Global Flexible Substrates Market Size, Trends & Analysis - Forecasts to 2026 By Type (Plastic, Metal, Glass) By Application (Consumer Electronics, Medical & Healthcare, Aerospace & Defense, Solar Energy); By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Company Market Share Analysis & Competitor Analysis

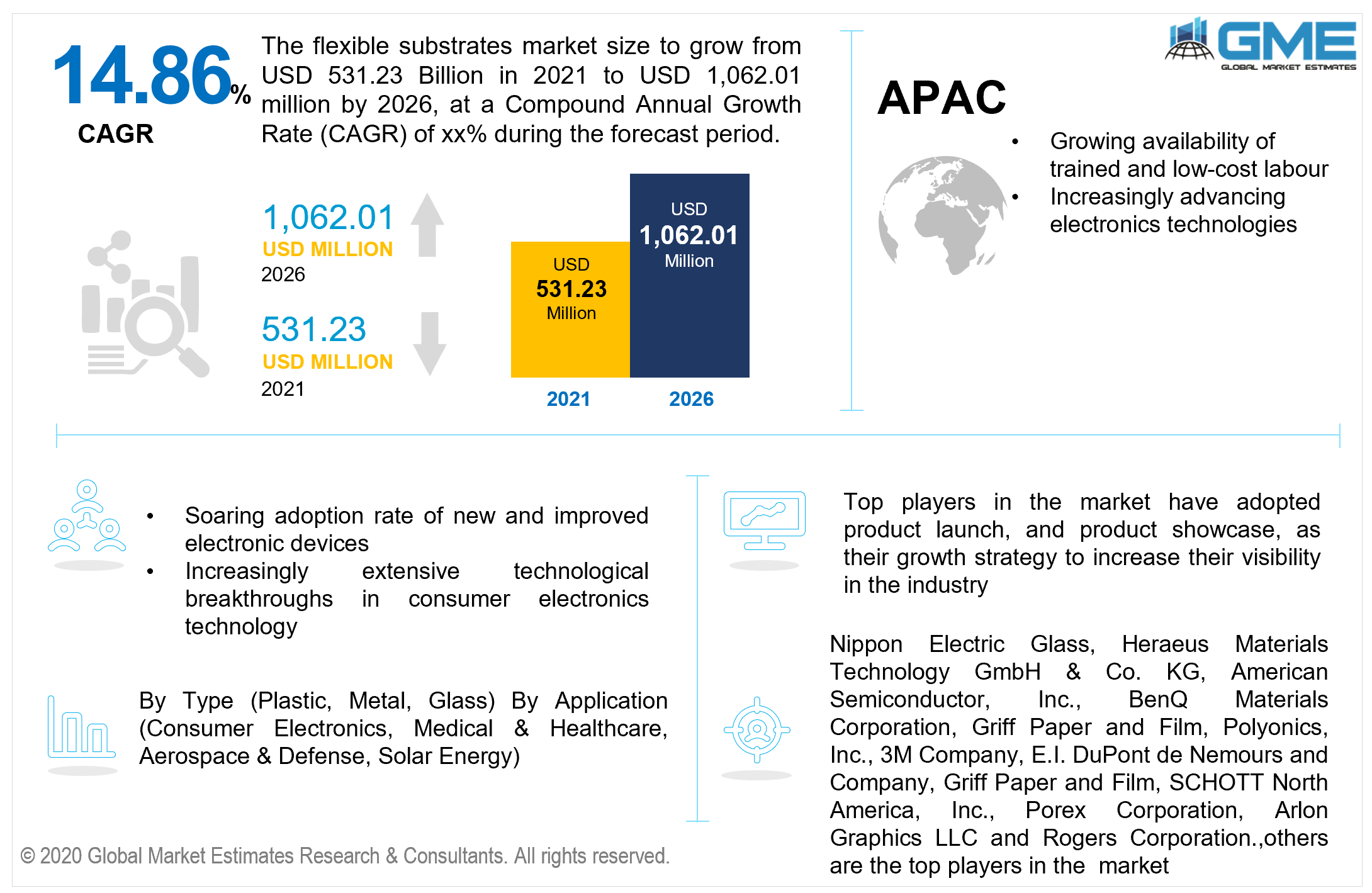

The flexible substrates market is estimated to be valued at USD 531.23 million in 2021 and is projected to reach USD 1,062.01 million by 2026 at a CAGR of 14.86%. Due to the rising need for printed electronics solutions, the global flexible substrates market is likely to rise rapidly. Flexible substrates are ultra-thin, ultra-light foundation constituents over which electronic equipment are collected during the assembly of electronic circuits to create compact flexible electronics.

Glass, plastic, and stainless steel are the most prevalent materials for flexible substrates. The overall market is foreseen to be driven by breakthroughs in flexible medical equipment, as well as increased usage of electronics-based IC development methodologies for non-invasive surveillance equipment throughout the forecast period. The market is likely to expand more as the demand for organic light-emitting diodes (OLED) grows. OLEDs are extensively employed in the development of white light panels for illumination and the creation of visually beautiful as well as economical displays, which may contribute to the market's continued expansion. The pervasive utilization of flexible substrate materials in photovoltaic research could potentially boost market demand.

Thin-film solar units' widespread usage for a variety of applications may present a significant prospect for producers. The growing demand for downsizing and microelectronics is propelling the market forward. Such substrates are projected to constitute an important component of flexible displays attributable to a variety of benefits, including functionality, resilience, and affordability. Flexible electronic components, such as display logic/memory, sensors, illumination, batteries, and solar cells, are also lighter and more robust than conventional silicon and glass-based electronics. In future years, the advent of the flexible electronics sector is expected to have a significant influence on the market.

Moreover, developments in display technologies and goods focused on scaling-to-large areas and producing high-resolution visuals are expected to drive demand for 3-D flexible substrates. Flexible substrates, especially flexible barrier films, protect electronic components from damage caused by oxygen, water, and other ecological factors. Electronic device advances that permit a flexible design aspect that enables discreet, sturdy, and customizable application usage without losing device performance could have a positive impact on the market.

Notwithstanding its many benefits, several constraints limit and hinder the entire market's development. Considerations such as the relatively high manufacturing expense of substrates displaying elevated temperature tolerance confine the area of their operations, limiting the market's expansion. On the other hand, the overall market is likely to be constrained by rigorous regulations, increased product introductions, and a significant frequency of mergers and acquisitions amongst key companies in various sectors.

Demand is predicted to rise through a comprehensive array of application industries, notably automotive, medical & healthcare, consumer electronics, defense & aerospace, energy, power & utility, and energy, power & utility. Additionally, the rising demand for organic, flexible, and printed electronics is a key driver of the market's expansion. In addition, continued research of substrate elements to enable translucent, versatile, and glass-like permeability features to the digital system is expected to drive market demand in the coming years. Furthermore, because such substrates are still in the early stages of development, poor penetration is likely. Breakthroughs in substrate materials and technology that match encapsulation agility with digital equipment could open up new markets for such substrates. Furthermore, the advent of scalable and cost-effective flexible electronic devices presents significant prospects, which may increase market demand throughout the forecast period.

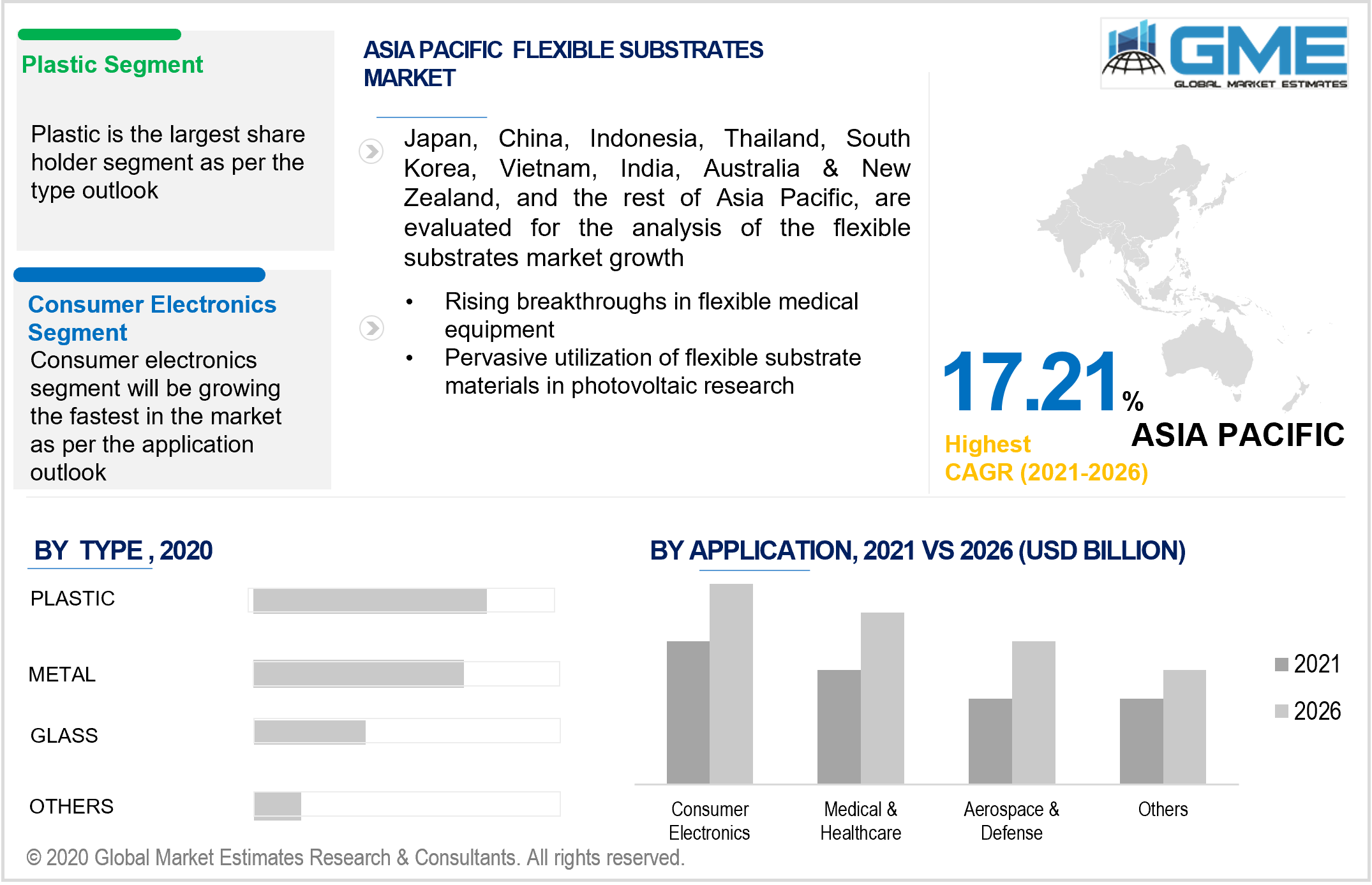

The market is divided into three types: plastic, metal, and glass. The plastic segment of the market is expected to lead the market during the forecast period due to the minimal expense involved in using technology to produce low-cost, flexible printed circuit boards, allowing for increased consumer electronics production. Furthermore, advancements in the display sector in terms of technology and products aimed at achieving high-resolution pictures are projected to drive demand for plastic based 3-D flexible substrates.

Based on the type of applications, the market is classified as consumer electronics, medical & healthcare, aerospace & defense, and solar energy. The consumer electronics application sector is expected to predominate. Soaring demand for consumer electronic goods in which such substrates are commonly employed in the fabrication of displays and other electronic devices is one of the elements that may be ascribed to the rising demand for the consumer electronics application segment. Additionally, substrate materials that provide translucent, flexible, and glass-like permeability features in electronic devices are expected to drive market demand in the coming years.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America.

Due to the soaring adoption rate of new and improved electronic devices, increasingly extensive technological breakthroughs in consumer electronics, rising need for flexible medical equipment, and the expanding use of organic electronics, North America is likely to account for the highest share of the market in the forecast period.

Due to sustained demand from industries like consumer electronics and solar energy across economies in this area the Asia Pacific is the fastest growing area in the global market throughout the forecast period. China's market is predicted to account for the majority of revenue in the area, while India's market is likely to grow at the fastest rate throughout the forecast period. The provision of trained labor, cheap salaries, increased usage of solar energy, significant expansion in electronics manufacturing, advancing electronics technologies, and widespread recognition of its application in medical and healthcare are among the main factors for the proliferation of flexible substrates in the Asia Pacific region.

Nippon Electric Glass, Heraeus Materials Technology GmbH & Co. KG, American Semiconductor, Inc., BenQ Materials Corporation, Griff Paper and Film, Polyonics, Inc., 3M Company, E.I. DuPont de Nemours and Company, Griff Paper and Film, SCHOTT North America, Inc., Porex Corporation, Arlon Graphics LLC and Rogers Corporation are the key players in the market.

Please note: This is not an exhaustive list of companies profiled in the report.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview And Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Flexible Substrates Industry Overview, 2019-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Application Overview

2.1.4 Regional Overview

Chapter 3 Flexible Substrates Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2019-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Technology Advancement in Consumer Electronics Industry

3.3.1.2 Increasing Demand For Printed Electronics Technologies

3.3.2 Industry Challenges

3.3.2.1 High Manufacturing Expense Of Substrates

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Application Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Flexible Substrates Market, By Type

4.1 Type Outlook

4.2 Plastic

4.2.1 Market Size, By Region, 2019-2026 (USD Million)

4.3 Metal

4.3.1 Market Size, By Region, 2019-2026 (USD Million)

4.4 Glass

4.4.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 5 Flexible Substrates Market, By Application

5.1 Application Outlook

5.2 Consumer Electronics

5.2.1 Market Size, By Region, 2019-2026 (USD Million)

5.3 Medical & Healthcare

5.3.1 Market Size, By Region, 2019-2026 (USD Million)

5.4 Aerospace & Defense

5.4.1 Market Size, By Region, 2019-2026 (USD Million)

5.5 Solar Energy

5.5.1 Market Size, By Region, 2019-2026 (USD Million)

Chapter 6 Flexible Substrates Market, By Region

6.1 Regional outlook

6.2 North America

6.2.1 Market Size, By Country 2019-2026 (USD Million)

6.2.2 Market Size, By Type, 2019-2026 (USD Million)

6.2.3 Market Size, By Application, 2019-2026 (USD Million)

6.2.4 U.S.

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.2.5 Canada

6.2.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3 Europe

6.3.1 Market Size, By Country 2019-2026 (USD Million)

6.3.2 Market Size, By Type, 2019-2026 (USD Million)

6.3.3 Market Size, By Application, 2019-2026 (USD Million)

6.3.4 Germany

6.2.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.2.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.5 UK

6.3.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.6 France

6.3.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.7 Italy

6.3.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.7.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.8 Spain

6.3.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.3.9 Russia

6.3.9.1 Market Size, By Type, 2019-2026 (USD Million)

6.3.9.2 Market Size, By Application, 2019-2026 (USD Million)

6.4 Asia Pacific

6.4.1 Market Size, By Country 2019-2026 (USD Million)

6.4.2 Market Size, By Type, 2019-2026 (USD Million)

6.4.3 Market Size, By Application, 2019-2026 (USD Million)

6.4.4 China

6.4.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.5 India

6.4.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.6 Japan

6.4.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.4.7 Australia

6.4.7.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.7.2 Market size, By Application, 2019-2026 (USD Million)

6.4.8 South Korea

6.4.8.1 Market Size, By Type, 2019-2026 (USD Million)

6.4.8.2 Market Size, By Application, 2019-2026 (USD Million)

6.5 Latin America

6.5.1 Market Size, By Country 2019-2026 (USD Million)

6.5.2 Market Size, By Type, 2019-2026 (USD Million)

6.5.3 Market Size, By Application, 2019-2026 (USD Million)

6.5.4 Brazil

6.5.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.5 Mexico

6.5.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.5.6 Argentina

6.5.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.5.6.2 Market Size, By Application, 2019-2026 (USD Million)

6.6 MEA

6.6.1 Market Size, By Country 2019-2026 (USD Million)

6.6.2 Market Size, By Type, 2019-2026 (USD Million)

6.6.3 Market Size, By Application, 2019-2026 (USD Million)

6.6.4 Saudi Arabia

6.6.4.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.4.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.5 UAE

6.6.5.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.5.2 Market Size, By Application, 2019-2026 (USD Million)

6.6.6 South Africa

6.6.6.1 Market Size, By Type, 2019-2026 (USD Million)

6.6.6.2 Market Size, By Application, 2019-2026 (USD Million)

Chapter 7 Company Landscape

7.1 Competitive Analysis, 2020

7.2 Nippon Electric Glass

7.2.1 Company Overview

7.2.2 Financial Analysis

7.2.3 Strategic Positioning

7.2.4 Info Graphic Analysis

7.3 Heraeus Materials Technology GmbH & Co. KG

7.3.1 Company Overview

7.3.2 Financial Analysis

7.3.3 Strategic Positioning

7.3.4 Info Graphic Analysis

7.4 American Semiconductor, Inc.

7.4.1 Company Overview

7.4.2 Financial Analysis

7.4.3 Strategic Positioning

7.4.4 Info Graphic Analysis

7.5 BenQ Materials Corporation

7.5.1 Company Overview

7.5.2 Financial Analysis

7.5.3 Strategic Positioning

7.5.4 Info Graphic Analysis

7.6 Griff Paper and Film

7.6.1 Company Overview

7.6.2 Financial Analysis

7.6.3 Strategic Positioning

7.6.4 Info Graphic Analysis

7.7 Polyonics, Inc.

7.7.1 Company Overview

7.7.2 Financial Analysis

7.7.3 Strategic Positioning

7.7.4 Info Graphic Analysis

7.8 3M

7.8.1 Company Overview

7.8.2 Financial Analysis

7.8.3 Strategic Positioning

7.8.4 Info Graphic Analysis

7.9 E.I. DuPont de Nemours and Company

7.9.1 Company Overview

7.9.2 Financial Analysis

7.9.3 Strategic Positioning

7.9.4 Info Graphic Analysis

7.10 Griff Paper and Film

7.10.1 Company Overview

7.10.2 Financial Analysis

7.10.3 Strategic Positioning

7.10.4 Info Graphic Analysis

7.11 SCHOTT North America, Inc.

7.11.1 Company Overview

7.11.2 Financial Analysis

7.11.3 Strategic Positioning

7.11.4 Info Graphic Analysis

7.12 Porex Corporation

7.12.1 Company Overview

7.12.2 Financial Analysis

7.12.3 Strategic Positioning

7.12.4 Info Graphic Analysis

7.13 Arlon Graphics LLC

7.13.1 Company Overview

7.13.2 Financial Analysis

7.13.3 Strategic Positioning

7.13.4 Info Graphic Analysis

7.14 Rogers Corporation

7.14.1 Company Overview

7.14.2 Financial Analysis

7.14.3 Strategic Positioning

7.14.4 Info Graphic Analysis

7.15 Other Companies

7.15.1 Company Overview

7.15.2 Financial Analysis

7.15.3 Strategic Positioning

7.15.4 Info Graphic Analysis

The Global Flexible Substrates Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Flexible Substrates Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS