal Splints Market, By Region, 2020-2028 (USD Mllion)

19 Global ENT Devices Market: By End-use Scope Key Takeaways

20 Global ENT Devices Market, By End-use Segment: Revenue Growth Analysis

21 Hospitals Market, By Region, 2020-2028 (USD Mllion)

22 Ambulatory Settings Market, By Region, 2020-2028 (USD Mllion)

23 ENT Clinics Market, By Region, 2020-2028 (USD Mllion)

24 Home-use Market, By Region, 2020-2028 (USD Mllion)

25 Others Market, By Region, 2020-2028 (USD Mllion)

26 Regional Segment: Revenue Growth Analysis

27 Global ENT Devices Market: Regional Analysis

28 North America ENT Devices Market Overview

29 North America ENT Devices Market, By Product

30 North America ENT Devices Market, By End-use

31 North America ENT Devices Market, By Country

32 U.S. ENT Devices Market, By Product

33 U.S. ENT Devices Market, By End-use

34 Canada ENT Devices Market, By Product

35 Canada ENT Devices Market, By End-use

36 Mexico ENT Devices Market, By Product

37 Mexico ENT Devices Market, By End-use

38 Four Quadrant Positioning Matrix

39 Company Market Share Analysis

40 Demant A/S: Company Snapshot

41 Demant A/S: SWOT Analysis

42 Demant A/S: Geographic Presence

43 Sonova: Company Snapshot

44 Sonova: SWOT Analysis

45 Sonova: Geographic Presence

46 GN Store Nord A/S: Company Snapshot

47 GN Store Nord A/S: SWOT Analysis

48 GN Store Nord A/S: Geographic Presence

49 Ambu A/S: Company Snapshot

50 Ambu A/S: Swot Analysis

51 Ambu A/S: Geographic Presence

52 Pentax Medical: Company Snapshot

53 Pentax Medical: SWOT Analysis

54 Pentax Medical: Geographic Presence

55 Karl Storz: Company Snapshot

56 Karl Storz: SWOT Analysis

57 Karl Storz: Geographic Presence

58 Olympus Corporation : Company Snapshot

59 Olympus Corporation : SWOT Analysis

60 Olympus Corporation : Geographic Presence

61 Richard Wolf GmbH: Company Snapshot

62 Richard Wolf GmbH: SWOT Analysis

63 Richard Wolf GmbH: Geographic Presence

64 Cochlear Ltd., Inc.: Company Snapshot

65 Cochlear Ltd., Inc.: SWOT Analysis

66 Cochlear Ltd., Inc.: Geographic Presence

67 Starkey Laboratories, Inc.: Company Snapshot

68 Starkey Laboratories, Inc.: SWOT Analysis

69 Starkey Laboratories, Inc.: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global ENT Devices Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the ENT Devices Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS