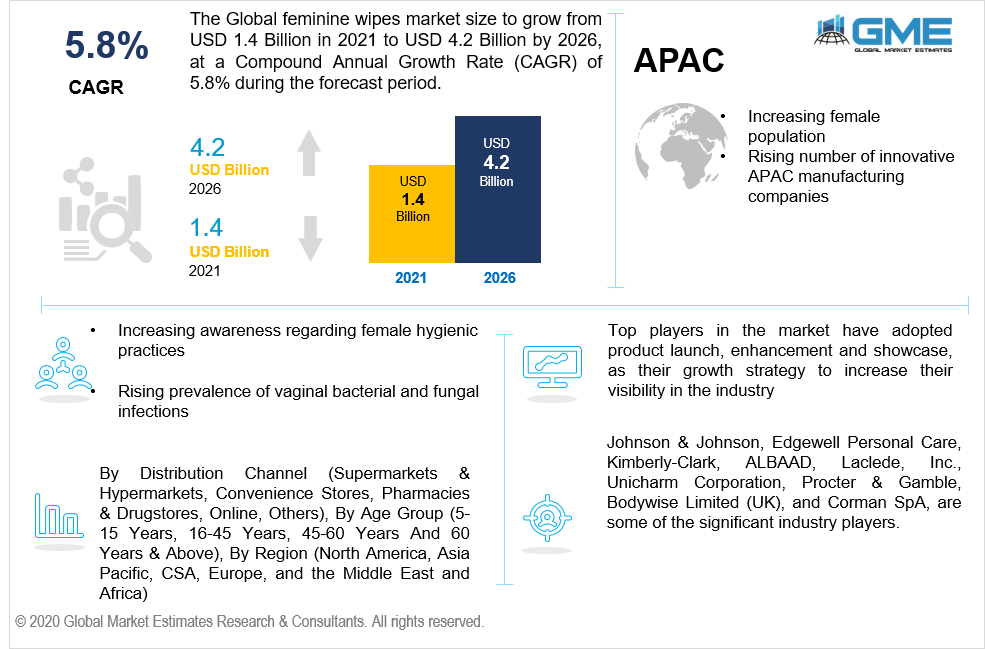

Global Feminine Wipes Market Size, Trends, and Analysis- Forecasts to 2026 By Distribution Channel (Supermarkets & Hypermarkets, Convenience Stores, Pharmacies & Drugstores, Online, Others), By Age Group (5-15 Years, 16-45 Years, 45-60 Years And 60 Years & Above), By Region (North America, Asia Pacific, CSA, Europe, and the Middle East and Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global feminine wipes market is projected to grow from USD 1.4 billion in 2021 and is analyzed to reach USD 4.2 billion by 2026 at a CAGR of 5.8%.

Increasing awareness regarding female hygienic practices, rising disposable incomes for medical facilities, rising prevalence of vaginal bacterial and fungal infections, increasing demand for chemical-free intimate products, and rising awareness of the advantages of using vaginal care wipes are some of the factors supporting the growth of the feminine wipes market.

Feminine wipes refer to cloth/wipes that are intended to clean the vaginal area. While other intimate care products, such as sanitary pads, are typically used during menstruation, feminine wipes are marketed as ideal for daily/everyday use.

Studies have shown that the vaginal area has different pH levels as compared to the other body parts. Also, the vaginal skin is more acidic in nature, as compared to the other parts because of which that region becomes more prone to harmful bacterias, if left unhygienic or not taken proper care of. It is crucial to maintain the pH balance. This can be facilitated by using specialized feminine wipes. Wipes are also used to prevent and avoid vaginal infection issues like bacterial vaginosis (BV). The feminine wipes is basically a cloth or wipes that are formulated with specific chemicals or alcohol that helps to bring the pH to the optimum level.

The impact of COVID-19 pandemic has been fairly well for healthcare and medical industry. The pandemic has created unprecedented market opportunities for all the medical sectors, given the rising consumer spending on hygiene and personal care products, especially in the intimate hygiene segment. Hence, the feminine wipes market is ought to be growing rapidly during the forecast period.

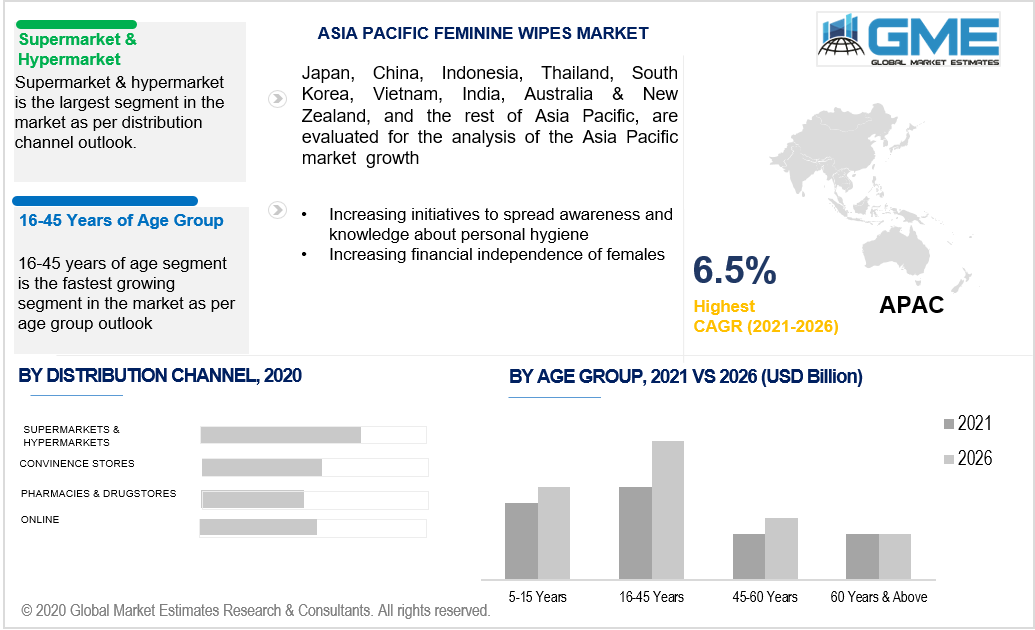

The feminine wipes market is segmented into Supermarkets & Hypermarkets, Convenience Stores, Pharmacies & Drugstores, Online, and Others. The supermarket and hypermarket segment is ought to be the largest shareholder in the market. This is mainly attributed to high sale value of feminie wipes earned from physical stores and supermarkets even before the online retail shopping industry flourished. Hypermarkets and supermarkets are the center points with all readily available resources, with no shortage on any day of the year especially for medical devices, instruments, supplments and hygiene care products. These supermarkets being the best wholesale dealers for the manufacturers to promote and sell their products have highly stocked resources with all the variety of options available for the customers to choose from. They have undertaken the monopoly over the sales of feminine wipes in many developed and developing countries, attributing to the high share in the market from 2021 to 2026.

However, due to the recent hit of the pandemic, the retail shopping industry has witnessed a massive change in the way consumers are buying medical products. The market witnessed an increasing number of online shoppers for personal care products, due to which the market for online channel will be growing the fastest during the forecast period.

Based on the age group, the market is segmented into 5-15 years, 16-45 years, 45-60 years and 60 years & above. The 16-45 years segment will be the largest shareholder in the market. The high incidence of bacterial and fungal infections in the vaginal area is witnessed more in adults than older women or children.

Based on region, the market is segmented into various regions such as North America, Europe, Central & South America, Middle East & North Africa, and Asia Pacific regions. North American region holds the largest share in the feminine wipes market. Rising awareness regarding personal care and hygiene products and favourable reimbursement scenarios for retail products for medical purposes are the major reasons for the NA market to be dominant.

The countries in the Asia Pacific region have the largest population as compared to the rest of the world. According to the world bank database and reports of 2019, the East Asia Pacific region holds approximately 1.15 billion female population. With such densely female populated countries, the APAC region is ought to be the fastest-growing region for feminine wipes. Increasing product launch strategies, rising company expansion projects, and increasing prevalence of bacterial vaginal infections in the APAC countries have helped the region grow the fastest. The rising personal care awareness in the APAC region has resulted from various initiatives undertaken by organizations like the Global Interfaith WASH Alliance (GIWA) based in India, in collaboration with various international agencies like the United Nations and UNICEF.

Johnson & Johnson, Edgewell Personal Care, Kimberly-Clark, ALBAAD, Laclede, Inc., Unicharm Corporation, Procter & Gamble, Bodywise Limited (UK), and Corman SpA, are some of the key players in the global feminine wipes market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Feminine Wipes Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Age Group Overview

2.1.3 Distribution Channel Overview

2.1.4 Regional Overview

Chapter 3 Feminine Wipes Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Online distribution channel advancement to promote feminine wipes

3.3.2 Industry Challenges

3.3.2.1 Lack of awareness regarding personal hygiene care products in developing countries

3.4 Prospective Growth Scenario

3.4.1 Age Group Growth Scenario

3.4.2 Distribution Channel Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Distribution Channel Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Feminine Wipes Market, By Age Group

4.1 Age Group Outlook

4.2 5-15 Years

4.2.1 Market Size, By Region, 2020-2026 (USD Million)

4.3 16-45 Years

4.3.1 Market Size, By Region, 2020-2026 (USD Million)

4.4 45-60 Years

4.4.1 Market Size, By Region, 2020-2026 (USD Million)

4.5 60 Years & Above

4.5.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 5 Feminine Wipes Market, By Distribution Channel

5.1 Distribution Channel Outlook

5.2 Supermarkets & Hypermarkets

5.2.1 Market Size, By Region, 2020-2026 (USD Million)

5.3 Convenience Stores

5.3.1 Market Size, By Region, 2020-2026 (USD Million)

5.4 Pharmacies & Drugstores

5.4.1 Market Size, By Region, 2020-2026 (USD Million)

5.5 Online

5.5.1 Market Size, By Region, 2020-2026 (USD Million)

5.6 Others

5.6.1 Market Size, By Region, 2020-2026 (USD Million)

Chapter 6 Feminine Wipes Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2020-2026 (USD Million)

6.2.2 Market Size, By Age Group, 2020-2026 (USD Million)

6.2.3 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.2.4.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.2.5.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2020-2026 (USD Million)

6.3.2 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.3 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3.4 Germany

6.3.4.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.4.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.5.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.6.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.7.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.8.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.3.9.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2020-2026 (USD Million)

6.4.2 Market Size, By Age Group, 2020-2026 (USD Million)

6.4.3 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.4.4.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.4.5.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.4.6.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.4.7.2 Market size, By Distribution Channel, 2020-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.4.8.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2020-2026 (USD Million)

6.5.2 Market Size, By Age Group, 2020-2026 (USD Million)

6.5.3 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.5.4.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.5.5.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.5.6.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2020-2026 (USD Million)

6.6.2 Market Size, By Age Group, 2020-2026 (USD Million)

6.6.3 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.6.4.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.6.5.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Age Group, 2020-2026 (USD Million)

6.6.6.2 Market Size, By Distribution Channel, 2020-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Johnson & Johnson

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Edgewell Personal Care

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 Kimberly-Clark

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 ALBAAD

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Laclede, Inc.

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Unicharm Corporation

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 Procter & Gamble

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7. Bodywise Limited

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Other Companies

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

The Global Feminine Wipes Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Feminine Wipes Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS