Global Food Encapsulation Market Size, Trends & Analysis - Forecasts to 2026 By Type (Micro Encapsulation, Nano Encapsulation, Hybrid Technology, Macro Encapsulation) By Shell Material (Polysaccharides, Lipids, Emulsifiers, Others), By Application (Functional Foods, Dairy Products, Confectioneries, Dietary Supplements, Others); By Technology (Physical Process, Chemical & Physiochemical Process), By Region (North America, Europe, Asia Pacific, MEA, and CSA); End-User Landscape, Vendor Landscape, and Company Market Share Analysis and Competitor Analysis

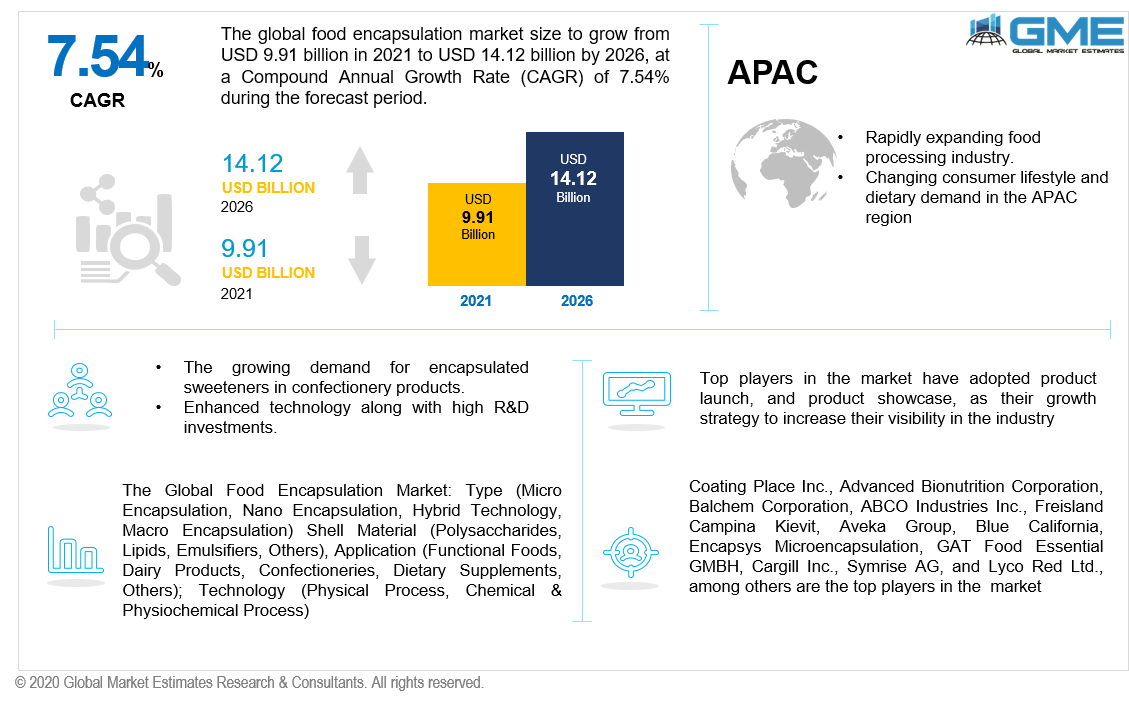

The global food encapsulation market is expected to be worth USD 9.91 billion in 2021 and USD 14.12 billion by 2026, growing at a CAGR of 7.54% during the forecast period [2021 to 2026]. Some of the primary driving forces for the food encapsulation market include increasing health-conscious consumers, rising consumption of functional foods, coupled with an increase in demand for convenience meals. People are becoming more attentive to their food and beverage routine as the global prevalence of illnesses such as diabetes and obesity is rising rapidly.

The need for healthy, flavourful, and nutrient-rich goods by health-conscious customers, provided through food encapsulation manufacturers, is driving the market. On the other hand, convenience meals are becoming increasingly popular as a result of people's hectic lifestyles. It also improves the taste, color, and flavour of food, extending its shelf life and enhancing commercial attractiveness. Hence, this trend will also support market growth.

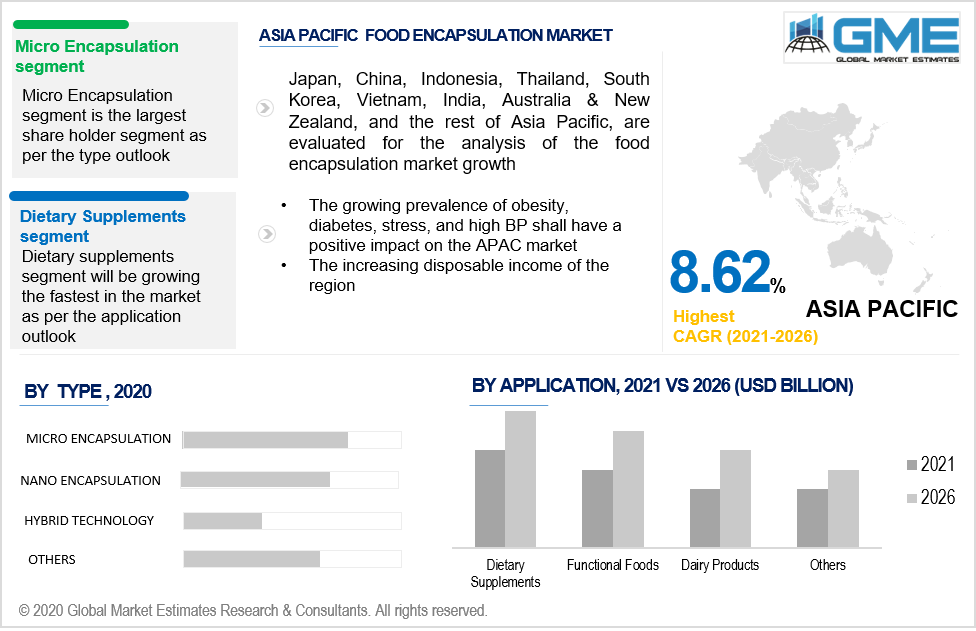

Based on the type, the market is divided into micro-encapsulation, Nano-encapsulation, hybrid technology, and macro encapsulation. The microencapsulation type segment is expected to hold the largest market share during the forecast period. Physical and physio-chemical processes can be used to create microencapsulated products with diameters ranging from 1 to 100 µm. The physical qualities of the material to be coated play a big role in microencapsulation method selection. During the forecast period, the market is expected to be driven by the increasing acceptance of microencapsulation for functional ingredients and rising customer preference for healthy and convenient food. Also, the advent of preservation techniques such as Nano-encapsulation and microencapsulation technologies expects a boost to the market.

Based on the shell material, the market is segmented into polysaccharides, lipids, and emulsifiers, among others. The polysaccharides category is expected to hold the largest market share due to the increasing use of polysaccharides as encapsulating matrices to preserve delicate oils and bioactive components. Polysaccharides are frequently favoured by food makers because they play an important role in the microstructure of many food items. Polysaccharides are big molecules composed of smaller monosaccharides linked together by glycoside linkages.

Based on the type of application, the market is segregated into functional foods, dairy products, confectioneries, and dietary supplements, among others. Dietary supplements are projected to grow rapidly during the anticipated period due to the increasing demand for food encapsulation dietary supplements. Meals encapsulation technology is an efficient method of putting health-promoting substances into food without compromising their bioavailability or usefulness. The food encapsulation method safeguards health-promoting components in dietary supplements. The strong demand for dietary supplements in nations such as the United States and Western Europe will drive market expansion.

Based on the technology, the market is segregated into the physical process and chemical & physiochemical processes. The physical process segment is expected to hold the lion’s share of the market during the forecast period. Spray drying, spray chilling, and spinning disc are some of the most common technologies. Economic feasibility is a major motivator for the widespread adoption of this technology. Water-based compounds, solvent-based materials, and temperature-sensitive materials can all benefit from spray drying.

As per the geographical analysis, the market can be classified into North America (the US, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa and Central & South America.

North America region is expected to hold the largest market share during the forecast period. Food items with higher heat and oxidative resistance increased shelf-life stability, and enhanced end-product quality are in high demand in this region. The rising consumption of functional food products will help to drive the market. The region's expansion is aided by the increasing demand for shell materials such as hydrocolloid and emulsions, as well as the presence of a large number of producers.

Moreover, due to rapidly developing food processing industries, Asia Pacific is projected to emerge as the fastest-growing area from 2021 to 2026. Due to increasing living standards and developing processed food industry, countries like China and India are likely to fuel market expansion in the Asia Pacific region. Furthermore, Europe is projected to increase at a steady rate throughout the forecast period, due to the region's processed food industry's increasing technical advancement.

Coating Place Inc., Advanced Bionutrition Corporation, Balchem Corporation, ABCO Industries Inc., Friesland Campina Kievit, Aveka Group, Blue California, Encapsys Microencapsulation, GAT Food Essential GMBH, Cargill Inc., Symrise AG, and Lyco Red Ltd., among others are the key players in the market. These players have adopted various marketing strategies, including R&D activities, a growing number of collaborations, awareness programs, technological progress, geographical expansion and the launching of new products, to increase their market presence and visibility.

Please note: This is not an exhaustive list of companies profiled in the report.

In November 2019, Givaudan, the world’s leading flavor and fragrance company launched its new product i.e. fat encapsulation technology to reduce up to 75% of the fat content and 30% of the calories in meat substitutes.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Global Food Encapsulation Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Type Overview

2.1.3 Shell Material Overview

2.1.4 Application Overview

2.1.5 Technology Overview

2.1.6 Regional Overview

Chapter 3 Food Encapsulation Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Growing demand for encapsulated sweeteners in confectionery products

3.3.1.2 Growing demand of dietary supplement

3.3.2 Industry Challenges

3.3.2.1 Low maintenance of food stability during processing and packaging

3.4 Prospective Growth Scenario

3.4.1 Type Growth Scenario

3.4.2 Technology Growth Scenario

3.4.3 Application Growth Scenario

3.4.4 Shell Material Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Food Encapsulation Market, By Type

4.1 Type Outlook

4.2 Micro Encapsulation

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Nano Encapsulation

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Hybrid Technology

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Macro Encapsulation

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Food Encapsulation Market, By Shell Material

5.1 Shell Material Outlook

5.2 Polysaccharides

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Lipids

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Emulsifiers

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Others

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Food Encapsulation Market, By Application

6.1 Application Outlook

6.2 Functional Foods

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Dairy Products

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Confectioneries

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Dietary Supplements

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

6.6 Others

6.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Food Encapsulation Market, By Technology

7.1 Technology Outlook

7.2 Physical Process

7.2.1 Market Size, By Region, 2020-2026 (USD Billion)

7.3 Chemical & Physicochemical Process

7.3.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 8 Food Encapsulation Market, By Region

8.1 Regional outlook

8.2 North America

8.2.1 Market Size, By Country 2020-2026 (USD Billion)

8.2.2 Market Size, By Type, 2020-2026 (USD Billion)

8.2.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.4 Market Size, By Application, 2020-2026 (USD Billion)

8.2.5 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.2.6 U.S.

8.2.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.2.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.6.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.2.7 Canada

8.2.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.2.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.2.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.2.7.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3 Europe

8.3.1 Market Size, By Country 2020-2026 (USD Billion)

8.3.2 Market Size, By Type, 2020-2026 (USD Billion)

8.3.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.4 Market Size, By Application, 2020-2026 (USD Billion)

8.3.5 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3.6 Germany

8.3.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.6.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3.7 UK

8.3.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.7.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3.8 France

8.3.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.8.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3.9 Italy

8.3.9.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.9.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.9.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.9.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3.10 Spain

8.3.10.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.10.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.10.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.3.11 Russia

8.3.11.1 Market Size, By Type, 2020-2026 (USD Billion)

8.3.11.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.3.11.3 Market Size, By Application, 2020-2026 (USD Billion)

8.3.11.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.4 Asia Pacific

8.4.1 Market Size, By Country 2020-2026 (USD Billion)

8.4.2 Market Size, By Type, 2020-2026 (USD Billion)

8.4.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.4 Market Size, By Application, 2020-2026 (USD Billion)

8.4.5 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.4.6 China

8.4.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.6.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.4.7 India

8.4.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.7.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.4.8 Japan

8.4.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.8.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.4.9 Australia

8.4.9.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.9.2 Market size, By Technology, 2020-2026 (USD Billion)

8.4.9.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.9.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.4.10 South Korea

8.4.10.1 Market Size, By Type, 2020-2026 (USD Billion)

8.4.10.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.4.10.3 Market Size, By Application, 2020-2026 (USD Billion)

8.4.10.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.5 Latin America

8.5.1 Market Size, By Country 2020-2026 (USD Billion)

8.5.2 Market Size, By Type, 2020-2026 (USD Billion)

8.5.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.4 Market Size, By Application, 2020-2026 (USD Billion)

8.5.5 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.5.6 Brazil

8.5.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.6.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.5.7 Mexico

8.5.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.7.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.5.8 Argentina

8.5.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.5.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.5.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.5.8.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.6 MEA

8.6.1 Market Size, By Country 2020-2026 (USD Billion)

8.6.2 Market Size, By Type, 2020-2026 (USD Billion)

8.6.3 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.4 Market Size, By Application, 2020-2026 (USD Billion)

8.6.5 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.6.6 Saudi Arabia

8.6.6.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.6.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.6.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.6.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.6.7 UAE

8.6.7.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.7.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.7.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.7.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

8.6.8 South Africa

8.6.8.1 Market Size, By Type, 2020-2026 (USD Billion)

8.6.8.2 Market Size, By Technology, 2020-2026 (USD Billion)

8.6.8.3 Market Size, By Application, 2020-2026 (USD Billion)

8.6.8.4 Market Size, By Shell Material, 2020-2026 (USD Billion)

Chapter 9 Company Landscape

9.1 Competitive Analysis, 2020

9.2 Coating Place Inc.

9.2.1 Company Overview

9.2.2 Financial Analysis

9.2.3 Strategic Positioning

9.2.4 Info-Graphic Analysis

9.3 Advanced Bionutrition Corporation

9.3.1 Company Overview

9.3.2 Financial Analysis

9.3.3 Strategic Positioning

9.3.4 Info-Graphic Analysis

9.4 Balchem Corporation

9.4.1 Company Overview

9.4.2 Financial Analysis

9.4.3 Strategic Positioning

9.4.4 Info-Graphic Analysis

9.5 ABCO Industries Inc

9.5.1 Company Overview

9.5.2 Financial Analysis

9.5.3 Strategic Positioning

9.5.4 Info-Graphic Analysis

9.6 Freisland Campina Kievit

9.6.1 Company Overview

9.6.2 Financial Analysis

9.6.3 Strategic Positioning

9.6.4 Info-Graphic Analysis

9.7 Aveka Group

9.7.1 Company Overview

9.7.2 Financial Analysis

9.7.3 Strategic Positioning

9.7.4 Info-Graphic Analysis

9.8 Blue California

9.8.1 Company Overview

9.8.2 Financial Analysis

9.8.3 Strategic Positioning

9.8.4 Info-Graphic Analysis

9.9 Encapsys Microencapsulation

9.9.1 Company Overview

9.9.2 Financial Analysis

9.9.3 Strategic Positioning

9.9.4 Info-Graphic Analysis

9.10 GAT Food Essential GMBH

9.10.1 Company Overview

9.10.2 Financial Analysis

9.10.3 Strategic Positioning

9.10.4 Info-Graphic Analysis

9.11 Cargill Inc.

9.11.1 Company Overview

9.11.2 Financial Analysis

9.11.3 Strategic Positioning

9.11.4 Info-Graphic Analysis

9.12 Other Companies

9.12.1 Company Overview

9.12.2 Financial Analysis

9.12.3 Strategic Positioning

9.12.4 Info-Graphic Analysis

The Global Food Encapsulation Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Food Encapsulation Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS