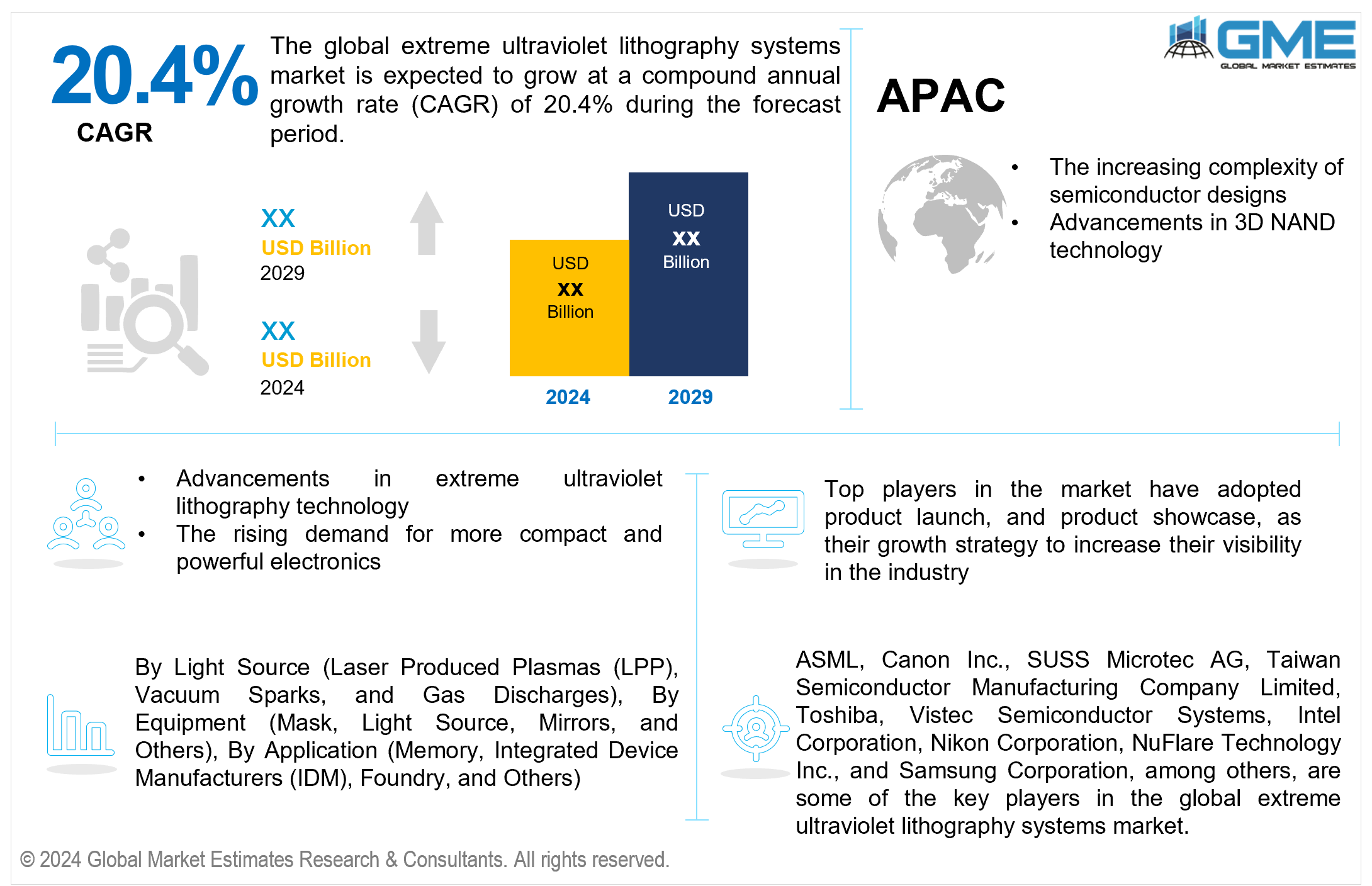

Global Extreme Ultraviolet Lithography Systems Market Size, Trends & Analysis - Forecasts to 2029 By Light Source (Laser Produced Plasmas (LPP), Vacuum Sparks, and Gas Discharges), By Equipment (Mask, Light Source, Mirrors, and Others), By Application (Memory, Integrated Device Manufacturers (IDM), Foundry, and Others), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global extreme ultraviolet lithography systems market is estimated to exhibit a CAGR of 20.4% from 2024 to 2029.

The increasing complexity of semiconductor designs and advancements in 3D NAND technology are the primary factors propelling the market growth. The complexity of semiconductor designs, together with their smaller feature sizes and tighter interconnects, makes it harder for classic lithography processes to provide the necessary accuracy and resolution. Since extreme ultraviolet light has a shorter wavelength in EUV lithography, it can produce finer details and complicated patterns to address complex design requirements. Additionally, to improve the functionality and efficiency of integrated circuits, the semiconductor industry continuously moves toward smaller process nodes (such as 7nm, 5nm, and beyond). Since EUV lithography offers the resolution required to pattern features at such small sizes, it is essential for production at these advanced nodes. For instance, Taiwan Semiconductor Manufacturing Company Limited (TSMC) declared in December 2019 that it planned to start supplying 5 nm process-based chips in the first half of 2020. It will begin producing 3 nm process chips in large quantities in 2022. By 2024, the company also plans to produce 2-nm process devices.

The market is expected to grow due to advancements in extreme ultraviolet lithography technology and the rising demand for more compact and powerful electronics. Technological developments improve the overall performance of EUV lithography systems in EUV light source technology, such as creating more potent and efficient laser-produced plasma (LPP) sources. These enhancements help the semiconductor manufacturing industry produce more semiconductors with greater throughput, stability, and productivity. Moreover, continuous advances in mask and optical technologies are essential to raising the quality, resolution, and precision of EUV lithography. Better image quality, fewer aberrations, and more pattern transfer precision are made possible by improved optics and masks, which make it possible to produce smaller and more intricate semiconductor features. For instance, Carl Zeiss AG developed an optical system especially for EUV lithography in December 2022. EUV lithography is a vacuum-operated technology that uses only mirrors.

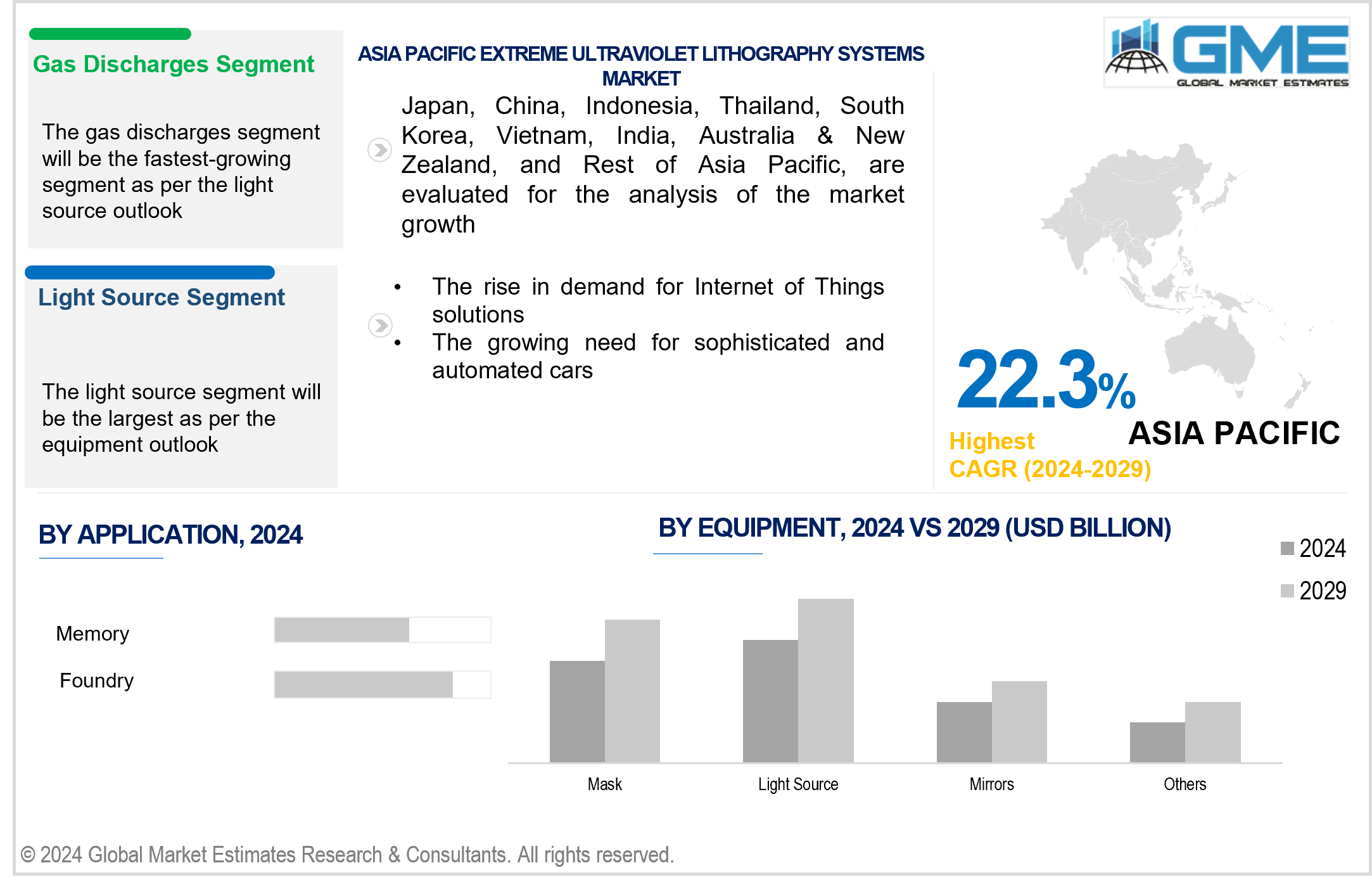

The rise in demand for Internet of Things solutions and the growing need for sophisticated and automated cars propel market growth. Semiconductor devices with a wide range of functions and strong integration capabilities are necessary for IoT solutions. EUV lithography makes it possible to create complex integrated circuits that can perform several tasks on a single chip, which advances the creation of increasingly powerful and complex Internet of Things devices. Additionally, many Internet of Things devices rely on battery power and must meet strict energy efficiency standards. Since EUV lithography makes it possible to produce smaller transistors and use less power, it can fabricate energy-efficient semiconductor components that meet the requirements of Internet of Things applications.

High-performance computing solutions are required due to the increasing usage of AI and ML technologies. EUV lithography opens up opportunities in this quickly growing field by making it possible to produce sophisticated semiconductor devices with the processing power required for AI and ML applications. Moreover, EUV lithography offers advantages for developing sophisticated packaging technologies, including 2.5D and 3D IC packaging. This creates opportunities for EUV systems to be crucial in developing the intricate structures and interconnects needed for advanced packaging.

However, complexities in developing proper photoresists and the high cost of implementing the EUV Lithography system hinder market growth.

The laser produced plasmas (LPP) segment is expected to hold the largest share of the market over the forecast period. Laser produced plasmas (LPP) systems use high-power lasers to generate plasma, producing EUV light. Comparing this method to other approaches, it provides higher power levels, which can lead to increased efficiency in the process of generating EUV light. Additionally, extreme ultraviolet (EUV) light, with a wavelength of about 13.5 nanometers, is produced by LPP systems and is appropriate for use in advanced semiconductor lithography. The wavelength accuracy and matching power of LPP make it the material of choice for EUV lithography.

The gas discharge segment is expected to be the fastest-growing in the market from 2024-2029. Gas discharge sources can be used in high-volume production settings since they have the potential to scale to greater power levels. To cater to the need of the manufacturing demands of advanced semiconductor nodes, the capacity to scale high power levels is important.

The light source segment is expected to hold the largest share of the market over the forecast period. Light source equipment is a central and critical component of EUV lithography systems. It is essential in producing the extreme ultraviolet (EUV) light needed for patterning semiconductors. As a result, the light source is a key determinant of system performance.

The mask segment is anticipated to be the fastest-growing in the market from 2024-2029. Advanced masks are becoming increasingly necessary as technology moves to lower nodes and more complicated semiconductor designs are produced. The need for complex mask equipment rises as semiconductor features get smaller and mask standards get stricter.

The foundry segment is expected to hold the largest share of the market over the forecast period. To cater to the needs of several clients, foundries frequently engage in high-volume production. Extreme ultraviolet lithography (EUVL) makes production at lower nodes more efficient. As foundries move to higher-tech nodes, there is a growing need for EUV lithography for high-volume manufacture. Additionally, advanced lithography methods are advantageous to foundries that provide multi-project wafer (MPW) services, which enable several designs on a single wafer. For MPW services, EUV lithography can be very helpful as it allows for numerous designs with reduced feature sizes on a single wafer.

The memory segment is anticipated to be the fastest-growing in the market from 2024-2029. Advanced memory technologies are required due to the increased need for high-capacity and high-performance memory solutions from applications like 5G, AI, and data centers. The higher density and smaller features needed in modern memory devices are best achieved using EUV lithography.

North America is expected to be the largest region in the global market. The requirement for advanced semiconductor technology is driven by North America's growing need for high-performance computing (HPC) and artificial intelligence (AI) solutions. EUV lithography supports the production of high-performance chips required for AI and HPC applications. For instance, The U.S. Department of Energy announced in January 2023 that it would invest USD 1.8 million for six teams to collaborate with the high-performance computing (HPC) department of the U.S. National Laboratories to assist manufacturers in streamlining their operations, boosting output, and reducing their carbon footprint in the nation.

Asia Pacific is anticipated to witness rapid growth during the forecast period. The rising need for complex semiconductor components in Asia Pacific is being driven by the automotive industry's integration of new technologies, such as connected and autonomous cars. EUV lithography presents ability in the automotive semiconductor industry by helping to provide high-performance and dependable solutions. For instance, the China Passenger Car Association (CPCA) reports that sales of passenger automobiles increased by 4.4% in 2021 to reach 20.15 million units in China.

ASML, Canon Inc., SUSS Microtec AG, Taiwan Semiconductor Manufacturing Company Limited, Toshiba, Vistec Semiconductor Systems, Intel Corporation, Nikon Corporation, NuFlare Technology Inc., and Samsung Corporation, among others, are some of the key players in the global extreme ultraviolet lithography systems market.

Please note: This is not an exhaustive list of companies profiled in the report.

In December 2021, ASML developed a new version of their extreme ultraviolet lithography apparatus, which is used to etch patterns onto silicon chips, to create the most advanced computers in the world.

In January 2022, ASML and Intel Corporation collaborated to get High-NA into production by 2025. The principal aim is to progress the state-of-the-art in semiconductor lithography technology.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL EXTREME ULTRAVIOLET LITHOGRAPHY SYSTEMS MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Application Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL EXTREME ULTRAVIOLET LITHOGRAPHY SYSTEMS MARKET, BY LIGHT SOURCE

4.1 Introduction

4.2 Extreme Ultraviolet Lithography Systems Market: Light Source Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Laser Produced Plasmas (LPP)

4.4.1 Laser Produced Plasmas (LPP) Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Vacuum Sparks

4.5.1 Vacuum Sparks Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Gas Discharges

4.6.1 Gas Discharges Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL EXTREME ULTRAVIOLET LITHOGRAPHY SYSTEMS MARKET, BY EQUIPMENT

5.1 Introduction

5.2 Extreme Ultraviolet Lithography Systems Market: Equipment Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 Mask

5.4.1 Mask Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Light Source

5.5.1 Light Source Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Mirrors

5.6.1 Mirrors Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 Others

5.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL EXTREME ULTRAVIOLET LITHOGRAPHY SYSTEMS MARKET, BY APPLICATION

6.1 Introduction

6.2 Extreme Ultraviolet Lithography Systems Market: Application Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Memory

6.4.1 Memory Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Integrated Device Manufacturers (IDM)

6.5.1 Integrated Device Manufacturers (IDM) Market Estimates and Forecast, 2021-2029 (USD Million)

6.6 Foundry

6.6.1 Foundry Market Estimates and Forecast, 2021-2029 (USD Million)

6.7 Others

6.7.1 Others Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL EXTREME ULTRAVIOLET LITHOGRAPHY SYSTEMS MARKET, BY REGION

7.1 Introduction

7.2 North America Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Light Source

7.2.2 By Equipment

7.2.3 By Application

7.2.4 By Country

7.2.4.1 U.S. Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Light Source

7.2.4.1.2 By Equipment

7.2.4.1.3 By Application

7.2.4.2 Canada Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Light Source

7.2.4.2.2 By Equipment

7.2.4.2.3 By Application

7.2.4.3 Mexico Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Light Source

7.2.4.3.2 By Equipment

7.2.4.3.3 By Application

7.3 Europe Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Light Source

7.3.2 By Equipment

7.3.3 By Application

7.3.4 By Country

7.3.4.1 Germany Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Light Source

7.3.4.1.2 By Equipment

7.3.4.1.3 By Application

7.3.4.2 U.K. Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Light Source

7.3.4.2.2 By Equipment

7.3.4.2.3 By Application

7.3.4.3 France Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Light Source

7.3.4.3.2 By Equipment

7.3.4.3.3 By Application

7.3.4.4 Italy Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Light Source

7.3.4.4.2 By Equipment

7.2.4.4.3 By Application

7.3.4.5 Spain Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Light Source

7.3.4.5.2 By Equipment

7.2.4.5.3 By Application

7.3.4.6 Netherlands Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Light Source

7.3.4.6.2 By Equipment

7.2.4.6.3 By Application

7.3.4.7 Rest of Europe Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Light Source

7.3.4.7.2 By Equipment

7.2.4.7.3 By Application

7.4 Asia Pacific Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Light Source

7.4.2 By Equipment

7.4.3 By Application

7.4.4 By Country

7.4.4.1 China Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Light Source

7.4.4.1.2 By Equipment

7.4.4.1.3 By Application

7.4.4.2 Japan Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Light Source

7.4.4.2.2 By Equipment

7.4.4.2.3 By Application

7.4.4.3 India Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Light Source

7.4.4.3.2 By Equipment

7.4.4.3.3 By Application

7.4.4.4 South Korea Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Light Source

7.4.4.4.2 By Equipment

7.4.4.4.3 By Application

7.4.4.5 Singapore Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Light Source

7.4.4.5.2 By Equipment

7.4.4.5.3 By Application

7.4.4.6 Malaysia Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Light Source

7.4.4.6.2 By Equipment

7.4.4.6.3 By Application

7.4.4.7 Thailand Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Light Source

7.4.4.7.2 By Equipment

7.4.4.7.3 By Application

7.4.4.8 Indonesia Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Light Source

7.4.4.8.2 By Equipment

7.4.4.8.3 By Application

7.4.4.9 Vietnam Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Light Source

7.4.4.9.2 By Equipment

7.4.4.9.3 By Application

7.4.4.10 Taiwan Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Light Source

7.4.4.10.2 By Equipment

7.4.4.10.3 By Application

7.4.4.11 Rest of Asia Pacific Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Light Source

7.4.4.11.2 By Equipment

7.4.4.11.3 By Application

7.5 Middle East and Africa Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Light Source

7.5.2 By Equipment

7.5.3 By Application

7.5.4 By Country

7.5.4.1 Saudi Arabia Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Light Source

7.5.4.1.2 By Equipment

7.5.4.1.3 By Application

7.5.4.2 U.A.E. Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Light Source

7.5.4.2.2 By Equipment

7.5.4.2.3 By Application

7.5.4.3 Israel Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Light Source

7.5.4.3.2 By Equipment

7.5.4.3.3 By Application

7.5.4.4 South Africa Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Light Source

7.5.4.4.2 By Equipment

7.5.4.4.3 By Application

7.5.4.5 Rest of Middle East and Africa Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Light Source

7.5.4.5.2 By Equipment

7.5.4.5.2 By Application

7.6 Central and South America Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Light Source

7.6.2 By Equipment

7.6.3 By Application

7.6.4 By Country

7.6.4.1 Brazil Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Light Source

7.6.4.1.2 By Equipment

7.6.4.1.3 By Application

7.6.4.2 Argentina Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Light Source

7.6.4.2.2 By Equipment

7.6.4.2.3 By Application

7.6.4.3 Chile Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Light Source

7.6.4.3.2 By Equipment

7.6.4.3.3 By Application

7.6.4.4 Rest of Central and South America Extreme Ultraviolet Lithography Systems Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Light Source

7.6.4.4.2 By Equipment

7.6.4.4.3 By Application

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 ASML

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Canon Inc.

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 SUSS Microtec AG

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Samsung Corporation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Taiwan Semiconductor Manufacturing Company Limited

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 TOSHIBA

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Products & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Vistec Semiconductor Systems

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Intel Corporation

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Nikon Corporation

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 NuFlare Technology Inc.

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

8.4.11 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Products & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Light Source Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Mllion)

2 Laser Produced Plasmas (LPP) Market, By Region, 2021-2029 (USD Mllion)

3 Vacuum Sparks Market, By Region, 2021-2029 (USD Mllion)

4 Gas Discharges Market, By Region, 2021-2029 (USD Mllion)

5 Global Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Mllion)

6 Mask Market, By Region, 2021-2029 (USD Mllion)

7 Light Source Market, By Region, 2021-2029 (USD Mllion)

8 Mirrors Market, By Region, 2021-2029 (USD Mllion)

9 Others Market, By Region, 2021-2029 (USD Mllion)

10 Global Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Mllion)

11 Memory Market, By Region, 2021-2029 (USD Mllion)

12 Integrated Device Manufacturers (IDM) Market, By Region, 2021-2029 (USD Mllion)

13 Foundry Market, By Region, 2021-2029 (USD Mllion)

14 Others Market, By Region, 2021-2029 (USD Mllion)

15 Regional Analysis, 2021-2029 (USD Mllion)

16 North America Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

17 North America Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

18 North America Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

19 North America Extreme Ultraviolet Lithography Systems Market, By Country, 2021-2029 (USD Million)

20 U.S Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

21 U.S Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

22 U.S Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

23 Canada Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

24 Canada Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

25 Canada Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

26 Mexico Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

27 Mexico Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

28 Mexico Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

29 Europe Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

30 Europe Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

31 Europe Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

32 Europe Extreme Ultraviolet Lithography Systems Market, By Country 2021-2029 (USD Million)

33 Germany Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

34 Germany Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

35 Germany Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

36 U.K Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

37 U.K Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

38 U.K Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

39 France Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

40 France Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

41 France Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

42 Italy Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

43 Italy Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

44 Italy Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

45 Spain Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

46 Spain Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

47 Spain Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

48 Netherlands Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

49 Netherlands Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

50 Netherlands Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

51 Rest Of Europe Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

52 Rest Of Europe Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

53 Rest of Europe Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

54 Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

55 Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

56 Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

57 Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Country, 2021-2029 (USD Million)

58 China Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

59 China Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

60 China Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

61 India Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

62 India Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

63 India Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

64 Japan Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

65 Japan Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

66 Japan Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

67 South Korea Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

68 South Korea Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

69 South Korea Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

70 malaysia Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

71 malaysia Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

72 malaysia Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

73 Thailand Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

74 Thailand Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

75 Thailand Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

76 Indonesia Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

77 Indonesia Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

78 Indonesia Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

79 Vietnam Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

80 Vietnam Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

81 Vietnam Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

82 Taiwan Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

83 Taiwan Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

84 Taiwan Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

85 Rest of Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

86 Rest of Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

87 Rest of Asia Pacific Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

88 Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

89 Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

90 Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

91 Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Country, 2021-2029 (USD Million)

92 Saudi Arabia Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

93 Saudi Arabia Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

94 Saudi Arabia Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

95 UAE Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

96 UAE Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

97 UAE Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

98 Israel Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

99 Israel Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

100 Israel Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

101 South Africa Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

102 South Africa Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

103 South Africa Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

105 Rest of Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

106 Rest of Middle East and Africa Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

107 Central and South America Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

108 Central and South America Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

109 Central and South America Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

110 Central and South America Extreme Ultraviolet Lithography Systems Market, By Country, 2021-2029 (USD Million)

111 Brazil Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

112 Brazil Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

113 Brazil Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

114 Argentina Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

115 Argentina Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

116 Argentina Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

117 Chile Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

118 Chile Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

119 Chile Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

120 Rest of Central and South America Extreme Ultraviolet Lithography Systems Market, By Light Source, 2021-2029 (USD Million)

121 Rest of Central and South America Extreme Ultraviolet Lithography Systems Market, By Equipment, 2021-2029 (USD Million)

122 Rest of Central and South America Extreme Ultraviolet Lithography Systems Market, By Application, 2021-2029 (USD Million)

123 ASML: Products & Services Offering

124 Canon Inc.: Products & Services Offering

125 SUSS Microtec AG: Products & Services Offering

126 Samsung Corporation: Products & Services Offering

127 Taiwan Semiconductor Manufacturing Company Limited: Products & Services Offering

128 TOSHIBA: Products & Services Offering

129 Vistec Semiconductor Systems : Products & Services Offering

130 Intel Corporation: Products & Services Offering

131 Nikon Corporation, Inc: Products & Services Offering

132 NuFlare Technology Inc.: Products & Services Offering

133 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Extreme Ultraviolet Lithography Systems Market Overview

2 Global Extreme Ultraviolet Lithography Systems Market Value From 2021-2029 (USD Mllion)

3 Global Extreme Ultraviolet Lithography Systems Market Share, By Light Source (2023)

4 Global Extreme Ultraviolet Lithography Systems Market Share, By Equipment (2023)

5 Global Extreme Ultraviolet Lithography Systems Market Share, By Application (2023)

6 Global Extreme Ultraviolet Lithography Systems Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Extreme Ultraviolet Lithography Systems Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Extreme Ultraviolet Lithography Systems Market

11 Impact Of Challenges On The Global Extreme Ultraviolet Lithography Systems Market

12 Porter’s Five Forces Analysis

13 Global Extreme Ultraviolet Lithography Systems Market: By Light Source Scope Key Takeaways

14 Global Extreme Ultraviolet Lithography Systems Market, By Light Source Segment: Revenue Growth Analysis

15 Laser Produced Plasmas (LPP) Market, By Region, 2021-2029 (USD Mllion)

16 Vacuum Sparks Market, By Region, 2021-2029 (USD Mllion)

17 Gas Discharges Market, By Region, 2021-2029 (USD Mllion)

18 Global Extreme Ultraviolet Lithography Systems Market: By Equipment Scope Key Takeaways

19 Global Extreme Ultraviolet Lithography Systems Market, By Equipment Segment: Revenue Growth Analysis

20 Mask Market, By Region, 2021-2029 (USD Mllion)

21 Light Source Market, By Region, 2021-2029 (USD Mllion)

22 Mirrors Market, By Region, 2021-2029 (USD Mllion)

23 Others Market, By Region, 2021-2029 (USD Mllion)

24 Global Extreme Ultraviolet Lithography Systems Market: By Application Scope Key Takeaways

25 Global Extreme Ultraviolet Lithography Systems Market, By Application Segment: Revenue Growth Analysis

26 Memory Market, By Region, 2021-2029 (USD Mllion)

27 Integrated Device Manufacturers (IDM) Market, By Region, 2021-2029 (USD Mllion)

28 Foundry Market, By Region, 2021-2029 (USD Mllion)

29 Others Market, By Region, 2021-2029 (USD Mllion)

30 Regional Segment: Revenue Growth Analysis

31 Global Extreme Ultraviolet Lithography Systems Market: Regional Analysis

32 North America Extreme Ultraviolet Lithography Systems Market Overview

33 North America Extreme Ultraviolet Lithography Systems Market, By Light Source

34 North America Extreme Ultraviolet Lithography Systems Market, By Equipment

35 North America Extreme Ultraviolet Lithography Systems Market, By Application

36 North America Extreme Ultraviolet Lithography Systems Market, By Country

37 U.S. Extreme Ultraviolet Lithography Systems Market, By Light Source

38 U.S. Extreme Ultraviolet Lithography Systems Market, By Equipment

39 U.S. Extreme Ultraviolet Lithography Systems Market, By Application

40 Canada Extreme Ultraviolet Lithography Systems Market, By Light Source

41 Canada Extreme Ultraviolet Lithography Systems Market, By Equipment

42 Canada Extreme Ultraviolet Lithography Systems Market, By Application

43 Mexico Extreme Ultraviolet Lithography Systems Market, By Light Source

44 Mexico Extreme Ultraviolet Lithography Systems Market, By Equipment

45 Mexico Extreme Ultraviolet Lithography Systems Market, By Application

46 Four Quadrant Positioning Matrix

47 Company Market Share Analysis

48 ASML: Company Snapshot

49 ASML: SWOT Analysis

50 ASML: Geographic Presence

51 Canon Inc.: Company Snapshot

52 Canon Inc.: SWOT Analysis

53 Canon Inc.: Geographic Presence

54 SUSS Microtec AG: Company Snapshot

55 SUSS Microtec AG: SWOT Analysis

56 SUSS Microtec AG: Geographic Presence

57 Samsung Corporation: Company Snapshot

58 Samsung Corporation: Swot Analysis

59 Samsung Corporation: Geographic Presence

60 Taiwan Semiconductor Manufacturing Company Limited: Company Snapshot

61 Taiwan Semiconductor Manufacturing Company Limited: SWOT Analysis

62 Taiwan Semiconductor Manufacturing Company Limited: Geographic Presence

63 TOSHIBA: Company Snapshot

64 TOSHIBA: SWOT Analysis

65 TOSHIBA: Geographic Presence

66 Vistec Semiconductor Systems : Company Snapshot

67 Vistec Semiconductor Systems : SWOT Analysis

68 Vistec Semiconductor Systems : Geographic Presence

69 Intel Corporation: Company Snapshot

70 Intel Corporation: SWOT Analysis

71 Intel Corporation: Geographic Presence

72 Nikon Corporation, Inc.: Company Snapshot

73 Nikon Corporation, Inc.: SWOT Analysis

74 Nikon Corporation, Inc.: Geographic Presence

75 NuFlare Technology Inc.: Company Snapshot

76 NuFlare Technology Inc.: SWOT Analysis

77 NuFlare Technology Inc.: Geographic Presence

78 Other Companies: Company Snapshot

79 Other Companies: SWOT Analysis

80 Other Companies: Geographic Presence

The Global Extreme Ultraviolet Lithography Systems Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Extreme Ultraviolet Lithography Systems Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS