Global ETFs Market Size, Trends & Analysis - Forecasts to 2028 By Distribution Channel (Retail and Institutional), By Type (Fixed Income/Bonds ETFs, Equity ETFs, Commodity ETFs, Currency ETFs, Specialty ETFs, and Others), By Investor Type (Individual Investor and Institutional Investor), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

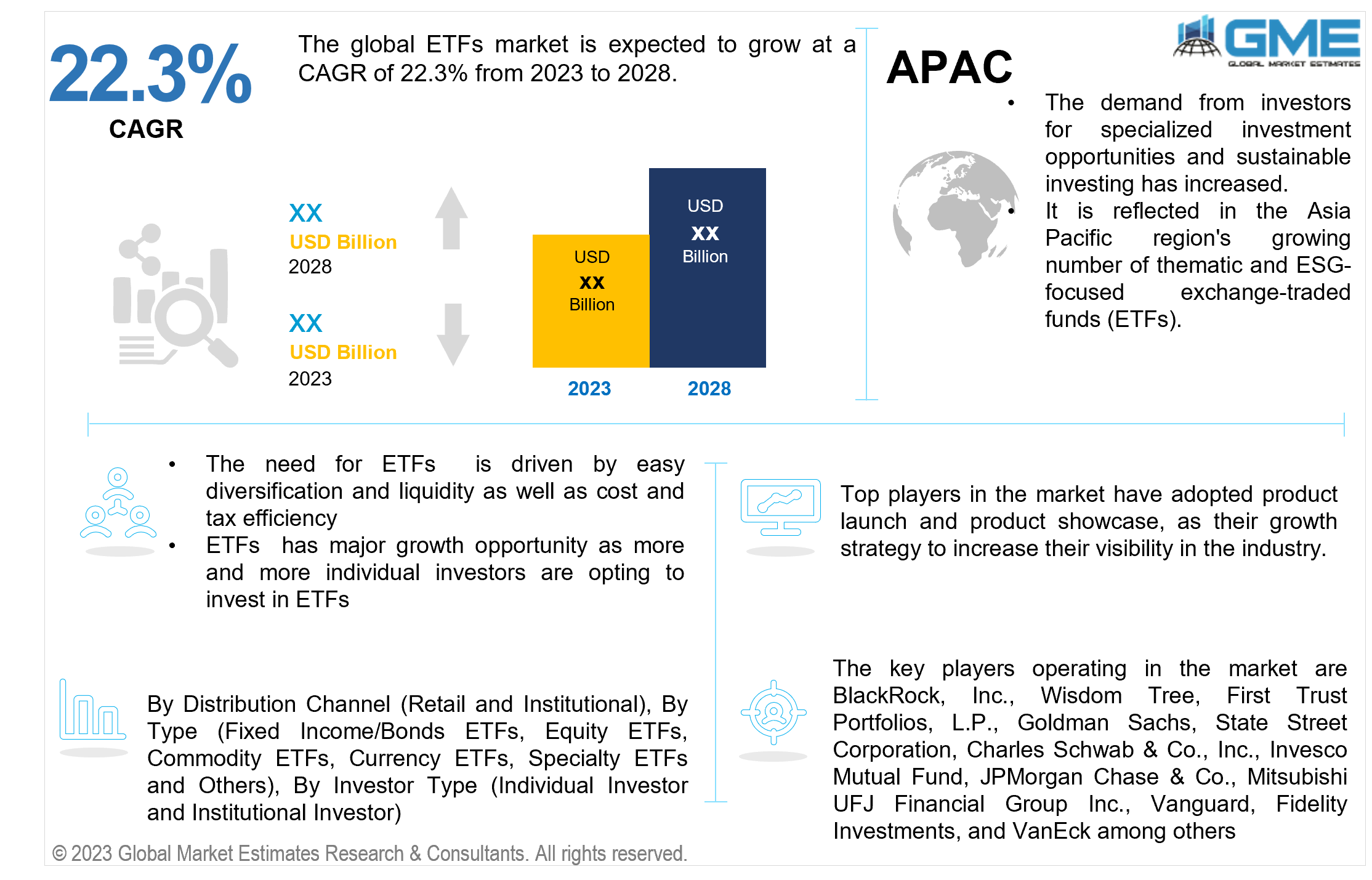

The global ETFs market is expected to grow at a CAGR of 22.3% from 2023 to 2028. ETFs or Exchange-Traded Funds are investment funds traded like individual stocks through stock exchanges. They are liquid investments that can be bought and sold throughout the trading day.

The main drivers of the global ETFs market are easy diversification and liquidity, as well as cost and tax efficiency. By giving investors exposure to a variety of assets, such as stocks, bonds, commodities, and more, exchange-traded funds (ETFs) provide a practical means of achieving diversification. Additionally, because of their high liquidity, investors can buy and sell shares on stock exchanges anytime during the trading day. Because many ETFs have cheaper expense ratios than conventional mutual funds, investors on a tight budget may find them a desirable alternative. Over time, the smaller fees may save more money overall. ETFs are typically tax-efficient financial instruments. In order to minimize capital gains distributions and the tax implications for investors, they frequently employ an "in-kind" creation and redemption process.

The market has certain restraints as well. It can be complex and have risks related to inflation and interest rates. For inexperienced investors, the increasing variety of ETF options—which includes inverse and leveraged ETFs—can be more complicated and riskier. These products need to be well understood to be appropriate for all investors. Fixed-income ETFs are susceptible to fluctuations in interest rates and inflationary pressures. Falling bond prices may impact bond ETF performance due to rising interest rates.

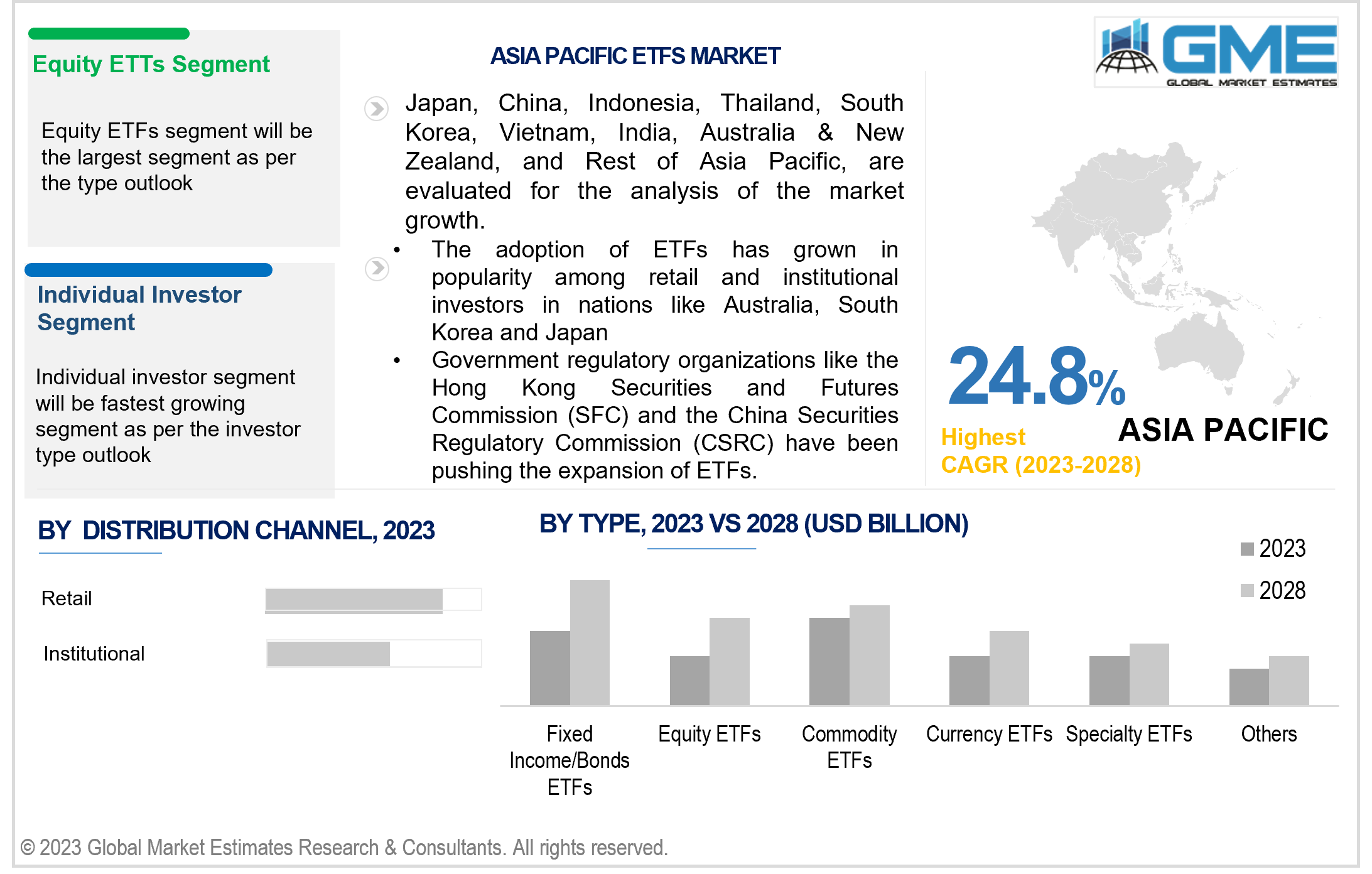

Based on distribution channel, the market is segmented into retail and institutional. The institutional segment is anticipated to hold a larger market share in the forecast period. Institutional investors, including asset managers, pension funds, and endowments, frequently manage large capital pools. ETFs offer them an economical and effective means of distributing large amounts of capital throughout a diverse portfolio. Institutions can enter and exit investments using ETFs in a manner consistent with their investment strategies. They frequently make sizeable investments in ETFs, especially to meet specific investment goals or for a strategic portfolio.

The retail segment is projected to grow fastest during the forecast period. A significant portion of the ETF market consists of retail investors, which include individual investors and financial advisors serving individual clients. ETFs are available for purchase and sale by retail investors through brokerage accounts, internet marketplaces, and financial advisors. Retail investors increasingly use exchange-traded funds (ETFs) because of their ease of use, diversification, and liquidity.

Based on type, the market is segmented into fixed income/bonds ETFs, equity ETFs, commodity ETFs, currency ETFs, specialty ETFs, and others. The equity ETFs segment is anticipated to hold the largest market share over the forecast period. They are known to track and provide exposure to various stock indices, sectors, or individual stocks. Equity ETFs are popular among investors because they offer diversified exposure to the equity market, allowing investors to participate in the performance of a broad or specific set of stocks.

The commodity ETFs segment is projected to witness the fastest growth during the forecast period. The main driving factor is that they offer diversification beyond traditional stocks and bonds, helping to minimize the financial risk. They serve as hedges against inflation and economic uncertainties, with precious metals like gold considered as valuable assest. Commodity ETFs offer a convenient way for investors to access these markets.

Based on investor type, the market is segmented into individual and institutional investors. The institutional investor segment is expected to hold the largest market share in the forecast period. This can be attributed to the fact that institutions have access to large amounts of financial capital that they can easily invest. ETFs are liquid, and thus, the invested capital can be easily recovered by the sale of the ETFs. Moreover, ETFs provide a cost-effective and efficient way for them to deploy substantial assets across diversified portfolios.

The individual investor segment is projected to exhibit the highest CAGR in the forecast period. This can be attributed to the fact that it is cost-effective and provides easy access to international markets. Investors can use ETFs for various trading strategies, including long-term investing, short-term trading, hedging, and sector rotation. Also, individuals look for passive income options, and due to these factors, ETFs are a preferred choice for several investors on an individual scale.

North America is analysed to be the largest region in the global ETFs market during the forecast period. The U.S. is home to the world's largest ETF market in terms of assets under management (AUM) valued at USD 426.6 billion (as of July 2023) and the number of ETF products available. The region is known to offer investors a diverse array of investment options, cost-effective solutions, and ease of access to the financial markets. There are regulations such as the U.S. Securities and Exchange Commission (SEC), which oversees ETF regulations.

Asia Pacific is analyzed to be the fastest-growing region in the global ETFs market during the forecast period. The adoption of ETFs differs among the different countries in the region. ETFs, which provide access to domestic and foreign markets, have become popular among retail and institutional investors in nations like Australia, South Korea, and Japan. Government regulatory organizations like the Hong Kong Securities and Futures Commission (SFC) and the China Securities Regulatory Commission (CSRC) have been pushing the development of the asset management sector, which has resulted in a rapid expansion of the ETF market in China. The demand from investors for specialized investment opportunities and sustainable investing is reflected in the Asia Pacific region's growing number of thematic and ESG-focused exchange-traded funds (ETFs).

The key players operating in the market are BlackRock, Inc., Wisdom Tree, First Trust Portfolios, L.P., Goldman Sachs, State Street Corporation, Charles Schwab & Co., Inc., Invesco Mutual Fund, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group Inc., Vanguard, Fidelity Investments, and VanEck among others.

Please note: This is not an exhaustive list of companies profiled in the report.

On October 5, 2023, the first ETFs launched by Goldman Sach’s ETF Accelorator fund platform got listed in the U.S. The rollout is the first time a big-name financial institution has helped small and mid-cap ETF issuers come to market. This marks as a significant development in the fast-growing USD 10 trillion ETF industry .

In August 2023, JPMorgan launched two new exchange-traded funds tied to Paris-aligned benchmarks that meet strict EU rules for investing in line with the goal of limiting global warming to 1.5C and has expanded USD 7 billion ETF platform.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL ETFS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL ETFS MARKET, BY DISTRIBUTION CHANNEL

4.1 Introduction

4.2 ETFs Market: Distribution Channel Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Retail

4.4.1 Retail Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Institutional

4.5.1 Institutional Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL ETFS MARKET, BY TYPE

5.1 Introduction

5.2 ETFs Market: Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Fixed Income/Bonds ETFs

5.4.1 Fixed Income/Bonds ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

5.5 Equity ETFs

5.5.1 Equity ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

5.6 Commodity ETFs

5.6.1 Commodity ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

5.7 Currency ETFs

5.7.1 Currency ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

5.8 Specialty ETFs

5.8.1 Specialty ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

5.9 Others

5.9.1 Others Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL ETFS MARKET, BY INVESTOR TYPE

6.1 Introduction

6.2 ETFs Market: Investor Type Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Individual Investor

6.4.1 Individual Investor Market Estimates and Forecast, 2020-2028 (USD Million)

6.5 Institutional Investor

6.5.1 Institutional Investor Market Estimates and Forecast, 2020-2028 (USD Million)

7 GLOBAL ETFS MARKET, BY REGION

7.1 Introduction

7.2 North America ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.1 By Distribution Channel

7.2.2 By Type

7.2.3 By Investor Type

7.2.4 By Country

7.2.4.1 U.S. ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.1.1 By Distribution Channel

7.2.4.1.2 By Type

7.2.4.1.3 By Investor Type

7.2.4.2 Canada ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.2.1 By Distribution Channel

7.2.4.2.2 By Type

7.2.4.2.3 By Investor Type

7.2.4.3 Mexico ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.2.4.3.1 By Distribution Channel

7.2.4.3.2 By Type

7.2.4.3.3 By Investor Type

7.3 Europe ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.1 By Distribution Channel

7.3.2 By Type

7.3.3 By Investor Type

7.3.4 By Country

7.3.4.1 Germany ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.1.1 By Distribution Channel

7.3.4.1.2 By Type

7.3.4.1.3 By Investor Type

7.3.4.2 U.K. ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.2.1 By Distribution Channel

7.3.4.2.2 By Type

7.3.4.2.3 By Investor Type

7.3.4.3 France ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.3.1 By Distribution Channel

7.3.4.3.2 By Type

7.3.4.3.3 By Investor Type

7.3.4.4 Italy ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.4.1 By Distribution Channel

7.3.4.4.2 By Type

7.2.4.4.3 By Investor Type

7.3.4.5 Spain ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.5.1 By Distribution Channel

7.3.4.5.2 By Type

7.2.4.5.3 By Investor Type

7.3.4.6 Netherlands ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.6.1 By Distribution Channel

7.3.4.6.2 By Type

7.2.4.6.3 By Investor Type

7.3.4.7 Rest of Europe ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.3.4.7.1 By Distribution Channel

7.3.4.7.2 By Type

7.2.4.7.3 By Investor Type

7.4 Asia Pacific ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.1 By Distribution Channel

7.4.2 By Type

7.4.3 By Investor Type

7.4.4 By Country

7.4.4.1 China ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.1.1 By Distribution Channel

7.4.4.1.2 By Type

7.4.4.1.3 By Investor Type

7.4.4.2 Japan ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.2.1 By Distribution Channel

7.4.4.2.2 By Type

7.4.4.2.3 By Investor Type

7.4.4.3 India ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.3.1 By Distribution Channel

7.4.4.3.2 By Type

7.4.4.3.3 By Investor Type

7.4.4.4 South Korea ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.4.1 By Distribution Channel

7.4.4.4.2 By Type

7.4.4.4.3 By Investor Type

7.4.4.5 Singapore ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.5.1 By Distribution Channel

7.4.4.5.2 By Type

7.4.4.5.3 By Investor Type

7.4.4.6 Malaysia ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.6.1 By Distribution Channel

7.4.4.6.2 By Type

7.4.4.6.3 By Investor Type

7.4.4.7 Thailand ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.7.1 By Distribution Channel

7.4.4.7.2 By Type

7.4.4.7.3 By Investor Type

7.4.4.8 Indonesia ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.8.1 By Distribution Channel

7.4.4.8.2 By Type

7.4.4.8.3 By Investor Type

7.4.4.9 Vietnam ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.9.1 By Distribution Channel

7.4.4.9.2 By Type

7.4.4.9.3 By Investor Type

7.4.4.10 Taiwan ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.10.1 By Distribution Channel

7.4.4.10.2 By Type

7.4.4.10.3 By Investor Type

7.4.4.11 Rest of Asia Pacific ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.4.4.11.1 By Distribution Channel

7.4.4.11.2 By Type

7.4.4.11.3 By Investor Type

7.5 Middle East and Africa ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.1 By Distribution Channel

7.5.2 By Type

7.5.3 By Investor Type

7.5.4 By Country

7.5.4.1 Saudi Arabia ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.1.1 By Distribution Channel

7.5.4.1.2 By Type

7.5.4.1.3 By Investor Type

7.5.4.2 U.A.E. ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.2.1 By Distribution Channel

7.5.4.2.2 By Type

7.5.4.2.3 By Investor Type

7.5.4.3 Israel ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.3.1 By Distribution Channel

7.5.4.3.2 By Type

7.5.4.3.3 By Investor Type

7.5.4.4 South Africa ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.4.1 By Distribution Channel

7.5.4.4.2 By Type

7.5.4.4.3 By Investor Type

7.5.4.5 Rest of Middle East and Africa ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.5.4.5.1 By Distribution Channel

7.5.4.5.2 By Type

7.5.4.5.2 By Investor Type

7.6 Central & South America ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.1 By Distribution Channel

7.6.2 By Type

7.6.3 By Investor Type

7.6.4 By Country

7.6.4.1 Brazil ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.1.1 By Distribution Channel

7.6.4.1.2 By Type

7.6.4.1.3 By Investor Type

7.6.4.2 Argentina Eaporative Air Cooler Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.2.1 By Distribution Channel

7.6.4.2.2 By Type

7.6.4.2.3 By Investor Type

7.6.4.3 Chile ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.3.1 By Distribution Channel

7.6.4.3.2 By Type

7.6.4.3.3 By Investor Type

7.6.4.4 Rest of Central & South America ETFs Market Estimates and Forecast, 2020-2028 (USD Million)

7.6.4.4.1 By Distribution Channel

7.6.4.4.2 By Type

7.6.4.4.3 By Investor Type

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 BlackRock, Inc.

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Wisdom Tree

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 First Trust Portfolios, L.P.

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Goldman Sachs

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 State Street Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 CHARLES SCHWAB & CO., INC.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Invesco Mutual Fund

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 JPMorgan Chase & Co.

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Mitsubishi UFJ Financial Group Inc.

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Vanguard

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Fidelity Investments

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

8.4.12 VanEck

8.4.12.1 Business Description & Financial Analysis

8.4.12.2 SWOT Analysis

8.4.12.3 Products & Services Offered

8.4.12.4 Strategic Alliances between Business Partners

8.4.13 Other Companies

8.4.13.1 Business Description & Financial Analysis

8.4.13.2 SWOT Analysis

8.4.13.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global ETFs Market, By Distribution Channel, 2020-2028 (USD Mllion)

2 Retail Market, By Region, 2020-2028 (USD Mllion)

3 Institutional Market, By Region, 2020-2028 (USD Mllion)

4 Global ETFs Market, By Type, 2020-2028 (USD Mllion)

5 Fixed Income/Bonds ETFs Market, By Region, 2020-2028 (USD Mllion)

6 Equity ETFs Market, By Region, 2020-2028 (USD Mllion)

7 Commodity ETFs Market, By Region, 2020-2028 (USD Mllion)

8 Currency ETFs Market, By Region, 2020-2028 (USD Mllion)

9 Specialty ETFs Market, By Region, 2020-2028 (USD Mllion)

10 Others Market, By Region, 2020-2028 (USD Mllion)

11 Global ETFs Market, By Investor Type, 2020-2028 (USD Mllion)

12 Individual Investor Market, By Region, 2020-2028 (USD Mllion)

13 Institutional Investor Market, By Region, 2020-2028 (USD Mllion)

14 Regional Analysis, 2020-2028 (USD Mllion)

15 North America ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

16 North America ETFs Market, By Type, 2020-2028 (USD Million)

17 North America ETFs Market, By Investor Type, 2020-2028 (USD Million)

18 North America ETFs Market, By Country, 2020-2028 (USD Million)

19 U.S ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

20 U.S ETFs Market, By Type, 2020-2028 (USD Million)

21 U.S ETFs Market, By Investor Type, 2020-2028 (USD Million)

22 Canada ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

23 Canada ETFs Market, By Type, 2020-2028 (USD Million)

24 Canada ETFs Market, By Investor Type, 2020-2028 (USD Million)

25 Mexico ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

26 Mexico ETFs Market, By Type, 2020-2028 (USD Million)

27 Mexico ETFs Market, By Investor Type, 2020-2028 (USD Million)

28 Europe ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

29 Europe ETFs Market, By Type, 2020-2028 (USD Million)

30 Europe ETFs Market, By Investor Type, 2020-2028 (USD Million)

31 EUROPE ETFs Market, By Country, 2020-2028 (USD Million)

32 Germany ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

33 Germany ETFs Market, By Type, 2020-2028 (USD Million)

34 Germany ETFs Market, By Investor Type, 2020-2028 (USD Million)

35 UK ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

36 UK ETFs Market, By Type, 2020-2028 (USD Million)

37 UK ETFs Market, By Investor Type, 2020-2028 (USD Million)

38 France ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

39 France ETFs Market, By Type, 2020-2028 (USD Million)

40 France ETFs Market, By Investor Type, 2020-2028 (USD Million)

41 Italy ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

42 Italy ETFs Market, By T End Use Type, 2020-2028 (USD Million)

43 Italy ETFs Market, By Investor Type, 2020-2028 (USD Million)

44 Spain ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

45 Spain ETFs Market, By Type, 2020-2028 (USD Million)

46 Spain ETFs Market, By Investor Type, 2020-2028 (USD Million)

47 Rest Of Europe ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

48 Rest Of Europe ETFs Market, By Type, 2020-2028 (USD Million)

49 Rest of Europe ETFs Market, By Investor Type, 2020-2028 (USD Million)

50 Asia Pacific ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

51 Asia Pacific ETFs Market, By Type, 2020-2028 (USD Million)

52 Asia Pacific ETFs Market, By Investor Type, 2020-2028 (USD Million)

53 Asia Pacific ETFs Market, By Country, 2020-2028 (USD Million)

54 China ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

55 China ETFs Market, By Type, 2020-2028 (USD Million)

56 China ETFs Market, By Investor Type, 2020-2028 (USD Million)

57 India ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

58 India ETFs Market, By Type, 2020-2028 (USD Million)

59 India ETFs Market, By Investor Type, 2020-2028 (USD Million)

60 Japan ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

61 Japan ETFs Market, By Type, 2020-2028 (USD Million)

62 Japan ETFs Market, By Investor Type, 2020-2028 (USD Million)

63 South Korea ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

64 South Korea ETFs Market, By Type, 2020-2028 (USD Million)

65 South Korea ETFs Market, By Investor Type, 2020-2028 (USD Million)

66 Middle East and Africa ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

67 Middle East and Africa ETFs Market, By Type, 2020-2028 (USD Million)

68 Middle East and Africa ETFs Market, By Investor Type, 2020-2028 (USD Million)

69 Middle East and Africa ETFs Market, By Country, 2020-2028 (USD Million)

70 Saudi Arabia ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

71 Saudi Arabia ETFs Market, By Type, 2020-2028 (USD Million)

72 Saudi Arabia ETFs Market, By Investor Type, 2020-2028 (USD Million)

73 UAE ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

74 UAE ETFs Market, By Type, 2020-2028 (USD Million)

75 UAE ETFs Market, By Investor Type, 2020-2028 (USD Million)

76 Central & South America ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

77 Central & South America ETFs Market, By Type, 2020-2028 (USD Million)

78 Central & South America ETFs Market, By Investor Type, 2020-2028 (USD Million)

79 Central & South America ETFs Market, By Country, 2020-2028 (USD Million)

80 Brazil ETFs Market, By Distribution Channel, 2020-2028 (USD Million)

81 Brazil ETFs Market, By Type, 2020-2028 (USD Million)

82 Brazil ETFs Market, By Investor Type, 2020-2028 (USD Million)

83 BlackRock, Inc.: Products & Services Offering

84 Wisdom Tree: Products & Services Offering

85 First Trust Portfolios, L.P.: Products & Services Offering

86 Goldman Sachs: Products & Services Offering

87 State Street Corporation: Products & Services Offering

88 CHARLES SCHWAB & CO., INC.: Products & Services Offering

89 Invesco Mutual Fund: Products & Services Offering

90 JPMorgan Chase & Co.: Products & Services Offering

91 Mitsubishi UFJ Financial Group Inc.: Products & Services Offering

92 Vanguard: Products & Services Offering

93 Fidelity Investments: Products & Services Offering

94 VanEck: Products & Services Offering

95 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global ETFs Market Overview

2 Global ETFs Market Value From 2020-2028 (USD Mllion)

3 Global ETFs Market Share, By Distribution Channel (2022)

4 Global ETFs Market Share, By Type (2022)

5 Global ETFs Market Share, By Investor Type (2022)

6 Global ETFs Market, By Region (Asia Pacific Market)

7 Technological Trends In Global ETFs Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global ETFs Market

11 Impact Of Challenges On The Global ETFs Market

12 Porter’s Five Forces Analysis

13 Global ETFs Market: By Distribution Channel Scope Key Takeaways

14 Global ETFs Market, By Distribution Channel Segment: Revenue Growth Analysis

15 Retail Market, By Region, 2020-2028 (USD Mllion)

16 Institutional Market, By Region, 2020-2028 (USD Mllion)

17 Global ETFs Market: By Type Scope Key Takeaways

18 Global ETFs Market, By Type Segment: Revenue Growth Analysis

19 Fixed Income/Bonds ETFs Market, By Region, 2020-2028 (USD Mllion)

20 Equity ETFs Market, By Region, 2020-2028 (USD Mllion)

21 Commodity ETFs Market, By Region, 2020-2028 (USD Mllion)

22 Currency ETFs Market, By Region, 2020-2028 (USD Mllion)

23 Specialty ETFs Market, By Region, 2020-2028 (USD Mllion)

24 Others Market, By Region, 2020-2028 (USD Mllion)

25 Global ETFs Market: By Investor Type Scope Key Takeaways

26 Global ETFs Market, By Investor Type Segment: Revenue Growth Analysis

27 Individual Investor Market, By Region, 2020-2028 (USD Mllion)

28 Institutional Investor Market, By Region, 2020-2028 (USD Mllion)

29 Regional Segment: Revenue Growth Analysis

30 Global ETFs Market: Regional Analysis

31 North America ETFs Market Overview

32 North America ETFs Market, By Distribution Channel

33 North America ETFs Market, By Type

34 North America ETFs Market, By Investor Type

35 North America ETFs Market, By Country

36 U.S. ETFs Market, By Distribution Channel

37 U.S. ETFs Market, By Type

38 U.S. ETFs Market, By Investor Type

39 Canada ETFs Market, By Distribution Channel

40 Canada ETFs Market, By Type

41 Canada ETFs Market, By Investor Type

42 Mexico ETFs Market, By Distribution Channel

43 Mexico ETFs Market, By Type

44 Mexico ETFs Market, By Investor Type

45 Four Quadrant Positioning Matrix

46 Company Market Share Analysis

47 BlackRock, Inc.: Company Snapshot

48 BlackRock, Inc.: SWOT Analysis

49 BlackRock, Inc.: Geographic Presence

50 Wisdom Tree: Company Snapshot

51 Wisdom Tree: SWOT Analysis

52 Wisdom Tree: Geographic Presence

53 First Trust Portfolios, L.P.: Company Snapshot

54 First Trust Portfolios, L.P.: SWOT Analysis

55 First Trust Portfolios, L.P.: Geographic Presence

56 Goldman Sachs: Company Snapshot

57 Goldman Sachs: Swot Analysis

58 Goldman Sachs: Geographic Presence

59 State Street Corporation: Company Snapshot

60 State Street Corporation: SWOT Analysis

61 State Street Corporation: Geographic Presence

62 CHARLES SCHWAB & CO., INC.: Company Snapshot

63 CHARLES SCHWAB & CO., INC.: SWOT Analysis

64 CHARLES SCHWAB & CO., INC.: Geographic Presence

65 Invesco Mutual Fund: Company Snapshot

66 Invesco Mutual Fund: SWOT Analysis

67 Invesco Mutual Fund: Geographic Presence

68 JPMorgan Chase & Co.: Company Snapshot

69 JPMorgan Chase & Co.: SWOT Analysis

70 JPMorgan Chase & Co.: Geographic Presence

71 Mitsubishi UFJ Financial Group Inc..: Company Snapshot

72 Mitsubishi UFJ Financial Group Inc..: SWOT Analysis

73 Mitsubishi UFJ Financial Group Inc..: Geographic Presence

74 Vanguard: Company Snapshot

75 Vanguard: SWOT Analysis

76 Vanguard: Geographic Presence

77 Fidelity Investments: Company Snapshot

78 Fidelity Investments: SWOT Analysis

79 Fidelity Investments: Geographic Presence

80 VanEck: Company Snapshot

81 VanEck: SWOT Analysis

82 VanEck: Geographic Presence

83 Other Companies: Company Snapshot

84 Other Companies: SWOT Analysis

85 Other Companies: Geographic Presence

The Global ETFs Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the ETFs Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS