Global eVTOL Aircraft Market Size, Trends & Analysis – Forecasts to 2027 By Lift Technology (Vectored Thrust, Multirotor, Lift plus Cruise ), By Propulsion Type (Fully Electric, Hybrid Electric, Hydrogen Electric), By System (Batteries & Cells, Electric Motor/Engine, Aerostructures, Avionics, Software, Others), By Application (Air Taxis, Air Shuttles & Air Metro, Private Transport, Cargo Transport, Air Ambulance & Medical Emergency, Last Mile Delivery, Inspection & Monitoring, Surveying & Mapping, Surveillance, Special Mission, Others), By Mode of Operation (Autonomous, Piloted), By MTOW (<100 kg, 100–1000 kg,1,000–2,000 kg, >2,000 kg), By Range (<= 200 km, > 200 km), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Company Market Share Analysis, and Competitor Analysis

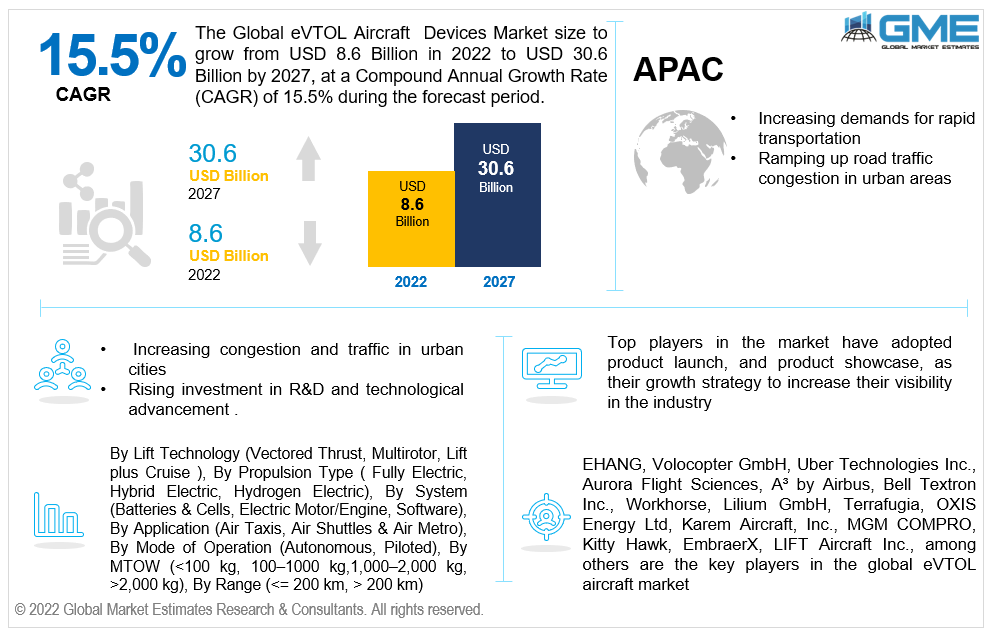

The Global e-VTOL Aircraft Market is projected to grow from USD 8.6 billion in 2022 to USD 30.8 billion by 2027 at a CAGR value of 15.5% from 2022 to 2027.

As per the 2019 Annual Review of IATA (International Air Transport Association), the demand for electric VTOL aircraft (eVTOL) is expected to grow by 5% per year by 2037, owing to anticipated growth in air transport traffic of 5% per year and a doubling of air travel passenger numbers to 8.2 billion by 2037. Recent advances in the realm of aerospace and photographic applications, as well as increased use for anti-terrorist and total surveillance objectives, with a continuous increase in medical emergencies, are propelling market expansion during the forecast period.

The increased need for eVTOL aircraft for security uses, naval reconnaissance, satellite imaging, cargo management in aerospace applications, and as a mode of transportation for product targeted delivery is propelling market expansion. The growing importance of identifying where victims are during natural disasters such as floods and earthquakes, and providing them with food packs, for rescue missions, as well as the strong urge for more ecologically friendly aircraft, are driving market demand.

However, one of the most difficult tasks facing eVTOL firms is to develop aircraft that are both financially feasible and comply with government restrictions.

Government investment in R&D and technological developments in the aviation industry, the demand for alternative means of transport such as air taxi services, increased public consciousness of ecological footprint, and the eagerness for contemporary as well as novel full-electric and hybrid-electric eVTOL configurations are all driving market growth.

In applications including firefighting, public health and safety, search-and-rescue, humanitarian assistance, and law enforcement, eVTOL aircraft have the potential to become a crucial instrument for public service agencies all over the world.

Additional factors driving the growth of this market include the high speed and efficiency of electric vertical take-off and landing aircraft, the growing demand for renewable technology and noise-free aircraft, and the expanding use of eVTOL aircraft for freight applications.

The unexpected outbreak of COVID-19 has wreaked havoc on a variety of industries, with aviation being among the hardest hit. The eVTOL aircraft market, on the other hand, did not appear to be as affected by the pandemic as the aviation sector as a whole.

Electric unmanned aerial vehicles (UAVs) were widely utilized by the military for a range of roles, including border protection, as government and law enforcement organizations experimented with them.

The market is segmented into vectored thrust, multirotor, and lift plus cruise based on lift technology. The vectored thrust segment is expected to grow the fastest in the eVTOL aircraft market from 2022 to 2027.

Thrust vectoring has two key advantages: VTOL/STOL and increased manoeuvrability. They also enable lower approaching velocities and faster de-rotation, as well as quicker revolution and lower take-off speeds.

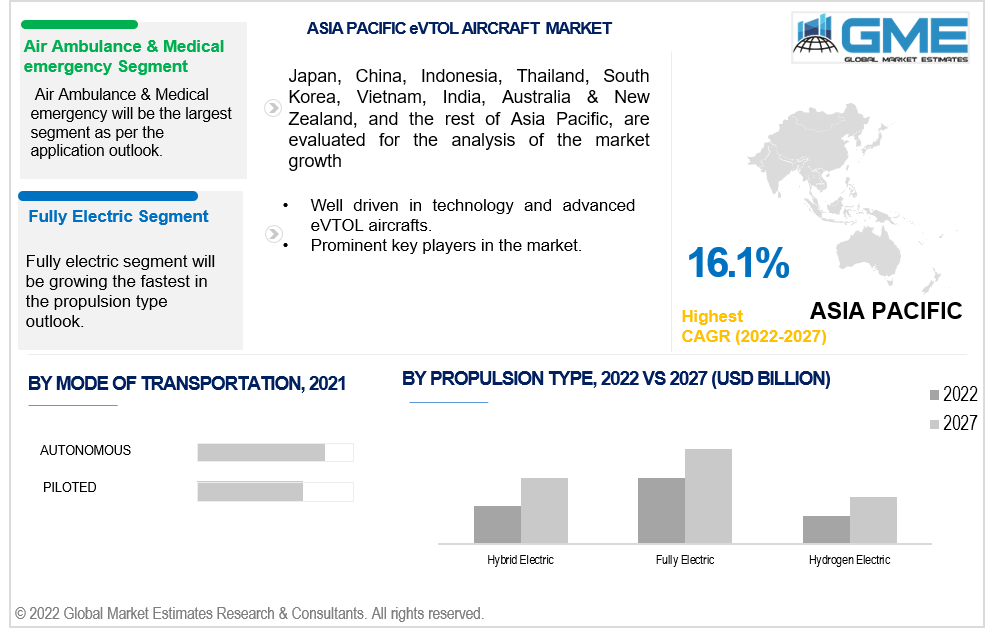

The market is segmented into fully electric, hybrid electric, and hydrogen-electric. The fully electric segment is expected to grow the fastest in the eVTOL aircraft market from 2022 to 2027.

The cheaper cost of electrical power relative to aviation gasoline is an advantage of fully electric aircraft for pilot training. In comparison to internal combustion, sound and emission standards are also minimized. Electric propulsion motors would not only remove immediate carbon emissions, but they would also lower fuel expenses by up to 90%, maintenance by up to 50%, and sound by nearly 70%.

The market is further divided into batteries & cells, electric motor/engine, aerostructures, avionics, software, and others based on the system. The electric motor/engine segment is expected to grow the fastest in the eVTOL aircraft market from 2022 to 2027.

Electric motors are extremely efficient machines that vary in efficiency depending on their operating circumstances and motor size. These motors do not consume gasoline and, unlike most other electrical equipment, do not necessitate motor oil upkeep, adding to segment growth.

Air taxis, air shuttles & air metro, private transport, cargo transport, air ambulance & medical emergency, last-mile delivery, inspection & monitoring, surveying &, mapping, surveillance, special mission, and others are the segmentation based on application.

The surveillance segment is expected to hold a larger share as compared to other segments. With the increasing usage of autonomous vehicles for product delivery without human intervention, interest in autonomous last-mile delivery is surging. Shorter travel time resulting in fewer contact points and lower transport duration between UPS facilities are also advantages contributing to segment growth.

The market is segmented into autonomous, and piloted based on the mode of operation. The autonomous segment is expected to hold a larger share as compared to other segments.

Autonomous vehicles, as per the house energy and commerce committee, can reduce fatal accidents by 90%. Fewer accidents, decreased traffic congestion, lower co2 emissions, improved lane capacity, and lower energy consumption are all benefits of autonomous vehicles.

The market is segmented into <100 kg, 100–1000 kg, 1,000–2,000 kg, >2,000 kg based on MTOW. The 100–1000 kg segment is expected to grow the fastest in the eVTOL aircraft market from 2022 to 2027.

For intercity passenger and freight transport, eVTOL aircraft with an MTOW of 100-1,000 kg are being used. These eVTOL aircraft have a payload of less than 200 kg. As a result, these planes are best suited for freight transport.

The market is segmented into <= 200 km, > 200 km based on range. The > 200 km segment is expected to grow the fastest in the eVTOL aircraft market from 2022 to 2027. Substantial battery capacity is found in eVTOL aircraft with a range of more than 200 kilometers. Last-mile deliveries, air ambulances, and private transportation are just a few of the uses for this aircraft.

As per the geographical analysis, the eVTOL aircraft market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico), will have a dominant share in the eVTOL aircraft market from 2022 to 2027. The region's growing demand for advanced optronics devices, the prevalence of most prominent players in the market, the rise in the need for commercial aircraft, and increasing investment in R&D activities by firms in eVTOL aircraft are promoting regional growth.

Moreover, the Asia-Pacific region is expected to be the fastest-growing segment in the eVTOL aircraft market during the forecast period. Early adoption of eVTOL aircraft for urban air mobility, the growing interest in sustainable forms of transportation, ramping up road traffic congestion in urban areas, as well as the increasing demands for rapid transportation, are all factors driving regional growth.

EHANG, Volocopter GmbH, Uber Technologies Inc., Aurora Flight Sciences, A³ by Airbus, Bell Textron Inc., Workhorse, Lilium GmbH, Terrafugia, OXIS Energy Ltd, Karem Aircraft, Inc., MGM COMPRO, Kitty Hawk, EmbraerX, LIFT Aircraft Inc., among others are the key players in the global eVTOL aircraft market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 EVTOL Aircraft Industry Overview, 2022-2027

2.1.1 Industry Overview

2.1.2 Lift Technology Overview

2.1.3 Propulsion Type Overview

2.1.4 Range Overview

2.1.5 Application Overview

2.1.6 Mode of Operation Overview

2.1.7 MTOW Overview

2.1.8 Range Overview

2.1.9 Regional Overview

Chapter 3 EVTOL Aircraft Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2022-2027

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for future generations safe and faster travels

3.3.2 Industry Challenges

3.3.2.1 High-cost Research and development in aircraft

3.4 Prospective Growth Scenario

3.4.1 Lift Technology Growth Scenario

3.4.2 Propulsion Type Growth Scenario

3.4.3 Range Growth Scenario

3.4.4 Application Growth Scenario

3.4.5 Mode of Operation Scenario

3.4.6 MTOW Scenario

3.4.7 Range Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 End-User Overview

3.11 Market Share Analysis, 2021

3.11.1 Company Positioning Overview, 2021

Chapter 4 EVTOL Aircraft Market, By Lift Technology

4.1 Lift Technology Outlook

4.2 Vectored Thrust

4.2.1 Market Size, By Region, 2022-2027 (USD Billion)

4.3 Multirotor

4.3.1 Market Size, By Region, 2022-2027 (USD Billion)

4.4 Lift plus Cruise

4.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 5 EVTOL Aircraft Market, By Propulsion Type

5.1 Propulsion Type Outlook

5.2 Fully Electric

5.2.1 Market Size, By Region, 2022-2027 (USD Billion)

5.3 Hybrid Electric

5.3.1 Market Size, By Region, 2022-2027 (USD Billion)

5.4 Hydrogen Electric

5.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 6 EVTOL Aircraft Market, By System

6.1 Batteries & Cells

6.1.1 Market Size, By Region, 2022-2027 (USD Billion)

6.2 Electric Motor/Engine

6.2.1 Market Size, By Region, 2022-2027 (USD Billion)

6.3 Aerostructures

6.3.1 Market Size, By Region, 2022-2027 (USD Billion)

6.4 Avionics

6.4.1 Market Size, By Region, 2022-2027 (USD Billion)

6.5 Software

6.5.1 Market Size, By Region, 2022-2027 (USD Billion)

6.6 Others

6.6.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 7 EVTOL Aircraft Market, By Application

7.1 Air Taxis

7.1.1 Market Size, By Region, 2022-2027 (USD Billion)

7.2 Air Shuttles & Air Metro

7.2.1 Market Size, By Region, 2022-2027 (USD Billion)

7.3 Private Transport

7.3.1 Market Size, By Region, 2022-2027 (USD Billion)

7.4 Cargo Transport

7.4.1 Market Size, By Region, 2022-2027 (USD Billion)

7.5 Air Ambulance & Medical Emergency

7.5.1 Market Size, By Region, 2022-2027 (USD Billion)

7.6 Last Mile Delivery

7.6.1 Market Size, By Region, 2022-2027 (USD Billion)

7.7 Inspection & Monitoring

7.7.1 Market Size, By Region, 2022-2027 (USD Billion)

7.8 Surveying & Mapping

7.8.1 Market Size, By Region, 2022-2027 (USD Billion)

7.9 Surveillance

7.9.1 Market Size, By Region, 2022-2027 (USD Billion)

7.10 Special Mission

7.10.1 Market Size, By Region, 2022-2027 (USD Billion)

7.11 Others

711.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 8 EVTOL Aircraft Market, By Mode of Operation

8.1 Autonomous

8.1.1 Market Size, By Region, 2022-2027 (USD Billion)

8.2 Piloted

8.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 9 EVTOL Aircraft Market, By MTOW

9.1 <100 kg

9.1.1 Market Size, By Region, 2022-2027 (USD Billion)

9.2 100–1000 kg

9.2.1 Market Size, By Region, 2022-2027 (USD Billion)

9.3 1,000–2,000 kg

9.3.1 Market Size, By Region, 2022-2027 (USD Billion)

9.4 >2,000 kg

9.4.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 10 EVTOL Aircraft Market, By Range

10.1 <= 200 km

10.1.1 Market Size, By Region, 2022-2027 (USD Billion)

10.2 > 200 km

10.2.1 Market Size, By Region, 2022-2027 (USD Billion)

Chapter 11 EVTOL Aircraft Market, By Region

11.1 Regional outlook

11.2 North America

11.2.1 Market Size, By Country 2022-2027 (USD Billion)

11.2.2 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.2.3 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.2.4 Market Size, By System, 2022-2027 (USD Billion)

11.2.5 Market Size, By Application, 2022-2027 (USD Billion)

11.2.6 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.2.7 Market Size, By MTOW, 2022-2027 (USD Billion)

11.2.8 Market Size, By Range, 2022-2027 (USD Billion)

11.2.9 U.S.

11.2.9.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.2.9.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.2.9.3 Market Size, By System, 2022-2027 (USD Billion)

11.2.9.4 Market Size, By Application, 2022-2027 (USD Billion)

11.2.9.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.2.9.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.2.9.7 Market Size, By Range, 2022-2027 (USD Billion)

11.2.10 Canada

11.2.10.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.2.10.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.2.10.3 Market Size, By System, 2022-2027 (USD Billion)

11.2.10.4 Market Size, By Application, 2022-2027 (USD Billion)

11.2.10.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.2.10.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.2.10.7 Market Size, By Range, 2022-2027 (USD Billion)

11.2.10 Mexico

11.2.11.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.2.11.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.2.11.3 Market Size, By System, 2022-2027 (USD Billion)

11.2.11.4 Market Size, By Application, 2022-2027 (USD Billion)

11.2.11.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.2.11.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.2.10.7 Market Size, By Range, 2022-2027 (USD Billion)

11.3 Europe

11.3.1 Market Size, By Country 2022-2027 (USD Billion)

11.3.2 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.3.3 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.3.4 Market Size, By System, 2022-2027 (USD Billion)

11.3.5 Market Size, By Application, 2022-2027 (USD Billion)

11.3.6 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.3.7 Market Size, By MTOW, 2022-2027 (USD Billion)

11.3.8 Market Size, By Range, 2022-2027 (USD Billion)

11.3.9 Germany

11.3.9.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.3.9.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.3.9.3 Market Size, By System, 2022-2027 (USD Billion)

11.3.9.4 Market Size, By Application, 2022-2027 (USD Billion)

11.3.9.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.3.9.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.3.9.7 Market Size, By Range, 2022-2027 (USD Billion)

11.3.10 UK

11.3.10.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.3.10.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.3.10.3 Market Size, By System, 2022-2027 (USD Billion)

11.3.10.4 Market Size, By Application, 2022-2027 (USD Billion)

11.3.10.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.3.10.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.3.10.7 Market Size, By Range, 2022-2027 (USD Billion)

11.3.11 France

11.3.11.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.3.11.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.3.11.3 Market Size, By System, 2022-2027 (USD Billion)

11.3.11.4 Market Size, By Application, 2022-2027 (USD Billion)

11.3.11.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.3.11.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.3.11.7 Market Size, By Range, 2022-2027 (USD Billion)

11.4 Asia Pacific

11.4.1 Market Size, By Country 2022-2027 (USD Billion)

11.4.2 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.4.3 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.4.4 Market Size, By System, 2022-2027 (USD Billion)

11.4.5 Market Size, By Application, 2022-2027 (USD Billion)

11.4.6 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.4.7 Market Size, By MTOW, 2022-2027 (USD Billion)

11.4.8 Market Size, By Range, 2022-2027 (USD Billion)

11.4.9 China

11.4.9.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.4.9.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.4.9.3 Market Size, By System, 2022-2027 (USD Billion)

11.4.9.4 Market Size, By Application, 2022-2027 (USD Billion)

11.4.9.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.4.9.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.4.9.7 Market Size, By Range, 2022-2027 (USD Billion)

11.4.10 India

11.4.10.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.4.10.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.4.10.3 Market Size, By System, 2022-2027 (USD Billion)

11.4.10.4 Market Size, By Application, 2022-2027 (USD Billion)

11.4.10.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.4.10.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.4.10.7 Market Size, By Range, 2022-2027 (USD Billion)

11.4.11 Japan

11.4.11.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.4.11.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.4.11.3 Market Size, By System, 2022-2027 (USD Billion)

11.4.11.4 Market Size, By Application, 2022-2027 (USD Billion)

11.4.11.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.4.11.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.4.11.7 Market Size, By Range, 2022-2027 (USD Billion)

11.5 MEA

11.5.1 Market Size, By Country 2022-2027 (USD Billion)

11.5.2 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.5.3 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.5.4 Market Size, By System, 2022-2027 (USD Billion)

11.5.5 Market Size, By Application, 2022-2027 (USD Billion)

11.5.6 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.5.7 Market Size, By MTOW, 2022-2027 (USD Billion)

11.5.8 Market Size, By Range, 2022-2027 (USD Billion)

11.5.9 Saudi Arabia

11.5.9.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.5.9.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.5.9.3 Market Size, By System, 2022-2027 (USD Billion)

11.5.9.4 Market Size, By Application, 2022-2027 (USD Billion)

11.5.9.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.5.9.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.5.9.7 Market Size, By Range, 2022-2027 (USD Billion)

11.5.10 UAE

11.5.10.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.5.10.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.5.10.3 Market Size, By System, 2022-2027 (USD Billion)

11.5.10.4 Market Size, By Application, 2022-2027 (USD Billion)

11.5.10.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.5.10.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.5.10.7 Market Size, By Range, 2022-2027 (USD Billion)

11.6 CSA

11.6.1 Market Size, By Country 2022-2027 (USD Billion)

11.6.2 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.6.3 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.6.4 Market Size, By System, 2022-2027 (USD Billion)

11.6.5 Market Size, By Application, 2022-2027 (USD Billion)

11.6.6 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.6.7 Market Size, By MTOW, 2022-2027 (USD Billion)

11.6.8 Market Size, By Range, 2022-2027 (USD Billion)

11.6.9 Brazil

11.6.9.1 Market Size, By Lift Technology, 2022-2027 (USD Billion)

11.6.9.2 Market Size, By Propulsion Type, 2022-2027 (USD Billion)

11.6.9.3 Market Size, By System, 2022-2027 (USD Billion)

11.6.9.4 Market Size, By Application, 2022-2027 (USD Billion)

11.6.9.5 Market Size, By Mode of Operation, 2022-2027 (USD Billion)

11.6.9.6 Market Size, By MTOW, 2022-2027 (USD Billion)

11.6.9.7 Market Size, By Range, 2022-2027 (USD Billion)

Chapter 12 Company Landscape

12.1 Competitive Analysis, 2022

12.2 EHANG

12.2.1 Company Overview

12.2.2 Financial Analysis

12.2.3 Strategic Positioning

12.2.4 Infographic Analysis

12.3 Volocopter GmbH

12.3.1 Company Overview

12.3.2 Financial Analysis

12.3.3 Strategic Positioning

12.3.4 Infographic Analysis

12.4 Uber Technologies Inc.

12.4.1 Company Overview

12.4.2 Financial Analysis

12.4.3 Strategic Positioning

12.4.4 Infographic Analysis

12.5 Aurora Flight Sciences

12.5.1 Company Overview

12.5.2 Financial Analysis

12.5.3 Strategic Positioning

12.5.4 Infographic Analysis

12.6 A³ by Airbus

12.6.1 Company Overview

12.6.2 Financial Analysis

12.6.3 Strategic Positioning

12.6.4 Infographic Analysis

12.7 Bell Textron Inc.

12.7.1 Company Overview

12.7.2 Financial Analysis

12.7.3 Strategic Positioning

12.7.4 Infographic Analysis

12.8 Workhorse

12.10.1 Company Overview

12.10.2 Financial Analysis

12.10.3 Strategic Positioning

12.10.4 Infographic Analysis

12.11 Lilium GmbH

12.12.1 Company Overview

12.12.2 Financial Analysis

12.12.3 Strategic Positioning

12.12.4 Infographic Analysis

12.10 Terrafugia

12.10.1 Company Overview

12.10.2 Financial Analysis

12.10.3 Strategic Positioning

12.10.4 Infographic Analysis

12.11 OXIS Energy Ltd

12.11.1 Company Overview

12.11.2 Financial Analysis

12.11.3 Strategic Positioning

12.11.4 Infographic Analysis

12.12 Karem Aircraft, Inc.

12.12.1 Company Overview

12.12.2 Financial Analysis

12.12.3 Strategic Positioning

12.12.4 Infographic Analysis

12.13 MGM COMPRO

12.13.1 Company Overview

12.13.2 Financial Analysis

12.13.3 Strategic Positioning

12.13.4 Infographic Analysis

12.14 Kitty Hawk

12.14.1 Company Overview

12.14.2 Financial Analysis

12.14.3 Strategic Positioning

12.14.4 Infographic Analysis

12.15 EmbraerX

12.15.1 Company Overview

12.15.2 Financial Analysis

12.15.3 Strategic Positioning

12.15.4 Infographic Analysis

12.16 LIFT Aircraft Inc.

12.16.1 Company Overview

12.16.2 Financial Analysis

12.16.3 Strategic Positioning

12.16.4 Infographic Analysis

12.17 Opener

12.17.1 Company Overview

12.17.2 Financial Analysis

12.17.3 Strategic Positioning

12.17.4 Infographic Analysis

12.18 Other Companies

12.18.1 Company Overview

12.18.2 Financial Analysis

12.18.3 Strategic Positioning

12.18.4 Infographic Analysis

The Global eVTOL Aircraft Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the eVTOL Aircraft Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS