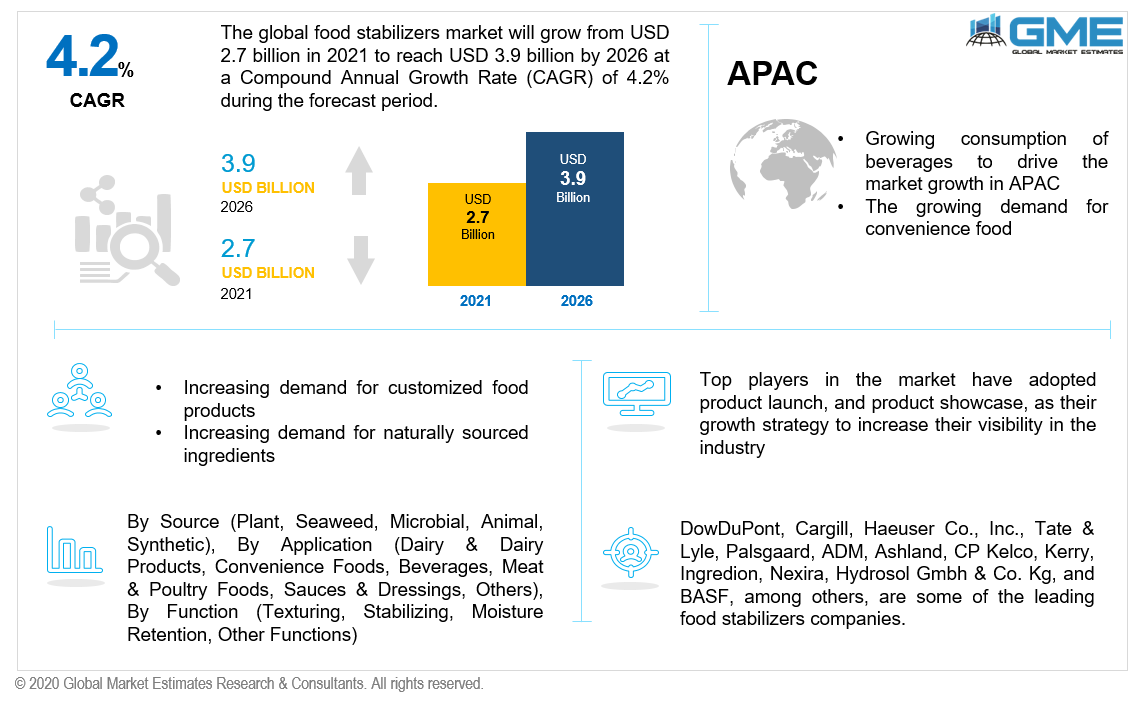

Global Food Stabilizers Market Size, Trends & Analysis - Forecasts to 2026 By Source (Plant, Seaweed, Microbial, Animal, Synthetic), By Application (Dairy & Dairy Products, Convenience Foods, Beverages, Meat & Poultry Foods, Sauces & Dressings, Others), By Function (Texturing, Stabilizing, Moisture Retention, Other Functions), By Region (North America, Europe, Asia Pacific, CSA, and the Middle East & Africa), Competitive Landscape Company Market Share Analysis, and Competitor Analysis

The global food stabilizers market will grow from USD 2.7 billion in 2021 to USD 3.9 billion in 2026 at a CAGR value of 4.2% between 2021 to 2026.

The increasing consumer awareness towards healthy food products, and also the increasing demand for food stabilizers in several food & beverage products, are some of the primary factors driving the food stabilizers market growth. The other factors supporting the growth of the food stabilizers market are the increasing consumption of food volume clubbed with rising world population, growing disposable income of consumers, and rising adoption of food stabilizers in the confectionary and dairy industry.

Furthermore, the rising demand for convenience foods and the increasing influence of westernized food consumption patterns, as well as an increasing preference for specialized and customized blends by food and beverage processing, are some of the leading factors driving the food stabilizer market size during the forecast period. Also, growing innovation in novel products and increasing research and development activities in the food & beverage sector are projected to open up new prospects for market players in the coming years [2021-2026].

The market for food stabilizers will be growing rapidly owing to other factors such as the rising consumption of alcoholic beverages in North America and the Asia Pacific region, the rising geriatric population, and the increasing launch of new food stabilizers. Moreover, the increasing adoption of food stabilizers in a broad range of food products in bakery, sauce, and beverage is also helping the market attain rapid growth.

The coronavirus outbreak caused a major catastrophe in both the food & beverage and economic sectors as a result of regulations established by various regulatory bodies. Global economic growth had slowed to near-zero levels. Many food & beverage manufacturing industrial operations were halted as a result of the strict lockdown measures. However, the food & beverage industry will pick up the pace during the forecast period owing to ease in manufacturing restrictions.

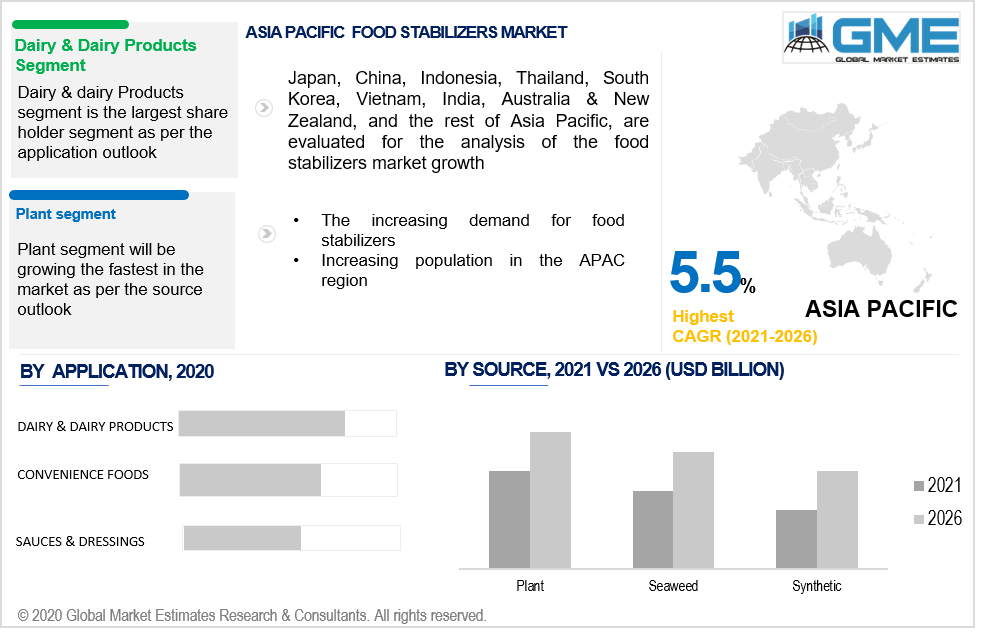

The food stabilizers market is segregated into the plant, seaweed, microbial, animal, and synthetic. The plant source segment is expected to grow at the highest CAGR during the forecast period [2021 to 2026]. This is mainly because of the growing demand for natural ingredients and the rising demand for vegan food. Moreover, consumer perception of the nutritious qualities of plant-derived food stabilizers has also increased the rate of acceptance of organically sourced stabilizers. To meet consumers' demand for natural food additives, food and beverage manufacturers prefer plant-sourced food stabilizers.

Based on the application, the market is segmented into dairy & dairy products, convenience foods, beverages, meat & poultry foods, sauces & dressings, and others. The dairy & dairy products segment is expected to hold the largest share of the market during the forecast period [2021-2026].

Based on the function, the food stabilizer market is segmented into texturing, stabilizing, moisture retention, and other functions. The texturing function is expected to be the fastest growing segment during the forecast period [2021-2026]. The usage of food stabilizers in the food sector serves to improve the appearance of the product, which in turn leads to greater revenue from the products sold. As a result, the demand for stabilizers in the food business is expanding and supporting the growth of the segment.

As per the geographical analysis, the food stabilizers market can be classified into North America (the United States, Canada, and Mexico), Asia Pacific (India, China, Japan, Malaysia, Singapore, and the Rest of Asia Pacific), Europe (Germany, United Kingdom, Italy, France, Spain, Netherlands, and Rest of Europe), Middle East & Africa (Saudi Arabia, United Arab Emirates, and Rest of the Middle East & Africa) and Central & South America (Brazil, Argentina, and Rest of Central and South America).

North America (the United States, Canada, and Mexico) will have a dominant share in the market during the forecast period [2021 to 2026].

The high share of this region is mainly due to the presence of prominent manufacturers in the United States market, increasing changing food lifestyle patterns, the increasing preference for customized and specialized blends from confectionary and bakery industries, and increasing investments in R&D activities for new stabilizers in the food & beverage sector.

However, the Asia Pacific region will grow with the highest CAGR rate in the food stabilizer market. Rising demand for beverages in emerging countries such as China, Australia, India, and Japan, increasing awareness of food additives and increasing demand for convenience food will impact the market positively.

DowDuPont, Cargill, Haeuser Co., Inc., Tate & Lyle, Palsgaard, ADM, Ashland, CP Kelco, Kerry, Ingredion, Nexira, Hydrosol Gmbh & Co. Kg, and BASF, among others, are some of the leading food stabilizer companies.

Please note: This is not an exhaustive list of companies profiled in the report.

Haeuser Co., Inc, a prominent player in edible coatings and specialty additives, entered into a collaborative partnership with Holton Food Products Company, who is a leading provider of food stabilizers in the United States in order to enhance its food stabilizer segment.

Chapter 1 Methodology

1.1 Market Scope & Definitions

1.2 Estimates & Forecast Calculation

1.3 Historical Data Overview and Validation

1.4 Data Sources

1.4.1 Secondary

1.4.2 Primary

Chapter 2 Report Outlook

2.1 Food Stabilizers Industry Overview, 2020-2026

2.1.1 Industry Overview

2.1.2 Source Overview

2.1.3 Application Overview

2.1.4 Function Overview

2.1.5 Regional Overview

Chapter 3 Global Food Stabilizers Market Trends

3.1 Market Segmentation

3.2 Industry Background, 2020-2026

3.3 Market Key Trends

3.3.1 Positive Trends

3.3.1.1 Rising demand for customized food products

3.3.1.2 Increasing investments for R&D to develop new stabilizers

3.3.2 Industry Challenges

3.3.2.1 Fluctuation in prices of raw materials

3.4 Prospective Growth Scenario

3.4.1 Source Growth Scenario

3.4.2 Application Growth Scenario

3.4.3 Function Growth Scenario

3.5 COVID-19 Influence over Industry Growth

3.6 Porter’s Analysis

3.7 PESTEL Analysis

3.8 Value Chain & Supply Chain Analysis

3.9 Regulatory Framework

3.9.1 North America

3.9.2 Europe

3.9.3 APAC

3.9.4 LATAM

3.9.5 MEA

3.10 Technology Overview

3.11 Market Share Analysis, 2020

3.11.1 Company Positioning Overview, 2020

Chapter 4 Global Food Stabilizers Market, By Source

4.1 Source Outlook

4.2 Plant

4.2.1 Market Size, By Region, 2020-2026 (USD Billion)

4.3 Seaweed

4.3.1 Market Size, By Region, 2020-2026 (USD Billion)

4.4 Microbial

4.4.1 Market Size, By Region, 2020-2026 (USD Billion)

4.5 Animal

4.5.1 Market Size, By Region, 2020-2026 (USD Billion)

4.6 Synthetic

4.6.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 5 Global Food Stabilizers Market, By Application

5.1 Application Outlook

5.2 Dairy & Dairy Products

5.2.1 Market Size, By Region, 2020-2026 (USD Billion)

5.3 Confectionery Products

5.3.1 Market Size, By Region, 2020-2026 (USD Billion)

5.4 Convenience Foods

5.4.1 Market Size, By Region, 2020-2026 (USD Billion)

5.5 Meat & Poultry Products

5.5.1 Market Size, By Region, 2020-2026 (USD Billion)

5.6 Beverages

5.6.1 Market Size, By Region, 2020-2026 (USD Billion)

5.7 Sauces & Dressings

5.7.1 Market Size, By Region, 2020-2026 (USD Billion)

5.8 Others

5.8.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 6 Food Stabilizers Market, By Function

6.1 Function Outlook

6.2 Texturizing

6.2.1 Market Size, By Region, 2020-2026 (USD Billion)

6.3 Stabilizing

6.3.1 Market Size, By Region, 2020-2026 (USD Billion)

6.4 Moisture Retention

6.4.1 Market Size, By Region, 2020-2026 (USD Billion)

6.5 Other Functions

6.5.1 Market Size, By Region, 2020-2026 (USD Billion)

Chapter 7 Food Stabilizers Market, By Region

7.1 Regional outlook

7.2 North America

7.2.1 Market Size, By Country 2020-2026 (USD Billion)

7.2.2 Market Size, By Source, 2020-2026 (USD Billion)

7.2.3 Market Size, By Application, 2020-2026 (USD Billion)

7.2.4 Market Size, By Function, 2020-2026 (USD Billion)

7.2.5 U.S.

7.2.5.1 Market Size, By Source, 2020-2026 (USD Billion)

7.2.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.5.3 Market Size, By Function, 2020-2026 (USD Billion)

7.2.6 Canada

7.2.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.2.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.2.6.3 Market Size, By Function, 2020-2026 (USD Billion)

7.3 Europe

7.3.1 Market Size, By Country 2020-2026 (USD Billion)

7.3.2 Market Size, By Source, 2020-2026 (USD Billion)

7.3.3 Market Size, By Application, 2020-2026 (USD Billion)

7.3.4 Market Size, By Function, 2020-2026 (USD Billion)

7.3.5 Germany

7.3.5.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.5.3 Market Size, By Function, 2020-2026 (USD Billion)

7.3.6 UK

7.3.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.6.3 Market Size, By Function, 2020-2026 (USD Billion)

7.3.7 France

7.3.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.7.3 Market Size, By Function, 2020-2026 (USD Billion)

7.3.8 Italy

7.3.8.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.8.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.8.3 Market Size, By Function, 2020-2026 (USD Billion)

7.3.9 Spain

7.3.9.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.9.3 Market Size, By Function, 2020-2026 (USD Billion)

7.3.10 Russia

7.3.10.1 Market Size, By Source, 2020-2026 (USD Billion)

7.3.10.2 Market Size, By Application, 2020-2026 (USD Billion)

7.3.10.3 Market Size, By Function, 2020-2026 (USD Billion)

7.4 Asia Pacific

7.4.1 Market Size, By Country,2020-2026 (USD Billion)

7.4.2 Market Size, By Source, 2020-2026 (USD Billion)

7.4.3 Market Size, By Application, 2020-2026 (USD Billion)

7.4.4 Market Size, By Function, 2020-2026 (USD Billion)

7.4.5 China

7.4.5.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.5.3 Market Size, By Function, 2020-2026 (USD Billion)

7.4.6 India

7.4.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.6.3 Market Size, By Function, 2020-2026 (USD Billion)

7.4.7 Japan

7.4.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.7.3 Market Size, By Function, 2020-2026 (USD Billion)

7.4.8 Australia

7.4.8.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.8.2 Market size, By Application, 2020-2026 (USD Billion)

7.4.8.3 Market Size, By Function, 2020-2026 (USD Billion)

7.4.9 South Korea

7.4.9.1 Market Size, By Source, 2020-2026 (USD Billion)

7.4.9.2 Market Size, By Application, 2020-2026 (USD Billion)

7.4.9.3 Market Size, By Function, 2020-2026 (USD Billion)

7.6.5 Latin America

7.5.1 Market Size, By Country 2020-2026 (USD Billion)

7.5.2 Market Size, By Source, 2020-2026 (USD Billion)

7.5.3 Market Size, By Application, 2020-2026 (USD Billion)

7.5.4 Market Size, By Function, 2020-2026 (USD Billion)

7.5.5 Brazil

7.5.5.1 Market Size, By Source, 2020-2026 (USD Billion)

7.5.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.5.3 Market Size, By Function, 2020-2026 (USD Billion)

7.5.6 Mexico

7.5.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.5.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.6.3 Market Size, By Function, 2020-2026 (USD Billion)

7.5.7 Argentina

7.5.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.5.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.5.7.3 Market Size, By Function, 2020-2026 (USD Billion)

7.6 MEA

7.6.1 Market Size, By Country 2020-2026 (USD Billion)

7.6.2 Market Size, By Source, 2020-2026 (USD Billion)

7.6.3 Market Size, By Application, 2020-2026 (USD Billion)

7.6.4 Market Size, By Function, 2020-2026 (USD Billion)

7.6.5 Saudi Arabia

7.6.5.1 Market Size, By Source, 2020-2026 (USD Billion)

7.6.5.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.5.3 Market Size, By Function, 2020-2026 (USD Billion)

7.6.6 UAE

7.6.6.1 Market Size, By Source, 2020-2026 (USD Billion)

7.6.6.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.6.3 Market Size, By Function, 2020-2026 (USD Billion)

7.6.7 South Africa

7.6.7.1 Market Size, By Source, 2020-2026 (USD Billion)

7.6.7.2 Market Size, By Application, 2020-2026 (USD Billion)

7.6.7.3 Market Size, By Function, 2020-2026 (USD Billion)

Chapter 8 Company Landscape

8.1 Competitive Analysis, 2020

8.2 DowDuPont

8.2.1 Company Overview

8.2.2 Financial Analysis

8.2.3 Strategic Positioning

8.3 Cargill

8.3.1 Company Overview

8.3.2 Financial Analysis

8.3.3 Strategic Positioning

8.3.4 Info-Graphic Analysis

8.4 Tate & Lyle

8.4.1 Company Overview

8.4.2 Financial Analysis

8.4.3 Strategic Positioning

8.4.4 Info-Graphic Analysis

8.5 Palsgaard

8.5.1 Company Overview

8.5.2 Financial Analysis

8.5.3 Strategic Positioning

8.5.4 Info-Graphic Analysis

8.6 ADM

8.6.1 Company Overview

8.6.2 Financial Analysis

8.6.3 Strategic Positioning

8.6.4 Info-Graphic Analysis

8.7 Ashland

8.7.1 Company Overview

8.7.2 Financial Analysis

8.7.3 Strategic Positioning

8.7.4 Info-Graphic Analysis

8.8 CP Kelco

8.8.1 Company Overview

8.8.2 Financial Analysis

8.8.3 Strategic Positioning

8.8.4 Info-Graphic Analysis

8.9 Kerry

8.9.1 Company Overview

8.9.2 Financial Analysis

8.9.3 Strategic Positioning

8.9.4 Info-Graphic Analysis

8.10 Nexira

8.10.1 Company Overview

8.10.2 Financial Analysis

8.10.3 Strategic Positioning

8.10.4 Info-Graphic Analysis

8.11 BASF

8.11.1 Company Overview

8.11.2 Financial Analysis

8.11.3 Strategic Positioning

8.11.4 Info-Graphic Analysis

8.12 Other Companies

8.12.1 Company Overview

8.12.2 Financial Analysis

8.12.3 Strategic Positioning

8.12.4 Info-Graphic Analysis

The Global Food Stabilizers Market has been studied from the year 2019 till 2026. However, the CAGR provided in the report is from the year 2021 to 2026. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Food Stabilizers Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS