Global Enterprise Mobility Market Size, Trends & Analysis - Forecasts to 2026 By Component (Solution and Service), By Solution Type (Mobile Content Management (MCM), Mobile Application Management (MAM), Mobile Device Management (MDM), Mobile Identity Management, and Others), By Deployment Model (On-Premise and Cloud), By Enterprise Size (Large Enterprises and Small & Medium Enterprises), By Device Type (Laptop, Tablet, and Smartphones), By Industry Vertical (BFSI, Healthcare, Government & Public Sector, IT & Telecom, Retail, Education, Energy & Utilities, and Others); Competitive Landscape, Company Market Share Analysis, and Competitor Analysis; By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

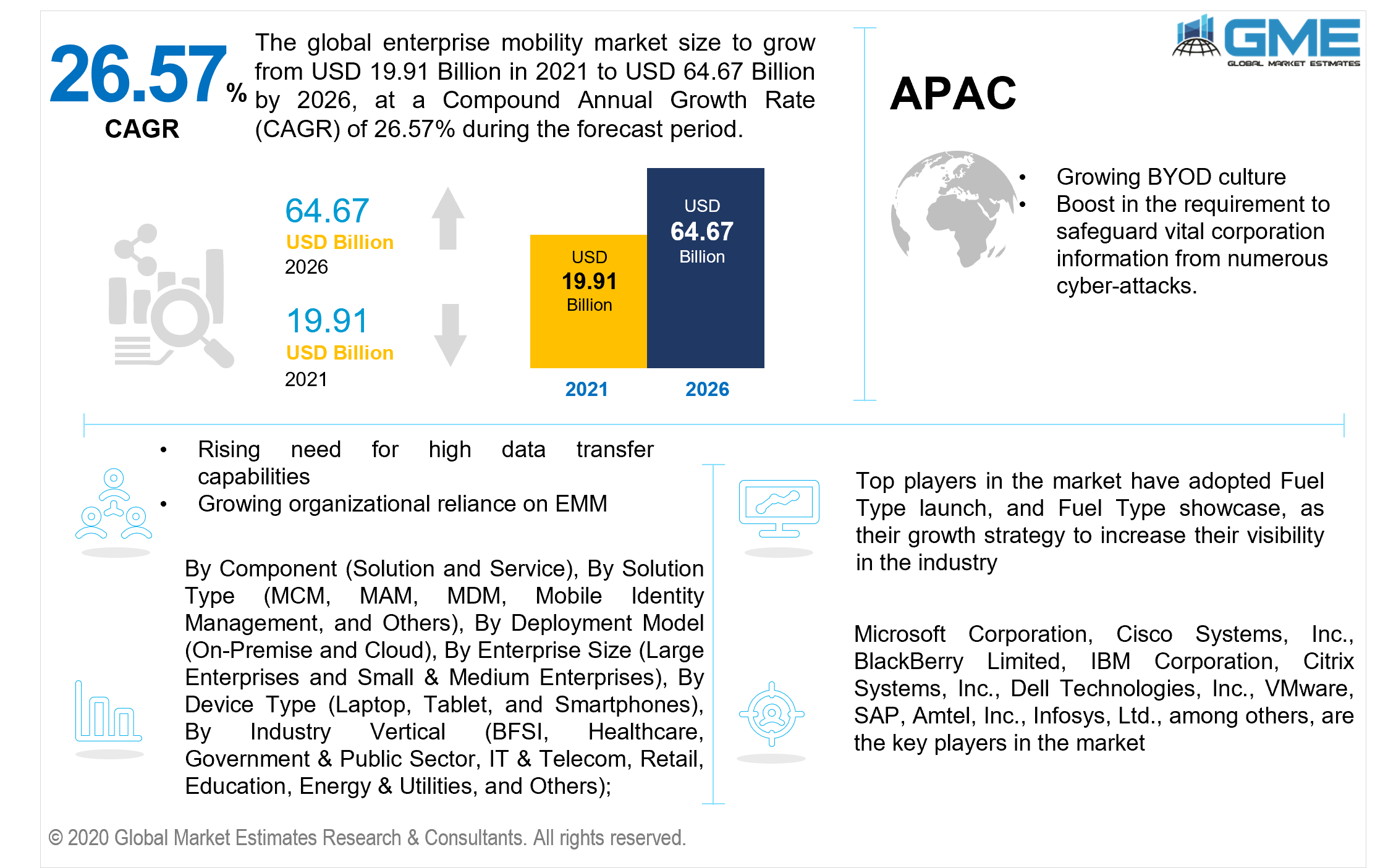

The enterprise mobility market is estimated to be valued at USD 19.91 billion in 2021 and is projected to reach USD 64.67 billion by 2026 at a CAGR of 26.57%. During the forecast period, the global enterprise mobility market size is expected to grow at a healthy rate because employees currently undertake their day-to-day operations using smart devices and cloud solutions due to the COVID-19 epidemic. The growing mobile working population and corporation implementation of BYOD programs to enhance workplace efficiency, enabling workers to work from anywhere, at any moment, and on every device to connect directly company information on the go, has increased demand for EMM workarounds. Furthermore, the prevalence of innovative portable devices on the market energizes the deployment of mobile device management solutions in different geographic areas.

The growing penetration of smartphones is a driving component in the development of the EMM market. Workplace productivity is increased by allowing them to work in favorable ecosystems outside of the firm's establishments. Unified interactions among executives and increased integration are vital enterprise mobility market trends. EMM has persuaded organizations to implement advancements including bring your device (BYOD) by protecting information, applications, and devices and streamlining mobile tactics, resulting in lower expenses and higher efficiency. Certain developments involve relevant data becoming offered in context-aware, customized, personalized, and pernicious genres; mobile devices will be able to activate real-time business analytics, location-based data, and big data. Clients will utilize NFC (Near Field Communication), mobile wallets, as well as other non-traditional financial transaction methods, allowing them to actively participate in realistic purchasing, visual browsing, micro-personalization, and multi-channel interaction.

Enterprise mobility management market 2021, is propelled by the advent of COVID-19. The information technology (IT) industry is confronting problems associated with the transition from employing a browser to incorporating native applications, as well as the emergence of an array of interconnected mobile devices, which has had a considerable impact on the development in demand for EMM management systems.

Furthermore, the migration of applications to the cloud and their availability via smartphone equipment is expanding demand from organizations seeking to improve real-time decision making and organizational productivity. Because of the global prevalence of intelligent mobile devices and portable apps, the market for EMM is intensifying. These manufacturers are facing excessive challenges as mobile environments have evolved further than the usage of cellphones and smartphones to include the utilization of intelligent sensors throughout industrial sectors and wearables.

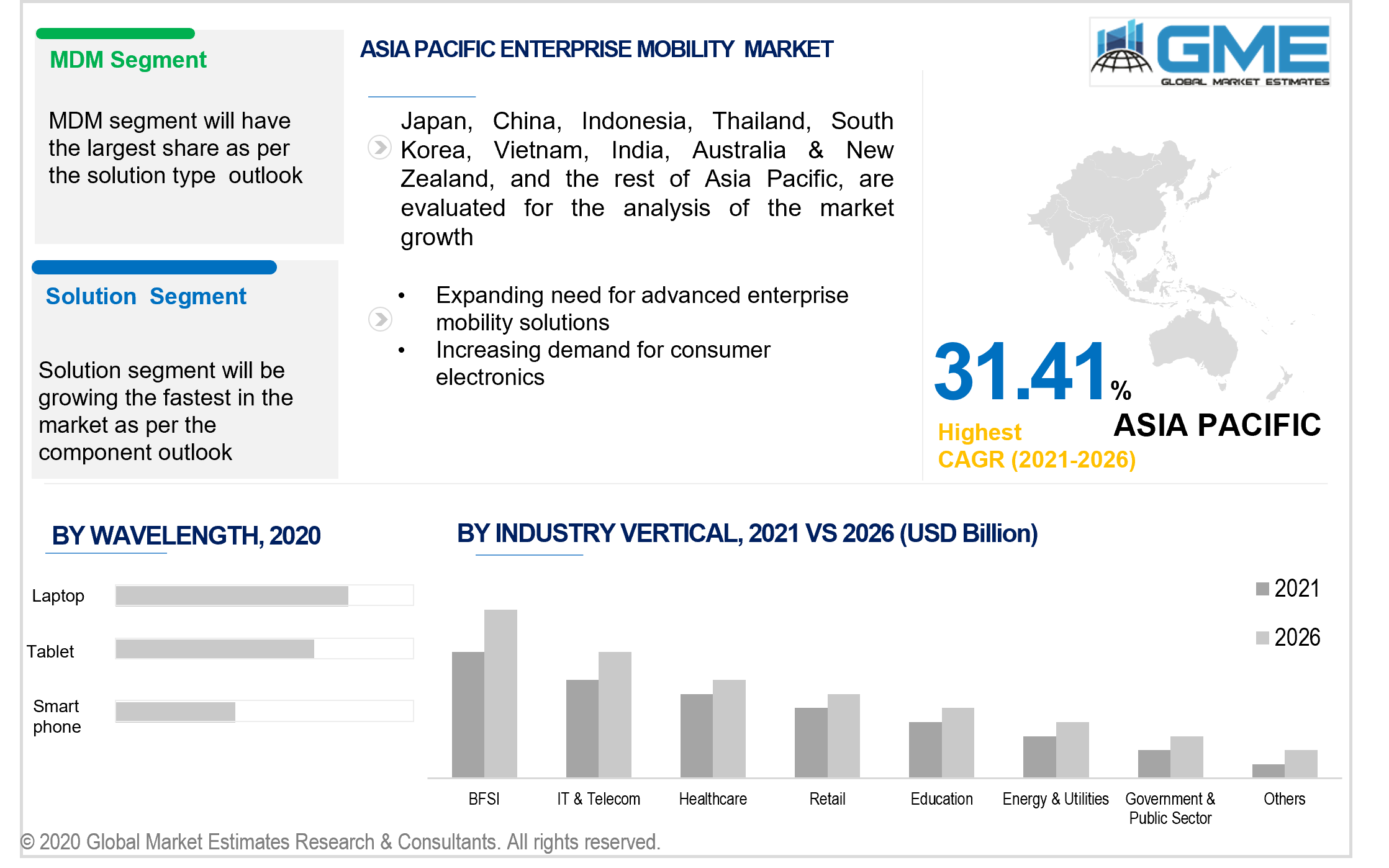

The solutions segment is presumed to lead. Organizations depend on EMM offerings to improve consumer acquisition, retain current clients and improve consumer experience and profit margins. The prevalence, of information resulting in big data, has compelled manufacturers to implement EMM solutions in order to assist IT workgroups in simplifying and managing their decision-making procedures. EMM strategies facilitate the interpretation of massive volumes of social media and sensor-based information to discover unique observations regarding the customer, product, and operation connections and embody them in an understandable fashion.

Current EMM trends indicate that these software solutions are now being recognized and enforced by large corporations and small and medium-sized businesses.

The market is foreseen to be led by the mobile device management solution segment. The increased penetration of smartphones in organizations, as well as the increased, requirements to maintain this equipment, drive the advancement of this segment. The other segment, on the other hand, is expected to grow at the fastest rate during the forecast period, attributed to the necessities to safeguard confidential information engendered by organizations via diverse applications.

The cloud segment is foreseen to predominate. Cloud-based solutions employ the Software-as-a-Service (SaaS) model, which allows users to access EMM solutions virtually via the web. EMM services are delivered through the cloud in this deployment type. Flexibility, optimization, cost-effectiveness, operating excellence, and easy operation are all benefits of implementing cloud-based EMM services. Because of the affiliated capabilities and cornerstone attributes, cumulative deployment of cloud-based EMM solutions is expected to be on the upswing and steep throughout the forecast period.

Large scale enterprise is foreseen to predominate because EMM aids in real-time information evaluation, efficacious alliance involvement, smarter resource allocation, boosts employee productivity, real-time partnership, emphasizing laws for working remotely, setting up equipment possession, and integrating with ERP systems.

The laptop segment is foreseen to predominate. Laptop’s information security is improved by EMM solutions, resulting in an increment in their usage. The existing workforce's demand for flexibility is increasing, owing in part to the implications of the COVID-19 epidemic, which is supporting the transition to remote working. Deployment of EMM solutions is increasing because these solutions enable businesses to remotely access, upgrade, or even erase electronic information. Remote workplaces and MDM will be more important than ever in the pandemic reassembly of 2020.

The BFSI segment is foreseen to predominate. All private and public banking institutions are focusing on enforcing cutting-edge technology to preclude cyber-attacks in order to protect their IT operations and frameworks safeguard user-sensitive information and abide by government legislation.

Furthermore, as customer expectations, technical prowess, and governmental guidelines increase, banking institutions are being spurred to take a more comprehensive methodology to protection. Customers are increasingly turning to digital platforms for financial services, including internet banking and mobile banking, as a result of rising technological penetration. Banks are increasingly required to use sophisticated verification and authorization monitoring mechanisms.

North America is foreseen to predominate during the forecast period. This is due to an uptick in organizational reliance on EMM and the involvement of notable manufacturers throughout the area. Corporations in North America seek out breakthroughs to keep up with the market's technological advancements. The U.S. is the most vital market in North America for EMM. The nation's paramount component of demand for mobility solutions is the elevated frequency of deployment of these approaches in banking, retail, manufacturing, and healthcare services.

Conversely, Asia-Pacific is presumed to grow significantly during the forecast period, attributed to an increment in BYOD culture and a boost in the requirement to safeguard vital corporation information from numerous cyber-attacks.

Microsoft Corporation, Cisco Systems, Inc., BlackBerry Limited, IBM Corporation, Citrix Systems, Inc., Dell Technologies, Inc., VMware, SAP, Amtel, Inc., Infosys, Ltd., among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

In March 2021, Microsoft has expanded its collaboration with Schlumberger, an oilfield services company. This advancement aims to bolster new energy-related technologies. As part of this growth, the corporations presented the Schlumberger Enterprise Data Management Solution for the OSDU Data Platform, an innovative business benchmark for energy data. This solution enables energy companies to easily connect to Schlumberger's DELFI cognitive E&P environment.

In March 2021, Mesh7, a cloud-based application security startup, has been acquired by VMware. This takeover will help the organization ramp up its Kubernetes, microservices, and cloud-native capabilities. This technology also compels VMware to improve API discovery, visibility, and security.

In February 2021, Cisco has expanded its partnership with Verizon Business, a multinational telecommunications conglomerate based in the United States. This advancement fixates on providing enterprise businesses with a broad global footprint, access to cutting-edge solutions and capabilities, and an unconventional management and policy administration model to supplement assumed corporate performance.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Enterprise Mobility Industry Overview, 2016-2026

2.1.1 Industry Overview

2.1.2 Component Overview

2.1.3 Solution Type Overview

2.1.4 Deployment Model Overview

2.1.5 Enterprise Size Overview

2.1.6 Device Type Overview

2.1.7 Industry Vertical Overview

2.1.8 Regional Overview

Chapter 3 Global Enterprise Mobility Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2016-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 The Expanding Demand For Solutions To Improve Operational Efficiency

3.3.1.2 Increasing Market Penetration of Consumer Electronics

3.3.2 Industry Challenges

3.3.2.1 High Cost of Enterprise Mobility Solutions

3.4 Prospective Growth Scenario

3.4.1 Component Growth Scenario

3.4.2 Solution Type Growth Scenario

3.4.3 Deployment Model Growth Scenario

3.4.4 Enterprise Size Growth Scenario

3.4.5 Device Type Growth Scenario

3.4.6 Industry Vertical Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.10.1 Company Positioning Overview, 2020

Chapter 4 Global Enterprise Mobility Market, By Component

4.1 Component Outlook

4.2 Solution

4.2.1 Market Size, By Region, 2016-2026 (USD Million)

4.3 Services

4.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 5 Global Enterprise Mobility Market, By Solution Type

5.1 Solution Type Outlook

5.2 Mobile Content Management (MCM)

5.2.1 Market Size, By Region, 2016-2026 (USD Million)

5.3 Mobile Application Management (MAM),

5.3.1 Market Size, By Region, 2016-2026 (USD Million)

5.4 Mobile Device Management (MDM),

5.4.1 Market Size, By Region, 2016-2026 (USD Million)

5.5 Mobile Identity Management

5.5.1 Market Size, By Region, 2016-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 6 Global Enterprise Mobility Market, By Deployment Model

6.1 Deployment Model Outlook

6.2 On-Premise

6.2.1 Market Size, By Region, 2016-2026 (USD Million)

6.3 Cloud

6.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 7 Global Enterprise Mobility Market, By Enterprise Size

7.1 Enterprise Size Outlook

7.2 Large Enterprises

7.2.1 Market Size, By Region, 2016-2026 (USD Million)

7.3 Small & Medium Enterprises

7.3.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 8 Global Enterprise Mobility Market, By Device Type

8.1 Device Type Outlook

8.2 Laptop

8.2.1 Market Size, By Region, 2016-2026 (USD Million)

8.3 Tablet

8.3.1 Market Size, By Region, 2016-2026 (USD Million)

8.4 Smartphones

8.4.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 9 Global Enterprise Mobility Market, By Device Type

9.1 Device Type Outlook

9.2 BFSI

9.2.1 Market Size, By Region, 2016-2026 (USD Million)

9.3 Healthcare

9.3.1 Market Size, By Region, 2016-2026 (USD Million)

9.4 Government & Public Sector

9.4.1 Market Size, By Region, 2016-2026 (USD Million)

9.5 IT & Telecom

9.5.1 Market Size, By Region, 2016-2026 (USD Million)

9.6 Retail

9.6.1 Market Size, By Region, 2016-2026 (USD Million)

9.7 Education

9.7.1 Market Size, By Region, 2016-2026 (USD Million)

9.8 Energy & Utilities

9.8.1 Market Size, By Region, 2016-2026 (USD Million)

9.9 Others

9.9.1 Market Size, By Region, 2016-2026 (USD Million)

Chapter 10 Global Enterprise Mobility Market, By Region

10.1 Regional outlook

10.2 North America

10.2.1 Market Size, By Country 2016-2026 (USD Million)

10.2.2 Market Size, By Component, 2016-2026 (USD Million)

10.2.3 Market Size, By Solution Type, 2016-2026 (USD Million)

10.2.4 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.2.5 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.2.6 Market Size, By Device Type, 2016-2026 (USD Million)

10.2.7 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.2.8 U.S.

10.2.8.1 Market Size, By Component, 2016-2026 (USD Million)

10.2.8.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.2.8.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.2.8.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.2.8.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.2.8.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.2.9 Canada

10.2.9.1 Market Size, By Component, 2016-2026 (USD Million)

10.2.9.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.2.9.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.2.9.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.2.9.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.2.9.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3 Europe

10.3.1 Market Size, By Country 2016-2026 (USD Million)

10.3.2 Market Size, By Component, 2016-2026 (USD Million)

10.3.3 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.4 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.5 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.6 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.7 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3.8 Germany

10.3.8.1 Market Size, By Component, 2016-2026 (USD Million)

10.3.8.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.8.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.8.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.8.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.8.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3.9 UK

10.3.9.1 Market Size, By Component, 2016-2026 (USD Million)

10.3.9.2 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.9.3 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.9.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.9.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.9.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3.10 France

10.3.10.1 Market Size, By Component, 2016-2026 (USD Million)

10.3.10.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.10.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.10.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.10.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.10.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3.11 Italy

10.3.11.1 Market Size, By Component, 2016-2026 (USD Million)

10.3.11.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.11.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.11.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.11.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.11.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3.11 Spain

10.3.11.1 Market Size, By Component, 2016-2026 (USD Million)

10.3.11.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.11.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.11.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.11.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.11.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.3.12 Russia

10.3.12.1 Market Size, By Component, 2016-2026 (USD Million)

10.3.12.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.3.12.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.3.12.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.3.12.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.3.12.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.4 Asia Pacific

10.4.1 Market Size, By Country 2016-2026 (USD Million)

10.4.2 Market Size, By Component, 2016-2026 (USD Million)

10.4.3 Market Size, By Solution Type, 2016-2026 (USD Million)

10.4.4 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.4.5 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.4.6 Market Size, By Device Type, 2016-2026 (USD Million)

10.4.7 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.4.8 China

10.4.8.1 Market Size, By Component, 2016-2026 (USD Million)

10.4.8.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.4.8.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.4.8.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.4.8.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.4.8.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.4.9 India

10.4.9.1 Market Size, By Component, 2016-2026 (USD Million)

10.4.9.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.4.9.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.4.9.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.4.9.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.4.9.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.4.10 Japan

10.4.10.1 Market Size, By Component, 2016-2026 (USD Million)

10.4.10.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.4.10.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.4.10.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.4.10.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.4.10.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.4.11 Australia

10.4.11.1 Market Size, By Component, 2016-2026 (USD Million)

10.4.11.2 Market size, By Solution Type, 2016-2026 (USD Million)

10.4.11.3 Market size, By Deployment Model, 2016-2026 (USD Million)

10.4.11.4 Market size, By Enterprise Size, 2016-2026 (USD Million)

10.4.11.5 Market size, By Device Type, 2016-2026 (USD Million)

10.4.11.6 Market size, By Industry Vertical, 2016-2026 (USD Million)

10.4.12 South Korea

10.4.12.1 Market Size, By Component, 2016-2026 (USD Million)

10.4.12.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.4.12.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.4.12.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.4.12.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.4.12.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.5 Latin America

10.5.1 Market Size, By Country 2016-2026 (USD Million)

10.5.2 Market Size, By Component, 2016-2026 (USD Million)

10.5.3 Market Size, By Solution Type, 2016-2026 (USD Million)

10.5.4 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.5.5 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.5.6 Market Size, By Device Type, 2016-2026 (USD Million)

10.5.7 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.5.8 Brazil

10.5.8.1 Market Size, By Component, 2016-2026 (USD Million)

10.5.8.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.5.8.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.5.8.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.5.8.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.5.8.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.5.9 Mexico

10.5.9.1 Market Size, By Component, 2016-2026 (USD Million)

10.5.9.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.5.9.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.5.9.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.5.9.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.5.9.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.5.10 Argentina

10.5.10.1 Market Size, By Component, 2016-2026 (USD Million)

10.5.10.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.5.10.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.5.10.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.5.10.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.5.10.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.6 MEA

10.6.1 Market Size, By Country 2016-2026 (USD Million)

10.6.2 Market Size, By Component, 2016-2026 (USD Million)

10.6.3 Market Size, By Solution Type, 2016-2026 (USD Million)

10.6.4 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.6.5 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.6.6 Market Size, By Device Type, 2016-2026 (USD Million)

10.6.7 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.6.8 Saudi Arabia

10.6.8.1 Market Size, By Component, 2016-2026 (USD Million)

10.6.8.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.6.8.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.6.8.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.6.8.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.6.8.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.6.9 UAE

10.6.9.1 Market Size, By Component, 2016-2026 (USD Million)

10.6.9.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.6.9.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.6.9.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.6.9.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.6.9.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

10.6.10 South Africa

10.6.10.1 Market Size, By Component, 2016-2026 (USD Million)

10.6.10.2 Market Size, By Solution Type, 2016-2026 (USD Million)

10.6.10.3 Market Size, By Deployment Model, 2016-2026 (USD Million)

10.6.10.4 Market Size, By Enterprise Size, 2016-2026 (USD Million)

10.6.10.5 Market Size, By Device Type, 2016-2026 (USD Million)

10.6.10.6 Market Size, By Industry Vertical, 2016-2026 (USD Million)

Chapter 11 Company Landscape

11.1 Competitive Analysis, 2020

11.2 Microsoft Corporation

11.2.1 Company Overview

11.2.2 Financial Analysis

11.2.3 Strategic Positioning

11.2.4 Info Graphic Analysis

11.3 Cisco Systems, Inc.

11.3.1 Company Overview

11.3.2 Financial Analysis

11.3.3 Strategic Positioning

11.3.4 Info Graphic Analysis

11.4 BlackBerry Limited

11.4.1 Company Overview

11.4.2 Financial Analysis

11.4.3 Strategic Positioning

11.4.4 Info Graphic Analysis

11.5 IBM Corporation

11.5.1 Company Overview

11.5.2 Financial Analysis

11.5.3 Strategic Positioning

11.5.4 Info Graphic Analysis

11.6 Citrix Systems, Inc.

11.6.1 Company Overview

11.6.2 Financial Analysis

11.6.3 Strategic Positioning

11.6.4 Info Graphic Analysis

11.7 Dell Technologies, Inc.

11.7.1 Company Overview

11.7.2 Financial Analysis

11.7.3 Strategic Positioning

11.7.4 Info Graphic Analysis

11.8 VMware

11.8.1 Company Overview

11.8.2 Financial Analysis

11.8.3 Strategic Positioning

11.8.4 Info Graphic Analysis

11.9 SAP

11.9.1 Company Overview

11.9.2 Financial Analysis

11.9.3 Strategic Positioning

11.9.4 Info Graphic Analysis

11.10 Amtel, Inc.

11.10.1 Company Overview

11.10.2 Financial Analysis

11.10.3 Strategic Positioning

11.10.4 Info Graphic Analysis

11.11 Infosys, Ltd.

11.11.1 Company Overview

11.11.2 Financial Analysis

11.11.3 Strategic Positioning

11.11.4 Info Graphic Analysis

11.12 Other Compaies

11.12.1 Company Overview

11.12.2 Financial Analysis

11.12.3 Strategic Positioning

11.12.4 Info Graphic Analysis

The Global Enterprise Mobility Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Enterprise Mobility Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS