Global Food Grade Calcium Carbonate Market Size, Trends & Analysis - Forecasts to 2028 By Type (Ground Calcium Carbonate and Precipitated Calcium Carbonate), By End-use (Fortified Beverages and Bakery Food), and By Region (North America, Asia Pacific, Central & South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

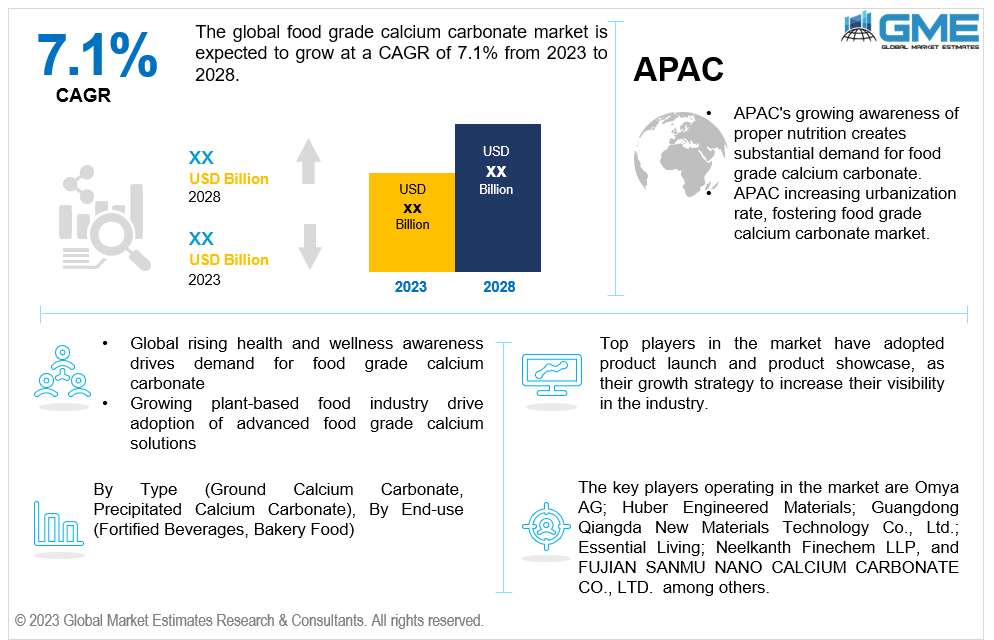

The global food grade calcium carbonate market is expected to grow at a CAGR of 7.1% from 2023 to 2028. A natural mineral compound called food-grade calcium carbonate is commonly used in the food business. It is made from premium limestone and put through rigorous purification procedures to ensure that it is safe for ingestion by people. It is suitable for various culinary products due to its white colour, lack of smell, and tastelessness. Food-grade calcium carbonate has a variety of uses in the food business, including as a calcium supplement, food additive, and pH regulator in different foods and beverages. Additionally, it is essential for enhancing the stability and texture of commodities like baked goods, dairy products, and nutritional supplements. Food-grade calcium carbonate is a well-acknowledged safe component that makes a substantial difference in many foods' nutritional value, quality, and safety.

Several key factors drive the global food grade calcium carbonate market growth. The growing need for healthy and fortified food items as health-conscious customers look for wholesome options is one of the main factors. Food-grade calcium carbonate plays a crucial role as a calcium supplement in various food items, aligning with the growing focus on health and wellness. Furthermore, the global population is continuously growing, and dietary patterns are evolving, leading to higher consumption of processed and convenience foods. These food products often require the addition of calcium carbonate as a food additive, further fuelling its demand in the market. Stringent food safety regulations and the rising preference for clean-label ingredients also compel manufacturers to choose natural and safe additives like food-grade calcium carbonate. This compound meets the criteria as it is derived from high-quality limestone and undergoes strict purification processes, ensuring its safety for human consumption. Moreover, the market growth is driven by the rapid growth of the food and beverage sectors, particularly in emerging economies. As consumers in these regions become more aware of the importance of calcium-rich diets, the demand for food-grade calcium carbonate is expected to rise even further. The dairy industry is a significant consumer of food-grade calcium carbonate due to its benefits and essential role in fortifying dairy products. Maintaining healthy bones and teeth, efficient nerve function, and muscular contraction depend on calcium, an essential mineral.

Fortifying dairy products with calcium carbonate allows dairy manufacturers to enhance the nutritional value of their products by increasing the calcium content. It enables them to address consumer demands for healthier and more nutritious options while meeting regulatory standards for calcium fortification in certain dairy products. Adding food-grade calcium carbonate to dairy products, such as milk and yogurt, provides a convenient and bioavailable source of calcium for consumers and improves the products' overall texture and stability. This is particularly important for products like yoghurt, where calcium carbonate can enhance its smoothness and prevent undesirable separation or settling. The application of food-grade calcium carbonate in the dairy industry is driven by the need to provide consumers with calcium-fortified dairy products that contribute to their daily nutritional requirements and align with their health-conscious choices. It serves as an efficient way for the dairy industry to meet consumer demands for functional and fortified foods without compromising the quality or taste of the products.

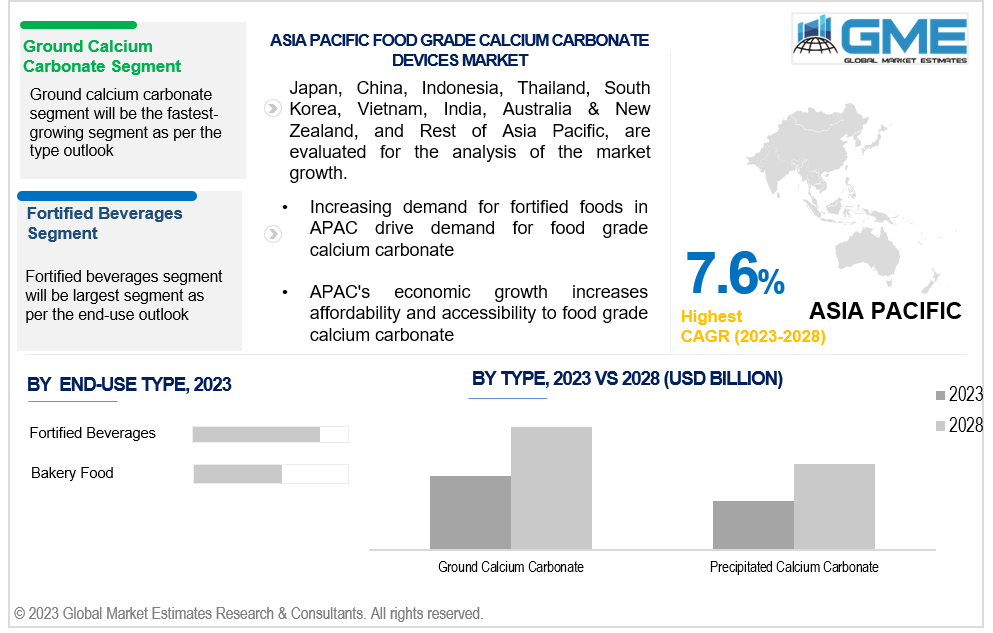

Based on type, the market is segmented into ground calcium carbonate and precipitated calcium carbonate. The ground calcium carbonate segment is expected to be the largest segment during the forecast period due to its versatility and wide range of applications in the food industry. Its fine particle size and white colour make it suitable for various food products, providing a smooth texture and an appealing appearance without altering the taste or sensory properties of the final food items. Ground calcium carbonate's significance in the food industry is observed as a calcium supplement and pH regulator in dairy products like yogurt and cheese. Dairy manufacturers frequently use ground calcium carbonate to fortify their products with calcium, enhancing their nutritional value. Moreover, GCC acts as a pH regulator during the production process of dairy items, stabilizing their acidity levels, which leads to improved shelf life and overall quality. Another example of its importance in the food industry is its presence in bakery goods, including bread, cakes, and pastries. By utilizing GCC as an additive in these food items, manufacturers can achieve desirable textures and structures, resulting in softer, fluffier, and better-performing products. The versatility and widespread use of ground calcium carbonate in various food products exemplify why it holds a dominant position in the food-grade calcium carbonate market.

Based on end-use, the market is segmented into fortified beverages and bakery food. Fortified beverages segment is expected to be the largest segment during the forecast period. This is because of the increasing consumer demand for healthier and functional drinks. As people become more health-conscious and seek ways to improve their diets, fortified beverages offer a convenient and accessible option for obtaining essential nutrients, such as calcium. Food-grade calcium carbonate is used in many fortified beverages, including plant-based milk alternatives, fruit juices, fortified water, and sports drinks. Numerous plant-based milk substitutes have grown in popularity among customers looking for dairy-free options, including soy, almond, and oat milk. However, these plant-based milks may not naturally contain sufficient levels of calcium. To address this nutritional gap and provide a calcium source comparable to dairy milk, manufacturers fortify these plant-based milk with food-grade calcium carbonate, making the fortified beverages segment the largest in the market.

North America is analysed to be the largest region in the global food grade calcium carbonate market during the forecast period. North American consumers are becoming increasingly health-conscious and actively seeking foods and beverages that offer added health benefits. Fortified foods containing added nutrients like calcium have gained popularity as people look for convenient ways to meet their nutritional needs. With the rising awareness of the importance of a balanced diet, there is a growing focus on health and wellness in North America. Calcium is a vital mineral essential for maintaining healthy bones and teeth. As a result, including food-grade calcium carbonate in various food products has become an effective way to ensure consumers receive their required calcium intake. North America has strict food safety regulations, and regulatory authorities generally recognize food-grade calcium carbonate as safe (GRAS). This safety recognition has facilitated its widespread usage in the food industry, giving consumers confidence in the products they consume, and key industry players make it the largest segment in the food grade calcium carbonate market.

Asia Pacific is also analysed to be the fastest growing region across the global food grade calcium carbonate market. The growth of the food-grade calcium carbonate market in the Asia Pacific region can be attributed to the increasing demand for products fortified with essential nutrients and the growing awareness of the importance of proper nutrition in addressing nutrient deficiencies. As the region undergoes significant industrialization and modernization in the food industry, advanced food processing technologies and the use of additives like calcium carbonate have become prevalent to enhance product quality, texture, and stability. Among the countries in the Asia Pacific region, China stands out as one of the largest consumers of food-grade calcium carbonate globally. With the world's largest population and an increasing urbanization rate, more people are moving to urban areas, leading to a higher demand for processed and convenience foods. These processed foods often include food-grade calcium carbonate as an ingredient to improve texture, provide fortification, and extend shelf life.

The key players operating in the market are Omya AG, Huber Engineered Materials, Guangdong Qiangda New Materials Technology Co., Ltd., Essential Living, Neelkanth Finechem LLP, and FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD. among others.

Please note: This is not an exhaustive list of companies profiled in the report.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

2.4 Data Metrics

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

4 GLOBAL FOOD GRADE CALCIUM CARBONATE MARKET, BY TYPE

4.2 Food Grade Calcium Carbonate Market: Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4.1 Ground Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

4.5 Precipitated Calcium Carbonate

4.5.1 Precipitated Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

5 GLOBAL FOOD GRADE CALCIUM CARBONATE MARKET, BY END- USER

5.2 Food Grade Calcium Carbonate Market: End-use Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4.1 Fortified Beverages Market Estimates and Forecast, 2020-2028 (USD Million)

5.5.1 Bakery Food Market Estimates and Forecast, 2020-2028 (USD Million)

5.6.1 Cosmetics Market Estimates and Forecast, 2020-2028 (USD Million)

6 GLOBAL FOOD GRADE CALCIUM CARBONATE MARKET, BY REGION

6.2.3.1 U.S. Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.2 Canada Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.2.3.3 Mexico Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.3 Europe Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.1 Germany Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.2 U.K. Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.3 France Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.4 Italy Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.3.3.5 Spain Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4 Asia Pacific Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.1 China Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.2 Japan Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.3 India Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.6 Malaysia Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.7 Thailand Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.9 Vietnam Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.4.3.10 Taiwan Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.2 U.A.E. Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.5.3.3 Israel Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.1 Brazil Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

6.6.3.3 Chile Food Grade Calcium Carbonate Market Estimates and Forecast, 2020-2028 (USD Million)

7.1 Company Market Share Analysis

7.2 Four Quadrant Positioning Matrix

7.4.1.1 Business Description & Financial Analysis

7.4.1.3 Products & Services Offered

7.4.1.4 Strategic Alliances between Business Partners

7.4.2 Huber Engineered Materials

7.4.2.1 Business Description & Financial Analysis

7.4.2.3 Products & Services Offered

7.4.2.4 Strategic Alliances between Business Partners

7.4.3 Guangdong Qiangda New Materials Technology Co., Ltd.

7.4.3.1 Business Description & Financial Analysis

7.4.3.3 Products & Services Offered

7.4.3.4 Strategic Alliances between Business Partners

7.4.4.1 Business Description & Financial Analysis

7.4.4.3 Products & Services Offered

7.4.4.4 Strategic Alliances between Business Partners

7.4.5.1 Business Description & Financial Analysis

7.4.5.3 Products & Services Offered

7.4.5.4 Strategic Alliances between Business Partners

7.4.6 FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD.

7.4.6.1 Business Description & Financial Analysis

7.4.6.3 Products & Services Offered

7.4.6.4 Strategic Alliances between Business Partners

7.4.11.1 Business Description & Financial Analysis

7.4.11.3 Products & Services Offered

7.4.11.4 Strategic Alliances between Business Partners

8.1.2 Market Scope & SegPrecipitated Calcium Carbonatetation

8.2 Information ProcurePrecipitated Calcium Carbonatet

8.2.1.2 GMEs Internal Data Repository

8.2.1.3 Secondary Resources & Third Party Perspectives

8.2.1.4 Company Information Sources

8.2.2.1 Various Types of Respondents for Primary Interviews

8.2.2.2 Number of Interviews Conducted throughout the Research Process

8.2.2.4 Discussion Guide for Primary Participants

8.2.3.1 Expert Panels Across 30+ Industry

8.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

8.3.1.1 Macro-Economic Indicators Considered

8.3.1.2 Micro-Economic Indicators Considered

8.3.2.1 Company Share Analysis Approach

8.3.2.2 Estimation of Potential Product Sales

8.4.2 Time Series, Cross Sectional & Panel Data Analysis

8.5.1 Inhouse AI Based Real Time Analytics Tool

8.5.2 Output From Desk & Primary Research

8.6 Research Assumptions & Limitations

LIST OF TABLES

1 Global Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

2 Ground Calcium Carbonate Market, By Region, 2020-2028 (USD Mllion)

3 Precipitated Calcium Carbonate Market, By Region, 2020-2028 (USD Mllion)

4 Global Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

5 Fortified Beverages Market, By Region, 2020-2028 (USD Mllion)

6 Bakery Food Market, By Region, 2020-2028 (USD Mllion)

7 Regional Analysis, 2020-2028 (USD Mllion)

8 North America Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

9 North America Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

10 U.S. Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

11 U.S. Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

12 Canada Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

13 Canada Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

14 Mexico Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

15 Mexico Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

16 Europe Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

17 Europe Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

18 Germany Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

19 Germany Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

20 U.K. Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

21 U.K. Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

22 France Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

23 France Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

24 Italy Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

25 Italy Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

26 Spain Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

27 Spain Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

28 Netherlands Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

29 Netherlands Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

30 Rest Of Europe Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

31 Rest Of Europe Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

32 Asia Pacific Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

33 Asia Pacific Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

34 China Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

35 China Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

36 Japan Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

37 Japan Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

38 India Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

39 India Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

40 South Korea Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

41 South Korea Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

42 Singapore Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

43 Singapore Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

44 Thailand Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

45 Thailand Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

46 Malaysia Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

47 Malaysia Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

48 Indonesia Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

49 Indonesia Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

50 Vietnam Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

51 Vietnam Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

52 Taiwan Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

53 Taiwan Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

54 Rest of APAC Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

55 Rest of APAC Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

56 Middle East and Africa Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

57 Middle East and Africa Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

58 Saudi Arabia Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

59 Saudi Arabia Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

60 UAE Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

61 UAE Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

62 Israel Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

63 Israel Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

64 South Africa Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

65 South Africa Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

66 Rest Of Middle East and Africa Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

67 Rest Of Middle East and Africa Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

68 Central & South America Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

69 Central & South America Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

70 Brazil Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

71 Brazil Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

72 Chile Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

73 Chile Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

74 Argentina Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

75 Argentina Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

76 Rest Of Central & South America Food Grade Calcium Carbonate Market, By Type, 2020-2028 (USD Mllion)

77 Rest Of Central & South America Food Grade Calcium Carbonate Market, By END-USE, 2020-2028 (USD Mllion)

78 Omya AG: Products & Services Offering

79 Huber Engineered Materials: Products & Services Offering

80 Guangdong Qiangda New Materials Technology Co., Ltd.: Products & Services Offering

81 Essential Living: Products & Services Offering

82 Carlings: Products & Services Offering

83 FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD.: Products & Services Offering

84 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Food Grade Calcium Carbonate Market Overview

2 Global Food Grade Calcium Carbonate Market Value From 2020-2028 (USD Mllion)

3 Global Food Grade Calcium Carbonate Market Share, By Type (2022)

4 Global Food Grade Calcium Carbonate Market Share, By End-use (2022)

5 Global Food Grade Calcium Carbonate Market, By Region (Asia Pacific Market)

6 Technological Trends In Global Food Grade Calcium Carbonate Market

7 Four Quadrant Competitor Positioning Matrix

8 Impact Of Macro & Micro Indicators On The Market

9 Impact Of Key Drivers On The Global Food Grade Calcium Carbonate Market

10 Impact Of Challenges On The Global Food Grade Calcium Carbonate Market

11 Porter’s Five Forces Analysis

12 Global Food Grade Calcium Carbonate Market: By Type Scope Key Takeaways

13 Ground Calcium Carbonate Market, By Region, 2020-2028 (USD Mllion)

14 Precipitated Calcium Carbonate Market, By Region, 2020-2028 (USD Mllion)

15 Global Food Grade Calcium Carbonate Market: By End-use Scope Key Takeaways

16 Fortified Beverages Market, By Region, 2020-2028 (USD Mllion)

17 Bakery Food Market, By Region, 2020-2028 (USD Mllion)

18 Regional SegPrecipitated Calcium Carbonatet: Revenue Growth Analysis

19 Global Food Grade Calcium Carbonate Market: Regional Analysis

20 North America Food Grade Calcium Carbonate Market Overview

21 North America Food Grade Calcium Carbonate Market, By Type

22 North America Food Grade Calcium Carbonate Market, By End-use

23 North America Food Grade Calcium Carbonate Market, By Country

24 U.S. Food Grade Calcium Carbonate Market, By Type

25 U.S. Food Grade Calcium Carbonate Market, By End-use

26 Canada Food Grade Calcium Carbonate Market, By Type

27 Canada Food Grade Calcium Carbonate Market, By End-use

28 Mexico Food Grade Calcium Carbonate Market, By Type

29 Mexico Food Grade Calcium Carbonate Market, By End-use

30 Four Quadrant Positioning Matrix

31 Company Market Share Analysis

32 Omya AG: Company Snapshot

33 Omya AG: SWOT Analysis

34 Omya AG: Geographic Presence

35 Huber Engineered Materials: Company Snapshot

36 Huber Engineered Materials: SWOT Analysis

37 Huber Engineered Materials: Geographic Presence

38 Guangdong Qiangda New Materials Technology Co., Ltd.: Company Snapshot

39 Guangdong Qiangda New Materials Technology Co., Ltd.: SWOT Analysis

40 Guangdong Qiangda New Materials Technology Co., Ltd.: Geographic Presence

41 Essential Living: Company Snapshot

42 Essential Living: Swot Analysis

43 Essential Living: Geographic Presence

44 Carlings: Company Snapshot

45 Carlings: SWOT Analysis

46 Carlings: Geographic Presence

47 FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD.: Company Snapshot

48 FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD.: SWOT Analysis

49 FUJIAN SANMU NANO CALCIUM CARBONATE CO., LTD.: Geographic Presence

50 Other Companies: Company Snapshot

51 Other Companies: SWOT Analysis

52 Other Companies: Geographic Presence

The Global Food Grade Calcium Carbonate Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Food Grade Calcium Carbonate Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS