Global Foreign Exchange Services Market Size, Trends & Analysis - Forecasts to 2028 By Services Type (Currency Exchange, Remittance Service, Foreign Currency Accounts, and Others), By Provider (Banks, Money Transfer Operators, and Others), By Application (Individuals and Businesses), and By Region (North America, Asia Pacific, Central and South America, Europe, and Middle East and Africa), Competitive Landscape, Company Market Share Analysis, and Competitor Analysis

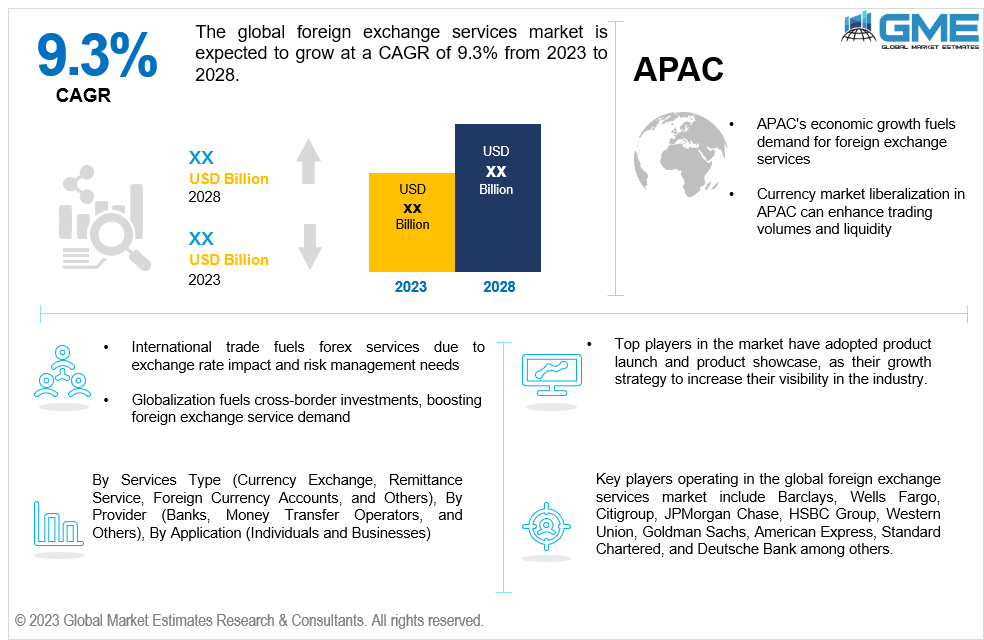

The global foreign exchange services market is expected to exhibit a CAGR of 9.3% from 2023 to 2028. Foreign exchange services, often known as forex or FX services, are financial services that facilitate the acquisition, selling, and exchange of currencies from other nations. These services are critical to the global economy because they allow firms, people, and governments to conduct worldwide commerce, investment, and financial activities. Various financial organizations offer forex services, including banks, currency exchange bureaus, internet trading platforms, and brokerage firms.

The growth of global foreign exchange services market is influenced by several market drivers that impact its dynamics and growth. International commerce is a key driver of the foreign exchange services sector. As businesses engage in cross-border trade and commerce, they require currency exchange services to facilitate transactions. Fluctuations in exchange rates can significantly impact the competitiveness of goods and services in global markets, driving the need for risk management solutions provided by forex services. The foreign exchange market attracts speculators and investors seeking profit opportunities from currency price fluctuations. These participants inject liquidity into the market and can drive significant short-term movements. Geopolitical developments, market sentiment, and economic data releases impact speculative trading. As globalization expands, individuals and businesses increasingly engage in cross-border investments. As investors strive to diversify their portfolios by investing in assets denominated in multiple currencies, demand for foreign exchange services rises. Some countries maintain fixed or semi-fixed exchange rate systems by pegging their currencies to a stronger currency or a basket of currencies. These systems can be influenced by central bank interventions, where governments actively buy or sell their currencies to maintain their desired exchange rate levels.

The growth of the global foreign exchange services market is affected by several market restraints. The forex market has no central authority and operates over-the-counter (OTC), implying it lacks the centrally managed exchange and clearance systems in conventional financial markets. This lack of transparency can lead to concerns about pricing fairness, counterparty risk, and market manipulation, rendering the services provided by forex service providers unreliable. Cybersecurity threats have become a significant concern with the increasing reliance on technology in forex trading. Hacks, data breaches, and other cyberattacks can disrupt trading platforms and compromise the security of client funds and information. This also causes issues for forex service providers.

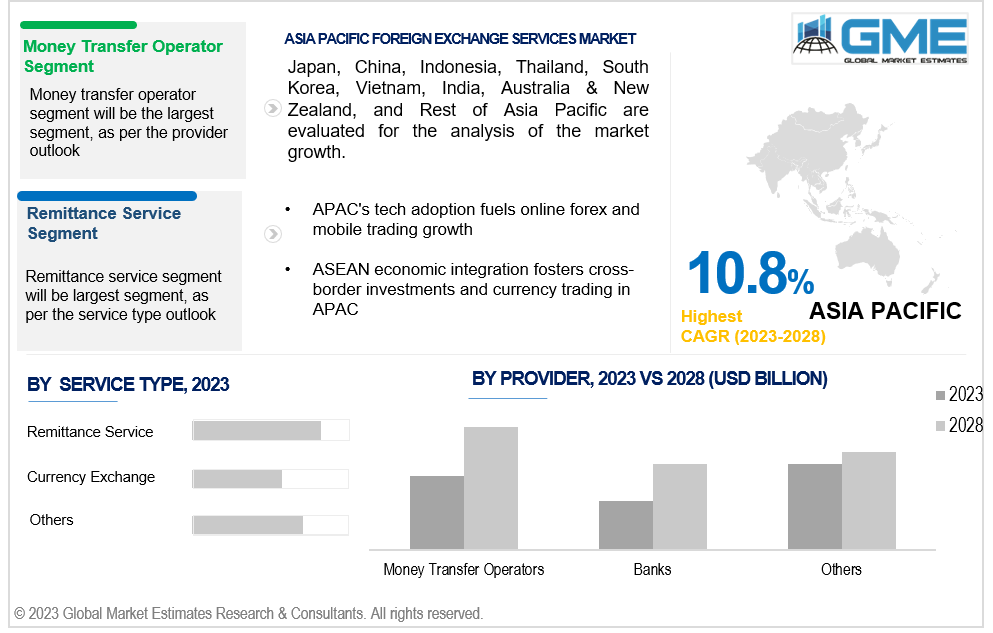

On the basis of service type, the market is segmented into currency exchange, remittance service, foreign currency accounts, and others. The remittance service segment is expected to be the largest segment during the forecast period. This dominance is due to the substantial volume of funds transferred by migrant workers and expatriates to their home countries. These cross-border money transfers are essential for supporting families and communities, driving a consistent demand for currency conversion. Additionally, the growth of digital remittance platforms has made the process more accessible, further boosting this segment's prominence.

The currency exchange service segment is expected to be the fastest-growing segment in the global foreign exchange services market due to increasing international travel, global trade, and the need for individuals and businesses to exchange currencies swiftly and conveniently. Moreover, the rise of online and mobile-based currency exchange platforms has accelerated the speed and accessibility of currency conversion, making it a highly sought-after service.

On the basis of provider, the market is segmented into banks, money transfer operators, and others. The money transfer operators (MTOs) segment is expected to be the largest segment during the forecast period. This is due to their vital role in facilitating cross-border remittances. The large volume of remittances worldwide, driven by migration and globalization, propels MTOs to the forefront of the market, making them the largest provider type in the industry.

Banks segment is expected to be the fastest-growing segment in the global foreign exchange services market due to their established reputation, extensive network, and ability to offer comprehensive forex services to businesses and individuals. They benefit from increased demand for currency exchange, international trade, and hedging services, making them a preferred choice for clients seeking trustworthiness and a wide range of financial services.

On the basis of applications, the market is segmented into individual and businesses. The businesses segment is expected to be the largest segment during the forecast period. This is due to its essential role in facilitating international trade, helping companies manage currency risk, and enabling cross-border investments. Businesses engage in forex services for currency conversion, hedging strategies, and operational needs, making this segment critical for corporate operations and global commerce.

The individual application segment is expected to be the fastest-growing in the global foreign exchange services market due to increasing accessibility to online trading platforms and the desire for personal wealth management. Individuals are becoming more involved in forex trading to diversify their financial portfolios and profit from currency swings. The ease of entry, availability of educational resources, and technological advancements have all contributed to the rapid growth of this segment.

North America is analysed to account for the largest share in the global foreign exchange services market during the forecast period. Firstly, the region's well-established and mature market reflects a consistently high demand for these services, driven by extensive international trade, investment activities, and a robust financial sector. Secondly, North America's technological prowess plays a pivotal role. The region is a hub for cutting-edge forex trading platforms and technologies, offering a competitive edge and attracting worldwide traders and investors. Additionally, major financial centers like New York and Toronto further solidify North America's dominance in the industry. Thus, these factors make North America a powerhouse in the global foreign exchange services market, continuously driving its growth and influence.

Asia Pacific is expected to be the fastest growing region across the global foreign exchange services market. APAC's robust economic growth, increased trade activity, expanding financial markets, and rising individual wealth have all contributed to the demand for foreign exchange services. Additionally, the region's technological advancements and widespread internet accessibility have facilitated greater retail participation in forex trading. Furthermore, the region's diverse currencies, including the Chinese Yuan and Japanese Yen, have gained prominence in international trade and investment, attracting traders and investors. Overall, APAC's dynamic economic landscape, combined with its embrace of forex technology and increased market integration, positions it as a vibrant hub for foreign exchange services and a significant driver of market growth.

Key players operating in the global foreign exchange services market include Barclays, Wells Fargo, Citigroup, JPMorgan Chase, HSBC Group, Western Union, Goldman Sachs, American Express, Standard Chartered, and Deutsche Bank, among others.

Please note: This is not an exhaustive list of companies profiled in the report.

In July 2022, EbixCash, an India-based technology-enabled provider of digital products and services, launched the Self Booking Corporate tool for foreign exchange. Self-Booking Corporate tool offers a spectrum of digital foreign exchange services to business and corporate travellers, and other corporates enabling increased efficiency.

1 STRATEGIC INSIGHTS ON NEW REVENUE POCKETS

1.1 Strategic Opportunity & Attractiveness Analysis

1.1.1 Hot Revenue Pockets

1.1.2 Market Attractiveness Score

1.1.3 Revenue Impacting Opportunity

1.1.4 High Growing Region/Country

1.1.5 Competitor Analysis

1.1.6 Consumer Analysis

1.2 Global Market Estimates' View

1.3 Strategic Insights across Business Functions

1.3.1 For Chief Executive Officers

1.3.2 For Chief Marketing Officers

1.3.3 For Chief Strategy Officers

1.4 Evaluate the Potential of your Existing Business Lines vs. New Lines to Enter Into

2 TECHNOLOGICAL TRENDS

2.1 Technological Adoption Rate

2.2 Current Trend Impact Analysis

2.3 Future Trend Impact Analysis

3 GLOBAL MARKET OUTLOOK

3.1 Market Pyramid Analysis

3.1.1 Introduction

3.1.2 Adjacent Market Opportunities

3.1.3 Ancillary Market Opportunities

3.2 Demand Side Analysis

3.2.1 Market Drivers: Impact Analysis

3.2.2 Market Restraints: Impact Analysis

3.2.3 Market Opportunities: Impact Analysis

3.2.4 Market Challenges: Impact Analysis

3.3 Supply Side Analysis

3.3.1 Porter’s Five Forces Analysis

3.3.1.1 Threat of New Entrants

3.3.1.2 Threat of New Substitutes

3.3.1.3 Bargaining Power of Suppliers

3.3.1.4 Bargaining Power of Buyers

3.3.1.5 Intensity of Competitive Rivalry

3.3.2 SWOT Analysis; By Factor (Political & Legal, Economic, and Technological)

3.3.2.1 Political Landscape

3.3.2.2 Economic Landscape

3.3.2.3 Social Landscape

3.3.2.4 Technology Landscape

3.3.3 Value Chain Analysis

3.3.4 Trend Analysis

3.3.5 Gap Analysis

3.3.6 Cost Analysis

4 GLOBAL FOREIGN EXCHANGE SERVICES MARKET, BY APPLICATION TYPE

4.1 Introduction

4.2 Foreign Exchange Services Market: Application Type Scope Key Takeaways

4.3 Revenue Growth Analysis, 2022 & 2028

4.4 Businesses

4.4.1 Businesses Market Estimates and Forecast, 2020-2028 (USD Billion)

4.5 Individuals

4.5.1 Individuals Market Estimates and Forecast, 2020-2028 (USD Billion)

5 GLOBAL FOREIGN EXCHANGE SERVICES MARKET, BY SERVICE TYPE

5.1 Introduction

5.2 Foreign Exchange Services Market: Service Type Scope Key Takeaways

5.3 Revenue Growth Analysis, 2022 & 2028

5.4 Remittance Service

5.4.1 Remittance Service Market Estimates and Forecast, 2020-2028 (USD Billion)

5.5 Currency Exchange

5.5.1 Currency Exchange Market Estimates and Forecast, 2020-2028 (USD Billion)

5.6 Foreign Currency Accounts

5.6.1 Foreign Currency Accounts Market Estimates and Forecast, 2020-2028 (USD Billion)

6 GLOBAL FOREIGN EXCHANGE SERVICES MARKET, BY PROVIDER

6.1 Introduction

6.2 Foreign Exchange Services Market: Provider Scope Key Takeaways

6.3 Revenue Growth Analysis, 2022 & 2028

6.4 Banks

6.4.1 Banks Market Estimates and Forecast, 2020-2028 (USD Billion)

6.5 Money Transfer Operators

6.5.1 Money Transfer Operators Market Estimates and Forecast, 2020-2028 (USD Billion)

6.6 Other Providers

6.6.1 Other Providers Market Estimates and Forecast, 2020-2028 (USD Billion)

7 GLOBAL FOREIGN EXCHANGE SERVICES MARKET, BY REGION

7.1 Introduction

7.2 North America Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.1 By Application Type

7.2.2 By Service Type

7.2.3 By Provider

7.2.4 By Country

7.2.4.1 U.S. Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.1.1 By Application Type

7.2.4.1.2 By Service Type

7.2.4.1.3 By Provider

7.2.4.2 Canada Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.2.1 By Application Type

7.2.4.2.2 By Service Type

7.2.4.2.3 By Provider

7.2.4.3 Mexico Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.2.4.3.1 By Application Type

7.2.4.3.2 By Service Type

7.2.4.3.3 By Provider

7.3 Europe Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.1 By Application Type

7.3.2 By Service Type

7.3.3 By Provider

7.3.4 By Country

7.3.4.1 Germany Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.1.1 By Application Type

7.3.4.1.2 By Service Type

7.3.4.1.3 By Provider

7.3.4.2 U.K. Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.2.1 By Application Type

7.3.4.2.2 By Service Type

7.3.4.2.3 By Provider

7.3.4.3 France Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.3.1 By Application Type

7.3.4.3.2 By Service Type

7.3.4.3.3 By Provider

7.3.4.4 Italy Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.4.1 By Application Type

7.3.4.4.2 By Service Type

7.2.4.4.3 By Provider

7.3.4.5 Spain Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.5.1 By Application Type

7.3.4.5.2 By Service Type

7.2.4.5.3 By Provider

7.3.4.6 Netherlands Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By Application Type

7.3.4.7.2 By Service Type

7.2.4.7.3 By Provider

7.3.4.7 Rest of Europe Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.3.4.7.1 By Application Type

7.3.4.7.2 By Service Type

7.2.4.7.3 By Provider

7.4 Asia Pacific Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.1 By Application Type

7.4.2 By Service Type

7.4.3 By Provider

7.4.4 By Country

7.4.4.1 China Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.1.1 By Application Type

7.4.4.1.2 By Service Type

7.4.4.1.3 By Provider

7.4.4.2 Japan Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.2.1 By Application Type

7.4.4.2.2 By Service Type

7.4.4.2.3 By Provider

7.4.4.3 India Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.3.1 By Application Type

7.4.4.3.2 By Service Type

7.4.4.3.3 By Provider

7.4.4.4 South Korea Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.4.1 By Application Type

7.4.4.4.2 By Service Type

7.4.4.4.3 By Provider

7.4.4.5 Singapore Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.5.1 By Application Type

7.4.4.5.2 By Service Type

7.4.4.5.3 By Provider

7.4.4.6 Malaysia Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By Application Type

7.4.4.7.2 By Service Type

7.4.4.7.3 By Provider

7.4.4.7 Thailand Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.7.1 By Application Type

7.4.4.7.2 By Service Type

7.4.4.7.3 By Provider

7.4.4.8 Indonesia Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.8.1 By Application Type

7.4.4.8.2 By Service Type

7.4.4.8.3 By Provider

7.4.4.9 Vietnam Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.9.1 By Application Type

7.4.4.9.2 By Service Type

7.4.4.9.3 By Provider

7.4.4.10 Taiwan Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.10.1 By Application Type

7.4.4.10.2 By Service Type

7.4.4.10.3 By Provider

7.4.4.11 Rest of Asia Pacific Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.4.4.11.1 By Application Type

7.4.4.11.2 By Service Type

7.4.4.11.3 By Provider

7.5 Middle East and Africa Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.1 By Application Type

7.5.2 By Service Type

7.5.3 By Provider

7.5.4 By Country

7.5.4.1 Saudi Arabia Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.1.1 By Application Type

7.5.4.1.2 By Service Type

7.5.4.1.3 By Provider

7.5.4.2 U.A.E. Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.2.1 By Application Type

7.5.4.2.2 By Service Type

7.5.4.2.3 By Provider

7.5.4.3 Israel Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.3.1 By Application Type

7.5.4.3.2 By Service Type

7.5.4.3.3 By Provider

7.5.4.4 South Africa Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.4.1 By Application Type

7.5.4.4.2 By Service Type

7.5.4.4.3 By Provider

7.5.4.5 Rest of Middle East and Africa Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.5.4.5.1 By Application Type

7.5.4.5.2 By Service Type

7.5.4.5.2 By Provider

7.6 Central and South America Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.1 By Application Type

7.7.2 By Service Type

7.7.3 By Provider

7.7.4 By Country

7.7.4.1 Brazil Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.1.1 By Application Type

7.7.4.1.2 By Service Type

7.7.4.1.3 By Provider

7.7.4.2 Argentina Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.2.1 By Application Type

7.7.4.2.2 By Service Type

7.7.4.2.3 By Provider

7.7.4.3 Chile Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.3.1 By Application Type

7.7.4.3.2 By Service Type

7.7.4.3.3 By Provider

7.7.4.4 Rest of Central and South America Foreign Exchange Services Market Estimates and Forecast, 2020-2028 (USD Billion)

7.7.4.4.1 By Application Type

7.7.4.4.2 By Service Type

7.7.4.4.3 By Provider

8 COMPETITIVE LANDCAPE

8.1 Company Market Share Analysis

8.2 Four Quadrant Positioning Matrix

8.2.1 Market Leaders

8.2.2 Market Visionaries

8.2.3 Market Challengers

8.2.4 Niche Market Players

8.3 Vendor Landscape

8.3.1 North America

8.3.2 Europe

8.3.3 Asia Pacific

8.3.4 Rest of the World

8.4 Company Profiles

8.4.1 Barclays

8.4.1.1 Business Description & Financial Analysis

8.4.1.2 SWOT Analysis

8.4.1.3 Products & Services Offered

8.4.1.4 Strategic Alliances between Business Partners

8.4.2 Wells Fargo

8.4.2.1 Business Description & Financial Analysis

8.4.2.2 SWOT Analysis

8.4.2.3 Products & Services Offered

8.4.2.4 Strategic Alliances between Business Partners

8.4.3 American Express

8.4.3.1 Business Description & Financial Analysis

8.4.3.2 SWOT Analysis

8.4.3.3 Products & Services Offered

8.4.3.4 Strategic Alliances between Business Partners

8.4.4 Deutsche Bank

8.4.4.1 Business Description & Financial Analysis

8.4.4.2 SWOT Analysis

8.4.4.3 Products & Services Offered

8.4.4.4 Strategic Alliances between Business Partners

8.4.5 Goldman Sachs

8.4.5.1 Business Description & Financial Analysis

8.4.5.2 SWOT Analysis

8.4.5.3 Products & Services Offered

8.4.5.4 Strategic Alliances between Business Partners

8.4.6 JPMorgan Chase

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.7.4 Strategic Alliances between Business Partners

8.4.7 Citigroup

8.4.7.1 Business Description & Financial Analysis

8.4.7.2 SWOT Analysis

8.4.7.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.8 Standard Chartered

8.4.8.1 Business Description & Financial Analysis

8.4.8.2 SWOT Analysis

8.4.8.3 Products & Services Offered

8.4.8.4 Strategic Alliances between Business Partners

8.4.9 HSBC Group

8.4.9.1 Business Description & Financial Analysis

8.4.9.2 SWOT Analysis

8.4.9.3 Products & Services Offered

8.4.9.4 Strategic Alliances between Business Partners

8.4.10 Other Companies

8.4.10.1 Business Description & Financial Analysis

8.4.10.2 SWOT Analysis

8.4.10.3 Products & Services Offered

8.4.10.4 Strategic Alliances between Business Partners

9 RESEARCH METHODOLOGY

9.1 Market Introduction

9.1.1 Market Definition

9.1.2 Market Scope & Segmentation

9.2 Information Procurement

9.2.1 Secondary Research

9.2.1.1 Purchased Databases

9.2.1.2 GMEs Internal Data Repository

9.2.1.3 Secondary Resources & Third Party Perspectives

9.2.1.4 Company Information Sources

9.2.2 Primary Research

9.2.2.1 Various Types of Respondents for Primary Interviews

9.2.2.2 Number of Interviews Conducted throughout the Research Process

9.2.2.3 Primary Stakeholders

9.2.2.4 Discussion Guide for Primary Participants

9.2.3 Expert Panels

9.2.3.1 Expert Panels Across 30+ Industry

9.2.4 Paid Local Experts

9.2.4.1 Paid Local Experts Across 30+ Industry Across each Region

9.3 Market Estimation

9.3.1 Top-Down Approach

9.3.1.1 Macro-Economic Indicators Considered

9.3.1.2 Micro-Economic Indicators Considered

9.3.2 Bottom Up Approach

9.3.2.1 Company Share Analysis Approach

9.3.2.2 Estimation of Potential Product Sales

9.4 Data Triangulation

9.4.1 Data Collection

9.4.2 Time Series, Cross Sectional & Panel Data Analysis

9.4.3 Cluster Analysis

9.5 Analysis and Output

9.5.1 Inhouse AI Based Real Time Analytics Tool

9.5.2 Output From Desk & Primary Research

9.6 Research Assumptions & Limitations

9.7.1 Research Assumptions

9.7.2 Research Limitations

LIST OF TABLES

1 Global Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

2 Businesses Market, By Region, 2020-2028 (USD Billion)

3 Individuals Market, By Region, 2020-2028 (USD Billion)

4 Global Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

5 Remittance Service Market, By Region, 2020-2028 (USD Billion)

6 Currency Exchange Market, By Region, 2020-2028 (USD Billion)

7 Foreign Currency Accounts Market, By Region, 2020-2028 (USD Billion)

8 Other Services Market, By Region, 2020-2028 (USD Billion)

9 Global Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

10 Banks Market, By Region, 2020-2028 (USD Billion)

11 Money Transfer Operators Market, By Region, 2020-2028 (USD Billion)

12 Other Providers Market, By Region, 2020-2028 (USD Billion)

13 Regional Analysis, 2020-2028 (USD Billion)

14 North America Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

15 North America Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

16 North America Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

17 North America Foreign Exchange Services Market, By Country, 2020-2028 (USD Billion)

18 U.S. Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

19 U.S. Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

20 U.S Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

21 Canada Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

22 Canada Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

23 Canada Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

24 Mexico Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

25 Mexico Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

26 Mexico Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

27 Europe Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

28 Europe Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

29 Europe Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

30 Germany Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

31 Germany Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

32 Germany Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

33 U.K. Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

34 U.K. Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

35 U.K. Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

36 France Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

37 France Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

38 France Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

39 Italy Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

40 Italy Foreign Exchange Services Market, By T Service Type Type, 2020-2028 (USD Billion)

41 Italy Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

42 Spain Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

43 Spain Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

44 Spain Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

45 Rest Of Europe Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

46 Rest Of Europe Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

47 Rest of Europe Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

48 Asia Pacific Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

49 Asia Pacific Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

50 Asia Pacific Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

51 Asia Pacific Foreign Exchange Services Market, By Country, 2020-2028 (USD Billion)

52 China Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

53 China Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

54 China Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

55 India Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

56 India Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

57 India Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

58 Japan Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

59 Japan Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

60 Japan Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

61 South Korea Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

62 South Korea Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

63 South Korea Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

64 Middle East and Africa Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

65 Middle East and Africa Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

66 Middle East and Africa Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

67 Middle East and Africa Foreign Exchange Services Market, By Country, 2020-2028 (USD Billion)

68 Saudi Arabia Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

69 Saudi Arabia Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

70 Saudi Arabia Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

71 UAE Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

72 UAE Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

73 UAE Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

74 Central and South America Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

75 Central and South America Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

76 Central and South America Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

77 Central and South America Foreign Exchange Services Market, By Country, 2020-2028 (USD Billion)

78 Brazil Foreign Exchange Services Market, By Application Type, 2020-2028 (USD Billion)

79 Brazil Foreign Exchange Services Market, By Service Type, 2020-2028 (USD Billion)

80 Brazil Foreign Exchange Services Market, By Provider, 2020-2028 (USD Billion)

81 Barclays: Products & Services Offering

82 Wells Fargo: Products & Services Offering

83 American Express: Products & Services Offering

84 Deutsche Bank: Products & Services Offering

85 Goldman Sachs: Products & Services Offering

86 JPMORGAN CHASE: Products & Services Offering

87 Citigroup : Products & Services Offering

88 Standard Chartered: Products & Services Offering

89 HSBC Group, Inc: Products & Services Offering

90 Other Companies: Products & Services Offering

LIST OF FIGURES

1 Global Foreign Exchange Services Market Overview

2 Global Foreign Exchange Services Market Value From 2020-2028 (USD Billion)

3 Global Foreign Exchange Services Market Share, By Application Type (2022)

4 Global Foreign Exchange Services Market Share, By Service Type (2022)

5 Global Foreign Exchange Services Market Share, By Provider (2022)

6 Global Foreign Exchange Services Market, By Region (Asia Pacific Market)

7 Technological Trends In Global Foreign Exchange Services Market

8 Four Quadrant Competitor Positioning Matrix

9 Impact Of Macro & Micro Indicators On The Market

10 Impact Of Key Drivers On The Global Foreign Exchange Services Market

11 Impact Of Challenges On The Global Foreign Exchange Services Market

12 Porter’s Five Forces Analysis

13 Global Foreign Exchange Services Market: By Application Type Scope Key Takeaways

14 Global Foreign Exchange Services Market, By Application Type Segment: Revenue Growth Analysis

15 Businesses Market, By Region, 2020-2028 (USD Billion)

16 Individuals Market, By Region, 2020-2028 (USD Billion)

17 Global Foreign Exchange Services Market: By Service Type Scope Key Takeaways

18 Global Foreign Exchange Services Market, By Service Type Segment: Revenue Growth Analysis

19 Remittance Service Market, By Region, 2020-2028 (USD Billion)

20 Currency Exchange Market, By Region, 2020-2028 (USD Billion)

21 Foreign Currency Accounts Market, By Region, 2020-2028 (USD Billion)

22 Other Services Market, By Region, 2020-2028 (USD Billion)

23 Global Foreign Exchange Services Market: By Provider Scope Key Takeaways

24 Global Foreign Exchange Services Market, By Provider Segment: Revenue Growth Analysis

25 Banks Market, By Region, 2020-2028 (USD Billion)

26 Money Transfer Operators Market, By Region, 2020-2028 (USD Billion)

27 Other Providers Market, By Region, 2020-2028 (USD Billion)

28 Regional Segment: Revenue Growth Analysis

29 Global Foreign Exchange Services Market: Regional Analysis

30 North America Foreign Exchange Services Market Overview

31 North America Foreign Exchange Services Market, By Application Type

32 North America Foreign Exchange Services Market, By Service Type

33 North America Foreign Exchange Services Market, By Provider

34 North America Foreign Exchange Services Market, By Country

35 U.S. Foreign Exchange Services Market, By Application Type

36 U.S. Foreign Exchange Services Market, By Service Type

37 U.S. Foreign Exchange Services Market, By Provider

38 Canada Foreign Exchange Services Market, By Application Type

39 Canada Foreign Exchange Services Market, By Service Type

40 Canada Foreign Exchange Services Market, By Provider

41 Mexico Foreign Exchange Services Market, By Application Type

42 Mexico Foreign Exchange Services Market, By Service Type

43 Mexico Foreign Exchange Services Market, By Provider

44 Four Quadrant Positioning Matrix

45 Company Market Share Analysis

46 Barclays: Company Snapshot

47 Barclays: SWOT Analysis

48 Barclays: Geographic Presence

49 Wells Fargo: Company Snapshot

50 Wells Fargo: SWOT Analysis

51 Wells Fargo: Geographic Presence

52 American Express: Company Snapshot

53 American Express: SWOT Analysis

54 American Express: Geographic Presence

55 Deutsche Bank: Company Snapshot

56 Deutsche Bank: Swot Analysis

57 Deutsche Bank: Geographic Presence

58 Goldman Sachs: Company Snapshot

59 Goldman Sachs: SWOT Analysis

60 Goldman Sachs: Geographic Presence

61 JPMorgan Chase: Company Snapshot

62 JPMorgan Chase: SWOT Analysis

63 JPMorgan Chase: Geographic Presence

64 Citigroup : Company Snapshot

65 Citigroup : SWOT Analysis

66 Citigroup : Geographic Presence

67 Standard Chartered: Company Snapshot

68 Standard Chartered: SWOT Analysis

69 Standard Chartered: Geographic Presence

70 HSBC Group, Inc.: Company Snapshot

71 HSBC Group, Inc.: SWOT Analysis

72 HSBC Group, Inc.: Geographic Presence

73 Other Companies: Company Snapshot

74 Other Companies: SWOT Analysis

75 Other Companies: Geographic Presence

The Global Foreign Exchange Services Market has been studied from the year 2019 till 2028. However, the CAGR provided in the report is from the year 2023 to 2028. The research methodology involved three stages: Desk research, Primary research, and Analysis & Output from the entire research process.

The desk research involved a robust background study which meant referring to paid and unpaid databases to understand the market dynamics; mapping contracts from press releases; identifying the key players in the market, studying their product portfolio, competition level, annual reports/SEC filings & investor presentations; and learning the demand and supply-side analysis for the Foreign Exchange Services Market.

The primary research activity included telephonic conversations with more than 50 tier 1 industry consultants, distributors, and end-use product manufacturers.

Finally, based on the above thorough research process, an in-depth analysis was carried out considering the following aspects: market attractiveness, current & future market trends, market share analysis, SWOT analysis of the company and customer analytics.

Frequently Asked Questions

Tailor made solutions just for you

80% of our clients seek made-to-order reports. How do you want us to tailor yours?

OUR CLIENTS