Global ESG Software for BFSI Market Size, Trends & Analysis - Forecasts to 2029 By Deployment Mode (On-premise and Cloud), By End User (SMEs and Large Sized Banks, Financial Institutes, and Insurance Companies), By Application (Enhanced Risk Assessment, Regulatory Compliance, Portfolio Customization, and Competitive Advantage), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

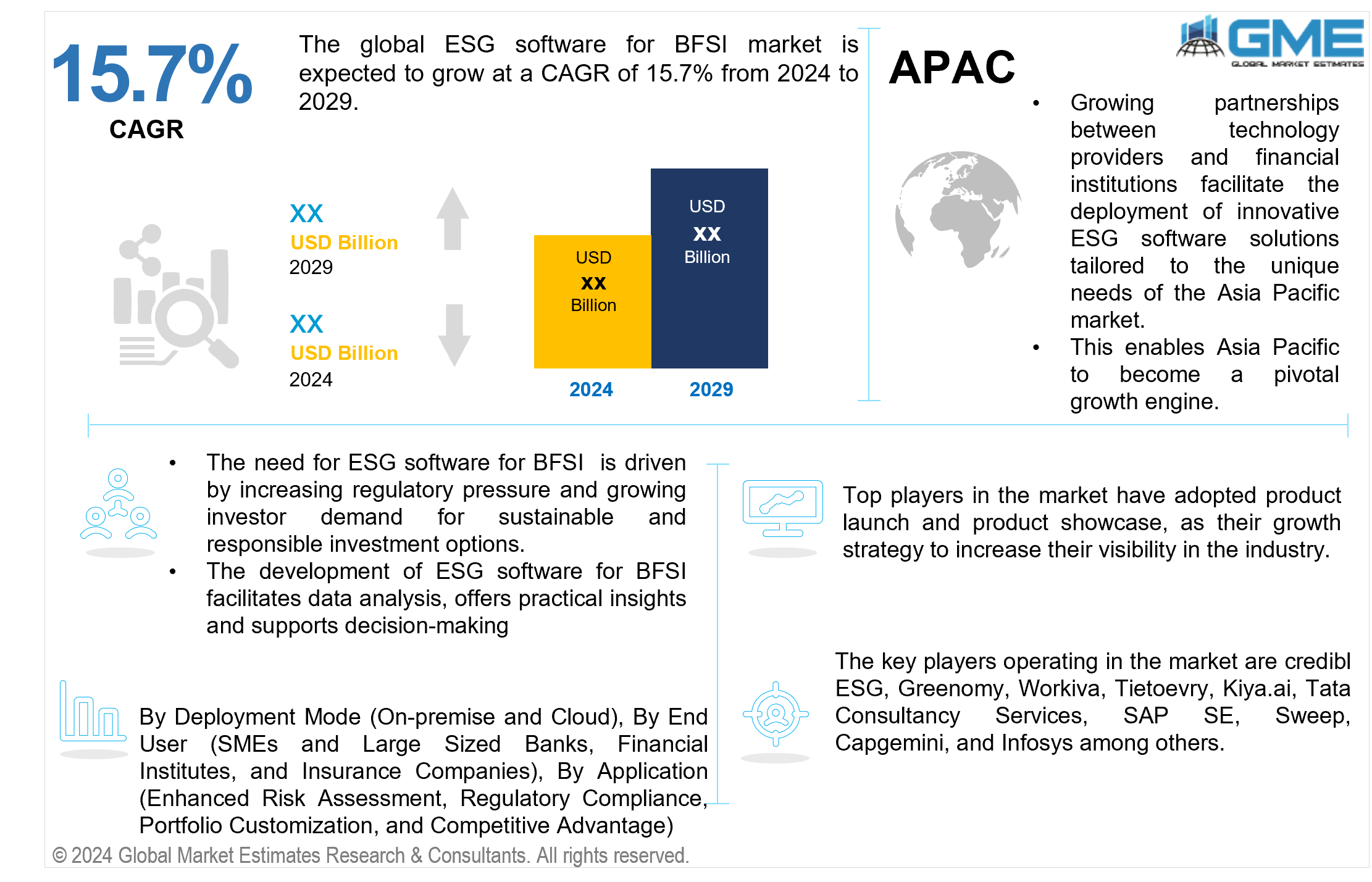

The global ESG software for BFSI market is expected to grow at a CAGR of 15.7% from 2024 to 2029. ESG (Environmental, Social, and Governance) software for the banking, financial services, and insurance (BFSI) sector typically helps institutions manage and report on their sustainability and responsible investing efforts. It is known for data and risk analysis. Some ESG software includes auditing and assurance features to verify the accuracy and reliability of ESG data and reporting processes.

The drivers of the ESG software for BFSI market are increasing regulatory pressure and growing investor demand for sustainable and responsible investment options. Integrating ESG principles into business strategies can give BFSI firms a competitive edge. Those who commit to strong ESG performance and transparency could appeal to customers, investors, and top talent who value sustainability and ethical conduct. ESG software assists BFSI institutions in monitoring and sharing their ESG efforts. Due to data analytics and AI advancements, BFSI companies can now better gather, analyze, and leverage ESG data. ESG software utilizes these technologies to offer practical insights and support decision-making.

The restraining factors of the market are associated costs and lack of standardization. For many smaller BFSI firms or those on a tight budget, the upfront costs of implementing ESG software and keeping it running may be daunting. Additionally, the lack of consistent ESG reporting guidelines and metrics across different regions and sectors poses a challenge for accurately assessing and comparing ESG performance.

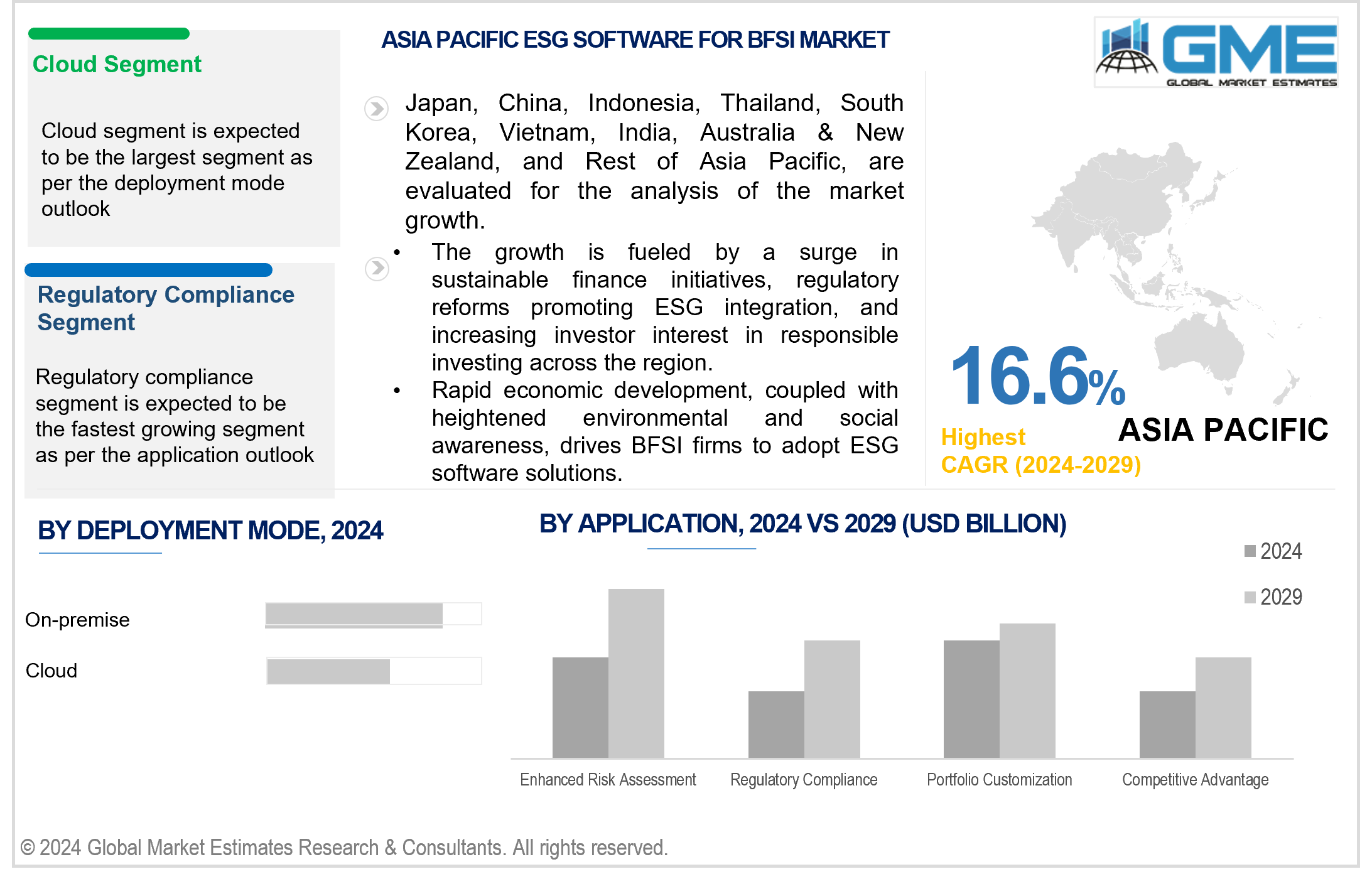

Based on deployment mode, the market is segmented into cloud and on-premise. The cloud segment is expected to dominate the market during the forecast period. The cloud segment growth is attributed to its scalability, cost-effectiveness, and flexibility, allowing BFSI firms to access ESG software remotely with minimal upfront investment. Moreover, increasing adoption of cloud-based solutions for their ease of deployment, maintenance, and accessibility drives the segment growth.

The on-premise segment is projected to grow fastest during the forecast period. The on-premise segment is experiencing rapid growth due to concerns around data security, regulatory compliance, and the need for greater control over sensitive ESG data within BFSI firms. Despite being a smaller segment initially, its growth is fueled by organizations seeking to maintain direct oversight and customization of their ESG software infrastructure.

Based on end user, the market is segmented into SMEs and large-sized banks, financial institutes, and insurance companies. The SMEs and large-sized banks segment is expected to dominate the market in the forecast period. Large banks opt for ESG software primarily due to their robust financial capabilities, enabling them to invest heavily in ESG initiatives. At the same time, SMEs are also comprehending the value of incorporating ESG principles and are actively pursuing solutions to integrate them into their business practices.

The insurance companies segment is projected to grow fastest during the forecast period. This growth can be attributed to increasing awareness among insurance companies about the impact of ESG factors on risk management, underwriting practices, and customer preferences. As insurers strive to incorporate ESG principles into their operations, there is a rising demand for ESG software solutions tailored to their specific needs.

Based on application, the market is segmented into enhanced risk assessment, regulatory compliance, portfolio customization, and competitive advantage. The regulatory compliance segment is expected to hold the largest share of the market during the forecast period. Financial institutions prioritize ESG reporting and disclosure to meet evolving regulations, ensuring transparency and adherence to compliance standards, reflecting the industry's commitment to responsible business practices.

The competitive advantage segment is projected to grow fastest during the forecast period. In the competitive landscape, BFSI firms are increasingly leveraging ESG factors to gain a competitive edge. By showcasing robust ESG performance and transparency, they aim to appeal to investors and customers who prioritize sustainability, differentiate themselves in the market, and enhance their brand reputation for responsible business practices.

North America is analyzed to be the largest region in the global ESG software for BFSI market during the forecast period. This can be attributed to stringent regulatory frameworks, strong adoption of ESG principles by financial institutions, and increasing investor demand for sustainability. The region's mature financial sector and advanced technological infrastructure further contribute to its dominance in the market.

Asia Pacific is analyzed to be the fastest-growing region in the global ESG software for BFSI market during the forecast period. This growth is fuelled by a surge in sustainable finance initiatives, regulatory reforms promoting ESG integration, and increasing investor interest in responsible investing across the region. Rapid economic development and heightened environmental and social awareness drive BFSI firms to adopt ESG software solutions to enhance risk management, compliance, and competitive positioning. Additionally, growing partnerships between technology providers and financial institutions facilitate deploying innovative ESG software solutions tailored to the unique needs of the Asia Pacific market. As a result, Asia Pacific has become a pivotal growth engine, capturing a significant share of the global ESG software market for BFSI.

Credibl ESG, Greenomy, Workiva, Tietoevry, Kiya.ai, Tata Consultancy Services, SAP SE, Sweep, Capgemini, and Infosys are some of the market players operating in the global market.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2023, Workiva collaborated with Amazon Web Services to enhance ESG reporting, boosting corporate strategy alignment and efficiency.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL ESG SOFTWARE FOR BFSI MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market RestrRegulatory Compliancents: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 BargRegulatory Compliancening Power of Suppliers

3.3.1.4 BargRegulatory Compliancening Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value ChRegulatory Compliancen Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ESG SOFTWARE FOR BFSI MARKET, BY DEPLOYMENT MODE

4.1 Introduction

4.2 ESG Software for BFSI Market: Deployment Mode Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 On-premise

4.4.1 On-premise Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Cloud

4.5.1 Cloud Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ESG SOFTWARE FOR BFSI MARKET, BY END USER

5.1 Introduction

5.2 ESG Software for BFSI Market: End User Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 SMEs and Large Sized Banks

5.4.1 SMEs and Large Sized Banks Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Financial Institutes

5.5.1 Financial Institutes Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Insurance Companies

5.6.1 Insurance Companies Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL ESG SOFTWARE FOR BFSI MARKET, BY APPLICATION

6.1 Introduction

6.2 ESG Software for BFSI Market: Technology Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Enhanced Risk Assessment

6.4.1 Enhanced Risk Assessment Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Regulatory Compliance

6.5.1 Regulatory Compliance Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Portfolio Customization

6.6.1 Portfolio Customization Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Competitive Advantage

6.7.1 Competitive Advantage Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL ESG SOFTWARE FOR BFSI MARKET, BY REGION

7.1 Introduction

7.2 North America ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Deployment Mode

7.2.2 By End User

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Deployment Mode

7.2.4.1.2 By End User

7.2.4.1.3 By Application

7.2.4.2 Canada ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Deployment Mode

7.2.4.2.2 By End User

7.2.4.2.3 By Application

7.2.4.3 Mexico ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Deployment Mode

7.2.4.3.2 By End User

7.2.4.3.3 By Application

7.3 Europe ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Deployment Mode

7.3.2 By End User

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Deployment Mode

7.3.4.1.2 By End User

7.3.4.1.3 By Application

7.3.4.2 U.K. ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Deployment Mode

7.3.4.2.2 By End User

7.3.4.2.3 By Application

7.3.4.3 France ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Deployment Mode

7.3.4.3.2 By End User

7.3.4.3.3 By Application

7.3.4.4 Italy ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Deployment Mode

7.3.4.4.2 By End User

7.2.4.4.3 By Application

7.3.4.5 Spain ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Deployment Mode

7.3.4.5.2 By End User

7.2.4.5.3 By Application

7.3.4.6 Netherlands ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Deployment Mode

7.3.4.6.2 By End User

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Deployment Mode

7.3.4.7.2 By End User

7.2.4.7.3 By Application

7.4 Asia Pacific ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Deployment Mode

7.4.2 By End User

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Deployment Mode

7.4.4.1.2 By End User

7.4.4.1.3 By Application

7.4.4.2 Japan ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Deployment Mode

7.4.4.2.2 By End User

7.4.4.2.3 By Application

7.4.4.3 India ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Deployment Mode

7.4.4.3.2 By End User

7.4.4.3.3 By Application

7.4.4.4 South Korea ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Deployment Mode

7.4.4.4.2 By End User

7.4.4.4.3 By Application

7.4.4.5 Singapore ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Deployment Mode

7.4.4.5.2 By End User

7.4.4.5.3 By Application

7.4.4.6 Malaysia ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Deployment Mode

7.4.4.6.2 By End User

7.4.4.6.3 By Application

7.4.4.7 Thailand ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Deployment Mode

7.4.4.7.2 By End User

7.4.4.7.3 By Application

7.4.4.8 Indonesia ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Deployment Mode

7.4.4.8.2 By End User

7.4.4.8.3 By Application

7.4.4.9 Vietnam ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Deployment Mode

7.4.4.9.2 By End User

7.4.4.9.3 By Application

7.4.4.10 Taiwan ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Deployment Mode

7.4.4.10.2 By End User

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Deployment Mode

7.4.4.11.2 By End User

7.4.4.11.3 By Application

7.5 Middle East and Africa ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Deployment Mode

7.5.2 By End User

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Deployment Mode

7.5.4.1.2 By End User

7.5.4.1.3 By Application

7.5.4.2 U.A.E. ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Deployment Mode

7.5.4.2.2 By End User

7.5.4.2.3 By Application

7.5.4.3 Israel ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Deployment Mode

7.5.4.3.2 By End User

7.5.4.3.3 By Application

7.5.4.4 South Africa ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Deployment Mode

7.5.4.4.2 By End User

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Deployment Mode

7.5.4.5.2 By End User

7.5.4.5.2 By Application

7.6 Central & South America ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Deployment Mode

7.6.2 By End User

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Deployment Mode

7.6.4.1.2 By End User

7.6.4.1.3 By Application

7.6.4.2 Argentina Eaporative Regulatory Compliancer Cooler Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Deployment Mode

7.6.4.2.2 By End User

7.6.4.2.3 By Application

7.6.4.3 Chile ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Deployment Mode

7.6.4.3.2 By End User

7.6.4.3.3 By Application

7.6.4.4 Rest of Central & South America ESG Software for BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Deployment Mode

7.6.4.4.2 By End User

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Credibl ESG

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Greenomy

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Workiva

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Tietoevry

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Kiya.ai

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Tata Consultancy Services

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Sweep

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Capgemini

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 SAP SE

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Infosys

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

2 On-premise Market, By Region, 2021-2029 (USD Million)

3 Cloud Market, By Region, 2021-2029 (USD Million)

4 Global ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

5 SMEs and Large Sized Banks Market, By Region, 2021-2029 (USD Million)

6 Financial Institutes Market, By Region, 2021-2029 (USD Million)

7 Insurance Companies Market, By Region, 2021-2029 (USD Million)

8 Global ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

9 Enhanced Risk Assessment Market, By Region, 2021-2029 (USD Million)

10 REGULATORY COMPLIANCE Market, By Region, 2021-2029 (USD Million)

11 PORTFOLIO CUSTOMIZATION Market, By Region, 2021-2029 (USD Million)

12 Competitive Advantage Market, By Region, 2021-2029 (USD Million)

13 Regional Analysis, 2021-2029 (USD Million)

14 North America ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

15 North America ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

16 North America ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

17 North America ESG Software for BFSI Market, By Country, 2021-2029 (USD Million)

18 U.S ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

19 U.S ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

20 U.S ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

21 Canada ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

22 Canada ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

23 Canada ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

24 Mexico ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

25 Mexico ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

26 Mexico ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

27 Europe ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

28 Europe ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

29 Europe ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

30 Europe ESG Software for BFSI Market, By COUNTRY, 2021-2029 (USD Million)

31 Germany ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

32 Germany ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

33 Germany ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

34 UK ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

35 UK ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

36 UK ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

37 France ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

38 France ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

39 France ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

40 Italy ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

41 Italy ESG Software for BFSI Market, By T End Use Type, 2021-2029 (USD Million)

42 Italy ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

43 SpAIn ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

44 SpAIn ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

45 SpAIn ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

46 Rest Of Europe ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

47 Rest Of Europe ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

48 Rest of Europe ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

49 Asia Pacific ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

50 Asia Pacific ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

51 Asia Pacific ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

52 Asia Pacific ESG Software for BFSI Market, By Country, 2021-2029 (USD Million)

53 China ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

54 China ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

55 China ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

56 India ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

57 India ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

58 India ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

59 Japan ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

60 Japan ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

61 Japan ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

62 South Korea ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

63 South Korea ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

64 South Korea ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

65 Malaysia ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

66 Malaysia ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

67 Malaysia ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

68 Vietnam ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

69 Vietnam ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

70 Vietnam ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

71 Rest of Asia Pacific ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

72 Rest of Asia Pacific ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

73 Rest of Asia Pacific ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

74 Middle East and Africa ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

75 Middle East and Africa ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

76 Middle East and Africa ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

77 Middle East and Africa ESG Software for BFSI Market, By Country, 2021-2029 (USD Million)

78 Saudi Arabia ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

79 Saudi Arabia ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

80 Saudi Arabia ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

81 UAE ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

82 UAE ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

83 UAE ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

84 Rest of Middle East and Africa ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

85 Rest of Middle East and Africa ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

86 Rest of Middle East and Africa ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

87 Central & South America ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

88 Central & South America ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

89 Central & South America ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

90 Central & South America ESG Software for BFSI Market, By Country, 2021-2029 (USD Million)

91 Brazil ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

92 Brazil ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

93 Brazil ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

94 Argentina ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

95 Argentina ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

96 Argentina ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

97 Rest of Central & South America ESG Software for BFSI Market, By Deployment Mode, 2021-2029 (USD Million)

98 Rest of Central & South America ESG Software for BFSI Market, By End User, 2021-2029 (USD Million)

99 Rest of Central & South America ESG Software for BFSI Market, By Application, 2021-2029 (USD Million)

100 Credibl ESG: Products & Services Offering

101 Greenomy: Products & Services Offering

102 Workiva: Products & Services Offering

103 Tietoevry: Products & Services Offering

104 Kiya.ai: Products & Services Offering

105 TATA CONSULTANCY SERVICES: Products & Services Offering

106 Sweep : Products & Services Offering

107 Capgemini: Products & Services Offering

108 SAP SE: Products & Services Offering

109 Infosys: Products & Services Offering

110 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global ESG Software for BFSI Market Overview

2 Global ESG Software for BFSI Market Value From 2021-2029 (USD Million)

3 Global ESG Software for BFSI Market Share, By Deployment Mode (2023)

4 Global ESG Software for BFSI Market Share, By End User (2023)

5 Global ESG Software for BFSI Market Share, By Application (2023)

6 Global ESG Software for BFSI Market, By Region (Asia Pacific Market)

7 Technological Trends In Global ESG Software for BFSI Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global ESG Software for BFSI Market

11 Impact Of Challenges On The Global ESG Software for BFSI Market

12 Porter’s Five Forces Analysis

13 Global ESG Software for BFSI Market: By Deployment Mode Scope Key Takeaways

14 Global ESG Software for BFSI Market, By Deployment Mode Segment: Revenue Growth Analysis

15 On-premise Market, By Region, 2021-2029 (USD Million)

16 Cloud Market, By Region, 2021-2029 (USD Million)

17 Global ESG Software for BFSI Market: By End User Scope Key Takeaways

18 Global ESG Software for BFSI Market, By End User Segment: Revenue Growth Analysis

19 SMEs and Large Sized Banks Market, By Region, 2021-2029 (USD Million)

20 Financial Institutes Market, By Region, 2021-2029 (USD Million)

21 Insurance Companies Market, By Region, 2021-2029 (USD Million)

22 Global ESG Software for BFSI Market: By Application Scope Key Takeaways

23 Global ESG Software for BFSI Market, By Application Segment: Revenue Growth Analysis

24 Enhanced Risk Assessment Market, By Region, 2021-2029 (USD Million)

25 Regulatory Compliance Market, By Region, 2021-2029 (USD Million)

26 Portfolio Customization Market, By Region, 2021-2029 (USD Million)

27 Competitive Advantage Market, By Region, 2021-2029 (USD Million)

28 Regional Segment: Revenue Growth Analysis

29 Global ESG Software for BFSI Market: Regional Analysis

30 North America ESG Software for BFSI Market Overview

31 North America ESG Software for BFSI Market, By Deployment Mode

32 North America ESG Software for BFSI Market, By End User

33 North America ESG Software for BFSI Market, By Application

34 North America ESG Software for BFSI Market, By Country

35 U.S. ESG Software for BFSI Market, By Deployment Mode

36 U.S. ESG Software for BFSI Market, By End User

37 U.S. ESG Software for BFSI Market, By Application

38 Canada ESG Software for BFSI Market, By Deployment Mode

39 Canada ESG Software for BFSI Market, By End User

40 Canada ESG Software for BFSI Market, By Application

41 Mexico ESG Software for BFSI Market, By Deployment Mode

42 Mexico ESG Software for BFSI Market, By End User

43 Mexico ESG Software for BFSI Market, By Application

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 Credibl ESG: Company Snapshot

47 Credibl ESG: SWOT Analysis

48 Credibl ESG: Geographic Presence

49 Greenomy: Company Snapshot

50 Greenomy: SWOT Analysis

51 Greenomy: Geographic Presence

52 Workiva: Company Snapshot

53 Workiva: SWOT Analysis

54 Workiva: Geographic Presence

55 Tietoevry: Company Snapshot

56 Tietoevry: Swot Analysis

57 Tietoevry: Geographic Presence

58 Kiya.ai: Company Snapshot

59 Kiya.ai: SWOT Analysis

60 Kiya.ai: Geographic Presence

61 TATA CONSULTANCY SERVICES: Company Snapshot

62 TATA CONSULTANCY SERVICES: SWOT Analysis

63 TATA CONSULTANCY SERVICES: Geographic Presence

64 Sweep : Company Snapshot

65 Sweep : SWOT Analysis

66 Sweep : Geographic Presence

67 Capgemini: Company Snapshot

68 Capgemini: SWOT Analysis

69 Capgemini: Geographic Presence

70 SAP SE.: Company Snapshot

71 SAP SE.: SWOT Analysis

72 SAP SE.: Geographic Presence

73 Infosys: Company Snapshot

74 Infosys: SWOT Analysis

75 Infosys: Geographic Presence

76 Other Companies: Company Snapshot

77 Other Companies: SWOT Analysis

78 Other Companies: Geographic Presence

The Global ESG Software for BFSI Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the ESG Software for BFSI Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS