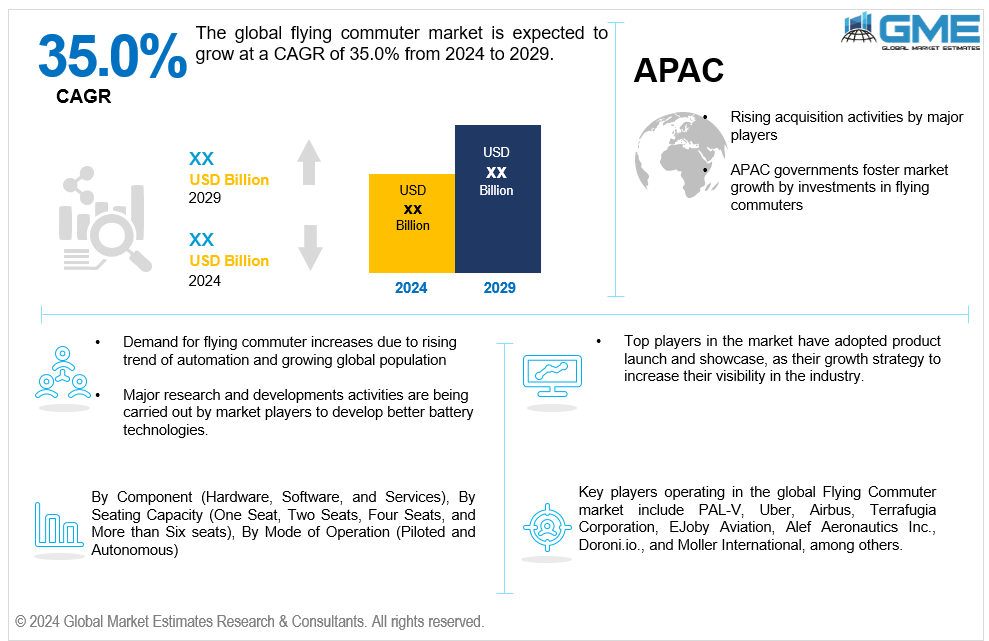

Global Flying Commuter Market Size, Trends & Analysis - Forecasts to 2029 By Component (Hardware, Software, and Services), By Seating Capacity (One Seat, Two Seats, Four Seats, and More than Six seats), By Mode of Operation (Piloted and Autonomous), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and End User Analysis

The global flying commuter market is expected to grow at a CAGR of 35.0% from 2024 to 2029. The flying commuter is the next-generation vehicle solution that can be used as an air transport solution as well as a personal road vehicle. Most of the flying cars have vertical take-off and landing due to the infrastructure and operational requirements of the urban commuting system. Flying cars are used for both personal and commercial purposes to meet the ever-changing commuting needs, especially in urban areas. Flying cars are expensive compared to other modes of transportation because of the huge capital investment required for their development and the need to integrate the latest technologies.

As technology advances around the world, so does the idea of flying cars. The flying commuters are no longer just something to be seen in science fiction movies. Recently, the flying commuter market has gained significant attention and investment. Key players, such as Uber and Airbus, have invested greatly in this sector. The awareness about air travel is now more acceptable than ever before.

However, a smooth transition from ground-based vehicles to flying cars will require infrastructure development, regulatory approval, and safety considerations. The market will also need to address concerns such as operation and maintenance efficacy, affordability, and general approval.

With advances in electric propulsion systems, sustainable and eco-friendly flying cars can travel short distances in congested urban areas or longer distances between urban areas. Although there are still some challenges to overcome, the increasing interest in and adoption of flying cars point to a bright future for this revolutionary mode of transportation.

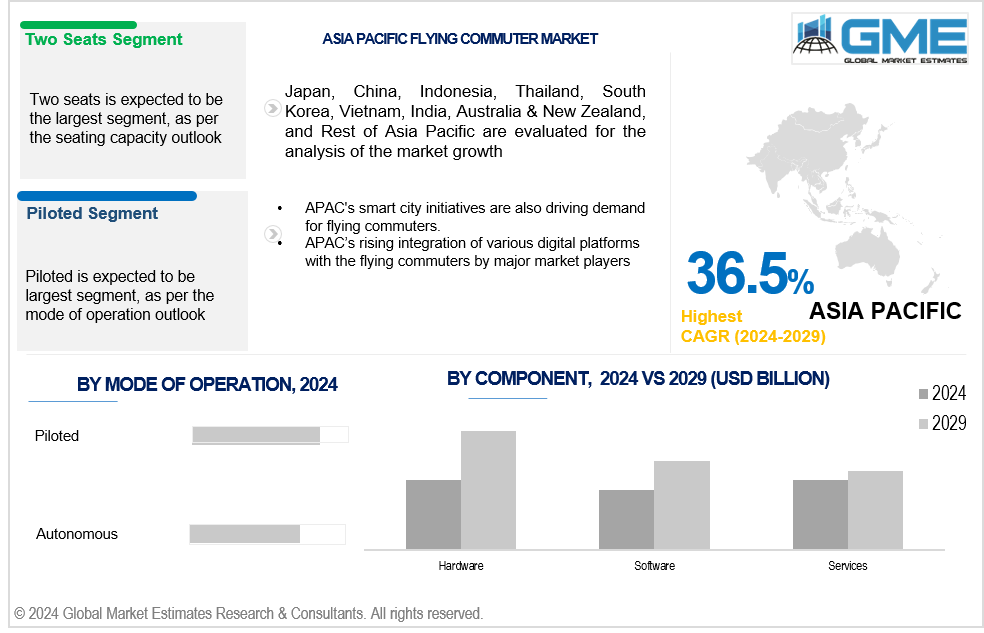

Based on component, the market is segmented into hardware, software, and services. The hardware segment is expected to lead the global market during the forecast period, as the actuation system plays a critical role in many essential aircraft functions. Actuation systems are used in several applications, including, cargo bay doors and lifts, horizontal stabilizer trim, stellar reversers, autopilot control, winch and gimbal systems, and visual guidance systems.

The software segment is expected to witness the fastest growth over the forecast period. This is mainly because many companies are developing software programs to make the operation of flying commuters safe and efficient. The software also helps in the autonomous control of the flying commuter without the need for manual processes. Many companies are collaborating to develop flying commuter software.

Based on seating capacity, the market is segmented into one seat, two seats, four seats, and more than six seats. The two seats is expected to be the largest segment in the market during the forecast period. One of the reasons for the growing popularity of two seats in the flying commuter segment is the growing interest in personal transportation solutions. Congested roads, long commuting distances, and restricted parking spaces are becoming a common problem in urban areas.

People are looking for an alternative mode of transportation that can move quickly through traffic and provide them with a convenient mode of transportation. The two seat flying cars provide a solution by combining the advantages of flying and driving. They allow people to travel quickly and conveniently while avoiding the restrictions and complexities that come with traditional modes of transportation.

Based on mode of operation, the market is segmented into piloted and autonomous. The piloted segment accounted for the largest share of the flying commuter market. The growth of the piloted segment can be attributed to several reasons. First, the need for convenience and efficiency is on the rise. People are increasingly looking for ways to save time and avoid traffic jams, and flying cars have the potential to solve these problems. Piloted flying cars offer door-to-door transportation, without the need for an airport.

However, the autonomous segment is anticipated to witness the fastest growth during the forecast period. An autonomous flying car uses artificial intelligence to carry passengers from place to place. It looks like a car sitting on a drone equipped with quadcopters. The coaxial quadrotor will allow the flying car to take off vertically and land horizontally. With the tightening of government regulations on road safety, more and more autonomous flying commuters are being built with cutting-edge technologies integrated with mobile phones.

North America is analysed to be the region with the largest share in the global flying commuter market during the forecast period. This is because North America is among the most technologically advanced regions in the world, among others, the region has a very well-developed infrastructure and they are one of the early adopters in the world of flying commuters. In addition, the United States and Canada are facing a high level of traffic congestion and need an alternative solution to reduce traffic congestion, which is also driving the market growth. In addition, many of the leading companies in the global flying commuter market are the key players across the region, which is also contributing to the market growth.

Asia Pacific is expected to exhibit the fastest growth over the forecast period. The high growth rate can be attributed to the large investments made by a number of flying car companies, including Australian industry giant Macchina volantis, which is set to construct a road-ready 5-seater electric aircraft as the world's population continues to grow, with countries like China, Singapore and Japan investing heavily in R&D of flying commute.

Key players operating in the global Flying Commuter market include PAL-V, Uber, Airbus, Terrafugia Corporation, EJoby Aviation, Alef Aeronautics Inc., Doroni.io., and Moller International, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In January 2021, Ferrovial and Lilium entered into an agreement to collaborate on manufacturing vertical port networks. The agreement is for ten vertical port networks.

In October 2019, the German startup Volocopter announced that its electrically powered air taxi, the Volocopter, had successfully completed its first public demonstration flight in Germany.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL FLYING COMMUTER MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Mode of Operation Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL FLYING COMMUTER MARKET, BY COMPONENT

4.1 Introduction

4.2 Flying Commuter Market: Component Scope Key Takeaways

4.3 Revenue Growth Analysis, 2023 & 2029

4.4 Hardware

4.4.1 Hardware Market Estimates and Forecast, 2021-2029 (USD Million)

4.5 Software

4.5.1 Software Market Estimates and Forecast, 2021-2029 (USD Million)

4.6 Services

4.6.1 Services Market Estimates and Forecast, 2021-2029 (USD Million)

5 GLOBAL FLYING COMMUTER MARKET, BY SEATING CAPACITY

5.1 Introduction

5.2 Flying Commuter Market: Seating Capacity Scope Key Takeaways

5.3 Revenue Growth Analysis, 2023 & 2029

5.4 One Seat

5.4.1 One Seat Market Estimates and Forecast, 2021-2029 (USD Million)

5.5 Two Seats

5.5.1 Two Seats Market Estimates and Forecast, 2021-2029 (USD Million)

5.6 Four Seats

5.6.1 Four Seats Market Estimates and Forecast, 2021-2029 (USD Million)

5.7 More than Six Seats

5.7.1 More than Six Seats Market Estimates and Forecast, 2021-2029 (USD Million)

6 GLOBAL FLYING COMMUTER MARKET, BY MODE OF OPERATION

6.1 Introduction

6.2 Flying Commuter Market: Mode of Operation Scope Key Takeaways

6.3 Revenue Growth Analysis, 2023 & 2029

6.4 Piloted

6.4.1 Piloted Market Estimates and Forecast, 2021-2029 (USD Million)

6.5 Autonomous

6.5.1 Autonomous Market Estimates and Forecast, 2021-2029 (USD Million)

7 GLOBAL FLYING COMMUTER MARKET, BY REGION

7.1 Introduction

7.2 North America Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.1 By Component

7.2.2 By Seating Capacity

7.2.3 By Mode of Operation

7.2.4 By Country

7.2.4.1 U.S. Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.1.1 By Component

7.2.4.1.2 By Seating Capacity

7.2.4.1.3 By Mode of Operation

7.2.4.2 Canada Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.2.1 By Component

7.2.4.2.2 By Seating Capacity

7.2.4.2.3 By Mode of Operation

7.2.4.3 Mexico Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.2.4.3.1 By Component

7.2.4.3.2 By Seating Capacity

7.2.4.3.3 By Mode of Operation

7.3 Europe Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.1 By Component

7.3.2 By Seating Capacity

7.3.3 By Mode of Operation

7.3.4 By Country

7.3.4.1 Germany Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.1.1 By Component

7.3.4.1.2 By Seating Capacity

7.3.4.1.3 By Mode of Operation

7.3.4.2 U.K. Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.2.1 By Component

7.3.4.2.2 By Seating Capacity

7.3.4.2.3 By Mode of Operation

7.3.4.3 France Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.3.1 By Component

7.3.4.3.2 By Seating Capacity

7.3.4.3.3 By Mode of Operation

7.3.4.4 Italy Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.4.1 By Component

7.3.4.4.2 By Seating Capacity

7.2.4.4.3 By Mode of Operation

7.3.4.5 Spain Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.5.1 By Component

7.3.4.5.2 By Seating Capacity

7.2.4.5.3 By Mode of Operation

7.3.4.6 Netherlands Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.6.1 By Component

7.3.4.6.2 By Seating Capacity

7.2.4.6.3 By Mode of Operation

7.3.4.7 Rest of Europe Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.3.4.7.1 By Component

7.3.4.7.2 By Seating Capacity

7.2.4.7.3 By Mode of Operation

7.4 Asia Pacific Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.1 By Component

7.4.2 By Seating Capacity

7.4.3 By Mode of Operation

7.4.4 By Country

7.4.4.1 China Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.1.1 By Component

7.4.4.1.2 By Seating Capacity

7.4.4.1.3 By Mode of Operation

7.4.4.2 Japan Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.2.1 By Component

7.4.4.2.2 By Seating Capacity

7.4.4.2.3 By Mode of Operation

7.4.4.3 India Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.3.1 By Component

7.4.4.3.2 By Seating Capacity

7.4.4.3.3 By Mode of Operation

7.4.4.4 South Korea Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.4.1 By Component

7.4.4.4.2 By Seating Capacity

7.4.4.4.3 By Mode of Operation

7.4.4.5 Singapore Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.5.1 By Component

7.4.4.5.2 By Seating Capacity

7.4.4.5.3 By Mode of Operation

7.4.4.6 Malaysia Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.6.1 By Component

7.4.4.6.2 By Seating Capacity

7.4.4.6.3 By Mode of Operation

7.4.4.7 Thailand Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.7.1 By Component

7.4.4.7.2 By Seating Capacity

7.4.4.7.3 By Mode of Operation

7.4.4.8 Indonesia Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.8.1 By Component

7.4.4.8.2 By Seating Capacity

7.4.4.8.3 By Mode of Operation

7.4.4.9 Vietnam Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.9.1 By Component

7.4.4.9.2 By Seating Capacity

7.4.4.9.3 By Mode of Operation

7.4.4.10 Taiwan Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.10.1 By Component

7.4.4.10.2 By Seating Capacity

7.4.4.10.3 By Mode of Operation

7.4.4.11 Rest of Asia Pacific Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.4.4.11.1 By Component

7.4.4.11.2 By Seating Capacity

7.4.4.11.3 By Mode of Operation

7.5 Middle East and Africa Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.1 By Component

7.5.2 By Seating Capacity

7.5.3 By Mode of Operation

7.5.4 By Country

7.5.4.1 Saudi Arabia Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.1.1 By Component

7.5.4.1.2 By Seating Capacity

7.5.4.1.3 By Mode of Operation

7.5.4.2 U.A.E. Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.2.1 By Component

7.5.4.2.2 By Seating Capacity

7.5.4.2.3 By Mode of Operation

7.5.4.3 Israel Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.3.1 By Component

7.5.4.3.2 By Seating Capacity

7.5.4.3.3 By Mode of Operation

7.5.4.4 South Africa Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.4.1 By Component

7.5.4.4.2 By Seating Capacity

7.5.4.4.3 By Mode of Operation

7.5.4.5 Rest of Middle East and Africa Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.5.4.5.1 By Component

7.5.4.5.2 By Seating Capacity

7.5.4.5.2 By Mode of Operation

7.6 Central and South America Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.1 By Component

7.6.2 By Seating Capacity

7.6.3 By Mode of Operation

7.6.4 By Country

7.6.4.1 Brazil Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.1.1 By Component

7.6.4.1.2 By Seating Capacity

7.6.4.1.3 By Mode of Operation

7.6.4.2 Argentina Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.2.1 By Component

7.6.4.2.2 By Seating Capacity

7.6.4.2.3 By Mode of Operation

7.6.4.3 Chile Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.3.1 By Component

7.6.4.3.2 By Seating Capacity

7.6.4.3.3 By Mode of Operation

7.6.4.4 Rest of Central and South America Flying Commuter Market Estimates and Forecast, 2021-2029 (USD Million)

7.6.4.4.1 By Component

7.6.4.4.2 By Seating Capacity

7.6.4.4.3 By Mode of Operation

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 PAL-V

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Components & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Uber

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Components & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 Airbus

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Components & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 EJoby Aviation

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Components & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Terrafugia Corporation

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Components & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 Alef Aeronautics Inc.

8.4.6.1 Business Description & Financial Analysis

8.4.6.2 SWOT Analysis

8.4.6.3 Components & Services Offered

8.4.6.4 Strategic Alliances between Business Partners

8.4.7 Doroni.io

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Components & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Moller International

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Components & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 Other Companies

8.4.11.1 Business Description & Financial Analysis

8.4.11.2 SWOT Analysis

8.4.11.3 Components & Services Offered

8.4.11.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Component Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Flying Commuter Market, By Component, 2021-2029 (USD Mllion)

2 Hardware Market, By Region, 2021-2029 (USD Mllion)

3 Software Market, By Region, 2021-2029 (USD Mllion)

4 SERVICES Market, By Region, 2021-2029 (USD Mllion)

5 Global Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Mllion)

6 One Seat Market, By Region, 2021-2029 (USD Mllion)

7 Two Seats Market, By Region, 2021-2029 (USD Mllion)

8 four Seats Market, By Region, 2021-2029 (USD Mllion)

9 More than Six seats Market, By Region, 2021-2029 (USD Mllion)

10 Global Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Mllion)

11 PILOTED Market, By Region, 2021-2029 (USD Mllion)

12 Autonomous Market, By Region, 2021-2029 (USD Mllion)

13 Regional Analysis, 2021-2029 (USD Mllion)

14 North America Flying Commuter Market, By Component, 2021-2029 (USD Million)

15 North America Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

16 North America Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

17 North America Flying Commuter Market, By Country, 2021-2029 (USD Million)

18 U.S Flying Commuter Market, By Component, 2021-2029 (USD Million)

19 U.S Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

20 U.S Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

21 Canada Flying Commuter Market, By Component, 2021-2029 (USD Million)

22 Canada Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

23 Canada Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

24 Mexico Flying Commuter Market, By Component, 2021-2029 (USD Million)

25 Mexico Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

26 Mexico Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

27 Europe Flying Commuter Market, By Component, 2021-2029 (USD Million)

28 Europe Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

29 Europe Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

30 Europe Flying Commuter Market, By Country 2021-2029 (USD Million)

31 Germany Flying Commuter Market, By Component, 2021-2029 (USD Million)

32 Germany Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

33 Germany Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

34 U.K Flying Commuter Market, By Component, 2021-2029 (USD Million)

35 U.K Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

36 U.K Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

37 France Flying Commuter Market, By Component, 2021-2029 (USD Million)

38 France Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

39 France Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

40 Italy Flying Commuter Market, By Component, 2021-2029 (USD Million)

41 Italy Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

42 Italy Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

43 Spain Flying Commuter Market, By Component, 2021-2029 (USD Million)

44 Spain Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

45 Spain Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

46 Netherlands Flying Commuter Market, By Component, 2021-2029 (USD Million)

47 Netherlands Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

48 Netherlands Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

49 Rest Of Europe Flying Commuter Market, By Component, 2021-2029 (USD Million)

50 Rest Of Europe Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

51 Rest of Europe Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

52 Asia Pacific Flying Commuter Market, By Component, 2021-2029 (USD Million)

53 Asia Pacific Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

54 Asia Pacific Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

55 Asia Pacific Flying Commuter Market, By Country, 2021-2029 (USD Million)

56 China Flying Commuter Market, By Component, 2021-2029 (USD Million)

57 China Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

58 China Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

59 India Flying Commuter Market, By Component, 2021-2029 (USD Million)

60 India Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

61 India Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

62 Japan Flying Commuter Market, By Component, 2021-2029 (USD Million)

63 Japan Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

64 Japan Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

65 South Korea Flying Commuter Market, By Component, 2021-2029 (USD Million)

66 South Korea Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

67 South Korea Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

68 malaysia Flying Commuter Market, By Component, 2021-2029 (USD Million)

69 malaysia Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

70 malaysia Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

71 Thailand Flying Commuter Market, By Component, 2021-2029 (USD Million)

72 Thailand Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

73 Thailand Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

74 Indonesia Flying Commuter Market, By Component, 2021-2029 (USD Million)

75 Indonesia Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

76 Indonesia Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

77 Vietnam Flying Commuter Market, By Component, 2021-2029 (USD Million)

78 Vietnam Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

79 Vietnam Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

80 Taiwan Flying Commuter Market, By Component, 2021-2029 (USD Million)

81 Taiwan Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

82 Taiwan Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

83 Rest of Asia Pacific Flying Commuter Market, By Component, 2021-2029 (USD Million)

84 Rest of Asia Pacific Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

85 Rest of Asia Pacific Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

86 Middle East and Africa Flying Commuter Market, By Component, 2021-2029 (USD Million)

87 Middle East and Africa Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

88 Middle East and Africa Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

89 Middle East and Africa Flying Commuter Market, By Country, 2021-2029 (USD Million)

90 Saudi Arabia Flying Commuter Market, By Component, 2021-2029 (USD Million)

91 Saudi Arabia Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

92 Saudi Arabia Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

93 UAE Flying Commuter Market, By Component, 2021-2029 (USD Million)

94 UAE Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

95 UAE Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

96 Israel Flying Commuter Market, By Component, 2021-2029 (USD Million)

97 Israel Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

98 Israel Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

99 South Africa Flying Commuter Market, By Component, 2021-2029 (USD Million)

100 South Africa Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

101 South Africa Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

102 Rest of Middle East and Africa Flying Commuter Market, By Component, 2021-2029 (USD Million)

103 Rest of Middle East and Africa Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

104 Rest of Middle East and Africa Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

105 Central and South America Flying Commuter Market, By Component, 2021-2029 (USD Million)

106 Central and South America Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

107 Central and South America Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

108 Central and South America Flying Commuter Market, By Country, 2021-2029 (USD Million)

109 Brazil Flying Commuter Market, By Component, 2021-2029 (USD Million)

110 Brazil Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

111 Brazil Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

112 Argentina Flying Commuter Market, By Component, 2021-2029 (USD Million)

113 Argentina Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

114 Argentina Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

115 Chile Flying Commuter Market, By Component, 2021-2029 (USD Million)

116 Chile Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

117 Chile Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

118 Rest of Central and South America Flying Commuter Market, By Component, 2021-2029 (USD Million)

119 Rest of Central and South America Flying Commuter Market, By Seating Capacity, 2021-2029 (USD Million)

120 Rest of Central and South America Flying Commuter Market, By Mode of Operation, 2021-2029 (USD Million)

121 PAL-V: Components & Services Offering

122 UBER: Components & Services Offering

123 Airbus: Components & Services Offering

124 EJoby Aviation: Components & Services Offering

125 Terrafugia Corporation: Components & Services Offering

126 ALEF AERONAUTICS INC. : Components & Services Offering

127 Doroni.io : Components & Services Offering

128 Moller International: Components & Services Offering

129 Other Companies: Components & Services Offering

LIST OF FIGURES

1 Global Flying Commuter Market Overview

2 Global Flying Commuter Market Value From 2021-2029 (USD Mllion)

3 Global Flying Commuter Market Share, By Component (2022)

4 Global Flying Commuter Market Share, By Seating Capacity (2022)

5 Global Flying Commuter Market Share, By Mode of Operation (2022)

6 Global Flying Commuter Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Flying Commuter Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Flying Commuter Market

11 Impact Of Challenges On The Global Flying Commuter Market

12 Porter’s Five Forces Analysis

13 Global Flying Commuter Market: By Component Scope Key Takeaways

14 Global Flying Commuter Market, By Component Segment: Revenue Growth Analysis

15 Hardware Market, By Region, 2021-2029 (USD Mllion)

16 Software Market, By Region, 2021-2029 (USD Mllion)

17 Services Market, By Region, 2021-2029 (USD Mllion)

18 Global Flying Commuter Market: By Seating Capacity Scope Key Takeaways

19 Global Flying Commuter Market, By Seating Capacity Segment: Revenue Growth Analysis

20 One Seat Market, By Region, 2021-2029 (USD Mllion)

21 Two Seats Market, By Region, 2021-2029 (USD Mllion)

22 Four Seats Market, By Region, 2021-2029 (USD Mllion)

23 More than Six Seats Market, By Region, 2021-2029 (USD Mllion)

24 Global Flying Commuter Market: By Mode of Operation Scope Key Takeaways

25 Global Flying Commuter Market, By Mode of Operation Segment: Revenue Growth Analysis

26 Piloted Market, By Region, 2021-2029 (USD Mllion)

27 Autonomous Market, By Region, 2021-2029 (USD Mllion)

28 Regional Segment: Revenue Growth Analysis

29 Global Flying Commuter Market: Regional Analysis

30 North America Flying Commuter Market Overview

31 North America Flying Commuter Market, By Component

32 North America Flying Commuter Market, By Seating Capacity

33 North America Flying Commuter Market, By Mode of Operation

34 North America Flying Commuter Market, By Country

35 U.S. Flying Commuter Market, By Component

36 U.S. Flying Commuter Market, By Seating Capacity

37 U.S. Flying Commuter Market, By Mode of Operation

38 Canada Flying Commuter Market, By Component

39 Canada Flying Commuter Market, By Seating Capacity

40 Canada Flying Commuter Market, By Mode of Operation

41 Mexico Flying Commuter Market, By Component

42 Mexico Flying Commuter Market, By Seating Capacity

43 Mexico Flying Commuter Market, By Mode of Operation

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 PAL-V: Company Snapshot

47 PAL-V: SWOT Analysis

48 PAL-V: Geographic Presence

49 Uber: Company Snapshot

50 Uber: SWOT Analysis

51 Uber: Geographic Presence

52 Airbus: Company Snapshot

53 Airbus: SWOT Analysis

54 Airbus: Geographic Presence

55 EJoby Aviation: Company Snapshot

56 EJoby Aviation: Swot Analysis

57 EJoby Aviation: Geographic Presence

58 Terrafugia Corporation: Company Snapshot

59 Terrafugia Corporation: SWOT Analysis

60 Terrafugia Corporation: Geographic Presence

61 ALEF AERONAUTICS INC. : Company Snapshot

62 ALEF AERONAUTICS INC. : SWOT Analysis

63 ALEF AERONAUTICS INC. : Geographic Presence

64 Doroni.io : Company Snapshot

65 Doroni.io : SWOT Analysis

66 Doroni.io : Geographic Presence

67 Moller International: Company Snapshot

68 Moller International: SWOT Analysis

69 Moller International: Geographic Presence

70 Other Companies: Company Snapshot

71 Other Companies: SWOT Analysis

72 Other Companies: Geographic Presence

The Global Flying Commuter Market has been studied from the year 2019 till 2029. However, the CAGR provided in the report is from the year 2024 to 2029. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Flying Commuter Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS