Global Exosomes Market Size, Trends & Analysis - Forecasts to 2026 By Workflow (Isolation Methods [Ultracentrifugation, Immunocapture on beads, Precipitation, Filtration], Downstream Analysis [Cell Surface Marker Analysis using Flow Cytometry, Protein analysis using Blotting & ELISA, RNA analysis with NGS & PCR, Proteomic analysis using Mass Spectrometry, Others]), By Biomolecule Type (Non-coding RNAs, mRNA (exoRNA), Proteins /peptides, DNA fragments (exosomal DNA, exoDNA), Lipids), By Application (Cancer, Neurodegenerative Diseases, Cardiovascular Diseases, Infectious Diseases, Others), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

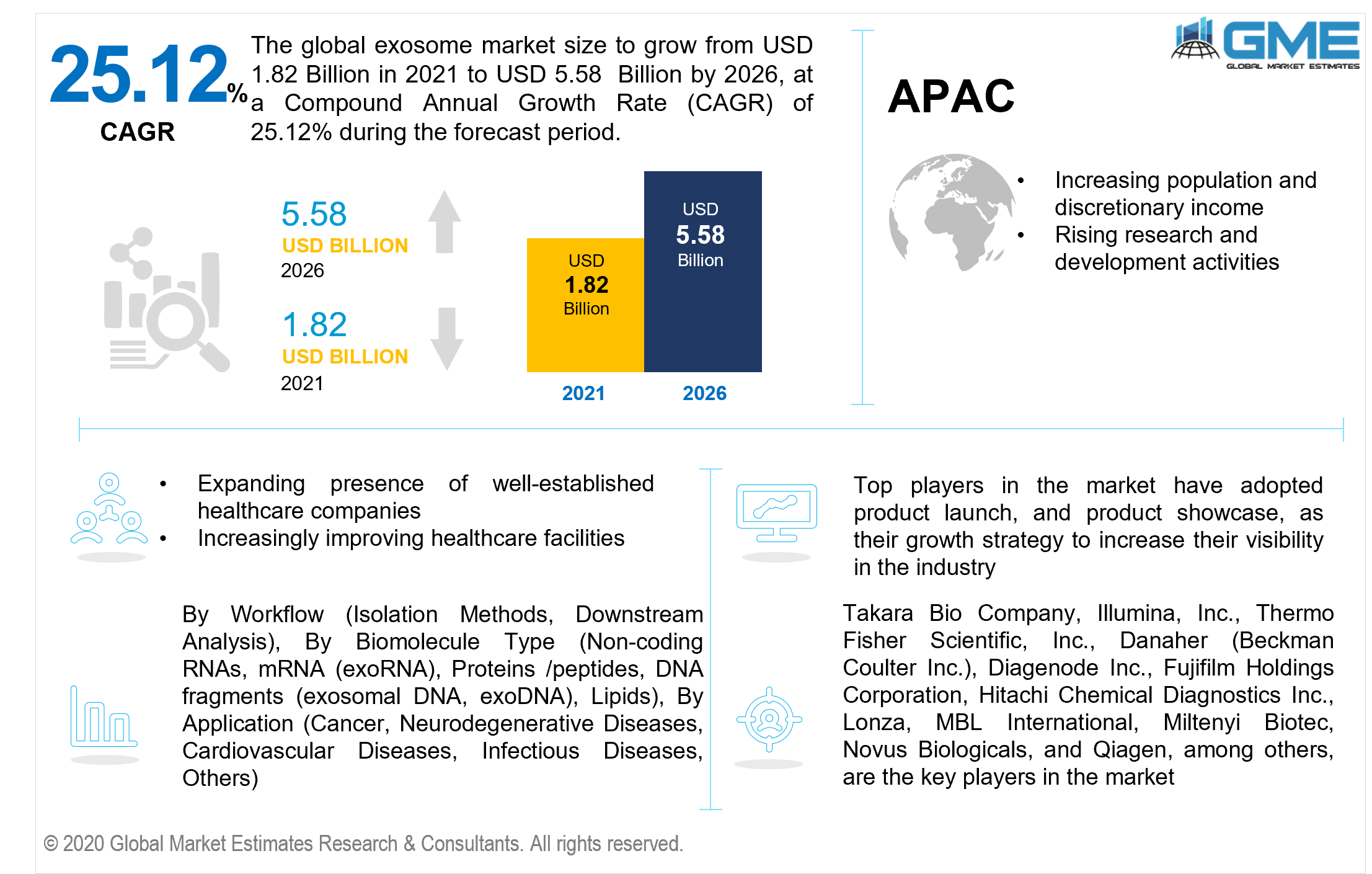

The exosome market is estimated to be valued at USD 1.82 Billion in 2021 and is projected to reach USD 5.58 Billion by 2026 at a CAGR of 25.12%. Exosome-related techniques have advanced swiftly in recent years and the exosome market size is estimated to expand significantly as they are assimilated into domains such as liquid biopsy, targeted therapy, and gene therapy. Cancer-derived exosomes, in specific, impact cell invasiveness by controlling angiogenesis, metastasis, and immune response, allowing them an exceedingly valuable citation of biological markers to be used in cancer identification, prognosis, and treatment classification.

With the expanding preponderance of cancer, technological breakthroughs in exosome isolation and analytical procedures, an increasing multitude of scientific papers being published on exosomes and their implementations; a growing proportion of clinical trials being conducted to investigate exosome treatments and prognostics, and increasingly enhanced innovative capabilities of exosomes are among the considerations supporting global exosomes market advancement.

Corporations are capitalising on exosomes' organic proclivity for transporting macromolecule payloads among cell types. The use of these molecules in immunotherapies and prognostics investigation is foreseen to expand at an incremental rate in the coming years. Furthermore, increased financial support for R&D in this domain is expected to have an optimistic impact on industrial growth. The increase in funding capability by government and private entities demonstrates the relevance of exRNA molecules throughout the community actively involved in translational data analysis for therapies and medicinal product innovation.

Nanovesicles, which perform an important function in intercellular interaction, are expected to see significant increases in research and development activities, resulting in sales growth in the forthcoming years. Market growth can be ascribed to the use of these vesicles as transporters of operational composition, including circulating nucleic acids, lipids, and proteins. Exosomes are also essential in immunosurveillance and tumour pathogenesis. The market is expected to be driven by increased research programmes concentrating on ascertaining the importance of exosomes in hepatocellular carcinoma (HCC).

Exosome market analysis indicates that, during the prevailing COVID-19 epidemic, there is an increase in demand for exosomes, which is pushing market advancement. The latest research paper published in the Journal of Microbiology, Immunology, and Infection 2020 by Devaux et al. acknowledged that a sudden increase in protein cleavage by Transmembrane protease, serine 2 (TMPRSS2) is required for COVID-19 virus admission and disease mostly through engagement with the angiotensin-converting enzyme 2 (ACE2) receptor. There is substantiation that exosomes transmit ACE2 to receiving cells (Wang et al., 2020), implying that exosomes play an encouraging role in COVID-19 virus internalisation and disease.

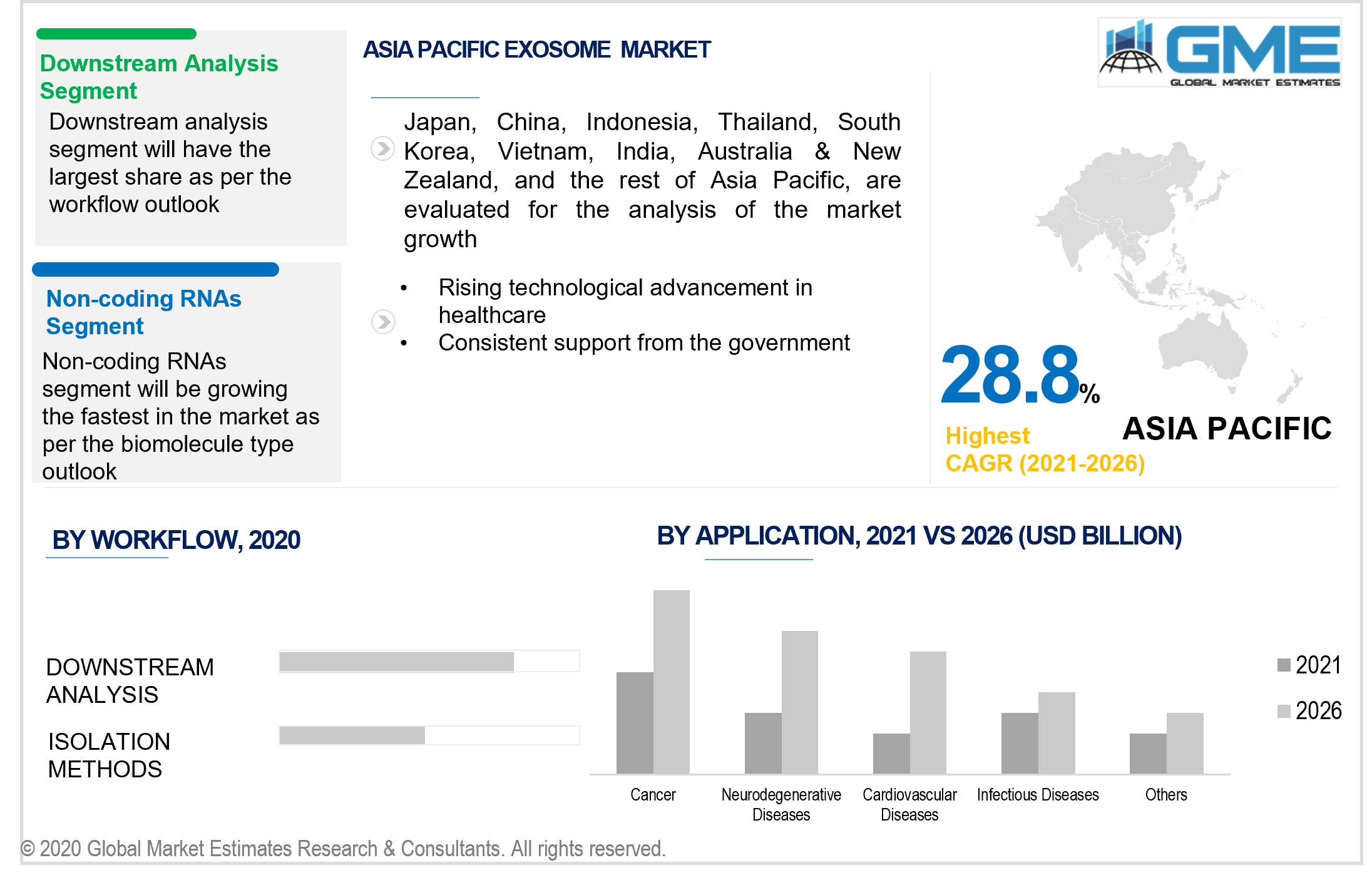

Depending on the workflow, the market is categorized as isolation methods and downstream analysis. Because of the burgeoning demand for sophisticated technologies and modulation for downstream processing, downstream analysis contributed to the majority of the share. Flow cytometry monopolised the downstream analysis market in terms of sales due to increased utilisation of the procedure. The provision of intelligent alternatives and simple procedures for cytometric techniques has aided the expansion of this sub-segment. Owing to an increase in the multitude of systems configured for NGS analysis, RNA analysis utilising NGS and PCR is presumed to see profitable expansion in the coming years.

Depending on the biomolecule type, the market is categorized as Non-coding RNAs, mRNA (exoRNA), Proteins /peptides, DNA fragments (exosomal DNA, exoDNA), Lipids. Non-coding RNAs are presumed to dominate the market. Non-coding RNAs are progressively used for scientific activities, allowing them to arise as the predominant segment. lncRNA operations are thought to be linked to psychological and psychological conditions, tumour development and patterning. The expansion of this segment is foreseen to be driven by the advancement of specialised policies and procedures for non-coding RNA studies and the prognostication of its supplementary framework.

Depending on the application, the market is categorized as cancer, neurodegenerative diseases, cardiovascular diseases, infectious diseases, and others. Because of the expanding contribution of exosomes to cancer investigation, cancer pervades the overall market. Exosomes' participation in tumorigenesis, chemotherapeutic susceptibility, and the production of innovative cancer therapies via the detection of cancer biomarkers is also culpable for the segment's expansion. Exosomes are utilised as a non-invasive biomarker as well as a medication delivery system and for chemotherapy sensitization. This has resulted in increased research and development on these messengers.

North America is foreseen to report the highest market revenue, owing to substantial financing in the United States. Because of improved healthcare facilities, efficacious government initiatives, a large foundation of multinational corporations, and increased public consciousness concerning diagnostics and medicare, the North American area retains one of the largest shares of the market.

A huge proportion of government-funded scientific analyses have been performed on the vocation of drugs containing exosomes in various types of cancers, including melanoma, breast cancer, lung cancer, and pancreatic cancer, among many others. Corporations have endorsed and cooperated with numerous academic institutions in the United States to undertake clinical studies. Besides that, government federal money is extensively allocated to these endeavours.

Due to the enormous capabilities outlined in developing economies such as China and India, Asia Pacific is foreseen to evolve as the fastest-growing area. Productive methodologies implemented by players to conduct research and development in this domain are a result of consistent support from the government, which is foreseen to reinforce the advancement of the Asia Pacific market.

Takara Bio Company, Illumina, Inc., Thermo Fisher Scientific, Inc., Danaher (Beckman Coulter Inc.), Diagenode Inc., Fujifilm Holdings Corporation, Hitachi Chemical Diagnostics Inc., Lonza, MBL International, Miltenyi Biotec, Novus Biologicals, and Qiagen, among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Exosome Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Workflow Overview

2.1.3 Biomolecule Type Overview

2.1.4 Application Overview

2.1.5 Regional Overview

Chapter 3 Exosome Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising Numbers of Clinicals Trials Investigating Exosome Therapeutics and Diagnostics

3.3.1.2 Growing Technological Developments

3.3.2 Industry Challenges

3.3.2.1 Inability to Distinguish Between Different Cancer Stages

3.4 Prospective Growth Scenario

3.4.1 Workflow Growth Scenario

3.4.2 Biomolecule Type Growth Scenario

3.4.3 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Exosome Market, By Workflow

4.1 Workflow Outlook

4.2 Isolation Methods

4.2.1 Market Size, By Region, 2019-2026 (USD Billion)

4.2.2 Market Size, By Ultracentrifugation, 2019-2026 (USD Billion)

4.2.3 Market Size, By Immunocapture on beads, 2019-2026 (USD Billion)

4.2.4 Market Size, By Precipitation, 2019-2026 (USD Billion)

4.2.5 Market Size, By Filtration, 2019-2026 (USD Billion)

4.3 Downstream Analysis

4.3.1 Market Size, By Region, 2019-2026 (USD Billion)

4.3.2 Market Size, By Cell Surface Marker Analysis using Flow Cytometry, 2019-2026 (USD Billion)

4.3.3 Market Size, By Protein analysis using Blotting & ELISA, 2019-2026 (USD Billion)

4.3.4 Market Size, By RNA analysis with NGS & PCR, 2019-2026 (USD Billion)

4.3.5 Market Size, By Proteomic analysis using Mass Spectrometry, 2019-2026 (USD Billion)

4.3.6 Market Size, By Others, 2019-2026 (USD Billion)

Chapter 5 Exosome Market, By Biomolecule Type

5.1 Biomolecule Type Outlook

5.2 Non-coding RNAs

5.2.1 Market Size, By Region, 2019-2026 (USD Billion)

5.3 mRNA (exoRNA)

5.3.1 Market Size, By Region, 2019-2026 (USD Billion)

5.4 Proteins /peptides

5.4.1 Market Size, By Region, 2019-2026 (USD Billion)

5.5 DNA fragments (exosomal DNA, exoDNA)

5.5.1 Market Size, By Region, 2019-2026 (USD Billion)

5.6 Lipids

5.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 6 Exosome Market, By Application

6.1 Application Outlook

6.2 Cancer

6.2.1 Market Size, By Region, 2019-2026 (USD Billion)

6.3 Neurodegenerative Diseases,

6.3.1 Market Size, By Region, 2019-2026 (USD Billion)

6.4 Cardiovascular Diseases

6.4.1 Market Size, By Region, 2019-2026 (USD Billion)

6.5 Infectious Diseases

6.5.1 Market Size, By Region, 2019-2026 (USD Billion)

6.6 Others

6.6.1 Market Size, By Region, 2019-2026 (USD Billion)

Chapter 7 Global Depth Filtration Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2019-2026 (USD Billion)

7.2.2 Market Size, By Workflow, 2019-2026 (USD Billion)

7.2.3 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.2.4 Market Size, By Application, 2019-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.2.5.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.2.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.2.6.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.2.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2019-2026 (USD Billion)

7.3.2 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.3 Market Size, By Biomolecule Type 2019-2026 (USD Billion)

7.3.4 Market Size, By Application, 2019-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.5.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.3.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.6.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.3.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.7.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.3.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.8.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.3.8.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.9.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.3.9.3 Market Size, By Application, 2019-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.3.10.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.3.10.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2019-2026 (USD Billion)

7.4.2 Market Size, By Workflow, 2019-2026 (USD Billion)

7.4.3 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.4.4 Market Size, By Application, 2019-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.4.5.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.4.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.4.6.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.4.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.4.7.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.4.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.4.8.2 Market size, By Biomolecule Type, 2019-2026 (USD Billion)

7.4.8.3 Market Size, By Application, 2019-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.4.9.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.4.9.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2019-2026 (USD Billion)

7.5.2 Market Size, By Workflow, 2019-2026 (USD Billion)

7.5.3 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.5.4 Market Size, By Application, 2019-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.5.5.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.5.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.5.6.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.5.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.5.7.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.5.7.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2019-2026 (USD Billion)

7.6.2 Market Size, By Workflow, 2019-2026 (USD Billion)

7.6.3 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.6.4 Market Size, By Application, 2019-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.6.5.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.6.5.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.6.6.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.6.6.3 Market Size, By Application, 2019-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Workflow, 2019-2026 (USD Billion)

7.6.7.2 Market Size, By Biomolecule Type, 2019-2026 (USD Billion)

7.6.7.3 Market Size, By Application, 2019-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 Takara Bio Company

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Illumina, Inc.

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info Graphic Analysis

8.4 Thermo Fisher Scientific, Inc.

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info Graphic Analysis

8.5 Danaher (Beckman Coulter Inc.)

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info Graphic Analysis

8.6 Diagenode Inc.

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info Graphic Analysis

8.7 Fujifilm Holdings Corporation

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info Graphic Analysis

8.8 Hitachi Chemical Diagnostics Inc.

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info Graphic Analysis

8.9 Lonza

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info Graphic Analysis

8.10 MBL International

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info Graphic Analysis

8.11 Miltenyi Biotec

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info Graphic Analysis

8.12 Novus Biologicals

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info Graphic Analysis

8.13 Qiagen

8.13.1 Company Overview

8.13.2 Financial Analysis

8.13.3 Strategic Positioning

8.13.4 Info Graphic Analysis

8.14 Other Companies

8.14.1 Company Overview

8.14.2 Financial Analysis

8.14.3 Strategic Positioning

8.14.4 Info Graphic Analysis

The Global Exosomes Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Exosomes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS