Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Size, Trends & Analysis - Forecasts to 2027 By Type (Plastics, Aluminum, and Lamination [Foil, Paper, Plastics]), By End-User (Pharmaceutical & Biopharmaceutical Companies, CMOs/CDMOs), By Region (North America, Asia Pacific, Central & South America, Europe, and the Middle East & Africa), End-User Landscape Analysis, Company Market Share Analysis, and Competitor Analysis

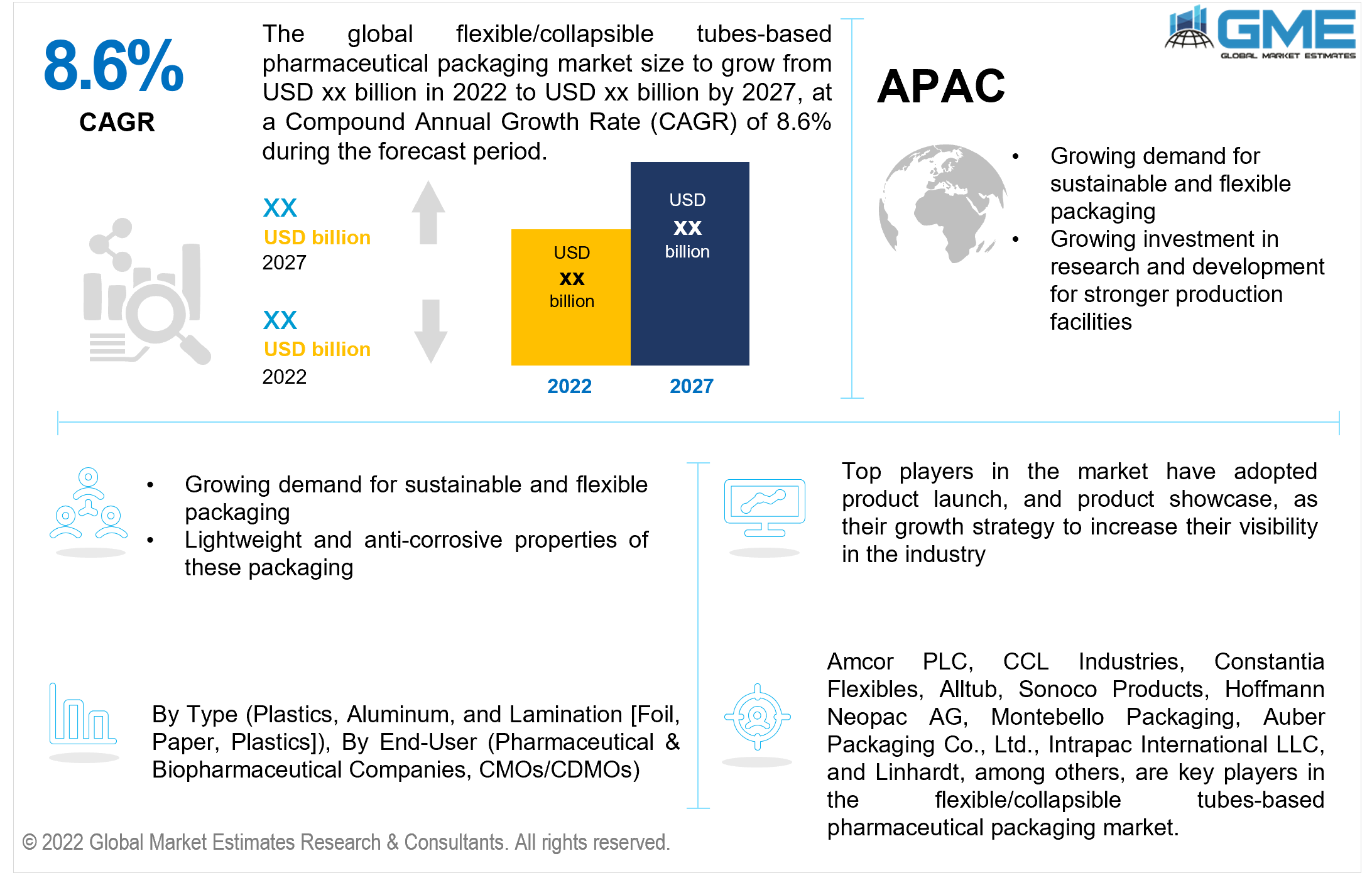

The global flexible/collapsible tubes-based pharmaceutical packaging market is projected to grow at a CAGR of 8.6% from 2022 to 2027.

The flexible/collapsible tubes-based pharmaceutical packaging market is driven by the growing demand for sustainable and flexible packaging, the growing demand for cheap and secure packaging, lightweight and anti-corrosive properties of these packaging, and recyclable properties of the packaging.

The market is anticipated to increase favorably as patient-focused pharmaceuticals and tailored treatments become more popular. Some drugs are frequently susceptible to contamination and are heat sensitive since they are made utilizing animal, microbial, plant, or human cells. These elements are predicted to fuel the market for flexible/collapsible tube-based pharmaceutical packaging by increasing the need for innovative packing solutions.

In the ongoing coronavirus phase, businesses in the pharmaceutical packaging sector are optimizing their benefits by concentrating on packaging solutions with favorable to low negative environmental impacts. The use of environmentally friendly packaging materials has emerged as a key purchase factor for consumers. Developing and underdeveloped countries are being overlooked in the global pharmaceutical packaging industry because industrialized countries have powerful regulatory structures which allow for conducting businesses with relative ease. Therefore, in addition to expanding new revenue streams, companies involved in the pharmaceutical packaging industry should cooperate closely with governments and regulatory authorities in emerging and poor countries. In developing and poor nations, there is a need to create anti-counterfeiting medicine packaging technologies and goods as well owing to the growth of the market for fake medications.

Drugs are stored, secured, and protected during transportation and storage using flexible/collapsible tube-based pharmaceutical packaging. To protect the medications from physical harm and other factors that may cause contamination before ingestion, these solutions are strictly monitored. Pharmaceutical packaging, which is also utilized for product marketing, contributes to the stability of the product during its shelf life. Furthermore, it aids producers in setting their goods apart from those of rivals. The market would expand as a direct result of the increasing demand for pharmaceutical treatments and medications.

The major restraints in the global flexible/collapsible tubes-based pharmaceutical packaging market are the rise in prices of raw materials, stringent government regulations on pharmaceutical packaging, and disruptions in supply chain management.

Coronavirus has negatively impacted several businesses, causing a shortage of raw materials and a disruption in supply networks. Pharmaceutical businesses were spared from the lockdown limitations, nonetheless, as a result of the importance of their operations to the community. Pharmaceutical businesses produce healthcare items, and government funding for prescription meds and generic versions of existing medications will encourage market expansion.

During the current coronavirus outbreak, an exceptional need for pharmaceutical packaging has been seen. In order to enhance patient outcomes during difficult times, manufacturers have been working furiously to assure a steady supply to hospitals, pharmacies, and allied healthcare institutions.

Due to the pandemic's heightened focus on the healthcare sector, powerful corporations are eager to invest in new material developments, equipment setup, and novel applications like child-resistant packaging to diversify their sources of income. Future disease outbreaks may be a factor, which is why R&D for innovative pharmaceutical packaging is gaining momentum.

The pharmaceutical packaging sector was significantly impacted by the conflict between Russia and Ukraine. Due to the prolonged conflict, Russia and Ukraine are experiencing poor sales, manufacturing delays, and an increase in transit expenses. Due to the fact that many businesses rely on trade with Russia and Ukraine for their packaging needs, the bottlenecks in the packaging industry also have an impact on other parts of Europe. The impact on the market for pharmaceutical packaging is anticipated to worsen as a result of several companies ceasing their operations in Russia.

The plastic segment is expected to witness the largest share in the global flexible/collapsible tube-based pharmaceutical packaging market. Due to its strengths and adaptability, plastic is frequently employed in the packaging sector. Plastic-based flexible/collapsible tube-based pharmaceutical packaging is widely utilized owing to its protective features and longer shelf life. However, the markets that are directly or indirectly related to the plastic sector have always been impeded by the adverse impacts on the environment. Strict laws have been implemented to control the manufacture and processing of plastic as a result of the growing awareness of the harmful impacts.

The aluminum segment is expected to grow the fastest during the forecast period. Generally, aluminum is used extensively for pharmaceutical packaging. Due to its powerful barrier and tear-resistant qualities, it is utilized as a material for blister pack lids. Making flexible strip packs for packaging tablets also uses it. Additionally, due to their effective barrier qualities against oxygen and UV radiation, aluminum is the material of choice for the majority of seals used in the flexible/collapsible tube-based pharmaceutical packaging industry.

The pharmaceutical & biopharmaceutical companies segment is expected to witness the largest share in the global flexible/collapsible tubes-based pharmaceutical packaging market, based on end-users. Pharmaceutical products have been growing in demand in recent years. Generic pharmaceutical manufacturers turn to innovative and eye-catching designs to improve sales which has led to the growing demand for flexible/collapsible tube-based pharmaceutical packaging from pharmaceutical and biopharmaceutical companies.

The CMOs/CDMOs segment is expected to grow the fastest during 2022-2027. A rising number of pharmaceutical companies turning to outsourcing of pharmaceutical manufacturing and research and development activities are expected to contribute to the growth of the CMOs/CDMOs segment.

The North America region is expected to witness the largest share in the global flexible/collapsible tubes-based pharmaceutical packaging market during the forecast period of 2022-2027. The region’s high purchasing power and rising usage of sophisticated and smart packaging have been responsible for the growing demand in the region. Additionally, the United States generated the greatest share and is anticipated to keep up the trend during the projection period. Since the United States is the sector that produces advanced drugs and commercializes new complex medicines with brand-specific packaging requirements.

The APAC region is anticipated to become the fastest-growing region owing to the increasing purchasing power of populous nations like China, Japan, and India. The development of innovative packaging materials, more awareness of environmental problems, and the implementation of new regulatory regulations on recycling packages are some factors that are anticipated to support the growth of the Asia-Pacific pharmaceutical packaging market.

Amcor PLC, CCL Industries, Constantia Flexibles, Alltub, Sonoco Products, Hoffmann Neopac AG, Montebello Packaging, Auber Packaging Co., Ltd., Intrapac International LLC, and Linhardt, among others, are key players in the flexible/collapsible tubes-based pharmaceutical packaging market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Research Methodology

1.1 Research Assumptions

1.2 Research Methodology

1.2.1 Estimates and Forecast Timeline

1.3 Information Procurement

1.3.1 Purchased Database

1.3.2 GME’s Internal Database

1.3.3 Primary Research

1.3.4 Secondary Sources & Third-Party Perspectives

1.3.4.1 Company Information Sources

1.3.4.2 Secondary Data Sources

1.4 Information or Data Analysis

1.4.1 Data Analysis Models

1.5 Market Formulation & Data Visualization

1.6 Data Validation & Publishing

1.7 Market Model

1.7.1 Model Details

1.7.1.1 Top-Down Approach

1.7.1.2 Bottom-Up Approach

1.8 Market Segmentation & Scope

1.9 Market Definition

Chapter 2 Executive Summary

2.1 Global Market Outlook

2.2 Type Outlook

2.3 End-User Outlook

2.4 Regional Outlook

Chapter 3 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Trend Analysis

3.1. Market Introduction

3.2 Penetration & Growth Prospect Mapping

3.3 Impact of COVID-19 on the Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market

3.4 Metric Data based on the industry

3.5 Market Dynamic Analysis

3.5.1 Market Driver Analysis

3.5.2 Market Restraint Analysis

3.5.3 Industry Challenges

3.5.4 Industry Opportunities

3.6 Porter’s Five Analysis

3.6.1 Supplier Power

3.6.2 Buyer Power

3.6.3 Substitution Threat

3.6.4 Threat from New Entrant

3.7 Market Entry Strategies

Chapter 4 Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: By End-User Trend Analysis

5.1 By End-User: Historic Data vs. Forecast Data Analysis, 2021 vs. 2027

5.2 Pharmaceutical & Biopharmaceutical Companies

5.2.1 Market Estimates & Forecast Analysis of Pharmaceutical & Biopharmaceutical Companies, By Region, 2019-2027 (USD Billion)

5.3 CMOs/CDMOs

5.3.1 Market Estimates & Forecast Analysis of CMOs/CDMOs, By Region, 2019-2027 (USD Billion)

Chapter 5 Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Type Trend Analysis

6.1 Type: Historic Data vs. Forecast Data Analysis, 2022 vs. 2027

6.2 Plastics

6.2.1 Market Estimates & Forecast Analysis of Plastics Segment, By Region, 2019-2027 (USD Billion)

6.3 Aluminum

6.3.1 Market Estimates & Forecast Analysis of Aluminum Segment, By Region, 2019-2027 (USD Billion)

6.4 Lamination

6.3.1 Market Estimates & Forecast Analysis of Lamination Segment, By Region, 2019-2027 (USD Billion)

Chapter 6 Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region

7.1 Regional Outlook

7.2 North America

7.2.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.2.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.2.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.4 U.S.

7.2.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.2.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.5 Canada

7.2.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.2.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.2.6 Mexico

7.2.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.2.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3 Europe

7.3.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.3.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.4 Germany

7.3.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.5 UK

7.3.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.6 France

7.3.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.7 Russia

7.3.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.10 Rest of Europe

7.3.10.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.10.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.4.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.4.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.4 China

7.4.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.4.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.5 India

7.4.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.4.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.6 Japan

7.4.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.4.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.7 Australia

7.4.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.4.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.4.8 South Korea

7.4.8.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.4.8.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.3.9 Rest of Asia Pacific

7.3.9.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.3.9.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.5 Central & South America

7.5.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.5.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.5.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.5.4 Brazil

7.5.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.5.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.5.5 Rest of Central & South America

7.5.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.5.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6 Middle East & Africa

7.6.1 Market Estimates & Forecast Analysis, By Country 2019-2027 (USD Billion)

7.6.2 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.6.3 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.4 Saudi Arabia

7.6.4.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.6.4.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.5 United Arab Emirates

7.6.5.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.6.5.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.6 South Africa

7.6.6.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.6.6.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

7.6.7 Rest of Middle East & Africa

7.6.7.1 Market Estimates & Forecast Analysis, By End-User, 2019-2027 (USD Billion)

7.6.7.2 Market Estimates & Forecast Analysis, By Type, 2019-2027 (USD Billion)

Chapter 7 Competitive Analysis

8.1 Key Global Players, Recent Developments & their Impact on the Industry

8.2 Four Quadrant Competitor Positioning Matrix

8.2.1 Key Innovators

8.2.2 Market Leaders

8.2.3 Emerging Players

8.2.4 Market Challengers

8.3 Vendor Landscape Analysis

8.4 End-User Landscape Analysis

8.5 Company Market Share Analysis, 2021

Chapter 8 Company Profile Analysis

9.1 Amcor PLC

9.1.1 Company Overview

9.1.2 Financial Analysis

9.1.3 Strategic Initiatives

9.1.4 Product Benchmarking

9.2 CCL Industries

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Initiatives

9.2.4 Product Benchmarking

9.3 Constantia Flexibles

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Initiatives

9.3.4 Product Benchmarking

9.4 Alltub

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Initiatives

9.4.4 Product Benchmarking

9.5 Sonoco Products

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Initiatives

9.5.4 Product Benchmarking

9.6 Hoffmann Neopac AG

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Initiatives

9.6.4 Product Benchmarking

9.7 Montebello Packaging

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Initiatives

9.7.4 Product Benchmarking

9.8 Auber Packaging Co., Ltd.

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Initiatives

9.8.4 Product Benchmarking

9.9 Intrapac International LLC

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Initiatives

9.9.4 Product Benchmarking

9.10 Other Companies

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Initiatives

9.10.4 Product Benchmarking

List of Tables

1 Technological Advancements in Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market

2 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Key Market Drivers

3 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Key Market Challenges

4 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Key Market Opportunities

5 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Key Market Restraints

6 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Estimates & Forecast Analysis, 2019-2027 (USD Billion)

7 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

8 Pharmaceutical & Biopharmaceutical Companies: Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region, 2019-2027 (USD Billion)

9 CMOs/CDMOs: Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region, 2019-2027 (USD Billion)

10 Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

11 Plastics: Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region, 2019-2027 (USD Billion)

12 Aluminum: Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region, 2019-2027 (USD Billion)

13 Lamination: Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region, 2019-2027 (USD Billion)

14 Regional Analysis: Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Region, 2019-2027 (USD Billion)

15 North America: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

16 North America: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

17 North America: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Country, 2019-2027 (USD Billion)

18 U.S: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

19 U.S: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

20 Canada: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

21 Canada: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

22 Mexico: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

23 Mexico: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

24 Europe: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

25 Europe: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

26 Europe: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Country, 2019-2027 (USD Billion)

27 Germany: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

28 Germany: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

29 UK: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

30 UK: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

31 France: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

32 France: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

33 Italy: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

34 Italy: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

35 Spain: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

36 Spain: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

37 Rest Of Europe: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

38 Rest Of Europe: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

39 Asia Pacific: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

40 Asia Pacific: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

41 Asia Pacific: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Country, 2019-2027 (USD Billion)

42 China: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

43 China: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

44 India: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

45 India: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

46 Japan: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

47 Japan: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

48 South Korea: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

49 South Korea: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

50 Middle East & Africa: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

51 Middle East & Africa: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

52 Middle East & Africa: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Country, 2019-2027 (USD Billion)

53 Saudi Arabia: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

54 Saudi Arabia: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

55 UAE: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

56 UAE: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

57 Central & South America: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

58 Central & South America: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

59 Central & South America: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Country, 2019-2027 (USD Billion)

60 Brazil: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By End-User, 2019-2027 (USD Billion)

61 Brazil: Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market, By Type, 2019-2027 (USD Billion)

62 Amcor PLC: Products Offered

63 CCL Industries: Products Offered

64 Constantia Flexibles: Products Offered

65 Alltub: Products Offered

66 Sonoco Products: Products Offered

67 Hoffmann Neopac AG: Products Offered

68 Intrapac International LLC: Products Offered

69 Montebello Packaging: Products Offered

70 Auber Packaging Co., Ltd.: Products Offered

71 Other Companies: Products Offered

List of Figures

1. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Segmentation & Research Scope

2. Primary Research Partners and Local Informers

3. Primary Research Process

4. Primary Research Approaches

5. Primary Research Responses

6. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Penetration & Growth Prospect Mapping

7. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Value Chain Analysis

8. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Drivers

9. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Restraints

10. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Opportunities

11. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Challenges

12. Key Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market Manufacturer Analysis

13. Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market: Porter’s Five Forces Analysis

14. PESTLE Analysis & Impact Analysis

15. Amcor PLC: Company Snapshot

16. Amcor PLC: Swot Analysis

17. CCL Industries: Company Snapshot

18. CCL Industries: Swot Analysis

19. Constantia Flexibles: Company Snapshot

20. Constantia Flexibles: Swot Analysis

21. Alltub: Company Snapshot

22. Alltub: Swot Analysis

23. Sonoco Products: Company Snapshot

24. Sonoco Products: Swot Analysis

25. Intrapac International LLC: Company Snapshot

26. Intrapac International LLC: Swot Analysis

27. Montebello Packaging: Company Snapshot

28. Montebello Packaging: Swot Analysis

29. Auber Packaging Co., Ltd.: Company Snapshot

30. Auber Packaging Co., Ltd.: Swot Analysis

31. Hoffmann Neopac AG: Company Snapshot

32. Hoffmann Neopac AG: Swot Analysis

33. Other Companies: Company Snapshot

34. Other Companies: SWOT Analysis

The Global Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market has been studied from the year 2019 till 2027. However, the CAGR provided in the report is from the year 2022 to 2027. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Flexible/Collapsible Tubes-based Pharmaceutical Packaging Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS