Global Feed Acidifiers Market Size, Trends & Analysis - Forecasts to 2026 By Type (Propionic Acid, Formic Acid, Lactic Acid, Citric Acid, Sorbic Acid, Malic Acid), By Form (Dry, Liquid), By Compound (Blended, Single), By Livestock (Swine, Poultry, Aquaculture, Ruminants, Others), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

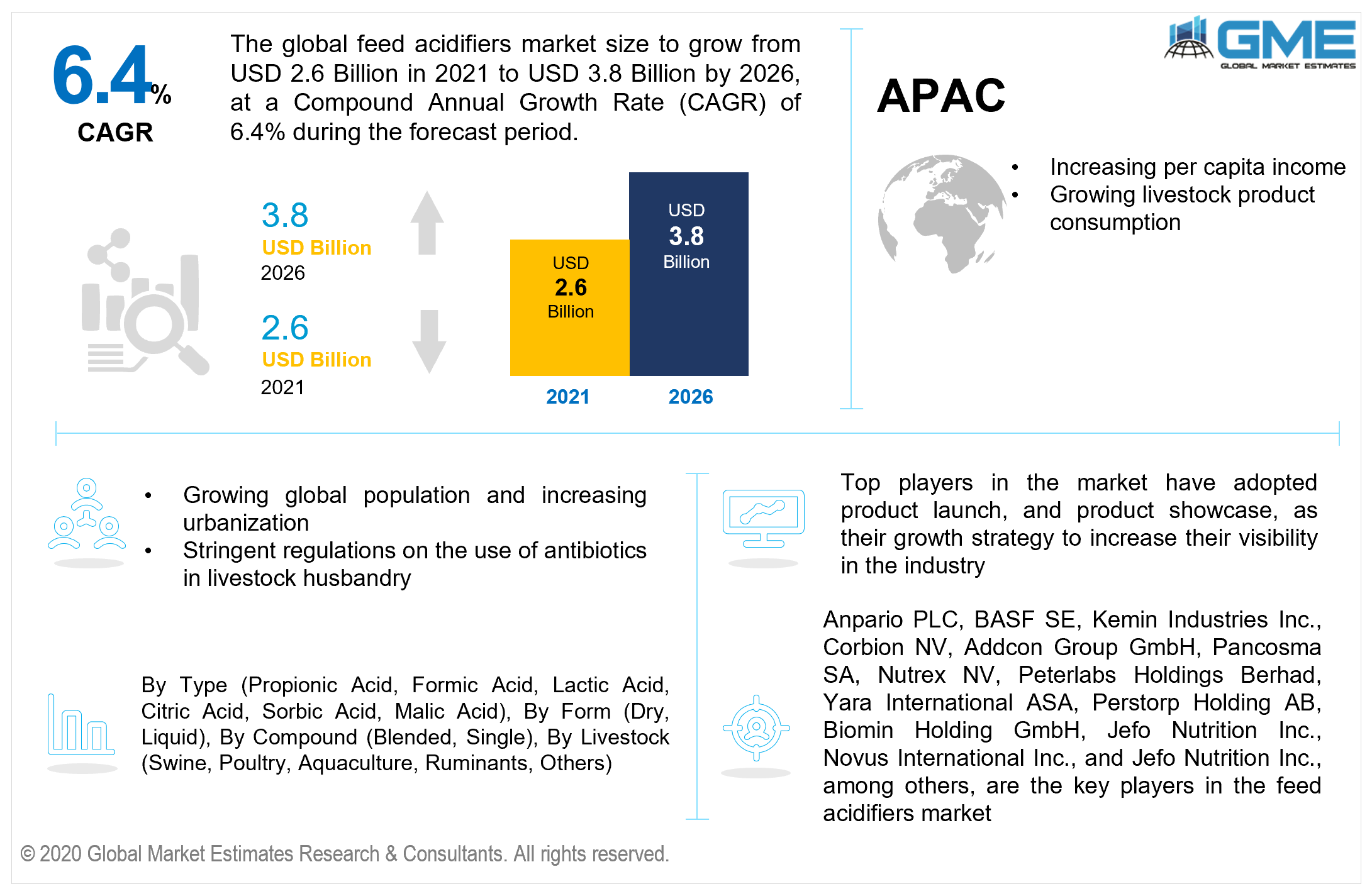

The global feed acidifiers market is projected to grow from USD 2.6 billion in 2021 to USD 3.8 billion by 2026 at a CAGR value of 6.4% from 2021 to 2026. The global market is largely driven by the growing demand for livestock products. The demand for food products has been increasing steadily as the global population increases. As urbanization rates increase and per capita income increases, people are turning to pre-packaged food for their dietary needs. In 2018, the global meat production stood at 340 million tonnes and 800 million tonnes of milk is produced annually. With such consumption and production of animal products, the health of livestock is of utmost importance to the animal husbandry sector.

Animal feed production has also gone up in recent years reaching 1.3 billion metric tonnes in 2018, as per Alltech's survey on global feed production. Traditionally, antibiotics have been used as a cure and for the prevention of diseases among livestock. There have been growing health concerns regarding the use of antibiotics in livestock as antibiotic resistance can be passed on to the consumers of animal products. Such concerns and the growing animal rights movement have resulted in the European Union banning the use of antibiotics in livestock.

In 2022, antibiotics can no longer be used in animal farming including preventative group treatment before the animals show signs of the disease. This has compelled the animal husbandry sector to look at alternatives like pre-biotics, enzymes, probiotics, and organic acids or feed acidifiers. Acidifiers improve the microbial populations in the animal’s intestines thereby improving the immune system response. Such acidifiers also improve the digestive action of the intestines, thereby increasing the absorption of minerals and other nutrients.

The effects of the acidifiers are similar to antibiotics in terms of the immune system response to the presence of pathogenic bacteria. The cost-effectiveness of such acidifiers also contributes to the growth of the global market. The growing number of diseases outbreaks among animals in recent years, such as bird flu, avian flu, and swine flu is a reason for concern among livestock owners. Combined with the ban on various antibiotics and multivitamins by various regulatory bodies in developed nations has increased the demand for such acidifiers. Studies have shown that coated salt acidifiers are the most effective form of acidifiers and are used regularly in gut acidifiers in poultry and pigs. Amasil formic acid for poultry, Biomin, and Kemin feed acidifiers for pigs are some of the common types of acidifiers available in the market.

The market is restrained by the growing prices of raw materials as these raw materials are used extensively in other industries as well. Such acidifiers are corrosive and lose their efficacy if not stored properly.

Depending on the type, the market can be segmented into lactic acid, citric acid, malic acid, sorbic acid, propionic acid, and formic acid. The propionic acid segment is envisaged to register the fastest growth rate among all segments owing to its high popularity among poultry farmers. Propionic acid is used to improve the silage used to feed poultry and to improve the preservation of silages as it helps to provide aerobic stability to silages.

Another advantage of propionic acid is its widespread acceptance among various regulatory bodies even when used as a chemical for preservative purposes of feeds. Propionic acid is recognized as a safe substance by the Food and Drug Administration body of the United States government. These advantages are expected to further improve the demand for propionic acid as feed acidifiers and cause the propionic acid segment to rise at a significantly improved rate than the other segments.

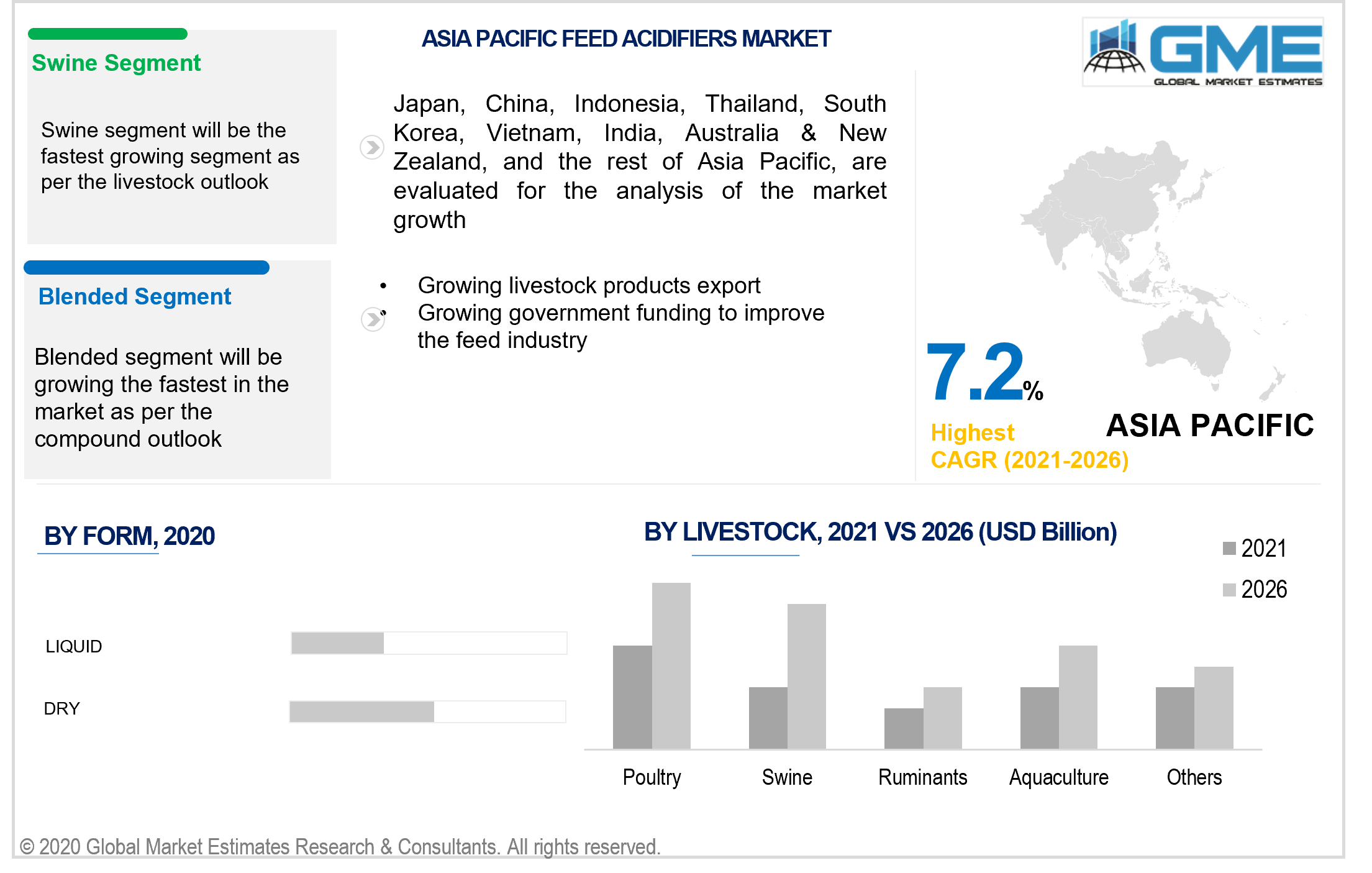

Based on the available forms, the market can be classified as dry and liquid. The dry segment is envisaged to clutch the lion’s share of the market during the forecast period. Dry feed additives are easier to store and have longer shelf lives than their liquid counterparts. While being easy to handle for livestock caretakers, dry feed acidifiers are much easier to transport, store, and handle for feed additives producers as well. These advantages have made them very common in the feed additives market and are expected to result in this segment to log the fastest growth rate during the forecast period.

Based on the compound, the market can be segmented as blended and single. The blended segment is expected to grasp the dominant share of the market. Blended feed additives are the most commonly used by livestock caretakers as they are easier to handle and cater for. They are also most effective than single feed additives. The blended segment is expected to continue its market dominance during the forecast period and is envisaged to log a higher growth rate than the single segment.

Based on the livestock, the market can be segmented into poultry, swine, ruminants, aquaculture, and others. The poultry segment will hold the dominant share of the market during the forecast period. The growing consumption of poultry across the globe is the major driver of this segment. Poultry holds the lion’s share of the global meat production industry. Unlike swine and ruminant products which are restricted in regions due to religious reasons, poultry does not have such restrictions. This has lead to the dominance of the poultry segment.

The swine segment is expected to grow at a significantly greater rate than the other segments during the forecast period. Swine products are consumed heavily in Europe, with the expected ban on antibiotics for livestock. Thus, there will be an increase in the demand for feed additives for swine during the forecast period.

The market can be categorized geographically as North America, Central & South America, Europe, Middle East & Africa, and Asia Pacific regions. The North American region held the lion’s share of the market during the forecast period. The region is a heavy consumer of meat products. In 2014, an average person in the U.S, consumed over 100 kgs of meat products while the global average was 43 kgs per person. The high demand for livestock products in the region is the major driver of the feed acidifier market in the North American region. Stringent regulations on antibiotics and multivitamins have also contributed to the growing demand for such acidifiers in the North American market.

The APAC region is expected to register the fastest growth rate during the forecast period. The increasing population in the region and increasing consumption of meat products are expected to have a positive impact on the growth of the market in the region. The APAC region also exports meat products to other parts of the world, the growing restrictions on the use of antibiotics in other parts of the world will also contribute to the growing demand for such acidifiers in the region. The region is heavily impacted by the outbreak of diseases among livestock, such acidifiers offer preventive measures to inhibit such outbreaks.

Anpario PLC, BASF SE, Kemin Industries Inc., Corbion NV, Addcon Group GmbH, Pancosma SA, Nutrex NV, Peterlabs Holdings Berhad, Yara International ASA, Perstorp Holding AB, Biomin Holding GmbH, Jefo Nutrition Inc., Novus International Inc., and Jefo Nutrition Inc., among others, are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Feed Acidifiers Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Form Overview

2.1.4 Compound Overview

2.1.5 Livestock Overview

2.1.6 Regional Overview

Chapter 3 Feed Acidifiers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing population and increased consumption of livestock products

3.3.1.2 Growing incidences of disease outbreaks among livestock

3.3.2 Industry Challenges

3.3.2.1 Increasing cost of raw materials are increasing the price of feed acidifiers

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Form Growth Scenario

3.4.3 Compound Growth Scenario

3.4.4 Livestock Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Feed Acidifiers Market, By Type

4.1 Type Outlook

4.2 Formic Acid

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 Propionic Acid

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 Lactic Acid

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 Citric Acid

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

4.6 Sorbic Acid

4.6.1 Market Size, By Region, 2020-2026 (USD Million)

4.7 Malic Acid

4.7.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Feed Acidifiers Market, By Compound

5.1 Compound Outlook

5.2 Blended

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Single

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Feed Acidifiers Market, By Form

6.1 Dry

6.1.1 Market Size, By Region, 2020-2026 (USD Million)

6.2 Liquid

6.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 7 Feed Acidifiers Market, By Livestock

7.1 Poultry

7.1.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 Swine

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 Ruminants

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 Aquaculture

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

7.2 Others

7.2.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 8 Feed Acidifiers Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Million)

8.2.2 Market Size, By Type, 2020-2026 (USD Million)

8.2.3 Market Size, By Form, 2020-2026 (USD Million)

8.2.4 Market Size, By Compound, 2020-2026 (USD Million)

8.2.5 Market Size, By Livestock, 2020-2026 (USD Million)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.2.4.2 Market Size, By Form, 2020-2026 (USD Million)

8.2.4.3 Market Size, By Compound, 2020-2026 (USD Million)

Market Size, By Livestock, 2020-2026 (USD Million)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.2.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.2.7.3 Market Size, By Compound, 2020-2026 (USD Million)

8.2.7.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Million)

8.3.2 Market Size, By Type, 2020-2026 (USD Million)

8.3.3 Market Size, By Form, 2020-2026 (USD Million)

8.3.4 Market Size, By Compound, 2020-2026 (USD Million)

8.3.5 Market Size, By Livestock, 2020-2026 (USD Million)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.6.3 Market Size, By Compound, 2020-2026 (USD Million)

8.3.6.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.7.3 Market Size, By Compound, 2020-2026 (USD Million)

8.3.7.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.3.8 France

8.3.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.8.3 Market Size, By Compound, 2020-2026 (USD Million)

8.3.8.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.9.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.9.3 Market Size, By Compound, 2020-2026 (USD Million)

8.3.9.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.10.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.10.3 Market Size, By Compound, 2020-2026 (USD Million)

8.3.10.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2020-2026 (USD Million)

8.3.11.2 Market Size, By Form, 2020-2026 (USD Million)

8.3.11.3 Market Size, By Compound, 2020-2026 (USD Million)

8.3.11.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Million)

8.4.2 Market Size, By Type, 2020-2026 (USD Million)

8.4.3 Market Size, By Form, 2020-2026 (USD Million)

8.4.4 Market Size, By Compound, 2020-2026 (USD Million)

8.4.5 Market Size, By Livestock, 2020-2026 (USD Million)

8.4.6 China

8.4.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.6.3 Market Size, By Compound, 2020-2026 (USD Million)

8.4.6.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.4.7 India

8.4.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.7.3 Market Size, By Compound, 2020-2026 (USD Million)

8.4.7.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.8.3 Market Size, By Compound, 2020-2026 (USD Million)

8.4.8.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.9.2 Market size, By Form, 2020-2026 (USD Million)

8.4.9.3 Market Size, By Compound, 2020-2026 (USD Million)

8.4.9.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2020-2026 (USD Million)

8.4.10.2 Market Size, By Form, 2020-2026 (USD Million)

8.4.10.3 Market Size, By Compound, 2020-2026 (USD Million)

8.4.10.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Million)

8.5.2 Market Size, By Type, 2020-2026 (USD Million)

8.5.3 Market Size, By Form, 2020-2026 (USD Million)

8.5.4 Market Size, By Compound, 2020-2026 (USD Million)

8.5.5 Market Size, By Livestock, 2020-2026 (USD Million)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.5.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.5.6.3 Market Size, By Compound, 2020-2026 (USD Million)

8.5.6.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.5.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.5.7.3 Market Size, By Compound, 2020-2026 (USD Million)

8.5.7.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.5.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.5.8.3 Market Size, By Compound, 2020-2026 (USD Million)

8.5.8.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Million)

8.6.2 Market Size, By Type, 2020-2026 (USD Million)

8.6.3 Market Size, By Form, 2020-2026 (USD Million)

8.6.4 Market Size, By Compound, 2020-2026 (USD Million)

8.6.5 Market Size, By Livestock, 2020-2026 (USD Million)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2020-2026 (USD Million)

8.6.6.2 Market Size, By Form, 2020-2026 (USD Million)

8.6.6.3 Market Size, By Compound, 2020-2026 (USD Million)

8.6.6.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2020-2026 (USD Million)

8.6.7.2 Market Size, By Form, 2020-2026 (USD Million)

8.6.7.3 Market Size, By Compound, 2020-2026 (USD Million)

8.6.7.4 Market Size, By Livestock, 2020-2026 (USD Million)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2020-2026 (USD Million)

8.6.8.2 Market Size, By Form, 2020-2026 (USD Million)

8.6.8.3 Market Size, By Compound, 2020-2026 (USD Million)

8.6.8.4 Market Size, By Livestock, 2020-2026 (USD Million)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 BASF SE

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info Graphic Analysis

9.3 Kemin Industries Inc.

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info Graphic Analysis

9.4 Corbion NV

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info Graphic Analysis

9.5 Addcon Group GmbH

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info Graphic Analysis

9.6 Pancosma SA

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info Graphic Analysis

9.7 Peterlabs Holdings Berhad

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info Graphic Analysis

9.8 Yara International ASA

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info Graphic Analysis

9.9 Perstorp Holding AB

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info Graphic Analysis

9.10 Biomin Holding GmbH

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info Graphic Analysis

9.11 Other Companies

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info Graphic Analysis

The Global Feed Acidifiers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Feed Acidifiers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS