Global ESG Software Market Size, Trends & Analysis - Forecasts to 2029 By Type (Climate Change Software, Sustainability Reporting Software, ESG Data Management Software, and ESG Risk Management Software), By Vertical (BFSI, IT and ITeS, Government and Public Sector, Manufacturing, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

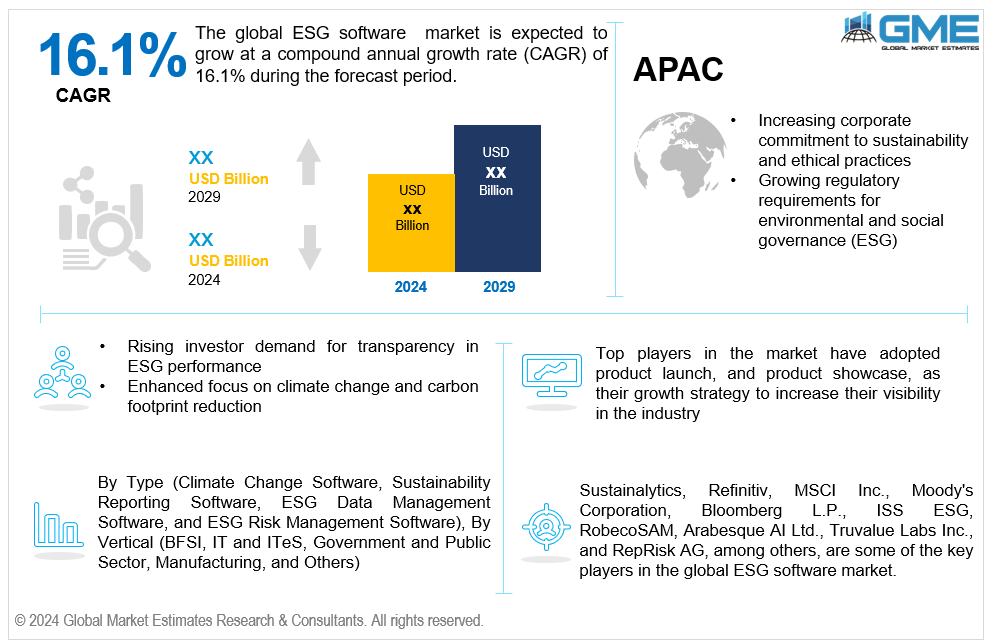

The global environmental, social, and governance (ESG) software market is estimated to exhibit a CAGR of 16.1% from 2024 to 2029.

The primary factors propelling the market growth are the increasing corporate commitment to sustainability and ethical practices and the growing regulatory requirements for environmental and social governance (ESG). Companies are investing significantly on sustainability reporting software so they can freely disclose their effects on the environment and society. This trend is fueled by the need for robust ESG performance management systems that help organizations track and improve their ESG metrics. Corporate responsibility software is becoming essential as businesses aim to align with global sustainability standards. The demand for ESG data analytics is rising, enabling companies to make data-driven decisions and demonstrate their commitment to stakeholders. Additionally, ESG compliance solutions are essential for fulfilling legal obligations and avoiding fines. Furthermore, companies are using ESG risk assessment tools to find and reduce any ESG-related risks. The growing emphasis on green finance software underscores the importance of integrating ESG considerations into financial decision-making, further propelling the market for ESG software solutions. For instance, Vena Solutions reports that 54% of banks worldwide include information on the climate in their financial statements.

Rising investor demand for transparency in ESG performance and the enhanced focus on climate change and carbon footprint reduction are expected to support the market growth. Organizations' increasing adoption of carbon footprint management methods helps measure and reduce greenhouse gas emissions. This shift is complemented by using social impact measurement software to assess and improve their broader social and environmental impacts. Ethical investment tools are in high demand, guiding investors toward more sustainable and responsible investment choices. ESG disclosure platforms facilitate transparent reporting and communication of ESG performance, meeting the growing expectations of stakeholders. Sustainable finance analytics are critical for evaluating the long-term financial impacts of ESG initiatives, while responsible investment software supports the integration of ESG criteria into investment strategies. ESG scoring systems provide standardized assessments of companies' ESG performance, helping investors and organizations make informed decisions that align with climate and sustainability goal.

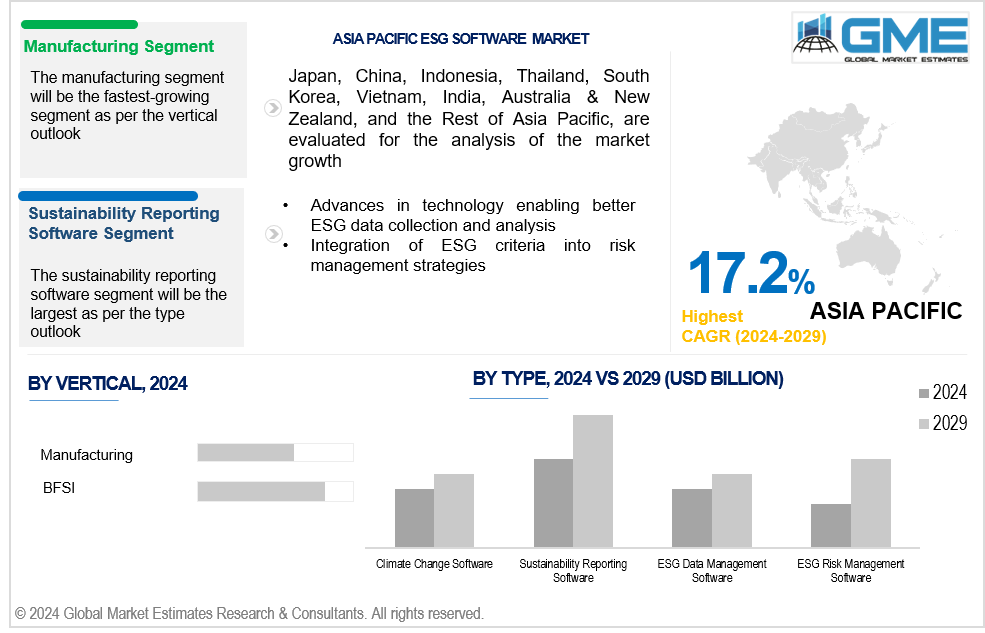

Advances in technology enabling better ESG data collection and analysis coupled with the integration of ESG criteria into risk management strategies propel market growth. Modern environmental management software enables companies to more efficiently monitor and control their environmental impact. The rise of social governance tools helps companies assess and improve their social policies and practices. ESG benchmarking software is increasingly used to compare ESG performance against industry standards, providing valuable insights for improvement. Solutions for climate risk management are essential for recognizing and reducing the dangers brought on by climate change. Organizations can meet the increasing number of ESG-related rules and standards with the help of enhanced skills in ESG regulatory compliance. Impact investing platforms also use sophisticated analytics to find investment possibilities that have a good influence on society and the environment in addition to financial benefits.

When combined with ESG software, artificial intelligence (AI) and machine learning can enhance risk assessment and predictive analytics, creating new business opportunities. Companies are also looking for ESG software that gives them insight into their supplier networks. Making sure suppliers adhere to ESG guidelines helps reduce risks and enhance sustainability overall.

However, the absence of standardized ESG metrics and varying and evolving ESG regulations across regions may impede market growth.

The sustainability reporting software segment is expected to hold the largest share of the market over the forecast period. Companies are forced to implement comprehensive reporting systems due to the growing legal obligations for sustainability disclosures. The global mandates for full ESG reporting issued by governments and regulatory agencies drive the need for sustainability reporting software.

The ESG risk management software segment is expected to be the fastest-growing segment in the market from 2024 to 2029. Companies are becoming increasingly conscious of the potential risks linked to environmental, social, and governance (ESG) elements. There is a growing need for sophisticated risk management solutions to successfully detect, evaluate, and mitigate these risks.

The BFSI segment is expected to hold the largest share of the market over the forecast period. The BFSI industry is highly regulated, with ever-increasing requirements for ESG compliance and transparency. Financial institutions must have comprehensive ESG reporting and management technologies to comply with these stringent regulations.

The manufacturing segment is anticipated to be the fastest-growing segment in the market from 2024 to 2029. Manufacturing is a highly environmentally impacting sector that is subject to strict laws around resource utilization, waste management, and emissions. Manufacturers can more effectively adhere to these rules by measuring and controlling their environmental footprint with the use of ESG software.

North America is expected to be the largest region in the global market. The need for ESG software in North America is driven by the growing number of federal, state, and local policies and standards in the United States and Canada that need rigorous ESG reporting and compliance.

Asia Pacific is anticipated to witness rapid growth during the forecast period. Asia Pacific companies are becoming increasingly conscious of the value of ESG practices in managing risk and ensuring long-term sustainability. These companies can manage and execute successful ESG initiatives with the use of ESG software.

Sustainalytics, Refinitiv, MSCI Inc., Moody's Corporation, Bloomberg L.P., ISS ESG, RobecoSAM, Arabesque AI Ltd., Truvalue Labs Inc., and RepRisk AG, among others, are some of the key players in the global ESG software market.

Please note: This is not an exhaustive list of companies profiled in the report.

In April 2024, the Oslo-based supplier of SaaS solutions for corporate sustainability reporting, Celsia, was acquired by ISS-Corporate.

In October 2023, SAI360 introduced new mastering gear and ESG software, enabling companies of all sizes to implement, manage, and report on their sustainability initiatives.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ESG SOFTWARE MARKET, BY Type

4.1 Introduction

4.2 ESG Software Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Climate Change Software

4.4.1 Climate Change Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Sustainability Reporting Software

4.5.1 Sustainability Reporting Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 ESG Data Management Software

4.6.1 ESG Data Management Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.7 ESG Risk Management Software

4.7.1 ESG Risk Management Software Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL ESG SOFTWARE MARKET, BY VERTICAL

5.1 Introduction

5.2 ESG Software Market: Vertical Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 BFSI

5.4.1 BFSI Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 IT and ITeS

5.5.1 IT and ITeS Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Government and Public Sector

5.6.1 Government and Public Sector Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Manufacturing

5.7.1 Manufacturing Market Estimates and Forecast, 2021-2029 (USD Million)

5.8 Others

5.8.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL ESG SOFTWARE MARKET, BY REGION

6.1 Introduction

6.2 North America ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.1 By Type

6.2.2 By Vertical

6.2.3 By Country

6.2.3.1 U.S. ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.1.1 By Type

6.2.3.1.2 By Vertical

6.2.3.2 Canada ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.2.1 By Type

6.2.3.2.2 By Vertical

6.2.3.3 Mexico ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.2.3.3.1 By Type

6.2.3.3.2 By Vertical

6.3 Europe ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.1 By Type

6.3.2 By Vertical

6.3.3 By Country

6.3.3.1 Germany ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.1.1 By Type

6.3.3.1.2 By Vertical

6.3.3.2 U.K. ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.2.1 By Type

6.3.3.2.2 By Vertical

6.3.3.3 France ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.3.1 By Type

6.3.3.3.2 By Vertical

6.3.3.4 Italy ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.4.1 By Type

6.3.3.4.2 By Vertical

6.3.3.5 Spain ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.5.1 By Type

6.3.3.5.2 By Vertical

6.3.3.6 Netherlands ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Vertical

6.3.3.7 Rest of Europe ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.3.3.6.1 By Type

6.3.3.6.2 By Vertical

6.4 Asia Pacific ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.1 By Type

6.4.2 By Vertical

6.4.3 By Country

6.4.3.1 China ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.1.1 By Type

6.4.3.1.2 By Vertical

6.4.3.2 Japan ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.2.1 By Type

6.4.3.2.2 By Vertical

6.4.3.3 India ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.3.1 By Type

6.4.3.3.2 By Vertical

6.4.3.4 South Korea ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.4.1 By Type

6.4.3.4.2 By Vertical

6.4.3.5 Singapore ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.5.1 By Type

6.4.3.5.2 By Vertical

6.4.3.6 Malaysia ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Vertical

6.4.3.7 Thailand ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.6.1 By Type

6.4.3.6.2 By Vertical

6.4.3.8 Indonesia ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.7.1 By Type

6.4.3.7.2 By Vertical

6.4.3.9 Vietnam ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.8.1 By Type

6.4.3.8.2 By Vertical

6.4.3.10 Taiwan ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.10.1 By Type

6.4.3.10.2 By Vertical

6.4.3.11 Rest of Asia Pacific ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.4.3.11.1 By Type

6.4.3.11.2 By Vertical

6.5 Middle East and Africa ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.1 By Type

6.5.2 By Vertical

6.5.3 By Country

6.5.3.1 Saudi Arabia ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.1.1 By Type

6.5.3.1.2 By Vertical

6.5.3.2 U.A.E. ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.2.1 By Type

6.5.3.2.2 By Vertical

6.5.3.3 Israel ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.3.1 By Type

6.5.3.3.2 By Vertical

6.5.3.4 South Africa ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.4.1 By Type

6.5.3.4.2 By Vertical

6.5.3.5 Rest of Middle East and Africa ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.5.3.5.1 By Type

6.5.3.5.2 By Vertical

6.6 Central and South America ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.1 By Type

6.6.2 By Vertical

6.6.3 By Country

6.6.3.1 Brazil ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.1.1 By Type

6.6.3.1.2 By Vertical

6.6.3.2 Argentina ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.2.1 By Type

6.6.3.2.2 By Vertical

6.6.3.3 Chile ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Vertical

6.6.3.3 Rest of Central and South America ESG Software Market Estimates and Forecast, 2021-2029 (USD Million)

6.6.3.3.1 By Type

6.6.3.3.2 By Vertical

7 COMPETITIVE LANDCAPE

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.2.1 Market Leaders

7.2.2 Market Visionaries

7.2.3 Market Challengers

7.2.4 Niche Market Players

7.3 Vendor Landscape

7.3.1 North America

7.3.2 Europe

7.3.3 Asia Pacific

7.3.4 Rest of the World

7.4 Company Profiles

7.4.1 Sustainalytics

7.4.1.1 Business Description & Financial Analysis

7.4.1.2 SWOT Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Refinitiv

7.4.2.1 Business Description & Financial Analysis

7.4.2.2 SWOT Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 MSCI Inc.

7.4.3.1 Business Description & Financial Analysis

7.4.3.2 SWOT Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4 Moody’s Corporation

7.4.4.1 Business Description & Financial Analysis

7.4.4.2 SWOT Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5 Bloomberg L.P.

7.4.5.1 Business Description & Financial Analysis

7.4.5.2 SWOT Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 ISS ESG

7.4.6.1 Business Description & Financial Analysis

7.4.6.2 SWOT Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.7 RobecoSAM

7.4.7.1 Business Description & Financial Analysis

7.4.7.2 SWOT Analysis

7.4.7.3 Products & Services Offered

7.4.7.4 Strategic Alliances between Business Partners

7.4.8 Arabesque AI Ltd.

7.4.8.1 Business Description & Financial Analysis

7.4.8.2 SWOT Analysis

7.4.8.3 Products & Services Offered

7.4.8.4 Strategic Alliances between Business Partners

7.4.9 Truvalue Labs Inc.

7.4.9.1 Business Description & Financial Analysis

7.4.9.2 SWOT Analysis

7.4.9.3 Products & Services Offered

7.4.9.4 Strategic Alliances between Business Partners

7.4.10 RepRisk AG

7.4.10.1 Business Description & Financial Analysis

7.4.10.2 SWOT Analysis

7.4.10.3 Products & Services Offered

7.4.10.4 Strategic Alliances between Business Partners

7.4.11 Other Companies

7.4.11.1 Business Description & Financial Analysis

7.4.11.2 SWOT Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8 RESEARCH METHODOLOGY

8.1 Market Introduction

8.1.1 Market Definition

8.1.2 Market Scope & Segmentation

8.2 Information Procurement

8.2.1 Secondary Research

8.2.1.1 Purchased Databases

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2 Primary Research

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.3 Primary Stakeholders

8.2.2.4 Discussion Guide for Primary Participants

8.2.3 Expert Panels

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4 Paid Local Experts

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3 Market Estimation

8.3.1 Top-Down Approach

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2 Bottom Up Approach

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4 Data Triangulation

8.4.1 Data Collection

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.4.3 Cluster Analysis

8.5 Analysis and Output

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

8.6.1 Research Assumptions

8.6.2 Research Limitations

LIST OF TABLES

1 Global ESG Software Market, By Type, 2021-2029 (USD Mllion)

2 Climate Change Software Market, By Region, 2021-2029 (USD Mllion)

3 Sustainability Reporting Software Market, By Region, 2021-2029 (USD Mllion)

4 ESG Data Management Software Market, By Region, 2021-2029 (USD Mllion)

5 ESG Risk Management Software Market, By Region, 2021-2029 (USD Mllion)

6 Global ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

7 BFSI Market, By Region, 2021-2029 (USD Mllion)

8 IT and ITeS Market, By Region, 2021-2029 (USD Mllion)

9 Government and Public Sector Market, By Region, 2021-2029 (USD Mllion)

10 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

11 Others Market, By Region, 2021-2029 (USD Mllion)

12 Regional Analysis, 2021-2029 (USD Mllion)

13 North America ESG Software Market, By Type, 2021-2029 (USD Mllion)

14 North America ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

15 North America ESG Software Market, By COUNTRY, 2021-2029 (USD Mllion)

16 U.S. ESG Software Market, By Type, 2021-2029 (USD Mllion)

17 U.S. ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

18 Canada ESG Software Market, By Type, 2021-2029 (USD Mllion)

19 Canada ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

20 Mexico ESG Software Market, By Type, 2021-2029 (USD Mllion)

21 Mexico ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

22 Europe ESG Software Market, By Type, 2021-2029 (USD Mllion)

23 Europe ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

24 EUROPE ESG Software Market, By COUNTRY, 2021-2029 (USD Mllion)

25 Germany ESG Software Market, By Type, 2021-2029 (USD Mllion)

26 Germany ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

27 U.K. ESG Software Market, By Type, 2021-2029 (USD Mllion)

28 U.K. ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

29 France ESG Software Market, By Type, 2021-2029 (USD Mllion)

30 France ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

31 Italy ESG Software Market, By Type, 2021-2029 (USD Mllion)

32 Italy ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

33 Spain ESG Software Market, By Type, 2021-2029 (USD Mllion)

34 Spain ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

35 Netherlands ESG Software Market, By Type, 2021-2029 (USD Mllion)

36 Netherlands ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

37 Rest Of Europe ESG Software Market, By Type, 2021-2029 (USD Mllion)

38 Rest Of Europe ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

39 Asia Pacific ESG Software Market, By Type, 2021-2029 (USD Mllion)

40 Asia Pacific ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

41 ASIA PACIFIC ESG Software Market, By COUNTRY, 2021-2029 (USD Mllion)

42 China ESG Software Market, By Type, 2021-2029 (USD Mllion)

43 China ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

44 Japan ESG Software Market, By Type, 2021-2029 (USD Mllion)

45 Japan ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

46 India ESG Software Market, By Type, 2021-2029 (USD Mllion)

47 India ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

48 South Korea ESG Software Market, By Type, 2021-2029 (USD Mllion)

49 South Korea ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

50 Singapore ESG Software Market, By Type, 2021-2029 (USD Mllion)

51 Singapore ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

52 Thailand ESG Software Market, By Type, 2021-2029 (USD Mllion)

53 Thailand ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

54 Malaysia ESG Software Market, By Type, 2021-2029 (USD Mllion)

55 Malaysia ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

56 Indonesia ESG Software Market, By Type, 2021-2029 (USD Mllion)

57 Indonesia ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

58 Vietnam ESG Software Market, By Type, 2021-2029 (USD Mllion)

59 Vietnam ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

60 Taiwan ESG Software Market, By Type, 2021-2029 (USD Mllion)

61 Taiwan ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

62 Rest of APAC ESG Software Market, By Type, 2021-2029 (USD Mllion)

63 Rest of APAC ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

64 Middle East and Africa ESG Software Market, By Type, 2021-2029 (USD Mllion)

65 Middle East and Africa ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

66 MIDDLE EAST & AFRICA ESG Software Market, By COUNTRY, 2021-2029 (USD Mllion)

67 Saudi Arabia ESG Software Market, By Type, 2021-2029 (USD Mllion)

68 Saudi Arabia ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

69 UAE ESG Software Market, By Type, 2021-2029 (USD Mllion)

70 UAE ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

71 Israel ESG Software Market, By Type, 2021-2029 (USD Mllion)

72 Israel ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

73 South Africa ESG Software Market, By Type, 2021-2029 (USD Mllion)

74 South Africa ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

75 Rest Of Middle East and Africa ESG Software Market, By Type, 2021-2029 (USD Mllion)

76 Rest Of Middle East and Africa ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

77 Central and South America ESG Software Market, By Type, 2021-2029 (USD Mllion)

78 Central and South America ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

79 CENTRAL AND SOUTH AMERICA ESG Software Market, By COUNTRY, 2021-2029 (USD Mllion)

80 Brazil ESG Software Market, By Type, 2021-2029 (USD Mllion)

81 Brazil ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

82 Chile ESG Software Market, By Type, 2021-2029 (USD Mllion)

83 Chile ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

84 Argentina ESG Software Market, By Type, 2021-2029 (USD Mllion)

85 Argentina ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

86 Rest Of Central and South America ESG Software Market, By Type, 2021-2029 (USD Mllion)

87 Rest Of Central and South America ESG Software Market, By Vertical, 2021-2029 (USD Mllion)

88 Sustainalytics: Products & Services Offering

89 Refinitiv: Products & Services Offering

90 MSCI Inc.: Products & Services Offering

91 Moody’s Corporation: Products & Services Offering

92 Bloomberg L.P.: Products & Services Offering

93 ISS ESG: Products & Services Offering

94 RobecoSAM: Products & Services Offering

95 Arabesque AI Ltd.: Products & Services Offering

96 Truvalue Labs Inc., Inc: Products & Services Offering

97 RepRisk AG: Products & Services Offering

98 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global ESG Software Market Overview

2 Global ESG Software Market Value From 2021-2029 (USD Mllion)

3 Global ESG Software Market Share, By Type (2023)

4 Global ESG Software Market Share, By Vertical (2023)

5 Global ESG Software Market, By Region (Asia Pacific Market)

6 Technological Trends In Global ESG Software Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global ESG Software Market

10 Impact Of Challenges On The Global ESG Software Market

11 Porter’s Five Forces Analysis

12 Global ESG Software Market: By Type Scope Key Takeaways

13 Global ESG Software Market, By Type Segment: Revenue Growth Analysis

14 Climate Change Software Market, By Region, 2021-2029 (USD Mllion)

15 Sustainability Reporting Software Market, By Region, 2021-2029 (USD Mllion)

16 ESG Data Management Software Market, By Region, 2021-2029 (USD Mllion)

17 ESG Risk Management Software Market, By Region, 2021-2029 (USD Mllion)

18 Global ESG Software Market: By Vertical Scope Key Takeaways

19 Global ESG Software Market, By Vertical Segment: Revenue Growth Analysis

20 BFSI Market, By Region, 2021-2029 (USD Mllion)

21 IT and ITeS Market, By Region, 2021-2029 (USD Mllion)

22 Government and Public Sector Market, By Region, 2021-2029 (USD Mllion)

23 Manufacturing Market, By Region, 2021-2029 (USD Mllion)

24 Others Market, By Region, 2021-2029 (USD Mllion)

25 Regional Segment: Revenue Growth Analysis

26 Global ESG Software Market: Regional Analysis

27 North America ESG Software Market Overview

28 North America ESG Software Market, By Type

29 North America ESG Software Market, By Vertical

30 North America ESG Software Market, By Country

31 U.S. ESG Software Market, By Type

32 U.S. ESG Software Market, By Vertical

33 Canada ESG Software Market, By Type

34 Canada ESG Software Market, By Vertical

35 Mexico ESG Software Market, By Type

36 Mexico ESG Software Market, By Vertical

37 Four Quadrant Positioning Matrix

38 Company Market Share Analysis

39 Sustainalytics: Company Snapshot

40 Sustainalytics: SWOT Analysis

41 Sustainalytics: Geographic Presence

42 Refinitiv: Company Snapshot

43 Refinitiv: SWOT Analysis

44 Refinitiv: Geographic Presence

45 MSCI Inc.: Company Snapshot

46 MSCI Inc.: SWOT Analysis

47 MSCI Inc.: Geographic Presence

48 Moody’s Corporation: Company Snapshot

49 Moody’s Corporation: Swot Analysis

50 Moody’s Corporation: Geographic Presence

51 Bloomberg L.P.: Company Snapshot

52 Bloomberg L.P.: SWOT Analysis

53 Bloomberg L.P.: Geographic Presence

54 ISS ESG: Company Snapshot

55 ISS ESG: SWOT Analysis

56 ISS ESG: Geographic Presence

57 RobecoSAM : Company Snapshot

58 RobecoSAM : SWOT Analysis

59 RobecoSAM : Geographic Presence

60 Arabesque AI Ltd.: Company Snapshot

61 Arabesque AI Ltd.: SWOT Analysis

62 Arabesque AI Ltd.: Geographic Presence

63 Truvalue Labs Inc., Inc.: Company Snapshot

64 Truvalue Labs Inc., Inc.: SWOT Analysis

65 Truvalue Labs Inc., Inc.: Geographic Presence

66 RepRisk AG: Company Snapshot

67 RepRisk AG: SWOT Analysis

68 RepRisk AG: Geographic Presence

69 Other Companies: Company Snapshot

70 Other Companies: SWOT Analysis

71 Other Companies: Geographic Presence

The Global ESG Software Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the ESG Software Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS